Carbon Fiber Bicycle Front Fork Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433972 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Carbon Fiber Bicycle Front Fork Market Size

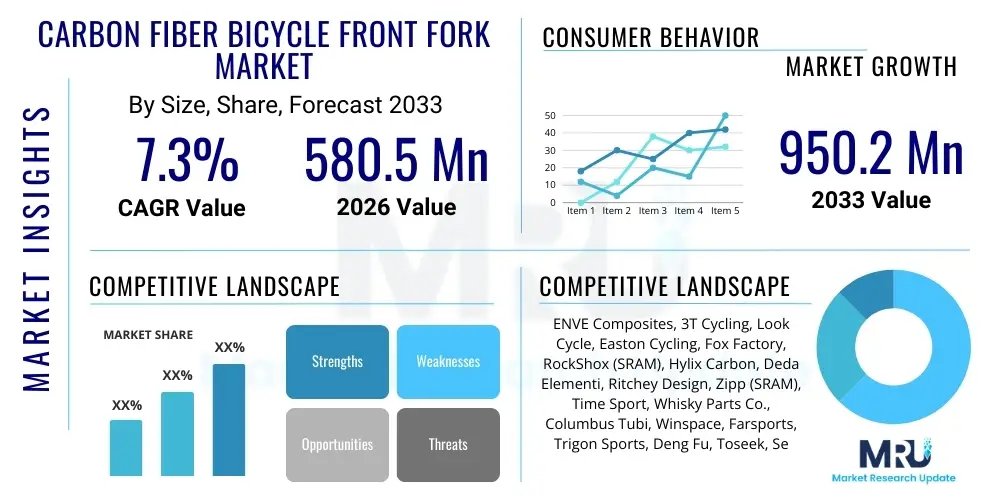

The Carbon Fiber Bicycle Front Fork Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.3% between 2026 and 2033. The market is estimated at USD 580.5 Million in 2026 and is projected to reach USD 950.2 Million by the end of the forecast period in 2033.

Carbon Fiber Bicycle Front Fork Market introduction

The Carbon Fiber Bicycle Front Fork Market encompasses the manufacturing, distribution, and sale of composite forks primarily utilized in high-performance and premium bicycles. Carbon fiber, renowned for its exceptional strength-to-weight ratio and vibration dampening characteristics, has become the material of choice over traditional aluminum or steel for serious cyclists and competitive athletes. These front forks are crucial structural components, connecting the bicycle's front wheel and handlebars to the frame, critically influencing handling, aerodynamics, and overall riding comfort. The increasing demand for lightweight and performance-oriented cycling equipment, driven by the global growth of professional racing, fitness cycling, and recreational enthusiast segments, underpins the market's robust expansion.

Major applications of carbon fiber front forks span across various cycling disciplines, including road racing, mountain biking (specifically cross-country and trail segments), gravel cycling, and increasingly, high-end electric bicycles (e-bikes). In road cycling, the aerodynamic advantages and low weight are paramount, leading to intricate fork designs that minimize drag. For off-road applications, carbon forks offer superior shock absorption compared to metal alloys, enhancing rider comfort and reducing fatigue without significant weight penalties. The integration of advanced manufacturing techniques, such as monocoque construction and optimized layup schedules, further ensures structural integrity and performance customization.

Key driving factors accelerating market adoption include technological advancements in resin and fiber chemistry, enabling the production of lighter yet stiffer forks. Furthermore, shifting consumer preferences towards sustainable and technologically advanced sporting goods, coupled with rising disposable incomes in emerging economies, are boosting demand for premium bicycle components. The inherent benefits, such as enhanced responsiveness, reduced inertial weight, and long-term durability when compared to alternative materials, position carbon fiber front forks as an essential upgrade component for both Original Equipment Manufacturers (OEMs) and the aftermarket segment.

Carbon Fiber Bicycle Front Fork Market Executive Summary

The Carbon Fiber Bicycle Front Fork Market is characterized by strong upward momentum driven primarily by the sustained global interest in fitness and competitive cycling, coupled with significant innovation in composite material science. Business trends indicate a strong reliance on automation in the manufacturing process to ensure precise fiber alignment and minimize defects, thereby justifying the premium pricing associated with these components. Strategic collaborations between carbon fiber suppliers, resin manufacturers, and large bicycle OEMs are becoming pivotal to secure material supply and co-develop next-generation products optimized for specific cycling segments, such as integrated cable routing and suspension compatibility. The market dynamics are highly influenced by the cycling industry's continuous drive toward achieving marginal gains in performance, pushing manufacturers to invest heavily in R&D for stiffness optimization and weight reduction.

Regional trends highlight Asia Pacific (APAC) as the dominant manufacturing and fastest-growing consumption hub, largely due to the presence of major global bicycle production facilities in countries like China, Taiwan, and Vietnam, which serve as key OEM suppliers. North America and Europe remain mature markets, focused primarily on high-value, aftermarket sales, and premium road and gravel bike segments, often adopting the latest technological standards earliest. The European market, in particular, shows strong growth influenced by increasing urban cycling infrastructure and the burgeoning popularity of high-performance e-bikes that utilize reinforced carbon fiber components to manage higher speeds and torque loads.

Segmentation trends reveal that the Road Bike segment holds the largest market share, driven by the massive volume of high-end consumer and racing bicycle sales. However, the Gravel/Cyclocross segment is exhibiting the highest growth rate, fueled by its niche market appeal combining road speed with off-road capability, demanding robust yet lightweight fork structures capable of handling disc brakes and wider tires. Furthermore, the OEM channel maintains a significantly larger volume share compared to the Aftermarket, though the aftermarket segment often commands higher profit margins due to branding and consumer upgrade behavior. Advancements in intermediate and high-modulus carbon fibers are enabling niche product development tailored specifically to meet stringent performance specifications demanded by elite athletes.

AI Impact Analysis on Carbon Fiber Bicycle Front Fork Market

User queries regarding the impact of Artificial Intelligence (AI) on the carbon fiber front fork market primarily revolve around optimizing design iteration, enhancing manufacturing quality control, and predicting material performance characteristics under varied load conditions. Users frequently ask if AI can reduce the labor intensity of the layup process, whether generative design tools can produce topologically optimized fork shapes that human engineers might overlook, and how machine learning algorithms are utilized in Non-Destructive Testing (NDT) to identify microscopic flaws in composite structures. Key themes center on efficiency, quality assurance, and predictive failure modeling, driven by the industry's need to produce extremely light components that meet strict safety standards.

The application of AI and Machine Learning (ML) is fundamentally transforming the R&D and production phases of carbon fiber forks. In the design stage, generative AI algorithms can take parameters like required stiffness, desired weight, and load profiles, then autonomously generate hundreds of optimized fork geometries, dramatically accelerating the prototyping phase. During manufacturing, AI-powered vision systems are deployed to monitor the complex carbon sheet layup process, ensuring precise fiber orientation and preventing human error, which is critical for structural integrity. This enhanced precision reduces material wastage and improves batch consistency, addressing major cost and quality concerns in composite manufacturing.

Furthermore, predictive maintenance and quality assurance benefit significantly from AI integration. By analyzing historical manufacturing data, cure cycles, and simulated stress tests, ML models can predict the optimal resin curing time or identify specific features in the manufacturing environment that correlate with higher defect rates. This level of granular control over quality management is paramount for ensuring the safety of high-stress components like front forks, particularly as designs become lighter and more aggressively aerodynamic. The ultimate outcome is a faster, more reliable, and ultimately safer carbon fiber product delivered to both OEMs and end-users.

- AI-Driven Generative Design: Optimizes fork geometry for maximum stiffness-to-weight ratio and complex aerodynamic profiles.

- Quality Control Automation: Machine vision and ML algorithms analyze fiber layup patterns and internal structure via NDT (e.g., ultrasound) to detect voids or inconsistencies automatically.

- Predictive Performance Modeling: AI models simulate component stress and fatigue life based on manufacturing inputs and real-world usage data, enhancing safety factor determination.

- Manufacturing Process Optimization: ML identifies optimal environmental controls and curing parameters to reduce defects and cycle time in autoclave processes.

DRO & Impact Forces Of Carbon Fiber Bicycle Front Fork Market

The market is predominantly driven by the relentless consumer demand for performance optimization in cycling, where every gram of weight savings is valued, alongside significant advancements in composite technology that make high-volume production more feasible. Restraints primarily revolve around the high raw material costs (carbon fiber tow and specialized resins) and the complex, labor-intensive manufacturing processes, which contribute to the high final price tag of carbon components, limiting widespread adoption in budget bicycle segments. Opportunities are emerging strongly within the burgeoning e-bike sector, which requires specialized, reinforced carbon forks to handle greater load, speed, and braking forces, and the gravel bike segment, which prioritizes durability and compliance. These elements collectively shape the competitive landscape, pushing manufacturers toward innovation under tight safety and regulatory scrutiny.

Drivers include the expansion of competitive cycling events globally, the rising popularity of professional cycling as a spectator sport, and increased government investment in cycling infrastructure promoting recreational use. Technological drivers, such as the widespread adoption of disc brakes, necessitate stronger, stiffer fork designs that carbon fiber is uniquely positioned to fulfill, often incorporating integrated mounting points and internal routing systems. Furthermore, the perceived superiority and aspirational value of carbon fiber among cycling enthusiasts continue to drive aftermarket upgrades and premium bicycle sales.

Restraints are notably focused on the stringent quality assurance requirements; any failure in a front fork can lead to severe injury, necessitating costly and intensive quality control protocols (like X-ray or ultrasound scanning). Additionally, the sustainability profile of carbon fiber production and disposal remains a complex challenge, presenting regulatory and consumer hurdles that must be addressed through recycling initiatives and greener manufacturing processes. Impact forces, driven by increasing raw material prices and geopolitical stability affecting global supply chains, necessitate robust sourcing strategies and diversification among key manufacturers.

Segmentation Analysis

The Carbon Fiber Bicycle Front Fork Market is comprehensively segmented based on product type, catering to specific cycling disciplines, and by distribution channel, differentiating between factory supply and consumer sales. The Type segmentation clearly reflects the diverse performance requirements, with road bikes demanding aerodynamic efficiency, mountain bikes needing robust trail clearance and strength, and gravel bikes balancing endurance and compliance. Analyzing these segments helps in understanding varying design and material demands, such as fork rake, axle standards, and tire clearance specifications. The distribution channels highlight the dominant reliance on OEM supply chains, indicating the market's high barrier to entry for new players focusing solely on manufacturing.

- By Type:

- Road Bike

- Mountain Bike (MTB)

- Gravel/Cyclocross

- E-Bike

- By Distribution Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket

- By Material Grade:

- Standard Modulus (SM)

- Intermediate Modulus (IM)

- High Modulus (HM)

Value Chain Analysis For Carbon Fiber Bicycle Front Fork Market

The value chain for carbon fiber front forks begins with upstream analysis, which involves the highly consolidated supply of precursor materials, primarily Polyacrylonitrile (PAN) fiber, which is then processed into carbon fiber tow. Key suppliers in this stage are concentrated globally, impacting material pricing and availability. This stage is followed by resin formulation, where specialized epoxy systems are developed to maximize the composite's strength and fatigue resistance. Downstream analysis focuses on the complex manufacturing process, including fiber cutting, manual layup (often the bottleneck), curing (autoclave or resin transfer molding), and rigorous finishing and quality inspection (NDT). Efficiency gains at this stage are crucial for cost competitiveness.

The primary distribution channel involves selling directly to major bicycle OEMs (Original Equipment Manufacturers) such as Specialized, Trek, Giant, and Cannondale. These sales account for the largest volume of forks, integrated into complete bicycle builds. The OEM channel demands high-volume capacity, consistent quality, and competitive pricing. The secondary channel, the aftermarket, distributes forks through specialized bicycle component distributors, wholesale networks, and direct-to-consumer platforms. This channel typically involves premium, branded products and replacement or upgrade parts, commanding higher retail margins.

Direct distribution often occurs through proprietary brand stores or online platforms operated by major component manufacturers, providing a streamlined sales path and better control over branding and pricing. Indirect distribution relies heavily on regional specialized distributors and independent bicycle dealers (IBDs), who provide crucial installation and technical support to the end-user. The success of the indirect channel is tied to the retailer's technical expertise in handling and installing high-performance carbon components correctly. Overall, the value chain is characterized by high technological requirements at the manufacturing stage and a dual distribution strategy targeting both mass production (OEM) and high-margin replacement (Aftermarket).

Carbon Fiber Bicycle Front Fork Market Potential Customers

The primary end-users and buyers of carbon fiber bicycle front forks fall into distinct categories defined by their purchasing volume and performance requirements. The largest volume purchasers are global bicycle Original Equipment Manufacturers (OEMs), who incorporate these forks into mid-to-high-end road, MTB, and gravel bikes. These manufacturers require consistent supply, adherence to strict specifications, and economies of scale, making their purchasing decisions highly price and reliability sensitive. The second major group comprises competitive and professional cycling teams, who demand the absolute highest performance, often requiring custom layups and specific aerodynamic profiles for marginal gains.

Individual consumers form the core of the aftermarket segment. This group is segmented into three main types: serious cycling enthusiasts who upgrade components for performance, recreational riders prioritizing comfort and weight savings, and e-bike owners looking for lighter or stiffer replacement components. These individual buyers are typically served through Independent Bicycle Dealers (IBDs) and online retail channels. They value brand reputation, warranty coverage, and technological innovation (e.g., integrated cable routing, vibration dampening features). Specialized component retailers and wholesale distributors act as intermediaries, stocking diverse inventories to meet the needs of this varied consumer base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 580.5 Million |

| Market Forecast in 2033 | USD 950.2 Million |

| Growth Rate | 7.3% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ENVE Composites, 3T Cycling, Look Cycle, Easton Cycling, Fox Factory, RockShox (SRAM), Hylix Carbon, Deda Elementi, Ritchey Design, Zipp (SRAM), Time Sport, Whisky Parts Co., Columbus Tubi, Winspace, Farsports, Trigon Sports, Deng Fu, Toseek, Sensation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Carbon Fiber Bicycle Front Fork Market Key Technology Landscape

The technological landscape of the carbon fiber bicycle front fork market is rapidly evolving, driven by the necessity for enhanced strength, reduced weight, and improved shock absorption capabilities. A key technology is Monocoque Construction, where the fork structure is molded as a single, integrated piece rather than bonded sections. This process eliminates potential stress points associated with joints, resulting in superior strength and lower overall weight, significantly enhancing the structural integrity critical for safety and performance, especially in competitive applications. Advanced Resin Transfer Molding (RTM) techniques are also gaining prominence, allowing for more precise control over fiber orientation and minimizing void content compared to traditional prepreg layup, thus improving consistency and reducing manufacturing cycle times.

Another crucial technological development involves optimized Fiber Layup Schedules. This entails using Computational Fluid Dynamics (CFD) and Finite Element Analysis (FEA) to determine the exact angle and placement of each carbon fiber sheet layer (ply) to maximize stiffness in key load-bearing areas (like the crown and dropouts) while ensuring compliance for vibration dampening in the fork legs. Manufacturers frequently utilize varied material grades—Standard, Intermediate, and High Modulus—within a single fork structure, a process known as selective material reinforcement, to precisely tune the ride quality and strength profile. High-modulus fibers offer extreme stiffness but are often more brittle, requiring strategic placement.

Integration of disc brake technology has also necessitated substantial redesigns, leading to the development of asymmetric fork legs to handle the intense, one-sided braking forces exerted by disc calipers. Most modern high-end carbon forks now feature fully integrated cable and hose routing systems. This not only significantly improves aerodynamics by hiding cables from the wind but also provides a sleek aesthetic valued by consumers. Furthermore, the adoption of proprietary damping technologies, sometimes embedded within the carbon structure itself, reflects ongoing efforts to enhance rider comfort and reduce fatigue over long distances, positioning technological superiority as a key differentiator in the highly competitive premium segment.

Regional Highlights

The global Carbon Fiber Bicycle Front Fork Market displays distinct regional characteristics in terms of production capacity, consumption trends, and market maturity. Asia Pacific (APAC) dominates the global manufacturing landscape, particularly due to Taiwan, China, and Vietnam housing the largest facilities for high-volume bicycle and component production, serving virtually all major global OEMs. This region benefits from established supply chains and expertise in composite manufacturing, making it the primary sourcing hub, driving both cost-effectiveness and rapid scaling.

North America and Europe represent mature, high-value consumption markets. These regions are characterized by a high penetration of premium bicycles, strong professional and enthusiast cycling cultures, and greater disposable income directed towards high-performance upgrades. Europe, in particular, is experiencing significant growth driven by favorable policies promoting cycling and the strong uptake of performance-oriented e-bikes, which require specialized, reinforced carbon components. The demand in these regions is focused on innovation, brand prestige, and the latest aerodynamic and integration standards.

The rest of the world, including Latin America, the Middle East, and Africa (MEA), currently holds a smaller market share but offers substantial long-term growth potential. As infrastructure improves and cycling interest grows in urban centers, demand for mid-range and high-end carbon components is expected to increase. However, market development in these areas is often hampered by import tariffs, lower income levels, and a preference for more cost-effective aluminum alternatives in entry-level and mid-range segments.

- Asia Pacific (APAC): Dominates manufacturing volume; key hub for OEM supply; fastest consumption growth due to rising domestic cycling trends and disposable income.

- North America: High penetration of premium and aftermarket components; strong market for gravel and high-end road cycling; focus on brand innovation (e.g., ENVE, Zipp).

- Europe: Mature market with robust growth fueled by performance e-bikes and urban commuting infrastructure; early adopter of integrated technology and safety standards.

- Latin America (LATAM): Emerging market; potential growth constrained by economic instability but increasing interest in recreational cycling.

- Middle East & Africa (MEA): Niche, high-end market focused on luxury sports equipment and limited to affluent consumer bases in major urban centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Carbon Fiber Bicycle Front Fork Market.- ENVE Composites

- 3T Cycling

- Look Cycle

- Easton Cycling

- Fox Factory

- RockShox (SRAM)

- Hylix Carbon

- Deda Elementi

- Ritchey Design

- Zipp (SRAM)

- Time Sport

- Whisky Parts Co.

- Columbus Tubi

- Winspace

- Farsports

- Trigon Sports

- Deng Fu

- Toseek

- Sensation

- Bontrager (Trek)

- Specialized Bicycle Components

Frequently Asked Questions

Analyze common user questions about the Carbon Fiber Bicycle Front Fork market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of a carbon fiber bicycle front fork over an aluminum fork?

Carbon fiber forks offer a superior strength-to-weight ratio, allowing for substantial weight reduction without compromising stiffness. Crucially, carbon fiber inherently possesses better vibration dampening properties, which significantly enhances rider comfort and reduces fatigue compared to stiffer metal alloys.

How does the adoption of disc brakes affect the design of carbon front forks?

Disc brake adoption requires carbon forks to be significantly reinforced, often asymmetrically, particularly on the left leg to manage the high torsional stress induced by disc braking forces. Modern designs also incorporate flat-mount standards and thru-axles for increased stiffness and reliable wheel retention.

Which market segment is expected to show the fastest growth rate?

The Gravel/Cyclocross segment is anticipated to exhibit the fastest growth, driven by consumer demand for versatile bikes capable of handling both pavement and rough terrain. This demands carbon forks with wider tire clearance and optimized compliance for mixed-surface riding.

Is the manufacturing process of carbon fiber forks automated?

While the curing and inspection phases utilize advanced automation (autoclaves, NDT), the critical process of laying up the individual carbon fiber sheets (prepregs) often remains partially manual to ensure the precise orientation necessary for optimal performance and safety, though robotic assistance is increasing.

What role does High Modulus (HM) carbon fiber play in fork manufacturing?

High Modulus (HM) carbon fiber is used selectively in critical areas, such as the steerer tube or crown, to achieve maximum stiffness with the minimum amount of material. This strategic use of HM fiber is key to reducing overall fork weight while maintaining required handling precision.

What are the main distribution channels for carbon fiber bicycle front forks?

The primary distribution channel is Original Equipment Manufacturer (OEM) sales, supplying forks directly to bicycle manufacturers for assembly. The secondary, high-margin channel is the Aftermarket, serving individual consumers through specialized retailers for upgrades and replacements.

How is sustainability addressed in the carbon fiber bicycle component market?

Sustainability efforts focus on developing effective composite recycling processes, reducing manufacturing waste through optimization (aided by AI), and exploring bio-based resin alternatives, although widespread industrial recycling of thermoset composites remains a significant technical challenge.

What are the key safety considerations for carbon front forks?

Safety considerations are paramount and include rigorous Non-Destructive Testing (NDT) like X-ray or ultrasound scanning to detect internal voids or fiber misalignment, ensuring compliance with international standards (e.g., ISO 4210) regarding fatigue life and impact resistance.

How does the cost structure of carbon forks compare to metal forks?

Carbon fiber forks typically have a much higher cost structure due to the expensive raw materials (PAN precursor, specialized resins), the energy-intensive curing process (autoclave), and the high level of skilled labor and advanced technology required for quality assurance.

What recent technological integration trends are observed in high-end carbon forks?

Recent trends include full cable/hose integration, adoption of proprietary elastomers or materials for enhanced compliance (vibration dampening), and optimized aerodynamic profiles achieved through advanced simulation and generative AI design tools.

Which geographic region is the largest consumer of carbon fiber front forks?

While manufacturing is concentrated in APAC, North America and Europe collectively represent the largest consuming regions for high-end and aftermarket carbon fiber forks, driven by a mature cycling culture and significant disposable income for premium cycling gear.

How do manufacturers ensure consistency in carbon fiber fork production?

Consistency is ensured through standardized prepreg handling protocols, automated process control in curing ovens, and comprehensive quality assurance measures, including detailed traceability records for every batch and rigorous post-production testing.

What defines the Road Bike segment's demand for carbon forks?

The road bike segment demands forks prioritizing low weight and superior aerodynamic characteristics, often featuring narrow profiles, minimum frontal area, and integrated designs that seamlessly blend with the frame to minimize drag at high speeds.

Are carbon fiber forks suitable for heavy-duty applications like electric mountain bikes (eMTBs)?

Yes, but eMTBs require specialized, reinforced carbon forks designed with thicker layups and higher-grade materials to withstand the increased weight, torque, and braking forces inherent to electric-assist bicycles, ensuring safety under greater stress loads.

What is the significance of the "Layup Schedule" in carbon fork manufacturing?

The layup schedule dictates the orientation, number, and type of carbon fiber layers used. It is the most critical design element, determining the final component's stiffness, compliance, and strength profile, often specifically tailored using FEA simulation to the fork's intended use.

What are the primary restraints hindering rapid market adoption?

The main restraints are the high raw material costs and the labor-intensive nature of composite manufacturing, which results in a premium price point, making carbon fiber front forks inaccessible to the mass-market, entry-level bicycle segments.

How do competitive cycling events influence market innovation?

Professional cycling acts as a critical testing ground, driving rapid innovation. Teams demand continuous weight reduction and aerodynamic improvements, forcing manufacturers to push material science and manufacturing boundaries to secure a competitive edge.

What are the differences between Monocoque and Bonded carbon fork construction?

Monocoque construction molds the fork as one piece, offering superior structural integrity and eliminating potential failure points at joints. Bonded construction involves separately molding sections (like the steerer and blades) and joining them, which can be less costly but potentially less strong.

Does the market rely more on direct or indirect distribution channels?

The market volume relies heavily on indirect distribution through large OEMs (Original Equipment Manufacturers). However, for high-margin aftermarket sales and branded components, direct-to-consumer online platforms are increasingly important.

What is the role of Finite Element Analysis (FEA) in fork design?

FEA is used to digitally simulate the stresses, strains, and fatigue life of a proposed fork design under various riding loads. This allows engineers to optimize the fiber layup and identify potential failure zones before physical prototyping, saving significant time and cost.

What are the barriers to entry for new companies in this market?

Barriers include the requirement for large capital investment in specialized manufacturing equipment (autoclaves, cleanrooms), the need for highly skilled composite engineering expertise, and the necessity of establishing a reputation for safety and reliability to secure OEM contracts.

How are carbon fork components prepared for paint and finishing?

After curing and demolding, the components undergo sanding and surface preparation to remove imperfections. Primer layers are applied, followed by high-performance paints or clear coats, often incorporating UV inhibitors to protect the underlying resin from sun degradation.

Which segments utilize the majority of Intermediate Modulus (IM) carbon?

Intermediate Modulus (IM) carbon strikes a balance between stiffness, durability, and cost. It is widely used in the main structural sections of premium mass-market road and mountain bike forks where high performance is needed without the cost fragility of HM fibers.

What are the primary characteristics driving demand in the Mountain Bike (MTB) segment?

MTB demand is driven by the need for exceptionally robust construction, high torsional stiffness (for precise steering), and features such as generous tire clearance and integrated mounts for suspension or fender systems, often requiring thicker carbon walls for impact protection.

What geopolitical factors influence the carbon fiber supply chain?

The supply chain is sensitive to geopolitical events because the production of the critical raw material, PAN precursor, is concentrated among a few global chemical giants, making pricing and availability susceptible to trade regulations and international stability.

How important is the steerer tube in the structural integrity of the fork?

The steerer tube is one of the most critical load-bearing components, connecting the fork to the bicycle frame and handlebars. Carbon steerers must meet extremely high strength and fatigue standards, often incorporating internal aluminum inserts or thickened carbon layups at stress points.

What is the typical weight range for a high-performance carbon road bike fork?

A typical high-performance carbon road bike front fork, including the uncut steerer tube, generally weighs between 300 grams and 400 grams, depending on the focus between pure aerodynamics and ultra-light climbing efficiency.

How do technological advancements support the E-Bike segment?

Technological advancements provide specialized resin and fiber chemistries that enable the creation of stiffer, higher-impact-resistant forks required for e-bikes, which carry heavier batteries and sustain higher average speeds, demanding enhanced safety margins.

What is the role of component distributors in the aftermarket?

Component distributors play a vital role in holding inventory, managing logistics, and providing technical support and warranty services to Independent Bicycle Dealers (IBDs), enabling efficient access to a wide variety of specialized branded forks for upgrade purposes.

What material is used to create the dropouts in modern carbon forks?

Dropouts are typically constructed from either reinforced carbon fiber with high-modulus layups or, more commonly for durability and thread integrity, bonded aluminum or titanium inserts, particularly in designs utilizing thru-axles.

How are aesthetic demands met in carbon fork manufacturing?

Aesthetic demands are met through high-quality surface finishes, precise mold tooling, seamless integration with bicycle frames, and custom paint or clear-coat options that showcase the visible carbon weave (3K or 12K), often achieved using high-gloss protective finishes.

What impact does raw material consistency have on final product quality?

Inconsistent raw materials, particularly variations in carbon fiber tow quality or resin viscosity, can lead to structural defects like uneven curing, porosity, or compromised fiber-resin adhesion, severely impacting the final fork's strength and safety profile.

What is the significance of the "rake" or "offset" dimension in fork design?

Rake (or offset) is the distance the front axle is positioned ahead of the steering axis. It is a critical geometric parameter that determines the trail dimension, directly influencing the bicycle's handling characteristics, stability, and responsiveness at speed.

Are specialized tools required for installing carbon front forks?

Yes, installation requires specialized tools, including a torque wrench for precise tightening of stem bolts (critical for carbon steerer tubes) and specific cutting guides for accurately trimming the carbon steerer tube, necessitating professional installation to maintain warranty and safety.

How do manufacturers cater to custom branding requests from OEMs?

OEMs receive customized specifications regarding geometry, layup schedule, and aesthetic requirements. Manufacturers provide co-branding options, including proprietary mold shapes and specific paint and decal applications, ensuring seamless integration with the OEM’s frame design.

What is the average lead time for high-volume OEM orders?

Lead times for high-volume OEM orders typically range from 90 to 180 days, depending on the complexity of the mold, material sourcing logistics, and the specific quality control requirements mandated by the bicycle brand.

What is the difference between dry carbon and prepreg carbon fiber?

Prepreg (pre-impregnated) carbon fiber is material that has already been saturated with a precise amount of resin and catalyst, offering consistency and requiring refrigeration. Dry carbon requires manual resin application (wet layup), which is less precise and less common in high-performance component manufacturing.

How is the market influenced by advancements in 3D printing technology?

3D printing technology primarily impacts the market by rapidly producing tooling, prototypes, and fixtures used in the composite layup process, significantly speeding up the research and development cycle for new fork geometries.

What risks are associated with purchasing unbranded carbon fiber forks?

Unbranded or generic carbon forks pose high risks due to uncertain quality control, unverified layup schedules, and unknown material grades. Such forks often fail to meet stringent safety standards, potentially leading to catastrophic failure and injury.

What factors determine the stiffness of a carbon front fork?

Stiffness is determined by three key factors: the grade of carbon fiber used (modulus), the total volume of material, and, most importantly, the fiber orientation (layup schedule) relative to the applied load vectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager