Cardiac Cath Lab Equipment and Consumable Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437378 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Cardiac Cath Lab Equipment and Consumable Market Size

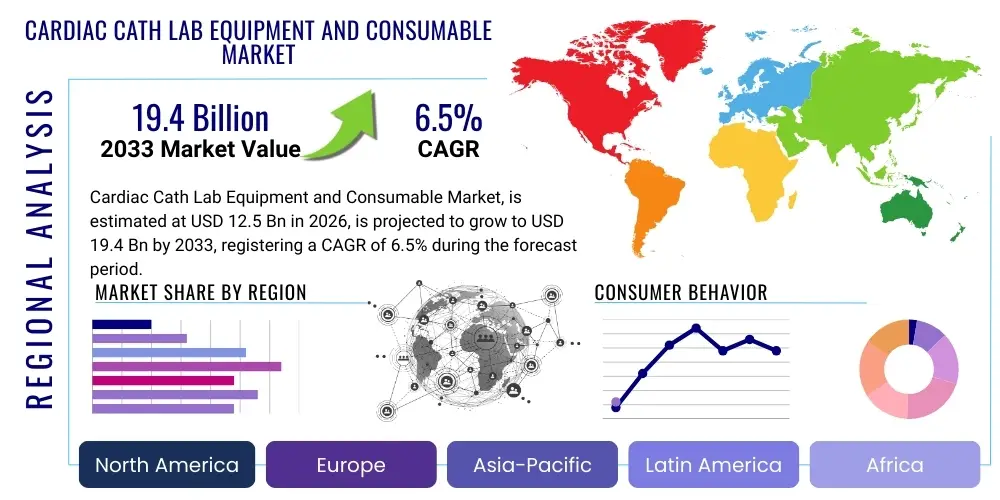

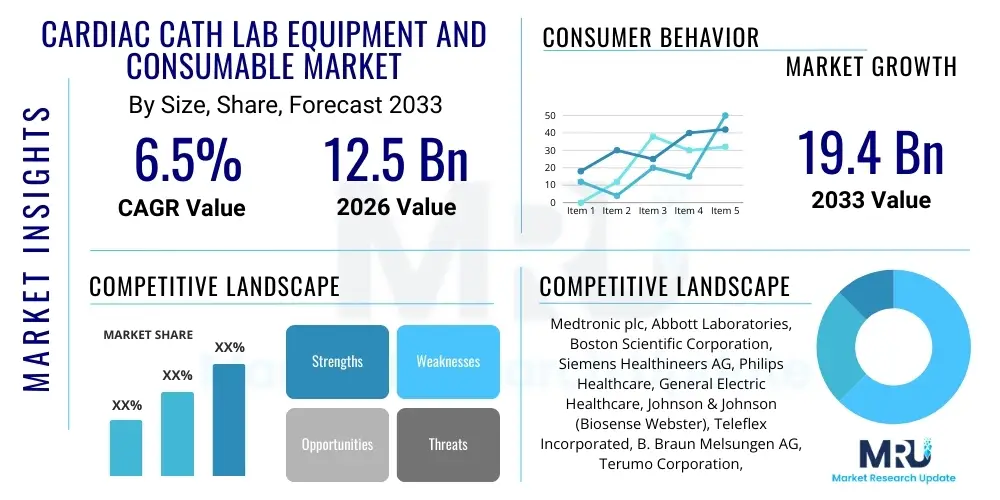

The Cardiac Cath Lab Equipment and Consumable Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 12.5 Billion in 2026 and is projected to reach USD 19.4 Billion by the end of the forecast period in 2033.

Cardiac Cath Lab Equipment and Consumable Market introduction

The Cardiac Catheterization Laboratory (Cath Lab) equipment and consumables market encompasses a sophisticated array of specialized medical devices, high-definition diagnostic imaging systems, and essential single-use supplies critical for performing minimally invasive interventional cardiology procedures. This sector provides the necessary technological infrastructure—including advanced angiography systems, hemodynamic monitoring stations, Intravascular Ultrasound (IVUS), and Optical Coherence Tomography (OCT) devices—that allows clinicians to accurately visualize coronary anatomy, diagnose structural heart defects, and measure physiological parameters in real-time. The core purpose of these technologies is the efficient and safe diagnosis and treatment of conditions such as Coronary Artery Disease (CAD), arrhythmias, and peripheral vascular diseases via procedures like Percutaneous Coronary Intervention (PCI), stenting, and specialized ablations. Continuous advancements focusing on improving image resolution while reducing patient and operator radiation exposure are key factors driving the modernization and replacement cycles for capital equipment.

The consumables segment forms the operational backbone of the cath lab, driving high-volume, recurring revenue streams due to the nature of interventional procedures requiring sterile, single-use items. This includes fundamental components like diagnostic and guiding catheters, specialized guidewires, angioplasty balloons, coronary stents (ranging from bare-metal to sophisticated drug-eluting varieties), and vascular closure devices designed to minimize recovery time post-procedure. The relentless pursuit of better clinical outcomes has fueled innovation in consumables, leading to the proliferation of next-generation drug-eluting stents (DES) featuring bioabsorbable polymers and anti-thrombotic coatings. These innovations significantly enhance long-term vessel patency and reduce the incidence of restenosis and thrombosis, making premium consumables indispensable for complex cardiac interventions.

Market expansion is fundamentally driven by the escalating global prevalence of cardiovascular diseases (CVDs), which remain the leading cause of mortality worldwide, alongside the demographic trend of an aging population particularly susceptible to these conditions. The market benefits significantly from the widespread adoption of minimally invasive techniques, which are preferred over traditional open-heart surgery due to reduced patient trauma, shorter hospital stays, and quicker overall recovery times. Furthermore, increased healthcare expenditure in rapidly developing economies, coupled with favorable reimbursement structures in established markets for complex procedures like Transcatheter Aortic Valve Replacement (TAVR) and sophisticated PCI, ensures sustained investment in cath lab infrastructure and continual demand for specialized consumables.

Cardiac Cath Lab Equipment and Consumable Market Executive Summary

The Cardiac Cath Lab Equipment and Consumable Market demonstrates robust growth, primarily fueled by the accelerating rate of interventional cardiology procedures worldwide and substantial technological migration toward advanced imaging modalities and specialized structural heart intervention tools. Business trends highlight intense competition among established medical device manufacturers, particularly in the consumables segment where differentiation is achieved through superior stent design, bioabsorbable materials, and specialized catheter systems for complex anatomies. Mergers and acquisitions remain a pivotal strategy for market leaders to consolidate product portfolios, secure distribution channels, and integrate advanced diagnostic capabilities like Fractional Flow Reserve (FFR) and Instantaneous Wave-free Ratio (iFR) into existing angiography platforms. Furthermore, the market is experiencing a shift towards hybrid operating rooms (ORs), which integrate advanced cath lab imaging with surgical capabilities, driving demand for flexible, high-capacity imaging systems.

Regionally, North America maintains its dominance due to high procedural volumes, established healthcare spending, rapid adoption of cutting-edge technology, and favorable reimbursement landscapes, particularly in the United States. However, the Asia Pacific (APAC) region is poised to exhibit the highest growth rate, driven by massive investments in public and private healthcare infrastructure, increasing prevalence of lifestyle-related CVDs, and growing access to specialized cardiac care in large economies like China and India. European markets, characterized by stringent regulatory environments, focus on adopting integrated systems that optimize workflow and reduce radiation exposure, balancing clinical efficacy with cost-effectiveness through centralized procurement models.

Segment trends underscore the criticality of the consumables segment, which accounts for the majority revenue share and is experiencing rapid innovation, especially in drug-eluting stent (DES) technology and novel specialized guidewires designed for chronic total occlusion (CTO) procedures. Within equipment, the hybrid angiography systems segment shows the strongest expansion, reflecting the institutional need for multipurpose procedural environments. The end-user analysis reveals that specialized cardiac centers and large hospitals remain the primary revenue generators, although ambulatory surgical centers (ASCs) are beginning to expand their procedural scope, selectively adopting specific cath lab technologies for less complex, high-volume interventions.

AI Impact Analysis on Cardiac Cath Lab Equipment and Consumable Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Cardiac Cath Lab market primarily revolve around three key themes: how AI can enhance diagnostic accuracy and procedural planning, its role in improving efficiency and reducing procedural time, and concerns regarding data security and regulatory approval for AI-driven clinical tools. Users frequently ask about AI's potential in automated lesion detection via angiography, real-time assessment of plaque vulnerability using OCT/IVUS data, and optimizing stent sizing and placement. Furthermore, operational questions focus on utilizing AI for predictive maintenance of capital equipment and improving cath lab workflow management, scheduling, and inventory control. The general expectation is that AI will transition the cath lab environment from reactive decision-making to predictive interventional strategy, ensuring superior and highly personalized patient outcomes while simultaneously addressing the critical issues of reducing variability and improving utilization rates.

The integration of AI algorithms into cardiac cath lab equipment promises a significant paradigm shift, enhancing the capability of diagnostic imaging systems and streamlining complex interventional processes. AI-powered image analysis can offer instant quantification of coronary stenosis severity, automate the measurement of complex anatomical structures, and predict patient-specific procedural risks, thereby significantly augmenting the capabilities of interventional cardiologists. This analytical layer enables more precise treatment decisions, such as determining the necessity for stenting versus medical therapy, based on automated interpretation of FFR and iFR measurements alongside angiographic data. The adoption of AI is expected to increase the efficiency of consumables usage by minimizing errors in sizing and selection, potentially lowering waste and improving the overall cost-effectiveness of procedures, which is critical for healthcare providers focused on value-based care.

For equipment manufacturers, integrating AI represents a crucial competitive differentiator, moving beyond traditional hardware improvements to offer smart systems that enhance procedural safety and throughput. AI is also instrumental in optimizing radiation dose management, automatically adjusting imaging parameters based on real-time feedback, thus protecting both patients and staff. However, successful market penetration requires robust validation of clinical efficacy, seamless integration with existing Picture Archiving and Communication Systems (PACS), and navigating stringent regulatory pathways, especially for algorithms intended to directly inform treatment decisions. The ethical considerations and the need for explainable AI (XAI) in clinical settings remain important factors influencing adoption rates in the short term.

- AI enhances diagnostic accuracy by automating quantitative coronary angiography (QCA) measurements.

- Real-time procedural guidance is optimized through AI interpretation of IVUS and OCT images for plaque characterization.

- Workflow efficiency improves via AI-driven scheduling, patient prioritization, and inventory management systems.

- Predictive maintenance algorithms reduce equipment downtime and operational costs for capital machinery.

- AI assists in optimal sizing and placement of stents, reducing the risk of procedural complications and improving long-term outcomes.

- Radiation dose reduction is achieved through intelligent exposure control based on real-time image quality assessment.

- Development of AI models to predict post-PCI restenosis risk based on patient and lesion characteristics.

DRO & Impact Forces Of Cardiac Cath Lab Equipment and Consumable Market

The market trajectory is shaped by a confluence of powerful forces, encompassing significant drivers (D), persistent restraints (R), and substantial opportunities (O). A primary driver is the accelerating global burden of cardiovascular diseases (CVDs), necessitating a continuous expansion of cardiac intervention capacity worldwide. This demographic pressure is compounded by technological innovation, particularly the refinement of minimally invasive techniques (like TAVR and advanced PCI), which encourages higher procedural volumes. Restraints include the extremely high capital investment required for state-of-the-art angiography systems and the resulting lengthy procurement cycles in institutional settings. Moreover, stringent regulatory approval processes, particularly for novel drug-eluting stents and bioabsorbable scaffolds, can slow down market introduction, coupled with ongoing concerns regarding high consumable costs, particularly in price-sensitive emerging markets.

The most compelling opportunities stem from the increasing adoption of hybrid cath labs and integrated imaging technologies, which provide operational flexibility and expand the scope of procedures that can be safely performed. Significant potential also lies in emerging economies, where substantial government investment in modernizing healthcare infrastructure creates new markets for both equipment upgrades and consumable demand. Furthermore, the development and integration of advanced adjunctive technologies, such as robotic-assisted catheterization systems and next-generation intravascular imaging tools (IVUS/OCT), offer clear differentiation and premium pricing potential for manufacturers, driving market value growth beyond simple volume increases.

These forces interact dynamically, with the accelerating prevalence of CVDs acting as the foundational driver that consistently overrides the restraints imposed by high costs and regulatory hurdles, especially as clinical benefits demonstrate superior long-term outcomes. The impact of technological advancement is high, acting as a crucial enabling force that turns demographic needs into market demand by making previously complex or high-risk procedures routine and safer. The overall impact force is strongly positive, indicating sustained, robust growth characterized by cycles of technological upgrades and continuous high-volume demand for sophisticated consumables.

Segmentation Analysis

The Cardiac Cath Lab Equipment and Consumable Market is structurally segmented based on the type of product, the application area or type of procedure performed, and the primary end-user facility. This segmentation provides a granular view of market dynamics, revealing varying growth rates and adoption patterns across different product categories. The consumables segment typically dominates the market by revenue, reflecting the high-volume, repetitive nature of cardiac interventions. However, the equipment segment, particularly advanced angiography systems and integrated diagnostic platforms, dictates the technological direction and capital spending cycles of healthcare facilities. Analysis across these segments is crucial for manufacturers in tailoring their R&D efforts and sales strategies to address specific clinical needs and budgetary constraints across different geographical regions.

Product segmentation differentiates between high-capital equipment and disposable, recurring-use items. Key equipment segments include fixed C-arm angiography systems (which are rapidly evolving towards high-definition, low-dose capabilities), intravascular imaging devices (IVUS and OCT), and electrophysiology (EP) devices used for ablation procedures. The consumables market is heavily influenced by innovation in stents, where drug-eluting stents (DES) maintain premium pricing, and in highly specialized catheters and guidewires required for complex, minimally invasive procedures. End-user segmentation highlights the dominance of large specialized cardiac hospitals and dedicated cath labs, but also tracks the emerging importance of smaller, regional hospitals and Ambulatory Surgical Centers (ASCs) that are adopting less complex interventional capabilities to meet local demand.

Procedure-based segmentation illustrates the shift from routine diagnostic angiography towards complex interventional procedures. Percutaneous Coronary Intervention (PCI) remains the most common procedure, driving stent and balloon demand, but the market for structural heart interventions (e.g., TAVR, TMVr, LAA closure) is exhibiting the fastest growth due to the development of specialized devices and expanding indications for these treatments. This rapid expansion in structural heart procedures requires high-specification, flexible imaging equipment and complex disposable delivery systems, reinforcing the need for continuous technological adaptation and specialized training within the clinical workforce.

- By Product Type:

- Equipment

- Angiography Systems (Fixed C-Arm, Biplane)

- Intravascular Ultrasound (IVUS) Systems

- Optical Coherence Tomography (OCT) Systems

- Ablation Systems (RF and Cryo)

- Hemodynamic Monitoring Systems

- Robotic Catheter Systems

- Consumables

- Stents (Drug-Eluting Stents, Bare Metal Stents, Bioabsorbable Scaffolds)

- Angioplasty Balloons (PTCA and Peripheral)

- Diagnostic and Guiding Catheters

- Guidewires and Access Sheaths

- Vascular Closure Devices

- Introducer Kits

- Equipment

- By Procedure:

- Percutaneous Coronary Intervention (PCI)

- Structural Heart Interventions (TAVR, TMVr)

- Electrophysiology (EP) Procedures/Ablations

- Diagnostic Angiography

- Peripheral Interventions

- By End-User:

- Hospitals and Cardiac Centers

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics

Value Chain Analysis For Cardiac Cath Lab Equipment and Consumable Market

The value chain for the Cardiac Cath Lab market begins with complex upstream activities, primarily involving the procurement of highly specialized raw materials, such as biocompatible polymers, specialized metals (e.g., cobalt-chromium, platinum), and advanced semiconductor components required for imaging sensors and control systems. Upstream analysis focuses heavily on R&D, patent protection, and clinical trials necessary to validate new stent coatings, catheter designs, and imaging software algorithms. Key challenges in this stage include maintaining supply chain integrity for high-grade medical materials and ensuring compliance with global biocompatibility and sterilization standards. Equipment manufacturers often rely on specialized third-party suppliers for advanced components like X-ray tubes and detectors, making supplier relationships critical for quality control and cost management.

The manufacturing stage involves high precision and cleanroom environment assembly, particularly for consumables like drug-eluting stents, which require sophisticated surface coating and drug loading processes. Equipment manufacturing involves intricate integration of hardware, software, and advanced robotics. Downstream analysis focuses on distribution and sales. Given the specialized nature of the products, distribution channels are highly regulated, relying heavily on direct sales forces and authorized, specialty medical distributors who possess the technical expertise to handle, install, and service complex capital equipment. The adoption of new technology is heavily influenced by key opinion leaders (KOLs) and professional training, making clinical education and technical support integral parts of the distribution channel, rather than mere logistics.

The direct sales model is prevalent for high-value capital equipment and highly specialized consumables, ensuring direct engagement with interventional cardiologists and hospital procurement decision-makers, allowing for customized solution selling and comprehensive service contracts. Indirect channels, involving third-party distributors, are more commonly used for broad-reach distribution of routine consumables and market access into remote or emerging geographies. The final link involves post-sale services, including maintenance, software updates for equipment, and continuous training for staff, which constitutes a significant recurring revenue source for equipment manufacturers and enhances customer retention, thereby completing a value chain characterized by high specialization and high-touch customer interaction.

Cardiac Cath Lab Equipment and Consumable Market Potential Customers

Potential customers for Cardiac Cath Lab equipment and consumables primarily comprise institutions dedicated to delivering high-level cardiovascular care. The largest and most influential buyer segment consists of tertiary care hospitals and specialized cardiac centers (including university medical centers and large private cardiology groups) globally. These institutions perform the highest volume and complexity of procedures, ranging from emergency PCI to advanced structural heart interventions, necessitating investment in premium, integrated angiography systems (biplane and hybrid setups) and continuous bulk purchase of specialized consumables like TAVR delivery systems and high-end drug-eluting stents. Their purchasing decisions are driven by clinical performance, technology integration capabilities (e.g., seamless interfacing with EP mapping systems), and total cost of ownership over the equipment's lifecycle.

The second key segment includes mid-sized general hospitals and regional medical centers that operate single-plane cath labs focused mainly on diagnostic angiography and routine PCI procedures. While their budget for capital equipment is generally more constrained than specialized centers, they represent a high-volume market for standard consumables such as bare-metal stents, diagnostic catheters, and guidewires. These customers prioritize reliability, ease of use, and competitive pricing, often favoring established product lines that offer proven clinical safety and require minimal specialized training. Their purchasing cycles are often tied to government or institutional budgetary allocations for infrastructure modernization, driven by regional demands for improved access to basic cardiac care.

An increasingly important, albeit smaller, segment includes Ambulatory Surgical Centers (ASCs) and outpatient clinics. These facilities are gradually expanding their scope to include lower-risk, elective interventional procedures, such as diagnostic angiography and peripheral vascular procedures, especially in developed markets like the U.S. ASCs seek streamlined, cost-effective equipment with a smaller footprint and efficient workflow management solutions. Although they purchase fewer capital items, they represent a growing market for mid-range, standard consumables used in outpatient settings. Healthcare Group Purchasing Organizations (GPOs) and integrated delivery networks (IDNs) act as major gatekeepers, influencing procurement decisions across all customer segments by negotiating favorable pricing and standardized product selections.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 12.5 Billion |

| Market Forecast in 2033 | USD 19.4 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Medtronic plc, Abbott Laboratories, Boston Scientific Corporation, Siemens Healthineers AG, Philips Healthcare, General Electric Healthcare, Johnson & Johnson (Biosense Webster), Teleflex Incorporated, B. Braun Melsungen AG, Terumo Corporation, Getinge AB, Canon Medical Systems Corporation, Shimadzu Corporation, Cardiovascular Systems, Inc., Penumbra, Inc., W. L. Gore & Associates, Inc., Conmed Corporation, Edwards Lifesciences Corporation, Cordis, AngioDynamics, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cardiac Cath Lab Equipment and Consumable Market Key Technology Landscape

The technology landscape within the Cardiac Cath Lab market is characterized by continuous innovation aimed at reducing invasiveness, improving image clarity at lower radiation doses, and enhancing procedural precision. A foundational technological pillar is the evolution of X-ray angiography systems, transitioning from standard single-plane systems to sophisticated biplane and hybrid C-arm configurations that allow for 3D reconstruction and integration with other imaging modalities. Modern angiography systems incorporate advanced flat-panel detectors and computational algorithms designed for dose minimization, image noise reduction, and real-time motion compensation, significantly improving visualization during complex interventions like TAVR or CTO procedures. Furthermore, the adoption of robotic catheterization systems represents a major technological leap, allowing clinicians to control guidewires and catheters remotely with enhanced dexterity, precision, and reduced exposure to radiation, promising improved ergonomics and reduced physical strain for the medical team.

Intracoronary imaging technologies, specifically Intravascular Ultrasound (IVUS) and Optical Coherence Tomography (OCT), have become essential adjunctive tools, providing crucial high-resolution cross-sectional visualization of vessel walls and plaque characteristics that X-ray angiography alone cannot provide. OCT, in particular, offers near-microscopic resolution, which is vital for optimizing stent selection, assessing lesion coverage, and confirming successful stent expansion, directly contributing to superior clinical outcomes and driving demand for compatible consumables (e.g., specialized catheters). Alongside imaging, physiological assessment tools such as Fractional Flow Reserve (FFR) and its newer iteration, Instantaneous Wave-free Ratio (iFR), are increasingly integrated into cath lab workflows. These pressure-wire-based technologies objectively determine the functional significance of coronary lesions, moving intervention decisions from anatomical assessment alone to functional necessity, improving patient selection and reducing unnecessary stenting.

In the consumables sector, the technological focus remains on therapeutic device advancements. Drug-Eluting Stents (DES) have evolved substantially, featuring thinner struts, novel polymer coatings, and bioabsorbable scaffold technology (BRS). While BRS faced initial challenges, R&D is pushing towards thinner, structurally reinforced bioresorbable designs that offer temporary vessel scaffolding before dissolving completely, potentially reducing long-term risks associated with permanent metal implants. Furthermore, technological improvements in specialized structural heart devices, such as transcatheter heart valves (TAVR, TMVr) and advanced LAA closure devices, are driving the need for extremely precise delivery systems that can navigate complex anatomical pathways and ensure accurate, predictable deployment, representing a major high-growth, high-value technology area within the market.

Regional Highlights

- North America: This region holds the largest market share, predominantly driven by the United States, which benefits from highly advanced healthcare infrastructure, significant per capita healthcare expenditure, and rapid adoption of innovative, high-cost technologies. The presence of major market players and favorable reimbursement policies for complex interventional procedures (e.g., TAVR, advanced PCI) ensure sustained demand for both premium equipment and specialized consumables. The regional focus is on integrating AI into imaging workflows and increasing procedural capacity through the expansion of hybrid operating rooms and sophisticated cardiac centers.

- Europe: Characterized by sophisticated public and private healthcare systems, Europe is a mature market exhibiting steady growth. Western European countries, particularly Germany, France, and the UK, are key consumers of integrated cath lab systems that prioritize radiation safety, image quality, and workflow efficiency. The market is influenced by health technology assessment (HTA) bodies and centralized procurement, leading to a strong demand for evidence-based technologies and systems that demonstrate long-term cost-effectiveness. Eastern Europe presents opportunities for market entry and infrastructure upgrades.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region during the forecast period. This accelerated growth is primarily attributed to the massive population base, rising incidence of cardiovascular diseases linked to urbanization and lifestyle changes, and substantial government investments aimed at expanding cardiac care access in countries like China, India, and Japan. While Japan focuses on advanced technological integration, China and India represent immense potential due to the sheer volume of untapped patient populations and a burgeoning medical tourism sector, driving high demand for both entry-level and mid-range cath lab installations and essential consumables.

- Latin America (LATAM): This region is an emerging market characterized by diverse economic conditions and varying levels of healthcare access. Growth is fueled by increasing privatization of healthcare and improvement in medical infrastructure, particularly in major economies like Brazil and Mexico. The market generally shows a strong preference for value-based equipment and reliable, economically priced consumables, though specialized centers in major cities are adopting high-end technologies to meet demand for complex procedures.

- Middle East and Africa (MEA): Growth in the MEA region is segmented, with high penetration in Gulf Cooperation Council (GCC) countries driven by significant healthcare infrastructure investments and high income levels, leading to the adoption of state-of-the-art equipment. However, the African continent faces challenges related to infrastructure limitations and funding, resulting in a market focused primarily on essential consumables and refurbished equipment, though strategic investments are expanding cardiac care capacity in key regional hubs like South Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cardiac Cath Lab Equipment and Consumable Market.- Medtronic plc

- Abbott Laboratories

- Boston Scientific Corporation

- Siemens Healthineers AG

- Philips Healthcare

- General Electric Healthcare

- Johnson & Johnson (Biosense Webster)

- Teleflex Incorporated

- B. Braun Melsungen AG

- Terumo Corporation

- Getinge AB

- Canon Medical Systems Corporation

- Shimadzu Corporation

- Cardiovascular Systems, Inc.

- Penumbra, Inc.

- W. L. Gore & Associates, Inc.

- Conmed Corporation

- Edwards Lifesciences Corporation

- Cordis

- AngioDynamics, Inc.

Frequently Asked Questions

Analyze common user questions about the Cardiac Cath Lab Equipment and Consumable market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for specialized cardiac cath lab consumables?

The primary factor is the increasing global prevalence of cardiovascular diseases (CVDs) coupled with the shift towards minimally invasive interventional cardiology procedures, particularly complex Percutaneous Coronary Interventions (PCI) and structural heart procedures, which require high volumes of specialized, single-use devices like drug-eluting stents and complex guiding catheters.

How is technological advancement influencing the capital equipment segment of the market?

Technological advancement is driving demand for sophisticated imaging systems (biplane, hybrid C-arms) that offer high-definition visualization at lower radiation doses. Key innovations include integrating Intravascular Ultrasound (IVUS) and Optical Coherence Tomography (OCT) for enhanced lesion assessment and adopting AI for improved workflow and diagnostic accuracy.

Which region is expected to demonstrate the highest growth rate in the cath lab market?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR). This acceleration is fueled by significant investments in healthcare infrastructure, growing medical tourism, and increasing access to specialized cardiac care across large economies like China and India.

What role do hybrid operating rooms play in the market growth?

Hybrid operating rooms (ORs) are major growth drivers for high-end equipment as they integrate advanced cath lab angiography systems with surgical functionality. This allows for complex procedures like TAVR or combined surgical and interventional approaches to be performed safely in a single, flexible environment, maximizing facility utilization and procedural scope.

What are the main restraints impacting market expansion?

The key restraints include the substantial capital investment required to purchase and maintain high-end cath lab equipment, necessitating lengthy procurement cycles. Additionally, stringent regulatory pathways for novel therapeutic devices and the high per-unit cost of specialized consumables in budget-sensitive markets pose significant challenges to widespread adoption.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager