Cardiac Care Medical Equipment Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439320 | Date : Jan, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Cardiac Care Medical Equipment Market Size

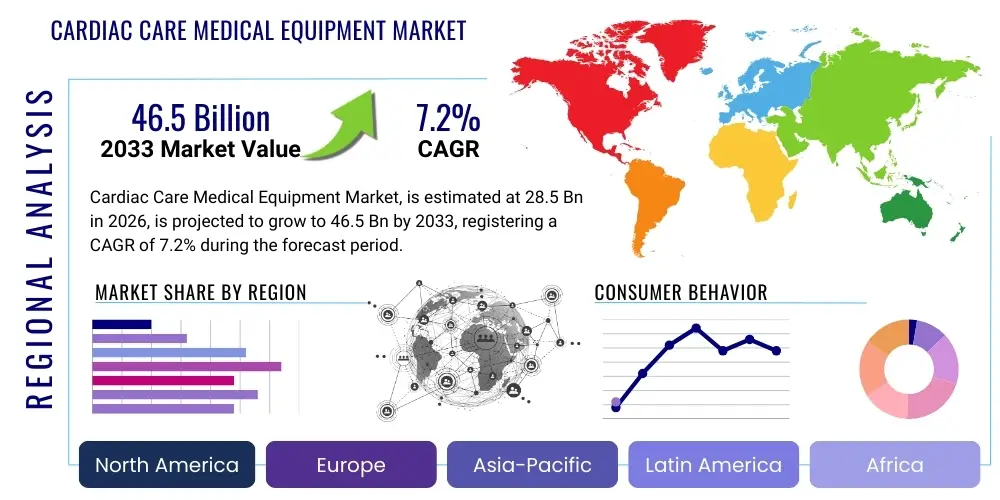

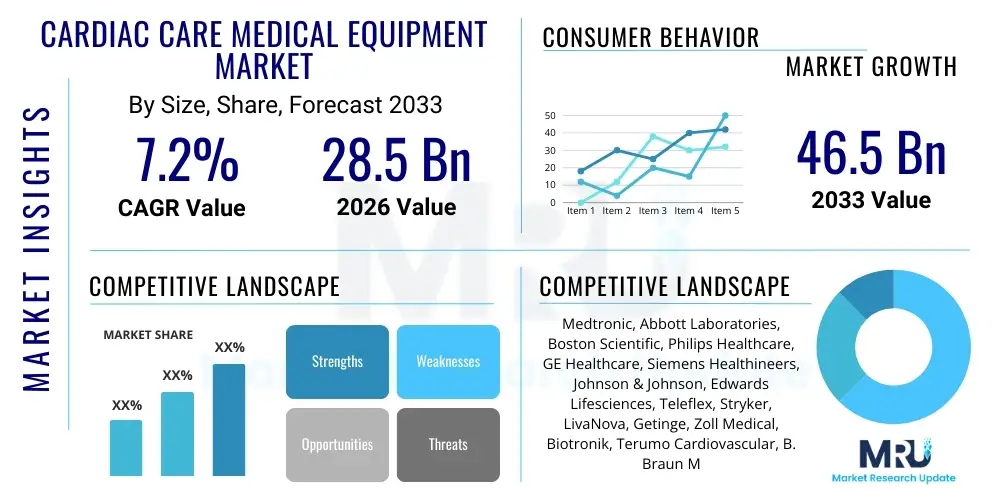

The Cardiac Care Medical Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% between 2026 and 2033. The market is estimated at USD 28.5 Billion in 2026 and is projected to reach USD 46.5 Billion by the end of the forecast period in 2033.

Cardiac Care Medical Equipment Market introduction

The Cardiac Care Medical Equipment Market encompasses a broad spectrum of devices and technologies designed for the diagnosis, monitoring, and treatment of various cardiovascular diseases (CVDs). This critical sector of healthcare plays a pivotal role in improving patient outcomes, extending life expectancy, and enhancing the quality of life for individuals suffering from conditions such as coronary artery disease, heart failure, arrhythmias, and structural heart defects. The continuous evolution of medical science and engineering has led to the development of sophisticated equipment ranging from basic diagnostic tools to advanced therapeutic implants, driving significant advancements in cardiac care delivery worldwide.

Products within this market are diverse, including electrophysiology devices, interventional cardiology devices, diagnostic and monitoring devices, and surgical instruments. Key product categories include electrocardiographs (ECGs), echocardiography systems, cardiac catheterization labs, pacemakers, defibrillators, heart-lung machines, and various stents and valves. These devices are utilized across different healthcare settings, from primary care clinics for initial screenings to highly specialized cardiac surgery units for complex interventions. The primary applications involve early detection of cardiac anomalies, precise diagnosis of specific conditions, continuous monitoring of cardiac function, and effective treatment through minimally invasive procedures or open-heart surgery.

The benefits derived from cardiac care medical equipment are profound, offering improved diagnostic accuracy, reduced invasiveness of procedures, faster recovery times, and ultimately, better prognosis for patients. Driving factors for market growth are numerous and include the escalating global prevalence of cardiovascular diseases, largely attributed to sedentary lifestyles, unhealthy dietary habits, and an aging population. Furthermore, significant technological advancements, increasing healthcare expenditure in developing economies, growing awareness about early diagnosis, and favorable government initiatives promoting heart health are all contributing to the expansion of this vital market.

Cardiac Care Medical Equipment Market Executive Summary

The Cardiac Care Medical Equipment Market is currently experiencing robust growth, propelled by a confluence of factors including an aging global demographic, a rising incidence of chronic cardiovascular conditions, and continuous innovation in medical technology. Business trends indicate a strong emphasis on research and development to introduce more compact, portable, and AI-enabled devices that offer enhanced diagnostic precision and therapeutic efficacy. Key market players are increasingly focusing on strategic collaborations, mergers, and acquisitions to expand their product portfolios, strengthen their market presence, and penetrate emerging markets. The shift towards value-based care and personalized medicine is also shaping business strategies, prompting manufacturers to develop cost-effective yet highly advanced solutions that cater to individual patient needs and improve overall healthcare system efficiency.

Regional trends reveal that North America and Europe currently dominate the market due to well-established healthcare infrastructures, high healthcare spending, and early adoption of advanced medical technologies. However, the Asia Pacific region is anticipated to exhibit the fastest growth rate over the forecast period, driven by its large and aging population, increasing prevalence of CVDs, improving healthcare access, and rising disposable incomes. Latin America, the Middle East, and Africa are also showing promising growth, albeit from a smaller base, as these regions invest more in healthcare infrastructure development and experience a growing demand for sophisticated cardiac care solutions. Government support for healthcare reforms and efforts to reduce the burden of NCDs are also instrumental in fostering regional market expansion.

Segmentation trends highlight the increasing demand for interventional cardiology devices, such as cardiac catheters and stents, owing to the growing preference for minimally invasive procedures. Diagnostic and monitoring devices, particularly those integrating remote monitoring capabilities and artificial intelligence for better interpretation, are also experiencing significant uptake. The end-user segment sees hospitals and specialized cardiac centers as the largest consumers, but ambulatory surgical centers and home care settings are emerging as crucial growth avenues due to their focus on cost-effectiveness and patient convenience. Technological advancements are continually blurring the lines between diagnostic and therapeutic devices, leading to integrated solutions that streamline patient care pathways and improve clinical workflow efficiency.

AI Impact Analysis on Cardiac Care Medical Equipment Market

The integration of Artificial Intelligence (AI) into the Cardiac Care Medical Equipment Market is transforming every facet of cardiovascular diagnostics, treatment, and patient management. Users frequently inquire about AI's capability to enhance diagnostic accuracy, reduce human error, and personalize treatment protocols. There's a keen interest in how AI can automate routine tasks, analyze vast datasets from patient monitors and imaging devices, and predict patient deterioration, thereby improving clinical workflow and potentially preventing adverse cardiac events. Concerns often revolve around data privacy, regulatory hurdles for AI-powered devices, the cost implications of AI integration, and the need for robust validation to ensure reliability and safety in critical cardiac applications. Expectations are high for AI to usher in an era of more proactive, precise, and accessible cardiac care, revolutionizing how cardiovascular diseases are detected, managed, and ultimately prevented.

- Enhanced Diagnostic Accuracy: AI algorithms improve the interpretation of ECGs, echocardiograms, and cardiac MRIs, detecting subtle patterns indicative of disease often missed by the human eye, leading to earlier and more accurate diagnoses.

- Predictive Analytics: AI models can analyze real-time patient data from wearable devices and hospital monitors to predict the likelihood of cardiac events like arrhythmias or heart attacks, enabling timely interventions.

- Personalized Treatment Plans: By processing individual patient data, AI assists clinicians in tailoring treatment strategies, drug dosages, and lifestyle recommendations for optimal outcomes, moving towards precision cardiology.

- Improved Workflow Efficiency: AI automates mundane tasks such as data entry, report generation, and image segmentation, freeing up cardiologists and technicians to focus on complex cases and direct patient care.

- Drug Discovery and Development: AI accelerates the identification of potential drug targets, streamlines clinical trials, and predicts drug efficacy and safety profiles for novel cardiovascular therapies.

- Remote Monitoring and Telemedicine: AI-powered devices facilitate continuous remote monitoring of cardiac patients, providing clinicians with actionable insights and enabling timely virtual consultations, particularly beneficial for rural or underserved populations.

- Robotics in Surgery: AI guides robotic systems during minimally invasive cardiac surgeries, enhancing precision, reducing tremor, and potentially improving surgical outcomes and patient recovery times.

DRO & Impact Forces Of Cardiac Care Medical Equipment Market

The Cardiac Care Medical Equipment Market is driven by several powerful forces. A primary driver is the accelerating global prevalence of cardiovascular diseases (CVDs), fueled by an aging population, sedentary lifestyles, obesity, and diabetes, which significantly increase the demand for diagnostic and therapeutic devices. Furthermore, continuous technological advancements, including the development of minimally invasive surgical techniques, smart monitoring devices, and AI-powered diagnostic tools, are expanding the capabilities and appeal of modern cardiac care. Growing awareness among both patients and healthcare providers about the benefits of early diagnosis and proactive disease management also contributes substantially to market expansion, alongside increasing healthcare expenditure, particularly in emerging economies that are rapidly upgrading their medical infrastructure and access to advanced treatments.

However, the market faces several significant restraints. The high cost associated with advanced cardiac care equipment and procedures often limits accessibility, especially in resource-constrained settings or for uninsured populations, posing a challenge for wider adoption. Stringent regulatory approval processes for new devices, designed to ensure patient safety and efficacy, can delay market entry and increase development costs for manufacturers. Moreover, a critical shortage of skilled healthcare professionals, including cardiologists, electrophysiologists, and cardiac surgeons, capable of operating and interpreting complex equipment, hinders optimal utilization and market growth. Reimbursement challenges and varying healthcare policies across different regions also create uncertainties for manufacturers and providers, impacting investment decisions and market penetration.

Despite these restraints, numerous opportunities abound for growth and innovation. Emerging markets in Asia Pacific, Latin America, and Africa present vast untapped potential as their healthcare systems mature and populations gain access to better care, creating a significant demand for advanced cardiac equipment. The advent of telehealth and remote monitoring solutions offers a new frontier for continuous patient management and data collection, particularly appealing in a post-pandemic world. Personalized medicine, driven by genetic insights and real-time patient data, opens avenues for highly tailored cardiac treatments, while the ongoing integration of artificial intelligence and machine learning into diagnostics and therapeutics promises to revolutionize precision and efficiency. These opportunities encourage strategic investments, technological breakthroughs, and novel service delivery models that can overcome existing barriers and redefine the future of cardiac care.

Segmentation Analysis

The Cardiac Care Medical Equipment Market is intricately segmented based on various factors, including the type of product, the application area, and the end-user, to provide a comprehensive understanding of its diverse landscape. This segmentation allows for a detailed analysis of market dynamics, growth drivers, and opportunities within specific niches, reflecting the specialized nature of cardiac diagnostics and therapeutics. Understanding these segments is crucial for stakeholders, including manufacturers, healthcare providers, and investors, to identify key trends, tailor product development, and strategize market entry or expansion in this rapidly evolving healthcare sector. Each segment caters to distinct clinical needs and technological advancements, collectively forming the expansive market for cardiovascular care solutions.

- By Product Type

- Diagnostic and Monitoring Devices

- Electrocardiograph (ECG) Systems

- Echocardiography Systems (Ultrasound)

- Stress Testing Systems

- Holter Monitors and Event Recorders

- Cardiac Biomarker Test Kits

- Cardiac PET/CT and MRI Systems

- Pulse Oximeters

- Cardiac Output Monitors

- Therapeutic Devices

- Defibrillators (External and Implantable)

- Pacemakers (Permanent and Temporary)

- Cardiac Resynchronization Therapy (CRT) Devices

- Ablation Devices (RF, Cryoablation)

- Cardiac Catheters (Diagnostic and Interventional)

- Stents (Drug-Eluting and Bare-Metal)

- Artificial Heart Valves (Mechanical and Tissue)

- Vascular Grafts

- Heart-Lung Machines (Cardiopulmonary Bypass)

- Ventricular Assist Devices (VADs)

- Transcatheter Aortic Valve Replacement (TAVR) Devices

- Diagnostic and Monitoring Devices

- By Application

- Coronary Artery Disease (CAD)

- Heart Failure

- Arrhythmias

- Peripheral Artery Disease (PAD)

- Hypertension

- Congenital Heart Defects

- Valvular Heart Disease

- Cardiomyopathy

- By End User

- Hospitals

- Cardiac Centers

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics

- Diagnostic Centers

- Home Care Settings

- Research and Academic Institutions

Value Chain Analysis For Cardiac Care Medical Equipment Market

The value chain for the Cardiac Care Medical Equipment Market is complex and multi-layered, beginning with raw material suppliers and extending to the end-users. Upstream activities involve the sourcing of specialized components, high-grade metals, plastics, and electronic modules from various vendors, along with intellectual property development through extensive research and development. Manufacturers then transform these raw materials and innovative designs into finished medical devices, often requiring sophisticated manufacturing processes, rigorous quality control, and substantial capital investment in R&D and production facilities. This phase is critical as it determines the quality, efficacy, and regulatory compliance of the final product, directly impacting patient safety and clinical outcomes.

Midstream activities focus on the distribution and logistics of these specialized devices. This includes warehousing, inventory management, and transportation to ensure products reach healthcare facilities efficiently and safely. Regulatory compliance, including adherence to FDA, CE, and other regional medical device regulations, is paramount throughout this stage. Companies often employ a mix of direct and indirect distribution channels. Direct sales forces are typically used for high-value, technologically complex equipment that requires significant installation, training, and ongoing technical support. This allows manufacturers to maintain direct relationships with key opinion leaders and large hospital networks, fostering product adoption and loyalty.

Downstream activities involve the direct delivery and utilization of cardiac care equipment by end-users, primarily hospitals, cardiac centers, and ambulatory surgical centers. Indirect channels often involve distributors, wholesalers, and group purchasing organizations (GPOs) that facilitate broader market access, particularly for less complex or more widely used consumables and smaller devices. These intermediaries play a crucial role in reaching smaller clinics and a wider geographical spread, offering logistical advantages and local market expertise. Post-sales services, including maintenance, repairs, upgrades, and technical support, form a critical part of the downstream value chain, ensuring the longevity and optimal performance of the equipment, and contributing significantly to customer satisfaction and repeat business.

Cardiac Care Medical Equipment Market Potential Customers

The primary potential customers for cardiac care medical equipment are diverse, encompassing a wide range of healthcare entities and professionals who directly engage in the diagnosis, monitoring, and treatment of cardiovascular diseases. Hospitals, particularly those with dedicated cardiology departments and cardiac surgery units, represent the largest segment of end-users. These institutions require a full spectrum of equipment, from advanced diagnostic imaging systems like echocardiography and cardiac MRI to interventional cardiology devices such as catheterization labs, and therapeutic implants including pacemakers, defibrillators, and heart-lung machines for complex surgeries. Their extensive patient load, comprehensive service offerings, and capacity for advanced procedures make them central to the market's demand.

Specialized cardiac centers and clinics, often standalone facilities or units within larger healthcare systems, constitute another significant customer base. These centers focus exclusively on cardiovascular care, offering specialized diagnostic services, outpatient procedures, and post-operative follow-up. They typically invest in high-precision diagnostic equipment, electrophysiology labs, and devices for minimally invasive interventions. The increasing trend towards outpatient care and specialized clinics, driven by efficiency and cost-effectiveness, positions these centers as rapidly growing consumers of advanced and specialized cardiac care technology. Their demand often leans towards sophisticated yet efficient equipment that supports a high volume of specialized procedures.

Furthermore, ambulatory surgical centers (ASCs) are emerging as crucial potential customers, especially for less invasive cardiac procedures and device implantations that do not require an overnight hospital stay. These facilities prioritize quick patient turnover, cost-efficiency, and a focused procedural environment. Diagnostic imaging centers, which provide specialized non-invasive diagnostic services, also form a critical customer segment, purchasing equipment like ECGs, Holter monitors, and stress testing systems. Lastly, home care settings are increasingly becoming important, driven by the rise of remote patient monitoring and telehealth. This segment requires portable, user-friendly, and connected devices for continuous monitoring of vital signs and cardiac rhythms, reflecting a shift towards patient-centric and decentralized care models.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 28.5 Billion |

| Market Forecast in 2033 | USD 46.5 Billion |

| Growth Rate | 7.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Medtronic, Abbott Laboratories, Boston Scientific, Philips Healthcare, GE Healthcare, Siemens Healthineers, Johnson & Johnson, Edwards Lifesciences, Teleflex, Stryker, LivaNova, Getinge, Zoll Medical, Biotronik, Terumo Cardiovascular, B. Braun Melsungen, Cook Medical, CryoLife, Canon Medical Systems, Fujifilm Holdings |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cardiac Care Medical Equipment Market Key Technology Landscape

The technological landscape of the Cardiac Care Medical Equipment Market is characterized by rapid innovation, driven by the demand for more precise diagnostics, less invasive treatments, and continuous, personalized patient monitoring. Advanced imaging technologies form a cornerstone, with developments in 3D/4D echocardiography offering real-time, high-resolution visualization of cardiac structures, and cardiac MRI/CT providing detailed anatomical and functional information crucial for complex procedural planning. These advancements significantly enhance diagnostic accuracy and guide interventional cardiologists and surgeons with unprecedented clarity. The ongoing miniaturization of devices allows for less invasive procedures, reducing recovery times and improving patient comfort, marking a significant shift in surgical approaches.

In the realm of therapeutic devices, there's a strong emphasis on smart implants and robotic-assisted systems. Smart pacemakers and implantable cardioverter-defibrillators (ICDs) now feature advanced algorithms for arrhythmia detection, remote monitoring capabilities, and adaptive therapies that respond to the patient's physiological needs. Robotics and navigation systems are increasingly being used in complex interventional procedures, such as catheter ablations and structural heart repairs, offering enhanced precision, stability, and control, thereby minimizing risks and improving outcomes. Drug-eluting stents and bioresorbable scaffolds represent another crucial area, designed to reduce restenosis rates and improve long-term vascular health, continuously evolving with new material science and drug delivery mechanisms.

Connectivity and artificial intelligence (AI) are perhaps the most transformative technologies reshaping the market. Wearable cardiac monitors, remote patient monitoring platforms, and telecardiology solutions leveraging IoT (Internet of Things) enable continuous data collection and transmission, allowing healthcare providers to track patient health proactively and intervene promptly. AI and machine learning algorithms are being integrated into diagnostic software to interpret ECGs, analyze medical images, and predict cardiac events with greater accuracy and speed. This not only streamlines clinical workflows but also facilitates personalized medicine by identifying individual patient risk factors and optimizing treatment plans. These interconnected technologies promise to usher in an era of predictive, preventive, and highly personalized cardiac care.

Regional Highlights

The global Cardiac Care Medical Equipment Market exhibits diverse growth patterns across different geographical regions, influenced by varying healthcare infrastructures, disease prevalence, economic conditions, and regulatory frameworks. Each region presents unique opportunities and challenges for market participants, necessitating tailored strategies for market penetration and expansion. Understanding these regional nuances is essential for effective business development and investment decisions within the cardiovascular healthcare sector, as it allows for the identification of high-growth areas and the allocation of resources to optimize market presence.

- North America: Dominates the market due to high prevalence of CVDs, advanced healthcare infrastructure, significant healthcare spending, rapid adoption of new technologies, and presence of major market players. The U.S. leads in R&D and innovative product launches.

- Europe: A mature market characterized by well-established healthcare systems, an aging population, and a strong focus on clinical research and technological integration. Germany, France, and the UK are key contributors to market growth.

- Asia Pacific (APAC): Expected to be the fastest-growing region, driven by a large and aging population, increasing disposable income, improving healthcare access, growing medical tourism, and rising awareness about cardiac health in countries like China, India, and Japan.

- Latin America: Showing steady growth, propelled by increasing healthcare investments, a rising burden of CVDs, and expanding access to advanced medical treatments. Brazil and Mexico are key markets in this region.

- Middle East and Africa (MEA): Emerging markets with significant growth potential, attributed to improving healthcare infrastructure, increasing government expenditure on healthcare, and a rising demand for specialized cardiac care facilities, particularly in Gulf Cooperation Council (GCC) countries and South Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cardiac Care Medical Equipment Market.- Medtronic

- Abbott Laboratories

- Boston Scientific Corporation

- Philips Healthcare

- GE Healthcare

- Siemens Healthineers AG

- Johnson & Johnson (Abiomed)

- Edwards Lifesciences Corporation

- Teleflex Incorporated

- Stryker Corporation

- LivaNova PLC

- Getinge AB

- Zoll Medical Corporation (Asahi Kasei)

- Biotronik SE & Co. KG

- Terumo Cardiovascular Systems Corporation

- B. Braun Melsungen AG

- Cook Medical LLC

- CryoLife, Inc.

- Canon Medical Systems Corporation

- Fujifilm Holdings Corporation

Frequently Asked Questions

What is the current market size and projected growth of the Cardiac Care Medical Equipment Market?

The Cardiac Care Medical Equipment Market is estimated at USD 28.5 Billion in 2026 and is projected to reach USD 46.5 Billion by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of 7.2%. This growth is primarily driven by the increasing global prevalence of cardiovascular diseases and continuous technological advancements in diagnostic and therapeutic devices.

What are the key drivers fueling the growth of the Cardiac Care Medical Equipment Market?

Key drivers include the rising global incidence of cardiovascular diseases due to aging populations and lifestyle changes, significant technological advancements leading to more effective and less invasive treatments, increasing awareness among patients and healthcare providers about early diagnosis, and growing healthcare expenditure, particularly in emerging economies.

Which geographical region is expected to lead market growth?

While North America currently dominates the market, the Asia Pacific (APAC) region is projected to exhibit the fastest growth rate during the forecast period. This acceleration is attributed to its large and aging population, increasing prevalence of CVDs, improving healthcare infrastructure, and rising disposable incomes in countries like China and India.

How is Artificial Intelligence (AI) impacting the Cardiac Care Medical Equipment Market?

AI is profoundly impacting the market by enhancing diagnostic accuracy through advanced image analysis, enabling predictive analytics for early detection of cardiac events, facilitating personalized treatment plans, improving workflow efficiency in clinical settings, and advancing remote patient monitoring capabilities. It is transforming cardiac care towards more precise and proactive approaches.

What are the primary challenges or restraints faced by the Cardiac Care Medical Equipment Market?

The market faces challenges such as the high cost of advanced cardiac equipment and procedures, stringent regulatory approval processes that delay product launches, a persistent shortage of skilled healthcare professionals to operate complex devices, and varying reimbursement policies that create financial hurdles for adoption and market penetration.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager