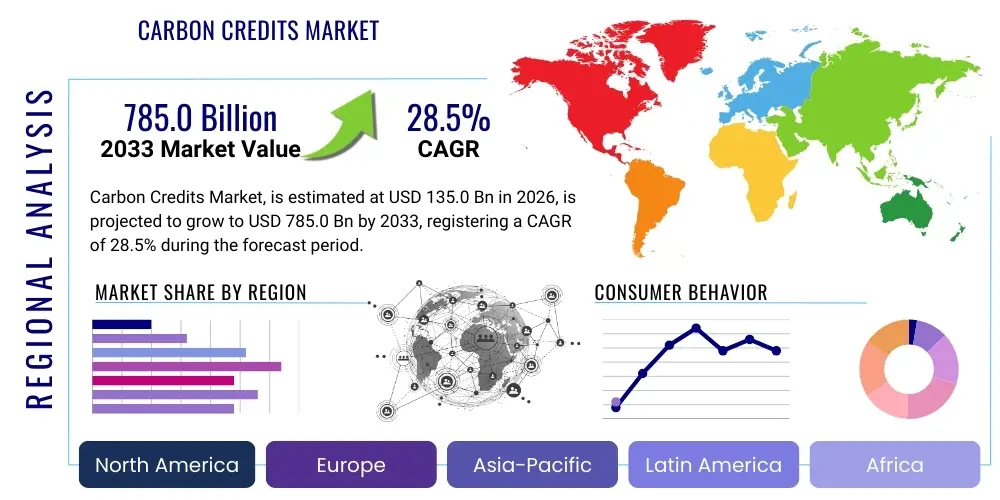

Carbon Credits Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437140 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Carbon Credits Market Size

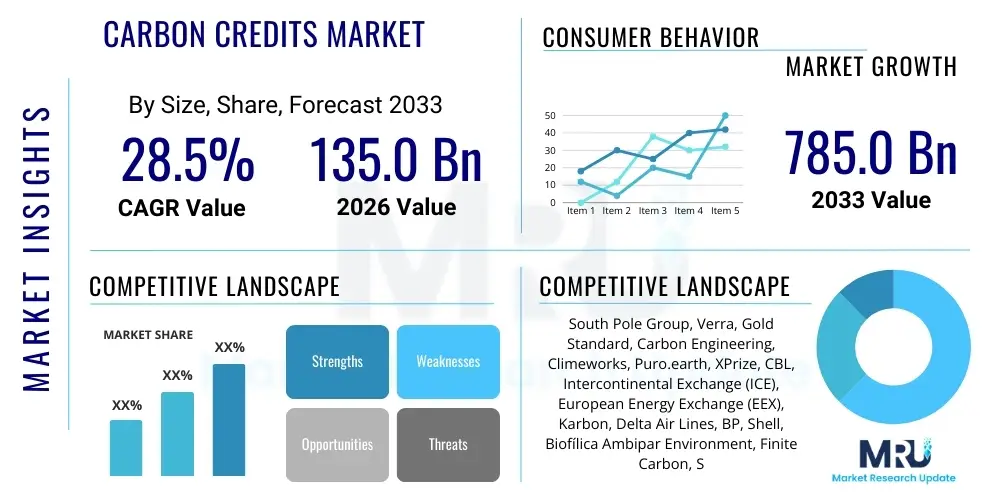

The Carbon Credits Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 28.5% between 2026 and 2033. The market is estimated at $135.0 Billion in 2026 and is projected to reach $785.0 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating global commitment toward achieving net-zero emissions targets, regulatory mandates strengthening existing compliance schemes, and the rapid adoption of corporate Environmental, Social, and Governance (ESG) frameworks that necessitate verifiable climate action.

The valuation reflects the increasing financialization and institutionalization of carbon as a commodity essential for managing climate risk. While the Compliance Carbon Market (CCM), anchored by systems like the European Union Emission Trading System (EU ETS) and regional schemes in North America and Asia, currently accounts for the largest share of market value, the Voluntary Carbon Market (VCM) is exhibiting disproportionately high growth potential. This growth is spurred by technological advancements in carbon removal solutions, enhanced standardization, and growing investor confidence in high-quality offset projects. Market stakeholders are increasingly focusing on scaling up nature-based solutions and engineered removal technologies to meet the future demands for high-integrity carbon credits.

Carbon Credits Market introduction

The Carbon Credits Market facilitates the trading of emission allowances or offsets, serving as a critical financial mechanism designed to reduce greenhouse gas (GHG) emissions efficiently across global economies. Carbon credits, fundamentally defined as a unit representing one metric ton of carbon dioxide equivalent (CO2e) either reduced, avoided, or sequestered, function as a crucial product for entities seeking to meet mandatory regulatory caps (Compliance Market) or voluntary sustainability goals (Voluntary Market). Major applications span hard-to-abate sectors such as energy, heavy industry, cement, and aviation, where immediate, deep decarbonization is technologically or economically infeasible. The product allows these entities to operationalize their climate commitments by compensating for their residual emissions, thereby providing necessary capital flows to global emission reduction and removal projects.

The primary benefits of the carbon credits market include the economic efficiency of emissions reduction, enabling reductions to occur where they are least costly, and the mobilization of private sector finance into climate mitigation projects worldwide. Furthermore, the market establishes a tangible price signal for carbon, internalizing the previously external cost of environmental damage and incentivizing innovation in clean technologies and sustainable land use practices. Successful deployment of carbon credits supports national and international climate goals, including those outlined under the Paris Agreement, by facilitating the transparent tracking and verification of decarbonization efforts, ultimately accelerating the global transition toward a net-zero future.

Driving factors propelling the market include the expansion of cap-and-trade programs globally, particularly in emerging economies and nascent regional pacts. The increasing stringency of national climate policies, coupled with robust corporate commitments to net-zero targets validated by science-based initiatives, generates sustained demand. Furthermore, innovations in Monitoring, Reporting, and Verification (MRV) technologies, including satellite imagery and blockchain, are enhancing the perceived integrity and quality of credits, attracting institutional investors and fostering liquidity. The development and deployment of Direct Air Capture (DAC) and enhanced weathering technologies, supported by offset purchases, further broadens the scope and potential of the removal segment of the market, offering high-quality, permanent carbon offsets necessary for deep decarbonization.

Carbon Credits Market Executive Summary

The Carbon Credits Market is undergoing unprecedented growth, characterized by significant increases in trading volumes and prices, primarily fueled by regulatory certainty and amplified corporate ESG mandates. Business trends highlight a strong movement towards market consolidation, with major financial institutions and energy corporations establishing dedicated carbon trading desks and investment vehicles. A paramount trend involves the shift from purely avoidance credits towards verifiable removal credits, reflecting stakeholder demand for higher-integrity offsets that contribute more definitively to long-term climate stability. Furthermore, the introduction of stricter governance standards, such as those promoted by the Integrity Council for the Voluntary Carbon Market (ICVCM), is crucial for building trust and unlocking institutional capital necessary for scaling the market effectively.

Regionally, Europe remains the dominant market epicenter due to the mature and highly priced EU ETS, which serves as a global benchmark for compliance mechanisms. North America, driven by California’s Cap-and-Trade Program and the evolving Canadian Federal backstop system, presents robust, stable growth. Asia Pacific (APAC) is emerging as the fastest-growing region, led by the formalization of national ETS systems in China and regional regulatory frameworks in South Korea and Australia, coupled with burgeoning voluntary demand from multinational corporations operating within the region. The Middle East and Africa (MEA) are also showing promising developments, particularly through project origination focused on nature-based solutions and renewable energy projects, increasingly attracting international investment for high-quality project development.

Segment trends demonstrate the bifurcation between the Compliance Carbon Market (CCM) and the Voluntary Carbon Market (VCM). While CCM dominates in terms of overall value and mandatory participation, the VCM is attracting significant innovation, particularly in areas like soil carbon sequestration and technological removals. Within the VCM, the Removal segment (e.g., afforestation, biochar, DAC) is experiencing exponential price appreciation compared to the Reduction/Avoidance segment (e.g., renewable energy projects), signaling a willingness among corporate buyers to pay a premium for permanent, verifiable carbon removal. The technology segment is highly dynamic, with blockchain-based platforms gaining traction for improved transparency, tokenization, and fractional ownership of credits, aiming to address critical issues of double counting and transactional efficiency.

AI Impact Analysis on Carbon Credits Market

User queries regarding AI's influence on the Carbon Credits Market heavily center on issues of transparency, credit quality verification, and market efficiency. Common questions include: "How can AI prevent greenwashing?", "Can machine learning accurately monitor forest carbon stocks?", and "Will AI reduce the cost of credit verification?". These concerns highlight key user expectations for AI to solve persistent market integrity issues, particularly those related to the accuracy and permanence of offsets from nature-based solutions and the efficiency of the trading infrastructure. Users anticipate AI will democratize access to high-fidelity data, standardize risk assessment for project developers, and ultimately stabilize the perceived quality premium for verified credits.

The integration of Artificial Intelligence and Machine Learning (ML) is fundamentally transforming the Monitoring, Reporting, and Verification (MRV) processes that underpin the integrity of carbon credits. AI models, utilizing input from remote sensing technologies like satellite imagery, LiDAR, and drone data, can provide unprecedented accuracy and frequency in quantifying emissions reductions or sequestration rates, particularly for complex nature-based solutions such as afforestation/reforestation and soil carbon projects. This enhanced capability significantly reduces human error, cuts down verification costs, and improves the timeliness of issuance, directly addressing concerns about offset quality and permanence.

Beyond MRV, AI is also revolutionizing the operational aspects of the market. Machine learning algorithms are now employed in predictive modeling to forecast the supply and demand of credits, assess the geopolitical and project-specific risks associated with different offset portfolios, and optimize trading strategies on exchange platforms. Furthermore, AI-driven tools are being developed to vet project proposals against established standards (e.g., Gold Standard, Verra) automatically, flagging potential additionality or leakage risks earlier in the development lifecycle. This comprehensive AI utilization is crucial for institutionalizing the market, making it more resilient, transparent, and attractive to long-term investment capital.

- AI significantly enhances Monitoring, Reporting, and Verification (MRV) accuracy using satellite and sensor data.

- Machine Learning models predict offset project failure rates and assess permanence risk, improving credit quality assurance.

- Natural Language Processing (NLP) is used to analyze project documentation for adherence to complex methodologies and standards.

- AI optimizes carbon credit trading by providing real-time pricing forecasts and improving liquidity management on exchanges.

- Predictive analytics supports decision-making for corporations developing high-integrity Net-Zero transition pathways.

DRO & Impact Forces Of Carbon Credits Market

The dynamics of the Carbon Credits Market are governed by a robust interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the impact forces acting upon participants. Primary drivers are rooted in increasingly ambitious regulatory frameworks, specifically the commitment of over 140 countries to net-zero targets and the expansion of jurisdictional compliance schemes like the EU ETS and emerging Asian ETS platforms. Corporate governance mandates, particularly the integration of material climate risks into financial reporting and the widespread adoption of ESG investing criteria, further solidify sustained demand. These forces create a structural necessity for carbon credits as a short-to-medium-term tool for decarbonization, thereby providing the necessary price floor and market stability for project development and financial investment.

However, the market faces significant restraints, chiefly concerning issues of credit integrity and transparency. High-profile allegations of greenwashing, difficulties in definitively proving "additionality" for certain offset types, and the risk of "permanence" failure (especially in nature-based projects like forestry) erode buyer confidence and suppress prices for lower-quality credits. Regulatory fragmentation across jurisdictions also complicates cross-border trading and standard harmonization, hindering the realization of a truly global, fungible carbon currency. Operational challenges, including the high upfront cost and long lead times associated with carbon removal technology deployment, also slow the necessary supply-side expansion of high-quality offsets.

Opportunities within the market center on technological innovation and market structure enhancement. The increasing viability of engineered carbon removal technologies, such as Direct Air Capture (DAC) and mineralization, offers a path toward scalable, permanent sequestration, representing the highest value segment. Furthermore, the digitalization of the market using blockchain technology and specialized exchanges promises to solve transparency issues, enabling instantaneous credit tracing and transfer while mitigating double-counting risks. The expansion of Article 6 mechanisms under the Paris Agreement is expected to facilitate international cooperation and the transfer of mitigation outcomes (ITMOs), potentially unlocking massive pools of high-quality supply from developing nations and further integrating global carbon markets, which represents a profound structural opportunity for the next decade.

Segmentation Analysis

The Carbon Credits Market is heterogeneously segmented across several critical dimensions, reflecting the diverse mechanisms of emission reduction and the varied needs of participating entities. Understanding these segments is crucial for strategic market participation, as different segments carry unique risks, pricing structures, and regulatory oversight levels. The segmentation primarily differentiates between the mandatory compliance market and the voluntary market, which fundamentally dictate demand drivers. Further critical segmentation occurs based on the mechanism of climate action (removal versus reduction/avoidance) and the type of end-user industry, allowing for granular analysis of supply-side project development and end-user demand patterns across key economic sectors like energy, manufacturing, and transportation. The market structure continues to evolve, with increasing specialization within segments, demanding standardized verification protocols to ensure fungibility and quality across different project types and geographies.

- By Market Type:

- Compliance Carbon Market (CCM)

- Voluntary Carbon Market (VCM)

- By Mechanism Type:

- Reduction/Avoidance Credits

- Carbon Removal Credits (e.g., DAC, Biochar, Afforestation)

- By Project Type:

- Renewable Energy (Wind, Solar, Hydro)

- Forestry and Land Use (REDD+, Afforestation/Reforestation)

- Energy Efficiency

- Waste Management (Methane Capture)

- Industrial Gases

- By End-Use Industry:

- Energy & Utilities

- Manufacturing

- Transportation (Aviation, Shipping)

- Technology & Telecommunications

- Finance & Insurance

- Consumer Goods

Value Chain Analysis For Carbon Credits Market

The Carbon Credits Market value chain is complex and involves multiple specialized stages, beginning with upstream project origination and extending through verification, issuance, trading, and final retirement. Upstream analysis focuses on the Project Developers who identify, design, and implement emission reduction or removal activities, such as setting up renewable energy farms or implementing sustainable forestry management practices. These developers secure financing, often facing significant technical and regulatory hurdles related to proving additionality and long-term permanence. This segment relies heavily on specialized consultants and technical experts for feasibility studies and adherence to complex protocol methodologies established by registries like Verra and Gold Standard, forming the initial, capital-intensive layer of the value chain.

The midstream stage is defined by Verification and Registration. Independent third-party auditors (Designated Operational Entities or DOEs) validate and verify the emission reductions achieved by the project. Upon successful verification, Carbon Registries (e.g., Verra, Gold Standard, jurisdictional registries) issue the credits. This stage is critical for market integrity, as the quality and credibility of the credit are established here. Once issued, the credits enter the trading infrastructure, characterized by diverse distribution channels. These include Direct sales (Over-The-Counter or OTC trades) between project developers and large corporate buyers, or Indirect transactions through Brokers, Intermediaries, and centralized Carbon Exchanges (e.g., ICE Futures, CBL, regional exchanges). The choice of channel depends on buyer sophistication, volume requirements, and price discovery needs, with institutional investors increasingly favoring liquid exchange platforms.

Downstream analysis involves the End-Users, which are the entities that ultimately purchase and retire the credits to meet their compliance obligations or voluntary net-zero goals. The efficiency of the downstream market is influenced by the ease of accessing various project types and the transparency of the retirement process. The continuous drive toward digitalization, including the use of blockchain for tracking credit ownership and retirement, aims to streamline the downstream flow, reduce transaction costs, and eliminate risks associated with double counting. The maturity of the downstream market dictates the demand signal, profoundly influencing upstream investment decisions regarding project pipeline development and technology scale-up, ensuring the value chain is responsive to evolving climate mandates and corporate sustainability strategies.

Carbon Credits Market Potential Customers

Potential customers in the Carbon Credits Market encompass a wide range of global organizations driven by mandatory compliance or proactive voluntary climate commitments. In the Compliance Market, the primary customers are large emitters in regulated sectors such as electric power generation, heavy industry (cement, steel, chemicals), and increasingly, the commercial aviation sector (via CORSIA). These entities are legally bound to surrender allowances equivalent to their annual emissions, making them captive and highly dependable buyers whose demand is directly tied to regulatory stringency and economic output. Their purchasing decisions are primarily cost-driven, focused on securing the cheapest available compliant instruments to maintain operational feasibility while meeting legal mandates, often relying on structured forward contracts and exchange-traded instruments for risk mitigation.

Within the Voluntary Carbon Market (VCM), the customer base is significantly broader and includes major multinational corporations across technology, finance, retail, and consumer packaged goods. These customers are motivated by ESG performance, stakeholder pressure, and achieving self-imposed net-zero or carbon-neutrality targets. They often prioritize high-integrity credits, such as certified removal credits (DAC, reforestation) that align with their corporate brand identity and offer co-benefits (e.g., biodiversity, social impact). Financial institutions and investment funds are also crucial customers, acting both as purchasers for their own operational footprints and as intermediaries, structuring specialized climate funds and derivatives based on carbon market fundamentals to meet investor demand for climate-aligned assets.

Furthermore, smaller and medium-sized enterprises (SMEs) are increasingly becoming potential customers through aggregated purchasing mechanisms and digital platforms that simplify access to the VCM. As climate-related disclosure mandates expand globally, even non-regulated companies are recognizing the strategic necessity of accounting for and offsetting their value chain emissions (Scope 3). This expansion of the buyer base, moving beyond just compliance-mandated entities to include any corporation seeking verifiable evidence of climate responsibility, ensures a diverse and resilient long-term demand curve for high-quality carbon assets, providing essential liquidity and market depth across all major segments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $135.0 Billion |

| Market Forecast in 2033 | $785.0 Billion |

| Growth Rate | 28.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | South Pole Group, Verra, Gold Standard, Carbon Engineering, Climeworks, Puro.earth, XPrize, CBL, Intercontinental Exchange (ICE), European Energy Exchange (EEX), Karbon, Delta Air Lines, BP, Shell, Biofílica Ambipar Environment, Finite Carbon, Sylvera, BeZero Carbon, EcoAct, MSCI. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Carbon Credits Market Key Technology Landscape

The technological landscape of the Carbon Credits Market is rapidly evolving, driven by the need for enhanced transparency, accuracy in measurement, and the scaling of removal solutions. Central to this evolution is the integration of Distributed Ledger Technology (DLT), commonly known as blockchain, which fundamentally addresses the perennial issues of double counting and transactional opacity. By creating an immutable, distributed record of a credit's issuance, ownership transfer, and final retirement, blockchain technology facilitates verifiable traceability, crucial for building institutional trust in the VCM. Specialized tokenization platforms are now leveraging DLT to create digital carbon assets, enabling fractional ownership and increasing market liquidity, thereby making it easier for smaller investors and decentralized autonomous organizations (DAOs) to participate in climate finance.

Equally critical is the adoption of advanced Monitoring, Reporting, and Verification (MRV) technologies, which substantially reduce the cost and uncertainty associated with credit generation. This category includes high-resolution satellite imagery, airborne Light Detection and Ranging (LiDAR), and ground-based sensor networks, often combined with geospatial mapping and remote sensing software. These tools provide objective, continuous data streams crucial for assessing the integrity and permanence of nature-based projects, particularly forestry and soil carbon sequestration. Machine Learning algorithms are then applied to this large volume of data to predict biomass changes, detect unauthorized logging (leakage), and standardize the quantification of sequestered carbon, significantly enhancing the scientific rigor of credit issuance and streamlining the traditionally slow verification cycle.

Furthermore, technology is redefining the supply side through the maturation of Carbon Dioxide Removal (CDR) technologies. Direct Air Capture (DAC), which chemically filters CO2 directly from the atmosphere, and enhanced weathering technologies represent high-potential, technology-driven solutions for permanent carbon sequestration. While currently high-cost, continuous technological advancements, supported by advance market commitments from major corporations, are driving down the Levelized Cost of Capture (LCOC). These removal technologies are strategically vital because they offer offsets with high additionality and permanence, aligning with the increasingly strict definitions of net-zero targets and positioning them as the premium tier of the future carbon credit portfolio, necessitating substantial ongoing R&D investment and infrastructure scaling.

Regional Highlights

- Europe maintains its position as the global leader in the Carbon Credits Market, primarily due to the maturity, depth, and highly influential pricing of the European Union Emission Trading System (EU ETS). The EU ETS is the world’s largest cap-and-trade scheme, covering approximately 40% of the bloc’s greenhouse gas emissions. Recent reforms, including the implementation of the Fit for 55 package and the integration of new sectors like maritime transport and building/road transport, ensure continued regulatory tightening and sustained, high-value demand for allowances. This regulatory environment drives significant investment in decarbonization and establishes Europe as the primary pricing reference for global compliance markets. The regional market benefits from robust institutional support and a commitment to high-integrity standards, which influences the voluntary market practices globally.

- North America, anchored by the California Cap-and-Trade Program (WCI) and the Regional Greenhouse Gas Initiative (RGGI) in the Northeast, represents a highly stable and valuable compliance market. California’s program is particularly notable for its stringent requirements and linkage with Québec, demonstrating successful cross-jurisdictional collaboration. The region is also a major source of demand in the Voluntary Carbon Market (VCM), driven by leading U.S. and Canadian technology companies and financial institutions committing to ambitious net-zero targets. The U.S. federal push towards climate-friendly infrastructure and tax incentives, particularly supporting DAC and carbon capture, utilization, and storage (CCUS), is rapidly accelerating the development and deployment of next-generation, high-permanence removal projects, significantly influencing the high-end supply segment.

- Asia Pacific (APAC) is characterized by having the highest growth potential, largely due to the emergence and expansion of national ETS systems, most notably the China National ETS. Although currently operating with relatively lower pricing compared to the EU ETS, the sheer scale of the Chinese system positions it to become the world’s largest in terms of covered emissions. Other developing compliance markets in South Korea, Australia, and potentially India signal a structural shift towards regulated climate action in the region. Furthermore, APAC is a crucial hub for project origination, particularly for forestry, renewable energy, and industrial gas destruction projects, feeding the global VCM supply. The rapid industrialization and escalating environmental awareness across countries like Japan, Singapore, and Australia are translating into substantial corporate voluntary demand for high-quality offsets.

- Latin America is predominantly a key supplier of nature-based carbon offsets, especially those derived from REDD+ (Reducing Emissions from Deforestation and Forest Degradation) and afforestation projects in the Amazon basin and other significant forest areas. The region benefits from vast natural resources capable of high sequestration rates, attracting significant foreign direct investment for project development and certification. Key challenges include political stability and establishing robust legal frameworks to ensure permanence and prevent leakage. However, increasing standardization and support from international development banks are stabilizing project pipelines, enhancing the market's reliability as a primary source of biodiversity and community co-benefit credits for the global VCM.

- The Middle East and Africa (MEA) region is exhibiting nascent but rapid development, often linked to oil and gas transitions and renewable energy initiatives. The establishment of localized voluntary carbon markets, such as the Saudi-led Regional Voluntary Carbon Market, aims to mobilize regional capital and address the climate impacts of energy sectors. Africa is emerging as a critical frontier for high-quality, nature-based project development, particularly in sustainable land management, agriculture, and renewable energy access, driven by internationally recognized standards. The potential for large-scale, low-cost project origination in MEA is high, provided regulatory and financial mechanisms are implemented to mitigate associated political and investment risks.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Carbon Credits Market.- South Pole Group

- Verra

- Gold Standard

- Carbon Engineering

- Climeworks

- Puro.earth

- Carbon Trade Exchange (CTX)

- Intercontinental Exchange (ICE)

- European Energy Exchange (EEX)

- CBL Markets

- Shell (Carbon Trading Division)

- BP (Carbon Trading Division)

- Biofílica Ambipar Environment

- Finite Carbon

- Sylvera

- BeZero Carbon

- EcoAct (Atos Group)

- MSCI

- Standard Chartered Bank

- Xpansiv

Frequently Asked Questions

Analyze common user questions about the Carbon Credits market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between Compliance and Voluntary Carbon Markets?

The Compliance Carbon Market (CCM) is mandatory, regulated by governments (e.g., EU ETS), setting legally binding caps on emissions for specific sectors. The Voluntary Carbon Market (VCM) is non-mandatory, where companies purchase credits to meet self-imposed sustainability and net-zero goals, relying on independent standards like Verra or Gold Standard.

How is the integrity or quality of a carbon credit verified?

Credit quality is verified through rigorous third-party auditing processes conducted by Designated Operational Entities (DOEs). Verification ensures that projects meet criteria for additionality, permanence, and leakage prevention, following specific methodologies set by established registries like Verra or Gold Standard before credits are issued.

What is Carbon Dioxide Removal (CDR) and why is it important for net-zero?

CDR refers to technologies or natural processes that actively remove CO2 from the atmosphere and lock it away permanently (e.g., Direct Air Capture, biochar). CDR is crucial for achieving net-zero goals because it is necessary to neutralize hard-to-abate residual emissions that cannot be eliminated through reduction alone.

How does blockchain technology impact carbon credit trading efficiency?

Blockchain (DLT) enhances market efficiency and trust by providing an immutable, transparent record of credit issuance, ownership, and retirement. This technology minimizes the risk of double counting, streamlines transactions, and reduces intermediary costs, making the assets more liquid and traceable.

Which factors are primarily driving the current high growth rates in the market?

The primary growth drivers are the increasing stringency and expansion of global regulatory schemes (e.g., tightened EU ETS caps), coupled with aggressive corporate commitments to net-zero strategies that necessitate the purchase of high-quality offsets and allowances to balance unavoidable emissions within mandated reporting frameworks.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager