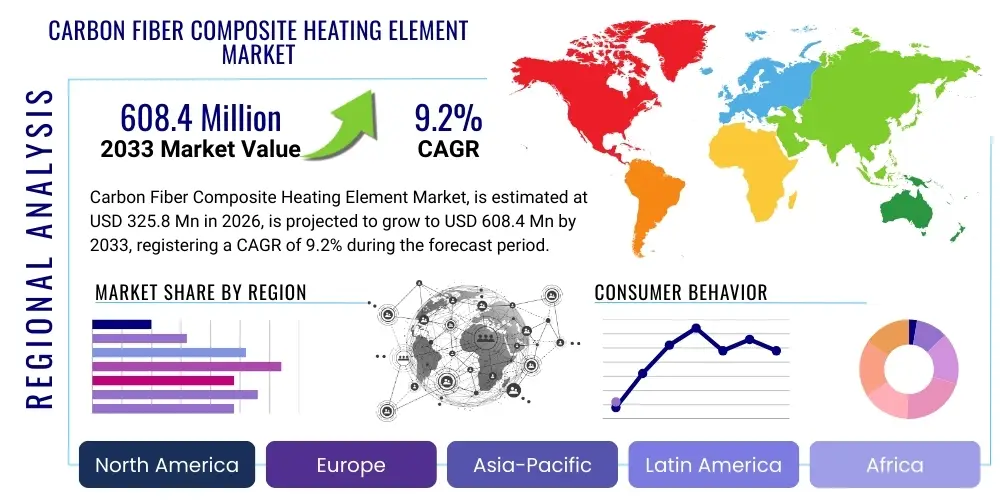

Carbon Fiber Composite Heating Element Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436214 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Carbon Fiber Composite Heating Element Market Size

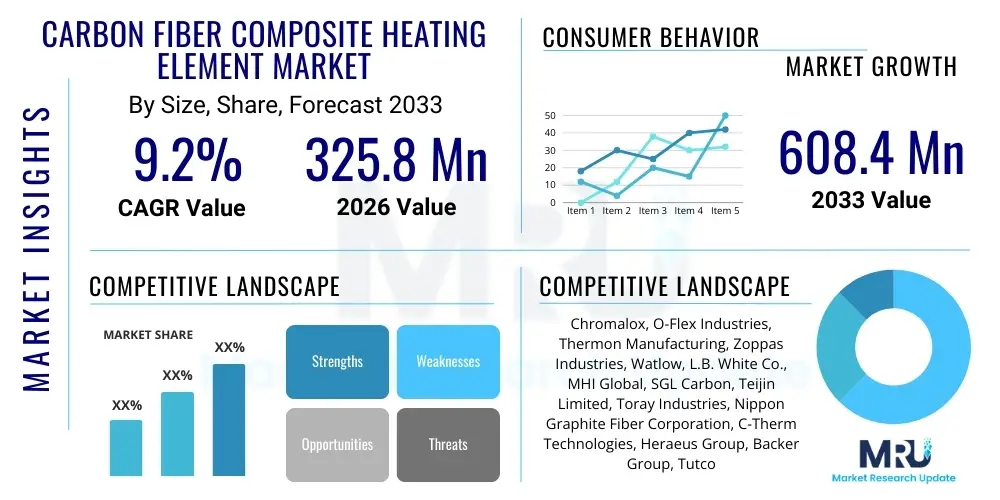

The Carbon Fiber Composite Heating Element Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.2% between 2026 and 2033. The market is estimated at USD 325.8 million in 2026 and is projected to reach USD 608.4 million by the end of the forecast period in 2033.

Carbon Fiber Composite Heating Element Market introduction

The Carbon Fiber Composite Heating Element market involves advanced thermal management solutions utilizing carbon fiber materials embedded within a polymer or ceramic matrix to generate heat efficiently and uniformly. These elements leverage the exceptional thermal conductivity, lightweight nature, and high tensile strength of carbon fibers, offering significant advantages over traditional metallic heating wires (such as Nichrome). The core product is a low-mass, rapid-response heater that provides durability and corrosion resistance across demanding environments.

Major applications driving market penetration include the automotive sector for lightweight seat heating and battery thermal management; aerospace for anti-icing systems on wings and fuselages; and various industrial processes requiring precise, localized heating, such as curing composite materials or thermal processing in volatile atmospheres. The demand is fundamentally driven by global mandates for energy efficiency, the electrification trend in transportation, and the need for heating systems that can conform to complex geometries without adding excessive weight or bulk.

The primary benefits of these elements encompass superior energy conversion efficiency, extremely fast ramp-up times due to low thermal mass, inherent flexibility, and excellent longevity due to resistance to thermal fatigue and oxidation. Furthermore, the inherent safety profile, stemming from lower operating voltages often required compared to high-voltage resistive wires, makes them attractive for consumer and medical applications. Key driving factors include technological advancements in matrix materials, cost reduction through improved manufacturing processes (like continuous carbon fiber processing), and increasing adoption in high-growth areas like electric vehicles (EVs) and advanced manufacturing.

Carbon Fiber Composite Heating Element Market Executive Summary

The Carbon Fiber Composite Heating Element Market is characterized by robust growth, primarily fueled by the increasing global emphasis on light weighting and energy efficiency, particularly within the automotive and aerospace industries. Business trends indicate a shift towards customization and integration, where manufacturers are focusing on developing flexible, geometrically complex heating pads tailored for specific applications like EV battery thermal regulation and wearable technology. Investment in research and development is concentrated on enhancing power density and reducing the overall element thickness to improve response time and integration ease. Strategic collaborations between carbon fiber suppliers, composite manufacturers, and end-user OEMs are crucial for streamlining the value chain and accelerating adoption.

Regional trends demonstrate that Asia Pacific (APAC) is emerging as the fastest-growing market, driven by massive electric vehicle production in China and South Korea, coupled with expanding industrial manufacturing sectors requiring precise thermal solutions. North America and Europe remain mature but vital markets, characterized by high adoption rates in premium automotive brands and critical aerospace maintenance and manufacturing. Legislative drivers in Europe related to vehicle efficiency and emissions standards further stimulate the demand for lightweight heating solutions.

Segmentation trends highlight that the Flexible Composite Heating Element segment dominates due to its applicability in seating, interiors, and portable medical devices. By application, the Automotive segment holds the largest market share, directly benefiting from the transition to battery electric vehicles (BEVs), where efficient thermal management is paramount for range optimization and battery life. The Industrial segment, focusing on composite curing and specialized drying, shows strong potential for high-value growth, driven by the increasing use of advanced materials that require precise thermal profiles during manufacturing.

AI Impact Analysis on Carbon Fiber Composite Heating Element Market

User inquiries regarding AI's influence typically revolve around how artificial intelligence can optimize the performance, manufacturing efficiency, and reliability of carbon fiber composite heating elements. Users frequently question AI's role in predictive maintenance (forecasting element failure), optimizing complex cure cycles during composite manufacturing, and designing new element geometries for maximum thermal uniformity. The key themes summarized from this analysis indicate that AI is expected to move beyond simple automation to highly complex material characterization and process optimization, ensuring material integrity, reducing waste, and customizing thermal output dynamically based on real-time operational data gathered from embedded sensors.

- AI-driven Predictive Maintenance: Utilizing machine learning algorithms to analyze sensor data (temperature, resistance, current) from installed heating elements to predict potential failure points, thereby extending service life and reducing unexpected downtimes in critical industrial or aerospace applications.

- Manufacturing Process Optimization: Employing AI for real-time control of curing and bonding processes during element fabrication, ensuring optimal fiber alignment, resin infusion, and dimensional stability, leading to higher quality and reduced material waste.

- Enhanced Thermal Management Systems: Integrating AI into smart heating systems (especially in EVs) to dynamically adjust heat distribution across the element based on ambient conditions, user preferences, or battery state-of-charge, maximizing energy efficiency and minimizing power consumption.

- Generative Design of Composite Structures: Using AI algorithms to rapidly explore millions of possible composite heating element geometries and fiber orientations, optimizing for factors such as weight, power density, heat distribution uniformity, and manufacturing feasibility.

- Quality Control and Inspection: Implementing computer vision and deep learning models for automated, high-speed inspection of manufactured heating element surfaces and internal structures (via ultrasound or thermal imaging), ensuring defect detection far beyond human capability.

DRO & Impact Forces Of Carbon Fiber Composite Heating Element Market

The market is primarily driven by the imperative for lightweight, high-performance thermal solutions across transportation sectors, juxtaposed against significant constraints related to manufacturing complexity and high raw material costs. Opportunities are vast, particularly in new high-tech applications like electric vehicle battery management and medical therapeutics. The interplay of these forces defines the market trajectory, creating an environment where technological innovation in composite processing is crucial for overcoming economic restraints and capitalizing on expanding application scopes.

The core drivers include the accelerating adoption of electric vehicles, which require highly efficient, low-mass thermal systems for cabin comfort and critical battery temperature regulation. Furthermore, stringent safety standards in aerospace demand reliable de-icing solutions that carbon composites provide due to their resilience and low power draw relative to performance. Restraints predominantly center around the high capital expenditure required for sophisticated composite manufacturing techniques, coupled with the volatility in carbon fiber prices, which impacts the final product cost and market accessibility for low-margin applications. The complexity of integrating these elements into existing systems also presents an adoption hurdle.

Opportunities lie in developing integrated multifunctional components—where the heating element is simultaneously a structural part—and expanding into emerging applications such as advanced medical warming blankets, therapeutic devices, and specialized high-efficiency industrial drying equipment. Impact forces, particularly the intense pressure from competing technologies like ceramic heaters and metallic foil heaters, necessitate continuous innovation in terms of power density and cost-effectiveness. The rising global environmental consciousness acts as a strong positive force, favoring carbon composite solutions due to their superior energy efficiency and contribution to lighter end-products, reducing overall energy consumption.

Segmentation Analysis

The Carbon Fiber Composite Heating Element Market is comprehensively segmented based on the product type (flexibility), the matrix material used in the composite, and the diverse end-use applications, providing granular insights into market dynamics. Analyzing these segments is essential for stakeholders to identify lucrative niche areas and tailor product development to specific industrial requirements. The performance characteristics of the heating element—such as power density and operational temperature limits—are heavily dependent on the chosen segment, driving specialization in manufacturing processes and material inputs.

The primary segmentation divides the market into flexible and rigid elements. Flexible elements, often embedded in polymer films, dominate the consumer and automotive seating sectors due to their conformability and ease of integration into curved surfaces. Rigid elements, typically employing ceramic or high-temperature resin matrices, are reserved for demanding industrial, aerospace, and high-heat applications where structural integrity and sustained high operating temperatures are required. Further differentiation exists based on the material choice for the matrix (polymer, ceramic, or carbon/carbon composites), directly impacting thermal resilience and cost efficiency.

Application-based segmentation reveals the highest growth potential in the electrification segment, specifically focusing on advanced thermal management required for lithium-ion battery packs in EVs. This application demands both rapid heating and cooling capabilities, often utilizing the carbon structure within a comprehensive thermal loop. Secondary high-growth areas include industrial drying processes, which benefit from the uniform heat distribution offered by these composites, and medical devices that require highly reliable, precisely controlled warming functions.

- By Type:

- Flexible Composite Heating Elements

- Rigid Composite Heating Elements

- By Matrix Material:

- Polymer Matrix Composites (PMC)

- Ceramic Matrix Composites (CMC)

- Carbon/Carbon Composites

- By Application:

- Automotive (Battery Thermal Management, HVAC, Seat Heaters)

- Aerospace & Defense (De-icing Systems, Interior Heating)

- Industrial (Composite Curing, Drying Processes, Pipeline Heating)

- Medical (Therapeutic Warming Devices, Sterilization)

- Consumer Electronics (Wearables, Appliances)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Carbon Fiber Composite Heating Element Market

The value chain for carbon fiber composite heating elements is complex, starting with specialized material synthesis and culminating in sophisticated system integration tailored to the end-user’s thermal management needs. Upstream activities involve the production of precursor materials (such as polyacrylonitrile or pitch) followed by the energy-intensive carbonization process to create carbon fibers. This stage is dominated by a few large chemical and materials companies who control the cost and quality of the fundamental raw material. Midstream activities, which include prepreg manufacturing, lay-up, molding, and curing the composite structure, are where the heating element is formed and embedded, requiring high-precision equipment and specialized composite expertise.

Downstream analysis focuses heavily on processing, finishing, and integration. Manufacturers must install electrical contacts, insulation layers, and often combine the element with thermal sensors and control units. This stage includes custom cutting and shaping to meet OEM specifications, particularly critical in automotive and aerospace applications where space and geometry are strictly limited. The value-add in the downstream segment lies in providing integrated solutions rather than just components, often requiring co-development with the end-user for validation and certification, especially for mission-critical systems.

The distribution channel is generally characterized by a mix of direct sales and specialized technical distributors. Direct distribution is common for large-volume OEM contracts (e.g., major automotive manufacturers) where continuous supply, quality assurance, and direct technical support are paramount. Indirect channels, using specialized technical dealers or integrators, serve smaller industrial users, custom fabrication shops, and aftermarket needs. Effective distribution relies on partners with deep knowledge of thermal physics and composite material handling, ensuring the sensitive elements are installed correctly for optimal performance and safety.

Carbon Fiber Composite Heating Element Market Potential Customers

The primary potential customers for carbon fiber composite heating elements span several high-value industries that prioritize energy efficiency, low weight, and reliable thermal performance in challenging operational environments. The largest and most immediate buyer base is the Electric Vehicle (EV) manufacturing sector, encompassing both established automotive giants and emerging EV startups. These companies require advanced, zone-specific thermal management solutions for maintaining optimal battery temperatures (crucial for range and longevity) and providing instantaneous, lightweight cabin comfort.

Another critical customer segment is the aerospace and defense industry. Aircraft manufacturers and maintenance organizations purchase these elements for critical de-icing systems on wings, engine inlets, and propellers, demanding elements that are robust against extreme temperature variations, mechanically resilient, and certified for safety. Industrial process engineers, particularly those in composite manufacturing (curing large structures) or high-precision drying applications (e.g., printing or textiles), form the third key customer group, valuing the uniform heat delivery and energy savings achieved through precise control.

Furthermore, medical device manufacturers are emerging as significant potential customers, especially for therapeutic heating pads, neonatal care incubators, and surgical warming devices where safety, lightweight portability, and highly accurate temperature regulation are non-negotiable requirements. These buyers seek suppliers capable of meeting stringent regulatory standards and delivering customized, highly reliable element designs often integrating low-voltage power requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 325.8 million |

| Market Forecast in 2033 | USD 608.4 million |

| Growth Rate | 9.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Chromalox, O-Flex Industries, Thermon Manufacturing, Zoppas Industries, Watlow, L.B. White Co., MHI Global, SGL Carbon, Teijin Limited, Toray Industries, Nippon Graphite Fiber Corporation, C-Therm Technologies, Heraeus Group, Backer Group, Tutco, LLC, Advanced Graphite Solutions, Custom Heaters & Controls, E.D. Bullard Company, Flex-A-Heat, Mikan Manufacturing |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Carbon Fiber Composite Heating Element Market Key Technology Landscape

The technological landscape of the Carbon Fiber Composite Heating Element market is rapidly evolving, driven by the need for higher power density, better thermal uniformity, and enhanced integration capabilities. A crucial area of focus involves advanced fiber orientation and deposition techniques, such as automated fiber placement (AFP) and tailored fiber placement (TFP), which allow manufacturers to precisely control the path of the carbon fibers. This precision is vital because the electrical resistance and resulting heat profile are directly linked to the fiber geometry and density within the composite matrix. Improved processing technologies are lowering the defect rate and enabling the creation of larger, seamless heating zones.

Material science innovation is equally significant, particularly concerning the matrix material and interfacial bonding. Researchers are developing high-performance polymer matrices (like PEEK or specialized epoxies) that can withstand higher continuous operating temperatures while maintaining flexibility and chemical resistance. For extreme applications, the use of Ceramic Matrix Composites (CMCs) is being refined to integrate carbon nanotubes or graphene into the fiber network, dramatically increasing the element's thermal stability and mechanical robustness at temperatures exceeding 500 degrees Celsius, crucial for applications in advanced industrial furnaces or rocket components.

Furthermore, the integration of smart features, enabled by micro-sensor technology and printed electronics, represents a key technological frontier. Embedding miniature thermocouples, strain gauges, and wireless communication chips directly within the composite structure allows for real-time monitoring of temperature profiles and structural integrity. This transition from passive heating elements to active, 'smart' thermal systems is enhancing performance, enabling predictive maintenance, and ensuring compliance with strict safety protocols, especially in the regulated aerospace and medical sectors. Low-voltage direct current (DC) operation is also a key feature, increasingly utilized to align with battery power sources in EVs and portable devices, necessitating specialized connector and power management technologies.

Regional Highlights

The global Carbon Fiber Composite Heating Element Market exhibits distinct regional dynamics driven by local manufacturing bases, regulatory environments, and the speed of EV adoption.

- North America (NA): NA is a mature market characterized by high demand from the aerospace and defense sectors for anti-icing solutions, leveraging the superior reliability of carbon composites. The region is also witnessing significant growth in specialized industrial applications and premium automotive markets, focusing on high-end performance and durability. Strong R&D infrastructure and high consumer acceptance of new technologies support continuous innovation and market expansion in medical therapeutics and advanced consumer appliances.

- Europe (EU): Europe is a key adopter due to stringent energy efficiency regulations and its dominant position in high-performance automotive manufacturing, particularly luxury and electric vehicle production. The region shows strong preference for integrated, lightweight solutions, driving demand for flexible composite elements for cabin heating and interior surfaces. Government mandates supporting decarbonization accelerate the replacement of metallic elements with more efficient composite alternatives in industrial heating processes.

- Asia Pacific (APAC): APAC represents the fastest-growing region, primarily fueled by the unparalleled scale of EV manufacturing in China, Japan, and South Korea. These countries drive massive volume demand for efficient battery thermal management systems and basic seat heating. Furthermore, expanding industrial infrastructure and the rising disposable income leading to increased demand for high-end consumer goods (like advanced appliances) contribute significantly to market volume and future revenue generation.

- Latin America (LATAM): LATAM is an emerging market with moderate growth, primarily driven by industrial expansion, particularly in mining and processing, requiring robust heating solutions. Automotive adoption is increasing, though generally focused on basic component integration rather than high-end thermal management systems seen in NA or EU, indicating potential for long-term penetration.

- Middle East & Africa (MEA): The MEA region's growth is concentrated in petrochemical processing and infrastructure development, requiring specialized, explosion-proof heating elements for pipelines and processing vessels. High investments in smart city infrastructure and diversified industrialization efforts in the UAE and Saudi Arabia are creating localized demand for energy-efficient heating technologies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Carbon Fiber Composite Heating Element Market.- Chromalox

- O-Flex Industries

- Thermon Manufacturing

- Zoppas Industries

- Watlow

- L.B. White Co.

- MHI Global

- SGL Carbon

- Teijin Limited

- Toray Industries

- Nippon Graphite Fiber Corporation

- C-Therm Technologies

- Heraeus Group

- Backer Group

- Tutco, LLC

- Advanced Graphite Solutions

- Custom Heaters & Controls

- E.D. Bullard Company

- Flex-A-Heat

- Mikan Manufacturing

Frequently Asked Questions

Analyze common user questions about the Carbon Fiber Composite Heating Element market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a Carbon Fiber Composite Heating Element and why is it superior to traditional metallic heaters?

A Carbon Fiber Composite Heating Element uses carbon fibers embedded in a matrix (polymer or ceramic) to generate heat. It is superior due to its significantly lower mass, resulting in faster heat-up times, higher energy efficiency, excellent corrosion resistance, and the ability to conform to complex geometries, making it ideal for lightweight and dynamic thermal management.

Which application segment drives the highest demand in the current market?

The Automotive segment, specifically the integration of elements for Electric Vehicle (EV) battery thermal management systems and lightweight interior heating (seats and steering wheels), currently drives the highest volume and value demand globally due to the ongoing transition to electrification.

What are the primary restraints affecting market growth and adoption?

The primary restraints are the high initial cost of carbon fiber raw materials and the complexity associated with precision composite manufacturing processes. These factors lead to a higher unit cost compared to established metallic resistive heaters, posing a challenge for cost-sensitive applications.

How does the use of composite elements benefit the aerospace industry?

In aerospace, composite heating elements are critical for high-reliability de-icing and anti-icing systems. Their lightweight nature reduces overall aircraft mass, contributing to fuel efficiency, while their high durability and resistance to thermal fatigue ensure reliable operation in extreme atmospheric conditions.

What technological advancements are shaping the future of these heating elements?

Key technological advancements include the integration of AI for predictive thermal control, the refinement of Ceramic Matrix Composites (CMCs) for high-temperature applications, and the development of embedded sensor technology to create 'smart' heating systems capable of real-time performance monitoring and dynamic temperature adjustment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Carbon Fiber Composite Heating Element Market Size Report By Type (Carbon Fiber Composite Heating Tube, Carbon Fiber Composite Heating Plate, Carbon Fiber Composite Heating Wire, Others), By Application (Industrial Application, Commercial Application, Household Application), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Carbon Fiber Composite Heating Element Market Statistics 2025 Analysis By Application (Industrial Application, Commercial Application, Household Application), By Type (Carbon Fiber Composite Heating Tube, Carbon Fiber Composite Heating Plate, Carbon Fiber Composite Heating Wire, Other Carbon Fiber Composite Heating Element), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager