Carbon Steel Retaining Rings Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436331 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Carbon Steel Retaining Rings Market Size

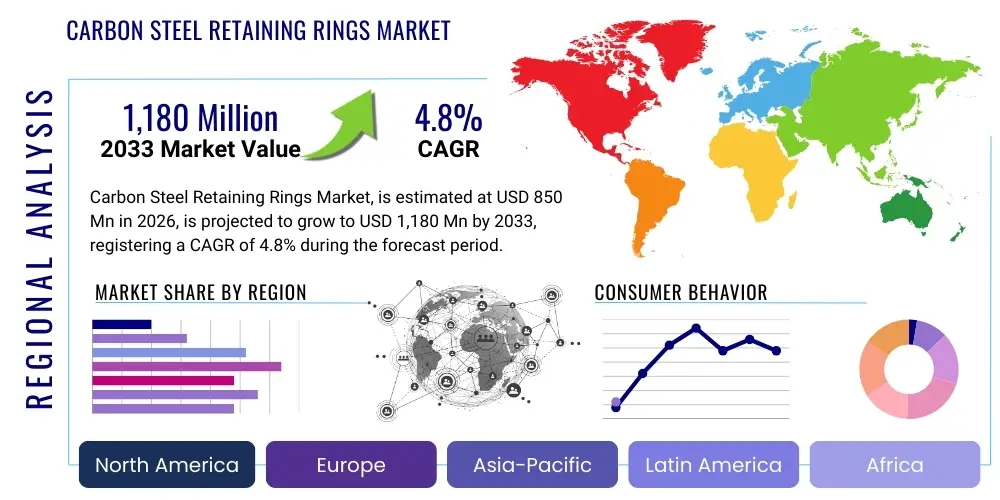

The Carbon Steel Retaining Rings Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $850 Million USD in 2026 and is projected to reach $1,180 Million USD by the end of the forecast period in 2033.

Carbon Steel Retaining Rings Market introduction

The Carbon Steel Retaining Rings Market encompasses the design, manufacturing, and distribution of mechanical fasteners crucial for securing components onto shafts or within bores (housings). Retaining rings, often known as circlips or snap rings, are essential components utilized across nearly every sector involving rotating or moving parts, preventing lateral movement and ensuring precise positioning. Carbon steel is the dominant material choice due to its superior tensile strength, fatigue resistance, and cost-effectiveness, particularly in high-volume, standard applications where extreme corrosion resistance is not the primary requirement. These rings are typically manufactured using stamping, coiling, or wire forming processes, followed by heat treatment to achieve the necessary spring properties and hardness required for reliable mechanical performance in demanding environments.

Product descriptions vary primarily by design type, including internal (housing) rings, external (shaft) rings, and specialized forms such as tapered section, constant section, or spiral rings. Carbon steel retaining rings are highly valued for their ability to withstand significant axial loads, making them indispensable in securing bearings, gears, pulleys, and pins within assemblies. Major applications span the automotive industry (transmissions, braking systems), heavy machinery (hydraulic pumps, gearboxes), aerospace (non-critical structural assemblies), and general industrial equipment (motors, valves). Their critical function ensures operational longevity and minimizes downtime caused by component dislocation or premature wear.

The primary benefits of utilizing carbon steel retaining rings include their robustness, ease of installation and removal (especially external types), and high load-bearing capacity relative to size, combined with a favorable cost structure compared to specialized stainless steel or exotic alloys. Driving factors for market growth include the robust expansion of global manufacturing output, particularly in emerging economies, the consistent demand for lighter and more efficient machinery requiring precise component retention, and the continuous innovation in material processing techniques that enhance the performance metrics of standard carbon steel formulations, making them suitable for increasingly high-stress applications.

Carbon Steel Retaining Rings Market Executive Summary

The Carbon Steel Retaining Rings market is characterized by stable demand driven by mandatory replacement cycles and expanding industrial production, though it faces structural challenges related to raw material price volatility and the persistent threat of substitution from other fastening technologies, such as specialty adhesives and advanced keyless bushings. Current business trends indicate a strong push towards customization, with end-users demanding tighter tolerances and specific surface treatments (like phosphating or black oxide coatings) to optimize performance in varying environmental conditions. Manufacturers are leveraging automation and predictive maintenance within their production lines to enhance consistency and reduce waste, crucial for maintaining competitiveness in this price-sensitive component segment. Furthermore, the push for miniaturization in electronics and light industrial equipment is creating demand for micro-retaining rings, necessitating advancements in precision stamping and coiling technologies.

Regional trends highlight Asia Pacific (APAC) as the dominant growth engine, fueled by massive investments in automotive manufacturing, infrastructure development, and industrial automation, particularly in China and India. North America and Europe maintain significant market shares, characterized by high demand for high-specification rings in aerospace, defense, and specialized machinery, emphasizing stringent quality control and certified traceability. Segmentation trends indicate that externally mounted retaining rings hold the largest market share due to their widespread use in shaft assemblies, while application analysis confirms the automotive and industrial machinery sectors as the primary consumers, accounting for over 60% of the total market revenue. There is also a notable growth trend in the use of heavy-duty rings driven by the expansion of wind energy turbines and specialized mining equipment.

Overall, the market trajectory is cautiously optimistic, balancing steady underlying industrial demand with operational pressures related to supply chain resilience and compliance with international standards (such as DIN and ANSI). Strategic acquisitions focused on expanding regional manufacturing footprints and consolidating specialized coating capabilities are key strategies being adopted by leading market players. The shift towards higher-strength carbon steel alloys (e.g., SAE 1070 to 1090) further emphasizes the market's focus on maximizing performance while retaining the cost advantages inherent to carbon steel as a base material.

AI Impact Analysis on Carbon Steel Retaining Rings Market

Common user inquiries concerning the impact of Artificial Intelligence (AI) on the Carbon Steel Retaining Rings Market typically revolve around operational efficiency, quality control, and predictive maintenance applications. Users frequently ask how AI can stabilize the fluctuating costs of raw carbon steel, whether machine vision systems can improve the inspection process faster than manual labor, and if AI algorithms can optimize the extremely complex scheduling required for heat treatment and finishing processes. Concerns often focus on the required investment in retrofitting legacy manufacturing equipment and the skills gap needed to manage AI-driven systems. Key expectations center on achieving near-zero defect rates through advanced analytics and utilizing generative design models to quickly prototype application-specific ring geometries, particularly for high-stress aerospace or electric vehicle components where marginal performance gains are critical.

AI's primary influence is seen in refining the manufacturing lifecycle from material procurement to final inspection, transforming previously reactive processes into predictive ones. Predictive analytics, trained on historical stress test data and real-time machine telemetry, enables manufacturers to anticipate equipment failures, thereby minimizing unplanned downtime and ensuring the continuous, high-volume production of standardized rings. Furthermore, in the realm of material science, AI-driven simulations are accelerating the development and validation of new carbon steel compositions and surface treatments, optimizing tensile strength and fatigue life specifically for retaining ring applications without the extensive physical testing traditionally required.

In the supply chain, AI tools are enhancing logistical efficiency by forecasting demand with greater accuracy, especially in highly segmented markets serving varied industrial cycles. This minimizes inventory holding costs for both manufacturers and distributors, a significant factor given the high-volume, low-margin nature of this component. The cumulative effect of AI adoption is expected to elevate overall product consistency, reduce manufacturing costs through waste minimization, and ultimately enhance the competitive landscape by rewarding manufacturers capable of integrating these sophisticated digital technologies effectively into their operations.

- AI-driven Predictive Maintenance: Reduces unplanned machine downtime in stamping and coiling operations by up to 25%.

- Machine Vision Quality Control: Utilizes deep learning algorithms for 100% inspection, identifying surface defects and dimensional inaccuracies beyond human capability.

- Generative Design Optimization: Accelerates the development of complex, lightweight ring geometries for specialized high-performance applications.

- Supply Chain Demand Forecasting: Improves accuracy of raw material (carbon steel wire/strip) procurement, mitigating exposure to commodity price volatility.

- Process Parameter Optimization: AI controls heat treatment furnace settings and coating application parameters to maximize mechanical properties and corrosion resistance uniformity.

DRO & Impact Forces Of Carbon Steel Retaining Rings Market

The market for Carbon Steel Retaining Rings is shaped by a critical balance of robust industrial growth drivers and inherent material and manufacturing constraints. Key drivers include the relentless expansion of the global automotive sector, particularly the surge in electric vehicle (EV) production which, despite reduced complexity in some areas, still utilizes retaining rings extensively in gear reduction units and ancillary systems. Furthermore, the essential nature of these components—they are required in virtually all mechanical power transmission systems—ensures sustained demand, directly correlating with global Gross Domestic Product (GDP) and manufacturing Purchasing Managers' Index (PMI) performance. However, the market faces significant restraints, most notably the high volatility and periodic sharp escalation in the price of raw carbon steel, which, given the fixed cost structure and competitive pricing of the final product, directly impacts profitability margins. Additionally, the constant pressure from alternative fastening methods, such as adhesive bonding agents offering weight reduction, presents a persistent challenge that necessitates continuous innovation in ring design to justify their continued use in modern engineering assemblies.

Opportunities for market expansion are primarily found in specialized, high-performance applications where standard carbon steel rings can be enhanced through advanced coatings, like zinc flake or proprietary polymers, offering corrosion resistance approaching that of stainless steel at a lower cost premium. The burgeoning maintenance, repair, and overhaul (MRO) segment also presents a stable revenue stream, as retaining rings are frequently replaced during routine equipment servicing, ensuring a consistent replacement market independent of new equipment sales. Furthermore, the penetration of industry standards in developing nations provides an opportunity for established global players to standardize production and leverage economies of scale, displacing lower-quality, non-compliant local products.

The overall impact forces are moderate to high, characterized by substantial supplier power due to specialized manufacturing expertise (especially in heat treatment and spring material technology) balanced against high buyer price sensitivity due to the commoditized perception of the standard product. Competitive intensity remains high, primarily driven by pricing wars among regional manufacturers, although differentiation based on quality certifications (like ISO/TS 16949 for automotive) and logistical efficiency provides critical leverage. The long-term viability of carbon steel retaining rings is secured by their proven reliability, high axial load performance, and inherent mechanical locking mechanism, which often outweighs the marginal weight savings offered by non-mechanical fastening solutions in heavy-duty and critical applications.

Segmentation Analysis

The Carbon Steel Retaining Rings market is highly segmented based on design type, mechanism, application sector, and end-use, reflecting the diverse operational requirements across various industries. Segmentation is crucial for manufacturers to target specialized markets efficiently and tailor product specifications, such as material hardness, surface finish, and dimensional tolerance. The market can primarily be split into two major categories based on mounting type: internal rings, designed to fit within a bore or housing groove, and external rings, designed to secure components on a shaft. Further segmentation by mechanism includes axially assembled rings (which require specialized pliers for installation) and radially assembled rings (which snap onto the shaft/bore from the side), each offering distinct advantages regarding ease of assembly and load-bearing direction. The high degree of standardization across industries, governed by international specifications such as DIN 471 (external) and DIN 472 (internal), ensures global interchangeability and drives mass production efficiencies within these segments.

Application-based segmentation is the most impactful driver of volume, with the automotive industry being the largest consumer, utilizing these rings extensively in powertrain components, braking systems, and accessory drives where high vibration resistance is mandatory. The industrial machinery sector is a close second, encompassing hydraulic and pneumatic equipment, machine tools, and heavy construction vehicles where robustness and reliability under extreme loads are paramount. Regional segmentation also plays a pivotal role, as different geographies often favor specific ring standards (e.g., metric systems dominating Europe and APAC, while imperial sizes remain common in certain North American legacy equipment). Analyzing these segments helps in optimizing inventory levels and strategic pricing decisions, recognizing that price elasticity varies significantly between the high-volume standard automotive segment and the low-volume, high-specification aerospace segment.

- By Type:

- External Retaining Rings (Shaft)

- Internal Retaining Rings (Bore/Housing)

- E-Rings and C-Rings (Radial Assembly)

- Spiral Retaining Rings

- Tapered Section Retaining Rings (Circlips)

- Constant Section Retaining Rings

- By Application/Mechanism:

- Axially Assembled Rings

- Radially Assembled Rings

- Self-Locking Rings

- By End-Use Industry:

- Automotive (Passenger Vehicles, Commercial Vehicles)

- Industrial Machinery and Equipment

- Aerospace and Defense (Non-Critical Systems)

- Agricultural Equipment

- Construction Equipment

- Hydraulics and Pneumatics

- Consumer Goods and Appliances

- By Material Grade:

- Standard Carbon Steel (SAE 1060-1075)

- High Carbon Steel (SAE 1080-1090)

- Alloyed Carbon Steel (for specific load/temperature requirements)

Value Chain Analysis For Carbon Steel Retaining Rings Market

The value chain for the Carbon Steel Retaining Rings market begins with the upstream segment, dominated by raw material suppliers providing high-quality carbon steel wire and strip, typically derived from high-carbon grades (SAE 1070 to 1090) to ensure the required tensile strength and spring qualities after heat treatment. This segment is highly concentrated, with a few global steel producers exerting significant pricing leverage over ring manufacturers, especially when global steel prices spike. Key considerations at this stage include material certification, quality consistency, and adherence to specific mechanical property ranges that dictate the final product’s performance. Efficient procurement and long-term supply contracts are crucial for ring manufacturers to mitigate volatility and ensure a stable flow of compliant material, constituting a major portion of the final product cost.

The midstream involves the core manufacturing processes, which include precision stamping, coiling, heat treatment (stress relieving, hardening, tempering), and surface finishing (phosphating, oiling, zinc plating). This phase is capital-intensive, relying heavily on specialized machinery and automated quality control systems to produce the rings with tight dimensional tolerances required for modern mechanical assemblies. Distribution channels are bifurcated into direct sales to large Original Equipment Manufacturers (OEMs), particularly in the automotive and heavy machinery sectors, and indirect sales through a vast network of industrial distributors, specialized fastening suppliers, and MRO providers. The indirect channel is vital for reaching smaller end-users and providing just-in-time inventory solutions, often adding significant value through localized stocking and technical support.

The downstream segment focuses on the application and consumption of the rings by end-user industries. OEMs typically integrate these components into their final products (e.g., transmissions, compressors). End-users rely on retaining rings for long-term component security; therefore, product failure is highly detrimental, placing immense pressure on manufacturers for zero-defect output. The effectiveness of the distribution channel directly impacts the overall efficiency of the supply chain, ensuring that the correct size and specification of ring reaches the point of assembly, minimizing production line stoppages. Direct sales offer higher margins and closer collaboration on design optimization, while indirect sales ensure market reach and penetration into the widespread MRO and general industrial landscape.

Carbon Steel Retaining Rings Market Potential Customers

Potential customers and end-users of carbon steel retaining rings are concentrated across industries that rely on mechanical assemblies involving rotating shafts, housed bearings, and fluid power systems requiring components to be precisely and securely located. The automotive sector remains the single largest customer segment, encompassing manufacturers of light vehicles, heavy trucks, and their Tier 1 and Tier 2 suppliers, all of whom utilize these rings extensively in transmissions (manual and automatic), steering mechanisms, engine accessories, and braking systems. The shift towards electric vehicles continues to necessitate retaining rings for securing shafts and components within high-speed reduction gearboxes and motor assemblies, ensuring sustained demand despite changes in traditional powertrain design.

Beyond transportation, the industrial machinery sector represents a substantial customer base, including manufacturers of hydraulic pumps, gear reducers, industrial motors, compressors, and specialized machine tools. These customers prioritize high axial load capacity and fatigue resistance, often demanding specific material grades of carbon steel to withstand continuous operational stress and temperature variations. Construction and agricultural equipment manufacturers also constitute crucial segments, utilizing heavy-duty retaining rings in axles, hydrostatic drives, and linkage systems where exposure to harsh environments requires robust, cost-effective fastening solutions, often necessitating rings with enhanced surface finishes for corrosion protection.

Furthermore, the MRO market is a consistently overlooked but high-value customer segment, comprising industrial maintenance teams, equipment repair specialists, and specialized distributors who stock retaining rings for immediate replacement needs during equipment servicing and unplanned breakdowns. Because retaining rings are consumable fasteners and are often destroyed during disassembly, replacement demand is structurally mandated. The diversity of these end-users, ranging from high-volume automated assembly lines (OEMs) to individualized repair shops (MRO), underscores the pervasive nature of the carbon steel retaining ring market across the entire global mechanical engineering landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $850 Million USD |

| Market Forecast in 2033 | $1,180 Million USD |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Rotor Clip Company, Inc., Smalley Steel Ring Company, Hugo Benzing GmbH & Co. KG, Barnes Group Inc. (Associated Spring), Anderton International Ltd., Cirteq Limited, Beneri S.p.A., Fastenal Company, Würth Group, MISUMI Group Inc., Seeger-Orbis GmbH, G&G Manufacturing Company, Daesung Spring Co., Ltd., IWATA DENKO Co., Ltd., Shanghai Hongmei Retaining Ring Co., Ltd., MK Engineering, American Ring, TruArc Manufacturing LLC, Mubea Group, Precision Brand Products. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Carbon Steel Retaining Rings Market Key Technology Landscape

The technological landscape of the Carbon Steel Retaining Rings market is defined less by radical product innovation and more by continuous process optimization aimed at improving dimensional precision, material utilization, and fatigue life. A core technology remains high-speed, multi-slide stamping and four-slide wire forming equipment, which allows for the rapid and precise creation of complex ring geometries at production volumes necessary to meet mass market demand, particularly from the automotive sector. Advanced control systems integrated into these machines minimize material scrap and enable real-time adjustments to compensate for minor variances in the incoming carbon steel strip or wire material. Furthermore, the selection and preparation of raw material, ensuring uniform grain structure and minimal inclusions, is highly reliant on sophisticated metallurgical testing and quality verification processes.

Crucially, the performance of a carbon steel retaining ring is critically dependent on its heat treatment process. Modern technology utilizes precisely controlled atmospheric furnaces and induction heating techniques to achieve optimal hardening (increasing wear resistance) followed by tempering (introducing toughness and spring properties) to meet the specified load requirements without risking brittle failure. Innovations here focus on highly repeatable thermal cycles and minimizing distortion, which is paramount for maintaining tight diameter and flatness tolerances. For high-stress applications, cryogenic treatment is emerging as a niche technology to further refine the microstructure, enhancing residual compressive stresses and improving overall fatigue resistance, thereby extending the service life of the component under cyclic loading conditions.

Surface finishing technologies represent another key area of technological advancement. While traditional processes like black oxide and oil dipping offer basic corrosion protection, the industry is increasingly adopting specialized proprietary coatings such as zinc-nickel and complex organic zinc flake systems. These coatings provide significantly enhanced salt spray resistance, often exceeding 1,000 hours, allowing carbon steel rings to be used in environments previously reserved exclusively for stainless steel components. The application of these coatings requires highly controlled, automated dipping and spinning processes to ensure uniform thickness and avoid compromising the ring's crucial mechanical spring properties. Integrating advanced machine vision and digital measurement tools throughout the production process ensures that all manufactured rings comply with the exacting geometric and performance standards demanded by global OEMs, contributing directly to product reliability and brand reputation.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing region, driven by unparalleled expansion in automotive manufacturing (especially China, India, and Southeast Asia) and heavy industrial infrastructure projects. High-volume manufacturing bases leverage economies of scale and favorable labor costs, positioning the region as a major global supplier and consumer.

- North America: Characterized by strong demand from the aerospace, heavy truck, and specialized industrial machinery sectors. The market here emphasizes high-specification products, strict quality certifications, and local supply chain reliability, often utilizing advanced carbon steel alloys for enhanced performance in extreme conditions.

- Europe: A mature market focused on innovation in electric vehicle component retention and specialized high-precision engineering (e.g., machine tools and robotics). European manufacturers adhere strictly to stringent DIN and ISO standards, prioritizing precision and advanced surface treatments, often driving technological advancements in coating technology.

- Latin America (LATAM): Growth is tied heavily to commodity cycles and localized automotive assembly plants (Brazil and Mexico). The market relies on a mix of local production and imported high-specification rings, showing moderate but consistent growth linked to industrial recovery and infrastructure investment.

- Middle East and Africa (MEA): A smaller, emerging market primarily driven by oil and gas extraction equipment (where retaining rings secure critical pump and valve components) and related infrastructure projects. Demand is project-based, emphasizing high reliability and corrosion-resistant coatings appropriate for harsh desert or coastal environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Carbon Steel Retaining Rings Market.- Rotor Clip Company, Inc.

- Smalley Steel Ring Company

- Hugo Benzing GmbH & Co. KG

- Barnes Group Inc. (Associated Spring)

- Anderton International Ltd.

- Cirteq Limited

- Beneri S.p.A.

- Fastenal Company

- Würth Group

- MISUMI Group Inc.

- Seeger-Orbis GmbH

- G&G Manufacturing Company

- Daesung Spring Co., Ltd.

- IWATA DENKO Co., Ltd.

- Shanghai Hongmei Retaining Ring Co., Ltd.

- MK Engineering

- American Ring

- TruArc Manufacturing LLC

- Mubea Group

- Precision Brand Products

Frequently Asked Questions

What is the primary factor driving demand in the Carbon Steel Retaining Rings Market?

The primary factor driving demand is the consistent and mandatory growth in the global automotive industry and the corresponding replacement demand in the Maintenance, Repair, and Overhaul (MRO) segment across industrial machinery worldwide. Carbon steel rings are essential, high-volume components in securing critical powertrain and linkage parts.

How does raw material volatility affect the profitability of retaining ring manufacturers?

Raw material volatility, particularly in high-carbon steel prices, significantly compresses profitability because retaining rings are high-volume, price-sensitive components. Manufacturers often struggle to pass rapid cost increases directly to high-volume OEM buyers, necessitating efficient procurement and hedging strategies.

Which application segment consumes the largest volume of carbon steel retaining rings?

The Automotive sector is the largest consumer of carbon steel retaining rings, utilizing them extensively in transmissions, braking systems, and various mechanical assemblies, driving demand across both internal combustion engine vehicles and the expanding electric vehicle platform.

What technological advancement is most critical for improving carbon steel retaining ring performance?

The most critical technological advancement lies in precision heat treatment and advanced surface coatings. Controlled heat treatment ensures optimal spring temper and fatigue resistance, while modern coatings like zinc flake systems significantly extend the component's life by protecting the carbon steel from corrosion in aggressive environments.

How are environmental standards impacting the production of carbon steel retaining rings?

Environmental standards are heavily impacting surface finishing, leading to the phase-out of traditional processes like cadmium plating. Manufacturers are transitioning towards safer, high-performance, trivalent chromium-free alternatives, such as organic zinc flake coatings, to meet strict regulatory requirements in Europe and North America.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager