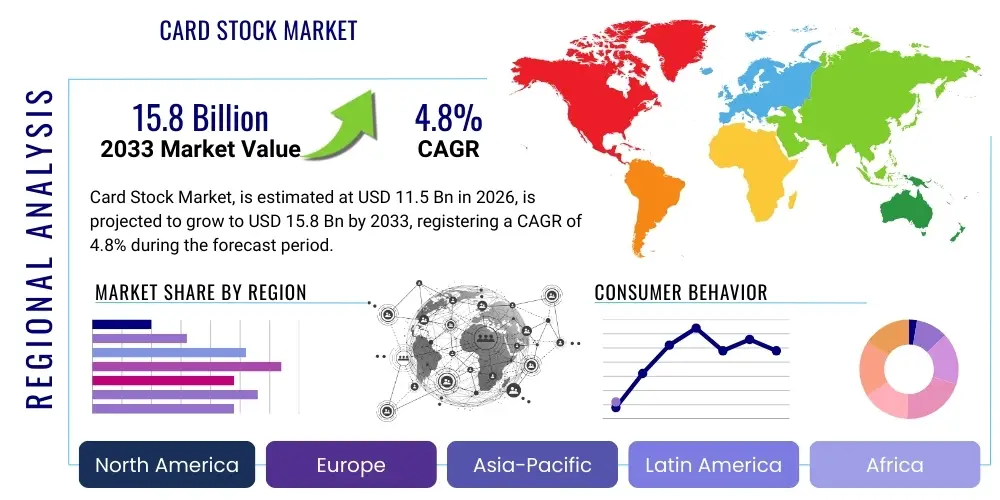

Card Stock Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436198 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Card Stock Market Size

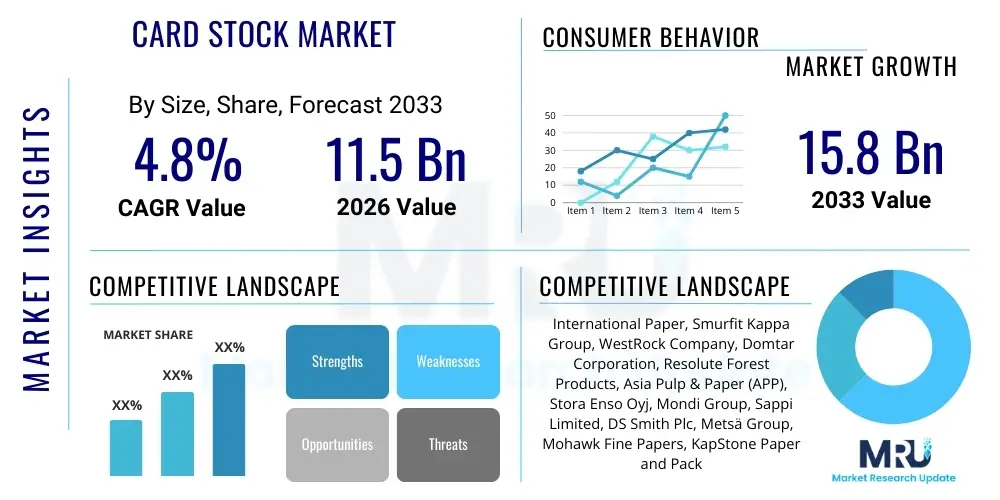

The Card Stock Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 11.5 billion in 2026 and is projected to reach USD 15.8 billion by the end of the forecast period in 2033.

Card Stock Market introduction

The Card Stock Market encompasses the production and distribution of heavyweight paper, often referred to as cover stock or pasteboard, which possesses significantly greater thickness and durability than standard writing or printing paper. This material is essential for applications requiring stiffness, longevity, and a premium tactile feel. Key product characteristics include basis weight (measured in GSM or pounds), finish (gloss, matte, uncoated), fiber composition (virgin pulp, recycled fibers, specialty materials), and color depth. The inherent robustness of card stock makes it the material of choice for demanding printing, packaging, and creative projects, bridging the gap between standard paper products and thin board materials. Its versatility allows for various finishing techniques such as embossing, die-cutting, and foil stamping, enhancing its appeal across professional and consumer segments.

Major applications for card stock are diverse, driving consistent demand across multiple industries. In the commercial printing sector, it is indispensable for producing high-quality business cards, brochures, presentation covers, and sophisticated direct mail materials. The packaging industry utilizes card stock heavily for lightweight retail boxes, hang tags, and inserts where brand presentation and structural integrity are paramount. Furthermore, the stationery and greetings segment represents a core application area, encompassing the manufacturing of greeting cards, invitations, wedding stationery, and personalized note cards, demanding specific aesthetic and archival qualities. The shift towards digital printing technologies has also expanded the usage of specialty card stocks tailored for high-speed, high-definition digital output, ensuring vibrant color reproduction and consistent runnability.

Key market drivers include the persistent demand for premium, sustainable, and customizable packaging solutions, particularly in the e-commerce and luxury goods sectors, where the 'unboxing experience' utilizes high-quality card stock. The global resurgence in handcrafted goods and specialized crafting hobbies further fuels the demand for premium, colored, and textured card stocks among individual consumers and small businesses. Simultaneously, advancements in sustainable manufacturing processes, focused on utilizing recycled content, certified wood sources (FSC/PEFC), and minimizing chemical inputs, are meeting stringent environmental regulations and rising consumer preferences for eco-friendly products. These factors collectively contribute to a robust and evolving market landscape characterized by innovation in materials science and finishing capabilities.

Card Stock Market Executive Summary

The global Card Stock Market exhibits stable growth driven primarily by structural shifts in packaging and commercial printing, coupled with increasing consumer focus on premium aesthetics. Business trends indicate a strong prioritization among manufacturers toward operational efficiency, incorporating advanced coating and finishing techniques to enhance product value and differentiate offerings in a competitive environment. The market is increasingly characterized by a dichotomy: high-volume commodity card stocks used for basic packaging, and highly specialized, low-volume, premium card stocks featuring unique textures, high recycled content, or specialized coatings optimized for digital printing. Strategic alliances and mergers, particularly involving pulp suppliers and specialized converters, are observed as companies seek to secure raw material supply chains and expand their geographical footprint and product specialization capabilities. Sustainability certification (e.g., FSC certification) is no longer a niche differentiator but a fundamental requirement for market access, impacting procurement and manufacturing decisions across the board.

Regionally, the Asia Pacific (APAC) market is projected to be the fastest-growing segment, propelled by rapid urbanization, expanding middle-class consumer bases, and explosive growth in manufacturing and e-commerce activities, particularly in China and India. This growth generates immense demand for high-volume packaging and retail communication materials requiring card stock. North America and Europe, while mature, remain dominant markets in terms of value, largely due to high per capita consumption of specialized printing and premium stationery products, alongside stringent regulatory pressures pushing for sustainable, fiber-based packaging alternatives over plastics. European markets, in particular, lead in the adoption of closed-loop recycling and sophisticated fiber processing technologies, setting global standards for material circularity within the card stock sector.

Segment trends highlight the uncoated segment’s strong performance, driven by its natural look, tactile appeal, and suitability for high-end correspondence and invitations, often favored for its authenticity and minimal processing footprint. Conversely, the coated segment continues to dominate based on volume and use in high-gloss printing and retail packaging, where photographic image reproduction and surface durability are crucial. Application trends show packaging as the most significant driver, rapidly accelerating due to the e-commerce boom necessitating robust and visually appealing shipping and product containment solutions. Furthermore, the specialized market for security card stock, used in ID cards and governmental documents, is also exhibiting steady growth, requiring specialized security features embedded during the manufacturing process, such as watermarks and micro-printing compatibility.

AI Impact Analysis on Card Stock Market

Analysis of common user questions regarding AI's influence on the Card Stock Market reveals three core themes: optimization, customization, and displacement. Users frequently inquire whether AI-driven design tools will reduce the need for physical card stock by favoring digital alternatives, and conversely, how AI can enhance the manufacturing process. The primary concern revolves around the potential disruption of traditional commercial printing workflows, while the expectation is centered on leveraging AI for predictive maintenance, supply chain optimization, and accelerating personalized product development. Consumers are keen to understand how AI facilitates hyper-customization of physical products, enabling bespoke card stock solutions for small-batch runs efficiently and affordably. Key user interest lies in the intersection of digital design and physical output efficiency, seeking tools that bridge the digital creative space with manufacturing constraints.

AI's direct impact on the physical production of card stock lies mainly in improving operational efficiency and material science. Manufacturers are deploying machine learning algorithms to analyze real-time data from pulp consistency, paper machine humidity, and calendering processes. This analysis enables predictive quality control, anticipating and correcting potential flaws (such as uneven coating or inconsistent thickness) before they lead to wastage, thereby increasing yield and reducing energy consumption. Furthermore, AI-driven demand forecasting allows card stock suppliers to optimize inventory levels for various grades and colors, minimizing holding costs and shortening lead times for specialized orders. This precision enhances supply chain responsiveness, particularly critical for Just-In-Time (JIT) manufacturing environments common in commercial printing.

Indirectly, AI significantly influences the downstream consumption patterns of card stock. AI-powered design software and marketing platforms facilitate the rapid creation of highly personalized print campaigns, invitations, and packaging designs. This hyper-personalization, often requiring short runs of specialized card stock, drives demand away from standardized commodity products towards custom, premium grades. While some design tasks become automated, the need for a tangible, physical manifestation of premium branding remains strong, thus shifting card stock utilization towards high-value, aesthetically superior products. AI helps marketers test and optimize physical collateral layouts and materials, ensuring that the chosen card stock (e.g., weight, texture, finish) maximizes consumer engagement and brand impact.

- AI optimizes manufacturing processes through predictive quality control, reducing material wastage and energy use in pulp and paper mills.

- Machine learning algorithms enhance supply chain efficiency, accurately forecasting demand for specific card stock grades and colors.

- AI-driven design tools facilitate hyper-personalization in commercial printing and packaging, increasing demand for specialized, custom card stock runs.

- Predictive maintenance schedules for high-speed printing and coating machinery are improved, minimizing downtime and ensuring consistent output quality.

- AI assists in material science R&D, analyzing fiber compatibility and coating formulations to develop next-generation sustainable card stock alternatives.

DRO & Impact Forces Of Card Stock Market

The Card Stock Market is propelled by robust drivers centered around the global demand for sustainable packaging and the need for premium brand presentation. Restraints primarily involve volatile raw material pricing, particularly pulp and chemicals, and increasing digitalization leading to paperless communication in certain transactional contexts. Opportunities arise from technological advancements in digital printing, allowing for greater customization, and the growing consumer preference for eco-friendly, recyclable fiber-based products over single-use plastics. These forces interact dynamically, with the sustainability push acting as both a major driver (creating new product markets) and an indirect restraint (increasing compliance costs and complexity for manufacturers). The net impact force is moderately positive, contingent on the industry's ability to innovate sustainable, cost-competitive solutions.

Drivers: A primary driver is the e-commerce boom, necessitating specialized corrugated and card stock packaging that offers protection, premium aesthetics, and easy recyclability. Brands recognize that high-quality card stock packaging enhances the consumer's perception of value and quality. Furthermore, the rising global awareness of environmental issues has significantly accelerated the demand for card stock made from certified virgin fibers and high post-consumer recycled (PCR) content, positioning fiber-based packaging as a preferred alternative to plastic packaging across multiple sectors, including food service and personal care products. The continuous innovation in printing and finishing techniques, such as UV coating, textured finishes, and specialized metallic inks, maintains card stock's relevance in high-end marketing and artistic applications, ensuring that physical media retains a crucial role in luxury and professional communications.

Restraints: The market faces significant headwinds from fluctuating prices of key raw materials, including wood pulp, energy (natural gas), and essential chemicals (fillers and coatings). These cost volatilities impact profit margins, particularly for commodity card stock producers, leading to unpredictable pricing structures for end-users. Additionally, while certain segments like high-end invitations remain stable, the pervasive trend of digitalization, particularly in corporate correspondence, billing, and educational materials, continues to displace volume demand for standard-grade card stock. Regulatory compliance related to environmental standards, effluent treatment, and responsible forestry practices imposes substantial capital expenditure burdens on manufacturers, potentially hindering expansion and product development, especially in developing economies lacking modern processing infrastructure.

Opportunities: Significant market opportunities exist in the development of functional card stock tailored for highly specialized applications, such as medical packaging, moisture-resistant food containers, and card stocks optimized for RFID embedding or smart packaging features. The rapid evolution of high-speed digital inkjet and toner printing technologies allows printers to efficiently handle small, customized batches, opening up new business models for personalized stationery and bespoke packaging solutions. Furthermore, investment in bio-based coatings derived from renewable sources, replacing traditional petroleum-based plastic laminations, presents a major opportunity to align card stock offerings with stringent circular economy goals, enhancing recyclability and addressing the growing demand for genuinely compostable and biodegradable materials.

Segmentation Analysis

The Card Stock Market segmentation provides a granular view of market dynamics based on material type, finishing characteristics, specific applications, and end-use sectors. Understanding these segments is critical for manufacturers to tailor product specifications, ranging from basis weight and stiffness to surface smoothness and archival quality, optimizing their offerings for distinct consumer and commercial needs. The market’s segmentation highlights the significant volume dedicated to functional uses (like packaging boards) versus the high-value segment dedicated to aesthetic applications (like premium coated paper for greeting cards). This analysis reveals shifting demand patterns driven by factors such as printing technology adoption and evolving sustainability standards across various end-user industries.

- By Type:

- Coated Card Stock (Gloss, Matte, Silk)

- Uncoated Card Stock (Vellum, Felt, Linen)

- Specialty Card Stock (Metallic, Pearlescent, Textured)

- By Application:

- Greeting Cards and Invitations

- Business Cards and Corporate Stationery

- Packaging and Folding Cartons

- Direct Mail and Brochures

- Art and Craft Supplies

- ID Cards and Security Documents

- By Basis Weight:

- Lightweight (170 GSM – 250 GSM)

- Medium Weight (251 GSM – 350 GSM)

- Heavy Weight (Above 350 GSM)

- By Raw Material Source:

- Virgin Pulp (Hardwood/Softwood)

- Recycled Content (Post-Consumer, Post-Industrial)

- Alternative Fibers (Bamboo, Cotton, Hemp)

- By End-Use Industry:

- Commercial Printing and Publishing

- Retail and E-commerce

- Food and Beverage Industry

- Healthcare and Pharmaceuticals

- Education and Government

Value Chain Analysis For Card Stock Market

The Value Chain for the Card Stock Market begins with the highly capital-intensive upstream sector, focused on sustainable forestry and pulp manufacturing. This initial stage involves harvesting timber or sourcing alternative raw fibers and then processing them into various grades of bleached and unbleached chemical or mechanical pulp. The cost structure and environmental compliance requirements here significantly dictate the downstream costs and product attributes, such as brightness, stiffness, and sustainability credentials (e.g., FSC certification). Stability in the pulp supply chain is paramount, and integration backward into forestry operations is a common strategy among major card stock producers to mitigate price volatility and secure consistent fiber quality. Effective resource management and circular economy initiatives, such as utilizing recycled paper streams, are integrated at this foundational stage.

The midstream sector is dominated by card stock manufacturing and converting, where the pulp is processed on large paper machines, involving stages like sheeting, drying, calendering, and crucially, surface coating and finishing. Manufacturers add value through specialized processes such as applying clay or polymer coatings (for glossy finishes), embossing, or incorporating security features. Product differentiation is achieved here by offering specialized grades optimized for specific printing technologies (e.g., high-speed inkjet compatibility). Quality control and precision engineering are essential to meet stringent dimensional and structural requirements for modern converting machinery. Direct distribution often involves large-scale agreements with international paper merchants, while indirect channels utilize regional distributors and wholesale suppliers who offer smaller lot sizes and specialized inventory management services to local printers.

The downstream flow involves the distribution channel and the final end-users. Distributors, including national and regional paper merchants, play a crucial role by providing warehousing, cutting services (sheeting to custom sizes), and just-in-time delivery to commercial printers, packaging converters, and large retailers. Commercial printers and converters act as the final value-add step, transforming the card stock into finished products like folding cartons, greeting cards, or brochures through printing, die-cutting, gluing, and assembly. Direct channels are typically reserved for very large volume contracts between manufacturers and global packaging corporations, while the majority of smaller-to-medium enterprises rely on the extensive network of indirect distributors for flexible sourcing and specialized stock access. The efficiency of this downstream segment is heavily reliant on effective logistics and strong partnerships between mills and regional distributors.

Card Stock Market Potential Customers

The Card Stock Market’s potential customer base is exceptionally broad, spanning multiple sectors that rely on durable, high-quality material for either communication, branding, or product containment. Primary end-users fall into the Commercial Printing and Packaging Converter categories. Commercial printers are continuous high-volume purchasers, requiring diverse card stock weights and finishes for marketing collateral, reports, and specialty stationery. Packaging converters, which serve the vast retail and e-commerce markets, demand structural integrity, consistent runnability, and food safety compliance, making them the largest volume consumers. These B2B customers prioritize suppliers capable of delivering materials reliably, offering technical support for complex converting processes, and ensuring material traceability, especially concerning sustainable sourcing certifications like FSC.

Secondary but significant customers include the Retail Sector (particularly luxury goods, cosmetics, and electronics), which utilizes card stock for premium primary and secondary packaging to convey brand quality and secure products. The Food and Beverage industry also represents a growing segment, requiring specific food-grade card stocks that are grease-resistant, often coated with specialized barriers, and approved for direct or indirect food contact, aligning with stringent health and safety regulations. These customers often negotiate long-term supply contracts directly with mills or major converters to ensure volume consistency and quality assurance. Their purchasing decisions are heavily influenced by the material’s performance on high-speed automated packaging lines and its final aesthetic appeal on the shelf.

Finally, the creative and personalized communication segments—including professional wedding planners, small business owners requiring custom stationery, and the large community of DIY crafters and artists—constitute the niche, high-margin customer base. While these customers purchase smaller volumes, they often require highly specialized, unique card stock attributes such as specific textures (e.g., vellum, linen), uncommon colors, or highly archival (acid-free) properties. Procurement for this segment typically occurs through specialized art supply retailers, online specialty paper merchants, or smaller, localized print shops. The demand here is driven by aesthetics, uniqueness, and the tactile experience, rather than pure cost optimization, allowing manufacturers to charge a premium for custom and imported specialty papers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 11.5 Billion |

| Market Forecast in 2033 | USD 15.8 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | International Paper, Smurfit Kappa Group, WestRock Company, Domtar Corporation, Resolute Forest Products, Asia Pulp & Paper (APP), Stora Enso Oyj, Mondi Group, Sappi Limited, DS Smith Plc, Metsä Group, Mohawk Fine Papers, KapStone Paper and Packaging Corporation, Sylvamo Corporation, Glatfelter Corporation, Oji Holdings Corporation, Nippon Paper Industries Co. Ltd., Packaging Corporation of America (PCA), Kruger Inc., Sonoco Products Company |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Card Stock Market Key Technology Landscape

The technology landscape in the Card Stock Market is characterized by continuous process optimization aimed at enhancing both efficiency and sustainability. One critical area is the advancement in fiber preparation and pulping technologies, including improved separation techniques for recycled fibers and the development of high-yield pulps that minimize wood resource consumption while maintaining strength and quality. Key technological innovations include the deployment of advanced refining systems that tailor fiber properties (length and fibrillation) to achieve specific characteristics such as bulk, stiffness, and surface uniformity, crucial for heavy card stock grades. Furthermore, modern paper machines are incorporating sophisticated process control systems, utilizing sensors and real-time analytics to manage sheet formation and water removal, significantly reducing energy usage during the drying stage and ensuring consistent sheet caliper across vast production runs.

Coating and finishing technologies represent another major technological frontier, essential for market differentiation, particularly in the premium coated card stock segment. Manufacturers are increasingly utilizing advanced pigment coating formulations, often incorporating minerals like kaolin clay and calcium carbonate, applied using high-precision curtain coating or blade coating techniques to achieve flawless, highly smooth surfaces optimized for high-resolution printing (both offset and digital). The shift towards environmentally friendly, aqueous-based and barrier coatings is paramount, addressing the need for grease and moisture resistance in packaging without compromising the material’s ultimate recyclability. This includes developing bio-based coatings derived from renewable polymers that replace traditional plastic laminations, positioning card stock as a truly sustainable material for food service and liquid packaging applications.

The integration of digital printing technologies directly impacts the demands placed on card stock substrate development. The rapid proliferation of industrial inkjet and high-speed digital presses necessitates card stocks that possess specific surface chemistries to facilitate rapid ink absorption and fixation without blurring or losing color vibrancy, ensuring efficiency and quality during high-volume, variable data printing. Manufacturers are developing surface treatments and primers that enhance the affinity of the card stock for digital inks (both aqueous and UV-cured), allowing for instantaneous drying and superior image quality on thicker substrates. This technological push is vital for servicing the personalized packaging and short-run custom printing markets, making card stock production highly specialized and technically demanding compared to standard paper manufacturing.

Regional Highlights

Regional dynamics within the Card Stock Market are defined by differing economic growth rates, regulatory environments, and consumption patterns. Asia Pacific (APAC) stands out as the primary growth engine, driven by massive increases in manufacturing output, infrastructure development, and exponential e-commerce expansion, which fuels immense demand for packaging board. Countries like China, India, and Southeast Asian nations are investing heavily in establishing new pulp and paper facilities, shifting the manufacturing center of gravity eastward. The focus in APAC is often on both high-volume packaging grades and rapidly increasing demand for mid-range office and commercial printing card stock due to expanding corporate sectors and educational needs. The challenge in this region centers on managing sustainable fiber sourcing and balancing rapid growth with environmental protection mandates.

North America and Europe represent mature, high-value markets characterized by a strong emphasis on premiumization and sustainability. In North America, demand is stable, primarily driven by high per-capita consumption of premium printing materials and robust growth in specialized folding carton packaging for branded consumer goods. The regulatory landscape, particularly in the European Union, exerts significant influence, pushing manufacturers to innovate materials with verifiable recycled content and enhanced circularity. European consumers show a higher willingness to pay for FSC-certified, low-carbon footprint card stock, making technological leadership in resource efficiency and advanced recycling paramount for regional market success. The shift away from plastics in retail packaging further stimulates demand for innovative, fiber-based solutions across both continents.

Latin America and the Middle East & Africa (MEA) are emerging regions offering high potential, though growth is often more volatile. Latin America benefits from expanding agricultural exports and localized manufacturing growth, creating demand for shipping and retail packaging card stock. Brazil, with its extensive forest resources, is a significant player in pulp production, impacting global supply. The MEA region, particularly the Gulf Cooperation Council (GCC) states, sees growth tied to urbanization, infrastructure projects, and the establishment of local food processing and retail industries, leading to increased demand for locally sourced or imported specialty packaging. Market penetration is often slower due to logistical challenges and varying levels of industrial development, but the long-term prospects remain strong as economies diversify and consumer spending increases.

- Asia Pacific (APAC): Highest projected CAGR; driven by e-commerce penetration, urbanization, and industrial manufacturing expansion (China, India).

- North America: Stable, high-value market; focusing on premium stationery, high-quality commercial printing, and sustainable packaging conversion.

- Europe: Regulatory leader in sustainability; strong demand for bio-based coatings and high recycled content card stock due to stringent EU circular economy policies.

- Latin America: Emerging market; growth linked to regional manufacturing, agricultural packaging, and domestic consumption patterns (Brazil, Mexico).

- Middle East & Africa (MEA): Growth potential in retail and food packaging, spurred by regional economic diversification and increasing consumer base in urban centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Card Stock Market.- International Paper

- Smurfit Kappa Group

- WestRock Company

- Domtar Corporation

- Resolute Forest Products

- Asia Pulp & Paper (APP)

- Stora Enso Oyj

- Mondi Group

- Sappi Limited

- DS Smith Plc

- Metsä Group

- Mohawk Fine Papers

- KapStone Paper and Packaging Corporation

- Sylvamo Corporation

- Glatfelter Corporation

- Oji Holdings Corporation

- Nippon Paper Industries Co. Ltd.

- Packaging Corporation of America (PCA)

- Kruger Inc.

- Sonoco Products Company

Frequently Asked Questions

Analyze common user questions about the Card Stock market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the sustainable card stock market?

The sustainable card stock market is primarily driven by rigorous global regulatory pressures, especially in Europe, mandating increased use of recyclable and biodegradable packaging materials. Additionally, consumer preference for eco-friendly products and corporate commitments to reduced environmental footprints compel brands to adopt certified card stock (FSC/PEFC) and materials with high post-consumer recycled content, accelerating market demand for environmentally responsible grades.

How is the rise of digital printing technology affecting the requirements for card stock substrates?

Digital printing demands highly specialized card stock substrates optimized for rapid ink drying and superior image quality in high-speed variable data applications. Substrates require precise surface treatments or primers to control ink absorption, prevent smearing, and ensure consistent color vibrancy across short runs, shifting market focus towards technologically advanced, coated card stocks compatible with inkjet and toner systems.

Which application segment holds the largest market share for card stock usage globally?

The Packaging and Folding Cartons segment currently holds the largest market share by volume. This dominance is attributed to the unprecedented expansion of the e-commerce sector, which necessitates durable, protective, and aesthetically appealing fiber-based solutions for shipping, branding, and product containment, driving immense demand for various weights of folding boxboard and solid bleached sulfate (SBS) card stock.

What is the main challenge related to raw material sourcing in the card stock industry?

The main challenge is the high volatility and unpredictable fluctuation of wood pulp and energy prices. Card stock manufacturing is extremely energy and resource-intensive, making profitability highly susceptible to global commodity markets and geopolitical stability, compelling manufacturers to implement robust supply chain risk mitigation strategies and invest in energy-efficient production methods.

What is the difference between Coated and Uncoated card stock and which is better for luxury printing?

Coated card stock has a sealant layer (often clay-based) applied, offering a smooth finish (gloss or matte) ideal for high-resolution photographic printing where color fidelity and durability are essential. Uncoated card stock retains the natural texture of the fibers, offering a tactile, sophisticated, and absorbent surface. For luxury printing, while coated stock is used for vibrant image reproduction, uncoated or specialty textured card stock is often preferred for invitations and high-end stationery due to its perceived quality and premium feel.

How do fiber quality and basis weight impact the end-use performance of card stock?

Fiber quality, determined by the ratio of softwood (long) to hardwood (short) fibers and the percentage of recycled content, directly impacts the material's structural integrity, stiffness, and tear resistance. Basis weight (measured in GSM) determines the thickness and perceived substance; a higher GSM signifies a heavier, more rigid card stock, which is critical for applications like business cards and sturdy folding cartons that require enhanced durability and structural support to maintain their form under pressure.

What role does Asia Pacific play in the global Card Stock Market?

Asia Pacific is the fastest-growing region and is expected to contribute the most to future market growth. This region serves as a massive consumption hub due to rapid industrialization and the establishment of expansive local packaging and commercial printing supply chains. High population density and rising disposable incomes further fuel demand for consumer goods packaging and premium paper products, establishing APAC as a key strategic region for global card stock producers.

Explain the significance of FSC certification for card stock manufacturers.

Forest Stewardship Council (FSC) certification signifies that the card stock’s fiber source is derived from responsibly managed forests, assuring consumers and corporate buyers of ethical and sustainable sourcing practices. FSC certification is essential for accessing high-value markets, particularly in Europe and North America, where corporate procurement policies often mandate the use of certified materials to meet internal sustainability targets and demonstrate environmental stewardship.

Are specialty card stocks, such as those with metallic or pearlescent finishes, experiencing increased demand?

Yes, specialty card stocks are experiencing increased demand, especially in the luxury packaging, cosmetics, and premium events stationery sectors. Brands utilize these materials to achieve unique visual effects and tactile differentiation, enhancing the perceived value of the product and providing a distinctive ‘unboxing experience.’ Although lower in volume compared to commodity grades, this segment offers higher profit margins due to the specialized manufacturing and finishing processes required.

How are manufacturers addressing the need for water-resistant card stock without using traditional plastic coatings?

Manufacturers are developing innovative, bio-based barrier coatings derived from renewable resources like starch, natural resins, or biodegradable polymers. These advanced coatings provide necessary grease and water resistance for food and beverage packaging (e.g., disposable cups, frozen food cartons) while maintaining the card stock’s fiber integrity, allowing it to be effectively recycled through standard paper recycling streams, addressing circular economy goals.

What is the expected long-term impact of artificial intelligence (AI) on the card stock supply chain?

AI is expected to significantly optimize the card stock supply chain by improving inventory management and logistics planning. Machine learning algorithms analyze historical sales data and external economic indicators to predict future demand for specific grades and colors with higher accuracy than traditional methods, resulting in reduced warehousing costs, minimized stock-outs, and a more responsive supply chain tailored for Just-In-Time (JIT) deliveries to converters.

What makes heavy weight card stock (above 350 GSM) particularly valuable in the market?

Heavy weight card stock is valuable because it offers maximum rigidity, durability, and a sense of permanence, making it ideal for high-end applications such as luxury rigid boxes, high-quality presentation folders, and durable point-of-sale displays. The structural integrity of these materials allows for complex die-cutting and folding processes required in premium packaging, ensuring the finished product maintains its shape and high-quality appearance.

How do tariffs and international trade agreements affect the Card Stock Market?

Tariffs and trade agreements significantly impact the cost structure and regional competitiveness of card stock. Duties on imported pulp or finished paper products can raise production costs for domestic converters reliant on international sourcing, leading to price volatility for end-users. Conversely, favorable trade agreements can open up new export opportunities for major producers, balancing regional supply and demand dynamics and influencing long-term investment in mill capacity.

Describe the role of converting operations in the Card Stock Value Chain.

Converting operations are a critical downstream step where large rolls of manufactured card stock are transformed into ready-to-use formats. This involves precision processes like sheeting (cutting rolls into specific flat sizes), slitting, die-cutting, folding, and gluing (for cartons), and applying specialized surface finishes. Converters add substantial value by tailoring the material precisely to the requirements of the final packaging or printing application.

Is card stock used in the healthcare and pharmaceutical sectors, and if so, for what applications?

Yes, card stock is extensively used in the healthcare and pharmaceutical sectors, primarily for packaging inserts, folding cartons for medications, and compliant labeling systems. These applications require high-quality, often virgin-fiber card stock that meets strict regulatory standards for hygiene, material traceability, and compatibility with specialized printing techniques necessary for anti-counterfeiting measures and detailed patient information leaflets.

How is the demand for security card stock evolving?

The demand for security card stock, used for identity documents, passports, certificates, and secure ticketing, is evolving due to increased global security concerns and technological advancements. This segment requires card stock with embedded security features, specialized chemical resistances, and surfaces optimized for micro-printing and integration with digital security elements like RFID tags, ensuring authentication and preventing fraudulent replication.

What technological innovations are being implemented to improve the manufacturing efficiency of card stock?

Key technological innovations focus on advanced process control systems utilizing sensors and machine vision to monitor uniformity and moisture content in real-time. Additionally, high-efficiency de-watering sections and optimized drying hoods in modern paper machines significantly reduce the energy consumed during production, leading to lower operating costs and improved consistency in the final card stock product.

How does the type of pulp (virgin vs. recycled) influence the final quality of card stock?

Virgin pulp typically yields card stock with superior strength, brightness, and consistency, ideal for premium printing and structural integrity where whiteness is key. Recycled pulp, while more environmentally friendly, often results in slightly lower strength and brightness, though technological improvements in de-inking and cleaning processes are rapidly closing this performance gap, making high-recycled-content card stock suitable for many mid-range and commodity packaging applications.

What factors are restraining market growth in developed economies like North America and Europe?

Market growth in developed economies is primarily restrained by the structural shift towards digitalization in communication (reducing transactional printing volume) and the mature nature of the consumer base. High operational costs, especially stringent environmental compliance requirements and elevated energy prices compared to emerging markets, also limit large-scale capacity expansion in these regions.

Why is consistent caliper (thickness) critical for card stock used in packaging?

Consistent caliper is critical because variations in thickness can cause major operational issues in high-speed converting machinery, leading to jams, uneven folding, and poor structural performance of the final carton. Packaging card stock must maintain extremely tight thickness tolerances to ensure seamless transition through automated die-cutters, folders, and gluing stations, guaranteeing efficient production and a structurally sound package.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager