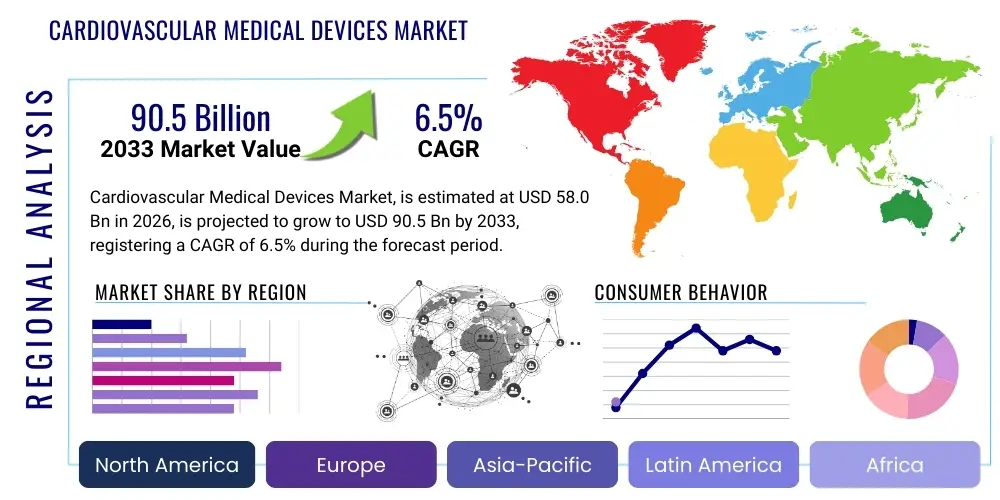

Cardiovascular Medical Devices Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437967 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Cardiovascular Medical Devices Market Size

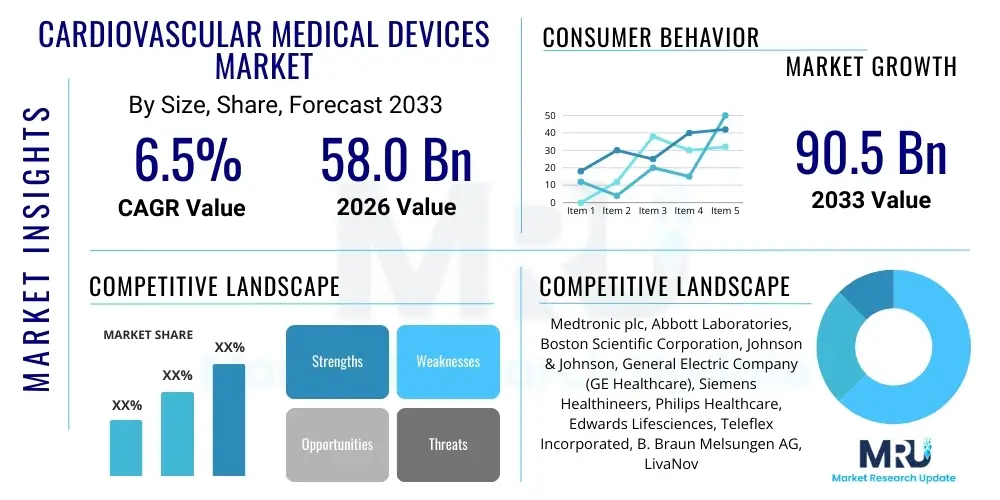

The Cardiovascular Medical Devices Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 58.0 Billion in 2026 and is projected to reach USD 90.5 Billion by the end of the forecast period in 2033.

Cardiovascular Medical Devices Market introduction

The Cardiovascular Medical Devices Market encompasses a broad range of instruments and implants used for the diagnosis, monitoring, treatment, and management of various cardiovascular diseases (CVDs). These devices are crucial in addressing conditions such as coronary artery disease, structural heart defects, heart failure, arrhythmias, and peripheral vascular diseases. The product landscape is highly diversified, ranging from sophisticated diagnostic tools like ECG systems and cardiac imaging modalities to complex therapeutic devices such as pacemakers, implantable cardioverter-defibrillators (ICDs), stents, and artificial heart valves. The rapid advancement in materials science, miniaturization, and bio-integration has been pivotal in enhancing the efficacy and longevity of these devices, thereby improving patient outcomes globally.

Major applications of cardiovascular devices span across interventional cardiology, cardiac rhythm management, diagnostic monitoring, and surgical procedures. Key benefits derived from these technological advancements include the shift towards minimally invasive procedures, reduced recovery times, lower infection rates, and enhanced precision in diagnosis. For instance, the deployment of transcatheter aortic valve replacement (TAVR) systems has offered a viable alternative to open-heart surgery for high-risk patients, dramatically expanding the treatable patient population. Furthermore, the integration of remote monitoring capabilities allows for continuous, real-time patient data collection, enabling proactive intervention and personalized care management, which is essential for chronic cardiovascular conditions.

The market growth is fundamentally driven by the escalating global prevalence of CVDs, which remains the leading cause of mortality worldwide, largely fueled by sedentary lifestyles, poor diet, and rising rates of obesity and diabetes. Concurrently, the increasing geriatric population across developed and developing nations represents a massive demographic tailwind, as older individuals are significantly more susceptible to cardiovascular complications requiring device intervention. Supportive governmental initiatives promoting early diagnosis, rising healthcare expenditure, and substantial investments in research and development (R&D) by key market players focused on creating next-generation, technologically superior devices are collectively accelerating market expansion. These factors ensure a sustained, robust demand trajectory for cardiovascular medical solutions over the forecast period.

Cardiovascular Medical Devices Market Executive Summary

The Cardiovascular Medical Devices Market is characterized by intense technological innovation, regulatory scrutiny, and robust merger and acquisition (M&A) activities aimed at consolidating specialized technology portfolios. Business trends indicate a strong move towards comprehensive procedural solutions, where manufacturers offer integrated platforms covering diagnostic imaging, device implantation, and post-operative monitoring, thereby simplifying clinical workflows and improving cost-efficiency for healthcare providers. The demand for bioresorbable vascular scaffolds (BVS) and advanced hemodynamic monitoring systems is trending upward, reflecting a market preference for temporary implants and data-driven patient management. Companies are strategically investing in digital health platforms and artificial intelligence integration to enhance device functionality and diagnostic accuracy, further strengthening their competitive positioning.

Regionally, North America maintains its dominance due to advanced healthcare infrastructure, high reimbursement rates, and the early adoption of cutting-edge technologies like complex electrophysiology catheters and advanced heart failure devices. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, propelled by rapidly improving access to specialized care, increasing disposable incomes, and the massive, underserved patient pool in countries such as China and India. European markets, while mature, are seeing sustained growth driven by structured screening programs and high technological penetration. Market players are tailoring their distribution and marketing strategies to navigate the diverse regulatory and commercial landscapes across these distinct geographic regions, particularly focusing on optimizing cost structures in emerging economies.

Segmentation trends reveal that the Therapeutic Devices segment, particularly interventional cardiology products (stents, catheters, guidewires), commands the largest market share, driven by the sheer volume of percutaneous coronary intervention (PCI) procedures performed globally. However, the Diagnostic and Monitoring Devices segment is expected to show accelerated growth, primarily due to the increasing adoption of remote patient monitoring (RPM) systems, advanced cardiac wearable sensors, and sophisticated cardiac imaging equipment (e.g., intravascular ultrasound (IVUS) and optical coherence tomography (OCT)). The growing clinical acceptance of devices for structural heart interventions, such as TAVR and MitraClip systems, is significantly bolstering the surgical and interventional sub-segments, reshaping the traditional balance between pharmacological and device-based treatments.

AI Impact Analysis on Cardiovascular Medical Devices Market

Common user questions regarding AI's influence in the Cardiovascular Medical Devices Market frequently revolve around its practical application in diagnostic accuracy, the role of machine learning in risk stratification, and the ethical/regulatory challenges associated with autonomous device functions. Users are keenly interested in how AI can move beyond simple data aggregation to truly personalize treatment protocols, specifically focusing on optimizing pacemaker settings or predicting potential device failure before it occurs. Key concerns often center on data privacy, the validation process for AI algorithms used in regulatory submissions, and ensuring that AI-driven decisions maintain clinical interpretability. The overarching expectation is that AI will dramatically accelerate the shift towards precision cardiology, reducing diagnostic variability and improving procedural success rates.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is rapidly transforming the design, functionality, and clinical utilization of cardiovascular medical devices. AI algorithms are being deployed in cardiac imaging systems (e.g., echocardiography, MRI) to automate image analysis, quantify critical metrics such as ejection fraction, and flag subtle anomalies indicative of early-stage disease, thus significantly increasing the speed and consistency of diagnosis. In the realm of rhythm management, ML models are utilized in pacemakers and ICDs to refine detection algorithms, minimize inappropriate shocks, and optimize energy consumption, leading to enhanced patient safety and device longevity. This sophisticated data processing capacity allows clinicians to move towards truly predictive cardiology.

Beyond diagnostics, AI plays a crucial role in operationalizing complex interventions and managing chronic conditions. Surgical planning for structural heart procedures, such as TAVR or complex ablation procedures, is increasingly supported by AI-powered visualization and modeling tools that simulate outcomes based on patient-specific anatomy, minimizing procedural risk. Furthermore, AI platforms are central to the efficacy of remote patient monitoring (RPM) devices, analyzing massive streams of physiological data (ECG, blood pressure, oxygen saturation) collected through wearables or implanted sensors. These systems identify patterns predictive of acute events, generating timely alerts for physicians and facilitating immediate, preventative therapeutic adjustments, effectively transitioning care from reactive to predictive models.

- AI-enhanced Diagnostic Accuracy: Improved automatic detection and quantification of cardiac anomalies in imaging and ECG data.

- Personalized Treatment Optimization: Machine learning algorithms refine device parameters (e.g., pacing rate, ablation targets) based on continuous patient feedback.

- Predictive Risk Stratification: AI analyzes patient history and real-time biometric data to forecast the likelihood of heart failure readmission or sudden cardiac events.

- Surgical Planning and Simulation: Use of AI for precise anatomical mapping and virtual procedural simulations in structural heart interventions.

- Efficiency in R&D: Acceleration of new device development through AI-driven material science and clinical trial analysis.

DRO & Impact Forces Of Cardiovascular Medical Devices Market

The Cardiovascular Medical Devices Market dynamics are profoundly shaped by a powerful confluence of driving forces, significant restraints, and expansive opportunities. The primary driver is the alarming global increase in the prevalence of cardiovascular diseases (CVDs), which demands constant innovation in treatment modalities. This demographic pressure is compounded by the rising aging population worldwide, inherently increasing the demand for chronic disease management and interventional procedures. Technological advancements, particularly in minimally invasive surgery (MIS) and bio-integrated materials, serve as core drivers, making complex procedures safer and more accessible. Furthermore, increased healthcare spending and improved insurance coverage in developed economies facilitate the adoption of premium, advanced device technologies, establishing a positive feedback loop for market growth and investment.

Conversely, several restraints impede the market’s full potential. The most significant constraint is the increasingly stringent and complex regulatory landscape, especially in regions governed by bodies like the FDA (U.S.) and the European Union’s MDR (Medical Device Regulation). These stricter approval pathways increase R&D costs and extend time-to-market, posing particular challenges for smaller innovative companies. Additionally, the high cost associated with advanced cardiovascular devices and surgical procedures creates accessibility barriers in developing and low-income nations, despite the high burden of disease. Product recalls and safety concerns, although infrequent, significantly erode market confidence and necessitate rigorous post-market surveillance, adding operational complexity.

The market is rich with opportunities, particularly those focused on tapping into underserved patient groups and utilizing advanced digital health infrastructure. The development of advanced remote patient monitoring (RPM) and wearable cardiac devices presents a massive opportunity to democratize access to care, shifting monitoring from clinic-based to home-based settings. Furthermore, substantial opportunities exist in emerging economies, where expanding healthcare infrastructure and growing middle-class populations represent untapped markets for both established and low-cost device solutions. The ongoing development of innovative therapeutic areas, such as devices for heart failure (e.g., Ventricular Assist Devices (VADs)) and the growth of the structural heart segment (e.g., devices for mitral and tricuspid valve repair), promise sustained high-value growth throughout the forecast period. The strategic impact of these forces dictates that market players must balance aggressive technological innovation with meticulous regulatory compliance and global market accessibility.

Segmentation Analysis

The Cardiovascular Medical Devices Market is highly fragmented and analyzed primarily based on Product Type, End-User, and Geography. Analyzing these segments provides a granular understanding of the market dynamics and the areas poised for the highest growth. The Product Type segmentation is critical, delineating the market into diagnostic, monitoring, and therapeutic categories, with the latter encompassing high-value implants and interventional tools that dominate revenue share. Understanding the End-User perspective, distinguishing between hospitals, specialized cardiac centers, and ambulatory surgical centers (ASCs), is vital for manufacturers to tailor their distribution networks and service offerings effectively. Hospitals remain the largest end-user due to the complexity and infrastructure required for device implantation and emergency cardiac care, but ASCs are gaining traction for less invasive and diagnostic procedures due to cost efficiencies and ease of scheduling.

The therapeutic segment, which includes Coronary Stents, Catheters, Pacemakers, and Defibrillators, is driven by high procedural volume and continuous product improvements focused on biocompatibility and reduced complication rates. Within the diagnostic segment, advanced cardiac imaging modalities such as CT and MRI are essential for complex pre-procedural planning. Conversely, the monitoring segment is experiencing transformative growth, fueled by the accelerating adoption of continuous glucose monitoring devices, advanced holter monitors, and remote telemetry systems, largely driven by the necessity for chronic disease management and post-discharge surveillance. Geographical segmentation highlights the mature yet high-value market of North America contrasted with the high-growth, volume-driven markets of the Asia Pacific, necessitating regionally specific product portfolio and pricing strategies.

- Product Type

- Diagnostic and Monitoring Devices

- ECG Devices

- Holter Monitors

- Event Recorders

- Diagnostic Catheters

- Cardiac Biomarkers Diagnostics

- Therapeutic and Surgical Devices

- Cardiac Rhythm Management (CRM) Devices

- Pacemakers (Single, Dual, Biventricular)

- Implantable Cardioverter Defibrillators (ICDs)

- Cardiac Resynchronization Therapy (CRT) Devices

- Interventional Cardiology Devices

- Coronary Stents (BMS, DES, BRS)

- Angioplasty Balloons and Catheters

- Guidewires and Accessories

- Structural Heart Devices

- Heart Valves (Mechanical, Tissue, Transcatheter)

- Vascular Grafts

- Repair Devices (e.g., MitraClip)

- Peripheral Vascular Devices

- Neurovascular Devices

- Cardiac Rhythm Management (CRM) Devices

- Diagnostic and Monitoring Devices

- End-User

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialty Cardiac Centers

- Clinics and Diagnostic Laboratories

- Region

- North America (U.S., Canada)

- Europe (Germany, U.K., France, Italy, Spain)

- Asia Pacific (China, Japan, India, South Korea)

- Latin America (Brazil, Mexico)

- Middle East & Africa (MEA)

Value Chain Analysis For Cardiovascular Medical Devices Market

The value chain for the Cardiovascular Medical Devices Market is complex and characterized by high intellectual property dependence and rigorous regulatory requirements. It begins with intensive R&D, requiring substantial investment in clinical trials, materials science, and software engineering to develop innovative, highly specialized devices like drug-eluting stents, leadless pacemakers, or advanced robotic surgery systems. The upstream analysis focuses heavily on the procurement of high-quality, bio-compatible raw materials (e.g., specialized polymers, titanium, medical-grade ceramics) and the manufacturing of precision components. Strategic partnerships with specialized component suppliers and contract manufacturing organizations (CMOs) are common to manage production complexities and control costs while ensuring strict quality assurance and regulatory compliance throughout the fabrication process.

The downstream analysis centers on distribution, sales, and post-sales service, which are crucial due to the complexity of the products and the highly specialized nature of the end-users. Distribution channels are predominantly indirect, leveraging specialized third-party distributors who maintain cold chain logistics and technical expertise required for device handling and inventory management, particularly for surgical implants. Direct distribution models are often utilized by major players for high-volume, high-value systems, enabling better control over pricing, installation, and essential technical training for surgeons and technicians. The efficiency of the distribution network directly impacts the surgical scheduling and overall adoption rates in various regional markets.

The final crucial steps involve the direct interaction with end-users—hospitals and specialty centers—which include training, technical support, and the provision of continuous software updates for implanted devices. Post-sales service and maintenance are vital components of the value proposition, especially for capital equipment like imaging systems and robotic platforms. The success of a cardiovascular device company is heavily contingent on securing favorable reimbursement policies and establishing strong relationships with key opinion leaders (KOLs) and hospital procurement groups. The move towards value-based care is pressuring the value chain to demonstrate long-term clinical and economic benefits, driving integration and efficiency from R&D through patient follow-up.

Cardiovascular Medical Devices Market Potential Customers

The primary customers for cardiovascular medical devices are institutions focused on acute and chronic cardiac care, demanding high-quality, reliable, and technologically advanced solutions for patient treatment. Hospitals, particularly large tertiary care centers and university medical centers, represent the largest customer segment, as they possess the necessary infrastructure, specialized surgical staff, and high patient volumes required for complex procedures like open-heart surgery, TAVR, and large-scale electrophysiology ablations. These institutional buyers focus not only on device efficacy but also on total cost of ownership, integration capabilities with existing hospital IT systems, and comprehensive support services offered by the manufacturer.

Specialty cardiac centers and dedicated cardiology clinics form another significant customer base, often specializing in non-invasive diagnostics, interventional procedures, and the management of chronic conditions through implanted devices and remote monitoring. These centers prioritize devices that facilitate quicker patient turnover, enhance diagnostic throughput, and provide robust data connectivity. Ambulatory Surgical Centers (ASCs) are emerging potential customers, especially for less complex, minimally invasive procedures and certain diagnostic studies. The growth of ASCs as a destination for cardiac care is driven by cost advantages over traditional hospitals, leading to increased demand for portable monitoring devices and single-use catheters suitable for this setting.

Furthermore, government procurement agencies and national health services (e.g., NHS in the UK) act as major consolidated buyers, especially in markets with centralized healthcare systems. Their purchasing decisions are heavily influenced by stringent health technology assessments (HTA) focusing on cost-effectiveness and long-term clinical data, often leading to competitive tendering processes. Finally, while not direct buyers, insurance providers and reimbursement authorities exert immense influence, as their coverage decisions determine which technologies are financially viable for mass adoption by the ultimate end-users—the healthcare institutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 58.0 Billion |

| Market Forecast in 2033 | USD 90.5 Billion |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Medtronic plc, Abbott Laboratories, Boston Scientific Corporation, Johnson & Johnson, General Electric Company (GE Healthcare), Siemens Healthineers, Philips Healthcare, Edwards Lifesciences, Teleflex Incorporated, B. Braun Melsungen AG, LivaNova PLC, MicroPort Scientific Corporation, Getinge AB, Biotronik, Terumo Corporation, Asahi Intecc Co., Ltd., W. L. Gore & Associates, Inc., Cook Medical, Inc., CryoLife, Inc., C. R. Bard, Inc. (acquired by BD) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cardiovascular Medical Devices Market Key Technology Landscape

The technology landscape of the Cardiovascular Medical Devices Market is undergoing rapid transformation, characterized by a persistent drive towards smaller, smarter, and less invasive devices that enhance patient recovery and quality of life. A central technological trend is the maturation of minimally invasive techniques, particularly in the structural heart segment, exemplified by procedures like Transcatheter Aortic Valve Replacement (TAVR) and transcatheter mitral valve repair (TMVr). These methods significantly reduce procedural risk and patient hospital stays compared to traditional open-heart surgery. Furthermore, advancements in specialized catheter technologies, including steerable and multi-electrode ablation catheters, are improving the precision and success rates of electrophysiology procedures, particularly for complex arrhythmias like atrial fibrillation.

Another major pillar of technological innovation involves materials science and bio-integration, particularly evident in the development of next-generation stents and implants. Bioresorbable vascular scaffolds (BVS), although facing initial setbacks, continue to be a focal point of R&D, aiming to provide temporary scaffolding that supports the vessel and then dissolves, leaving no permanent metal implant behind. In the Cardiac Rhythm Management (CRM) space, the introduction of leadless pacemakers represents a significant breakthrough, eliminating the risks associated with pacemaker leads and allowing for remote programming and monitoring capabilities. These miniaturized devices utilize advanced battery technology and sophisticated communication protocols to ensure patient safety and long-term efficacy without the traditional surgical pocket.

Digital health and connectivity technologies are fundamentally redefining cardiac monitoring and disease management. Remote Patient Monitoring (RPM) systems, often utilizing wearable patches or smart devices integrated with implanted sensors, provide continuous, high-fidelity physiological data streams to clinicians. This capability allows for proactive clinical adjustments and significantly reduces the need for costly and inconvenient in-person clinic visits. Furthermore, advanced imaging technologies, such as Intravascular Ultrasound (IVUS) and Optical Coherence Tomography (OCT), are increasingly integrated into interventional procedures, providing high-resolution visualization from within the coronary arteries, enhancing diagnostic clarity, and guiding precise stent deployment, thereby optimizing procedural outcomes.

Regional Highlights

- North America: North America, led by the United States, commands the largest share of the global cardiovascular medical devices market. This dominance is attributed to several factors: highly advanced healthcare infrastructure, high consumer awareness regarding cardiac health, favorable and stable reimbursement policies for high-cost interventional and therapeutic devices (like ICDs and TAVR systems), and the rapid adoption of cutting-edge technologies. The presence of major industry players and substantial R&D investment in areas like leadless pacemakers and robotic-assisted cardiac surgery further solidifies its market leadership.

- Europe: The European market represents the second-largest segment, characterized by centralized healthcare systems in many Western European countries (e.g., Germany, UK, France). Market growth is driven by the aging population and the widespread implementation of structured CVD prevention programs. Strict regulatory compliance, particularly under the Medical Device Regulation (MDR), influences market entry and product cycles. There is high demand for advanced structural heart devices and electrophysiology solutions, supported by established clinical practice guidelines.

- Asia Pacific (APAC): The APAC region is forecast to be the fastest-growing market globally. This exponential growth is fueled by escalating healthcare expenditure, rapid expansion of hospital infrastructure, and increasing medical tourism. Countries like China and India present vast, largely untapped patient populations suffering from CVDs, driven by rapid urbanization and lifestyle changes. While price sensitivity remains a factor, the increasing acceptance of Western medical standards and local manufacturing initiatives are accelerating the uptake of both diagnostic and therapeutic devices.

- Latin America (LATAM): LATAM offers significant growth potential, driven by improving economic conditions, increased healthcare access, and modernization of clinical facilities, particularly in Brazil and Mexico. Challenges include regulatory fragmentation and relatively lower penetration rates of advanced devices compared to North America. The market sees strong demand for basic coronary intervention tools and external monitoring devices.

- Middle East & Africa (MEA): The MEA region's growth is heterogeneous, primarily concentrated in the Gulf Cooperation Council (GCC) countries (e.g., UAE, Saudi Arabia) which benefit from high per capita income and robust government investment in specialized healthcare facilities. Market expansion is driven by the increasing prevalence of lifestyle diseases and efforts to reduce reliance on medical treatments abroad. Africa, outside of South Africa, remains a highly nascent market with significant infrastructural challenges.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cardiovascular Medical Devices Market.- Medtronic plc

- Abbott Laboratories

- Boston Scientific Corporation

- Johnson & Johnson (J&J)

- General Electric Company (GE Healthcare)

- Siemens Healthineers

- Koninklijke Philips N.V. (Philips Healthcare)

- Edwards Lifesciences

- Teleflex Incorporated

- B. Braun Melsungen AG

- LivaNova PLC

- MicroPort Scientific Corporation

- Getinge AB

- Biotronik

- Terumo Corporation

- Asahi Intecc Co., Ltd.

- W. L. Gore & Associates, Inc.

- Cook Medical, Inc.

- Shandong Weigao Group Medical Polymer Co., Ltd.

- CryoLife, Inc.

Frequently Asked Questions

Analyze common user questions about the Cardiovascular Medical Devices market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Cardiovascular Medical Devices Market?

The market growth is primarily driven by the escalating global prevalence of cardiovascular diseases (CVDs), the rapidly expanding aging population, and continuous technological advancements favoring minimally invasive surgical procedures and sophisticated remote patient monitoring systems.

Which product segment holds the largest share in the Cardiovascular Medical Devices Market?

The Therapeutic and Surgical Devices segment, specifically those related to Interventional Cardiology (e.g., coronary stents, angioplasty catheters) and Cardiac Rhythm Management (CRM) devices (pacemakers, ICDs), currently holds the dominant market share due to high procedural volumes worldwide.

How is Artificial Intelligence (AI) impacting the future of cardiovascular devices?

AI is significantly enhancing device efficacy by improving diagnostic accuracy in imaging, optimizing treatment parameters for implanted devices, and enabling predictive analytics in remote monitoring systems to anticipate and prevent acute cardiac events, leading to truly personalized patient care.

What is the projected growth rate (CAGR) for the Cardiovascular Medical Devices Market through 2033?

The market is projected to experience a Compound Annual Growth Rate (CAGR) of 6.5% between the years 2026 and 2033, driven largely by adoption in emerging economies and continued innovation in structural heart and digital health solutions.

What regulatory challenges face manufacturers in the cardiovascular device sector?

Manufacturers face significant challenges from increasingly stringent regulations, such as the European MDR and stricter FDA requirements, which necessitate extensive clinical data validation, extended approval times, and substantial investment in post-market surveillance and reporting.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager