Card Scanners Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440680 | Date : Jan, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Card Scanners Market Size

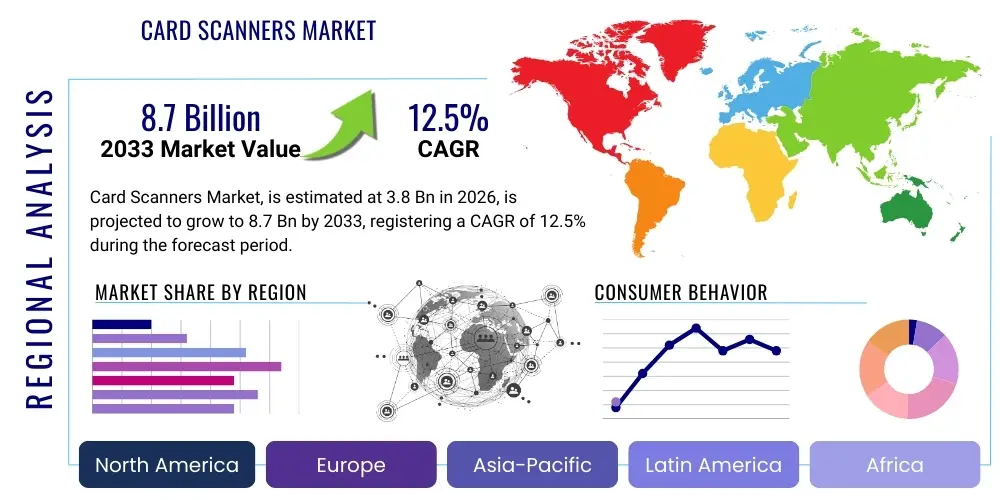

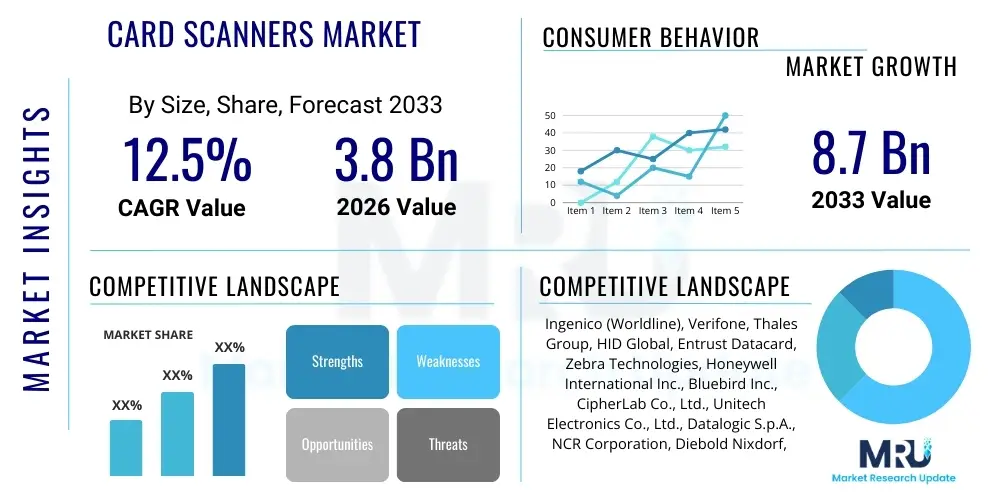

The Card Scanners Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 3.8 Billion in 2026 and is projected to reach USD 8.7 Billion by the end of the forecast period in 2033.

Card Scanners Market introduction

The Card Scanners Market encompasses a wide array of devices designed to read and process information embedded in various types of cards, including magnetic stripe cards, smart cards (EMV), RFID/NFC cards, and even barcodes or QR codes on identification or payment cards. These devices are fundamental to modern commerce and security, facilitating transactions, identity verification, access control, and data capture across numerous sectors. The evolution of card scanner technology has been driven by the need for faster, more secure, and versatile methods of data interaction, moving beyond simple magnetic stripe readers to sophisticated multi-technology devices capable of encryption and real-time data processing. This market's growth is inherently linked to the global shift towards digital payments, enhanced security protocols, and the increasing reliance on automated identification systems in both public and private sectors.

The product landscape within the Card Scanners Market is diverse, ranging from compact handheld devices used for mobile payments or field service applications to integrated units found in point-of-sale (POS) systems, ATMs, kiosks, and access control terminals. Major applications span retail and e-commerce for payment processing, banking and financial services for secure transactions and customer identification, healthcare for patient registration and insurance verification, and government for citizen services and secure access. The benefits derived from these devices are manifold, including increased transactional efficiency, enhanced security through encryption and authentication protocols, reduced human error in data entry, and improved customer experience through faster service. As businesses strive for operational excellence and robust security postures, the adoption of advanced card scanning solutions becomes increasingly critical.

Driving factors for the Card Scanners Market are deeply rooted in the digital transformation trends observed globally. The burgeoning demand for contactless payment options, accelerated by public health concerns and convenience, is a significant catalyst. Regulatory mandates, such as the global EMV migration for chip card security, have compelled businesses to upgrade their infrastructure, further boosting scanner adoption. Furthermore, the imperative for robust identity verification across various industries, coupled with the integration of card scanners into broader IoT ecosystems and smart city initiatives, is expanding their application scope. The continuous innovation in card technology, including the proliferation of biometric-enabled cards and multi-application smart cards, necessitates equally advanced scanning solutions, ensuring sustained market momentum.

Card Scanners Market Executive Summary

The Card Scanners Market is experiencing robust growth, primarily propelled by the accelerating global transition towards digital and cashless transactions, alongside an escalating demand for enhanced security and identity verification solutions across diverse industries. Business trends indicate a strong emphasis on integrating card scanning capabilities into comprehensive payment systems, access control frameworks, and data management platforms, moving beyond standalone devices to embedded solutions. There is a discernible shift towards multi-functional scanners capable of reading various card types—magnetic stripe, EMV chip, RFID/NFC, and even biometric data—to accommodate an increasingly complex payment and identification ecosystem. Furthermore, the market is witnessing significant innovation in terms of miniaturization, wireless connectivity, and the development of ruggedized devices suitable for a wider range of operational environments, including mobile and outdoor applications. Businesses are investing in these technologies to improve operational efficiency, streamline customer experiences, and mitigate fraud risks, with a particular focus on solutions that offer seamless integration with existing IT infrastructures and cloud-based platforms.

Regional trends reveal varied growth trajectories and adoption rates, reflecting differences in economic development, technological infrastructure, and regulatory landscapes. North America and Europe, characterized by mature digital economies and stringent data security regulations like GDPR and PCI DSS, are seeing sustained demand driven by upgrades to comply with new standards and the continuous innovation in payment methods. The Asia Pacific region stands out as a high-growth market, fueled by rapid urbanization, a burgeoning middle class, widespread smartphone adoption, and government initiatives promoting digital financial inclusion, especially in emerging economies. Countries like China and India are at the forefront of mobile and contactless payment adoption, creating a fertile ground for advanced card scanning solutions. Latin America, the Middle East, and Africa are also exhibiting significant potential, as these regions increasingly invest in modernizing their financial infrastructure, expanding banking services, and enhancing public sector efficiency, thereby driving the demand for reliable and secure card scanners.

Segment trends within the Card Scanners Market highlight several key areas of development and opportunity. By technology, smart card (EMV) and RFID/NFC readers are experiencing the most rapid growth due to their enhanced security features and support for contactless transactions, overshadowing traditional magnetic stripe readers. In terms of product type, integrated scanners, often found within POS terminals, kiosks, and ATMs, dominate the market due to their convenience and seamless operational integration, while handheld and mobile card scanners are gaining traction, particularly in sectors requiring portability and on-the-go data capture, such as logistics, field services, and small businesses. End-user segmentation shows that the retail & e-commerce and banking & financial services (BFSI) sectors remain the largest consumers, driven by payment processing and customer service needs. However, healthcare, government, and hospitality sectors are increasingly adopting card scanners for identity management, access control, and streamlined operational workflows, contributing significantly to market diversification and expansion.

AI Impact Analysis on Card Scanners Market

User inquiries concerning the impact of AI on the Card Scanners Market frequently revolve around how artificial intelligence can enhance security, streamline operations, and introduce new functionalities. Common questions include whether AI can improve fraud detection, personalize customer interactions, or automate data processing more effectively. There is also significant interest in AI's role in predictive maintenance for card scanner hardware, its ability to integrate with broader smart systems, and how it might influence the user experience by making interactions more intuitive and efficient. Users are keen to understand if AI can move card scanners beyond simple data reading devices into intelligent platforms capable of real-time analytics, adaptive security protocols, and proactive issue identification. The overarching theme is an expectation that AI will transform card scanners from passive data input tools into active, intelligent components of a dynamic digital ecosystem, offering greater value beyond their primary function.

The integration of Artificial Intelligence into the Card Scanners Market is poised to revolutionize various aspects, from enhancing data security to optimizing operational efficiency and enriching the user experience. AI algorithms can significantly bolster fraud detection capabilities by analyzing transaction patterns, identifying anomalies in real-time, and flagging suspicious activities with greater accuracy than traditional rule-based systems. This proactive approach to security is crucial in an era of sophisticated cyber threats, offering an advanced layer of protection for sensitive cardholder data. Furthermore, AI can enable more intelligent identity verification processes, leveraging machine learning to authenticate users not just through their card, but also by cross-referencing behavioral biometrics or facial recognition data, thereby creating a multi-faceted and highly secure verification environment. This level of intelligent oversight minimizes financial losses due to fraud and enhances trust in digital transactions.

Beyond security, AI's influence extends to operational improvements and personalization. Predictive analytics, powered by AI, can forecast potential hardware failures in card scanners, enabling proactive maintenance and reducing downtime, which is critical for businesses relying on continuous operations, such as retail and banking. AI can also enhance the user experience by facilitating quicker and more seamless transactions. For instance, intelligent scanners could adapt their reading parameters to different card types or environmental conditions, optimizing performance. In customer service, AI-driven insights from card usage data can help businesses offer personalized promotions, tailor service offerings, and improve loyalty programs, thereby deepening customer engagement and driving revenue growth. The ability of AI to process and interpret vast amounts of data collected through card scanners unlocks new opportunities for business intelligence, allowing companies to gain deeper insights into consumer behavior and market trends, which can inform strategic decision-making and product development.

- Enhanced Fraud Detection: AI algorithms analyze transaction patterns and anomalies in real-time, significantly improving the identification and prevention of fraudulent activities.

- Predictive Maintenance: AI can monitor scanner performance and predict potential hardware failures, enabling proactive maintenance and reducing operational downtime.

- Personalized Customer Experience: AI leverages card usage data to provide tailored recommendations, offers, and services, enhancing customer loyalty and satisfaction.

- Advanced Identity Verification: Integration with AI-powered biometrics and behavioral analysis creates more robust and secure identity authentication processes.

- Automated Data Capture & Analysis: AI streamlines data entry, reduces human error, and provides real-time analytics from captured card information for business intelligence.

- Optimized Operational Efficiency: AI can improve transaction speed and accuracy, reducing processing times and streamlining workflows across various applications.

- Adaptive Security Protocols: AI enables scanners to dynamically adapt security measures based on risk assessment, responding to evolving threat landscapes.

- Seamless Integration: AI facilitates better integration of card scanners into broader IoT ecosystems, smart payment systems, and cloud-based platforms for holistic data management.

- Voice and Gesture Control: Future AI integrations might enable more intuitive interactions with scanners through voice commands or gesture recognition, particularly in kiosks or public terminals.

- Contextual Awareness: AI can allow scanners to understand the context of a transaction or interaction, providing more relevant prompts or information to the user or operator.

DRO & Impact Forces Of Card Scanners Market

The Card Scanners Market is subject to a dynamic interplay of Drivers, Restraints, Opportunities (DRO), and overarching Impact Forces that collectively shape its trajectory and competitive landscape. A primary driver is the pervasive global shift towards digital and cashless transactions, spurred by consumer convenience, security demands, and the rapid expansion of e-commerce and mobile payments. This trend necessitates robust card reading infrastructure. Alongside this, regulatory mandates, such as the EMV chip card standard, PCI DSS compliance for data security, and various national payment system regulations, compel businesses across sectors to upgrade to compliant and secure scanning solutions. The increasing need for reliable and swift identity verification in sectors like banking, healthcare, and government, coupled with the rising demand for efficient data capture and management, further fuels market growth. Technological advancements, particularly in contactless payment (NFC/RFID) and biometric integration, present compelling opportunities for market expansion and product innovation, addressing the constant demand for frictionless and secure interactions.

Despite the strong growth drivers, the market faces several notable restraints. High initial investment costs for advanced card scanner systems can be a significant barrier, especially for small and medium-sized enterprises (SMEs) with limited capital. This financial hurdle often delays or prevents the adoption of newer, more secure technologies. Furthermore, persistent concerns regarding data privacy and security breaches remain a critical restraint. While card scanners aim to enhance security, the fear of data compromise, particularly with sensitive payment or identity information, can lead to consumer hesitancy and stringent regulatory oversight, impacting deployment strategies. Compatibility issues with legacy systems present another challenge, as integrating new card scanning technologies into older infrastructures can be complex and expensive. Lastly, the rapid pace of technological obsolescence in the payment and identity tech space means that investments in current systems may quickly become outdated, posing a perpetual upgrade cycle challenge for businesses.

Opportunities within the Card Scanners Market are abundant and diverse, often stemming from technological evolution and unmet market needs. The burgeoning adoption of biometric authentication, integrated directly into payment cards or via multi-modal scanners, represents a significant growth avenue, promising enhanced security and user convenience. Expansion into emerging markets, particularly in Asia Pacific, Latin America, and MEA, offers substantial untapped potential as these regions undergo rapid digital transformation and financial inclusion initiatives. The development of multi-functional devices that combine card scanning with other capabilities like receipt printing, barcode reading, or biometric authentication streamlines operations and provides greater value. Cloud-based solutions for data management and scanner diagnostics are also creating new opportunities by offering scalability, remote management, and reduced on-premise infrastructure requirements. The impact forces influencing this market are predominantly technological advancements, dictating the pace of innovation and the introduction of new features, alongside evolving regulatory frameworks that shape security standards and compliance requirements, and shifts in consumer preferences towards faster, more secure, and convenient payment and identification methods. Economic conditions and the competitive landscape further dictate pricing strategies, market penetration, and the overall strategic direction of key players.

Segmentation Analysis

The Card Scanners Market is meticulously segmented to provide a granular understanding of its diverse components and dynamics. This segmentation facilitates a comprehensive analysis of market trends, consumer behavior, and competitive landscapes across various dimensions. Key segments typically include classification by product type, technology adopted, end-user applications, and geographical regions. Understanding these distinctions is crucial for stakeholders to identify niche opportunities, tailor product development strategies, and optimize market entry points. The evolution of card scanning technology has led to a proliferation of specialized devices and solutions, each designed to meet specific functional requirements and industry demands, ranging from high-volume transaction processing to mobile identity verification. This structured approach to market analysis ensures that all facets of the market, from fundamental technology to application-specific nuances, are thoroughly examined, providing valuable insights for strategic planning and investment decisions.

The segmentation by product type typically differentiates between standalone desktop scanners, portable handheld devices, and integrated units that are embedded within larger systems such as POS terminals or kiosks. Each type caters to distinct operational needs and mobility requirements, influencing their adoption across various sectors. Technology segmentation highlights the core reading mechanisms, including traditional magnetic stripe readers, the more secure EMV chip card readers, contactless RFID/NFC scanners, and devices capable of reading barcodes or QR codes. This technological diversity reflects the varying security levels, data capacities, and interaction methods supported by different card formats. The end-user segment is particularly vital, delineating the primary industries leveraging card scanners. This includes prominent sectors like Retail & E-commerce, Banking & Financial Services (BFSI), Healthcare, Government & Public Sector, and Hospitality, each with unique operational environments and compliance requirements for card data handling.

Further granularity is achieved through application-based segmentation, which categorizes scanners by their primary use cases, such as payment processing, access control, identity verification, document scanning, and general data capture. This allows for a detailed assessment of demand drivers within specific functional areas. For example, payment processing applications demand high throughput and robust encryption, while identity verification might prioritize accuracy and integration with biometric systems. Geographic segmentation divides the market into major regions like North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, acknowledging the significant regional disparities in technological adoption, regulatory frameworks, economic development, and consumer preferences. Analyzing these segments individually and collectively offers a holistic view of the Card Scanners Market, enabling a targeted approach for market participants to develop relevant products and services, identify growth corridors, and effectively navigate the competitive landscape while meeting the diverse needs of a global clientele.

- By Type:

- Desktop Card Scanners

- Handheld Card Scanners

- Integrated Card Scanners (POS terminals, Kiosks, ATMs)

- By Technology:

- Magnetic Stripe Readers

- Smart Card (EMV) Readers

- RFID/NFC Readers

- Barcode/QR Code Scanners

- Hybrid/Multi-Technology Scanners

- By End-User:

- Retail & E-commerce

- Banking & Financial Services (BFSI)

- Healthcare

- Government & Public Sector

- Hospitality & Entertainment

- Transportation & Logistics

- Education

- Others (Manufacturing, IT & Telecom)

- By Application:

- Payment Processing

- Access Control

- Identity Verification

- Document Scanning & Data Capture

- Loyalty & Gift Card Programs

- Time & Attendance Tracking

Value Chain Analysis For Card Scanners Market

The value chain for the Card Scanners Market is a complex ecosystem involving multiple stages, from raw material sourcing to the end-user deployment and post-sales support, each adding value to the final product. At the upstream stage, this involves the procurement of various electronic components, microprocessors, sensors, optical readers, secure elements, and casing materials from specialized manufacturers. Key players at this stage include semiconductor companies, component suppliers, and material producers who provide the foundational elements necessary for building sophisticated card scanning devices. The quality and availability of these components directly impact the performance, security, and cost-effectiveness of the finished scanners. Strong relationships with reliable upstream suppliers are crucial for ensuring a steady supply chain, managing costs, and incorporating cutting-edge technologies into scanner designs.

Further down the chain, the manufacturing and assembly phase involves the design, development, and production of the card scanners themselves. This stage is dominated by specialized hardware manufacturers who integrate the various components, develop the necessary firmware and software, and conduct rigorous quality control and security testing. These manufacturers invest heavily in research and development to innovate new scanning technologies, improve encryption capabilities, enhance user interfaces, and ensure compliance with global standards such as EMV, PCI DSS, and various national regulations. After manufacturing, products move through distribution channels, which can be direct or indirect. Direct channels involve manufacturers selling directly to large enterprises, financial institutions, or government bodies, often through dedicated sales teams and custom solution providers. This approach allows for tailored solutions and direct engagement with end-users, facilitating better understanding of specific requirements and offering direct support.

Indirect distribution channels are typically more prevalent for reaching a broader market, especially SMEs and diverse retail segments. These channels involve a network of wholesalers, distributors, system integrators, value-added resellers (VARs), and online retailers. Distributors play a critical role in inventory management, logistics, and regional market penetration, while VARs and system integrators often add value by bundling card scanners with other hardware, software, and services to create complete solutions for end-users. The downstream segment of the value chain focuses on deployment, installation, and ongoing support services, which are critical for ensuring optimal performance and customer satisfaction. This includes technical support, maintenance contracts, software updates, and training for end-users. Both direct and indirect channels are essential for market reach, with the choice often depending on the target customer segment, product complexity, and geographic considerations, ultimately ensuring that card scanners reach their intended users efficiently and are effectively supported throughout their lifecycle.

Card Scanners Market Potential Customers

The Card Scanners Market serves an expansive and diverse base of potential customers, spanning virtually every sector that handles financial transactions, manages access, or requires identity verification. At the forefront are businesses within the Retail and E-commerce sectors, which utilize card scanners extensively at point-of-sale (POS) systems for processing credit and debit card payments, managing loyalty programs, and handling gift cards. The continuous demand for faster checkout experiences, enhanced payment security, and seamless integration with inventory management systems makes retailers, from large chains to small boutiques, primary end-users. The rapid growth of e-commerce also fuels demand for robust back-end card processing infrastructure that often relies on secure scanning technologies for initial data capture or dispute resolution, further cementing this sector as a critical customer base for card scanner manufacturers and service providers.

Another immensely significant segment of potential customers is the Banking and Financial Services Industry (BFSI). Banks, credit unions, investment firms, and other financial institutions rely on card scanners for a multitude of critical functions, including secure payment processing, customer onboarding, identity verification for account opening or loan applications, and access control for restricted areas. The stringent regulatory environment in BFSI, mandating high levels of data security and fraud prevention, drives continuous investment in advanced card scanning technologies, particularly those supporting EMV chip cards, contactless payments, and biometric authentication. ATMs and self-service kiosks within this sector are also major deployment points, requiring integrated card readers that are highly durable and secure. The ongoing digital transformation within BFSI means that these institutions are consistently seeking cutting-edge solutions that can handle increased transaction volumes, provide superior security, and enhance customer experience across various touchpoints.

Beyond retail and finance, the Healthcare sector represents a rapidly growing customer segment for card scanners. Hospitals, clinics, pharmacies, and insurance providers use these devices for patient registration, insurance verification, secure access to patient records, and processing payments for medical services. The need for accurate and secure patient identification, coupled with compliance requirements like HIPAA in the US, necessitates reliable and efficient card scanning solutions. Similarly, the Government and Public Sector entities are substantial customers, deploying card scanners for citizen identification (e.g., national ID cards, driver's licenses), access control for secure facilities, voter registration, and processing various government-issued permits or payments. The Hospitality and Transportation industries also heavily rely on card scanners for check-ins, payment processing, loyalty programs, and ticketing. Essentially, any organization that interacts with physical or digital cards for transactions, access, or identification purposes across a broad spectrum of industries constitutes a potential customer for the sophisticated and diverse offerings within the Card Scanners Market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.8 Billion |

| Market Forecast in 2033 | USD 8.7 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ingenico (Worldline), Verifone, Thales Group, HID Global, Entrust Datacard, Zebra Technologies, Honeywell International Inc., Bluebird Inc., CipherLab Co., Ltd., Unitech Electronics Co., Ltd., Datalogic S.p.A., NCR Corporation, Diebold Nixdorf, Bixolon Co., Ltd., Epson, PAX Global Technology Limited, CASTLES TECHNOLOGY CO., LTD., Newland Payment Technology, Shenzhen Xinguodu Technology Co., Ltd., Fujitsu |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Card Scanners Market Key Technology Landscape

The Card Scanners Market is characterized by a rapidly evolving technological landscape, driven by the relentless pursuit of enhanced security, speed, and versatility. Central to this landscape is the widespread adoption of EMV (Europay, MasterCard, and Visa) chip technology, which provides significantly greater security against fraud compared to traditional magnetic stripe cards through encrypted data and dynamic transaction codes. Modern card scanners are increasingly equipped with EMV compliance, capable of reading chip cards via contact or contactless methods. Complementing EMV is Near Field Communication (NFC) and Radio-Frequency Identification (RFID) technology, which enables contactless transactions and identification. NFC/RFID readers allow users to simply tap their cards or mobile devices to complete payments or gain access, offering unparalleled convenience and speed, a feature particularly favored in high-traffic environments like retail and public transport.

Another crucial technological advancement is the integration of biometric authentication methods. While not always directly part of the card scanner hardware itself, many advanced card scanning solutions are designed to work seamlessly with biometric verification systems, such as fingerprint, facial, or iris recognition. Some next-generation cards even embed biometric sensors directly (Biometric Payment Cards), requiring scanners that can facilitate this secure authentication process. This convergence of card reading with biometrics offers a superior layer of security and convenience for identity verification and high-value transactions. Furthermore, the development of robust encryption standards, such as end-to-end encryption (E2EE) and Point-to-Point Encryption (P2PE), is paramount. These technologies ensure that sensitive cardholder data is encrypted from the moment it is swiped, tapped, or inserted, safeguarding it against interception and unauthorized access throughout the transaction lifecycle, significantly reducing the risk of data breaches.

Beyond the core reading and security technologies, the Card Scanners Market is also benefiting from advancements in connectivity and software integration. Many modern scanners feature wireless connectivity options such as Bluetooth and Wi-Fi, allowing for greater mobility and flexibility in deployment, especially for handheld and mobile POS devices. This facilitates integration with cloud-based payment platforms and enterprise resource planning (ERP) systems, enabling real-time data synchronization, remote management, and comprehensive analytics. The software accompanying these scanners has become increasingly sophisticated, offering features like robust API support for seamless integration with third-party applications, secure firmware updates, and comprehensive device management tools. The emergence of multi-functional scanners that combine various reading technologies (magnetic stripe, EMV, NFC/RFID, barcode/QR code) into a single device, alongside capabilities like receipt printing or signature capture, further underscores the industry's drive towards consolidation, efficiency, and enhanced user experience through technological convergence.

Regional Highlights

- North America: This region is a mature market characterized by early adoption of new payment technologies and stringent security standards. The US and Canada have largely completed their EMV migration, leading to a focus on contactless payments (NFC) and integration of card scanners with mobile wallets and advanced analytics. Strong infrastructure, high consumer spending, and the presence of major tech innovators drive consistent demand for sophisticated, secure, and integrated card scanning solutions across retail, BFSI, and healthcare.

- Europe: Europe is a leader in EMV adoption and contactless payment usage, driven by strong regulatory frameworks such as GDPR (General Data Protection Regulation) and PSD2 (Revised Payment Services Directive), which emphasize data security and open banking. Countries like the UK, Germany, France, and the Nordic nations show high penetration of smart card and NFC readers. The region's diverse economic landscape fosters demand for a range of solutions, from high-end integrated systems in Western Europe to cost-effective, secure options in Eastern Europe.

- Asia Pacific (APAC): The APAC region represents the fastest-growing market for card scanners, fueled by rapid economic development, increasing digitalization, and the immense growth of mobile payments in countries like China, India, and Southeast Asian nations. Governments are actively promoting digital financial inclusion, leading to widespread adoption of card-based and mobile payment infrastructures. This region sees a high demand for both traditional and advanced hybrid scanners, catering to a vast and diverse consumer base in both urban and rural areas.

- Latin America: This region is undergoing significant digital transformation, with increasing adoption of electronic payments and financial inclusion initiatives. Countries like Brazil, Mexico, and Argentina are investing in modernizing their payment infrastructure, driving demand for EMV-compliant and contactless card scanners. The market here is characterized by a need for robust, cost-effective, and secure solutions that can operate reliably in various economic conditions and regulatory environments, often with a focus on mitigating high rates of payment fraud.

- Middle East and Africa (MEA): The MEA region is emerging as a promising market, driven by government-led initiatives to diversify economies away from oil, invest in smart city projects, and enhance digital services. Countries in the GCC (Gulf Cooperation Council) such as UAE and Saudi Arabia are rapidly adopting advanced payment technologies and have high digital penetration. In Africa, the push for financial inclusion and the growth of mobile money services are creating opportunities for affordable, portable card scanning solutions that can extend banking and payment services to underserved populations, often through mobile POS devices.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Card Scanners Market.- Ingenico (Worldline)

- Verifone

- Thales Group

- HID Global

- Entrust Datacard

- Zebra Technologies

- Honeywell International Inc.

- Bluebird Inc.

- CipherLab Co., Ltd.

- Unitech Electronics Co., Ltd.

- Datalogic S.p.A.

- NCR Corporation

- Diebold Nixdorf

- Bixolon Co., Ltd.

- Epson

- PAX Global Technology Limited

- CASTLES TECHNOLOGY CO., LTD.

- Newland Payment Technology

- Shenzhen Xinguodu Technology Co., Ltd.

- Fujitsu

Frequently Asked Questions

What is a card scanner and how does it work?

A card scanner is an electronic device designed to read and process information stored on various types of cards, such as magnetic stripe cards, EMV chip cards, or RFID/NFC cards. It typically works by physically swiping, inserting, or tapping a card, which then allows the scanner to capture the encoded data. This data is then transmitted securely to a payment processor, identity management system, or another designated application for verification, transaction authorization, or record-keeping, often utilizing encryption to protect sensitive information during transmission.

What are the primary applications of card scanners in various industries?

Card scanners are widely used across multiple industries for diverse applications. In retail and e-commerce, they facilitate payment processing and loyalty programs. The banking and financial services sector uses them for secure transactions, customer identification, and access control. In healthcare, they are essential for patient registration and insurance verification. Government agencies deploy them for identity verification and access to secure facilities. Hospitality utilizes them for check-ins and payment, while transportation uses them for ticketing and access control. Essentially, any sector requiring secure data capture, payment processing, or identity authentication benefits from card scanner technology.

How do card scanners enhance security for transactions and data?

Card scanners significantly enhance security through several mechanisms. Modern scanners incorporate EMV chip technology, which generates unique, encrypted transaction codes to prevent cloning and fraud. Many also support Point-to-Point Encryption (P2PE) or end-to-end encryption (E2EE), securing data from the moment of capture until it reaches the payment processor, protecting against interception. Furthermore, advanced scanners can integrate with biometric authentication systems for multi-factor verification, and robust internal security measures, such as tamper detection, help protect the device itself from physical breaches. These features collectively reduce the risk of fraud and data breaches, ensuring secure transactions.

What are the key technological trends influencing the Card Scanners Market?

Key technological trends influencing the Card Scanners Market include the pervasive adoption of contactless payment technologies like NFC/RFID for speed and convenience, the integration of advanced biometric authentication methods for enhanced security and identity verification, and the development of multi-functional hybrid scanners that can read various card types (magnetic stripe, EMV, NFC) and sometimes even barcodes. There is also a strong trend towards wireless connectivity (Bluetooth, Wi-Fi) for greater mobility, cloud-based management for scalability and remote diagnostics, and the incorporation of AI and machine learning for improved fraud detection and personalized customer experiences, making scanners more intelligent and versatile.

What challenges does the Card Scanners Market face and how are they being addressed?

The Card Scanners Market faces challenges such as high initial investment costs, data security and privacy concerns, compatibility issues with legacy systems, and rapid technological obsolescence. These are being addressed through various strategies: manufacturers are developing more cost-effective and versatile solutions for SMEs, while simultaneously enhancing encryption and integrating AI for advanced fraud detection to mitigate security risks. Industry standards bodies and manufacturers are working on improving interoperability between new and existing systems. Furthermore, modular designs and regular firmware updates are helping to extend the lifespan of devices and ensure they remain compliant with evolving security standards, thus tackling the issue of rapid obsolescence.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager