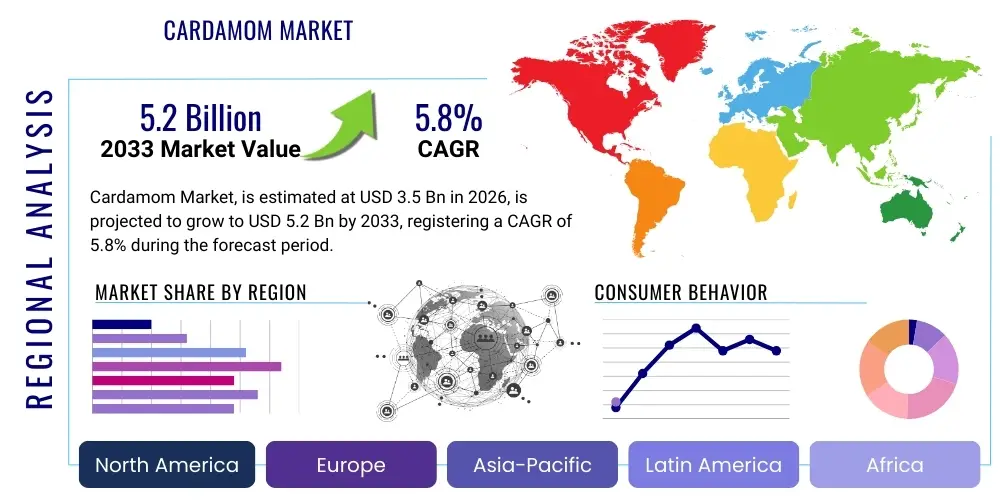

Cardamom Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438067 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Cardamom Market Size

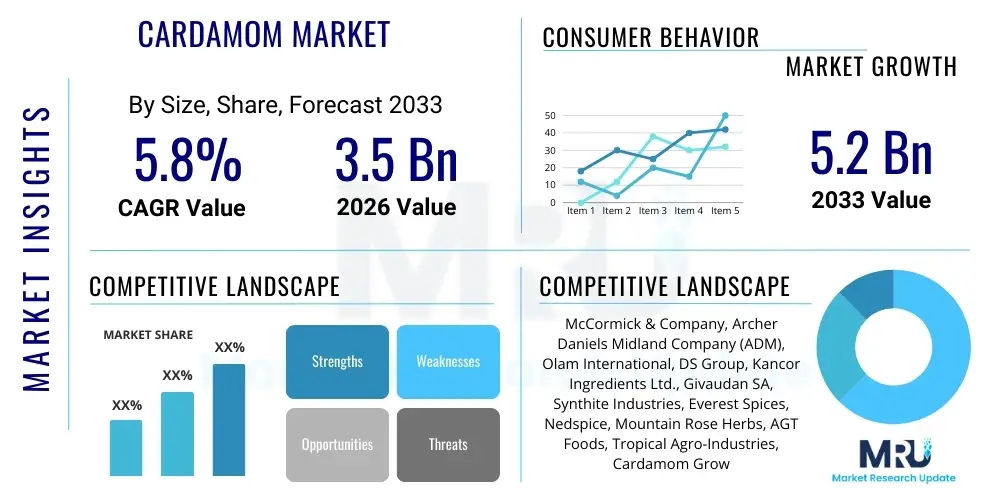

The Cardamom Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.2 Billion by the end of the forecast period in 2033.

Cardamom Market introduction

Cardamom, often referred to as the "Queen of Spices," is derived from the seeds of plants in the genera Elettaria (producing green or true cardamom) and Amomum (producing black, brown, or white cardamom). This highly aromatic spice is characterized by its strong, unique flavor profile, featuring resinous, sweet, and pungent notes, making it indispensable in global cuisine, particularly in the Middle East, South Asia, and Scandinavia. Historically, cardamom has been valued not only for culinary purposes but also for its medicinal properties, dating back thousands of years in Ayurvedic and traditional Chinese medicine. The commercial product is typically harvested from the capsules, which are dried and processed, with the quality heavily dependent on the climate and post-harvest handling practices.

The product's description encompasses two major commercial varieties: small cardamom (Elettaria cardamomum), which commands a premium price due to its superior aroma and flavor, and large cardamom (Amomum subulatum), often used for savory dishes and spice blends due to its smoky undertones. Major applications span several sectors, including the dominant Food & Beverages industry, where it is crucial in flavoring curries, baked goods, traditional sweets, tea (masala chai), and coffee (gahwa). Furthermore, the essential oil extracted from cardamom seeds finds increasing utility in the pharmaceutical, personal care, and fragrance industries, contributing to its sustained demand growth across diverse market verticals.

The market expansion is significantly driven by heightened global awareness regarding natural ingredients and the functional health benefits associated with cardamom consumption, such as its antioxidant, anti-inflammatory, and digestive properties. Coupled with rising disposable incomes in key emerging economies and the expanding globalization of ethnic cuisines, the demand trajectory remains robust. Key driving factors also include innovation in food processing technology, which allows for better preservation and extraction of flavor compounds, thereby meeting the stringent quality standards of international buyers and facilitating trade across complex global supply chains.

Cardamom Market Executive Summary

The Cardamom Market is characterized by intense price volatility linked closely to geopolitical stability in major producing regions and the erratic nature of monsoon seasons, which directly impacts yield and quality. Current business trends indicate a significant shift towards value-added products, moving beyond raw spice trade to processed cardamom derivatives like essential oils, tinctures, and standardized extracts tailored for the nutraceutical and cosmetic industries. This trend is supported by substantial investment in advanced drying and grading technologies to ensure consistency and meet the high safety and traceability standards mandated by developed economies. Strategic alliances between large corporate buyers and farmer cooperatives in origin countries are becoming commonplace, aimed at securing consistent, high-quality supply and mitigating the risks associated with unpredictable harvests.

Regionally, Asia Pacific (APAC) continues its dominance, driven by India and Guatemala—the two largest producers—and robust consumer demand within South Asia for traditional culinary and beverage applications. However, significant growth potential is being observed in the Middle East and North Africa (MENA) region, particularly the Gulf Cooperation Council (GCC) countries, where cardamom consumption per capita is exceptionally high, primarily driven by traditional coffee culture and luxury dining. European and North American markets exhibit steady growth, fueled by the rising popularity of exotic and specialty spices among health-conscious consumers and the diversification of product offerings in packaged foods and specialty beverages, demanding transparent and sustainably sourced ingredients.

Segment trends reveal that the Food & Beverages sector maintains its undisputed lead, but the fastest growth trajectory is anticipated within the Pharmaceuticals and Nutraceuticals segment, driven by scientific validation of cardamom's medicinal properties, particularly concerning digestive health and metabolic regulation. Furthermore, within the product type segmentation, Green Cardamom (Elettaria) maintains its premium status due to superior aroma and is the primary driver of market value. Distribution channel dynamics show an increasing proliferation of the Online segment, especially in B2C sales, as specialty spice brands leverage e-commerce platforms to reach niche markets and provide detailed product information on sourcing and ethical farming practices, appealing directly to the discerning modern consumer.

AI Impact Analysis on Cardamom Market

User inquiries regarding AI's influence on the Cardamom Market predominantly revolve around three critical areas: optimizing agricultural yield under variable climate conditions, enhancing supply chain transparency and traceability, and predicting volatile commodity pricing. Users seek to understand how AI-driven predictive modeling can mitigate risks associated with climate change, which poses a significant threat to delicate cardamom cultivation. There is also substantial interest in leveraging machine learning algorithms for real-time quality assessment post-harvest, ensuring that international quality specifications are consistently met. Furthermore, stakeholders are concerned with minimizing post-harvest losses and utilizing AI to analyze complex global demand signals to better inform planting and stock management decisions, thereby stabilizing market supply and pricing.

The integration of Artificial Intelligence and Machine Learning (ML) platforms is fundamentally poised to revolutionize cardamom cultivation and trade, offering tools that move beyond traditional farming methods. AI algorithms can process vast datasets related to hyperlocal weather patterns, soil moisture, pest occurrences, and historical yield data to generate precise recommendations for irrigation, fertilization, and disease management. This precision agriculture approach is critical for maximizing productivity in small, specialized cardamom farms, ensuring resource efficiency, and crucially, improving the resilience of crops against increasingly unpredictable environmental factors, a central challenge for cardamom growers globally.

Beyond the farm gate, AI applications are transforming market intelligence and logistics. Utilizing natural language processing (NLP) and predictive analytics, AI can scrutinize global trade volumes, import regulations, geopolitical shifts, and consumer purchasing trends simultaneously, providing near real-time commodity price forecasting that is far superior to traditional econometric models. This capability significantly benefits large traders and processors in making informed purchasing and hedging decisions. Moreover, blockchain-enabled traceability, often managed and verified by AI systems, allows consumers and regulators to track the spice from farm to table, verifying claims related to organic status, fair trade practices, and geographical origin (terroir), thereby elevating consumer trust and justifying premium pricing for sustainably sourced products.

- AI-driven Precision Agriculture: Optimization of irrigation, nutrient management, and pest control using sensor data and predictive modeling to maximize crop yield under fluctuating climatic conditions.

- Supply Chain Transparency: Implementation of machine learning to analyze and verify data points within blockchain systems, ensuring accurate traceability from producer to end-consumer.

- Commodity Price Forecasting: Advanced algorithms analyzing geopolitical events, climate data, and real-time market sentiment to predict price volatility and assist trading firms in risk management.

- Automated Quality Grading: Utilization of computer vision and spectral analysis (hyperspectral imaging) to non-destructively grade cardamom pods based on color, size, and essential oil content, enhancing consistency.

- Resource Efficiency: ML optimization of energy consumption in drying and processing units, contributing to reduced operational costs and a lower carbon footprint in the manufacturing process.

DRO & Impact Forces Of Cardamom Market

The dynamics of the Cardamom Market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming a powerful set of impact forces that determine market growth and stability. A primary driver is the accelerating international demand, particularly from the Middle East and North Africa (MENA) region, where cardamom is integral to cultural identity and daily consumption, especially in the preparation of traditional coffee and sweets. Concurrently, the increasing awareness of cardamom's health benefits, including its role as a natural digestive aid and source of antioxidants, fuels its adoption in the rapidly expanding nutraceutical and functional food segments across Western markets. These demand-side factors create a strong upward pull on global trade volumes, justifying investments in production expansion and technological upgrades.

However, the market faces significant restraints, chiefly its inherent susceptibility to extreme weather events. Cardamom cultivation requires specific, stable tropical conditions; droughts or excessive rainfall due to climate change directly lead to crop failures, sharp supply shortages, and severe price spikes, impacting global buyer confidence. Furthermore, the high initial capital investment required for new plantations, coupled with a long gestation period before the first significant yield, poses a barrier to entry for new farmers and limits the immediate ability of the market to respond to sudden surges in demand. The fragmented nature of the market, characterized by numerous smallholders, often leads to inconsistent post-harvest handling and quality variability, which restricts premium market access.

Opportunities for growth are concentrated in diversifying the application base and enhancing sustainability. There is a burgeoning opportunity in the organic and sustainably certified cardamom segment, catering to the ethical purchasing trends in developed economies, offering significant price premiums over conventional spice. Furthermore, the development of new, standardized cardamom extracts for use in functional beverages, dietary supplements, and high-end cosmetics presents avenues for enhanced profitability and market penetration beyond traditional culinary uses. The collective impact forces push the industry towards modernization, necessitating improved irrigation techniques, reliable storage infrastructure, and collaborative agreements between producers and international buyers to stabilize supply chains and unlock the market's long-term potential for stable, sustainable growth.

Segmentation Analysis

The Cardamom Market segmentation provides a granular view of consumption patterns, product variations, and distribution dynamics, crucial for strategic market positioning. The market is primarily dissected based on Product Type (Green, Black, White Cardamom), Application (Food & Beverages, Pharmaceuticals & Health Supplements, Personal Care & Cosmetics, Industrial Use), and Distribution Channel (Offline Retail, Online Retail, and Direct Sales/B2B). Understanding these segments allows market participants to tailor their sourcing, processing, and marketing efforts to specific consumer needs and regional culinary traditions. The complexity arises from the vast quality differentials within each product type, necessitating stringent grading standards often utilized by segment-specific end-users, such as essential oil extractors versus direct spice consumers.

In terms of value, the Food & Beverages segment overwhelmingly dominates the market, representing the foundational demand for both whole and ground cardamom in culinary traditions globally, from Middle Eastern coffee to Indian curries and Nordic baking. However, the fastest projected growth is concentrated in the Personal Care and Pharmaceuticals segments. This acceleration is driven by the validated efficacy of cardamom essential oil (rich in cineole, terpinyl acetate, and limonene) in natural cosmetics for its antiseptic properties and fragrance, as well as its increasing acceptance in standardized herbal supplements designed to aid digestion and promote overall gut health. Manufacturers are responding by focusing on high-purity, solvent-free extracts to meet the strict regulatory requirements of these specialized segments.

Analyzing the distribution landscape highlights the efficiency of the direct B2B channel for large industrial buyers, especially food manufacturers and pharmaceutical companies who require bulk, standardized supply under long-term contracts. Conversely, the proliferation of the Online Retail channel is democratizing access to premium and specialty cardamom varieties (like Malabar or Mysore origins), allowing small-scale, fair-trade producers to bypass traditional intermediaries and reach discerning global consumers directly. This diversification across distribution channels reflects the dual nature of the commodity: a mass-market staple versus a high-end specialty ingredient.

- By Product Type:

- Green Cardamom (Elettaria Cardamomum)

- Black Cardamom (Amomum Subulatum)

- White Cardamom

- By Application:

- Food and Beverages (Baking, Confectionery, Savory Dishes, Beverages like Tea and Coffee)

- Pharmaceuticals and Health Supplements (Digestive Aids, Herbal Remedies)

- Personal Care and Cosmetics (Fragrances, Essential Oils, Skin Care Products)

- Industrial Use (Dyeing, Flavoring Agents)

- By Distribution Channel:

- Offline Retail (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores)

- Online Retail (E-commerce Platforms, Direct-to-Consumer Websites)

- By End-Use Form:

- Whole Pods

- Ground/Powdered

- Essential Oils and Extracts

Value Chain Analysis For Cardamom Market

The Cardamom Market value chain is inherently complex, starting with highly specialized agricultural production and extending through multiple stages of processing, trade, and end-user consumption. The upstream analysis begins with smallholder farmers, primarily located in regions like India, Guatemala, and Sri Lanka, who are responsible for cultivation and initial harvest. This stage is labor-intensive, requiring meticulous care, hand-picking, and precise post-harvest drying techniques, often done using traditional curing houses. The upstream sector is characterized by low mechanization and high dependence on local climatic conditions and labor availability, leading to high variability in raw material supply and quality. Ensuring fair pricing and technical support for these farmers is crucial for stabilizing the base of the entire value chain.

Midstream activities involve primary processing, grading, bulk packaging, and consolidation by local traders or cooperatives. Cardamom then enters the extensive domestic and international distribution channels. Direct channels involve large processors and essential oil extractors sourcing directly from major plantations or government auctions, ensuring strict quality control and traceability. Indirect channels, which are more common for commodity-grade spice, involve multiple layers of regional agents, intermediaries, and commission houses before reaching international importers and large food manufacturers. The efficiency of the midstream logistics, especially temperature and moisture control during transit, directly impacts the final quality and market price of the commodity.

The downstream analysis focuses on the final processing, formulation, and distribution to end consumers. This stage is dominated by large multinational food and beverage companies, pharmaceutical firms, and cosmetic manufacturers who utilize cardamom as a key ingredient. Distribution moves through organized retail (supermarkets and hypermarkets), foodservice providers, and increasingly, specialized online platforms. Profit margins tend to increase significantly at the downstream, value-addition stage, where cardamom is incorporated into finished goods such as spice mixes, packaged foods, essential oils, and nutraceutical capsules, highlighting the strategic importance of branding and product differentiation in the final consumer market.

Cardamom Market Potential Customers

Potential customers for cardamom span a wide array of industries, categorized broadly into industrial users, commercial consumers, and direct retail buyers, each demanding specific quality grades and processing forms. The largest and most consistent buyers are food and beverage manufacturing companies, including global spice blenders, tea and coffee producers, and large-scale bakeries. These entities require bulk volumes of standardized, often ground or powdered, cardamom for incorporation into mass-produced items like curry pastes, beverage premixes, and confectioneries. Their purchasing decisions are primarily driven by stable pricing, large-volume supply capacity, and adherence to international food safety certifications (such as ISO, HACCP, and FSSAI).

A rapidly growing segment of potential customers includes pharmaceutical and nutraceutical companies. These buyers are specifically interested in high-potency, standardized extracts or essential oils derived from cardamom, rather than the raw pods. They use these extracts to formulate digestive health supplements, herbal remedies, and traditional medicine products, focusing heavily on the active ingredient concentration (e.g., cineole content). Their stringent procurement criteria mandate detailed certificate of analysis (COA) confirming purity, absence of heavy metals, and consistent pharmacological efficacy, often leading them to prefer direct sourcing from specialized extractors who use advanced supercritical fluid extraction (SFE) techniques.

Finally, the retail and foodservice sectors represent the point of final consumption. This includes supermarket chains, specialty spice shops, ethnic grocery stores, high-end restaurants, and catering services globally. Retail customers demand high-quality, attractively packaged whole pods or freshly ground spices, valuing origin traceability and premium branding (e.g., organic or fair-trade labels). The foodservice industry, particularly in regions with high traditional consumption (e.g., the Middle East), buys large containers of whole cardamom, demanding reliable logistics and consistent inventory availability to support daily high-volume operations like coffee preparation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | McCormick & Company, Archer Daniels Midland Company (ADM), Olam International, DS Group, Kancor Ingredients Ltd., Givaudan SA, Synthite Industries, Everest Spices, Nedspice, Mountain Rose Herbs, AGT Foods, Tropical Agro-Industries, Cardamom Growers Association, Vasant Masala, MDH Spices, Keya Foods, Green Earth Products, Akay Flavours & Aromatics Pvt. Ltd., Mane Kancor, Elburg Global |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cardamom Market Key Technology Landscape

The technological landscape of the Cardamom Market is rapidly evolving, driven by the necessity to enhance yield stability, improve quality consistency, and ensure global supply chain integrity. At the cultivation level, the adoption of advanced agricultural technologies, particularly precision irrigation systems, sensor-based monitoring for soil health, and weather forecasting models, is becoming standard practice in large plantations. These technologies are crucial for managing the delicate balance of moisture and nutrients required by cardamom plants, which are highly sensitive to environmental stress. Furthermore, the use of biotechnology research is accelerating, focusing on developing drought-resistant and disease-tolerant cardamom varieties through selective breeding and genomic analysis, thereby mitigating the severe impact of pests like the cardamom thrips and fungal infections.

Post-harvest technology represents a crucial area of innovation aimed at preserving the potent flavor and aroma compounds. The transition from traditional wood-fired drying (which often imparts a smoky flavor, especially in black cardamom) to modern mechanical dryers, controlled-atmosphere drying chambers, and fluidized bed drying is enabling processors to achieve consistent moisture levels and color retention, which are vital for export quality. Additionally, sophisticated sorting and grading machines employing optical sensors and computer vision are replacing manual inspection, ensuring that only uniformly sized and defect-free pods proceed to the market. This technological upgrade reduces post-harvest losses and significantly increases the marketability of the spice on the international stage.

In the value-addition segment, advanced extraction technologies are driving market growth in the nutraceutical and cosmetic industries. Supercritical Fluid Extraction (SFE) using CO2 is gaining prominence because it allows for the extraction of highly pure, solvent-free essential oils and oleoresins, preserving the volatile aromatic compounds better than traditional steam distillation or solvent extraction methods. Coupled with technologies like encapsulation and microencapsulation, the active compounds of cardamom can be stabilized and delivered efficiently in finished products, extending shelf life and enhancing bioavailability. Traceability technologies, particularly the integration of QR codes and blockchain across the supply chain, are becoming essential for verifying origin claims and meeting the increasing consumer demand for transparency and ethical sourcing.

Regional Highlights

- Asia Pacific (APAC): Dominance in Production and Consumption

The APAC region holds the undisputed leadership position in the global Cardamom Market, characterized by both high production volumes, primarily from India (Kerala, Karnataka, Tamil Nadu) and Sri Lanka, and immense domestic consumption. India, historically a major producer and the world's largest consumer, drives the market through its integral use in traditional cuisine, ayurvedic medicine, and as a key component of tea (Masala Chai). The market dynamics are highly influenced by governmental policies related to agricultural subsidies and export regulations. Challenges in the region include fragmented land holdings and unpredictable monsoon patterns, necessitating significant technological investment in irrigation and pest control. The regional demand is further fueled by rising affluence in China and Southeast Asian countries, leading to higher consumption of luxury and specialty spices.

The growth trajectory in APAC is maintained by continuous efforts to enhance yield through scientific farming practices and the development of resistant varieties. Additionally, the region is rapidly moving up the value chain by increasing local processing capabilities, particularly for high-quality oleoresins and essential oils destined for export. Key opportunities lie in targeting the massive population base with cardamom-infused processed foods and functional beverages, leveraging the spice's traditional medicinal credibility. The competitive landscape is characterized by the presence of large domestic spice conglomerates vying for control over high-quality raw materials and efficient processing infrastructure.

- Middle East and Africa (MEA): High Per Capita Consumption and Import Reliance

The MEA region, particularly the Gulf Cooperation Council (GCC) countries (Saudi Arabia, UAE, Qatar), is the world's most critical consumption center for premium green cardamom, often relying almost entirely on imports from Guatemala and India. Cardamom is central to the culture and hospitality of the region, specifically being a mandatory ingredient in 'Gahwa' (Arabic coffee). The massive purchasing power and traditional importance of the spice translate into exceptionally high per capita consumption rates and a consistent demand for the highest quality, large, bright-green pods, which command significant price premiums. The stability of imports and efficient logistical pipelines are paramount to market stability in this region.

Market trends in the MEA show sustained growth aligned with population expansion and tourism, driving demand in the foodservice and hospitality sectors. While consumption dominates, the African side of the MEA market, specifically countries like Tanzania, shows emerging potential as a producer of black cardamom (Amomum) varieties. Strategic focus for exporters targeting MEA must be on quality control, reliable logistics (cold chain management), and adherence to strict Halal certification standards. The region acts as a price stabilizer for premium cardamom globally, often absorbing excess supply and influencing international pricing benchmarks.

- North America: Focus on Health, Specialty Foods, and Ethnic Cuisine

The North American market (primarily the US and Canada) is characterized by demand driven by two main factors: the rising popularity of ethnic cuisines (Indian, Middle Eastern, Nordic) requiring authentic ingredients, and a strong consumer focus on health and wellness. Cardamom consumption here is shifting from purely culinary use to increased incorporation into functional foods, dietary supplements, and specialty coffee and tea products. Consumers are increasingly sophisticated, demanding transparency regarding sourcing, ethical labor practices, and organic certifications, leading to premiumization within the spice segment.

Growth in this region is primarily facilitated by specialized importers and distributors who cater to niche market segments. The opportunity lies in providing processed, value-added products like standardized essential oils for the fragrance industry and ready-to-use spice blends for home cooking. Regulatory compliance, particularly concerning FDA import standards and food labeling, is a significant determinant of market success. The market structure is less fragmented compared to APAC, dominated by large food corporations and spice houses that control distribution to major retail chains and food service providers, ensuring consistent and large-scale supply.

- Europe: High Standards and Nutraceutical Integration

The European market shows steady and mature growth, particularly in countries with strong baking traditions (Scandinavia) and high interest in natural health products (Germany, UK). European demand for cardamom is highly quality-conscious, with strict regulations concerning pesticide residues, aflatoxins, and heavy metals, pushing suppliers to adopt stringent farming and processing practices. This regulatory environment favors large-scale, certified producers who can consistently meet EU import standards, fostering growth in the certified organic segment.

Key drivers include the strong position of cardamom essential oil in the cosmetics and aromatherapy sectors, capitalizing on the European affinity for natural fragrances and therapeutic applications. Furthermore, the expansion of the nutraceutical industry utilizes cardamom extracts for digestive health and anti-inflammatory formulations. Distribution is managed through highly efficient logistic networks, with major ports serving as hubs for re-export across the continent. Future expansion will rely heavily on innovation in product forms, such as ready-to-use cardamom pastes or liquid extracts, appealing to the convenience-driven consumer base.

- Latin America: The Producer and the Emerging Consumer

Latin America's role in the global cardamom market is dual: it is home to Guatemala, the world's largest exporter of green cardamom, and it represents a modest but growing consumer base. Guatemala's production dominates global supply, significantly influencing international pricing and trade flows. The country benefits from ideal agro-climatic conditions and specialized farming practices, making it a reliable source for high-quality green cardamom demanded by the MEA region. The reliance on this single crop, however, exposes the Guatemalan economy to price volatility and climate risks.

Apart from production, consumption within Latin America is minimal but is slowly increasing due to greater urbanization and the influence of international culinary trends. The strategic focus in this region remains on optimizing export logistics, improving crop yields through sustainable practices, and establishing long-term trade agreements to stabilize export revenues. Technological advancements are focused primarily on post-harvest processing and quality control to maintain Guatemala's competitive edge against Asian producers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cardamom Market.- McCormick & Company

- Archer Daniels Midland Company (ADM)

- Olam International

- DS Group

- Kancor Ingredients Ltd.

- Givaudan SA

- Synthite Industries

- Everest Spices

- Nedspice

- Mountain Rose Herbs

- AGT Foods

- Tropical Agro-Industries

- Cardamom Growers Association

- Vasant Masala

- MDH Spices

- Keya Foods

- Green Earth Products

- Akay Flavours & Aromatics Pvt. Ltd.

- Mane Kancor

- Elburg Global

Frequently Asked Questions

Analyze common user questions about the Cardamom market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the current growth of the global Cardamom Market?

The primary growth drivers are the substantial, non-discretionary demand from the Middle East for traditional beverages like Arabic coffee, coupled with the increasing global adoption of cardamom in the nutraceutical and functional food sectors due to its proven digestive and anti-inflammatory health benefits. The globalization of ethnic cuisine further expands consumption patterns in Western markets, requiring reliable international supply.

Which geographical region dominates the production and trade of high-quality Green Cardamom?

While Asia Pacific (specifically India) is the largest consumer, Guatemala is the world's leading exporter and typically dominates the international trade of high-quality Green Cardamom (Elettaria cardamomum). Guatemala's stable climatic conditions allow for consistent, large-scale production, making it the primary source for major importing regions like the Middle East.

What are the primary restraints affecting market stability and price volatility?

The market faces significant restraints primarily due to its high vulnerability to climate change, including unpredictable rainfall and extreme weather events, which directly impact crop yield and quality. Additionally, high initial capital investment for cultivation and the long maturation period of the plant restrict supply responsiveness, leading to pronounced price volatility in the global commodity exchanges.

How is technology impacting the Cardamom Market value chain?

Technology is significantly impacting the market through the adoption of precision agriculture (AI-driven irrigation and pest management) to stabilize yields and quality. Post-harvest, advanced technologies like Supercritical Fluid Extraction (SFE) are used to produce high-purity essential oils, while blockchain traceability systems are increasingly employed to ensure supply chain transparency and combat fraudulent origin claims.

Beyond culinary uses, which application segment is projected to experience the fastest growth rate?

The Pharmaceuticals and Nutraceuticals application segment is projected to witness the fastest Compound Annual Growth Rate. This growth is driven by increasing clinical validation of cardamom extracts for digestive health supplements and its use in natural formulations, addressing the rising consumer trend toward preventive healthcare and herbal remedies globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Instant Tea Market Size Report By Type (Cardamom Tea Premix, Ginger Tea Premix, Masala Tea Premix, Lemon Tea Premix, Lemon grass Tea Premix, Other Tea Premix), By Application (Supermarkets/Hypermarkets, Specialty Stores, Discount Stores, Convenience Stores, E-commerce, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Cardamom Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Ingredient, Powder, Liquid Extract), By Application (Food and Beverage, Pharmaceuticals, Cardamom Oil, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Cardamom Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Elettaria (Green Cardamom), Amomum (Black Cardamom)), By Application (Food and beverage, Pharmaceuticals, Cardamom oil, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager