Cardboard Sheet Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438275 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Cardboard Sheet Market Size

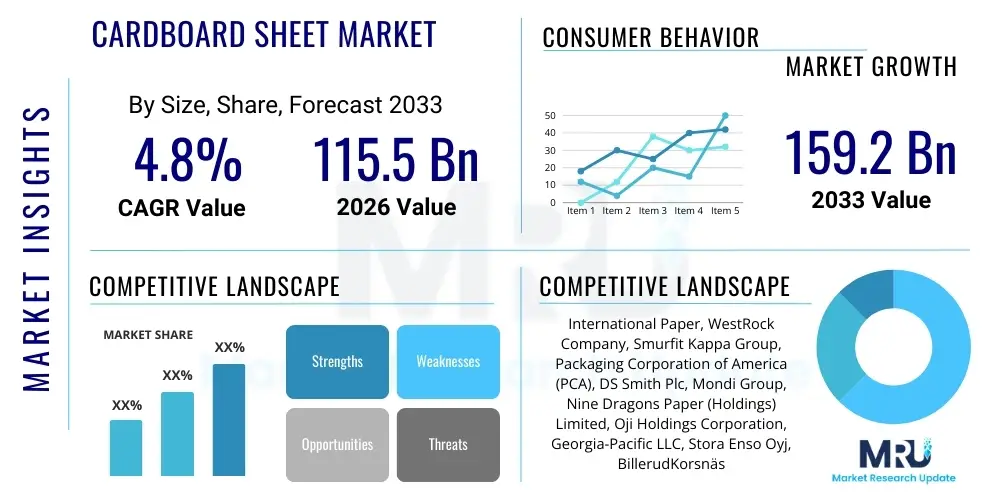

The Cardboard Sheet Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% (CAGR) between 2026 and 2033. The market is estimated at USD 115.5 Billion in 2026 and is projected to reach USD 159.2 Billion by the end of the forecast period in 2033.

Cardboard Sheet Market introduction

The Cardboard Sheet Market encompasses the production, distribution, and consumption of various grades of corrugated and non-corrugated board materials used primarily in packaging, shipping, and protective applications. Cardboard sheets, characterized by their high strength-to-weight ratio and recyclability, are fundamental to modern logistics and supply chains. They are manufactured predominantly from wood pulp and recycled fibers, offering a sustainable alternative to plastic packaging in numerous industrial sectors. Key products range from single-wall sheets for general packaging to multi-ply, heavy-duty sheets designed for transporting sensitive or heavy goods. The versatility and customization options available in terms of thickness, fluting profile, and coating further cement their dominance across diverse end-use verticals.

Major applications of cardboard sheets span retail packaging, e-commerce fulfillment, industrial protection, and display materials. In the rapidly expanding e-commerce sector, cardboard is indispensable for robust transit packaging that must withstand rigorous handling. Furthermore, the rising global emphasis on environmental accountability has amplified the benefits of cardboard, which include excellent biodegradability and an established recycling infrastructure. These benefits are pivotal in driving legislative mandates and corporate sustainability goals aimed at reducing reliance on non-renewable materials. The market's growth is inherently tied to global economic activity, manufacturing output, and consumer spending patterns, especially within emerging economies where infrastructure development necessitates reliable and cost-effective packaging solutions.

Driving factors for sustained market expansion include the exponential rise in online shopping, necessitating durable secondary and tertiary packaging solutions. Additionally, stringent regulatory frameworks promoting sustainable packaging practices compel manufacturers across sectors—from food and beverage to electronics—to adopt fiber-based materials. Technological advancements in corrugating machinery and digital printing capabilities are allowing for higher quality, customized, and brand-differentiating packaging solutions. The continuous innovation in material science, focusing on enhanced moisture resistance and structural integrity, ensures that cardboard sheets remain competitive against alternative packaging substrates.

Cardboard Sheet Market Executive Summary

The Cardboard Sheet Market is experiencing robust expansion driven by pronounced business trends centered on sustainability, supply chain resilience, and the digitalization of retail. Business trends indicate a shift towards lightweight yet high-strength materials, with manufacturers investing heavily in advanced corrugating technology and recycled fiber processing to meet corporate net-zero goals. Consolidation among major players is notable as they seek vertical integration to secure raw material supply (pulp and paperboard) and optimize production efficiency, particularly in high-volume regions. The increasing demand for customized packaging solutions, spurred by direct-to-consumer (D2C) brands, necessitates flexible manufacturing processes and advanced short-run printing capabilities, transforming traditional operational models across the industry.

Regional trends highlight the Asia Pacific (APAC) region as the primary growth engine, fueled by burgeoning manufacturing activity, rapid urbanization, and massive growth in e-commerce markets, especially in China and India. North America and Europe, while mature, are characterized by high per capita consumption and strict environmental regulations that favor premium, certified sustainable cardboard sheets, driving innovation in protective coatings and barrier properties. Latin America and the Middle East & Africa (MEA) represent significant opportunities due to developing infrastructure and increasing industrialization, although these regions often face challenges related to volatile raw material costs and fragmented logistics chains. Localization of production facilities near major consumption hubs is a key strategic regional focus to mitigate transportation costs and improve responsiveness.

Segmentation trends reveal significant growth within the high-performance corrugated board segment, driven by complex industrial packaging requirements and palletizing applications that demand maximum stacking strength. The virgin fiber segment, though smaller, commands premium pricing due to superior aesthetic qualities and suitability for sensitive applications like food contact packaging, where material purity is paramount. Furthermore, the application segmentation shows e-commerce as the fastest-growing end-use sector, consistently outpacing traditional retail and industrial goods. There is a perceptible trend toward integrating smart packaging features, such as RFID tags or QR codes, directly into the cardboard structure to enhance supply chain traceability and consumer interaction, signaling future areas for technological differentiation.

AI Impact Analysis on Cardboard Sheet Market

User inquiries regarding the influence of Artificial Intelligence (AI) on the Cardboard Sheet Market predominantly center on how AI can optimize manufacturing processes, enhance supply chain efficiency, and contribute to material sustainability. Key themes include the implementation of predictive maintenance for corrugating machines, the use of machine learning algorithms to optimize material usage (reducing trim waste), and the potential for demand forecasting models to stabilize volatile inventory levels. Users are particularly concerned about the skills gap required to adopt these technologies and the return on investment (ROI) associated with integrating sophisticated AI platforms into legacy production environments. Expectations focus on AI’s ability to move the industry towards zero-waste manufacturing and hyper-efficient logistical routing, ensuring that the final packaged product is robust, cost-effective, and sustainably produced.

AI deployment is rapidly transforming cardboard sheet manufacturing from a traditional, reactive industry into a proactive, data-driven ecosystem. In the production phase, AI models analyze real-time sensor data from corrugators—monitoring temperature, moisture content, adhesive application, and speed—to prevent equipment failure and maintain precise sheet specifications, significantly improving quality consistency and reducing costly downtime. Furthermore, advanced AI optimization algorithms are crucial in layout and design processes, enabling automated structural integrity testing based on simulated transport conditions, thus reducing the need for extensive physical prototyping and accelerating time-to-market for bespoke packaging solutions.

In the commercial and logistics spheres, AI enhances market responsiveness. Machine learning models predict demand fluctuations with unprecedented accuracy, allowing sheet manufacturers to optimize production schedules and raw material procurement, thereby minimizing warehousing costs and mitigating the risks associated with raw pulp price volatility. This integration also extends to sustainable sourcing, where AI monitors fiber quality and tracks the chain of custody for recycled materials, ensuring compliance with circular economy principles. The overarching impact of AI is to foster an environment of intelligent automation that drives cost efficiency, elevates product quality, and substantially improves the industry's environmental footprint, preparing it for the complexities of modern, integrated global supply chains.

- Predictive maintenance schedules for corrugating and converting machinery, minimizing unplanned downtime and maximizing asset utilization.

- Optimization of material cutting patterns using machine learning to minimize trim waste (zero-waste initiatives), improving yield rate significantly.

- Enhanced demand forecasting and inventory management through AI algorithms analyzing vast sales data and macroeconomic indicators, stabilizing raw material procurement.

- Automated quality control systems utilizing computer vision to detect minor defects, ensuring high sheet integrity and consistency before shipment.

- Intelligent route planning and logistics optimization for timely delivery of sheets to converters, reducing fuel consumption and associated carbon emissions.

- AI-driven personalized design optimization based on product characteristics and shipping environment, creating right-sized, resource-efficient packaging.

- Improved fiber tracking and recycling purity verification, supporting sustainable sourcing and circular economy goals through advanced traceability.

DRO & Impact Forces Of Cardboard Sheet Market

The dynamics of the Cardboard Sheet Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively influencing the competitive landscape and strategic direction. Key drivers include the relentless expansion of global e-commerce, which structurally increases demand for protective and transit packaging, and the powerful governmental and consumer mandates favoring sustainable, recyclable materials over plastics. However, growth is tempered by significant restraints, primarily the volatile pricing and supply chain unpredictability of raw materials, specifically wood pulp and recycled fiber, coupled with rising energy costs essential for operating intensive processes like corrugation and drying. The major opportunities reside in technological advancements, such as developing high-barrier coatings to expand cardboard applicability into sensitive areas like moisture-prone food packaging, and leveraging digitalization for process optimization and supply chain transparency.

Impact forces within the market are predominantly characterized by intense competitive rivalry among established international players and localized manufacturers, necessitating continuous investment in modern, high-speed machinery to maintain cost leadership. The bargaining power of major packaging buyers, particularly large consumer goods companies and mega-retailers, is high, exerting downward pressure on pricing and demanding increasingly complex specifications and rapid fulfillment times. Simultaneously, the bargaining power of pulp suppliers remains moderate to high, as the specialized nature of containerboard and linerboard pulp creates dependency, especially during periods of global supply constraint or trade friction. The threat of substitutes, while present (e.g., reusable plastic crates or flexible plastic films), is mitigated by cardboard's superior cost-effectiveness and inherent sustainability advantages, though innovation in lightweight plastic alternatives requires constant monitoring.

The most compelling opportunities driving long-term strategic planning involve circular economy initiatives and bio-based material innovation. Manufacturers focusing on maximizing the recycled content without compromising performance, or integrating novel bio-coatings to replace conventional plastic laminates, are positioned for premium market penetration. Furthermore, expanding geographical reach into underserved emerging markets, where packaging consumption per capita is rapidly rising, offers substantial revenue diversification. Successfully navigating the raw material volatility through long-term procurement contracts and efficient forward planning, alongside strategic operational scaling, will differentiate market leaders and ensure resilience against macroeconomic shifts.

Segmentation Analysis

Segmentation of the Cardboard Sheet Market provides a nuanced understanding of market dynamics by dissecting the diverse product offerings, material composition, application spectrums, and geographical spread. The fundamental division revolves around material type, distinguishing between containerboard (linerboard and fluting medium used in corrugated structures) and folding boxboard (typically solid board used for primary packaging). Further granularity is achieved by analyzing the grade of board, which ranges from recycled fiber-based materials to virgin fiber products, each catering to distinct quality, strength, and aesthetic requirements. This detailed segmentation is crucial for stakeholders to tailor production capabilities and strategic investments toward the most lucrative and rapidly evolving sectors of the packaging industry, ensuring alignment with specific end-user demands for durability, presentation, and environmental compliance.

The market is also heavily segmented by the specific end-use application, which includes industrial packaging, food and beverage, electronics, health and personal care, and the rapidly accelerating e-commerce sector. The demands placed upon cardboard sheets vary significantly across these applications; industrial uses require maximum burst strength and stacking endurance, whereas food packaging prioritizes barrier protection, hygiene, and low migration risk. Analyzing these segments helps predict future demand trends, as shifts in global retail and manufacturing consumption directly translate into varied requirements for packaging material volume and specification. The increasing complexity of global supply chains requires robust, standardized packaging, boosting demand for highly durable, multi-ply sheets within the industrial and logistics application categories.

Furthermore, segmentation based on printing technology (flexography, lithography, and digital printing) is becoming increasingly relevant, particularly for branding and retail applications. The transition towards high-resolution digital printing on cardboard sheets facilitates customization and short production runs, catering specifically to the needs of small-to-medium enterprises and specialized D2C brands. Geographic segmentation remains critical, reflecting differences in regulatory environments, recycling infrastructure maturity, and localized consumption habits, requiring manufacturers to maintain regionally specific product portfolios and distribution networks to optimize market penetration and profitability across diverse global markets.

- By Material Type:

- Containerboard

- Folding Boxboard (FBB)

- Solid Bleached Sulfate (SBS)

- Recycled Containerboard

- By Flute Type (Corrugated):

- A-Flute

- B-Flute

- C-Flute

- E-Flute

- F-Flute (Micro-flute)

- Double-Wall (BC Flute, EB Flute)

- By Application:

- E-commerce & Logistics Packaging

- Food and Beverage Packaging

- Consumer Durables & Electronics

- Industrial Protective Packaging

- Health and Personal Care Products

- Retail Ready Packaging (RRP) & Displays

- By Printing Technology:

- Flexography

- Lithography (Pre-Print and Post-Print)

- Digital Printing

- Rotogravure

- By Geography:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Cardboard Sheet Market

The value chain for the Cardboard Sheet Market begins with the upstream sourcing of raw materials, primarily virgin wood pulp (hardwood and softwood) and increasingly, high-quality recycled paper and old corrugated containers (OCC). Upstream activities are capital-intensive, focusing on sustainable forestry management, efficient pulping processes, and securing reliable, cost-effective fiber supply, often through integrated mills. The quality and purity of the sourced fiber directly dictate the final performance characteristics, such as burst strength and printability, of the resulting cardboard sheet. Logistical efficiency in transporting massive volumes of raw wood or wastepaper to the mills is a critical success factor in controlling overall production costs, positioning vertically integrated companies at a distinct competitive advantage due to their control over material inputs.

The core manufacturing process involves the paper mill producing large rolls of paperboard (linerboard and fluting medium), followed by the converting stage, where these rolls are processed through corrugators. Corrugators bond the linerboards and fluting medium using specialized adhesives under heat and pressure to create the final cardboard sheets of specified flute profiles (A, B, C, E, etc.). This manufacturing step demands significant energy consumption and precision engineering. The distribution channel then takes over, characterized by both direct sales from large sheet manufacturers to high-volume end-users (e.g., large industrial corporations) and indirect sales through specialized sheet brokers or regional distributors who manage inventory and fulfill smaller, localized orders for packaging converters. The shift towards just-in-time inventory models mandates highly responsive and geographically dispersed distribution networks.

The downstream segment encompasses the subsequent utilization of the cardboard sheets. Direct utilization occurs when industrial companies use the sheets immediately for internal protective padding or palletizing. Indirect utilization is more common, involving independent packaging converters who purchase the sheets and perform secondary processes such as die-cutting, scoring, folding, gluing, and high-quality printing to create finished boxes, displays, or specialized protective inserts tailored to the final consumer product. End-users, ranging from small e-commerce sellers to multinational consumer goods corporations, represent the final buyers. Efficiency throughout the downstream process, particularly the precision of the converting machinery and the sophistication of printing capabilities, adds significant value and differentiates market offerings beyond the basic material commodity.

Cardboard Sheet Market Potential Customers

The primary potential customers and end-users of cardboard sheets span a vast array of industries, driven by the universal need for protective, standardized, and sustainable packaging materials. The largest customer base includes major e-commerce retailers and third-party logistics (3PL) providers, for whom corrugated sheets are foundational for shipping and fulfillment operations, requiring standardized box sizes with robust edge crush test (ECT) ratings to handle complex supply chain stress. Secondly, the food and beverage industry represents a critical segment, utilizing high-quality, often virgin-fiber-based sheets for primary and secondary packaging of fresh produce, processed foods, and beverages, adhering strictly to food safety and hygiene regulations, and often requiring specialized moisture-resistant coatings.

Another significant customer category involves multinational manufacturers of consumer durables and electronics. These sectors demand bespoke packaging solutions that provide shock absorption and precise fitting to protect high-value, sensitive components during transit, often requiring complex die-cut inserts made from multi-ply corrugated sheets. Furthermore, the agricultural sector uses substantial volumes of waxed or coated cardboard sheets designed to endure cold chain logistics and high humidity environments typical of produce harvesting and storage. The demand from these industrial customers often correlates directly with global manufacturing output and consumer technology cycles, making them highly sensitive to macroeconomic indicators.

Lastly, the burgeoning market for retail-ready packaging (RRP) and point-of-sale (POS) displays represents a growing, high-value customer segment. Retailers and brand owners require high-definition printed sheets that serve dual functions: protection during transit and attractive display once unpacked in the store. These customers prioritize aesthetic quality, high graphic fidelity (often achieved through litho-laminated sheets), and ease of assembly. Packaging converters targeting this segment must invest in advanced printing and finishing equipment, differentiating their offerings beyond basic brown box production and serving the highly dynamic, branding-focused demands of modern retail environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 115.5 Billion |

| Market Forecast in 2033 | USD 159.2 Billion |

| Growth Rate | 4.8% ( Include CAGR Word with % Value ) |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | International Paper, WestRock Company, Smurfit Kappa Group, Packaging Corporation of America (PCA), DS Smith Plc, Mondi Group, Nine Dragons Paper (Holdings) Limited, Oji Holdings Corporation, Georgia-Pacific LLC, Stora Enso Oyj, BillerudKorsnäs AB, Rengo Co., Ltd., Pratt Industries, Saica Group, Sonoco Products Company, Shanying International Holdings Co., Ltd., Cascades Inc., Green Bay Packaging, Inc., KapStone Paper and Packaging Corporation, and Atlantic Packaging. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cardboard Sheet Market Key Technology Landscape

The technological landscape of the Cardboard Sheet Market is rapidly evolving, driven by the dual pressures of enhancing structural performance and achieving rigorous sustainability targets. A cornerstone technology remains the corrugator, where advancements focus on high-speed operation (reaching speeds exceeding 400 meters per minute), precise temperature control, and automated glue kitchens that utilize advanced starch-based adhesives for optimal bonding while minimizing moisture introduction. Modern corrugators incorporate sophisticated process control systems and integrated sensors that monitor web tension and warp control in real-time, ensuring uniform sheet quality and reducing waste, which is critical for maintaining profitability in a commodity-driven market. Furthermore, lightweighting technologies are pivotal, involving fiber chemistry optimization and structural design modifications to maintain strength using less material, directly addressing sustainability and cost efficiency demands.

In the converting stage, digital printing technology is fundamentally reshaping how cardboard sheets are finished, moving beyond traditional flexography and lithography for short runs and highly personalized packaging. High-speed, single-pass digital presses allow converters to print high-resolution graphics directly onto corrugated sheets, reducing setup times and inventory costs associated with pre-printed liners, enabling agile response to fluctuating market demands and seasonal promotions. Coupled with advanced die-cutting and folding equipment, often utilizing lasers or high-precision rotary cutters, this technology facilitates the production of complex, intricate packaging designs required by premium and D2C brands. The integration of advanced computer-aided design (CAD) software with manufacturing execution systems (MES) streamlines the entire workflow from concept to final product, minimizing human error and maximizing throughput.

Material innovation represents another key technological frontier. Research and development are intensely focused on developing sustainable, high-barrier coatings to overcome cardboard’s inherent weakness to moisture, grease, and gases. Bio-based and biodegradable barrier coatings derived from materials like starch or specialized polymers are replacing traditional paraffin waxes and plastic laminates, allowing the resulting cardboard sheets to remain fully recyclable and compostable. Furthermore, smart packaging technologies, including near-field communication (NFC) chips, integrated sensors, and printable electronics embedded within the cardboard structure, are being trialed. These technologies enhance supply chain visibility, provide anti-counterfeiting measures, and facilitate direct consumer engagement, significantly elevating the functional value of the basic cardboard substrate and positioning the material at the forefront of the smart logistics evolution.

Regional Highlights

The global Cardboard Sheet Market exhibits significant regional disparities in terms of growth rates, material preference, and regulatory environments, necessitating tailored market entry and operational strategies. North America and Europe, representing mature markets, are characterized by high per capita consumption and stringent environmental regulations that prioritize the use of high-recycled content sheets and certified sustainable forestry sources (e.g., FSC certified pulp). Innovation in these regions centers on advanced printing capabilities for retail displays, structural design optimization for e-commerce efficiency, and pioneering the use of biodegradable barrier coatings. While growth in volume is steady, the focus is predominantly on high-value, specialized segments requiring premium performance and customization, driving investment in state-of-the-art automation within converting facilities.

Conversely, the Asia Pacific (APAC) region is the undisputed powerhouse for volume growth, fueled by immense manufacturing output in countries like China, India, and Vietnam, coupled with the world's most rapidly expanding consumer base and e-commerce penetration. The market in APAC is driven by cost efficiency and sheer volume, although regulatory pressure, particularly in China regarding environmental protection and waste import restrictions, is accelerating the domestic investment in high-quality recycled fiber processing infrastructure and modern, efficient mills. This rapid infrastructure development ensures that APAC will not only dominate consumption but also increasingly lead in production capacity, often focusing on standard, high-volume B/C-flute corrugated sheets essential for export goods and domestic delivery logistics.

Latin America (LATAM) and the Middle East & Africa (MEA) represent significant emerging market opportunities. LATAM’s market growth is highly influenced by agricultural exports, requiring specialized, durable sheets for packaging perishable goods, while MEA is benefiting from diversification away from oil economies, leading to increased industrialization and infrastructural development, boosting localized demand for basic and standard packaging. Challenges in these regions include securing consistent, high-quality local raw material supply and navigating complex, often less-developed, logistics networks. Strategic expansion here often involves establishing joint ventures or localized production hubs to mitigate import costs and provide responsive service to fast-growing local consumer markets and developing industrial sectors.

- Asia Pacific (APAC): Dominant market share by volume, driven by massive e-commerce growth (China, India) and manufacturing output. Focus on establishing domestic recycled pulp capabilities and high-volume, cost-competitive production.

- North America: Mature market characterized by high consumption of specialized packaging; emphasis on high-performance sheets (ECT ratings) for complex logistics and sustainable sourcing mandates.

- Europe: Highly regulated market with a strong push for circular economy principles; significant demand for packaging made from 100% recycled fibers and bio-based barrier technologies, driving premium segment growth.

- Latin America (LATAM): Growth tied to agricultural exports and increasing urbanization; focused on moisture-resistant packaging for perishable goods and optimizing supply chains.

- Middle East and Africa (MEA): Emerging growth hub, boosted by infrastructural projects and rising consumerism, with increasing localized manufacturing driving demand for industrial and standard corrugated sheets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cardboard Sheet Market.- International Paper

- WestRock Company

- Smurfit Kappa Group

- Packaging Corporation of America (PCA)

- DS Smith Plc

- Mondi Group

- Nine Dragons Paper (Holdings) Limited

- Oji Holdings Corporation

- Georgia-Pacific LLC

- Stora Enso Oyj

- BillerudKorsnäs AB

- Rengo Co., Ltd.

- Pratt Industries

- Saica Group

- Sonoco Products Company

- Shanying International Holdings Co., Ltd.

- Cascades Inc.

- Green Bay Packaging, Inc.

- KapStone Paper and Packaging Corporation (A WestRock Company)

- Atlantic Packaging

Frequently Asked Questions

Analyze common user questions about the Cardboard Sheet market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Cardboard Sheet Market?

The exponential rise in global e-commerce activity is the primary growth driver. E-commerce necessitates standardized, durable, and lightweight transit packaging, increasing the demand for high-performance corrugated sheets globally to protect goods throughout complex supply chains.

How is sustainability impacting the selection of cardboard sheet materials?

Sustainability mandates are shifting demand toward high-recycled content boards and certified virgin fibers (FSC/PEFC). Consumer and regulatory pressure forces end-users to prefer easily recyclable cardboard over non-recyclable plastic packaging, prioritizing materials with optimized life cycle assessments.

What is the difference between Linerboard and Fluting Medium in corrugated sheets?

Linerboard forms the flat outer facings of the corrugated sheet, providing structural rigidity and a printable surface. Fluting medium (the wavy layer) is bonded between the liners, providing cushioning and compression resistance (ECT value), which is crucial for stacking strength.

Which geographical region holds the largest potential for future market growth?

The Asia Pacific (APAC) region, specifically emerging economies like China and India, holds the largest potential for market growth. This is due to rapidly industrializing infrastructure, massive domestic consumer bases, and unprecedented expansion in local e-commerce and manufacturing sectors.

How are AI and automation technologies being utilized in cardboard sheet manufacturing?

AI is primarily used for predictive maintenance on corrugators, optimizing material cutting patterns to minimize trim waste, and improving complex demand forecasting models. Automation ensures high-speed, consistent quality production and enhances efficiency in high-volume converting processes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager