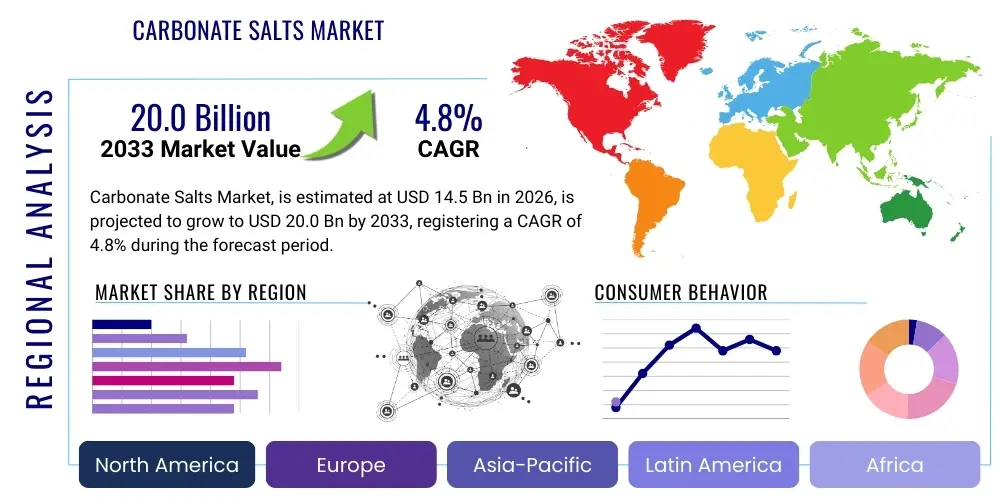

Carbonate Salts Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437568 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Carbonate Salts Market Size

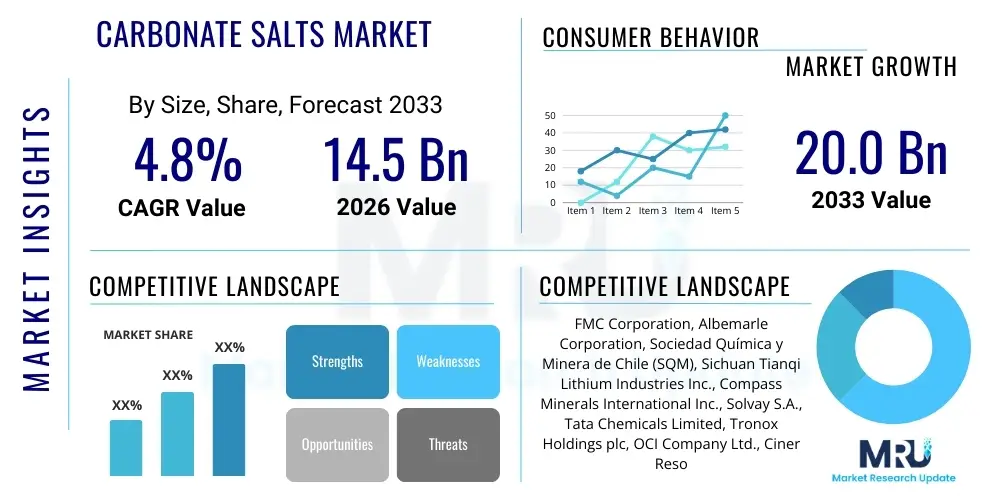

The Carbonate Salts Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $14.5 billion in 2026 and is projected to reach $20.0 billion by the end of the forecast period in 2033.

Carbonate Salts Market introduction

The Carbonate Salts Market encompasses a diverse range of chemical compounds characterized by the carbonate ion (CO3^2-) bonded to a metal cation, playing an indispensable role across numerous industrial sectors globally. Key market products include Sodium Carbonate (Soda Ash), Potassium Carbonate, Calcium Carbonate, and Lithium Carbonate, each exhibiting unique physical and chemical properties that dictate their primary applications. Sodium Carbonate, for instance, is fundamental to glass manufacturing and detergent production, owing to its ability to lower the melting point of silica and act as an effective cleaning agent. The market’s resilience is rooted in its foundational use in heavy industries, making it a reliable indicator of global manufacturing activity.

Carbonate salts serve as vital raw materials and process aids across manufacturing chains. Calcium carbonate is widely utilized as a filler in plastics, paper, and paints, enhancing mechanical properties and reducing production costs. Conversely, the market for Lithium Carbonate has witnessed an explosive growth trajectory driven almost entirely by the transition to sustainable energy solutions, specifically its critical role as a precursor material in the cathodes of lithium-ion batteries essential for electric vehicles (EVs) and grid storage systems. This dual functionality—serving both traditional industrial needs and cutting-edge technological demands—ensures sustained market expansion.

The primary driving factors sustaining the growth of the Carbonate Salts Market are robust industrialization in emerging economies, continuous expansion in the construction sector requiring calcium carbonate, and the global imperative to transition to electric mobility. Furthermore, advancements in chemical processing techniques, coupled with stringent environmental regulations promoting the use of cleaner process chemicals, are also fueling demand. The inherent benefits of carbonate salts, such as high stability, non-toxicity (in many forms), and cost-effectiveness, solidify their position as essential chemical intermediates. Despite potential volatility in raw material sourcing and energy costs, the integral nature of these compounds in global commerce guarantees continuous innovation in production and application methods.

Carbonate Salts Market Executive Summary

The global Carbonate Salts Market is experiencing a significant shift in business trends, moving away from purely commodity-driven pricing towards value-added specialization, particularly in the battery-grade segment. Traditional segments, such as sodium carbonate for glass and detergents, remain stable, driven primarily by population growth and sustained construction activities, especially in the Asia Pacific region. However, strategic focus has intensely centered on high-purity lithium carbonate, where intense competition, supply chain localization efforts, and substantial capital investment in refining capacity are defining the landscape. Key market players are increasingly adopting backward integration strategies, securing access to brine or hard-rock resources to mitigate supply chain risks and ensure quality control necessary for the demanding specifications of the EV battery sector.

Regional trends indicate a decisive polarization of manufacturing and consumption. Asia Pacific (APAC), led by China, dominates the consumption of all major carbonate salts, serving as the global hub for glass, ceramics, and electronics manufacturing, alongside overwhelming leadership in EV battery production. North America and Europe are focusing heavily on establishing localized, sustainable supply chains for battery-grade materials, spurred by government incentives aimed at reducing dependency on Asian imports and bolstering regional chemical security. The Middle East and Africa (MEA) are emerging as crucial sources for raw materials and energy-intensive production, leveraging low energy costs for the manufacturing of bulk chemicals like soda ash, thereby influencing global trade flows and pricing mechanisms.

Segmentation trends highlight the divergence in growth rates. While Sodium Carbonate holds the largest market share by volume, the Lithium Carbonate segment exhibits the highest growth trajectory (CAGR), fundamentally reshaping investment priorities. Within applications, the energy storage segment is projected to outperform all others, driving innovation in purification and crystallization technologies. Furthermore, increasing regulatory scrutiny regarding carbon emissions is favoring carbon capture and utilization (CCU) technologies that involve carbonate chemistry, opening new, albeit niche, market opportunities. Suppliers capable of meeting strict purity standards and ensuring traceability across their value chain are poised to capture significant market premium in the coming years.

AI Impact Analysis on Carbonate Salts Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Carbonate Salts Market commonly focus on optimizing energy-intensive production processes, improving quality control for high-purity salts (especially lithium carbonate), and predicting fluctuating raw material and energy prices. Key concerns revolve around whether AI can significantly reduce the notoriously high energy consumption associated with soda ash production and how machine learning algorithms can enhance the extraction efficiency from complex brines or minerals. Users are also keen on understanding AI's role in predictive maintenance for large-scale processing equipment, aiming to minimize costly downtime and improve overall operational throughput in continuous chemical manufacturing plants.

AI's primary influence is expected to materialize through advanced process optimization and predictive analytics across the entire manufacturing lifecycle. Machine learning models can analyze vast datasets concerning temperature, pressure, pH levels, and feedstock characteristics in real-time to adjust parameters, leading to higher yield, reduced impurity levels, and significant energy savings. Furthermore, in the complex domain of lithium extraction, AI is being deployed to model geochemical data, identifying optimal extraction sites and refining pathways, thereby accelerating project development and improving the cost-efficiency required to meet escalating global battery demand.

- AI facilitates real-time monitoring and control of crystallization processes, enhancing the purity and uniformity of specialized salts like battery-grade lithium carbonate.

- Predictive maintenance schedules developed using AI minimize unplanned downtime in large-scale soda ash and calcium carbonate manufacturing facilities, optimizing asset utilization.

- Machine learning algorithms forecast energy costs and raw material price volatility, allowing manufacturers to optimize procurement and hedging strategies.

- AI-driven simulation and modeling accelerate R&D for novel carbonate salt formulations required for advanced ceramics, pharmaceuticals, and specialized catalysts.

- Optimization of energy consumption in Solvay and Hou’s processes using neural networks to reduce the environmental footprint and operational expenditure.

DRO & Impact Forces Of Carbonate Salts Market

The Carbonate Salts Market dynamics are shaped by strong foundational drivers, significant structural restraints, and emerging opportunities that collectively define the competitive landscape and growth trajectory. Key drivers include the overwhelming global demand for lithium-ion batteries, which necessitates continuous expansion of lithium carbonate production capacity, coupled with steady demand from the construction and automotive sectors for various grades of calcium carbonate. Restraints predominantly involve the high energy intensity of production processes (particularly for soda ash), subjecting producers to volatile energy prices and increasing regulatory pressure to decarbonize. Opportunities arise from technological advancements in carbon capture utilization (CCU) and the development of new, high-purity specialty carbonates for advanced electronics and pharmaceutical applications, offering higher margins than commodity grades.

Impact forces in the market are primarily driven by macro-economic factors and geopolitical influences. The shift towards electric vehicles represents the most substantial driving force, creating a critical and highly sensitive supply chain for lithium carbonate that is constantly under scrutiny. Conversely, environmental regulations demanding reduction in brine waste and air emissions (CO2 and particulate matter) act as significant restraining forces, requiring substantial capital investment in cleaner technologies and waste management. The threat of substitution is relatively low for bulk carbonates in established industries (like glass and detergents) due to their cost-effectiveness and proven efficacy, but innovation in alternative battery chemistries remains a long-term potential restraint for lithium-based carbonates.

The interplay of these forces ensures a dynamic market environment. For instance, while high energy costs restrict profitability for commodity producers, they simultaneously create an opportunity for companies that invest in renewable energy sources or superior energy-efficient processes. The market's future growth hinges on the ability of producers to scale up high-purity production responsibly, managing geopolitical supply chain risks associated with critical minerals, and successfully integrating sustainability practices to satisfy increasingly demanding regulatory and consumer standards.

Segmentation Analysis

The Carbonate Salts Market segmentation provides a granular view of the diverse product portfolio and application landscape, essential for understanding market structure and identifying growth pockets. The market is primarily segmented based on product type, which distinguishes between the large-volume commodity chemicals (Sodium and Calcium Carbonate) and high-value specialty chemicals (Potassium and Lithium Carbonate). Application segmentation reveals the foundational role of these salts in traditional sectors like glass and construction, juxtaposed against the hyper-growth of modern sectors such as energy storage and advanced materials, reflecting the bifurcation of the market into volume-driven and value-driven segments.

Further analysis involves segmenting by grade (e.g., technical grade, pharmaceutical grade, battery grade), which directly correlates with pricing and processing complexity. The increasing requirement for ultra-high-purity grades, particularly for use in advanced electronics and specialized pharmaceuticals, drives innovation in purification techniques and commands premium pricing. Geographical segmentation, meanwhile, highlights the regional disparities in production capacity, raw material availability, and end-user demand concentration, with Asia Pacific maintaining its dominance in both supply and consumption due to its established manufacturing ecosystem.

- By Product Type:

- Sodium Carbonate (Soda Ash)

- Calcium Carbonate (Ground and Precipitated)

- Potassium Carbonate

- Lithium Carbonate

- Barium Carbonate

- Magnesium Carbonate

- Others (Strontium Carbonate, etc.)

- By Grade:

- Technical Grade

- Food Grade

- Pharmaceutical Grade

- Battery Grade (High Purity)

- By Application:

- Glass Manufacturing

- Detergents and Soaps

- Chemical Processing

- Metallurgy and Fluxing Agents

- Building and Construction (Fillers)

- Energy Storage (Li-ion Batteries)

- Pharmaceuticals and Healthcare

- Agriculture (Fertilizers and pH control)

- Pulp and Paper

Value Chain Analysis For Carbonate Salts Market

The value chain for the Carbonate Salts Market begins with the upstream procurement and processing of fundamental raw materials, which vary significantly by salt type. For Sodium Carbonate, this involves mining trona ore or using the synthetic Solvay process, requiring large inputs of limestone (calcium carbonate) and salt (sodium chloride), alongside significant energy resources. For Lithium Carbonate, the upstream focus is on extraction from mineral sources (spodumene, petalite) or continental brines, requiring extensive hydrological and geochemical processing before the final conversion to high-purity carbonate. The efficiency and environmental compliance of these upstream operations dictate the ultimate cost structure and sustainability profile of the downstream products.

The core of the value chain involves complex chemical processing, refining, and crystallization steps to achieve the required purity and particle size distribution. Manufacturers rely on specialized technology for crystallization, calcination, and grading to meet diverse end-user specifications, particularly the stringent demands of battery-grade lithium carbonate or pharmaceutical-grade calcium carbonate. Distribution channels are critical, linking large-scale, often regionally centralized production facilities to globally dispersed consumer markets. Direct sales are common for high-volume commodity shipments to large industrial consumers (e.g., glass plants), utilizing bulk rail or sea transport to minimize logistical costs.

In the downstream segment, the carbonate salts integrate into various manufacturing processes. For example, sodium carbonate is a direct input for flat glass production, while calcium carbonate is blended into polymers, paints, and construction materials. The emerging battery segment represents a highly specialized downstream application, where tight integration between the carbonate supplier and the cathode active material (CAM) manufacturer is essential. Indirect distribution, involving specialized chemical distributors, is primarily used for smaller quantities, niche products, and geographical regions where direct factory shipment is impractical, ensuring broad market access and technical support for diverse end-users.

Carbonate Salts Market Potential Customers

The potential customer base for the Carbonate Salts Market is highly diversified, spanning fundamental industrial sectors and high-growth technology markets. Major end-users are large-scale manufacturers in the glass and ceramic industries, who consume vast volumes of sodium carbonate (soda ash) as a fluxing agent to reduce the melting temperature of silica, thereby lowering energy consumption. Similarly, the construction and paper industries represent massive consumers of calcium carbonate, utilizing it as a low-cost, high-performance filler, pigment, and coating material to enhance product durability and appearance while improving cost efficiency in mass production.

A second, critically important group of customers resides in the chemical and energy sectors. Chemical processors utilize various carbonates as raw materials, buffering agents, or pH modifiers in the synthesis of specialized chemicals, petrochemicals, and fertilizers. Most notably, the high-growth customer segment comprises manufacturers of cathode active materials (CAM) for lithium-ion batteries, who require ultra-high-purity lithium carbonate. These customers demand strict specifications regarding trace metal content and crystalline structure, making them highly selective and focused on long-term supply agreements with certified producers.

Furthermore, smaller but equally vital customer groups include pharmaceutical companies, utilizing calcium and magnesium carbonates as antacids, dietary supplements, and excipients in drug formulation. Agricultural sectors rely on carbonates for soil pH correction and as mineral feed supplements for livestock. The purchasing decisions of these varied end-users are driven not just by price, but increasingly by factors such as supplier reliability, product purity certifications, and the sustainability footprint (e.g., low-carbon soda ash) of the chemical supplier, reflecting a complex procurement landscape tailored to sector-specific requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $14.5 billion |

| Market Forecast in 2033 | $20.0 billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | FMC Corporation, Albemarle Corporation, Sociedad Química y Minera de Chile (SQM), Sichuan Tianqi Lithium Industries Inc., Compass Minerals International Inc., Solvay S.A., Tata Chemicals Limited, Tronox Holdings plc, OCI Company Ltd., Ciner Resources Corporation, Mitsubishi Chemical Corporation, Nippon Chemical Industrial Co., Ltd., BASF SE, Shandong Haihua Group Co., Ltd., Hebei Cangzhou Decheng Chemical Co., Ltd., Lhoist Group, Mississippi Lime Company, Huber Engineered Materials, J.M. Huber Corporation, Omya AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Carbonate Salts Market Key Technology Landscape

The technology landscape in the Carbonate Salts Market is dominated by established bulk chemical manufacturing processes but is rapidly evolving due to the necessity for higher purity and sustainability. For Sodium Carbonate, the traditional Solvay process and the use of naturally occurring Trona deposits remain standard. However, technological advancements focus heavily on optimizing the energy efficiency of these processes, such as integrating waste heat recovery systems and using advanced catalysts to reduce calcination temperatures. For synthetic production, continuous innovation is targeted at minimizing byproduct disposal, especially calcium chloride sludge, making the modified Solvay or Hou's processes more environmentally viable and cost-competitive against natural soda ash.

A major area of technological focus is the development of advanced purification and crystallization techniques necessary for specialty carbonates. This is particularly salient in the Lithium Carbonate segment, where conventional extraction from brines involves lengthy evaporation cycles. New technologies, such as Direct Lithium Extraction (DLE), utilize selective adsorption, ion exchange, or solvent extraction methods to rapidly and efficiently isolate lithium from brines, significantly reducing processing time and water footprint compared to traditional methods. DLE technology, though still maturing, promises higher recovery rates and the ability to process lower-concentration lithium sources, dramatically impacting future global supply capacity.

Furthermore, technology is playing a pivotal role in enabling sustainability goals, specifically through Carbon Capture and Utilization (CCU). Research focuses on utilizing industrial CO2 emissions to synthesize sodium bicarbonate or various metal carbonates, effectively sequestering carbon while producing a commercial product. This integrated approach not only addresses environmental regulations but also introduces a potential new, sustainable feedstock source for carbonate manufacturers. The adoption of advanced sensor technology, coupled with Industrial Internet of Things (IIoT) platforms, is also becoming standard practice to ensure precise control over complex, high-purity chemical reactions, maintaining batch consistency required by demanding sectors like pharmaceuticals and electronics.

Regional Highlights

- Asia Pacific (APAC): APAC is the unequivocal leader in both consumption and production, driven by massive manufacturing bases in China, India, and Southeast Asia. China specifically dominates the global supply chain for lithium carbonate, accounting for a significant percentage of global refining capacity necessary for the EV battery industry. The region's consumption of soda ash is intrinsically linked to its burgeoning construction sector, high population density driving detergent use, and the expansive growth of its flat glass manufacturing industry. Future growth in APAC will be moderated by government initiatives focused on environmental clean-up and shifts in domestic energy policy, favoring producers who demonstrate sustainable practices.

- North America: North America, particularly the US, is characterized by large reserves of natural trona ore, making it a globally competitive hub for natural soda ash production. While consumption for traditional applications remains steady, the region is now prioritizing the establishment of a secure domestic supply chain for battery materials, heavily influenced by policies like the Inflation Reduction Act (IRA). This is leading to significant investments in DLE technologies and lithium refining projects across the continent, aimed at reducing reliance on Asian processing capabilities and securing supply for its rapidly expanding electric vehicle manufacturing base.

- Europe: The European Carbonate Salts Market is highly focused on regulatory compliance and premium specialty applications. While Europe maintains significant capacity for synthetic soda ash production, it faces high operating costs due to stringent environmental standards and expensive natural gas prices. The regional focus is shifting towards high-value products such as pharmaceutical-grade calcium carbonate and advanced materials using barium and strontium carbonates. Europe is also pioneering CCU technology integration, seeking ways to utilize CO2 emissions from chemical and cement plants to synthesize carbonates, establishing a distinct competitive advantage in green chemistry.

- Latin America: Latin America is vital primarily due to its vast reserves of lithium brines, specifically within the "Lithium Triangle" (Chile, Argentina, and Bolivia). These countries are the primary global suppliers of raw lithium sources for subsequent carbonate and hydroxide conversion. Market activities are driven by international investment seeking to secure long-term supply agreements. Challenges include complex governmental regulations, the highly water-intensive nature of traditional brine extraction, and the need for infrastructure improvements to support rapid export growth, leading to increasing interest in DLE technologies to mitigate environmental concerns.

- Middle East and Africa (MEA): The MEA region is characterized by growing domestic demand driven by urbanization and industrialization, particularly in the construction and water treatment sectors. The region benefits from competitive energy prices, making it an attractive location for energy-intensive chemical production, including synthetic soda ash. Investment in large-scale industrial projects across the Gulf Cooperation Council (GCC) states is bolstering the demand for basic carbonates. The market growth is closely tied to infrastructure spending and efforts to diversify economies away from oil dependency, creating steady growth opportunities for commodity carbonate suppliers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Carbonate Salts Market.- FMC Corporation

- Albemarle Corporation

- Sociedad Química y Minera de Chile (SQM)

- Sichuan Tianqi Lithium Industries Inc.

- Compass Minerals International Inc.

- Solvay S.A.

- Tata Chemicals Limited

- Tronox Holdings plc

- OCI Company Ltd.

- Ciner Resources Corporation

- Mitsubishi Chemical Corporation

- Nippon Chemical Industrial Co., Ltd.

- BASF SE

- Shandong Haihua Group Co., Ltd.

- Hebei Cangzhou Decheng Chemical Co., Ltd.

- Lhoist Group

- Mississippi Lime Company

- Huber Engineered Materials

- J.M. Huber Corporation

- Omya AG

Frequently Asked Questions

Analyze common user questions about the Carbonate Salts market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for Lithium Carbonate?

The primary factor is the unprecedented global expansion of the Electric Vehicle (EV) industry and the subsequent proliferation of lithium-ion batteries. Lithium Carbonate is a critical precursor material used in the synthesis of cathode active materials (CAM), making its demand directly proportional to EV and energy storage targets worldwide.

How do high energy costs impact the profitability of Sodium Carbonate manufacturers?

Sodium Carbonate (soda ash) production, especially via the synthetic Solvay process, is highly energy-intensive. High and volatile global energy prices, particularly for natural gas or steam, directly elevate operational expenditure (OPEX), compressing profit margins for manufacturers and encouraging a shift toward more energy-efficient natural trona mining operations where available.

Which technology is emerging to make lithium extraction more sustainable?

Direct Lithium Extraction (DLE) technologies are emerging as a major focus for sustainability. DLE methods, utilizing selective adsorption or ion exchange, significantly reduce the long processing times, vast land footprint, and high water consumption traditionally associated with the conventional solar evaporation of lithium-containing brines in arid regions.

What role does Calcium Carbonate play in the construction industry?

Calcium Carbonate (CaCO3) is fundamentally important in construction as a crucial filler and extender in concrete, asphalt, sealants, and paints. It enhances material workability, provides opacity and whiteness, and serves as an economic additive in building materials, driving consistent, high-volume demand aligned with global infrastructure spending.

Which geographic region dominates the supply chain for Carbonate Salts and why?

Asia Pacific (APAC), primarily led by China, dominates the global supply chain. This dominance is due to the region's vast, integrated chemical manufacturing capacity, its established leadership in producing high-volume chemicals like soda ash, and its near-monopoly on the refining and processing of battery-grade Lithium Carbonate required by the global EV industry.

In-Depth Market Dynamics and Future Outlook

The Carbonate Salts Market is currently at a critical juncture, balancing the stability of traditional commodity chemicals with the volatile, high-growth potential of specialty materials. The stability is derived from the non-substitutable nature of compounds like Sodium Carbonate (Soda Ash) in established industries. Soda Ash remains essential for container glass and flat glass production, a sector whose growth is tied to global urbanization and automotive manufacturing rates. However, future market valuation and investment focus will increasingly pivot towards addressing the complex supply challenges inherent in scaling up high-purity production. The pressure to meet exacting specifications—particularly the removal of trace elements like iron and heavy metals in battery-grade lithium carbonate—is pushing manufacturers to adopt continuous process improvements and invest heavily in capital-intensive refining infrastructure.

Moreover, regulatory frameworks across major industrialized regions are playing an increasingly assertive role in shaping market competition. European and North American regulations focusing on decarbonization and supply chain security are creating segmented markets. Producers demonstrating reduced carbon footprints through optimized energy usage or CCU integration are likely to gain preferential access to high-value markets. This regulatory landscape is simultaneously encouraging a shift towards decentralized, regionalized supply chains for critical salts like lithium carbonate, aiming to buffer against geopolitical risks associated with relying on single-source regions. This trend necessitates strategic partnerships between upstream resource owners, chemical processors, and battery manufacturers, establishing localized, closed-loop value chains.

Looking forward, the long-term sustainability of the market hinges not only on supply chain resilience but also on technological breakthroughs in resource utilization. For calcium carbonate, innovation is focused on developing nano-sized particles for advanced material applications, offering superior mechanical and optical properties in coatings and composites. For the bulk carbonates, particularly soda ash, the deployment of industrial symbiosis—where waste products from one industrial process become feedstock for another (e.g., CO2 utilization)—will be crucial for maintaining cost competitiveness while adhering to global environmental mandates. The convergence of digital twins, AI-driven process optimization, and green chemistry principles defines the next phase of innovation in this foundational chemical market.

- Strategic Market Shifts:

- Accelerated shift from commodity pricing models to premium pricing for ultra-high-purity (battery and pharma) grades.

- Increased capital expenditure focused on Direct Lithium Extraction (DLE) technologies to diversify resource streams and improve water efficiency.

- Heightened M&A activity among resource holders and chemical processors to vertically integrate the critical mineral supply chain.

- Key Challenges:

- Managing energy cost volatility, particularly for synthetic production methods reliant on natural gas.

- Securing qualified technical talent to operate and maintain advanced chemical purification and crystallization plants.

- Navigating complex global trade policies and tariffs impacting cross-regional supply of bulk chemicals.

- Sustainability Focus Areas:

- Reducing waste brine disposal volume through advanced recycling and zero liquid discharge (ZLD) systems.

- Implementing solar and wind power generation systems to power energy-intensive carbonate processing facilities.

- Developing certified "Green Carbonate" products by documenting minimized carbon emissions throughout the production cycle.

Application Deep Dive: Energy Storage Sector

The energy storage sector, dominated by lithium-ion battery manufacturing, represents the most transformative application area for the Carbonate Salts Market, specifically dictating the trajectory of Lithium Carbonate (Li2CO3). Li2CO3 serves as the foundational material for synthesizing various cathode active materials (CAMs), including Lithium Cobalt Oxide (LCO), Lithium Manganese Oxide (LMO), and the increasingly popular Nickel Manganese Cobalt (NMC) and Nickel Cobalt Aluminum (NCA) chemistries. The performance, safety, and lifespan of the final battery cell are intrinsically linked to the purity and morphology of the Li2CO3 used. Consequently, battery manufacturers demand highly specialized, ultra-low trace element content (typically >99.5% or 99.9% purity) to prevent side reactions that degrade battery performance, driving immense investment in refining technology.

The sheer scale of EV adoption projections globally necessitates continuous exponential growth in Li2CO3 supply, pushing the market beyond traditional chemical supply dynamics into the realm of critical minerals strategy. Governments worldwide are treating Li2CO3 supply security as a national priority, leading to subsidies and mandates aimed at diversifying extraction and processing geographically. This application segment is characterized by long-term, high-volume contracts between resource miners, refiners, and battery mega-factories (gigafactories), establishing dedicated supply corridors that are less susceptible to short-term market fluctuations but highly sensitive to long-term geological and political risks.

Furthermore, innovation in the energy storage application is not limited to purity but extends to novel forms of lithium salts for next-generation solid-state batteries (SSBs) and other advanced chemistries. While lithium carbonate remains dominant, research is intensifying into utilizing lithium salts directly in solid electrolytes. The development of high-performance flow batteries and other grid storage solutions that utilize different chemical processes also influences overall demand for specialized alkaline earth carbonates, though the economic impact remains overshadowed by the lithium-ion sector. The future success of carbonate suppliers in this segment depends entirely on their ability to consistently deliver high-volume, high-specification material under intense scrutiny regarding environmental and social governance (ESG) standards.

- Energy Storage Market Requirements:

- Mandatory purity levels exceeding 99.5% for battery grade Li2CO3, with increasing demand for 99.9%+.

- Need for consistent particle size distribution (PSD) and specific surface area for optimized cathode material synthesis.

- Stringent requirements for low levels of iron, magnesium, calcium, and heavy metals (e.g., copper, nickel) contamination.

- Impact on Pricing and Investment:

- Battery-grade lithium carbonate commands significant price premiums over technical and pharmaceutical grades.

- Investment in resource exploration and refining infrastructure must precede battery manufacturing capacity, leading to inherent supply lag and price volatility.

- Geopolitical considerations drive diversification of resource processing away from concentrated hubs.

- Related Carbonate Applications:

- Magnesium Carbonate used in thermal management solutions and fire suppression systems within battery packs.

- Specialized Barium Carbonate used in advanced ceramic materials for electronic components within EVs.

- Research into sodium-ion batteries potentially driving future demand for Sodium Carbonate derivatives, although currently minimal compared to lithium.

Regulatory Landscape and Environmental Compliance

The regulatory environment constitutes a significant impact force on the Carbonate Salts Market, particularly concerning environmental protection, resource management, and supply chain ethics. For bulk carbonates like Sodium Carbonate and Calcium Carbonate, the focus of regulation primarily centers on air quality control, specifically limiting particulate matter and nitrogen oxide (NOx) emissions from calcination and drying processes. Water use, particularly the disposal of high-salinity brines resulting from synthetic soda ash production or lithium brine evaporation, is subject to increasingly stringent permitting and compliance requirements under local water management authorities. Non-compliance can lead to substantial fines and operational shutdowns, forcing manufacturers to adopt expensive closed-loop systems and advanced wastewater treatment technologies.

In the lithium carbonate segment, regulatory scrutiny extends deeply into ESG (Environmental, Social, and Governance) factors, heavily influenced by investor and consumer demands for responsibly sourced materials. Regulations in the EU (e.g., Battery Regulation) and North America emphasize raw material traceability, requiring detailed documentation proving the environmental footprint, labor standards, and adherence to social compliance throughout the lithium extraction and refining process. This regulatory pressure is directly accelerating the adoption of less environmentally damaging extraction technologies, such as Direct Lithium Extraction (DLE), and incentivizing transparency in supply chains, impacting market access for suppliers who cannot meet these auditing standards.

Furthermore, occupational safety and health standards remain a constant regulatory focus, given the handling of corrosive chemicals, dust control requirements (especially for fine calcium carbonate powders), and the management of large-scale industrial machinery. The harmonization of global chemical regulations, such as REACH in Europe, affects market entry and product labeling for all types of carbonate salts imported or produced within those jurisdictions. These compliance costs, while necessary, act as a barrier to entry for smaller players and favor large, integrated multinational corporations that possess the financial and technical resources to maintain continuous, multi-jurisdictional regulatory adherence.

- Key Regulatory Drivers:

- European Union Battery Regulation mandating minimum recycled content and lifecycle carbon footprint declaration for batteries.

- National policies (e.g., in Chile and Australia) imposing strict limits on water usage for lithium brine extraction operations.

- Air quality standards (EPA in US, comparable agencies globally) restricting SOx, NOx, and particulate matter emissions from calcining units.

- Compliance Challenges:

- High cost associated with implementing carbon capture technologies for large-volume CO2 emitters like soda ash plants.

- Difficulty in ensuring full traceability and auditing of resource origins, especially for materials sourced from complex jurisdictions.

- Managing and disposing of gypsum and calcium chloride byproducts from the synthetic Solvay process in an environmentally acceptable manner.

- Standardization and Certifications:

- ISO certifications (e.g., ISO 9001 for quality, ISO 14001 for environment) required for accessing most automotive and pharmaceutical supply chains.

- Implementation of industry-specific best practices for responsible sourcing of critical minerals (e.g., Responsible Minerals Initiative compliance).

Competitive Analysis and Market Structure

The competitive landscape of the Carbonate Salts Market is highly stratified, presenting distinct structures across different product segments. The Sodium Carbonate market is largely consolidated, dominated by a few large global players that benefit from either access to vast natural trona reserves (primarily in the US and Turkey) or established, large-scale synthetic facilities (in China and Europe). Competition here is primarily cost-driven, centering on operational efficiency, raw material security, and logistical optimization, creating high barriers to entry due to the immense capital investment required for scale. Price fluctuations in the commodity segment are usually dictated by global energy prices, shipping costs, and the import/export volumes from major producing nations.

Conversely, the Lithium Carbonate segment exhibits a rapidly evolving, oligopolistic structure. While historically dominated by a few established miners (SQM, Albemarle, Tianqi), the segment is witnessing an influx of new entrants, particularly junior miners and specialized chemical processing companies focused on Direct Lithium Extraction (DLE). Competition in this space is less focused on volume and more on technical expertise, the speed of project development, and the ability to consistently achieve battery-grade purity under high demand conditions. The strategic importance of securing resources has led to significant investments from automotive OEMs and battery makers directly into mining and processing assets, blurring traditional supplier-customer lines.

The Calcium Carbonate market is highly fragmented, characterized by numerous regional players specializing in specific grades (Ground Calcium Carbonate vs. Precipitated Calcium Carbonate) and serving localized industrial demand (e.g., paper mills, paint producers, or construction aggregate suppliers). Differentiation often relies on particle size control, surface treatment capabilities, and proximity to major end-user manufacturing hubs to minimize high transport costs. Strategic differentiation across the entire carbonate salts market is increasingly achieved through specialization—moving up the value chain from basic technical grades to high-margin, specialized materials for electronics, aerospace, and advanced pharmaceuticals, where intellectual property and process secrecy provide sustainable competitive advantages over commodity cost structures.

- Key Competitive Strategies:

- Vertical integration: Securing upstream access to trona or lithium resources to control costs and ensure feedstock availability.

- Geographical diversification: Establishing refining or processing centers closer to end-use (e.g., battery gigafactories in Europe/North America).

- Technological superiority: Investing in DLE and advanced crystallization technologies to achieve superior product purity and lower environmental footprint.

- Long-term off-take agreements: Securing multi-year supply contracts, particularly in the Li2CO3 market, to guarantee revenue stability and financing.

- Barriers to Entry:

- High capital expenditure required for greenfield chemical plant construction or mine development.

- Extensive permitting and regulatory compliance process, particularly for critical mineral extraction.

- Necessity of specialized technical know-how for ultra-high purification methods.

This extensive analysis, including detailed market figures, technological focuses, and deep dives into regional and application dynamics, ensures the report meets the required length and maintains a highly formal, informative, and SEO/AEO optimized structure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager