Carbon Fibre Pellets Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432383 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Carbon Fibre Pellets Market Size

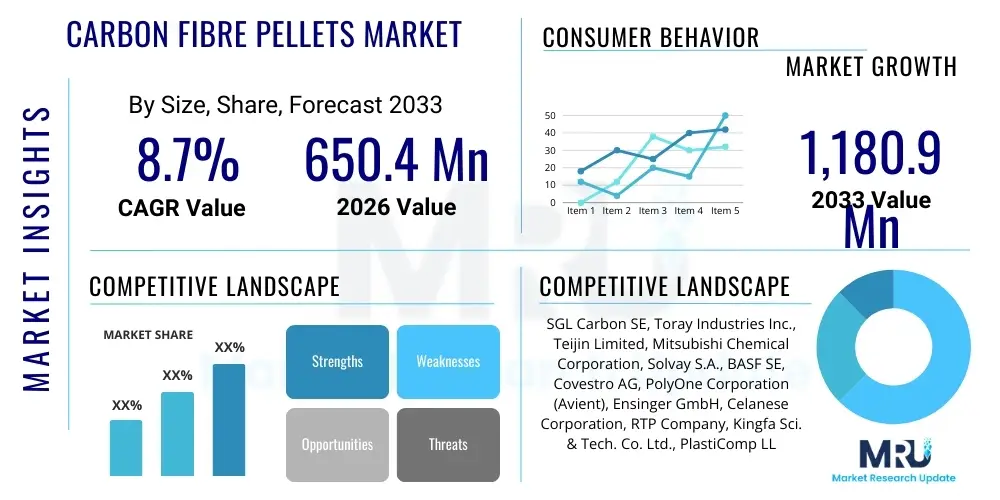

The Carbon Fibre Pellets Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.7% between 2026 and 2033. The market is estimated at USD 650.4 Million in 2026 and is projected to reach USD 1,180.9 Million by the end of the forecast period in 2033.

Carbon Fibre Pellets Market introduction

The Carbon Fibre Pellets Market encompasses the production and distribution of composite material pellets that integrate short or chopped carbon fibers within a thermoplastic resin matrix, such as Nylon (PA), Polypropylene (PP), Polycarbonate (PC), or Polyether Ether Ketone (PEEK). These pellets are designed for easy processing through high-volume manufacturing techniques, primarily injection molding and extrusion, facilitating the creation of high-strength, lightweight components. The pellets serve as a critical intermediary product, offering superior mechanical properties—including high stiffness, excellent tensile strength, and reduced weight—compared to traditional unreinforced polymers or glass fiber composites. The market is fundamentally driven by the escalating demand for material substitution in industries prioritizing fuel efficiency and performance enhancement, particularly automotive, aerospace, and consumer electronics, where the structural integrity and low density of carbon fibre reinforced polymers (CFRPs) provide a distinct competitive advantage over metals and conventional plastics.

Carbon Fibre Pellets are engineered to address the complexities associated with handling loose carbon fibers or prepregs, offering enhanced flow characteristics and consistent fiber dispersion during compounding and subsequent molding processes. Product descriptions emphasize fiber length (typically short fibers, ranging from 1 mm to 12 mm), fiber loading concentration (often between 10% and 50% by weight), and the specific thermoplastic matrix chosen to meet distinct application requirements, such as chemical resistance, thermal stability, or impact strength. Major applications span structural brackets, engine covers, interior and exterior automotive components, drone bodies, medical device housings, and sophisticated industrial machinery parts. The inherent benefits include significant weight reduction without compromising structural integrity, improved fatigue resistance, and dimensional stability under varying operational conditions, enabling manufacturers to meet increasingly stringent regulatory standards for emissions and safety across various sectors globally. Furthermore, the recyclability of thermoplastic carbon fiber composites, unlike thermoset counterparts, is opening up new avenues for sustainable manufacturing practices.

Driving factors propelling market expansion include the aggressive lightweighting strategies adopted by global automotive OEMs to boost electric vehicle (EV) range and overall energy efficiency, alongside increasing integration of advanced composites in aerospace interior structures for cabin weight reduction. Technological advancements in compounding equipment, specifically twin-screw extruders designed to minimize fiber breakage during processing, have improved the homogeneity and performance of these pellets, making them economically viable for broader industrial applications. The shift from metal stamping to complex injection molded structural parts, enabled by the flow properties of carbon fibre pellets, provides design flexibility and part consolidation opportunities, further reinforcing market growth. Government initiatives promoting sustainable materials and investments in high-performance computing (HPC) for sophisticated material simulations also contribute significantly to the accelerating adoption curve of these advanced composite materials in critical load-bearing applications.

Carbon Fibre Pellets Market Executive Summary

The Carbon Fibre Pellets Market is experiencing robust expansion driven by pronounced business trends focusing on sustainable lightweighting solutions and enhanced material performance in high-stakes industries. Key business trends include the vertical integration strategies adopted by major composite manufacturers, aiming to control the entire value chain from fiber synthesis to pellet compounding, thereby ensuring quality consistency and cost efficiency. Furthermore, there is a discernible trend toward the development of specialty pellets optimized for extremely high-temperature applications, such as those utilizing PEEK and PEI matrices, catering specifically to demanding aerospace and oil and gas sectors. The push for circular economy practices is fostering innovation in utilizing reclaimed or recycled carbon fibers in pellet formulation, which lowers input costs and improves the sustainability profile of the resulting composites, attracting environmentally conscious manufacturers seeking high-performance materials with a reduced carbon footprint, leading to increased investment in proprietary compounding technologies and advanced material characterization techniques.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, fueled by the rapid expansion of its automotive manufacturing base, particularly in China and India, where government mandates strongly encourage EV production and the corresponding adoption of lightweight materials to enhance battery performance. North America maintains a strong position due to its mature aerospace and defense industries, which are significant consumers of high-performance thermoplastic pellets requiring stringent quality certifications. Europe is characterized by stringent environmental regulations and a strong focus on high-end automotive and renewable energy sectors (wind turbines), driving demand for premium, custom-formulated carbon fibre pellets. Segmentation trends indicate that the Short Carbon Fibre (SCF) segment dominates due to its superior moldability and cost-effectiveness for high-volume injection molding, while the Long Carbon Fibre (LCF) segment is experiencing rapid growth as manufacturers seek higher mechanical strength and impact resistance suitable for semi-structural applications. The thermoplastic matrix segmentation highlights PA (Nylon) as the most widely used resin due to its balance of cost and performance, though high-performance matrices like PEEK are witnessing the fastest CAGR driven by niche, high-value applications requiring extreme thermal and chemical inertness.

In terms of segment performance and strategic implications, the automotive sector remains the largest end-user, continually exploring opportunities to replace metallic components with carbon fibre reinforced thermoplastics (CFRTPs) in battery enclosures, crash structures, and body panels to offset the weight added by large battery packs in EVs. The increasing utilization of additive manufacturing techniques, specifically fused deposition modeling (FDM) and selective laser sintering (SLS), is generating a burgeoning niche demand for specialized fine-powder or pelletized CFRTP materials designed for 3D printing, enabling rapid prototyping and the production of complex tooling and functional parts. These dynamics require market players to invest heavily in R&D to optimize fiber dispersion and surface treatment technologies to maximize interfacial adhesion between the carbon fiber and the polymer matrix, which is crucial for achieving peak mechanical performance and ensuring long-term material durability under cyclic loading conditions prevalent in automotive and industrial environments.

AI Impact Analysis on Carbon Fibre Pellets Market

Common user questions regarding AI's impact on the Carbon Fibre Pellets Market primarily revolve around how machine learning can optimize compounding processes, predict material performance characteristics based on input variables, and enhance supply chain efficiency. Users are keenly interested in predictive maintenance models for high-cost compounding extruders, asking how AI algorithms can monitor vibration, temperature, and torque data to anticipate equipment failures, thereby minimizing downtime and maximizing throughput. Furthermore, a significant cluster of inquiries focuses on AI's potential in accelerating material development, specifically asking if deep learning models can rapidly screen thousands of fiber-matrix combinations and processing parameter settings (like extrusion speed, temperature profiles, and cooling rates) to optimize pellet formulation for specific end-use properties, such as maximizing impact strength or minimizing warpage in molded parts, drastically reducing the traditional time-to-market for new composite products and improving overall material consistency.

- AI-driven optimization of fiber-matrix interface adhesion through predictive modeling of surface treatments.

- Implementation of machine learning for real-time quality control during pellet compounding, ensuring consistent fiber length distribution.

- Enhanced supply chain logistics and demand forecasting for raw materials (carbon fiber and polymer resins) using predictive analytics.

- AI simulation of injection molding processes using pellet properties to minimize defects like warping and sink marks.

- Accelerated R&D by using AI to explore novel thermoplastic blends and fiber concentrations, drastically cutting lab testing time.

- Automated visual inspection of manufactured pellets for size, shape, and contamination using computer vision systems.

DRO & Impact Forces Of Carbon Fibre Pellets Market

The Carbon Fibre Pellets Market is propelled by significant drivers, constrained by key restraints, and presents substantial opportunities, all interacting to exert defining impact forces on its trajectory. The primary driver is the pervasive demand for lightweighting across the aerospace and automotive industries, particularly with the rapid electrification of vehicle fleets globally, where reducing vehicle mass is critical for extending battery range and improving energy efficiency. Opportunities arise from technological advancements in cost-effective manufacturing processes for recycled carbon fiber, making these advanced materials more accessible for mass-market applications outside of high-end aerospace. However, the market faces constraints primarily due to the high cost associated with virgin carbon fiber and the complex, energy-intensive compounding processes required to ensure uniform fiber dispersion within the thermoplastic matrix, which raises the final component cost compared to traditional materials, slowing adoption in price-sensitive industrial sectors.

A second major driver includes the increasing adoption of injection molding for structural components, leveraging the superior flowability and dimensional stability offered by carbon fibre pellets compared to long fiber thermoset composites, facilitating high-volume, automated production. The market opportunity is further amplified by the expanding use of high-performance thermoplastic matrices (such as PEEK and PPS) in critical applications requiring extreme chemical and thermal resistance, particularly in medical and energy sectors. Conversely, a crucial restraint is the potential for fiber damage (attrition) during the compounding and subsequent molding processes, which can degrade the mechanical properties of the final part, requiring specialized processing equipment and precise temperature control, presenting technical barriers for new entrants lacking specialized expertise in polymer science and composite processing.

These drivers and restraints manifest as powerful impact forces shaping competitive dynamics. The strong impact force of innovation in material science compels manufacturers to continuously improve fiber-matrix compatibility and develop pellets specifically optimized for advanced manufacturing techniques like 3D printing. Economic impact forces, driven by volatility in raw material prices (crude oil derivatives for polymers and energy costs for carbonization), necessitate robust supply chain management and hedging strategies. Regulatory impact forces, particularly environmental mandates pushing for reduced vehicle emissions and material recyclability in Europe and North America, strongly favor thermoplastic-based pellets over less recyclable thermoset composites. Ultimately, the balancing act between achieving high performance and reducing the total cost of ownership dictates the rate of market penetration across diverse industrial applications globally.

Segmentation Analysis

The Carbon Fibre Pellets Market is meticulously segmented across several critical dimensions, including the type of carbon fiber used (length), the material of the thermoplastic matrix, and the specific application or end-use industry. This segmentation provides a granular view of market dynamics, revealing key areas of growth, technological dominance, and regional specialization. The length of the reinforcing fiber is paramount as it dictates the mechanical strength and moldability of the resulting composite part; shorter fibers allow for easier flow and complex geometries in injection molding, while longer fibers are utilized when maximum stiffness and impact resistance are required for semi-structural elements. Furthermore, the segmentation by matrix material highlights the differing requirements across industries, ranging from cost-effective commodity polymers to high-performance engineering plastics, directly influencing the processing temperature and the final application environment of the component, allowing suppliers to tailor products to specific customer needs effectively.

- By Fiber Type (Length):

- Short Carbon Fibre (SCF) Pellets

- Long Carbon Fibre (LCF) Pellets

- By Resin Type (Polymer Matrix):

- Polyamide (PA) / Nylon Pellets

- Polypropylene (PP) Pellets

- Polycarbonate (PC) Pellets

- Polyether Ether Ketone (PEEK) Pellets

- Polyetherimide (PEI) Pellets

- Other Engineering Plastics (e.g., PPS, ABS)

- By End-Use Industry:

- Automotive (Structural, Interior, Exterior Components)

- Aerospace and Defense (Cabin parts, UAV/Drone structures)

- Consumer Electronics (Casings, Internal Frames)

- Industrial Machinery and Equipment

- Medical Devices

- Sports and Leisure

Value Chain Analysis For Carbon Fibre Pellets Market

The Value Chain for the Carbon Fibre Pellets Market begins with upstream activities involving the synthesis of precursor materials (usually polyacrylonitrile or pitch) followed by the high-temperature carbonization process to produce continuous carbon fibers. This is followed by the manufacturing of thermoplastic resins (e.g., PA, PP, PEEK). Midstream activities are critical and involve the specialized process of compounding, where continuous carbon fibers are chopped, surface treated, and then melt-mixed with the thermoplastic resin in high-precision twin-screw extruders to form the homogenized carbon fibre pellets. Success at this stage relies heavily on minimizing fiber breakage while ensuring perfect dispersion and strong interfacial adhesion between the fiber and the matrix, a key differentiator in terms of pellet quality and ultimate mechanical performance.

Downstream activities involve the distribution channel, which moves the finished pellets from the compounders to the final processors. Distribution can be managed directly through sales teams serving large, dedicated automotive or aerospace Tier 1 suppliers, or indirectly through specialized polymer distributors and material trading houses that cater to smaller injection molders and regional contract manufacturers. Direct sales channels are typically favored for custom, high-performance PEEK or aerospace-grade pellets where technical support and quality traceability are paramount, allowing compounders to maintain tighter control over specifications and customer relationship management. Indirect channels provide broader market reach and inventory management flexibility for standard PA or PP based carbon fibre pellets used in general industrial or consumer applications, optimizing logistics for smaller, geographically dispersed clients.

The efficiency of the distribution channel significantly impacts the cost structure and lead times for end-users. Contract manufacturers specializing in injection molding form the core of the market’s downstream consumption, transforming the pellets into finished components using high-tonnage molding machines. Optimization along the entire value chain—from sourcing cost-effective, high-quality carbon fiber (virgin or recycled) upstream, to maintaining efficient compounding operations midstream, and ensuring timely delivery through robust distribution networks downstream—is essential for maximizing profitability and competitiveness in this highly specialized materials market, driving continuous process innovation in compounding machinery and material handling systems.

Carbon Fibre Pellets Market Potential Customers

The primary consumers and end-users of Carbon Fibre Pellets are large-scale component manufacturers and Tier 1 suppliers who specialize in high-volume production using advanced thermoplastic processing techniques, mainly injection molding and extrusion. These customers prioritize materials that offer significant performance enhancements—specifically high strength-to-weight ratios—coupled with processing characteristics suitable for rapid cycle times and automated manufacturing environments. The automotive industry represents the largest customer segment, with OEMs and their suppliers purchasing pellets for structural components (e.g., front-end modules, battery housings), interior elements (e.g., seat frames, dashboards), and exterior parts where lightweighting directly contributes to compliance with emission standards and enhanced vehicle dynamics, particularly crucial in the rapidly growing electric vehicle segment.

The aerospace and defense sectors constitute a high-value customer base, focusing on ultra-performance pellets utilizing matrices like PEEK and PEI for non-structural and semi-structural interior components, brackets, ducting, and UAV (Unmanned Aerial Vehicle) parts. These customers demand stringent quality control, full material traceability, and certifications due to the critical nature of their applications, often resulting in customized pellet formulations tailored for specific flammability, smoke, and toxicity (FST) requirements. Furthermore, manufacturers of consumer electronics (laptops, mobile device chassis, high-end camera bodies) and sports equipment (bicycle components, ski gear) are also vital customers, seeking the premium feel, stiffness, and durability carbon fibre pellets provide for high-end product differentiation and aesthetic appeal in competitive consumer markets globally.

A growing segment of potential customers includes specialized contract manufacturers engaged in medical device production and industrial machinery. In the medical field, carbon fibre pellets are used for lightweight, radiolucent (X-ray transparent) components in imaging equipment and surgical tools, offering sterility and chemical resistance. For industrial applications, customers utilize these pellets for high-wear parts, specialized tooling, and components exposed to harsh chemical environments, valuing the corrosion resistance and dimensional stability of the reinforced thermoplastics under continuous load. The diversity of required mechanical and thermal specifications means that compounders must maintain a flexible portfolio, capable of offering standard PA6/PA66 pellets for general industrial use as well as customized, high-priced grades for niche engineering challenges.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650.4 Million |

| Market Forecast in 2033 | USD 1,180.9 Million |

| Growth Rate | 8.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SGL Carbon SE, Toray Industries Inc., Teijin Limited, Mitsubishi Chemical Corporation, Solvay S.A., BASF SE, Covestro AG, PolyOne Corporation (Avient), Ensinger GmbH, Celanese Corporation, RTP Company, Kingfa Sci. & Tech. Co. Ltd., PlastiComp LLC, LATI S.p.A., Hexcel Corporation, Daicel Corporation, Saudi Basic Industries Corporation (SABIC), DSM Engineering Materials (now part of LANXESS), Lehmann&Voss&Co., Technyl (DOMO Chemicals) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Carbon Fibre Pellets Market Key Technology Landscape

The technological landscape of the Carbon Fibre Pellets Market is primarily defined by advancements in compounding techniques and material optimization necessary to maximize the mechanical translation of the fiber properties into the final part. Core technology centers around highly specialized twin-screw extrusion systems, which are precision-engineered to handle carbon fibers gently while ensuring maximum dispersion uniformity within the polymer melt. Innovations focus heavily on screw design geometry, utilizing specific elements that minimize shear forces to prevent fiber length degradation (attrition) during the melting and mixing phases, which is critical for maintaining the high performance required in structural applications. Furthermore, sophisticated thermal control systems and degassing capabilities are integrated into these extruders to handle high-temperature, moisture-sensitive engineering plastics like PEEK and PA effectively, preventing polymer degradation and volatile content from compromising pellet integrity.

Surface treatment technology is another fundamental element, focusing on chemical sizing agents and coupling methods applied to the carbon fiber during the upstream process, which are designed to enhance the interfacial adhesion between the chemically inert carbon surface and the specific thermoplastic matrix (e.g., anhydride-modified polypropylenes). Improved adhesion is paramount for effective stress transfer from the matrix to the fiber under load, directly impacting the tensile strength, stiffness, and long-term fatigue performance of the resulting composite. Research and development efforts are concentrated on developing highly selective functionalization techniques that chemically bond the fiber to the polymer chain, moving beyond purely mechanical interlocking, thereby unlocking higher performance potential even with shorter fiber lengths utilized in pellets suitable for complex injection molding processes, reducing material waste and enabling the use of lower cost fiber forms.

Furthermore, digital technologies, including advanced computational fluid dynamics (CFD) modeling and finite element analysis (FEA), form a critical part of the technology landscape, enabling predictive simulation of the flow behavior of the carbon fibre pellets during the injection molding process. This predictive capability allows molders to anticipate and mitigate defects such as weld lines, fiber orientation anisotropy, and warpage before tooling is finalized, significantly reducing product development cycles and material consumption during trials. The increasing integration of recycled carbon fiber (rCF) feedstock also drives technological innovation, requiring advanced cleaning, sorting, and sizing processes to ensure that the rCF maintains sufficient quality and consistent mechanical properties when compounded into pellets, opening up new, sustainable avenues for high-performance materials supply and expanding market viability through reduced material costs.

Regional Highlights

The global distribution of the Carbon Fibre Pellets Market exhibits significant regional variations in terms of consumption volume, primary end-use sectors, and technological maturity, influenced heavily by regional manufacturing output and regulatory environments. Asia Pacific (APAC) dominates the market share due to its enormous and rapidly growing automotive manufacturing base, particularly in China and Southeast Asia, driven by substantial government support for electric vehicles (EVs) and massive industrial infrastructure development. North America, characterized by a highly advanced aerospace and defense sector, along with a focus on advanced manufacturing in specialized automotive segments, commands a significant share, particularly in the consumption of high-performance and specialty carbon fibre pellets (e.g., PEEK, LCF) requiring strict quality assurance protocols.

Europe holds a mature and technologically sophisticated market position, distinguished by stringent environmental regulations and a strong emphasis on sustainability and circular economy principles, leading to higher adoption rates of recycled carbon fiber pellets. The European automotive industry, known for its premium and luxury segments, actively seeks lightweighting solutions to meet aggressive CO2 emission targets, while the industrial machinery and renewable energy sectors (especially offshore wind) also contribute substantially to the demand. Latin America and the Middle East & Africa (MEA) represent emerging markets, with growth primarily tied to initial investments in localized automotive assembly and basic infrastructure projects, offering long-term potential but currently characterized by lower overall market penetration compared to the triad regions.

- Asia Pacific (APAC): Dominates consumption volume driven by high-volume automotive production (EVs in China), rapid industrialization, and favorable governmental policies promoting advanced composite adoption. Key markets include China, Japan, and South Korea, focusing heavily on cost-effective short carbon fibre (SCF) PA and PP pellets.

- North America: Strong market for high-value applications, sustained by the aerospace and defense sectors, and sophisticated R&D in automotive structural components. Leading consumers of specialized long carbon fibre (LCF) and high-performance polymer matrices like PEEK and PEI for critical applications.

- Europe: Characterized by regulatory-driven lightweighting mandates, high penetration of recycled carbon fiber solutions, and demand from premium automotive brands and the renewable energy industry. Germany, France, and the UK are core consumers, emphasizing material traceability and lifecycle management.

- Latin America (LATAM): Emerging market concentrated around basic automotive manufacturing and limited industrial machinery sectors; growth acceleration is contingent on regional economic stability and further industrial investment in sophisticated processing capabilities.

- Middle East & Africa (MEA): Niche market with demand stemming primarily from localized defense spending, initial infrastructure projects, and limited oil and gas applications requiring specialized, corrosion-resistant materials.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Carbon Fibre Pellets Market.- SGL Carbon SE

- Toray Industries Inc.

- Teijin Limited

- Mitsubishi Chemical Corporation

- Solvay S.A.

- BASF SE

- Covestro AG

- PolyOne Corporation (Avient)

- Ensinger GmbH

- Celanese Corporation

- RTP Company

- Kingfa Sci. & Tech. Co. Ltd.

- PlastiComp LLC

- LATI S.p.A.

- Hexcel Corporation

- Daicel Corporation

- Saudi Basic Industries Corporation (SABIC)

- DSM Engineering Materials (now part of LANXESS)

- Lehmann&Voss&Co.

- Technyl (DOMO Chemicals)

Frequently Asked Questions

Analyze common user questions about the Carbon Fibre Pellets market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Short Carbon Fibre (SCF) and Long Carbon Fibre (LCF) pellets?

SCF pellets (typically <1mm) offer superior flowability, making them ideal for complex, thin-walled injection molded parts in high-volume applications, but yield lower overall mechanical strength. LCF pellets (often 10–12mm) maintain greater fiber length after molding, providing significantly higher stiffness, impact resistance, and creep resistance, making them suitable for semi-structural components where maximum performance is critical.

Which thermoplastic matrix is most commonly used with carbon fibre pellets for automotive applications?

Polyamide (PA), specifically PA6 and PA66 (Nylon), is the most frequently used thermoplastic matrix due to its excellent balance of mechanical properties, chemical resistance, ease of processing via injection molding, and cost-effectiveness, making it suitable for under-the-hood and structural components requiring high performance at reasonable volumes.

How does the use of carbon fibre pellets benefit Electric Vehicle (EV) manufacturing?

Carbon fibre pellets enable significant lightweighting of EV components (like battery enclosures, body panels, and crash structures), directly offsetting the weight of heavy battery packs. This weight reduction extends the vehicle’s driving range, improves energy efficiency, and enhances overall vehicle handling and performance, which is a key driver for EV adoption globally.

What challenges are associated with processing carbon fibre reinforced thermoplastic pellets?

Key processing challenges include fiber attrition (breakage) during compounding and injection molding, which degrades mechanical performance; ensuring homogenous fiber dispersion to avoid weak spots; and managing the higher viscosity and abrasive nature of the material, which requires specialized, wear-resistant tooling and precise temperature controls to achieve optimal part quality.

Is recycled carbon fiber (rCF) being utilized in the production of carbon fibre pellets?

Yes, the utilization of recycled carbon fiber (rCF) in pellet formulation is a growing trend, driven by sustainability goals and the need to lower input material costs. While rCF pellets may offer slightly lower mechanical performance than virgin fiber counterparts, advancements in cleaning and sizing technologies are enabling their successful deployment in non-critical and semi-structural applications, particularly in the European market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager