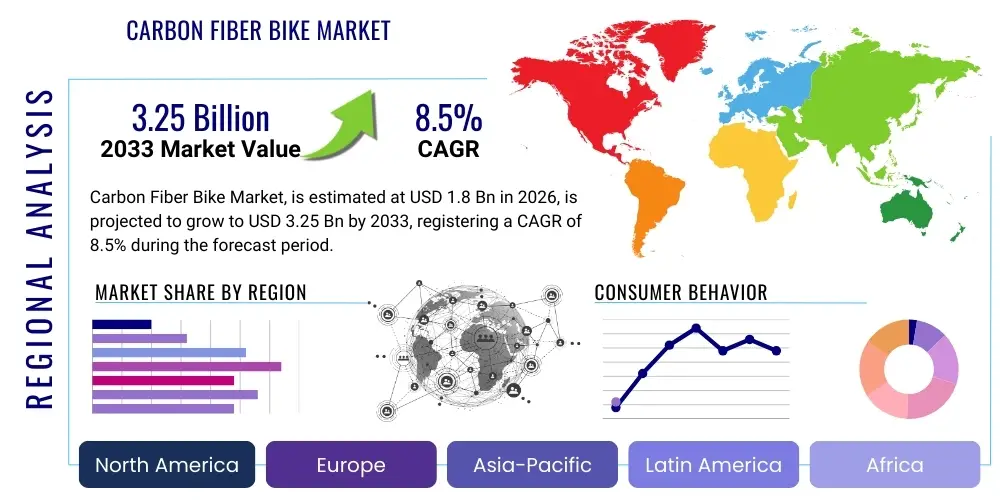

Carbon Fiber Bike Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439137 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Carbon Fiber Bike Market Size

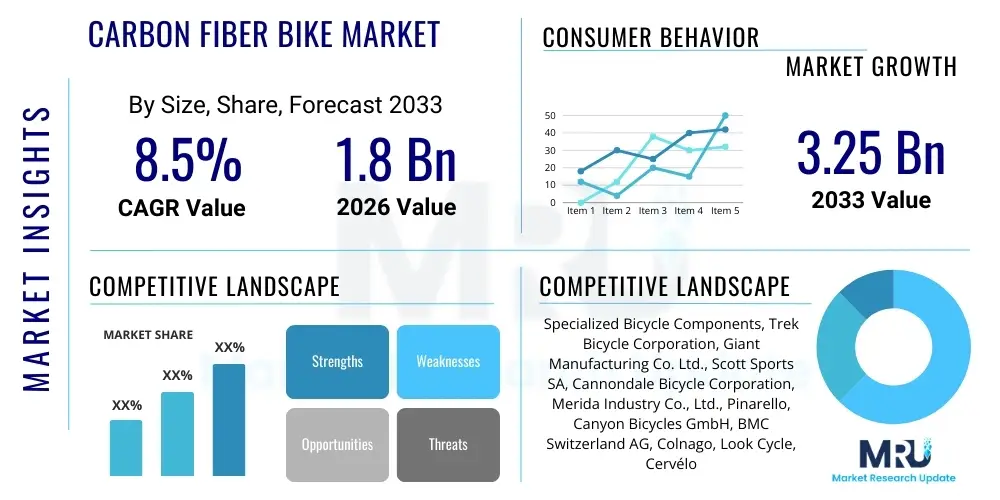

The Carbon Fiber Bike Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 3.25 Billion by the end of the forecast period in 2033.

Carbon Fiber Bike Market introduction

The Carbon Fiber Bike Market encompasses the production and sale of bicycles featuring frames and major components constructed primarily from carbon fiber reinforced polymer (CFRP). Carbon fiber is highly valued in bicycle manufacturing due to its exceptional strength-to-weight ratio, allowing for the creation of extremely lightweight yet stiff frames crucial for high-performance cycling, particularly in racing and competitive environments. The superior vibration damping characteristics of carbon fiber also enhance rider comfort and efficiency, contributing to its increasing adoption across various bicycle segments, including road, mountain, and gravel biking. This market is fundamentally driven by continuous innovation in material science and composite manufacturing techniques, leading to optimized aerodynamic profiles and customized stiffness zones in bike design.

Product descriptions within this segment highlight advanced manufacturing processes such as monocoque construction, which minimizes stress points and maximizes structural integrity. Major applications span professional sports, competitive amateur cycling, high-end recreational riding, and specialized commuting where low weight and high performance are paramount. The inherent benefits of carbon fiber, including unparalleled performance characteristics, resistance to fatigue compared to traditional metals, and the ability to achieve complex geometric frame shapes, firmly position it as the material of choice for premium bicycles. These benefits translate directly into measurable performance gains for cyclists, fueling demand, particularly in economically developed regions with strong cycling cultures and high disposable incomes.

The primary driving factors sustaining the market's trajectory include the rising global interest in cycling as both a professional sport and a leisure activity focused on health and fitness. Furthermore, technological advancements in carbon fiber fabrication, such as automated layup and resin infusion technologies, are improving production efficiency and frame reliability. Increased spending by consumers on premium sporting goods and the growing adoption of cycling for commuting in urban centers, where lightweight bikes offer significant advantages, further bolster market expansion. The continuous development of specialized carbon fiber components, beyond just frames, such as wheels, handlebars, and seat posts, is broadening the overall market scope.

Carbon Fiber Bike Market Executive Summary

The Carbon Fiber Bike Market is experiencing robust expansion, fundamentally driven by shifts in consumer preference towards high-performance, lightweight sporting equipment and increasing investment in professional cycling events globally. Business trends indicate a strong focus on vertical integration among leading manufacturers, enabling tighter control over the supply chain, particularly raw carbon fiber sourcing and advanced composite fabrication. Key market players are prioritizing research and development to introduce frames with superior aerodynamic efficiency and integrated electronic component compatibility, responding to the demand for smart and highly optimized cycling machines. Furthermore, the segmentation of the market is becoming increasingly specialized, with distinct categories emerging for gravel bikes, e-bikes utilizing carbon components, and ultra-lightweight climbing bikes, showcasing diversification beyond traditional road and mountain biking segments.

Regionally, the market demonstrates varied growth patterns. Asia Pacific, led by emerging economies and a surge in domestic cycling activities, is rapidly becoming a pivotal manufacturing hub and a significant consumption market. North America and Europe remain the primary revenue generators due to high consumer disposable income, established professional racing circuits, and deeply ingrained cycling infrastructures. Trends in these developed regions lean towards sustainability, driving demand for locally sourced or sustainably manufactured carbon components, although the overall environmental impact of carbon fiber production remains a point of consideration. Governments' investments in cycling infrastructure are also positively influencing market dynamics across major metropolitan areas.

Segment-wise, the road bike segment maintains market dominance, attributed to its large competitive and amateur base. However, the mountain bike and gravel bike segments are exhibiting the fastest growth rates, spurred by the rising popularity of off-road cycling and adventure sports. The high-performance segment (bicycles priced over USD 4,000) contributes significantly to market value, demonstrating consumers' willingness to pay a premium for incremental performance advantages. E-bike integration is a notable segment trend; while batteries add weight, manufacturers are utilizing carbon fiber to offset this weight and maintain desirable handling characteristics, ensuring carbon fiber remains relevant even in the motorized bicycle category.

AI Impact Analysis on Carbon Fiber Bike Market

Common user questions regarding AI's impact on the carbon fiber bike market often revolve around design optimization, material wastage reduction, and customization capabilities. Users are keen to understand if AI can democratize access to high-end custom frame geometry currently limited to professional athletes, and how AI-driven simulation can improve safety and structural integrity checks before physical prototyping. The key themes summarized from user concerns focus on AI’s role in automating the complex layup process to reduce human error and minimize expensive material scrap, thereby potentially lowering the overall cost of premium carbon frames. Users also expect AI to facilitate predictive maintenance recommendations based on integrated sensor data and riding patterns, enhancing the longevity and performance management of their high-value assets.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is rapidly revolutionizing the design and manufacturing lifecycle of carbon fiber bicycles. AI algorithms are increasingly employed in Computational Fluid Dynamics (CFD) simulations, allowing engineers to iterate thousands of frame designs virtually to achieve unparalleled aerodynamic efficiency, far exceeding the optimization achievable through traditional manual design methods. This capability accelerates the product development cycle and allows manufacturers to fine-tune specific stiffness and compliance characteristics tailored to different riding conditions or user profiles, leading to truly personalized cycling experiences. Furthermore, AI contributes significantly to predictive modeling for material stress and fatigue analysis, ensuring frames meet rigorous safety standards while pushing the boundaries of lightweight construction.

In the production phase, AI-powered computer vision systems are crucial for quality control, detecting microscopic flaws or inconsistencies in the carbon fiber layup process that are invisible to the naked eye. This precision is vital, as even minor imperfections in CFRP can lead to catastrophic failure under stress. Moreover, generative design tools, driven by AI, are being utilized to create complex internal structures (lattices or honeycomb patterns) that maximize strength using the minimum possible material, directly addressing material cost and sustainability concerns. This high level of precision and automation, driven by AI, is setting new benchmarks for quality, reliability, and performance in the premium segment of the carbon fiber bike market.

- AI-driven Generative Design for optimal frame geometry and aerodynamic profiles.

- Machine Learning applied to predictive fatigue analysis, improving frame longevity and safety.

- AI-powered Vision Systems for automated, precise quality control during carbon layup and curing processes.

- Optimization of production parameters (temperature, pressure, resin content) to reduce manufacturing waste and increase yield.

- Development of smart bikes utilizing embedded sensors and AI for real-time performance tracking and maintenance alerts.

DRO & Impact Forces Of Carbon Fiber Bike Market

The Carbon Fiber Bike Market's trajectory is primarily shaped by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), alongside significant external Impact Forces. The market is propelled by key drivers such as the escalating professionalization of cycling sports, constant demand for lightweight and high-performance bicycles, and technological breakthroughs in composite materials allowing for lighter and stiffer structures. Opportunities reside in the emerging segment of high-end e-bikes, where carbon fiber is critical for offsetting the battery weight, and in expanding into developing markets where disposable incomes are rising. However, the market faces strong restraints, notably the high cost associated with raw carbon fiber materials and skilled labor required for frame fabrication, making these bikes unaffordable for the mass market.

Significant impact forces are continually reshaping the industry landscape. Economic volatility affects discretionary consumer spending on luxury items like premium bicycles, creating demand fluctuations. Furthermore, stringent environmental regulations governing material sourcing and manufacturing waste disposal are pushing companies to invest in more sustainable, potentially recyclable, composite alternatives. Competitive forces remain high, driven by intellectual property disputes related to complex frame designs and manufacturing patents. The high barrier to entry for new competitors stems from the massive capital investment required for advanced composite manufacturing facilities and the necessity of establishing a reputation for uncompromising safety and reliability.

The primary driver remains the consumer desire for performance superiority. Unlike metal bikes, carbon fiber allows for customization of ride characteristics (e.g., stiffness in the bottom bracket area for power transfer vs. compliance in the seat stays for comfort), which is a unique selling proposition. This highly engineered customization capability sustains premium pricing and drives brand loyalty. Conversely, the market must navigate the significant restraint posed by concerns over frame repairability and environmental disposal at the end of the product lifecycle. Successful market players are those who can effectively mitigate the high costs through optimized production techniques while continuously leveraging opportunities in technological integration (such as integrating IoT components and advanced internal cable routing) to enhance product value.

Segmentation Analysis

The Carbon Fiber Bike Market is intricately segmented based on Type, Application, and Distribution Channel, reflecting the diverse requirements of the global cycling community. Type segmentation, which includes Road Bikes, Mountain Bikes, and Hybrid/Gravel Bikes, dictates the fundamental design characteristics—such as frame geometry, suspension requirements, and stiffness profile—necessary for optimal performance in specific terrains or racing disciplines. The Application segment differentiates between competitive racing, which demands ultimate performance and lightweight design, and leisure or fitness cycling, which prioritizes comfort and durability. This detailed segmentation allows manufacturers to target specific demographic and performance niches with highly optimized products, maximizing market penetration and revenue potential across the global consumer base.

The Road Bike segment traditionally holds the largest market share, driven by its established presence in professional sports and the amateur peloton. Road carbon frames are characterized by aerodynamic shaping and exceptional power transfer stiffness. However, the fastest-growing segment is Mountain Bikes, particularly the full-suspension cross-country (XC) and trail categories, where the weight savings and tunable strength of carbon fiber provide a measurable competitive edge over aluminum alternatives on challenging courses. The rapid growth of the Hybrid and Gravel bike segment, which blends the features of road and mountain biking, also signals a consumer trend toward versatile, multi-terrain cycling, capitalizing on the strength and comfort carbon frames offer.

Distribution channels further define market dynamics. The Offline channel, comprising specialized bike shops and retailers, is crucial as it offers consumers essential services like professional fitting, assembly, and maintenance, vital for high-value carbon products. The Online segment, while providing convenience and price comparison advantages, is primarily focused on components and accessories, though direct-to-consumer (D2C) sales of complete bikes are increasing, challenging traditional retail models. Understanding the nuanced interaction between these segments is essential for strategic planning, allowing companies to allocate resources effectively toward high-growth areas and optimize their supply chain and market communication strategies.

- By Type:

- Road Bikes

- Mountain Bikes (MTB)

- Hybrid/Gravel Bikes

- By Application:

- Racing and Professional Sports

- Leisure and Fitness Cycling

- Commuting

- By Distribution Channel:

- Online Sales (E-commerce, D2C)

- Offline Sales (Specialty Stores, Retail Chains)

Value Chain Analysis For Carbon Fiber Bike Market

The value chain of the Carbon Fiber Bike Market is complex and capital-intensive, starting with upstream raw material supply and culminating in downstream sales and post-purchase services. Upstream analysis focuses heavily on the procurement of high-grade carbon fiber prepregs and resins, which are typically sourced from specialized chemical and material science companies. The quality and cost of these raw materials critically influence the final product's performance and price. Due to the specialized nature of these materials, strong, long-term relationships with material suppliers are necessary to ensure supply stability and proprietary access to next-generation composites. Manufacturing itself involves intricate processes like filament winding, automated cutting, and precise hand layup of plies, requiring specialized machinery and highly skilled technicians.

Downstream activities are dominated by distribution and sales. The distribution channel is bifurcated into direct and indirect routes. Direct sales (D2C) channels, often utilized by newer, performance-focused brands, offer higher margins and direct customer feedback but require significant investment in logistics and customer service. The indirect channel, consisting of independent bicycle retailers (IBDs) and large sports goods chains, remains vital for market reach, especially for brands requiring widespread representation. IBDs are crucial as they provide the expert assembly, bike fitting, and maintenance services that are non-negotiable for high-end carbon fiber products, thereby validating the product's value proposition to the end consumer.

The efficiency of the distribution channel is paramount due to the fragility and high value of the product during transit. Both direct and indirect models rely on sophisticated logistics networks capable of handling large, irregularly shaped items with care. Value addition occurs not only in manufacturing but significantly in after-sales support, warranties, and crash replacement programs, which build consumer confidence in the long-term durability of the product. Optimization across the entire value chain, from negotiating favorable material costs upstream to optimizing inventory management downstream, is necessary to maintain competitiveness in this premium market segment.

Carbon Fiber Bike Market Potential Customers

Potential customers for the Carbon Fiber Bike Market primarily fall into three distinct demographic categories: the competitive professional and amateur racer, the high-income fitness enthusiast, and the technology-conscious commuter. The core market centers on competitive cyclists who prioritize performance metrics—weight, stiffness, and aerodynamics—above all else, viewing the carbon fiber bicycle as an essential tool for competitive advantage. These buyers are typically highly knowledgeable about component specifications, often making purchasing decisions based on marginal gains and brand reputation associated with professional endorsements. They represent the segment willing to invest the highest amounts, often upgrading frequently to the latest technological iterations.

The second major group comprises affluent recreational riders and dedicated fitness enthusiasts who utilize cycling as their primary form of exercise and leisure. For these buyers, while performance is important, factors such as comfort, aesthetics, and frame customization options play a significant role. They seek the premium riding experience that carbon fiber offers, valuing the material's superior vibration dampening for long-distance comfort and its durability. Marketing efforts towards this segment often focus on lifestyle branding, health benefits, and technological integration, such as compatibility with fitness trackers and GPS systems, making the product an attractive part of their upscale, active lifestyle.

The third emerging customer base includes urban commuters in developed economies who prioritize lightweight, durable, and low-maintenance bikes for daily transport. Although often overlooked for high-end carbon, this segment is increasingly targeted with specialized carbon hybrid or gravel bikes that offer the rigidity and speed needed to navigate urban environments efficiently. For this group, the long-term reliability and rust resistance of carbon fiber frames provide a strong incentive, justifying the higher initial investment compared to heavier aluminum frames. Manufacturers are beginning to design more practical carbon bikes for this use case, incorporating features like integrated fender mounts and rack attachments without sacrificing the material's inherent performance benefits.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 3.25 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Specialized Bicycle Components, Trek Bicycle Corporation, Giant Manufacturing Co. Ltd., Scott Sports SA, Cannondale Bicycle Corporation, Merida Industry Co., Ltd., Pinarello, Canyon Bicycles GmbH, BMC Switzerland AG, Colnago, Look Cycle, Cervélo Cycles, Fuji Bikes, Ridley Bikes, Wilier Triestina, Orbea, Time Sport, Argon 18, De Rosa, Lightweight. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Carbon Fiber Bike Market Key Technology Landscape

The technology landscape of the Carbon Fiber Bike Market is defined by continuous evolution in material science, manufacturing automation, and integrated design principles. Central to this landscape is the advancement in prepreg (pre-impregnated fiber) technology, where variations in fiber modulus (stiffness) and resin systems allow engineers to fine-tune the frame's ride quality, stiffness-to-weight ratio, and impact resistance. High-modulus fibers are employed in areas requiring maximum stiffness for power transfer (like the bottom bracket), while intermediate-modulus fibers are used where strength and durability are paramount. Furthermore, nanotechnology integration, particularly the use of carbon nanotubes or graphene, is being explored to enhance the interlaminar toughness of composites, potentially reducing the risk of catastrophic failure from impacts.

Manufacturing techniques are transitioning towards greater precision and automation. The adoption of robotics for automated fiber placement (AFP) and automated tape laying (ATL) is increasing, particularly for large-volume frame production, which significantly improves consistency and reduces manual layup errors inherent in traditional methods. However, many high-end frames still rely on expert hand layup for complex joints and intricate structures. Vacuum bagging, Resin Transfer Molding (RTM), and proprietary compression molding techniques are crucial for achieving optimal fiber compaction and minimizing voids within the composite structure, ensuring structural integrity while keeping weight at a minimum. These proprietary molding technologies form a significant part of the intellectual property held by leading manufacturers.

Beyond material and process innovation, the market is characterized by advancements in integrated design. This includes computational optimization methods like Finite Element Analysis (FEA) and Computational Fluid Dynamics (CFD), which are standard tools for design validation and aerodynamic shaping. The trend is moving towards complete system integration, where the frame, handlebars, seat post, and even wheels are designed holistically as a single aerodynamic unit, minimizing drag and maximizing efficiency. Furthermore, the integration of electronic shifting, power meters, and internal wiring systems within the carbon structure necessitates complex internal molding techniques that are constantly being refined to improve maintenance accessibility without compromising aerodynamic or structural goals.

Regional Highlights

Regional dynamics significantly influence the Carbon Fiber Bike Market, with North America and Europe historically dominating consumption and innovation, while Asia Pacific rapidly establishes itself as the global manufacturing and an increasingly important consumption hub.

- North America: The market here is characterized by high demand for premium, high-performance road and mountain bikes. Driven by a robust professional racing circuit and high consumer disposable incomes, North America focuses heavily on technological adoption, particularly disc brakes, electronic shifting, and advanced suspension systems in MTBs. Key market relevance is centered on early adoption of new technology and strong consumer demand for personalized and custom frame geometries.

- Europe: Europe remains the heartland of competitive cycling, hosting major events like the Tour de France. This region sustains strong demand across all segments, particularly high-end road and gravel bikes. Government policies promoting cycling as a sustainable mode of transport in countries like Germany, the Netherlands, and Scandinavia further boost the market, particularly in the premium commuter segment. Germany, Italy, and France are major production centers and crucial consumption markets.

- Asia Pacific (APAC): APAC is crucial both as a manufacturing base (Taiwan and China housing major global production facilities) and as the fastest-growing consumption market. Rising middle-class populations in China, Japan, and South Korea, coupled with increasing interest in fitness and cycling events, are fueling explosive demand. The region is seeing rapid urbanization, pushing demand for higher quality, lightweight bikes for fitness and leisure purposes.

- Latin America: This region presents significant growth potential, though currently limited by varying economic stability and lower disposable incomes compared to North America and Europe. Demand is concentrated in professional competitive cycling (e.g., Colombia) and upper-income recreational riders. The market requires localized strategies focusing on durable, performance-oriented frames suitable for diverse terrain.

- Middle East and Africa (MEA): Market growth in the MEA region is niche but expanding, driven primarily by government investment in promoting sporting events and leisure activities in affluent Gulf Cooperation Council (GCC) nations. Demand is heavily concentrated on high-end luxury carbon road bikes, reflecting high discretionary spending among a specific demographic.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Carbon Fiber Bike Market.- Specialized Bicycle Components

- Trek Bicycle Corporation

- Giant Manufacturing Co. Ltd.

- Scott Sports SA

- Cannondale Bicycle Corporation

- Merida Industry Co., Ltd.

- Pinarello

- Canyon Bicycles GmbH

- BMC Switzerland AG

- Colnago

- Look Cycle

- Cervélo Cycles

- Fuji Bikes

- Ridley Bikes

- Wilier Triestina

- Orbea

- Time Sport

- Argon 18

- De Rosa

- Lightweight

Frequently Asked Questions

Analyze common user questions about the Carbon Fiber Bike market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Carbon Fiber Bike Market?

The Carbon Fiber Bike Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% during the forecast period from 2026 to 2033, driven by increasing consumer demand for lightweight performance bicycles.

Are carbon fiber bikes durable and how long do they typically last?

Carbon fiber bikes are highly durable and, when properly maintained, can last indefinitely as the material does not fatigue like metal. However, their longevity is sensitive to high-impact damage. Leading manufacturers offer extensive warranties, reflecting confidence in their structural integrity.

What are the primary segments driving demand in the carbon fiber bicycle market?

The primary segments driving demand include high-performance Road Bikes, which hold the largest market share, and Mountain Bikes and Gravel Bikes, which are exhibiting the fastest growth due to the rising popularity of off-road and adventure cycling disciplines.

What role does Artificial Intelligence (AI) play in the manufacturing of carbon fiber bikes?

AI is crucial for optimizing frame design (generative design and aerodynamic simulation), improving manufacturing efficiency through automated quality control, and performing predictive fatigue analysis to enhance safety and structural reliability before prototyping.

Which geographical region is the major manufacturing hub for carbon fiber bikes?

Asia Pacific (APAC), particularly Taiwan and China, serves as the dominant global manufacturing hub for carbon fiber bikes due to established composite material supply chains, advanced manufacturing infrastructure, and competitive production costs.

What are the main restraints affecting market growth for carbon fiber bikes?

The primary restraints include the high cost of specialized raw carbon fiber materials, the labor-intensive nature of the manufacturing process requiring specialized skills, and increasing environmental concerns regarding the repairability and end-of-life disposal of carbon composites.

How is the e-bike trend impacting the demand for carbon fiber frames?

The e-bike trend is positively impacting the demand for carbon fiber frames, as manufacturers utilize the material's lightweight and high-stiffness properties to offset the significant added weight of batteries and motors, maintaining optimal handling and performance characteristics.

What is the significance of the distribution channel in the carbon fiber bike market?

The Offline Distribution Channel (specialty bike shops) is highly significant because it provides essential services for high-value carbon products, such as professional bike fitting, expert assembly, and crucial long-term maintenance, which are necessary to validate the product's premium price point.

How do manufacturers ensure the safety and structural integrity of carbon fiber frames?

Manufacturers ensure safety through rigorous testing including Finite Element Analysis (FEA), extensive fatigue testing, proprietary lay-up schedules, and the use of high-tech manufacturing processes like Resin Transfer Molding (RTM) to minimize voids and maximize material density and strength.

Who are the primary end-users or potential customers for carbon fiber bikes?

Potential customers include competitive professional and serious amateur racers prioritizing performance, high-income fitness and leisure cyclists valuing comfort and aesthetics, and an emerging segment of commuters seeking lightweight, durable, high-performance transportation options.

What technological advancements are key in the carbon fiber material science for cycling?

Key advancements include proprietary high-modulus and ultra-high-modulus carbon fiber usage, advanced resin systems for enhanced interlaminar toughness, and exploration of nanotechnology integration (e.g., carbon nanotubes) to improve composite strength and impact resistance.

How is the market addressing the high cost of carbon fiber materials?

The market addresses high material costs through vertical integration, optimizing production yields via AI-assisted automated layup processes, and focusing on high-value, high-margin premium products where consumers accept the cost premium for performance gains.

Which type of carbon bike, Road or Mountain, holds the largest market share?

Road Bikes traditionally hold the largest market share in terms of value, driven by the size of the competitive road cycling community and the high-end nature of aerodynamic race frames.

What defines the upstream segment of the carbon fiber bike value chain?

The upstream segment is defined by the sourcing and procurement of specialized raw materials, primarily high-grade carbon fiber prepregs and proprietary resins, which are critical inputs determining the final product's quality and performance characteristics.

Why is customization important in the carbon fiber bike market?

Customization is vital because carbon fiber allows for the precise tuning of stiffness and compliance in different frame sections, enabling manufacturers to tailor the bicycle's ride quality and performance characteristics specifically for racing, endurance, or off-road use, maximizing rider efficiency and comfort.

What is the role of professional racing in driving carbon fiber bike market trends?

Professional racing acts as a crucial technology incubator and marketing platform. New innovations in aerodynamics, material science, and integration are first validated in professional circuits before being trickled down to the consumer market, fueling aspirational purchases.

How does the environmental impact of carbon fiber bikes pose a restraint?

The environmental impact acts as a restraint due to the energy-intensive nature of carbon fiber production and the difficulty associated with recycling cured composite materials, leading to concerns regarding sustainability and end-of-life disposal among environmentally conscious consumers and regulators.

What are the key features of the fastest-growing segment in the market?

The fastest-growing segment, Mountain and Gravel Bikes, features highly resilient carbon frames, often incorporating full-suspension designs (for MTBs) or compliance-enhancing features (for Gravel bikes), focusing on lightweight durability suitable for challenging, multi-terrain adventure cycling.

How are leading manufacturers differentiating their carbon fiber products?

Leading manufacturers differentiate products through proprietary composite lay-up techniques, unique aerodynamic frame shapes validated by CFD, patented manufacturing processes (e.g., compression molding), and seamless integration of electronic components and hydraulic lines.

What economic factors influence consumer spending on high-end carbon bikes?

Economic stability, high consumer disposable incomes, and positive consumer confidence indices significantly influence purchasing decisions, as carbon fiber bikes are typically considered high-value discretionary luxury goods.

What is the primary benefit of monocoque construction in carbon fiber frames?

Monocoque construction, where the frame is molded as one continuous piece, minimizes the number of joints and bonding points, leading to a stronger, lighter, and more structurally integrated frame that maximizes power transfer and aerodynamic efficiency.

How does carbon fiber manufacturing compare to traditional metal frame production?

Carbon fiber manufacturing is significantly more complex, involving specialized layup and curing processes requiring high-pressure and temperature control, contrasting with the welding and manipulation techniques used for aluminum and steel frames. This complexity increases costs but allows for greater design freedom.

Why are specialized retailers important for carbon fiber bike sales?

Specialized retailers are crucial because the high cost and performance demands of carbon bikes require personalized attention, expert sizing, professional assembly, and ongoing technical support that standard mass retailers cannot adequately provide, ensuring customer satisfaction and safety.

What is the significance of the stiffness-to-weight ratio in carbon frame design?

The stiffness-to-weight ratio is paramount as it dictates a bike's efficiency; high stiffness ensures minimal energy loss during pedaling (maximum power transfer), while low weight is critical for climbing and acceleration, offering a competitive advantage.

How do global supply chain issues affect the carbon fiber bike market?

Global supply chain disruptions, particularly impacting the delivery of high-grade carbon fiber prepregs and high-end components (like electronic groupsets), lead to increased lead times, inflated production costs, and potential inventory shortages across the market.

What opportunities exist for new entrants in the carbon fiber bike market?

Opportunities for new entrants lie primarily in the direct-to-consumer (D2C) model, focusing on niche segments like custom geometry gravel bikes, utilizing AI-driven design tools, or pioneering sustainable, partially recyclable composite materials to appeal to environmentally conscious consumers.

Which technological trend is currently revolutionizing frame aerodynamics?

The technological trend of complete system integration, where frame, handlebars, stem, and even wheel interfaces are designed concurrently using advanced Computational Fluid Dynamics (CFD) to operate as a single, low-drag unit, is currently revolutionizing frame aerodynamics.

How is the market utilizing big data and IoT?

Big data and IoT are utilized by integrating smart sensors into carbon frames and components to gather real-time performance, maintenance, and stress data, allowing manufacturers to refine future designs and offer cyclists personalized performance feedback and predictive maintenance alerts.

What are the key differences between carbon road bikes and carbon mountain bikes?

Carbon road bikes prioritize aerodynamic profiles, maximum power transfer stiffness, and minimal weight. Carbon mountain bikes prioritize impact resistance, durability, and often feature complex carbon layups designed to accommodate full-suspension pivot points while offering engineered flex for comfort and traction.

What are the barriers to entry for manufacturers in this market?

Significant barriers to entry include the immense capital investment required for specialized composite manufacturing facilities, the need for proprietary technological know-how (especially related to layup and curing processes), and the time required to build a reputation for product safety and reliability.

How do intellectual property (IP) disputes affect the market?

IP disputes, frequently centered around complex aerodynamic frame patents, proprietary carbon layups, and unique manufacturing processes, can stifle innovation and create legal uncertainty, impacting smaller companies and leading to costly litigation among major players.

What are the future prospects for sustainable carbon fiber in cycling?

Future prospects involve significant investment in developing thermoplastic carbon fibers that are theoretically more recyclable than current thermoset composites, alongside exploration of bio-based resins, aiming to mitigate the material's current environmental challenges and meet future regulatory demands.

How has the adoption of disc brakes affected carbon frame design?

The widespread adoption of disc brakes necessitated complete redesigns of carbon frames, requiring increased stiffness and strength in fork blades and chainstays to manage the asymmetric forces exerted by the disc calipers, while also accommodating new axle standards.

Where is the highest concentration of high-income consumers driving market value?

The highest concentration of high-income consumers driving market value is found primarily in North America (especially the USA) and Western Europe (Germany, UK, France), which have established cultures of cycling expenditure and strong economic stability.

How is the market balancing weight reduction with safety standards?

The market balances weight reduction and safety through advanced engineering techniques such as precise Finite Element Analysis (FEA) to ensure load-bearing zones maintain required strength, and by using varying moduli of fiber only where specific stiffness is needed, minimizing material in non-critical areas.

What is the significance of the warranty offered by carbon fiber bike manufacturers?

The warranty is highly significant as it provides consumers with assurance regarding the structural integrity and durability of a high-value product, often covering manufacturing defects for several years or the lifetime of the frame, crucial for building trust in the material.

Which application segment shows strong potential for growth in developing regions?

The Leisure and Fitness Cycling application segment shows strong growth potential in developing regions, fueled by rising disposable incomes and increasing governmental promotion of non-motorized transport and active lifestyle choices in urban centers.

What are prepregs in the context of carbon fiber bike manufacturing?

Prepregs (pre-impregnated materials) are carbon fiber sheets or tapes that have been uniformly coated with a precise amount of thermosetting resin, ready for precise cutting and layup. They are essential as they ensure optimal fiber-to-resin ratio for maximum strength and minimal weight.

How are carbon fiber manufacturing techniques evolving to improve quality consistency?

Manufacturing techniques are evolving by integrating robotics for automated fiber placement (AFP), employing sophisticated laser cutting for precise ply shaping, and utilizing AI-powered vision systems for real-time quality inspection during the manual or automated layup process.

Why is frame repairability a significant concern for carbon fiber bikes?

Frame repairability is a concern because damage often requires specialized knowledge, material science expertise, and sometimes proprietary processes to ensure the repaired structure maintains the original intended strength and performance characteristics, making repairs costly and often complex.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Carbon Fiber Bike Wheelset Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Carbon Fiber Bike Market Size Report By Type (Road Bikes, Mountain Bikes, Others), By Application (Bicycle Racing, Bicycle Touring, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager