Carbon Fiber Pressure Vessel Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433845 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Carbon Fiber Pressure Vessel Market Size

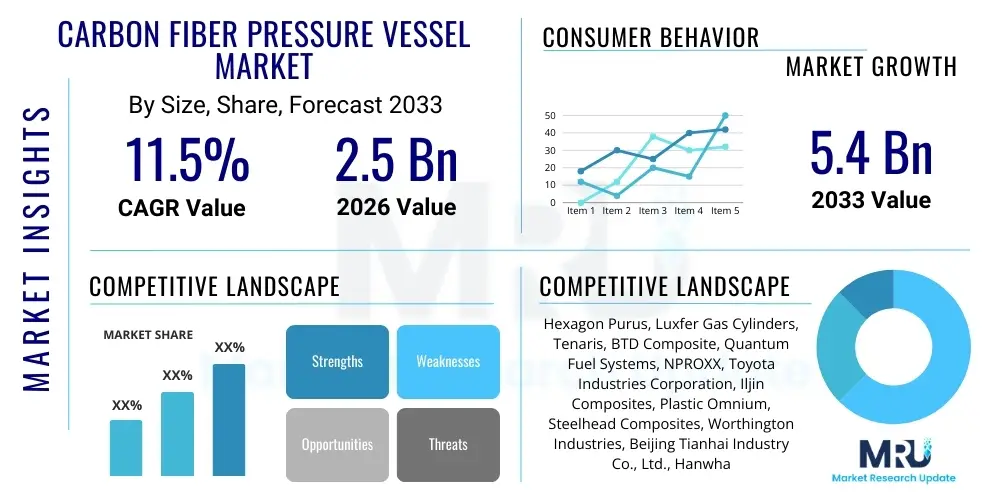

The Carbon Fiber Pressure Vessel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at $2.5 Billion in 2026 and is projected to reach $5.4 Billion by the end of the forecast period in 2033.

Carbon Fiber Pressure Vessel Market introduction

The Carbon Fiber Pressure Vessel (CFPV) market encompasses the design, manufacture, and deployment of lightweight composite storage tanks utilized primarily for containing gases and liquids under high pressure. These vessels, typically constructed using carbon fiber filaments wound around a metallic or non-metallic liner, offer superior strength-to-weight ratios compared to traditional steel or aluminum tanks. This exceptional performance characteristic makes them indispensable in applications where weight reduction is critical, such as in aerospace, defense, and particularly in the burgeoning hydrogen mobility sector. The core product categories include Type I (metal), Type II (hoop-wrapped composite), Type III (fully wrapped composite with metal liner), and Type IV (fully wrapped composite with non-metallic liner), with Type IV vessels being the primary driver of current market innovation due to their minimal weight and high safety standards.

Major applications for CFPVs are centered around high-pressure gas storage and transportation. The most significant demand originates from the alternative fuel vehicle segment, specifically for Compressed Natural Gas (CNG) and Hydrogen Fuel Cell Vehicles (FCVs). Beyond mobility, CFPVs are extensively used in breathing apparatus (SCBA) for firefighting and industrial safety, and in high-altitude environments for oxygen storage. Their inherent corrosion resistance and fatigue performance further enhance their utility across diverse industrial and medical settings. The ongoing global transition towards cleaner energy sources directly correlates with the increasing demand for robust and safe hydrogen storage solutions, firmly positioning CFPVs as a critical enabling technology.

Key driving factors accelerating market adoption include stringent government regulations mandating lower vehicle emissions and higher fuel efficiency, particularly in North America and Europe, necessitating lightweight components. Furthermore, significant investments in hydrogen infrastructure development, propelled by international energy policies focused on decarbonization, are creating substantial opportunities for Type IV vessels. The technological maturity of automated winding processes, coupled with decreasing carbon fiber raw material costs, is improving the economic viability of these vessels across mass-market applications. The benefits derived from CFPVs—including enhanced safety, prolonged lifespan, and reduction in operational energy consumption due to weight savings—ensure sustained market growth throughout the forecast period.

Carbon Fiber Pressure Vessel Market Executive Summary

The Carbon Fiber Pressure Vessel Market is experiencing robust expansion, primarily fueled by transformative shifts in the global energy and transportation sectors. Business trends indicate a clear pivot towards Type IV vessels, driven by the escalating requirements of the hydrogen economy, specifically in fuel cell electric vehicles (FCEVs) and hydrogen infrastructure (storage and transport). Key manufacturers are intensely focused on optimizing production automation, specifically filament winding and resin transfer molding (RTM) techniques, to scale output and reduce per-unit costs, thereby making these vessels competitive against traditional materials. Strategic partnerships between vessel manufacturers and automotive Original Equipment Manufacturers (OEMs) are defining the supply chain landscape, ensuring integrated design and rapid qualification of next-generation high-pressure storage solutions. Furthermore, increasing mergers and acquisitions are observed as companies seek to consolidate technological expertise, particularly in advanced liner materials and composite integrity monitoring systems.

Regionally, Asia Pacific (APAC) stands out as the highest growth region, dominated by heavy governmental backing for hydrogen infrastructure in countries like China, Japan, and South Korea. These nations are heavily subsidizing FCEV deployment and establishing large-scale hydrogen fueling stations, generating immense demand for high-capacity hydrogen storage CFPVs. North America and Europe maintain significant market shares, characterized by stringent safety regulations and strong adoption in aerospace and defense, alongside accelerating investment in green hydrogen projects. European directives, such as the Fit for 55 package, further stimulate demand for lightweight storage solutions necessary for achieving ambitious decarbonization targets, cementing the region's position as a hub for advanced composite manufacturing.

Segment trends reveal that the Hydrogen segment, categorized under Gas Type, is projected to exhibit the fastest Compound Annual Growth Rate (CAGR), overshadowing traditional segments like CNG and SCBA during the forecast period. In terms of Application, the Automotive sector, particularly heavy-duty trucks and buses utilizing hydrogen fuel cells, will consume the largest share of market volume. The Materials segment is seeing innovation focused on thermoset resins, offering better resistance to hydrogen embrittlement and enhancing structural durability. The focus on Type IV vessels, characterized by polyethylene (PE) or polyamide (PA) liners, reflects the industry’s commitment to achieving higher gravimetric density and reducing manufacturing complexity compared to earlier vessel types with metallic liners.

AI Impact Analysis on Carbon Fiber Pressure Vessel Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Carbon Fiber Pressure Vessel (CFPV) market frequently revolve around how AI can enhance manufacturing precision, optimize material usage, and improve the in-service lifespan prediction of these critical components. Users are particularly interested in AI's role in detecting subtle defects during the automated filament winding process, which is essential for ensuring the integrity of high-pressure vessels. Concerns also center on the use of machine learning (ML) models for predicting composite degradation under extreme cyclic loading conditions typical of hydrogen storage, aiming to shift from scheduled maintenance to predictive maintenance strategies. Expectations are high that AI will significantly shorten the R&D cycle for new vessel designs by simulating complex failure modes and optimizing structural layups far faster than traditional finite element analysis (FEA) methods, ultimately reducing the high cost associated with qualifying new composite designs for safety standards.

The integration of AI and machine learning algorithms is rapidly transforming the CFPV manufacturing environment, moving towards a paradigm of smart composite manufacturing. During production, computer vision systems coupled with AI are employed to continuously monitor the filament winding tension, fiber placement accuracy, and resin impregnation quality in real-time. This sophisticated monitoring allows for immediate adjustments, drastically reducing process variability and minimizing the chance of latent defects that could compromise vessel safety under extreme pressure. Furthermore, generative AI is playing a role in material science, aiding researchers in the development of novel liner materials and composite matrix systems optimized for hydrogen permeability resistance, a crucial performance metric for Type IV vessels.

Beyond manufacturing, AI models are essential for enabling advanced structural health monitoring (SHM). By analyzing data streams from embedded sensors (e.g., strain gauges, acoustic emission sensors) during vessel operation, ML algorithms can identify stress anomalies or early signs of structural fatigue. This capability is vital for fleet operators of FCEVs or high-pressure gas trailers, allowing them to precisely determine the remaining useful life (RUL) of each vessel. This AI-driven predictive maintenance approach not only enhances operational safety by preempting catastrophic failures but also minimizes unnecessary downtime and associated operational costs, providing a significant competitive advantage to users adopting these smart CFPV systems. The deployment of digital twins, facilitated by AI, ensures that the virtual representation accurately reflects the physical vessel’s condition, optimizing inspection schedules and enhancing regulatory compliance.

- AI-Driven Quality Control: Real-time visual inspection systems using deep learning for defect detection during winding and curing processes.

- Manufacturing Process Optimization: Machine learning algorithms optimizing winding angles, speed, and resin flow to reduce material waste and cycle time.

- Predictive Maintenance (PdM): Use of sensor data and ML models to accurately forecast remaining useful life (RUL) and structural fatigue under cyclic pressure.

- Design and Simulation Acceleration: Generative AI and advanced simulation tools replacing lengthy physical prototyping cycles for new vessel geometries and composite layups.

- Material Science Innovation: AI-guided discovery of new polymer liners or resin systems with enhanced barrier properties against hydrogen permeation.

- Supply Chain Forecasting: Utilizing predictive analytics to manage complex supply chains for carbon fiber and specialized resins based on fluctuating energy demands.

- Digital Twin Deployment: Creating virtual replicas of CFPVs to simulate operational stresses and environmental impacts, enhancing safety qualification.

- Safety and Compliance Auditing: Automated data analysis facilitating rapid verification of compliance with international standards (e.g., ISO 11119, EC 79).

DRO & Impact Forces Of Carbon Fiber Pressure Vessel Market

The dynamics of the Carbon Fiber Pressure Vessel (CFPV) market are governed by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and potent Impact Forces. The primary drivers are rooted in global decarbonization efforts, specifically the massive push toward hydrogen as a clean energy carrier, necessitating robust, lightweight Type IV storage solutions for vehicles and bulk transport. However, market restraints are significant, mainly centering on the exceedingly high initial production costs of carbon fiber raw material and the capital intensity of establishing automated manufacturing facilities. Opportunities are emerging through material innovation, such as the development of lower-cost, aerospace-grade recycled carbon fiber and advancements in thermoplastic liners. These factors collectively exert powerful impact forces on market profitability, supply chain integration, and the speed of regulatory adaptation to accommodate higher-pressure storage standards (e.g., 700 bar systems).

Drivers (D)

The foundational driver for the CFPV market is the imperative for light weighting across critical industrial and transportation applications. Weight reduction directly translates into higher energy efficiency, extended range for vehicles, and lower operational costs for aerospace and defense equipment. This efficiency drive is particularly crucial in the automotive sector, where stringent corporate average fuel economy (CAFE) standards and Euro emission norms compel manufacturers to adopt advanced composite materials. The lightweight nature of CFPVs, which can be up to 70% lighter than equivalent steel tanks, offers an undeniable advantage in payload capacity and energy consumption, justifying the higher initial cost.

A second major driver is the accelerating investment in the global hydrogen economy. Government mandates, subsidies, and global energy initiatives, such as those in the European Green Deal and the US Infrastructure Investment and Jobs Act, are channeling vast amounts of capital into developing hydrogen production, storage, and distribution infrastructure. This proliferation requires thousands of high-pressure storage vessels for various applications, including on-board vehicle storage (700 bar), stationary storage for fueling stations, and tube trailers for bulk transportation (200 bar to 500 bar). The safety and performance mandates for these high-pressure, cyclically loaded vessels are overwhelmingly met by certified Type III and Type IV carbon fiber composites.

Furthermore, enhanced safety standards across industrial applications, such as Self-Contained Breathing Apparatus (SCBA) used by firefighters and rescue personnel, drive demand for CFPVs. Carbon fiber tanks offer superior burst resistance and fatigue life compared to metallic alternatives. The focus on enhancing the safety envelope and durability, coupled with regulatory compliance requirements in industries like medical oxygen delivery and high-pressure industrial gas storage, continuously reinforces the adoption of these advanced composite vessels, replacing older, heavier tank technologies globally.

Restraints (R)

The primary restraint hindering broader market penetration is the high initial cost of production, directly linked to the expense of aerospace-grade carbon fiber precursors (Polyacrylonitrile or PAN) and the energy-intensive nature of converting them into usable fiber. While carbon fiber costs have trended downwards, the specialized handling, complex winding geometry, and necessity for highly automated production facilities require significant capital investment, resulting in a high unit cost for the final pressure vessel, particularly compared to mass-produced metal tanks.

A secondary constraint involves the complexity and duration of the regulatory qualification and standardization processes. Given the critical safety nature of high-pressure vessels, new designs, materials, or manufacturing sites must undergo rigorous and time-consuming testing and certification procedures (e.g., adherence to ASME, ISO, and UN regulations). This lengthy qualification cycle acts as a bottleneck, slowing down the introduction of innovative, potentially lower-cost designs, and increasing the overall barrier to entry for new market players. Addressing potential hydrogen embrittlement in liners and ensuring long-term material compatibility adds complexity to this testing regime.

Finally, the existing limitations in global hydrogen refueling infrastructure pose a temporary but significant restraint on the FCEV segment, which is the largest potential consumer of CFPVs. While infrastructure development is accelerating, the current lack of widespread refueling stations compared to traditional fuel or battery electric charging points limits the immediate scaling of FCEV fleets, consequently restraining the immediate demand for on-board hydrogen storage tanks, especially in regions outside East Asia and parts of Europe.

Opportunities (O)

The most substantial opportunity lies in the advancement towards higher pressure and larger capacity Type IV vessels, specifically those rated for 700 bar and above, for mass hydrogen storage. Developing larger, cost-effective Type IV tanks for stationary storage at power plants and industrial facilities, known as cascade storage systems, represents an untapped growth avenue. Furthermore, the marine and rail sectors are increasingly exploring hydrogen power, requiring customized, large-scale CFPVs that can withstand harsh operating environments, opening up new specialized application niches beyond road transport.

Another key opportunity revolves around circular economy initiatives and sustainable manufacturing practices. The development and commercialization of recycled carbon fiber (rCF) derived from aerospace waste, which maintains sufficient strength properties for less demanding pressure vessel applications (e.g., lower pressure industrial gas storage), offers a pathway to significantly reduce material costs and improve the environmental footprint of CFPV production. Investment in continuous fiber manufacturing and rapid resin curing technologies further provides opportunities to drastically shorten production lead times and lower energy consumption.

The increasing digitalization of manufacturing presents an opportunity for greater supply chain efficiency and product integration. Implementing Industry 4.0 techniques, including AI-driven defect detection and digital twin technology, allows manufacturers to offer value-added services such as continuous structural health monitoring (SHM). This capability enhances safety and allows for flexible servicing contracts, differentiating key players and creating new revenue streams based on data analytics and predictive maintenance rather than solely on hardware sales.

Impact Forces (I)

The global push for climate neutrality, driven by international agreements like the Paris Accord, exerts a monumental impact force on the CFPV market, guaranteeing long-term growth by prioritizing zero-emission technologies like FCEVs. This political and environmental mandate ensures continuous research funding and regulatory support for clean energy infrastructure, locking in sustained demand for high-performance hydrogen storage.

Technological standardization is a major impact force. The establishment of harmonized global standards (e.g., GTR No. 13 for FCEV safety) accelerates cross-border trade and reduces fragmentation in manufacturing processes. As standards become clearer and universally accepted, they lower testing costs, improve consumer confidence, and enable faster mass production scalability, particularly for Type IV vessels used in hydrogen mobility.

Finally, raw material price volatility, particularly concerning PAN-based carbon fiber, is a critical external impact force. Fluctuations in energy costs (natural gas and electricity, required for stabilization and carbonization) directly influence the profitability and pricing strategies of CFPV manufacturers. Companies that can vertically integrate or secure long-term raw material contracts are better positioned to mitigate these external price shocks and maintain market stability, influencing competitive dynamics significantly.

Segmentation Analysis

The Carbon Fiber Pressure Vessel Market segmentation provides a detailed map of the industry landscape, categorized primarily by vessel type, gas type stored, end-use application, and operating pressure. This granular analysis is crucial for understanding specific growth pockets and technological preferences across various sectors. The shift from Type III to Type IV vessels represents the most defining segmentation trend, driven by the mobility sector's relentless pursuit of light weighting. Similarly, the rapid acceleration of hydrogen usage is fundamentally reshaping the market share distribution among gas types, pulling significant investment into specialized high-pressure systems. Application segmentation highlights the dominance of automotive, followed closely by aerospace and defense, which require absolute reliability under extreme operational conditions.

- By Vessel Type:

- Type I (Metal)

- Type II (Hoop Wrapped Composite)

- Type III (Fully Wrapped Composite with Metal Liner)

- Type IV (Fully Wrapped Composite with Non-Metallic Liner)

- By Gas Type:

- Compressed Natural Gas (CNG)

- Hydrogen

- Oxygen/Air (SCBA/Medical)

- Other Industrial Gases (Nitrogen, Helium, etc.)

- By Application:

- Automotive (Passenger Vehicles, Buses, Trucks)

- Aerospace & Defense (Aircraft Oxygen, Missile Systems)

- Industrial Gas Storage & Transport (Tube Trailers)

- SCBA/Life Support

- Others (Medical, Energy Infrastructure)

- By Operating Pressure:

- Low Pressure (Up to 300 Bar)

- High Pressure (300 Bar to 500 Bar)

- Very High Pressure (Above 500 Bar, predominantly 700 Bar)

- By Manufacturing Process:

- Filament Winding

- Wet Filament Winding

- Dry Filament Winding (Towpreg)

Value Chain Analysis For Carbon Fiber Pressure Vessel Market

The value chain for the Carbon Fiber Pressure Vessel (CFPV) market is characterized by high levels of specialization and tight integration, beginning with highly technical upstream material suppliers and culminating in complex downstream distribution and post-sale services. Upstream activities are dominated by specialized chemical and material processing companies responsible for producing the carbon fiber precursor (PAN), converting it into fiber, and formulating high-performance epoxy resins. This stage is capital-intensive and highly sensitive to energy costs. The quality and cost of these raw materials critically dictate the final performance and economic viability of the vessel, making secure, long-term sourcing relationships essential for manufacturers.

The midstream section involves the core vessel manufacturers. These companies employ advanced composite manufacturing techniques, primarily automated filament winding, along with processes like resin transfer molding (RTM) for composite domes and specialized liner extrusion or molding. This stage requires significant investment in precise machinery and quality control systems capable of adhering to rigorous safety standards (e.g., ISO, EC 79). Direct distribution channels are often preferred, especially for large volume B2B sales to major Original Equipment Manufacturers (OEMs) in the automotive and aerospace industries. This direct engagement allows for co-development, customized sizing, and precise integration into vehicle platforms, ensuring the vessels meet specific application requirements.

Downstream activities center on deployment, installation, and end-of-life management. For applications like FCEVs, installation is often performed at the vehicle OEM's assembly line. Indirect distribution channels primarily utilize specialized gas distributors and certified resellers for smaller markets, such as SCBA and industrial gas storage, where regional technical support is necessary. The value chain concludes with vital post-sale services, including periodic inspection, requalification, and eventual decommissioning or recycling. As the market for Type IV vessels matures, the development of cost-effective and compliant recycling methods for composite materials will become a critical, high-value component of the overall supply chain sustainability and compliance profile.

Carbon Fiber Pressure Vessel Market Potential Customers

The potential customers for the Carbon Fiber Pressure Vessel market are highly diverse, spanning multiple high-stakes industries where lightweight structure and safety under pressure are paramount. Automotive OEMs represent the largest and most rapidly growing segment of buyers. These include global manufacturers of passenger cars, buses, and heavy-duty commercial trucks that are investing heavily in fuel cell electric vehicle (FCEV) technology. For these OEMs, CFPVs are not merely components but strategic assets that directly impact vehicle range, efficiency, and compliance with stringent emission regulations, positioning the purchasing decision at the strategic sourcing level.

A second crucial customer segment comprises aerospace, defense, and maritime organizations. The aerospace sector procures CFPVs for critical applications such as onboard oxygen supply for pilots and crew, high-pressure gas storage for auxiliary power units (APUs), and crucial components within advanced missile and launch systems where every kilogram saved significantly enhances performance. Defense contractors prioritize CFPVs for their robust impact resistance and reliability in extreme operational environments. Maritime industries are beginning to adopt hydrogen and other clean fuels, positioning shipbuilding and logistics companies as emerging high-value customers needing large, robust storage tanks.

Furthermore, major industrial gas suppliers, specialized safety equipment manufacturers, and infrastructure developers constitute substantial buyer groups. Industrial gas companies purchase CFPVs for the bulk transport of gases (e.g., hydrogen, helium) via tube trailers, prioritizing vessel longevity and pressure rating for efficient logistics. Safety equipment companies, such as those manufacturing SCBA gear for firefighters and industrial workers, are consistent buyers of Type III and Type IV vessels to reduce the physical burden on the user while maintaining maximum air capacity. Infrastructure developers installing hydrogen fueling stations also require large, reliable stationary storage cascade systems, often demanding customized, high-volume CFPVs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.5 Billion |

| Market Forecast in 2033 | $5.4 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hexagon Purus, Luxfer Gas Cylinders, Tenaris, BTD Composite, Quantum Fuel Systems, NPROXX, Toyota Industries Corporation, Iljin Composites, Plastic Omnium, Steelhead Composites, Worthington Industries, Beijing Tianhai Industry Co., Ltd., Hanwha Solutions, Faber Industrie S.p.A., Caley Carbon Fiber, Avanco Group, ZIM Compuesto, Xperion Energy & Environment, EIK Engineering, GAC Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Carbon Fiber Pressure Vessel Market Key Technology Landscape

The technology landscape of the Carbon Fiber Pressure Vessel (CFPV) market is rapidly evolving, driven by the need to increase volumetric and gravimetric energy density while reducing manufacturing costs for mass production. The core technology remains automated filament winding, but significant advancements are occurring in towpreg winding (dry winding) techniques, which utilize pre-impregnated fiber to ensure precise resin control and faster processing speeds compared to traditional wet winding. These advanced winding patterns, often optimized using sophisticated simulation software, are crucial for achieving the high structural integrity required for 700 bar hydrogen storage. Furthermore, the selection of the resin matrix—moving towards rapid-curing epoxy or vinylester systems—is critical for reducing curing time, a traditional bottleneck in composite manufacturing, thereby enabling higher throughput.

Innovation is heavily focused on the liner technology, which serves as the gas permeation barrier. Type IV vessels utilize polymer liners, typically high-density polyethylene (HDPE) or polyamide (PA). The current technological frontier involves optimizing these polymer liners to minimize hydrogen embrittlement and permeation, which is crucial for maintaining gas purity and minimizing storage losses over the vessel's lifetime. Research efforts are concentrating on multilayer liner systems, often incorporating nanomaterials or advanced coatings to enhance barrier properties without sacrificing the liner's flexibility or ability to withstand pressure cycling. Additionally, technologies related to the dome structure and boss attachment—the critical interface between the composite shell and the metal valve connection—are being refined to eliminate stress concentration points and improve fatigue performance.

Beyond material and structural technology, digitalization plays an increasingly central role. Non-Destructive Testing (NDT) methodologies, such as ultrasonic testing and advanced acoustic emission monitoring, are being integrated inline during production and post-qualification to ensure zero-defect output. Furthermore, the implementation of Structural Health Monitoring (SHM) systems, which embed fiber optic or electrical sensors within the composite matrix, provides real-time data on strain and temperature. This data, processed by AI/ML algorithms, allows for continuous safety assurance and condition-based maintenance schedules, which is essential for regulated transport and stationary storage applications where uptime and safety compliance are paramount.

- Filament Winding Advancements:

- Automated dry filament winding (Towpreg) systems offering superior fiber placement accuracy and reduced processing time.

- In-situ curing technologies (e.g., UV or electron beam curing) to accelerate the polymerization process, moving away from slow oven curing.

- Advanced winding simulation software (FEA-based) for optimizing geodesic and non-geodesic fiber paths to minimize weight and maximize burst pressure.

- Liner and Material Technology:

- Development of multilayer polymer liners (e.g., PA/EVOH barriers) with enhanced resistance to hydrogen permeation and blistering.

- Thermoplastic liners (e.g., PEEK, Nylon) enabling potential thermal welding and greater recyclability compared to thermoset components.

- Lower-cost Carbon Fiber Precursors: Research into textile-grade and recycled carbon fiber (rCF) for non-critical composite layers to drive down overall material expense.

- High-performance resin systems: Utilizing specialized epoxy systems optimized for crack resistance under cryogenic or extreme thermal cycling conditions.

- Quality Control and Monitoring:

- Non-Destructive Testing (NDT): Automated ultrasonic testing (UT) and radiography integrated into production lines for volumetric inspection.

- Acoustic Emission (AE) Monitoring: Continuous surveillance of vessels during pressure cycling tests to detect micro-cracking and evaluate structural integrity.

- Structural Health Monitoring (SHM): Embedding fiber optic strain sensors (FBGs) or piezoceramic sensors to monitor real-time stress and damage accumulation.

- Manufacturing and Digital Integration:

- Industry 4.0 Integration: Connecting winding machines, curing chambers, and inspection systems via IoT platforms for centralized data collection and AI analysis.

- Robotic Handling and Automation: Utilizing robotics for material loading, liner insertion, and post-winding finishing to minimize human error and accelerate throughput.

- Digital Twin Technology: Creation of high-fidelity virtual models of individual vessels for predictive life-cycle management and maintenance scheduling.

Regional Highlights

The global Carbon Fiber Pressure Vessel market exhibits distinct regional growth patterns, largely dictated by local government policies regarding clean energy adoption and established industrial bases in aerospace and defense.

- Asia Pacific (APAC): APAC is projected to lead the market in terms of both volume and growth rate, primarily due to aggressive national hydrogen strategies in countries like China, Japan, and South Korea. These governments have set ambitious targets for FCEV deployment and investment in hydrogen fueling infrastructure, creating massive demand for 350 bar and 700 bar Type IV vessels. China’s push for hydrogen-powered commercial fleets (buses and trucks) dominates the regional application segment. Furthermore, the presence of major carbon fiber manufacturers and large automotive OEMs provides a strong, integrated supply chain advantage, enabling cost-effective mass production.

- North America: North America represents a mature, yet highly dynamic market, characterized by strong demand from specialized segments such as aerospace, defense (missile systems), and high-pressure industrial gas logistics. The U.S. government’s commitment to hydrogen hubs and tax credits through acts like the Inflation Reduction Act (IRA) is rapidly accelerating the adoption of CFPVs for stationary storage and heavy-duty hydrogen transport. While Type III vessels historically dominated military and SCBA applications, the focus is now shifting towards high-capacity Type IV systems to service the emerging hydrogen corridor infrastructure and FCEV market growth on the West Coast.

- Europe: Europe is a highly regulated market prioritizing safety and sustainability, driving rapid innovation in CFPV technology. Countries such as Germany, France, and the UK are heavily investing in green hydrogen production and distribution networks under the European Green Deal framework. This necessitates large-scale, certified composite vessels for tube trailers and stationary storage. The region also maintains significant market share in SCBA and medical oxygen applications. European manufacturers are focused on material circularity, exploring advanced recycling techniques for composite materials to meet future sustainability criteria.

- Latin America (LATAM): The LATAM market is currently characterized by niche applications, primarily in Compressed Natural Gas (CNG) storage for vehicles in countries like Brazil and Argentina, where CNG penetration is high due to economic factors. CFPVs, particularly Type III, are used to upgrade CNG vehicles, offering better range. While hydrogen adoption is nascent, significant potential exists, particularly in countries utilizing renewable energy sources (hydro and solar) to produce green hydrogen, which will eventually spur demand for high-pressure Type IV vessels for export and local use.

- Middle East and Africa (MEA): The MEA region is emerging as a critical market, driven by large-scale strategic green hydrogen production initiatives, often leveraging abundant solar and wind resources (e.g., Saudi Arabia’s NEOM project). These projects require immense stationary storage capacity for hydrogen before liquefaction or conversion. Although the adoption of FCEVs is low, the requirement for high-capacity, robust vessels for industrial and export logistics positions MEA as a future high-growth area for specialized, large-diameter CFPVs used in cascade storage systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Carbon Fiber Pressure Vessel Market.- Hexagon Purus

- Luxfer Gas Cylinders

- Tenaris

- BTD Composite

- Quantum Fuel Systems

- NPROXX

- Toyota Industries Corporation

- Iljin Composites

- Plastic Omnium

- Steelhead Composites

- Worthington Industries

- Beijing Tianhai Industry Co., Ltd. (BTIC)

- Hanwha Solutions

- Faber Industrie S.p.A.

- Caley Carbon Fiber

- Avanco Group

- ZIM Compuesto

- Xperion Energy & Environment

- EIK Engineering

- GAC Group

Frequently Asked Questions

Analyze common user questions about the Carbon Fiber Pressure Vessel market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of Carbon Fiber Pressure Vessels (CFPVs) over traditional metal tanks?

CFPVs offer a critical advantage in terms of weight reduction, typically achieving a 50% to 70% decrease compared to steel tanks of equivalent capacity. This lightweight nature significantly improves fuel efficiency, range, and payload capacity in vehicles (especially FCEVs). They also exhibit superior corrosion resistance and excellent fatigue performance under repeated high-pressure cycling, leading to longer service life and enhanced safety.

What is the difference between Type III and Type IV Carbon Fiber Pressure Vessels?

Type III vessels utilize a load-bearing metal liner (usually aluminum) around which the carbon fiber composite is wound. They are strong but heavier. Type IV vessels, which dominate the hydrogen mobility market, use a lightweight, non-load-bearing polymer liner (e.g., HDPE) wrapped entirely by the carbon fiber composite. Type IV vessels are significantly lighter, offer superior gravimetric density, and minimize weight for vehicle integration.

Which application segment drives the highest growth in the CFPV market?

The Automotive application segment, specifically the deployment of Hydrogen Fuel Cell Electric Vehicles (FCEVs), is the dominant driver of market growth. The shift towards 700 bar storage systems for passenger vehicles, buses, and heavy-duty trucks necessitates high-performance, lightweight Type IV CFPVs, which generates the highest revenue potential throughout the forecast period.

What are the key technological restraints limiting mass adoption of CFPVs?

The primary technological restraint is the high manufacturing cost, driven mainly by the expense of aerospace-grade carbon fiber and the capital investment required for automated, precision filament winding machinery. Furthermore, ensuring the longevity and preventing hydrogen permeation in polymer liners under extreme pressure cycling presents ongoing material science challenges that require continuous R&D investment.

How does the increasing focus on green hydrogen production impact the CFPV market?

The expansion of green hydrogen production necessitates large-scale storage and transport solutions, significantly boosting demand for large-capacity, high-pressure CFPVs. These vessels are essential not only for on-board vehicle use but also for tube trailers and stationary cascade storage at production and refueling sites, directly tying the market's trajectory to global clean energy policy mandates.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager