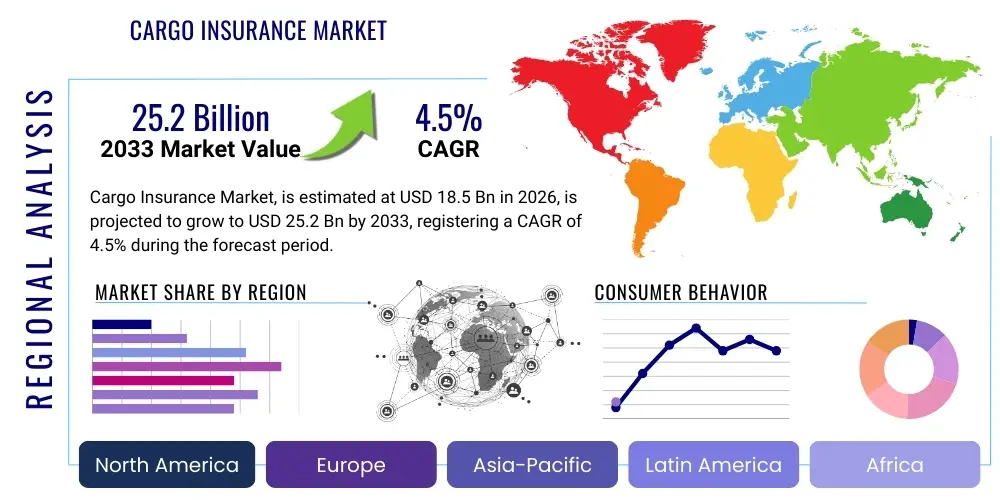

Cargo Insurance Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436191 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Cargo Insurance Market Size

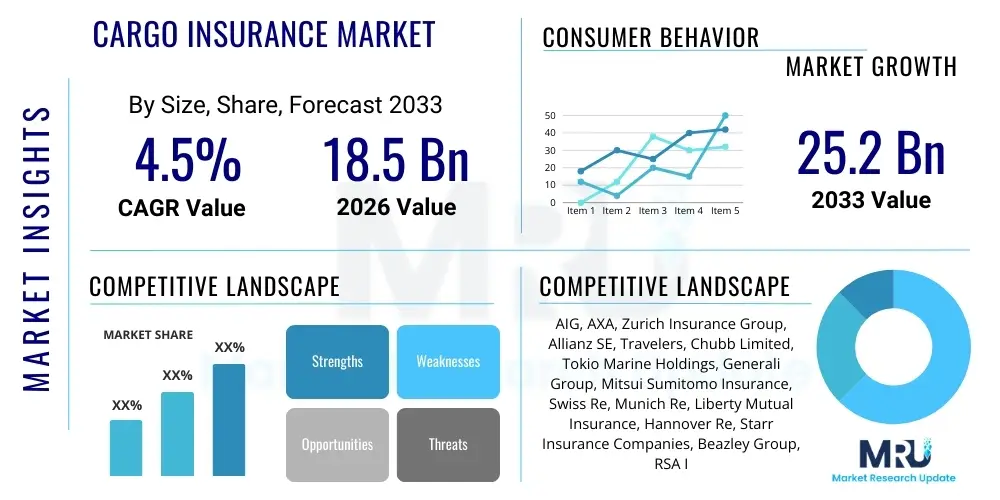

The Cargo Insurance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 25.2 Billion by the end of the forecast period in 2033.

Cargo Insurance Market introduction

The Cargo Insurance Market is fundamentally driven by the expanding complexity of global trade and the indispensable need for risk mitigation within international supply chains. Cargo insurance provides financial protection against losses or damages to goods while in transit, covering risks associated with marine, air, and land transportation. This protection is crucial for importers, exporters, freight forwarders, and logistics providers, ensuring business continuity and solvency despite unforeseen events such as accidents, theft, natural disasters, or geopolitical disruptions. As globalized manufacturing and e-commerce continue to flourish, the volume and value of goods transported internationally increase, directly correlating with the demand for robust insurance solutions that can adapt to multimodal transport challenges.

The core product offerings within this market include specialized policies like All Risks coverage, which provides the broadest protection against external causes of loss, and Named Perils coverage, which insures against specific, predetermined events. Key applications span a vast range of industries, including manufacturing (machinery and components), retail (consumer goods), commodities (oil, grains, metals), and high-value logistics (pharmaceuticals and electronics). The primary benefits of securing cargo insurance extend beyond simple claims recovery; they include regulatory compliance, enhanced creditworthiness for trading parties, and establishing trust within complex cross-border transactions. Effective cargo insurance is now viewed not merely as a cost but as a strategic asset that stabilizes financial exposure in high-risk environments.

Major driving factors propelling market expansion include the increasing frequency and severity of extreme weather events necessitating better coverage, rapid technological integration leading to more specialized high-value shipments, and the growth of emerging markets requiring substantial import/export activity. Furthermore, regulatory tightening around international shipping standards and the requirement for specific contractual insurance clauses (such as Incoterms) enforce mandatory uptake of certain policy types. The shift towards digitization in insurance underwriting, leveraging real-time logistics data, is further optimizing policy pricing and efficiency, making coverage more accessible and customized for varied enterprise risk profiles across the global landscape.

Cargo Insurance Market Executive Summary

The global Cargo Insurance Market is characterized by robust business trends centered on digitalization and enhanced risk modeling. Leading insurers are heavily investing in proprietary data analytics platforms that integrate real-time tracking, weather forecasting, and geopolitical risk mapping to offer dynamic pricing models and personalized underwriting. A significant business trend involves the shift from traditional annual policies to highly flexible, on-demand, or pay-as-you-go coverage tailored specifically to the unique journey profile of high-value or sensitive cargo. This flexibility appeals strongly to modern logistics operators seeking optimized operational expenditures and precise risk management. Furthermore, merger and acquisition activities among insurance giants and tech-focused insurtech startups are accelerating the incorporation of artificial intelligence and machine learning into claims processing, driving down administrative costs and improving payout speed.

Regionally, the market exhibits divergent growth profiles. The Asia Pacific (APAC) region is experiencing the highest growth trajectory, fueled by rapid industrialization, massive infrastructure development, and the dominance of key manufacturing hubs (China, India, Southeast Asia). This growth is inherently linked to increasing maritime trade volumes and expanding e-commerce logistics networks. North America and Europe, while representing mature markets, continue to contribute substantial market value, driven by high-value goods movement, stringent regulatory environments demanding comprehensive coverage, and advanced adoption of technology in risk management. Latin America and the Middle East and Africa (MEA) are emerging as high-potential areas, particularly due to growing oil and gas export routes and infrastructure projects that necessitate specialized, large-scale cargo coverage.

Segment trends reveal that the Marine Cargo Insurance segment remains the largest revenue contributor, reflecting the sustained dominance of sea freight in global commerce, especially for bulk and containerized goods. However, the Air Cargo Insurance segment is demonstrating faster growth, driven by the increased global movement of time-sensitive, high-value electronics, pharmaceuticals, and specialized components required for advanced manufacturing. By policy type, the All Risks policy segment commands a premium due to its comprehensive nature, although there is a rising trend in specialized, bespoke parametric policies designed to trigger payouts based on pre-defined external events (e.g., hurricane intensity exceeding a certain threshold) without requiring lengthy loss assessment, optimizing the value proposition for sophisticated corporate clients.

AI Impact Analysis on Cargo Insurance Market

Common user questions regarding AI's impact on cargo insurance predominantly revolve around efficiency gains, risk reduction, and the potential for job displacement in traditional underwriting roles. Users frequently ask: How is AI optimizing premium pricing? Can AI accurately predict supply chain bottlenecks or theft risks? Will AI-driven automation lead to fairer and faster claims settlement? The key themes emerging from this user analysis focus on AI's ability to ingest and synthesize vast datasets—including telematics, satellite imagery, historical loss patterns, and geopolitical instability indexes—to generate far more precise risk assessments than human underwriters alone. Expectations are high that AI will move the industry from reactive loss assessment to proactive risk prevention, enabling insurers to advise clients on safer routes, better packaging, and optimal loading practices, fundamentally shifting the insurer's role toward integrated risk partnership.

The integration of Artificial Intelligence and Machine Learning (ML) is rapidly transforming core functions within the cargo insurance value chain, starting from predictive risk modeling. AI algorithms are highly effective at processing real-time data feeds from Internet of Things (IoT) sensors installed on containers—tracking location, temperature, shock, and humidity—to immediately identify deviations that could indicate a potential claim event. This real-time monitoring allows insurers to issue immediate warnings or even authorize mitigation steps proactively. Furthermore, in the realm of catastrophic risk modeling, deep learning networks are simulating complex scenarios, such as the cumulative impact of concurrent natural disasters across multiple shipping lanes, providing unparalleled clarity on portfolio exposure and reinsurance needs.

Beyond risk assessment, AI is fundamentally altering the claims handling process. Natural Language Processing (NLP) is being utilized to rapidly analyze complex policy documents, bills of lading, and damage reports, automating the verification of claim validity and calculating provisional payouts. This acceleration drastically reduces the cycle time for claims, significantly improving customer satisfaction and freeing up experienced human adjusters to focus solely on complex, high-value disputes. The predictive maintenance aspect is also crucial; by analyzing sensor data, AI can predict when equipment failure (e.g., container refrigeration breakdown) is imminent, allowing preventative intervention and reducing the incidence of spoilage claims, particularly vital for temperature-sensitive cargo like pharmaceuticals and fresh produce.

- AI enhances predictive risk modeling using real-time IoT data, resulting in highly precise premium calculations.

- Machine Learning algorithms identify anomalous shipping patterns indicative of potential fraud or theft risks.

- NLP automates the review and processing of complex documentation for rapid and efficient claims settlement.

- AI provides proactive supply chain risk advice, optimizing routes and mitigating exposure before incidents occur.

- Advanced robotics and computer vision systems aid in remote, rapid damage assessment and verification of losses.

DRO & Impact Forces Of Cargo Insurance Market

The dynamics of the Cargo Insurance Market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), all subject to persistent impact forces emanating from global economic and geopolitical shifts. Key drivers include the sustained expansion of global maritime trade and the corresponding increase in the volume of goods transported, driven largely by free trade agreements and the relentless growth of cross-border e-commerce requiring specialized logistics and insurance solutions. Furthermore, increasing awareness among small and medium-sized enterprises (SMEs) about the mandatory nature of insurance for international trade and the financial vulnerability associated with uninsured losses is significantly bolstering market penetration. The adoption of stringent international shipping standards and regulations also acts as a primary enforcement mechanism for insurance uptake.

Despite strong drivers, several restraints challenge market growth. The most significant restraint is the high cost and complexity associated with securing comprehensive coverage, especially for highly fragmented supply chains involving multiple carriers and geographies, which can deter smaller players. Moreover, volatility in global commodity prices and fluctuating freight rates introduce financial uncertainty, making long-term premium planning difficult. The proliferation of cyber risks targeting logistics management systems poses a significant, evolving challenge, as defining and underwriting losses arising from sophisticated cyberattacks on supply chain infrastructure remains a complex and sometimes excluded area within standard cargo policies. Regulatory fragmentation across different trade blocs adds layers of administrative and compliance burden, slowing down seamless global policy integration.

Opportunities for market stakeholders primarily lie in leveraging technological advancements to streamline operations and offer innovative products. The development and deployment of blockchain technology present a vast opportunity to enhance transparency, reduce documentation fraud, and accelerate smart contract execution for claims settlement, drastically improving efficiency. Insurers also have a major opportunity in creating specialized parametric insurance products that utilize emerging climate data and real-time weather monitoring to offer immediate, event-triggered payouts for catastrophic losses, minimizing dispute resolution time. The expansion into untapped emerging markets in Africa and Latin America, paired with education on the strategic value of cargo insurance, represents a substantial long-term growth avenue for global carriers and localized providers alike. These forces collectively shape a market characterized by high inherent risk, high growth potential, and a mandatory reliance on sophisticated data infrastructure.

Segmentation Analysis

The Cargo Insurance Market is meticulously segmented based on key criteria, including type of coverage, mode of transport, and end-user industry, reflecting the diverse and specialized requirements inherent in global logistics. Understanding these segments is vital for insurers and underwriters to accurately price risk and tailor policy offerings to specific client needs. The fundamental segmentation by coverage type differentiates between Marine, Air, and Land freight policies, reflecting the distinct risk profiles associated with each transport method—for example, marine cargo policies often account for general average loss and piracy, which are irrelevant in air transport. Further specialization occurs within end-use industries, where policies are adjusted to account for the fragility, perishability, or strategic value of the cargo being shipped, necessitating specialized handling and enhanced security measures.

In terms of segmentation by policy type, the differentiation between All Risks and Named Perils remains crucial. All Risks policies dominate the high-value commercial sector due to their comprehensive protection against any external cause of loss not specifically excluded. Conversely, Named Perils policies are often preferred for bulk commodities or lower-value goods, where the primary risk exposure is limited to specific catastrophic events like fire or collision. Analyzing segment growth reveals that while marine insurance remains the largest segment by volume, technological advancements and the increasing speed required for global fulfillment are driving disproportionate growth in the air cargo insurance segment. This segmentation landscape reinforces the necessity for insurers to maintain flexible underwriting capacity capable of switching between high-frequency, low-severity land freight claims and low-frequency, high-severity marine catastrophe events.

The end-user segmentation provides critical insights into demand generation and specific risk profiles. Key industries driving demand include manufacturing, which requires continuous protection for components and finished goods; retail and e-commerce, needing highly flexible policies to cover direct-to-consumer delivery across vast networks; and the commodities sector (energy, mining, agriculture), which demands coverage for large-volume, relatively standardized shipments prone to market price volatility. The increasing globalization of the pharmaceutical and electronics industries, characterized by high-value, sensitive cargo requiring climate control and enhanced security, is creating a lucrative niche for specialized insurance products that incorporate IoT data integration and sophisticated risk mitigation services alongside traditional coverage.

- By Coverage Type:

- Marine Cargo Insurance

- Air Cargo Insurance

- Land Cargo Insurance

- By Policy Type:

- All Risks

- Named Perils

- By End User:

- Manufacturing

- Retail and E-commerce

- Commodities (Energy, Agriculture, Mining)

- Logistics and Freight Forwarding

- Pharmaceuticals and Healthcare

- By Distribution Channel:

- Brokers and Agents

- Direct Writers

- Bancassurance

Value Chain Analysis For Cargo Insurance Market

The Value Chain for the Cargo Insurance Market begins with the upstream activities centered on capital management, reinsurance, and risk data provisioning. Upstream participants include primary insurance carriers, specialized reinsurance providers who absorb the high-risk catastrophic exposures, and data vendors supplying critical inputs such as actuarial data, historical loss records, and real-time geopolitical risk assessments. The stability and availability of sophisticated capital in the reinsurance sector are paramount, as this enables primary carriers to underwrite large, complex, and high-exposure global risks, particularly in the marine segment. Efficient capital deployment and accurate modeling of mega-catastrophe events determine the overall capacity and pricing stability of the entire market.

The core processing layer involves the underwriting and distribution channels. Underwriters translate the raw risk data into priced policies, a process increasingly reliant on advanced analytics and AI for instantaneous risk grading. Distribution is dominated by brokers and agents, who act as crucial intermediaries, linking complex insurer offerings with the specific needs of end-users (shippers, consignees, freight forwarders). Brokers provide critical advisory services on policy structure, compliance (especially regarding Incoterms), and claims advocacy. Direct distribution channels, primarily utilized by large logistics companies or through specialized digital platforms, are growing, driven by the desire for greater control over the policy purchasing experience and immediate coverage issuance.

Downstream activities focus heavily on claims management and payout services, forming the critical touchpoint for end-user satisfaction. This stage involves loss adjusters, surveyors, legal counsel, and the operational teams responsible for processing payments. The efficiency of the downstream chain is being dramatically optimized through technology; digital claims submission, automated document analysis, and the use of smart contracts are accelerating resolution times. Furthermore, the downstream relationship extends into risk mitigation consulting, where insurers work with clients post-loss to implement better packing, security, and route planning strategies, completing a feedback loop that integrates claims experience back into the upstream risk modeling process, thus enhancing the overall value proposition.

Cargo Insurance Market Potential Customers

The primary customers for cargo insurance are entities that bear financial risk for goods during transit, fundamentally driven by the terms of trade (e.g., Incoterms) agreed upon between the buyer and the seller. This encompasses a broad range of businesses, starting with exporters and importers who rely on predictable financial outcomes for their cross-border transactions. Large multinational corporations involved in global supply chains, particularly in industries such as automotive, electronics, and heavy machinery, represent the largest potential customer segment. These corporations require complex, master policies covering global stock throughput—insuring inventory not only while in transit but also potentially while temporarily stored in warehouses or distribution centers, demanding sophisticated, tailored coverage solutions that span multiple modes of transport and international jurisdictions.

A second major customer category includes the vast network of logistics service providers, encompassing freight forwarders, Non-Vessel Operating Common Carriers (NVOCCs), and third-party logistics (3PL) providers. While these entities often carry their own liabilities, they frequently purchase primary or supplemental cargo insurance on behalf of their clients to manage contractual liability limits and enhance their service offerings. For 3PLs, the ability to offer comprehensive, single-source insurance alongside transportation and warehousing services acts as a significant competitive differentiator. Their purchasing decisions are often driven by aggregated risk volume and the need for seamless, technologically integrated policy management systems that can issue thousands of certificates quickly.

The third substantial group comprises SMEs involved in international trade and the rapidly expanding e-commerce sector. While SMEs often face budget constraints, the consequence of an uninsured loss can be catastrophic to their business viability. Consequently, this segment represents a growing area where simplified, modular, and affordable insurance products are gaining traction, often facilitated through digital platforms and brokers specializing in small business risk. As global trade liberalization continues, and as digital marketplaces connect smaller producers directly with international consumers, the demand for accessible, transaction-specific cargo insurance among these smaller end-users is expected to accelerate significantly, demanding higher levels of automation and transparency in the policy issuance process.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 25.2 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AIG, AXA, Zurich Insurance Group, Allianz SE, Travelers, Chubb Limited, Tokio Marine Holdings, Generali Group, Mitsui Sumitomo Insurance, Swiss Re, Munich Re, Liberty Mutual Insurance, Hannover Re, Starr Insurance Companies, Beazley Group, RSA Insurance Group, Marsh McLennan, Willis Towers Watson, Aon, The Hartford |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cargo Insurance Market Key Technology Landscape

The technology landscape of the Cargo Insurance Market is rapidly evolving, moving far beyond simple paper-based policy issuance toward complex, integrated digital ecosystems designed for real-time risk assessment and automated claims processing. A foundational technology driving this transformation is the Internet of Things (IoT), involving sensor deployment within containers and pallets. These IoT devices collect critical data points—such as location via GPS, temperature stability, shock exposure, and unauthorized container access—providing continuous, granular visibility into the cargo's condition and environment. This influx of high-frequency, reliable data is essential for enabling dynamic pricing models, where premiums can be adjusted based on real-time risk exposure along the journey, incentivizing safer shipping practices and significantly reducing the informational asymmetry between the shipper and the insurer.

Artificial Intelligence (AI) and Machine Learning (ML) constitute the second pillar of the technological revolution. These systems leverage the massive datasets generated by IoT and historical loss information to execute highly accurate predictive modeling, anticipating potential failures, congestion points, or weather-related threats far in advance. AI also powers automated underwriting engines, allowing insurers to instantly assess complex risk profiles and issue policies through digital channels, dramatically cutting down the time from quotation to binding, which is critical in the fast-paced logistics industry. Furthermore, advanced AI techniques like Natural Language Processing (NLP) are automating the analysis of unstructured data, such as contract language and claims documentation, ensuring policy compliance and accelerating payment timelines, thereby enhancing operational efficiency across the entire claims lifecycle.

Finally, distributed ledger technology (DLT), specifically blockchain, is emerging as a critical enabler for transparency and fraud reduction. Blockchain creates immutable, shared records of transactions, ownership transfers, and policy attestations, solving long-standing issues related to documentation discrepancies and verification delays inherent in multi-party international trade. The implementation of smart contracts on blockchain platforms allows for the automatic execution of claims payouts upon verifiable, predetermined conditions (e.g., container arrival at a specified port after a predefined delay threshold), significantly removing human intervention and associated errors. Collectively, these technologies are transforming cargo insurance from a necessary administrative burden into a proactive, data-driven risk management service.

Regional Highlights

The Asia Pacific (APAC) region stands out as the primary engine of growth for the Cargo Insurance Market, driven by unprecedented levels of maritime trade and the region’s increasing role as the global manufacturing powerhouse. Countries like China, India, Vietnam, and Indonesia are witnessing rapid industrialization, leading to massive export and import volumes across sea and air lanes. Infrastructure investments, such as the Belt and Road Initiative (BRI), further stimulate trade flows that require comprehensive cargo coverage. This region’s growth is characterized by a strong demand for policies covering high-volume bulk commodities as well as specialized coverage for the rapidly expanding electronics and automotive supply chains. The challenge in APAC remains the diversity of regulatory environments and varying levels of digital adoption, necessitating regional insurers to adopt highly flexible and localized distribution and compliance strategies.

North America and Europe represent mature, high-value markets defined by stringent regulation and high technological penetration. In North America, the market is characterized by sophisticated risk management practices, driven by high-value pharmaceutical, aerospace, and high-tech goods, demanding exceptional policy security and often integrated risk consulting services. European demand is bolstered by robust intra-continental trade (primarily land and short-sea shipping) and significant international connections, particularly in highly specialized industrial sectors such as machinery and luxury goods. These regions are pioneers in the adoption of InsurTech solutions, leveraging AI for underwriting and blockchain for supply chain transparency. The key trend here involves addressing mounting cyber risks and ensuring resilience against severe, climate-change-induced weather events that threaten coastal infrastructure and shipping routes.

Latin America (LATAM) and the Middle East and Africa (MEA) are critical emerging markets offering substantial growth opportunities. LATAM’s growth is tied to commodity exports (agriculture, minerals, energy) and increased consumer goods imports, though the market faces challenges related to political instability, high rates of cargo theft (particularly land transport), and macroeconomic volatility, which necessitate higher premiums and specialized theft coverage. The MEA region is driven by massive infrastructure projects, burgeoning oil and gas exports, and the development of major shipping hubs (e.g., Dubai, Saudi Arabia). The region requires bespoke policies addressing unique geopolitical risks, war, and terrorism exclusions, driving demand for specialized marine insurance and high-value cargo protection, particularly along critical maritime choke points. Investment in localized underwriting expertise and specialized risk engineering is crucial for capitalizing on these regional market potentials.

- Asia Pacific (APAC): Highest growth driver due to massive manufacturing and e-commerce expansion; focus on bulk and high-tech cargo insurance.

- North America: Mature market characterized by high-value goods, stringent regulation, and leading adoption of AI and InsurTech solutions.

- Europe: Stable growth driven by intra-EU trade, sophisticated industrial goods movement, and high demand for climate change risk mitigation policies.

- Latin America (LATAM): Emerging market with high growth potential, but constrained by elevated rates of cargo theft and macroeconomic uncertainty, demanding robust security solutions.

- Middle East and Africa (MEA): Growth tied to energy exports and infrastructure development, requiring specialized coverage for geopolitical risks and major catastrophic events.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cargo Insurance Market.- Allianz SE

- AXA

- Zurich Insurance Group

- American International Group (AIG)

- Travelers Companies Inc.

- Chubb Limited

- Tokio Marine Holdings Inc.

- Generali Group

- Mitsui Sumitomo Insurance Co., Ltd.

- Swiss Re

- Munich Re

- Liberty Mutual Insurance

- Hannover Re

- Starr Insurance Companies

- Beazley Group

- RSA Insurance Group

- Marsh McLennan

- Willis Towers Watson

- Aon

- The Hartford

Frequently Asked Questions

Analyze common user questions about the Cargo Insurance market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between All Risks and Named Perils cargo insurance policies?

All Risks coverage provides the broadest protection against all external causes of physical loss or damage, unless specifically excluded in the policy, offering comprehensive coverage for most commercial goods. Named Perils coverage, conversely, only insures against losses resulting from events explicitly listed in the policy, such as fire, collision, or sinking, and is typically suitable for lower-value or bulk commodities.

How is technology, specifically IoT, changing cargo insurance underwriting and claims?

IoT sensors provide underwriters with real-time data on location, temperature, and shock, allowing for highly accurate risk modeling and dynamic pricing based on actual transit conditions. For claims, this data offers objective evidence of loss causation and timing, significantly streamlining the investigation process, reducing fraud potential, and accelerating claims settlement cycles through automated verification.

Which geographic region is expected to lead market growth and why?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR). This acceleration is driven by robust manufacturing output, exponential growth in regional and global maritime trade, extensive infrastructure development (e.g., ports and logistics networks), and surging cross-border e-commerce activity requiring diverse logistics insurance solutions.

What role do geopolitical risks and supply chain volatility play in premium pricing?

Geopolitical risks, including conflicts, trade wars, and sanctions, significantly increase the perceived risk exposure for cargo traversing affected areas, leading to higher premiums, mandatory war risk surcharges, or outright exclusions in standard policies. Increased supply chain volatility also necessitates more flexible coverage solutions, often leading to slightly higher costs to account for potential delays, route changes, or unforeseen storage needs.

Are cyberattacks on logistics systems covered by standard cargo insurance policies?

Standard cargo policies typically focus on physical damage or loss of goods and often contain strict exclusions regarding non-physical perils, including losses derived from cyberattacks on logistics or operational technology systems. Insurers are increasingly developing specialized cyber insurance riders or standalone policies specifically to cover contingent business interruption and financial losses resulting from sophisticated cyber incidents affecting the supply chain.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Marine Cargo Insurance Market Statistics 2025 Analysis By Application (Personal, Commercial), By Type (Free from Particular Average, with Particular Average, All Risk, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Airfreight Forwarding Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Documentation and PO Management, Warehousing and Cargo Tracking, Cargo Insurance and Claims, Freight Consolidation, Others), By Application (Residential Use, Commercial Use, Industrial Use), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager