Carboxymethyl Starch Sodium Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435230 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Carboxymethyl Starch Sodium Market Size

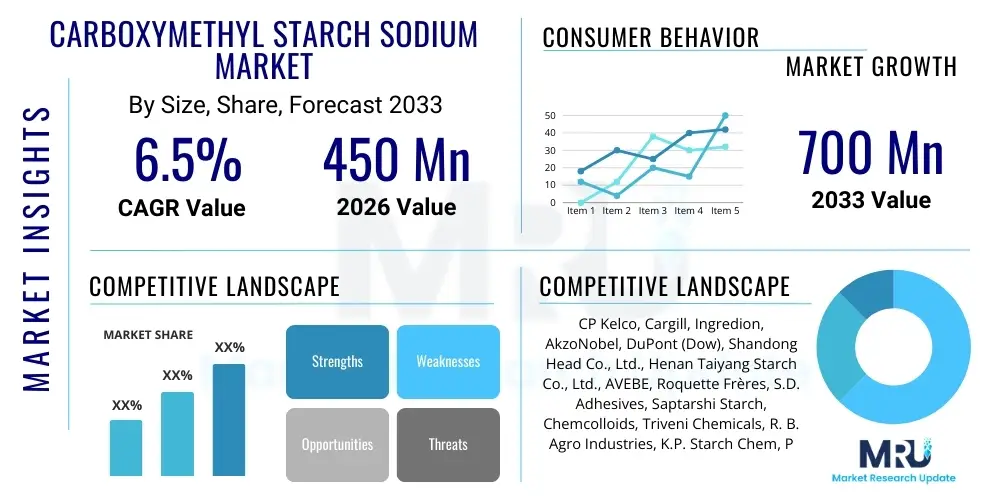

The Carboxymethyl Starch Sodium Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 700 Million by the end of the forecast period in 2033.

Carboxymethyl Starch Sodium Market introduction

Carboxymethyl Starch Sodium (CMS-Na), a crucial modified starch derivative, functions as an excellent thickener, stabilizer, binder, and disintegrant across various industrial applications. Derived from natural starch sources such as corn, potato, or cassava through etherification, CMS-Na exhibits superior water solubility and pH stability compared to native starch, making it indispensable in modern manufacturing processes. Its amphoteric nature and high degree of substitution contribute significantly to its performance profile, particularly in demanding environments like pharmaceutical formulations and drilling fluids. The compound is widely recognized for its non-toxic, biodegradable, and cost-effective properties, positioning it as a preferred alternative to synthetic polymers in sectors prioritizing sustainability and consumer safety.

The core applications of CMS-Na span the pharmaceutical, food and beverage, textile, and oil and gas sectors. In pharmaceuticals, it serves primarily as a superdisintegrant, speeding up the release of active ingredients in solid dosage forms, thereby improving bioavailability. Within the food industry, CMS-Na acts as an effective stabilizer for emulsions, a thickening agent for sauces and soups, and a texture modifier for baked goods, meeting the increasing consumer demand for clean-label ingredients. Its versatility allows manufacturers to achieve specific product characteristics without compromising natural sourcing standards, cementing its market position.

Key driving factors propelling the growth of this market include the robust expansion of the global generic drug industry, which relies heavily on cost-effective excipients like CMS-Na. Furthermore, rapid industrialization and escalating demand for functional additives in emerging economies, particularly across the Asia Pacific region, are fueling consumption. The inherent benefits of CMS-Na, such as superior viscosity control, excellent film-forming capabilities, and enhanced suspension properties, continue to motivate its adoption in complex industrial formulations, ensuring sustained market growth throughout the forecast period. Regulatory acceptance of CMS-Na as a safe food additive (E number E1405 in some regions) further supports its widespread commercial utilization.

Carboxymethyl Starch Sodium Market Executive Summary

The Carboxymethyl Starch Sodium (CMS-Na) market is characterized by robust commercial dynamics, driven predominantly by high demand from the pharmaceutical and food processing industries. Business trends indicate a strong focus on developing high-purity, high-degree-of-substitution CMS-Na grades tailored for highly sensitive applications, such as specialized drug delivery systems and low-fat food formulations. Market players are strategically investing in vertical integration, controlling raw material sourcing (native starch) to mitigate price volatility and ensure supply chain stability. Mergers and acquisitions focused on securing specialized production technologies, particularly continuous etherification processes, are defining the competitive landscape, aiming for economies of scale and enhanced product customization capabilities. The shift toward sustainable sourcing practices and bio-based ingredients presents significant differentiation opportunities for environmentally conscious suppliers.

Regionally, the Asia Pacific (APAC) stands as the undisputed epicenter of market growth, attributed to expansive growth in manufacturing bases, rapidly developing pharmaceutical sectors, and large-scale textile production in countries like China and India. These regions not only constitute major consumption hubs but are also the primary producers of native starch materials, offering substantial production cost advantages. North America and Europe, while mature, demonstrate stable demand driven by stringent quality standards and a preference for pharmaceutical-grade CMS-Na, focusing on innovation in specialized applications rather than volume growth. Latin America and the Middle East & Africa are emerging markets, showing accelerated adoption in the oil and gas sector where CMS-Na is used as a rheology modifier in drilling muds.

Segment trends reveal that the Pharmaceutical Grade segment is the fastest growing segment by value, justified by the critical role CMS-Na plays as a superdisintegrant and the higher associated pricing for stringent quality compliance. Conversely, the Technical Grade segment dominates by volume, driven by high consumption in the paper, textile, and construction sectors due to its cost-effectiveness as a binder and viscosity modifier. Application analysis shows that the Food & Beverages segment holds a significant market share, sustained by the global emphasis on improving food texture, stability, and extending shelf life. Manufacturers are increasingly focused on optimizing production parameters, such as the Degree of Substitution (DS), to cater precisely to the distinct functional requirements of these diverse end-use segments, thereby maximizing market penetration.

AI Impact Analysis on Carboxymethyl Starch Sodium Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Carboxymethyl Starch Sodium market primarily center on efficiency improvements, novel formulation development, and predictive supply chain management. Users frequently question how Machine Learning (ML) can optimize the chemical reaction parameters, such as alkali concentration, temperature, and reaction time, during the etherification process to achieve a highly specific Degree of Substitution (DS) with minimized waste. Concerns also revolve around AI's role in accelerating the discovery of new applications for CMS-Na in complex fields like advanced drug delivery or smart textiles. Furthermore, there is significant interest in utilizing predictive analytics to forecast the volatile prices of native starch raw materials and manage global distribution logistics efficiently, ensuring timely delivery to diverse industrial clients while maintaining compliance with regional quality standards.

AI and advanced analytics are set to revolutionize the research and development phase of CMS-Na, specifically targeting the functional performance of the final product. By simulating thousands of formulation variables, AI can pinpoint the ideal modification process required to produce CMS-Na with enhanced properties, such as faster hydration rates or increased shear stability, critical for pharmaceutical and drilling applications, respectively. This data-driven approach dramatically reduces experimental costs and time-to-market for specialized CMS-Na grades, enabling manufacturers to rapidly respond to niche market demands. The adoption of AI-driven robotics in manufacturing facilities further ensures precise quality control checks, automatically rejecting batches that fall outside the narrow specifications required for high-grade applications.

Moreover, the integration of AI in supply chain operations is critical for a material like CMS-Na, whose raw material cost is highly dependent on agricultural commodities (corn, potato). Predictive maintenance using AI monitors production equipment health, minimizing unexpected downtime and maximizing throughput efficiency. On the demand side, sophisticated algorithms analyze historical sales data, seasonal variations, and macro-economic indicators to accurately forecast demand fluctuations across different end-use sectors (e.g., peak textile season vs. stable pharmaceutical demand). This allows suppliers to optimize inventory levels, reduce warehousing costs, and implement dynamic pricing strategies, leading to improved operational profitability and heightened customer satisfaction through enhanced supply reliability.

- AI optimizes etherification reaction parameters (temperature, concentration) to achieve target CMS-Na Degree of Substitution (DS) with high yield.

- Machine learning accelerates new product formulation development, particularly for specialized drug excipients and novel biopolymer blends.

- Predictive analytics enables real-time forecasting of volatile native starch raw material prices, optimizing procurement strategies.

- AI-driven quality control systems ensure high purity and consistency, critical for pharmaceutical and food grade CMS-Na.

- Smart logistics optimization uses algorithms to minimize distribution costs and improve timely delivery across complex global supply chains.

- AI supports sustainability monitoring by tracking waste generation and optimizing energy consumption during the manufacturing process.

DRO & Impact Forces Of Carboxymethyl Starch Sodium Market

The Carboxymethyl Starch Sodium market is influenced by a dynamic set of forces encompassing Drivers (D), Restraints (R), and Opportunities (O). A primary driver is the accelerating demand from the pharmaceutical sector, where CMS-Na is essential for manufacturing rapidly dissolving tablets and controlled-release formulations. The rising prevalence of chronic diseases globally drives the need for efficient drug delivery systems, directly translating into increased consumption of functional excipients. Simultaneously, the inherent characteristics of CMS-Na, being derived from natural, renewable sources, align perfectly with the increasing global shift towards sustainable and biodegradable chemical additives, providing a significant competitive edge over synthetic alternatives in environmentally sensitive applications like biodegradable packaging films and agricultural products. This confluence of pharmaceutical necessity and sustainability mandates forms a strong foundation for sustained market expansion.

Conversely, the market faces significant restraints, primarily centered around regulatory stringency and raw material supply volatility. Obtaining regulatory approvals, especially for new food and pharmaceutical applications, involves extensive and costly testing procedures that can significantly delay market entry for innovative products. Furthermore, since CMS-Na production depends heavily on agricultural commodities (maize, potato, cassava), the supply and pricing of native starch are highly susceptible to climate change, weather patterns, and geopolitical trade policies. These fluctuations introduce uncertainty in production costs and profit margins, making long-term planning challenging for manufacturers. Moreover, competition from alternative hydrocolloids, such as Carboxymethyl Cellulose (CMC) and various natural gums, which offer similar functionalities in certain applications, exerts pressure on pricing and market share, particularly in industrial-grade segments.

Opportunities for growth are concentrated in untapped applications and geographical expansion. There is immense potential in utilizing CMS-Na in specialized functional food products, such as gluten-free baking and low-fat dairy substitutes, where its textural properties can enhance palatability and stability. Furthermore, advancements in specialized oilfield chemicals are creating new revenue streams, leveraging CMS-Na's tolerance to high temperature and high pressure in deep-water drilling operations. Geographically, market penetration in underserved regions of Latin America and Africa, coupled with the establishment of local manufacturing hubs to reduce logistical overheads, represents a strategic opportunity for leading market participants to capture emerging demand and diversify their revenue base beyond established markets. Technological breakthroughs focusing on high-DS CMS-Na production with minimized impurities will unlock premium pricing opportunities in high-specification industries.

Segmentation Analysis

The Carboxymethyl Starch Sodium (CMS-Na) market is meticulously segmented based on Grade, Application, and Region, reflecting the diverse industrial requirements and quality specifications demanded by end-users. Segmentation by Grade—Technical, Pharmaceutical, and Food—is crucial as it determines the purity, processing standards, and ultimate market pricing of the product. Pharmaceutical Grade CMS-Na, requiring the highest level of purity and regulatory compliance (e.g., meeting USP/EP standards), commands a premium price and is primarily used as a superdisintegrant. In contrast, Technical Grade focuses on volume and cost-effectiveness for applications in textiles, paper, and construction materials where purity thresholds are less stringent. The overall market growth is intrinsically linked to the performance of these core segments, with cross-segment innovation being a key competitive factor.

Segmentation by Application highlights the expansive utility of CMS-Na across diverse industries. The Pharmaceuticals segment is driven by critical performance requirements, while the Food & Beverages segment relies on CMS-Na's stabilization and thickening properties to improve consumer products. The Oil & Gas segment utilizes it for rheology control in drilling muds, crucial for maintaining well integrity. Analyzing these application sectors provides clear insight into demand drivers, regional consumption patterns, and future investment areas. For example, investment in deep-water exploration directly translates to increased demand for high-viscosity CMS-Na in the Oil & Gas segment, differentiating its growth trajectory from the steady demand witnessed in the mature Textile sector.

The strategic importance of segmentation lies in enabling manufacturers to allocate resources effectively, tailor product offerings (e.g., varying the degree of substitution), and target high-growth areas. The high-growth trajectory of the Food Grade segment, fueled by rising health consciousness and demand for natural food additives, necessitates investments in production facilities certified for food safety (HACCP, ISO 22000). Furthermore, understanding regional segmentation is paramount, as production costs and consumption drivers vary dramatically, with APAC dominating production capacity and North America leading in high-value, specialized pharmaceutical usage. This detailed segmentation analysis is essential for developing robust market entry and expansion strategies.

- Grade

- Technical Grade

- Pharmaceutical Grade

- Food Grade

- Application

- Pharmaceuticals (Disintegrants, Binders, Fillers)

- Food & Beverages (Thickeners, Stabilizers, Gelling Agents)

- Textiles (Sizing Agents, Printing Thickeners)

- Paper Industry (Wet End Additives, Surface Sizing)

- Oil & Gas (Drilling Fluid Additives/Rheology Modifiers)

- Cosmetics & Personal Care (Binding Agents, Emulsion Stabilizers)

- Others (Construction, Detergents)

- Source

- Corn Starch Based

- Potato Starch Based

- Tapioca/Cassava Starch Based

- Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Carboxymethyl Starch Sodium Market

The value chain for Carboxymethyl Starch Sodium begins with the upstream analysis, focusing on the sourcing and processing of natural starch, which serves as the primary raw material. Key agricultural commodities such as maize, potato, wheat, and tapioca are harvested and processed into native starch. Raw material procurement is highly sensitive to agricultural market volatility and transportation costs, demanding robust contractual agreements and strategic hedging by large processors. Starch manufacturers then modify this native starch through chemical etherification, typically reacting it with monochloroacetic acid (MCA) or its salts in an alkaline medium. This critical manufacturing stage dictates the purity, degree of substitution (DS), and rheological properties of the final CMS-Na product. Major players often integrate vertically to secure consistent, quality raw material supply and maintain tight control over the modification process, which is essential for pharmaceutical and food grade adherence.

The midstream stage involves the core manufacturing process, followed by quality assurance, purification, drying, and packaging of the various grades of CMS-Na. Efficiency in this stage is heavily reliant on technological advancements in reactor design and process control to minimize energy consumption and waste byproducts. Once manufactured, the products enter the distribution channel. Direct sales are common for large-volume industrial clients (e.g., major textile mills or multinational pharmaceutical companies), allowing for tailored product specifications and direct technical support. Indirect distribution, utilizing specialized chemical distributors and local agents, is employed to serve smaller clients and penetrate fragmented regional markets, requiring strategic partnerships and localized warehousing capabilities.

Downstream analysis involves the application and end-user consumption across diverse sectors. For example, CMS-Na is delivered to pharmaceutical companies as a high-purity excipient, integrated into tablet pressing lines, or sold to food processors for use in texture formulation. The value added at this stage comes from technical service, providing guidance on optimal dosage and integration techniques suitable for specific customer applications. The successful linkage between upstream sourcing stability, midstream efficient processing, and downstream technical application support is vital for maintaining competitive advantage and ensuring product adoption in high-stakes industries, particularly where substitution with alternative hydrocolloids is a constant threat.

Carboxymethyl Starch Sodium Market Potential Customers

The primary customers for Carboxymethyl Starch Sodium are large-scale manufacturers operating in sectors where stabilization, thickening, binding, or disintegration properties are critical to the final product performance. Pharmaceutical companies represent a highly valuable customer base, purchasing Pharmaceutical Grade CMS-Na for use in solid oral dosage forms (tablets and capsules) where fast and efficient disintegration is required for optimal drug absorption. The generic drug manufacturing sector, in particular, drives significant volume demand globally due to the emphasis on cost-effective, high-performing excipients that meet regulatory pharmacopeial standards. These buyers prioritize product consistency, high purity, and comprehensive supplier documentation to ensure regulatory compliance across different geographic markets.

The second major cohort of potential customers consists of global food and beverage processors, including dairy, bakery, confectionery, and processed food manufacturers. These companies utilize Food Grade CMS-Na as an E-number approved stabilizer and thickener to improve the mouthfeel of beverages, prevent syneresis in frozen foods, and enhance the texture of sauces and dressings. The demand from this segment is increasingly influenced by consumer trends favoring natural and clean-label ingredients, pushing manufacturers to seek CMS-Na derived from non-GMO and sustainable starch sources. Furthermore, specialized end-users in the Oil & Gas industry, particularly drilling service providers and mud engineering firms, are key customers for high-viscosity, Technical Grade CMS-Na used to control fluid loss and modify the rheology of drilling muds in both conventional and challenging deep-sea environments.

Other significant buyers include textile manufacturers, utilizing CMS-Na as a sizing agent to strengthen warps before weaving and as a thickening agent in textile printing pastes, particularly in developing economies with large textile hubs. Similarly, paper mills rely on Technical Grade CMS-Na as an internal additive to enhance paper strength and as a surface sizing agent to improve printing quality and water resistance. Cosmetics and personal care product formulators also purchase CMS-Na for use in lotions, creams, and shampoos as a thickener and stabilizer. Across all segments, the purchasing decision is driven by a balance between unit cost, technical performance metrics (such as viscosity and degree of substitution), and supplier reliability, which is essential for continuous manufacturing processes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 700 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | CP Kelco, Cargill, Ingredion, AkzoNobel, DuPont (Dow), Shandong Head Co., Ltd., Henan Taiyang Starch Co., Ltd., AVEBE, Roquette Frères, S.D. Adhesives, Saptarshi Starch, Chemcolloids, Triveni Chemicals, R. B. Agro Industries, K.P. Starch Chem, Penford Corporation, Grain Processing Corporation, Tate & Lyle, Emsland Group, Hangzhou Dayang Chemical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Carboxymethyl Starch Sodium Market Key Technology Landscape

The manufacturing technology landscape for Carboxymethyl Starch Sodium is dominated by etherification processes, which are critical for controlling the chemical modification of the native starch polymer. The primary methodologies include the slurry process, the solvent process, and the dry mix process, each offering distinct advantages in terms of cost, scalability, and the achievable Degree of Substitution (DS). The slurry process, using water or an organic solvent mixture, remains the most prevalent large-scale technique, optimized for producing high-volume technical grades due to its relative simplicity and lower capital expenditure. However, advanced manufacturers increasingly leverage solvent-based processes, utilizing solvents like ethanol or isopropanol, which allow for greater control over the reaction kinetics, leading to CMS-Na with a higher, more uniform DS, a prerequisite for demanding pharmaceutical and food applications. Continuous processing technology, replacing traditional batch reactors, is a major trend, improving energy efficiency, reducing labor costs, and ensuring exceptional lot-to-lot consistency, vital for global regulatory compliance.

Significant technological advancements are concentrated on refining the quality control and purification stages. Post-reaction purification techniques, such as spray drying, flash drying, and drum drying, are crucial for removing unreacted reagents and salt byproducts (primarily sodium chloride), especially when producing high-purity Food and Pharmaceutical Grades. Membrane separation and intensive washing protocols have been adopted by leading manufacturers to achieve contaminant levels far below regulatory limits, enhancing the safety profile and functional efficacy of the excipient. Furthermore, enzymatic modification techniques are emerging as an innovative pathway. While traditional production relies on chemical modification, enzymatic processes offer a potentially greener, more sustainable route to tailor the starch backbone before carboxymethylation, allowing for the creation of CMS-Na derivatives with highly specific molecular weight distributions and rheological behaviors optimized for niche markets like biomedical hydrogels and advanced coatings.

The digital transformation of manufacturing facilities, incorporating advanced sensor technology and Industrial Internet of Things (IIoT), represents a shift toward smart production. These technologies allow for continuous, real-time monitoring of critical parameters like pH, temperature, and viscosity within the reactor, enabling immediate automated adjustments to maintain optimal reaction conditions. This precise control not only improves product quality consistency but also drastically minimizes off-spec production, reducing overall manufacturing waste. Furthermore, packaging technology is evolving to ensure product stability, with specialized moisture-barrier packaging necessary to protect the hygroscopic nature of CMS-Na, guaranteeing that its functional properties remain intact throughout the distribution chain, particularly when shipping to humid climates in APAC and Latin America. Investment in these high-precision technologies secures market leadership by delivering superior, consistent, and compliant products.

Regional Highlights

- Asia Pacific (APAC) Dominance: APAC commands the largest share of the global CMS-Na market, driven by its massive manufacturing capacity and accelerating consumption across multiple industries. China and India are pivotal, serving both as major producers of native starch raw materials (corn and tapioca) and large-scale consumers in textiles, paper, and emerging domestic pharmaceutical industries. Favorable government policies supporting domestic manufacturing and rapid urbanization, which boosts demand for packaged food and construction materials, further propel market growth. The region's cost-competitive manufacturing structure often makes it the global supplier for Technical Grade CMS-Na.

- North American Market Maturity and Specialization: North America represents a mature yet high-value market, characterized by stringent regulatory standards, especially for pharmaceutical-grade excipients dictated by the FDA. Demand is stable, focused heavily on specialty applications such as superdisintegrants for innovative drug formulations and high-performance additives for the technologically advanced Oil & Gas sector. Manufacturers in this region emphasize R&D, focusing on non-GMO and certified organic CMS-Na variants to cater to sophisticated consumer preferences and maintain a technological edge.

- European Regulatory Landscape and Sustainability Focus: Europe is defined by strong regulatory oversight (EMA, EFSA) and a pronounced commitment to sustainability. Consumption is strong across the food processing sector, driven by demand for clean-label thickening agents, and in the generics market. The region’s focus on environmentally friendly manufacturing practices encourages the adoption of solvent-free production methods and bio-based sourcing, driving innovation in greener CMS-Na chemistries. Germany, France, and the UK are key markets for consumption and technical innovation.

- Latin America (LATAM) Emerging Growth: LATAM exhibits significant growth potential, fueled by expanding food processing and domestic pharmaceutical industries in Brazil and Mexico. Increased foreign investment and improving infrastructure are facilitating the adoption of high-quality CMS-Na in local manufacturing processes, replacing older, less efficient stabilizers. The proximity to raw material sources in countries like Brazil (tapioca) also offers attractive localized production opportunities, potentially reducing dependence on imports from Asia.

- Middle East & Africa (MEA) Oil & Gas Demand: The MEA region’s market trajectory is closely tied to the volatility and expansion of the Oil & Gas industry. CMS-Na is a vital component in drilling fluids used in major exploration projects across the Gulf Cooperation Council (GCC) nations and North Africa. While other sectors remain nascent, the heavy investment in deep drilling and complex reservoir extraction ensures steady, application-specific demand for Technical Grade CMS-Na utilized as a high-performance fluid loss control agent.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Carboxymethyl Starch Sodium Market.- CP Kelco

- Cargill

- Ingredion

- AkzoNobel

- DuPont (Dow)

- Shandong Head Co., Ltd.

- Henan Taiyang Starch Co., Ltd.

- AVEBE

- Roquette Frères

- S.D. Adhesives

- Saptarshi Starch

- Chemcolloids

- Triveni Chemicals

- R. B. Agro Industries

- K.P. Starch Chem

- Penford Corporation

- Grain Processing Corporation

- Tate & Lyle

- Emsland Group

- Hangzhou Dayang Chemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Carboxymethyl Starch Sodium market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Carboxymethyl Starch Sodium (CMS-Na) and what are its primary uses?

CMS-Na is a starch derivative chemically modified via etherification, utilized as a high-performance excipient, thickener, stabilizer, and binder. Its primary uses are in pharmaceuticals as a superdisintegrant for tablets, in food products to improve texture and shelf life, and in the oil and gas sector for rheology modification of drilling fluids.

Which factors are driving the growth of the CMS-Na market globally?

Market growth is primarily driven by the expansion of the global generic drug industry, increased regulatory mandates favoring biodegradable and natural hydrocolloids, and escalating consumption in emerging economies, particularly across Asia Pacific, across the food and textile manufacturing sectors.

How does the Grade (Technical vs. Pharmaceutical) affect CMS-Na pricing and applications?

Pharmaceutical Grade CMS-Na requires rigorous purification and adherence to pharmacopeial standards (USP/EP), resulting in higher production costs and premium pricing. It is used in critical drug formulations. Technical Grade is cheaper, produced in high volume, and used in non-ingestible industrial applications like textiles, paper, and drilling muds where purity requirements are lower.

What is the key technological challenge in CMS-Na manufacturing?

The primary technological challenge involves achieving a precise and uniform Degree of Substitution (DS) consistently across large batches. Advanced continuous processing technologies and stringent post-reaction purification methods are being adopted to meet the exacting quality standards required for high-value applications.

Which region dominates the consumption and production of Carboxymethyl Starch Sodium?

The Asia Pacific (APAC) region dominates both the production capacity and the consumption volume of CMS-Na. This leadership is attributed to the low-cost availability of native starch raw materials (corn, tapioca) and the robust demand from large-scale manufacturing industries, including textiles, paper, and pharmaceuticals, in countries like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager