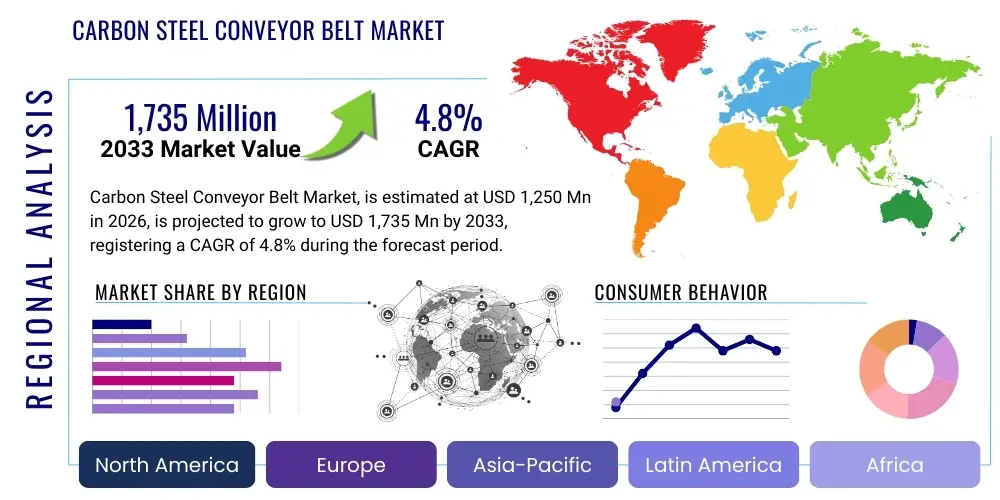

Carbon Steel Conveyor Belt Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436335 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Carbon Steel Conveyor Belt Market Size

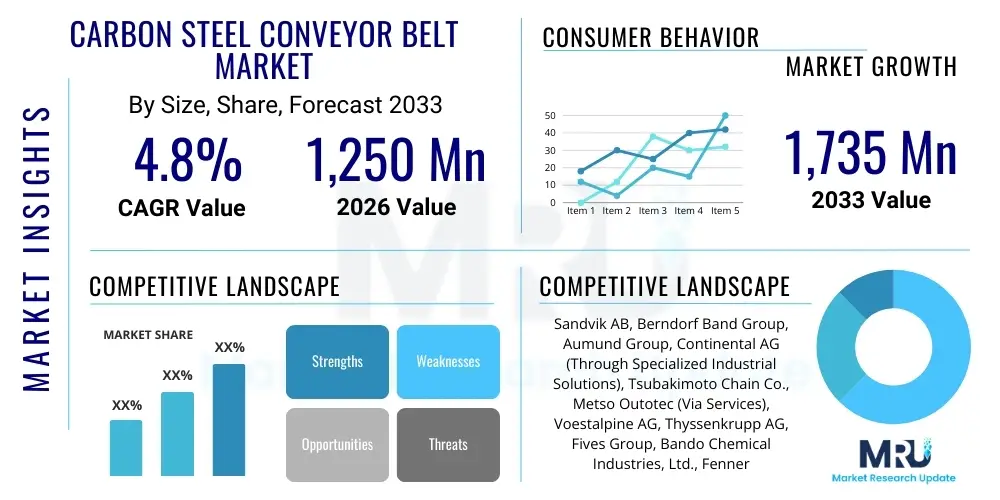

The Carbon Steel Conveyor Belt Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 1,250 Million in 2026 and is projected to reach USD 1,735 Million by the end of the forecast period in 2033. This consistent growth is primarily driven by the expanding need for robust, durable, and high-temperature tolerant material handling solutions across heavy industries, particularly mining, cement, steel manufacturing, and specialized applications requiring resistance to wear and tear that conventional rubber belts cannot satisfy. The demand surge reflects increased global infrastructural development and automation investments.

Carbon Steel Conveyor Belt Market introduction

The Carbon Steel Conveyor Belt Market encompasses specialized material handling systems utilizing belts constructed predominantly from high-strength carbon steel alloys. These belts are essential in environments demanding extreme durability, high tensile strength, precise tracking, resistance to high temperatures, and non-porous surfaces for hygienic applications. Unlike fabric-reinforced rubber belts, carbon steel variants offer superior longevity and operational reliability in demanding industrial settings, minimizing downtime and maintenance costs.

Major applications of these belts include transporting hot materials such as sintered ore, clinker, hot asphalt, and glass, as well as handling abrasive materials like coal, iron ore, and specialized chemicals in sectors such as cement production, metallurgy, and mining. Key benefits driving adoption include exceptional wear resistance, minimal elongation under load, and the ability to operate effectively in temperatures exceeding 400°C. The fundamental driving factors include the rapid pace of global industrialization, stringent efficiency requirements in bulk handling operations, and continuous technological advancements improving steel alloy composition and belt welding techniques to enhance fatigue life.

The carbon steel conveyor belt is an integral component in automating continuous process flows. Its superior structural integrity supports heavier loads over longer distances compared to lighter-duty alternatives. The market evolution is characterized by innovations focusing on optimizing belt thickness, edge sealing mechanisms, and modular design for easier installation and maintenance. These technical improvements are crucial for maintaining operational uptime in critical infrastructure projects and high-volume processing facilities globally, securing its position as a preferred solution in the heavy-duty material transport sector.

Carbon Steel Conveyor Belt Market Executive Summary

The Carbon Steel Conveyor Belt Market is poised for substantial expansion, underpinned by accelerated industrial growth in Asia Pacific and increasing automation across Europe and North America. Key business trends include a notable shift towards specialized, corrosion-resistant steel grades and the integration of smart monitoring systems to predict belt failure and optimize maintenance schedules. Regional trends show APAC, particularly China and India, leading demand due to massive investments in mining and infrastructure, while developed markets focus on replacing aging rubber systems with more efficient, high-performance steel alternatives.

Segment trends highlight the heavy-duty application segment as the dominant revenue generator, driven by the requirement for robust transport solutions in primary resource extraction and processing. Furthermore, there is growing emphasis on the light and medium-duty segments within the food processing and pharmaceuticals sectors, where stainless steel variants (often grouped operationally but distinct technically) are employed for hygiene, while carbon steel remains crucial for high-temperature drying and specialized thermal processes. The market structure remains moderately consolidated, with major players competing on material science expertise, custom engineering capabilities, and global service networks. Strategic collaborations focused on belt installation and maintenance services are becoming crucial competitive differentiators.

Overall market dynamics reflect a balancing act between material cost volatility and the long-term total cost of ownership benefits offered by carbon steel systems. End-users are increasingly prioritizing belts with extended operational lifespans and superior resilience against environmental stressors. This executive summary underscores the robust demand outlook, driven by foundational economic activities and supported by technological improvements aimed at maximizing throughput and minimizing environmental impact through efficient energy use in conveyance systems.

AI Impact Analysis on Carbon Steel Conveyor Belt Market

User inquiries regarding AI's impact on the Carbon Steel Conveyor Belt Market frequently revolve around predictive maintenance, operational efficiency improvements, and quality control during manufacturing. Common questions ask how AI algorithms can predict belt failure years in advance, optimize motor power consumption based on load dynamics, and ensure flawless welding and joint integrity during the belt production phase. Users are concerned about the implementation costs versus the return on investment (ROI) from reduced unplanned downtime and whether AI integration will necessitate significant changes to existing infrastructure. The underlying theme is the expectation that AI and Machine Learning (ML) will transform these traditionally mechanical assets into "smart assets," substantially extending service life and enhancing reliability in highly abrasive and stressful operating environments.

- AI-driven Predictive Maintenance: Utilizing ML models analyzing vibration, temperature, and acoustic data from sensors to forecast belt component failure, drastically reducing unplanned downtime.

- Optimized Operational Efficiency: AI algorithms dynamically adjusting conveyor speed and tension based on real-time material flow and load characteristics, leading to significant energy savings.

- Manufacturing Quality Control: AI vision systems monitoring the fabrication process of carbon steel belts, identifying micro-cracks or welding inconsistencies immediately, ensuring high product integrity.

- Supply Chain Optimization: ML predicting future demand for specific steel grades and customized belt widths, enabling manufacturers to optimize raw material inventory and production schedules.

- Enhanced Safety Protocols: AI analyzing surveillance and sensor data to detect abnormal operating conditions or potential safety hazards related to belt movement and material spillage, triggering automated shutdowns.

DRO & Impact Forces Of Carbon Steel Conveyor Belt Market

The Carbon Steel Conveyor Belt Market is primarily driven by expanding global mining activities and high demand from heavy manufacturing sectors, necessitating durable material transport. However, it faces restraints related to the high initial capital expenditure compared to conventional belting systems and inherent susceptibility to corrosion if not properly maintained or treated. Opportunities arise from technological advancements in specialized alloys and surface treatments enhancing durability and the increasing global focus on automation. The impact forces show that high capital costs exert a moderate restraint, while the overwhelming necessity for high-temperature and high-abrasion resistance in core industrial applications acts as a strong, positive driving force, pushing the market forward despite initial investment hurdles.

Segmentation Analysis

The Carbon Steel Conveyor Belt Market is systematically segmented based on Type, focusing on material thickness and application intensity; by Application, distinguishing between end-use industries like mining and logistics; and by geography. This detailed segmentation allows manufacturers and stakeholders to precisely target strategic growth areas. The Type segmentation often dictates the cost and performance metrics, with heavier belts commanding premium pricing due to increased material content and complex fabrication processes required to achieve higher tensile strength and load-bearing capacity.

- By Type:

- Light Duty

- Medium Duty

- Heavy Duty (Thicker gauge belts used in mining and cement)

- By Application:

- Mining and Quarrying

- Cement and Aggregates

- Steel and Metallurgy

- Glass Manufacturing

- Food and Beverage Processing (Specialized thermal drying)

- Chemical and Fertilizer

- By End-User:

- Original Equipment Manufacturers (OEMs)

- Aftermarket Replacement and Maintenance

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Carbon Steel Conveyor Belt Market

The value chain for carbon steel conveyor belts begins with the upstream procurement of high-quality raw materials, primarily specialized carbon steel alloys (e.g., high-tensile steel sheets) and associated components like fasteners, tracking guides, and coating materials. Key upstream activities involve steel producers and material processing specialists ensuring the metal meets rigorous specifications for strength, flatness, and weldability. Manufacturers then engage in precision engineering, utilizing advanced laser cutting, specialized welding techniques (often plasma or friction welding), and surface treatments (galvanization or specialized coatings) to produce the final belt product. Quality control at this stage is critical, impacting the operational life and fatigue resistance of the belt.

Downstream activities focus on system integration, installation, and ongoing maintenance. Given the specialized nature and size of these belts, installation often requires highly specialized engineering teams. Distribution channels are typically bifurcated into direct sales to large OEMs (Original Equipment Manufacturers) who integrate the belts into their complete conveyor systems, and indirect sales through specialized industrial distributors and regional service providers catering primarily to the aftermarket segment for replacements and customized installations. The aftermarket segment is vital, as conveyor belts are consumable assets requiring periodic replacement due to wear and tear.

The direct channel ensures robust technical support and customization for large-scale projects in mining and infrastructure, while the indirect channel provides localized access and quicker turnaround times for smaller projects and emergency replacements. Efficiency within this value chain is increasingly measured by the lead time from material order to installation completion, emphasizing the role of robust inventory management and global logistical capabilities for major market players. Maintaining strong relationships with upstream steel suppliers who can guarantee consistent, high-specification materials is paramount to sustaining competitive advantage and controlling production costs.

Carbon Steel Conveyor Belt Market Potential Customers

The primary end-users and buyers of carbon steel conveyor belts are large industrial entities that rely on continuous, heavy-duty material transport in harsh environments. These typically include integrated steel plants, which require belts capable of handling hot slab and coil components; major global mining companies extracting coal, iron ore, copper, and precious metals; and cement manufacturers, utilizing these belts for transporting hot clinker and aggregates. These customers prioritize reliability and durability, often opting for high-specification, heavy-duty belts to minimize catastrophic failure and subsequent production losses, justifying the higher initial capital expenditure.

Secondary but rapidly growing customer bases include specialized manufacturers in the glass, heat treatment, and food processing industries (for baking/drying ovens). While the volumes in these sectors may be lower than heavy industry, their needs are highly technical, requiring belts with specific thermal conductivity and surface characteristics. For example, glass manufacturers use these belts for controlled cooling processes, demanding precise dimensional stability at elevated temperatures. These customers value customization, material certification, and compliance with high hygiene standards (even for carbon steel variants used in non-food contact, heat-intensive processes).

Ultimately, procurement decisions are highly technical, involving engineering teams and asset managers focused on maximizing the Mean Time Between Failures (MTBF) and achieving the lowest possible Total Cost of Ownership (TCO). Buyers look beyond the initial purchase price, focusing on supplier reputation for quality, technical support, and the provision of long-term maintenance contracts. Large EPC (Engineering, Procurement, and Construction) firms acting on behalf of major project owners also represent a significant customer group, specifying these belts during the design and build phase of new industrial facilities globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1,250 Million |

| Market Forecast in 2033 | USD 1,735 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sandvik AB, Berndorf Band Group, Aumund Group, Continental AG (Through Specialized Industrial Solutions), Tsubakimoto Chain Co., Metso Outotec (Via Services), Voestalpine AG, Thyssenkrupp AG, Fives Group, Bando Chemical Industries, Ltd., Fenner Group (Michelin), Intralox, PVS Process Equipment, Rexnord Corporation, Belt Technologies, Inc., Wire Belt Company of America, Capco Steel Belt Systems, Daifuku Co., Ltd., Schaefer Systems International, Flexco. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Carbon Steel Conveyor Belt Market Key Technology Landscape

The technology landscape for carbon steel conveyor belts is centered on material science innovation, precision manufacturing processes, and integration with advanced monitoring systems. Core technological advancements involve the development of specialized, high-tensile carbon and stainless steel alloys that offer enhanced fatigue resistance and superior performance at extremely high operating temperatures, often exceeding 500°C. Manufacturing technologies focus heavily on seamless welding techniques, such as continuous laser welding or electron beam welding, ensuring uniform thickness and eliminating potential stress points along the belt, which are crucial for maintaining structural integrity and preventing catastrophic failure in dynamic load applications.

A critical technological area is the refinement of belt tracking and guidance systems. Since steel belts are rigid, maintaining precise lateral tracking is challenging and essential to prevent edge damage and spillage. Modern systems utilize sophisticated roller and pulley designs, often incorporating sensors and actuators for automated dynamic alignment correction. Furthermore, surface treatment technologies, including specialized passivation layers and proprietary coatings, are used to enhance corrosion resistance, particularly when the belts operate in humid or chemically aggressive environments, extending the operational lifespan and reducing the reliance on high-cost materials like stainless steel for all applications.

The increasing digitalization of industrial processes is driving the integration of Internet of Things (IoT) devices and advanced sensors (vibration, thermal imaging, strain gauges) directly into the conveyor system components. These technologies facilitate real-time condition monitoring, providing operators with detailed data on load distribution, potential damage, and roller wear. This data feeds into AI-driven predictive maintenance platforms, marking a significant technological shift from reactive repair to proactive system management, maximizing uptime and contributing substantially to the system's overall economic feasibility over its extended service life.

Regional Highlights

The market dynamics show a distinct geographical variance in growth drivers and technology adoption across major regions. The Asia Pacific (APAC) region stands out as the global growth engine for the carbon steel conveyor belt market, primarily driven by large-scale mining operations, massive infrastructural development projects, and booming cement and metal production in China, India, and Southeast Asian nations. The demand here is volume-driven, focusing on heavy-duty, robust belts capable of continuous operation in aggressive environments. Government initiatives supporting manufacturing capacity expansion further fuel this regional dominance.

North America and Europe represent mature markets characterized by stringent safety regulations, a focus on efficiency, and high automation penetration. While overall industrial growth may be slower than APAC, these regions drive innovation in specialized, high-performance belts, particularly those incorporating advanced materials and smart monitoring systems. Demand is significantly focused on replacing aging infrastructure and adopting belts capable of handling specialized processes in the petrochemical, automotive, and advanced manufacturing sectors, prioritizing high precision and extended product guarantees over sheer volume.

Latin America and the Middle East & Africa (MEA) offer high growth potential, largely centered around raw material extraction and processing. Latin America, rich in copper and iron ore deposits, consistently requires heavy-duty belts for mining. MEA’s market is influenced by investments in petrochemical refining, cement manufacturing, and regional infrastructure projects. Both regions often rely on international players for high-quality carbon steel belt systems, reflecting a reliance on imports for specialized conveyance technology.

- Asia Pacific (APAC): Dominant region driven by large-scale mining, infrastructure, and metallurgy investments, leading in volume consumption and rapid installation of new industrial capacity.

- North America: Focus on efficiency gains, adoption of smart monitoring technologies, and replacement of older systems in manufacturing and specialized material handling.

- Europe: Characterized by stringent environmental standards and a high demand for precision-engineered, energy-efficient conveyor solutions, particularly in the steel and high-temperature processing industries.

- Latin America: Strong demand driven by the large-scale copper, iron ore, and agricultural processing sectors, requiring high-abrasion resistant, heavy-duty belts.

- Middle East & Africa (MEA): Growth stimulated by expanding petrochemical, cement, and construction industries; increasing reliance on technologically advanced imported systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Carbon Steel Conveyor Belt Market.- Sandvik AB

- Berndorf Band Group

- Aumund Group

- Continental AG (Through Specialized Industrial Solutions)

- Tsubakimoto Chain Co.

- Metso Outotec

- Voestalpine AG

- Thyssenkrupp AG

- Fives Group

- Bando Chemical Industries, Ltd.

- Fenner Group (Michelin)

- Intralox

- PVS Process Equipment

- Rexnord Corporation

- Belt Technologies, Inc.

- Wire Belt Company of America

- Capco Steel Belt Systems

- Daifuku Co., Ltd.

- Schaefer Systems International

- Flexco

Frequently Asked Questions

Analyze common user questions about the Carbon Steel Conveyor Belt market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of using carbon steel conveyor belts over traditional rubber belts?

Carbon steel conveyor belts offer superior mechanical strength, extreme resistance to high temperatures (often exceeding 400°C), minimal elongation under heavy load, and exceptional resistance to abrasion and cutting, making them ideal for handling hot or sharp materials in heavy industry.

Which industrial applications are the largest consumers of heavy-duty carbon steel conveyor belts?

The largest consumers are industries requiring continuous transport of abrasive or hot bulk materials, specifically mining and quarrying, cement and clinker production, and the ferrous and non-ferrous metallurgy sector (steel and glass manufacturing).

How does the total cost of ownership (TCO) compare for steel belts versus standard rubber belts?

While carbon steel belts have a significantly higher initial capital cost, their TCO is often lower over the long term due to dramatically extended operational lifespan, reduced maintenance frequency, superior durability, and minimized production losses from unscheduled downtime.

What technological advancements are driving market growth in carbon steel belts?

Key drivers include the integration of AI-enabled predictive maintenance systems for real-time fault detection, continuous development of high-tensile specialized steel alloys, and advancements in seamless welding and dynamic tracking systems for improved operational efficiency and reliability.

Is the Carbon Steel Conveyor Belt Market expected to see significant growth in the aftermarket segment?

Yes, the aftermarket segment is projected to grow robustly due to the necessity of periodic replacement of worn-out belts and components, driven by the increasing global installed base of heavy-duty material handling systems that require high-precision maintenance and replacement parts.

The analysis presented herein provides a foundational understanding of the strategic landscape, technological trajectory, and competitive dynamics shaping the Carbon Steel Conveyor Belt Market. The strong correlation between global infrastructure spending and the demand for robust conveyance systems ensures sustained growth, focusing heavily on operational resilience and long-term asset value in critical industrial operations. Further detailed market segmentation and competitive profiling are available to stakeholders seeking nuanced strategic insights into specific regional or application opportunities.

The transition toward smart manufacturing and Industry 4.0 principles, even within the context of traditionally mechanical components like conveyor belts, underscores the market's evolution. Manufacturers must increasingly invest in digital capabilities—from smart coatings to predictive analytics platforms—to meet the sophisticated demands of modern industrial operators who view conveyor systems not merely as transport mechanisms but as vital, continuously monitored assets contributing directly to production efficiency and regulatory compliance. This mandate for higher performance and data integration is set to define competitive success over the forecast period.

The environmental sustainability factor is also gaining prominence, particularly in Europe. While steel production carries an environmental footprint, the exceptional longevity of carbon steel belts reduces the frequency of replacement and minimizes waste compared to faster-wearing polymer or rubber alternatives. Market leaders are focusing on developing belts that are fully recyclable and optimizing the energy consumption of the associated drive systems, aligning product development with global sustainability mandates and appealing to environmentally conscious industrial procurement teams globally.

Geopolitical stability and trade policies impacting the supply of specialized steel alloys pose inherent risks to the market, particularly regarding cost predictability and sourcing consistency. Companies mitigating this risk are diversifying their supply chains and forging long-term contracts with specialized steel mills. Furthermore, the specialized skillset required for the installation, joining, and complex tensioning of these belts creates significant barriers to entry for new service providers, cementing the advantage held by experienced OEMs and specialized global service networks in the deployment and maintenance ecosystem.

Overall, the Carbon Steel Conveyor Belt Market is characterized by high product quality requirements, intense competition on technical specification and service quality, and a clear correlation between industrial capital investment cycles and market revenue volatility. Strategic positioning involves excelling in custom engineering, offering robust after-sales support, and leading the integration of emerging digital technologies that enhance system reliability and performance in the world’s most demanding industrial environments. The resilience and capacity for high-stress operations remain the core value proposition driving widespread adoption globally.

Technological differentiation is increasingly achieved through material composites and layered construction techniques rather than relying solely on monolithic steel. Innovations include integrating high-wear resistant materials at the edges and specialized coatings on the running surface to enhance durability against friction and chemical attack. This focus on composite engineering allows manufacturers to fine-tune the belt's properties, such as tensile strength and thermal expansion characteristics, precisely matching the requirements of niche applications like high-heat drying in food production or intense abrasive transport in taconite mining. Such specialization drives higher profit margins and solidifies market leadership for technical innovators.

The standardization aspect, driven by organizations setting benchmarks for conveyor belt performance (e.g., ISO standards for material handling equipment), ensures a minimum level of quality across the industry. However, the true competitive edge lies in exceeding these standards, particularly concerning fatigue life testing and stress corrosion cracking resistance. Customers in critical infrastructure projects demand rigorous testing documentation and proven field performance data, forcing manufacturers to adopt advanced simulation techniques and comprehensive quality assurance protocols throughout the production lifecycle, from initial alloy sourcing to final installation oversight.

The heavy-duty nature of these systems often correlates with high energy consumption. Consequently, market opportunities are emerging for belts designed to reduce frictional resistance on idlers and pulleys. Lightweighting initiatives—without sacrificing strength—through advanced metallurgy offer a direct route to improving the energy efficiency of the entire conveying system. Furthermore, optimizing the drive and gearbox interface to ensure smooth start-up and stopping sequences minimizes dynamic stresses on the carbon steel belt, contributing to both energy savings and extended product life.

Within the value chain, logistics represents a non-trivial challenge. Carbon steel belts are heavy, inflexible, and often custom-sized components that require specialized transportation and handling equipment, particularly for delivery to remote mining sites or large factory complexes. Efficiency in logistics management, including specialized packaging and coordinated installation planning, becomes a key service offering that differentiates top-tier suppliers. Delays or damage during transport can be incredibly costly, making robust supply chain management a strategic competency for global market players.

The regulatory environment, particularly concerning worker safety around large, powerful machinery, continues to influence belt design. Features such as specialized edge protectors, improved tracking mechanisms to prevent belt run-off (which can cause severe structural damage and hazards), and systems that enable safer inspection and maintenance procedures are continuously being implemented. Compliance with regional safety directives (like CE marking in Europe) is non-negotiable and requires ongoing investment in engineering design and testing, ensuring that operational reliability does not compromise human safety in the industrial environment.

The competitive landscape is marked by continuous R&D investment focused on minimizing material degradation. Exposure to harsh chemicals, extreme temperature cycling, and high mechanical stress necessitates constant iteration in surface finish and material composition. Companies that hold proprietary knowledge regarding specialized treatments for corrosion mitigation, particularly in high-humidity or acid-exposure environments (common in chemical processing and some mining types), maintain a strong intellectual property advantage, providing solutions that competitors using generic steel alloys cannot replicate cost-effectively or reliably. This specialized knowledge is a core driver of technological segmentation within the market.

The trend towards modular and segmented carbon steel belts is another critical development. While seamless belts offer peak strength, modular designs, which allow for easier repair and localized replacement of damaged sections without needing to replace the entire belt, are gaining traction in certain applications where rapid repair is prioritized. This design flexibility offers operational advantages, especially in remote locations where logistical challenges make transporting and installing a single, extremely long belt prohibitively difficult. Manufacturers offering both seamless and modular solutions are best positioned to capture diverse market needs.

The strong dependence of the Carbon Steel Conveyor Belt Market on the cyclical nature of commodity prices (e.g., iron ore, coal, cement demand) inherently ties its performance to global macroeconomic trends. While long-term industrialization ensures foundational demand, short-term market fluctuations must be managed through flexible manufacturing capacity and diversified customer portfolios across different sectors (mining, manufacturing, specialized processing) to buffer against sector-specific downturns. This need for resilience underscores the strategic importance of geographical diversification, ensuring revenue streams are generated from regions in varying phases of their economic cycles.

Finally, the growing environmental scrutiny on heavy industries worldwide is pushing innovation toward resource-efficient material handling. Carbon steel conveyor belts, when combined with optimized conveyor system designs that minimize spillage, reduce dust emissions, and ensure precise material flow, contribute positively to the operational sustainability goals of end-users. Suppliers capable of providing comprehensive system solutions—including high-efficiency drive components and integrated environmental controls—alongside the belt itself are increasingly preferred by major corporate clients focusing on their ESG (Environmental, Social, and Governance) performance metrics.

The rigorous requirements of industrial environments necessitate that carbon steel conveyor belts not only provide mechanical resilience but also adhere to highly specific dimensional and performance tolerances. Manufacturers leverage sophisticated computer-aided design (CAD) and finite element analysis (FEA) to simulate real-world stresses, optimizing belt thickness and component geometries to prevent premature failure. This engineering intensity requires substantial upfront R&D investment, reinforcing the dominance of established players with extensive historical performance data and dedicated metallurgical research teams. Smaller entrants often struggle to match this level of performance guarantee without significant technological partnerships.

Demand segmentation by belt width and material grade is crucial. Extremely wide belts are typically required for high-volume bulk handling in mining, while narrower, highly specialized belts are used in precision applications like heat treatment furnaces. The material grade is selected based on the specific operating environment—for instance, belts requiring exceptional corrosion resistance in coastal or chemical plants may use treated carbon steel or even shift toward high-grade stainless steel equivalents for specialized functions, although carbon steel remains the cost-effective and structurally preferred option for purely high-temperature/high-abrasion duties without intense corrosive elements.

The training and certification of installation and maintenance technicians represent a critical component of the overall market offering. Improper installation of a carbon steel belt can significantly reduce its service life and lead to immediate operational issues like mistracking or joint failure. Leading vendors provide comprehensive, certified training programs for client staff or deploy their own specialized field service teams globally. This service competency is a major differentiator, assuring customers that their substantial investment in a steel belt system is correctly implemented and maintained according to the manufacturer's precise specifications, thereby maximizing ROI.

Competitive strategies often involve securing long-term service agreements (LSAs) rather than relying solely on product sales. These LSAs encompass regular inspections, predictive maintenance using remote monitoring tools, and guaranteed parts replacement, effectively transferring the risk of unscheduled downtime from the end-user back to the manufacturer. This service-centric approach not only stabilizes revenue streams for the market players but also deepens customer loyalty, making it challenging for competitors to penetrate established accounts based purely on price competition for the physical belt product.

The global reach of key manufacturers is a major factor influencing market share. The ability to supply, install, and service massive conveyor systems in remote locations—whether in the Chilean mountains for copper mining or in the Australian outback for iron ore extraction—requires immense logistical competence and a reliable global footprint. Companies with established local subsidiaries and service hubs across North America, Europe, and especially APAC are best equipped to handle the rapid deployment and intensive ongoing support demanded by the largest infrastructure and mining projects worldwide.

Finally, the market is seeing increased pressure from alternative conveyance technologies, such as pipe conveyors or vertical lifts, particularly in urban or space-constrained environments. While carbon steel belts remain superior for long-distance, high-capacity, and high-temperature horizontal transport, manufacturers must continuously innovate to demonstrate the cost-effectiveness and performance superiority of their solutions in emerging application contexts. This constant comparative assessment against competing bulk handling methods drives technological adaptation within the carbon steel conveyor belt manufacturing sector.

The continuous improvement cycle in specialized welding techniques is essential for enhancing the longevity of carbon steel conveyor belts. The joint, or splice, is typically the weakest point of any belt system. Recent advancements focus on minimizing the heat-affected zone (HAZ) during welding to preserve the base material's mechanical properties, crucial for ensuring the splice maintains the same tensile strength and fatigue resistance as the rest of the belt body. Ultrasonic testing and radiographic inspection are now standard quality control measures to verify weld integrity, elevating the overall reliability of the finished product and meeting the increasingly strict quality assurance requirements of high-value industrial operations.

The impact of Industry 4.0 extends significantly into the manufacturing floor of carbon steel belt producers. Smart factories utilize sophisticated robotics for material handling and welding processes, ensuring repeatable precision that manual labor cannot achieve, especially when dealing with high-gauge steel plates. This automation in production is key to scaling output while maintaining micron-level tolerances required for flawless belt tracking and tensioning on the customer's site. The capital intensity of these advanced manufacturing facilities reinforces the market concentration among global leaders who possess the resources for such technological adoption.

Market growth opportunities are notably concentrated in emerging economies where large-scale infrastructure and industrial complex construction are booming. Governments in regions like Southeast Asia and parts of Africa are heavily investing in raw material processing and logistics hubs, creating substantial long-term demand for high-capacity material handling solutions. For manufacturers, securing early-stage involvement in these mega-projects, often through strategic alliances with major EPC contractors, is vital for establishing a dominant market position and locking in future aftermarket service revenues.

The importance of custom engineering cannot be overstated in this niche market. Few large industrial projects utilize off-the-shelf conveyor belts. Instead, each belt system is meticulously tailored based on parameters such as the material conveyed (density, temperature, lump size), the required throughput (tons per hour), and the physical layout (inclination, length, and curvature). This requirement for bespoke solutions mandates close collaboration between the belt manufacturer's engineering team and the end-user's plant designers, creating strong relationship barriers that often exclude less technically capable or non-customized suppliers.

In terms of sustainability, beyond the longevity of the product, manufacturers are also exploring techniques for material recovery and recycling at the end of the belt's service life. As carbon steel is highly recyclable, establishing efficient take-back and reprocessing programs adds a valuable layer to the circular economy model for these industrial components. This focus not only reduces waste but also provides a sustainable source of raw material, potentially mitigating the reliance on volatile primary steel markets in the future.

Finally, the competitive threat from specialized conveying systems using alternative materials, such as high-strength textile or aramid fiber-reinforced belts, must be constantly monitored. While these alternatives offer flexibility and weight advantages, they generally cannot match the temperature resistance and sheer rigidity of carbon steel. Therefore, the core strategy for carbon steel belt providers remains focused on dominating niche applications characterized by extreme heat, heavy impact, and highly abrasive environments where no viable cost-effective substitute currently exists.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager