Carbon Management Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438600 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Carbon Management Software Market Size

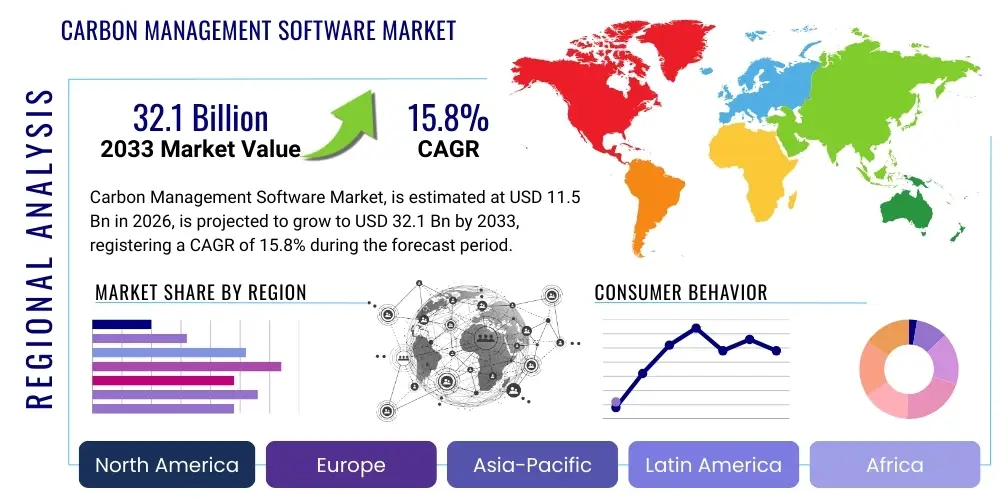

The Carbon Management Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. The market is estimated at USD 11.5 billion in 2026 and is projected to reach USD 32.1 billion by the end of the forecast period in 2033.

Carbon Management Software Market introduction

The Carbon Management Software Market encompasses technological solutions designed to help organizations track, monitor, report, and reduce their greenhouse gas (GHG) emissions across Scope 1, Scope 2, and Scope 3 categories. These specialized platforms provide automated data collection, calculation, auditing, and visualization tools essential for meeting increasingly stringent global regulatory requirements, such as the European Union’s Corporate Sustainability Reporting Directive (CSRD) and evolving mandates from the U.S. Securities and Exchange Commission (SEC). The software serves as a critical infrastructure layer for Environmental, Social, and Governance (ESG) reporting, enabling corporate entities to establish credible decarbonization strategies and transparently communicate their climate performance to stakeholders, investors, and regulatory bodies. Major applications include compliance reporting, energy consumption optimization, supply chain emissions tracking, and internal carbon pricing mechanisms.

Carbon Management Software Market Executive Summary

The Carbon Management Software Market is undergoing rapid expansion, driven primarily by pervasive business trends emphasizing climate accountability and mandatory disclosure frameworks across major economies. Regional trends indicate North America and Europe currently hold the largest market shares due to early regulatory adoption and high corporate sustainability maturity, while the Asia Pacific region is demonstrating the highest growth potential, fueled by massive industrial decarbonization efforts in countries like China and India. Segment trends show a significant pivot towards cloud-based Software-as-a-Service (SaaS) deployment models, which offer enhanced scalability, lower total cost of ownership, and quicker implementation times, appealing particularly to large multinational corporations seeking centralized data management. Furthermore, the solutions segment, focused on comprehensive platform capabilities, continues to dominate the market, though the associated services segment—covering consulting and implementation—is growing robustly as organizations require expert assistance in standardizing complex Scope 3 data collection protocols and establishing verifiable emission reduction targets.

AI Impact Analysis on Carbon Management Software Market

User queries regarding the impact of Artificial Intelligence (AI) frequently center on how these technologies can move carbon management beyond basic reporting into predictive and prescriptive action. Common themes include the ability of AI to automate complex Scope 3 data aggregation from fragmented supply chains, the use of Machine Learning (ML) for accurate real-time emissions forecasting, and how Generative AI (GenAI) can simplify compliance documentation and scenario planning. Users are particularly concerned with whether AI can resolve the long-standing issues of data quality, completeness, and standardization across diverse operational boundaries, transforming carbon accounting from a historical audit function into a dynamic decision-making tool for corporate sustainability officers.

The integration of AI and ML is revolutionizing the computational backbone of carbon management platforms, shifting the focus from manual data input to intelligent data ingestion and validation. AI algorithms are crucial for parsing unstructured data from thousands of invoices, IoT sensors, and enterprise resource planning (ERP) systems, automatically identifying inconsistencies and filling data gaps with statistically robust proxies, thereby significantly reducing the labor intensity and uncertainty associated with traditional emissions quantification. This enhanced data veracity is paramount for organizations subjected to rigorous external audits and regulatory scrutiny, ensuring that reported carbon footprints are both comprehensive and defensible. Furthermore, AI facilitates automated linkage between financial data and operational data, enabling true integration of climate risk metrics into core business intelligence platforms.

Beyond data processing, the most transformative application of AI lies in its predictive modeling and optimization capabilities. ML models can analyze historical energy consumption patterns, weather data, and operational efficiencies to forecast future emissions under various business scenarios, such as expansion or supply chain restructuring. This predictive layer allows companies to conduct sophisticated climate risk modeling and proactively identify the most cost-effective and operationally feasible levers for emissions reduction, such as optimizing fleet routes, managing building HVAC systems in real-time, or selecting low-carbon procurement options. Generative AI is increasingly used to draft customized, audience-specific disclosures for different stakeholders (investors, consumers, regulators), ensuring messaging consistency while adhering to specific reporting standards like the Task Force on Climate-related Financial Disclosures (TCFD) or Global Reporting Initiative (GRI).

- AI-driven automation of complex Scope 3 data collection and normalization.

- Machine Learning for real-time emissions forecasting and predictive modeling of climate risk.

- Enhanced data validation and quality assurance, boosting auditability and compliance confidence.

- Optimization algorithms prescribing cost-effective decarbonization pathways and operational efficiencies.

- Generative AI assistance in drafting sophisticated, compliant sustainability reports and disclosures.

- Improved integration of climate metrics into financial planning and core enterprise resource management systems.

DRO & Impact Forces Of Carbon Management Software Market

The Carbon Management Software Market expansion is significantly driven by a confluence of accelerating regulatory pressures and a dramatic shift in corporate accountability expectations. Stringent governmental mandates, particularly those aimed at achieving net-zero targets, compel organizations to adopt advanced tracking solutions to ensure compliance and avoid punitive financial penalties. However, the complexity inherent in quantifying global, decentralized Scope 3 emissions, coupled with the substantial initial capital outlay required for comprehensive platform integration, presents a notable restraint to faster market penetration. The primary opportunity lies in expanding the utility of these platforms through integration with emerging technologies like AI/ML and blockchain, enabling unprecedented levels of data transparency and creating new markets in voluntary carbon credit tracking and trading, which collectively constitute the primary impact forces shaping the market trajectory.

Drivers fueling market growth are highly concentrated around legislative momentum and financial incentives. The global push toward standardized ESG reporting, evidenced by the mandatory adoption of directives like the CSRD in Europe and the forthcoming mandates globally, forces thousands of large and mid-sized enterprises into the compliance ecosystem, generating massive demand for robust, verifiable carbon accounting tools. Furthermore, investor and stakeholder activism is pushing corporations beyond mere compliance; institutions are increasingly utilizing climate performance as a core metric for capital allocation and long-term valuation, rewarding companies that demonstrate credible, measurable progress towards decarbonization targets. This pressure transforms carbon management software from a compliance necessity into a strategic asset for attracting capital and mitigating brand risk.

Despite the strong drivers, several inherent restraints challenge the market's seamless evolution. The most significant is the profound challenge of data fragmentation and standardization, particularly concerning Scope 3 emissions, which often account for over 70% of a company’s total carbon footprint and rely heavily on data from third-party suppliers, many of whom lack adequate tracking capabilities. Additionally, the initial high cost of enterprise-level software licenses, coupled with the substantial resources required for integration, training, and consulting services, can be prohibitive for smaller organizations or those with limited IT infrastructure budgets. Nevertheless, these restraints are mitigated by significant opportunities, particularly the untapped Small and Medium Enterprise (SME) segment, which is increasingly being pulled into the reporting requirements of their large corporate clients, creating a burgeoning demand for accessible, scalable, and standardized SaaS solutions tailored for simplified carbon accounting processes.

Segmentation Analysis

The Carbon Management Software Market is analyzed across critical dimensions including deployment model, organizational component, industry vertical, and enterprise size, reflecting the diverse needs of the global user base. The fundamental segmentation relies heavily on the deployment architecture, with the shift towards cloud-based SaaS models dominating due to their flexibility, lower infrastructure requirement, and continuous feature updates, offering a significant advantage over legacy on-premise installations. Furthermore, the market is broadly divided between solutions (the core software platform) and services (consulting, implementation, and maintenance), recognizing that effective carbon management requires both sophisticated technology and expert guidance, especially in navigating complex regulatory landscapes and supply chain data integration challenges. This granularity allows vendors to tailor their offerings—whether focused on real-time Scope 1 monitoring for energy-intensive manufacturing or comprehensive Scope 3 tracking for financial institutions—to maximize relevance and market penetration across specialized end-user sectors.

- By Deployment:

- Cloud-based

- On-premise

- By Component:

- Solution (Software/Platform)

- Service (Consulting, Implementation, Support, Training)

- By Industry Vertical:

- Manufacturing

- Energy & Utilities

- IT & Telecom

- Transportation & Logistics

- BFSI (Banking, Financial Services, and Insurance)

- Government & Public Sector

- Retail & Consumer Goods

- By Organization Size:

- Large Enterprises

- Small and Medium Enterprises (SMEs)

Value Chain Analysis For Carbon Management Software Market

The value chain for the Carbon Management Software Market initiates with upstream activities focused on foundational technological development, primarily involving database infrastructure providers, data aggregators, and providers of specific emission factor libraries (such as those maintained by the EPA or Defra). This upstream segment is characterized by intensive R&D to ensure the accuracy and scalability of data ingestion capabilities, which form the bedrock of any credible carbon accounting platform. Midstream activities involve the core software vendors who integrate these technological building blocks into comprehensive platforms, focusing on features like regulatory mapping, visualization dashboards, scenario planning tools, and integration capabilities with standard enterprise software (e.g., SAP, Oracle). The quality of the midstream vendor is judged by the sophistication of their algorithms for normalizing highly disparate data sources and ensuring real-time calculation accuracy across multiple international protocols.

The downstream segment focuses entirely on delivery, implementation, and utilization of the software by end-users. This stage involves strategic partnerships with specialized sustainability consulting firms that assist clients not just in deploying the software (direct channel) but also in establishing internal governance structures, training personnel, and interpreting the complex data output to formulate actionable decarbonization strategies. Distribution channels are largely bifurcated: direct sales via the vendor’s own sales force are common for large, customized enterprise deployments, while indirect channels leverage partnerships with IT integrators, regional resellers, and managed service providers to reach the vast SME market and ensure seamless integration into existing IT ecosystems. These indirect partnerships are crucial for localized market penetration and providing ongoing technical support, transforming the software purchase into a continuous, managed service.

Successful optimization of the value chain hinges on seamless data flow and robust interoperability between upstream data sources and downstream application layers. Critical areas of focus include standardizing APIs for rapid data exchange and maintaining up-to-date, geographically relevant emission factor databases, which are often proprietary and key competitive differentiators for the core software providers. Furthermore, the increasing reliance on third-party services for Scope 3 data verification and supplier engagement mandates tight collaboration between the software vendor, the client, and external consultants to ensure the platform’s output aligns with corporate decarbonization commitments and regulatory expectations, making the service component of the downstream value chain increasingly vital.

Carbon Management Software Market Potential Customers

Potential customers for Carbon Management Software span the entire spectrum of large organizations globally that are either mandated by regulation to report emissions or are voluntarily engaging in ambitious ESG initiatives to satisfy investor and consumer demands. The primary buyers are large enterprises in energy-intensive sectors such as Manufacturing, Energy & Utilities, and Transportation & Logistics, where Scope 1 and Scope 2 emissions are high and the need for operational efficiency through carbon tracking is paramount. These entities require highly customized, scalable solutions capable of integrating thousands of disparate data points from global assets and complex industrial processes, often necessitating on-premise or hybrid cloud deployments due to data sensitivity and legacy systems.

A rapidly expanding customer base includes the BFSI and IT & Telecom sectors, where Scope 3 emissions—particularly those related to financed emissions (in banking) or supply chain hardware (in tech)—constitute the majority of their footprint. These customers require platforms with strong financial linkage capabilities and sophisticated tools for engaging and auditing their extensive supply chains. For banks, insurance companies, and asset managers, the software is crucial for managing portfolio emissions (PCAs) and conducting climate scenario analysis required by financial regulators, making the software a critical component of risk management, not just compliance reporting.

The emerging segment of potential customers includes SMEs, often those operating within the supply chains of multinational corporations (MNCs). As MNCs are increasingly required to report comprehensive Scope 3 data, they exert downward pressure on their suppliers to provide verifiable carbon data. This creates a mandatory requirement for SMEs to adopt simplified, affordable, and readily deployable SaaS solutions to maintain lucrative business contracts. Government agencies and public sector organizations, driven by national decarbonization goals, also represent significant, stable customers, demanding solutions that can track emissions across infrastructure projects and public services while ensuring data security and regulatory adherence.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 11.5 Billion |

| Market Forecast in 2033 | USD 32.1 Billion |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SAP SE, Salesforce (Net Zero Cloud), IBM, Microsoft (Sustainability Manager), Schneider Electric, Accruent, Cority, Sphera, Measurabl, Enablon, Persefoni, Plan A, EcoVadis, Clarity AI, Watershed, Sinai Technologies, Greenly, OneTrust, Emitwise, Diligent. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Carbon Management Software Market Key Technology Landscape

The Carbon Management Software market is underpinned by several converging technological advancements, moving far beyond basic spreadsheet calculations into sophisticated enterprise-level platforms. At the core is the Software-as-a-Service (SaaS) architecture, which facilitates rapid updates, seamless scalability, and accessibility, making it the dominant deployment model for both large enterprises and SMEs. Critical to functionality is the development of robust Application Programming Interfaces (APIs) and connectors that ensure interoperability with existing operational technologies (OT), Internet of Things (IoT) sensors, and financial Enterprise Resource Planning (ERP) systems (such as SAP S/4HANA or Oracle Fusion). These integration capabilities are vital for automating the ingestion of real-time energy usage, travel data, and procurement records, minimizing manual data entry and calculation error, which directly addresses one of the primary constraints in carbon accounting.

Advanced data science technologies, specifically Machine Learning (ML) and predictive analytics, represent the cutting edge of the technology landscape. ML algorithms are deployed for data gap filling, using historical trends and industry benchmarks to estimate emissions where primary data is unavailable—a common challenge in complex Scope 3 reporting. Furthermore, these predictive tools enable forward-looking scenario modeling, allowing corporations to simulate the carbon and cost impact of strategic decisions, such as transitioning to renewable energy sources or optimizing logistics routes. The use of advanced visualization tools, including digital twins and interactive dashboards, is also essential, translating complex climate data into actionable insights for both C-suite executives and operational managers, fostering enterprise-wide engagement in decarbonization efforts.

Blockchain technology is emerging as a critical component, particularly for ensuring the integrity and traceability of carbon credits, offsets, and verifiable claims related to renewable energy certificates (RECs). By providing an immutable, decentralized ledger, blockchain enhances transparency and reduces the risk of double counting in voluntary carbon markets, increasing the credibility of corporate net-zero assertions. Furthermore, continuous investment in specialized emission factor databases that comply with various international standards (GHG Protocol, ISO 14064) remains crucial, ensuring that the calculations performed by the software are defensible in regulatory audits. The convergence of AI for data processing, cloud architecture for delivery, and blockchain for verification solidifies the technological foundation required for the next generation of climate intelligence platforms.

Regional Highlights

Regional dynamics play a crucial role in shaping the demand, regulation, and technological adoption patterns within the Carbon Management Software Market. While North America and Europe currently dominate the market in terms of spending and maturity, Asia Pacific is projected to exhibit the highest CAGR due to rapid industrialization, increasing awareness, and a nascent but accelerating regulatory environment.

- North America: This region is a leading market, characterized by sophisticated technological adoption and driven primarily by voluntary corporate commitments, large institutional investor pressure, and emerging regulatory frameworks, particularly the SEC’s proposed climate disclosure rules. The market benefits from a high concentration of leading software vendors and a strong culture of enterprise data management. Demand is concentrated among large tech companies, financial institutions, and the oil and gas sector seeking to manage extensive Scope 3 footprints and demonstrate climate resilience.

- Europe: Europe represents the most regulatory-driven market, largely fueled by the implementation of the European Green Deal, the EU Taxonomy, and the mandatory CSRD. These regulations compel thousands of companies, including non-EU firms operating within the bloc, to standardize and verify their carbon reporting. This stringent environment drives high demand for integrated software solutions specializing in complex, auditable compliance reporting and alignment with various EU directives, fostering strong growth in the SaaS segment.

- Asia Pacific (APAC): APAC is positioned as the fastest-growing market. While regulatory enforcement historically lagged behind the West, key economies like Japan, South Korea, and increasingly China and India, are establishing ambitious national net-zero targets and local disclosure requirements. The market growth is fueled by massive industrial sectors (manufacturing, power generation) needing to modernize operational efficiency and manage high Scope 1 and 2 emissions, leading to high adoption rates of advanced monitoring and optimization software.

- Latin America (LATAM): The LATAM market is emerging, with demand concentrated in large commodity-exporting economies such as Brazil and Mexico, driven by international trade requirements and pressure from multinational corporate partners. Adoption is segmented, with multinational subsidiaries requiring software to align with global headquarters' ESG mandates, while local companies focus on basic inventory and compliance tools tailored to localized regulatory standards.

- Middle East and Africa (MEA): Growth in MEA is concentrated around major energy producers and financial hubs like the UAE and Saudi Arabia, which are executing ambitious national diversification and sustainability visions (e.g., Saudi Vision 2030). Demand is primarily focused on large-scale infrastructure projects, energy transition management, and utilizing carbon management solutions to attract foreign investment and participate in global climate initiatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Carbon Management Software Market.- SAP SE

- Salesforce (Net Zero Cloud)

- IBM

- Microsoft (Sustainability Manager)

- Schneider Electric

- Accruent

- Cority

- Sphera

- Measurabl

- Enablon

- Persefoni

- Plan A

- EcoVadis

- Clarity AI

- Watershed

- Sinai Technologies

- Greenly

- OneTrust

- Emitwise

- Diligent

Frequently Asked Questions

Analyze common user questions about the Carbon Management Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Carbon Management Software and why is it essential for corporate reporting?

Carbon Management Software is an integrated platform used by organizations to track, calculate, and report greenhouse gas (GHG) emissions across Scope 1, 2, and 3 categories. It is essential for compliance with evolving global regulations (e.g., CSRD, SEC mandates) and for demonstrating verifiable progress toward corporate net-zero targets to investors and stakeholders.

What is the key driver of market growth in the European region?

The primary driver in Europe is stringent and mandatory regulatory pressure, notably the Corporate Sustainability Reporting Directive (CSRD) and associated EU Taxonomy requirements. These directives compel a large number of companies to adopt auditable, comprehensive software solutions for standardized ESG and climate-related disclosure.

How does AI technology specifically enhance Scope 3 emissions tracking?

AI, through Machine Learning, significantly enhances Scope 3 tracking by automating the collection of fragmented data from thousands of suppliers, validating data quality, filling gaps using predictive modeling and proxies, and ensuring standardized conversion factors are applied, thereby overcoming the critical challenge of supply chain data complexity.

Which deployment model dominates the Carbon Management Software Market?

The Cloud-based Software-as-a-Service (SaaS) model dominates the market. SaaS solutions offer superior scalability, lower initial capital expenditure, continuous feature updates, and faster deployment cycles, making them highly attractive to multinational corporations managing decentralized global operations.

What is the primary constraint impacting the wider adoption of these solutions by SMEs?

The primary constraint for Small and Medium Enterprises (SMEs) is the high initial cost associated with complex enterprise-level software licenses and the need for extensive consulting services for integration and training. However, the rise of simplified, affordable SaaS tools is mitigating this constraint, driven by pressure from large corporate clients.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager