Card Personalization Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433081 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Card Personalization Equipment Market Size

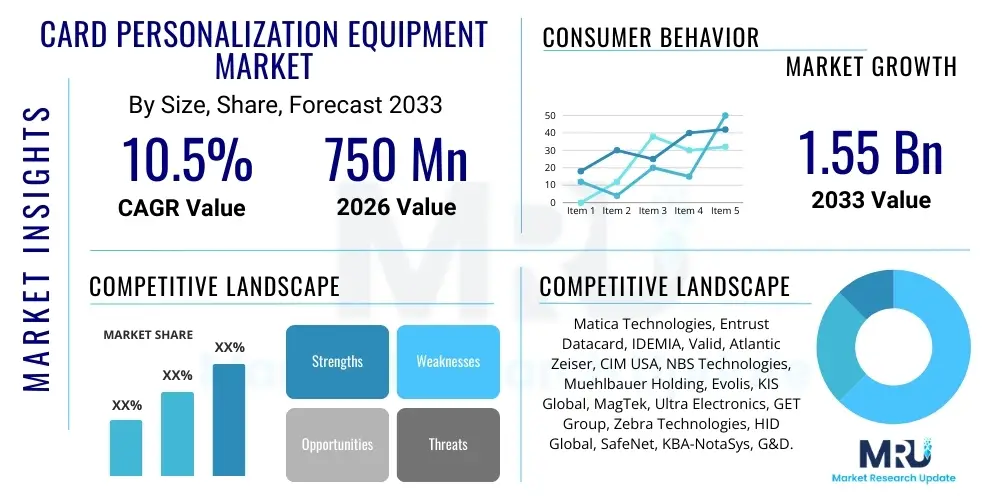

The Card Personalization Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at USD 750 Million in 2026 and is projected to reach USD 1.55 Billion by the end of the forecast period in 2033. This substantial growth trajectory is driven primarily by the global shift towards advanced secure payment mechanisms, the rapid digitization of governmental identity programs, and the continuous renewal cycle of existing payment card infrastructure worldwide. The increasing complexity of security requirements, including the mandatory integration of EMV chips and advanced cryptographic features, necessitates high-precision personalization equipment, thereby propelling market valuation.

The market expansion is heavily correlated with the proliferation of instant issuance programs, particularly within developing economies where access to traditional banking infrastructure is expanding rapidly. Financial institutions are increasingly investing in modular and scalable personalization systems to meet fluctuating demand, enabling the efficient production of customized cards instantly at branch locations. Furthermore, the rising adoption of multi-functional cards that combine payment, access control, and identity features also drives the demand for versatile personalization systems capable of handling multiple encoding and printing technologies simultaneously, ensuring robust market size growth over the forecast period.

Card Personalization Equipment Market introduction

The Card Personalization Equipment Market encompasses machinery and systems utilized for customizing secure identity and financial cards, including credit cards, debit cards, national ID cards, and access control badges. These specialized machines perform critical functions such as embossing, laser engraving, thermal printing, magnetic stripe encoding, chip contact and contactless programming, and visual security element integration (e.g., holograms). The product range spans from compact, desktop instant issuance systems used in retail bank branches to high-volume, central issuance systems employed by third-party service bureaus and large governmental agencies, providing tailored solutions based on required throughput and complexity.

Major applications of card personalization equipment are concentrated across the financial services sector, where secure and immediate card issuance is paramount, and the government sector for producing highly secure national identification documents, driver's licenses, and electronic health cards. Additional applications include transportation, loyalty programs, and corporate access control systems. The primary benefits offered by these solutions include enhanced security through integrated anti-counterfeiting features, improved customer experience via instant issuance capabilities, and increased operational efficiency due to automated high-speed processing. These systems are essential components of the global secure credentials ecosystem, ensuring that every card issued adheres to stringent international standards and specifications.

Driving factors for this market include the global migration from traditional magnetic stripe cards to advanced EMV (Europay, MasterCard, and Visa) chip cards, requiring specialized chip personalization equipment. Additionally, regulatory mandates for biometric and enhanced security features in ID documents across numerous countries foster continuous technological upgrades. The increasing demand for instant card issuance to improve customer satisfaction and reduce wait times further stimulates market investment. Continuous innovation in printing technologies, such as high-definition re-transfer printing and durable laser engraving, also acts as a significant market driver by enhancing card durability and security features, positioning the market for sustained expansion.

Card Personalization Equipment Market Executive Summary

The Card Personalization Equipment Market is defined by intense technological competition and a strong focus on security standardization. Business trends indicate a robust shift toward modular systems capable of handling both high-speed central issuance and distributed instant issuance, offering greater operational flexibility to card issuers. Key players are prioritizing the integration of sophisticated software platforms that manage personalization data, workflow, and system diagnostics, moving beyond hardware provision alone into holistic secure issuance solutions. Geographically, while established markets like North America and Europe continue to focus on technology upgrades and replacement cycles, the highest growth rates are emanating from emerging Asia Pacific and Latin American regions, fueled by accelerating financial inclusion and government digitization projects, creating a globally diversified market landscape.

Regional trends are characterized by distinct security and regulatory compliance requirements. Europe, driven by GDPR and strict payment service directives, shows high demand for equipment capable of processing complex digital identities securely. North America maintains a strong instant issuance segment, catering to consumer demands for immediate replacement cards and faster onboarding. Asia Pacific is witnessing massive infrastructure investment in mass transit cards, national identity schemes (such as India’s Aadhaar and similar projects in Southeast Asia), and foundational banking expansion, making it the most critical region for volume growth. This dynamic regional segmentation ensures continuous investment in both high-end security features and high-throughput volume production capabilities across various geographical markets.

Segment trends highlight the dominance of technology capable of smart card personalization, reflecting the near-universal adoption of chip technology globally. Within card types, financial cards remain the largest segment due to the sheer volume of new and replacement cards, but the government/ID card segment is projected to exhibit the fastest growth owing to large-scale national projects involving sophisticated personalization features like laser-engraved ghost images and tactile security elements. Furthermore, the shift towards re-transfer printing technology is notable, as it offers superior edge-to-edge printing quality and enhanced durability compared to traditional direct-to-card methods, meeting the stringent aesthetic and longevity requirements of premium financial and ID cards, optimizing the performance metrics across the value chain.

AI Impact Analysis on Card Personalization Equipment Market

Common user questions regarding AI's influence on the Card Personalization Equipment Market frequently revolve around efficiency gains, predictive maintenance capabilities, and enhanced security verification processes. Users are keenly interested in how Artificial Intelligence can optimize complex personalization workflows, particularly in large bureau settings, by minimizing errors, managing dynamic data streams, and automating quality control checks without human intervention. Concerns also focus on the integration costs and the ethical implications of using AI to process highly sensitive personal identification data. The prevailing expectation is that AI will transform equipment from purely mechanical devices into intelligent, self-optimizing systems, primarily impacting yield rates, uptime, and the overall security posture of the card issuance process.

AI is beginning to integrate into the personalization lifecycle, primarily through advanced machine vision systems. These AI-powered visual inspection systems utilize deep learning algorithms to automatically identify micro-defects, alignment issues, and potential tampering that traditional human inspection or simple programmed checks might miss. This dramatically improves the quality assurance process, crucial for maintaining the integrity of highly secure documents like passports and national ID cards. Furthermore, AI algorithms are being applied to predictive maintenance, analyzing machine telemetry data in real-time to forecast component failures, scheduling maintenance proactively, and significantly reducing unexpected equipment downtime, which is a major operational cost for high-volume issuers.

Beyond internal process optimization, AI is set to influence data security and fraud prevention at the point of issuance. Advanced analytics driven by AI can monitor the data flow through the personalization equipment, flagging unusual patterns or unauthorized data access attempts, providing an additional layer of cyber security protection. In instant issuance environments, AI models can assist in real-time identity verification workflows, ensuring the person receiving the personalized card is indeed the authorized user, thereby streamlining compliance with KYC (Know Your Customer) regulations. While current integration is modest, the future trend points toward AI managing the entire personalization data pipeline, from secure key injection to final visual verification, establishing new benchmarks for operational integrity and security.

- AI enhances quality control through advanced machine vision inspection systems.

- Predictive maintenance algorithms minimize equipment downtime by forecasting failures.

- Optimization of production schedules and personalization sequence management for higher throughput.

- Improved fraud detection by monitoring unusual data flow patterns during key injection.

- Automation of sophisticated security feature verification (e.g., micro-text, laser alignment).

DRO & Impact Forces Of Card Personalization Equipment Market

The Card Personalization Equipment Market is heavily influenced by a combination of powerful drivers centered around security and digitization, balanced by significant restraints related to capital investment and technological complexity, and compelling opportunities stemming from emerging market growth. The core drivers include global regulatory mandates for EMV chip migration, the necessity for multi-factor authentication credentials, and government initiatives promoting national e-ID projects. These forces necessitate continuous investment in sophisticated machinery. Restraints include the high initial cost of central issuance equipment and the long lifecycle of personalization systems, which can slow down replacement cycles. The complexity of integrating new technologies, such as biometric scanners and secure element programming modules, also poses an operational challenge for smaller service bureaus.

Opportunities are predominantly found in rapidly expanding regions like APAC and LATAM, where financial inclusion efforts are driving massive volumes of first-time card issuance. Furthermore, the increasing demand for instant issuance solutions, particularly in the retail banking sector, creates a strong market opportunity for compact, secure desktop personalization systems. Technological advancement also presents an opportunity, specifically the move towards laser-based personalization for highly durable government credentials, offering new revenue streams for equipment manufacturers. The overall impact forces are high, characterized by the intense pressure from regulatory bodies to adopt the highest security standards, requiring manufacturers to continuously innovate and adapt their equipment capabilities, ensuring the market remains dynamic and technologically focused.

The impact of these forces is substantial: the need for interoperability and compliance with international standards (ISO/IEC 7816, EMVCo) dictates equipment design and functionality globally. The cyclical nature of card replacement (typically every 3–5 years for financial cards) ensures a stable baseline demand, while large, infrequent governmental projects provide significant revenue spikes. The ongoing threat of identity theft and financial fraud acts as a perpetual driver, ensuring that security features—and the equipment needed to implement them—always remain the primary focus of development, effectively elevating the market importance of secure personalization solutions. This continuous security challenge solidifies the long-term necessity and inherent value of specialized personalization machinery.

Segmentation Analysis

The Card Personalization Equipment Market is critically segmented based on the technology utilized for personalization, the type of card being processed, and the end-use application or industry served. Understanding these segments is crucial for manufacturers to tailor their product offerings and marketing strategies to specific customer needs, whether those needs prioritize high-volume speed, extreme security durability, or instant, distributed issuance capabilities. The market segmentation reflects the diverse requirements of modern secure credential issuance, encompassing everything from basic loyalty card printing to highly complex biometric passport chip encoding and laser personalization, providing a detailed map of the competitive landscape.

Technology segmentation is vital, distinguishing systems based on their output methods, such as thermal printing (direct-to-card or re-transfer), laser engraving (for high-security, tamper-proof documents), and traditional mechanical methods like embossing and tipping, often necessary for backward compatibility in certain financial card environments. Segmentation by card type—financial, government/ID, retail/loyalty—determines the required security levels and throughput specifications for the equipment. For instance, government card personalization requires complex security modules and high precision for laser engraving, while financial card personalization emphasizes speed and secure key injection for EMV chips, driving distinct product development paths across the industry.

- By Technology

- Dye Sublimation Printing (Direct-to-Card)

- Re-transfer Printing (High-Definition)

- Laser Engraving and Personalization

- Inkjet Printing (Specialized & UV)

- Embossing and Tipping

- Encoding (Magnetic Stripe, Contact/Contactless Chip)

- By Card Type

- Financial Cards (Credit, Debit, Prepaid)

- Government and Healthcare Cards (National ID, Passport Data Pages, Driver's Licenses)

- Access Control Cards

- Loyalty and Membership Cards

- By End-User

- Financial Institutions (Banks, Credit Unions)

- Government and Public Sector

- Service Bureaus and Card Manufacturers

- Retail and Commercial Enterprises

- By Deployment Model

- Central Issuance Systems (High Volume)

- Instant Issuance Systems (Desktop/Distributed)

Value Chain Analysis For Card Personalization Equipment Market

The value chain for the Card Personalization Equipment Market is complex, beginning with upstream suppliers of core components and culminating in downstream end-users receiving the personalized secure credentials. Upstream activities involve the sourcing of precision engineering components, thermal print heads, laser optics, secure programming modules, and specialized card stock (PVC, polycarbonate). Key participants at this stage include sensor manufacturers, software developers specializing in secure data management and encryption, and component integrators. The high degree of specialization in secure encryption chips and laser systems dictates that the upstream segment is concentrated and highly regulated, impacting final equipment cost and security capabilities, forming the foundation of the equipment quality.

Midstream activities involve the core equipment manufacturers who design, assemble, and integrate the various personalization technologies (e.g., printing, embossing, encoding) into complete, functional systems. These manufacturers often specialize in either high-volume central issuance solutions or compact desktop instant issuance machines, requiring significant R&D investment in software interface, secure data handling, and mechanical reliability. Downstream activities involve distribution channels, which include direct sales teams for large government contracts, and a network of value-added resellers (VARs) and system integrators who handle localized sales, installation, maintenance, and ongoing support for financial institutions and smaller enterprises. The involvement of VARs is critical for providing technical expertise and localized compliance knowledge in diverse regional markets, ensuring effective market penetration.

The distribution channel utilizes both direct and indirect models. High-value, complex systems for central banks or national ID projects are typically handled through direct sales and bespoke contract negotiations, ensuring customized integration and stringent security protocols. Indirect channels, utilizing specialized distributors, are common for instant issuance equipment and maintenance contracts, allowing manufacturers to leverage local support expertise and reach a wider base of smaller banks and retail organizations. The secure nature of the product mandates that all downstream partners possess certified security clearances and expertise in handling sensitive personalization data, differentiating this value chain from general manufacturing industries and emphasizing trust and compliance throughout the entire process.

Card Personalization Equipment Market Potential Customers

The primary potential customers for Card Personalization Equipment are large-scale organizations that require the secure, high-volume production of personalized credentials. The most significant customer base resides within financial institutions, including major commercial banks, credit unions, and payment networks, which continuously require equipment for both new card issuance and replacement cycles due to expiry, damage, or security breaches. The ongoing global shift towards digital and mobile banking necessitates systems that can rapidly issue secure physical cards to support omnichannel strategies, making instant issuance technology particularly attractive to this sector.

Another crucial customer segment is the governmental and public sector. This includes national ministries responsible for issuing high-security documents such as national ID cards, driver's licenses, healthcare cards, voter registration cards, and biometric passports. These customers demand the most advanced personalization technologies, specifically laser engraving and sophisticated data encoding, due to stringent anti-counterfeiting regulations and long card lifecycles. These projects are typically characterized by high volume, centralized production facilities, and long-term maintenance contracts, representing substantial revenue opportunities for specialized equipment providers.

Finally, third-party service bureaus and specialized card manufacturers represent a growing customer base. These entities act as outsourced personalization centers for financial, retail, and corporate clients who prefer not to manage the complexity and capital cost of in-house personalization. Service bureaus require flexible, high-throughput, and scalable systems capable of handling diverse card types and personalization requirements under strict service level agreements (SLAs). Additionally, large retail chains and universities that manage extensive loyalty programs or campus access systems also constitute important niche customers for smaller, dedicated personalization solutions, expanding the market reach beyond core secure credential issuance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 750 Million |

| Market Forecast in 2033 | USD 1.55 Billion |

| Growth Rate | 10.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Matica Technologies, Entrust Datacard, IDEMIA, Valid, Atlantic Zeiser, CIM USA, NBS Technologies, Muehlbauer Holding, Evolis, KIS Global, MagTek, Ultra Electronics, GET Group, Zebra Technologies, HID Global, SafeNet, KBA-NotaSys, G&D. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Card Personalization Equipment Market Key Technology Landscape

The technology landscape of the Card Personalization Equipment Market is dominated by the convergence of high-precision mechanics and advanced digital security software. The core technologies utilized can be broadly categorized into physical personalization methods (embossing, laser engraving) and digital/visual personalization methods (thermal printing, encoding). Laser engraving has emerged as a crucial technology, particularly for governmental identity documents made of polycarbonate, as it creates permanent, tamper-proof security features by modifying the card material internally. This shift is driven by the need for credentials with lifecycles exceeding five years and enhanced resistance to physical alteration, positioning laser systems at the high-security end of the market spectrum.

Thermal printing technologies, including direct-to-card dye sublimation and the increasingly popular re-transfer methods, remain standard for visual personalization. Re-transfer technology, which prints the image onto a thin film and then heat-transfers the film to the card surface, offers superior edge-to-edge coverage and protection against wear, making it the preferred method for high-quality financial and loyalty cards. Concurrently, the rise of chip technology (EMV contact and contactless) mandates sophisticated encoding stations integrated directly into personalization lines. These stations must securely inject cryptographic keys, payment application data, and personal information into the chip, requiring specialized hardware modules and secure key management systems that comply with stringent payment industry standards.

Furthermore, software integration is a defining technological trend. Modern personalization equipment is no longer standalone hardware but is managed by sophisticated software suites that handle secure data input, workflow orchestration, compliance logging, and quality control. This software must interface seamlessly with Customer Information Systems (CIS) and Card Management Systems (CMS), ensuring end-to-end data integrity and security throughout the issuance process. The adoption of modular, scalable architectures, which allow customers to add or remove personalization stations (e.g., adding a laser module or a dual-chip encoder) based on evolving requirements, represents a significant technological advancement focused on flexibility and future-proofing investment, ensuring long-term operational viability.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven by large-scale government initiatives focused on national identity schemes (e.g., e-passports, national ID cards) and massive financial inclusion programs across countries like India, Indonesia, and China. The sheer volume of population and the accelerating transition from cash to digital payments necessitate high-volume, continuous equipment deployment for both central and instant issuance, providing unparalleled market expansion opportunities for manufacturers.

- North America: This region is characterized by high adoption rates of instantaneous issuance systems, primarily driven by retail banking efforts to improve customer service and expedite card replacement. The market here is mature but focuses heavily on technology refresh cycles, adoption of complex smart card features, and migration towards advanced personalization methods for physical access control and highly secure corporate ID badges, ensuring demand remains stable and focused on high-tech solutions.

- Europe: Europe is highly regulated, necessitating compliance with strict data protection laws (GDPR) and complex payment directives. The market is driven by the replacement of existing card stocks with enhanced security features and the continuous upgrade of personalization systems to handle advanced contactless payment applications and multimodal public transport cards. Emphasis is placed on secure software integration and GDPR-compliant data handling throughout the personalization process.

- Latin America (LATAM): The LATAM market is experiencing significant growth due to improving financial infrastructure and increased penetration of banking services. Governments are also investing in modernizing national ID and driver's license systems, spurring demand for reliable, mid-to-high-volume personalization equipment capable of handling foundational card issuance across rapidly developing economic segments.

- Middle East and Africa (MEA): Growth in MEA is fueled by robust government spending on national security and ID infrastructure projects, coupled with expanding financial services markets. Specific demand drivers include the implementation of biometric ID systems and the need for durable, high-security cards in politically sensitive or high-fraud regions, requiring robust equipment capable of complex security feature implementation.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Card Personalization Equipment Market.- Matica Technologies

- Entrust Datacard

- IDEMIA

- Valid

- Atlantic Zeiser

- CIM USA

- NBS Technologies

- Muehlbauer Holding

- Evolis

- KIS Global

- MagTek

- Ultra Electronics

- GET Group

- Zebra Technologies

- HID Global

- SafeNet (Thales)

- KBA-NotaSys

- G&D (Giesecke+Devrient)

- Ingenico (Worldline)

- Toppan Forms

Frequently Asked Questions

Analyze common user questions about the Card Personalization Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for high-end card personalization equipment?

The primary factor is global regulatory compliance, specifically the mandatory migration to EMV chip technology for financial cards and the necessity for advanced laser personalization to secure governmental identity documents against counterfeiting and tampering, ensuring the highest standards of security and durability are met.

How does instant issuance equipment differ from central issuance systems?

Instant issuance equipment is typically desktop-sized, decentralized, and used by bank branches or retail outlets for immediate card printing, focusing on customer convenience and low volume. Central issuance systems are high-throughput industrial machines located in secure bureaus, designed for mass production and complex security feature integration, optimizing cost and speed for high volumes.

Which card personalization technology offers the highest level of security and durability?

Laser engraving offers the highest level of security and durability, particularly when applied to polycarbonate cards. Laser technology creates permanent, tamper-evident features beneath the surface of the card material, making it ideal for high-security credentials such as national IDs and biometric passports where longevity is critical.

What role does software play in modern card personalization systems?

Software is essential for modern personalization, managing secure data workflow, cryptographic key injection, system diagnostics, and compliance logging. It integrates the personalization hardware with the issuer’s Card Management Systems (CMS) to ensure data integrity, security, and traceability throughout the entire issuance cycle.

Which geographic region is expected to experience the highest market growth rate?

The Asia Pacific (APAC) region is expected to exhibit the highest Compound Annual Growth Rate (CAGR), driven by rapid financial inclusion initiatives, massive government investments in new e-ID and healthcare card programs, and the accelerating transition towards digital and secure payment infrastructures across populous economies.

What is Re-transfer printing and why is it preferred for premium cards?

Re-transfer printing utilizes an indirect method where the image is first printed onto a transfer film and then thermally bonded to the card surface. This technique provides superior edge-to-edge coverage, vibrant colors, and added durability, protecting the printed image from abrasion, making it the preferred choice for high-quality financial and corporate ID cards where aesthetic appeal and longevity are paramount.

How is AI impacting the maintenance and uptime of personalization equipment?

AI is significantly impacting maintenance through predictive analytics. By analyzing real-time operational data from machine sensors, AI algorithms can accurately forecast potential component failures, allowing service teams to perform proactive maintenance. This minimizes unexpected equipment downtime, which is critical for high-volume central issuance bureaus that operate on stringent production schedules.

What are the main restraints hindering the market's full potential?

The main restraints include the high capital expenditure required for acquiring sophisticated central issuance systems, which can be prohibitive for smaller organizations. Additionally, the long operational lifecycle of current equipment often leads to slow replacement cycles, temporarily limiting new sales of advanced machinery until major technological shifts or security mandates necessitate an upgrade.

Who are the typical upstream suppliers in the card personalization value chain?

Upstream suppliers are specialized providers of high-precision components, including secure element chip manufacturers, sensor and optical component suppliers, manufacturers of thermal print heads, and software companies developing secure encryption and data management platforms necessary for controlling the sensitive personalization process, forming the technical backbone of the equipment.

Beyond finance and government, what are the emerging application areas for card personalization?

Emerging applications include the use of highly secure personalized credentials in corporate physical and logical access control systems, sophisticated loyalty programs that integrate multiple functions, and the issuance of secure digital IDs and associated physical tokens for large educational institutions and integrated public transportation networks utilizing multi-application smart cards.

Why is secure key injection considered the most critical security step in smart card personalization?

Secure key injection is critical because it involves loading the unique, cryptographic keys necessary for payment processing and secure communication directly into the EMV chip. Any compromise during this step could expose sensitive data or allow for cloning, necessitating dedicated, highly secure hardware security modules (HSMs) and stringent physical and digital security protocols during the equipment operation.

What are the key differences between dye sublimation and re-transfer printing in terms of quality?

Dye sublimation prints directly onto the card surface, sometimes leaving a small unprinted white border and being more susceptible to wear. Re-transfer prints onto a film first, which is then sealed onto the card, providing true edge-to-edge printing, superior image resolution, and greater resistance to fading and physical abrasion, justifying its higher cost for premium cards.

How do governmental mandates influence equipment design and complexity?

Governmental mandates, especially those requiring biometric data integration, tactile elements, and laser security features (like Multiple Laser Image or Changeable Laser Image), directly drive the design towards highly complex, multi-module systems capable of executing these specific, high-precision tasks. Compliance with ICAO standards for e-passports is a significant factor shaping equipment development.

What is the role of Value Added Resellers (VARs) in the market distribution?

VARs play a crucial indirect role, especially for desktop instant issuance systems. They provide localized sales, technical expertise, installation, and ongoing maintenance support. VARs are essential for reaching small to medium-sized financial institutions and managing regional distribution complexities, acting as crucial intermediaries between manufacturers and end-users.

What is the significance of the shift from PVC to Polycarbonate card materials?

The shift from PVC to Polycarbonate is significant because polycarbonate offers much greater durability and heat resistance, making it suitable for laser engraving personalization. This material change is primarily driven by government documents (ID cards, passports) that require a minimum lifespan of 10 years and enhanced security against delamination, directly boosting demand for specialized laser equipment.

How does the concept of modularity benefit card personalization operators?

Modularity allows operators to scale their systems according to fluctuating demand and technological changes. They can start with basic printing and encoding modules and later add features like laser personalization, advanced chip encoding, or specific inspection systems without replacing the entire infrastructure. This future-proofing minimizes capital risk and optimizes operational flexibility in a rapidly evolving security landscape.

What are the key challenges in integrating personalization equipment with existing bank infrastructure?

Key challenges include ensuring secure, compliant data exchange between the bank's core banking systems (CBS) and the personalization management software. Issues often arise from API compatibility, complex network security protocols, and maintaining strict audit trails for sensitive PII (Personally Identifiable Information) and cryptographic keys, requiring deep integration expertise and robust IT security measures.

Describe the market's dependency on the financial card renewal cycle.

The market has a stable baseline demand based on the financial card renewal cycle, which typically occurs every three to five years. This periodic replacement ensures continuous sales of consumables (ribbons, films) and periodically drives the need for replacement or upgrade of the personalization hardware to handle new card features, providing a predictable revenue stream for manufacturers and service bureaus.

How do manufacturers address the growing threat of cyber attacks targeting personalization data?

Manufacturers address cyber threats by implementing Hardware Security Modules (HSMs) to protect cryptographic keys, utilizing end-to-end encryption for all data transport, designing proprietary secure operating system kernels within the personalization units, and ensuring the software platform adheres to global security standards like PCI-DSS (Payment Card Industry Data Security Standard) requirements for data processing.

What specific types of security features require specialized personalization equipment?

Specialized equipment is needed for features such as tactile embossing (raised lettering), micro-text printing, UV fluorescent printing, holographic patch application (overlays), and laser-engraved security elements like ghost images and surface relief structures. These features require high-precision mechanical and optical systems that standard printers cannot accommodate, thereby driving the specialized equipment market.

Why is the Asia Pacific region experiencing exponential growth in ID card personalization?

The exponential growth is driven by large government population registration programs (e.g., national e-ID projects) designed to streamline social welfare, voting, and border control. These initiatives require the rapid deployment of systems capable of mass personalization and centralized management of demographic and biometric data onto secure physical documents.

What are the environmental considerations being addressed by equipment manufacturers?

Manufacturers are addressing environmental concerns by focusing on the development of more energy-efficient equipment, supporting eco-friendly card materials (e.g., recycled PVC, bio-PVC), and reducing consumable waste. The trend toward laser engraving also contributes environmentally by eliminating the need for inks and ribbons, offering a greener personalization option for durable cards.

How does the demand for multi-functional cards influence equipment specifications?

Multi-functional cards (combining payment, access, and identity features) demand equipment capable of handling multiple encoding technologies simultaneously within a single pass. This requires more complex and robust personalization lines that can integrate magnetic stripe encoders, dual contact/contactless chip programmers, and specialized visual security application units, increasing the overall complexity and cost of the machinery.

What is the significance of EMVCo certification for personalization equipment?

EMVCo certification is crucial as it signifies that the equipment and its software components comply with the global standards set by EMVCo for processing secure payment transactions on smart cards. This certification is mandatory for any equipment used to personalize financial cards, ensuring interoperability, security, and market acceptance across the payment ecosystem.

In the context of the market, what is meant by "downstream analysis"?

Downstream analysis refers to the study of the distribution, sales, installation, and support phases of the value chain. It focuses on how the personalized cards reach the end-user, involving distributors, integrators, service bureaus, and the end-user sectors (banks, governments), assessing logistical efficiency, customer support, and localized market penetration strategies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager