Caribbean Food and Drink Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433249 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Caribbean Food and Drink Market Size

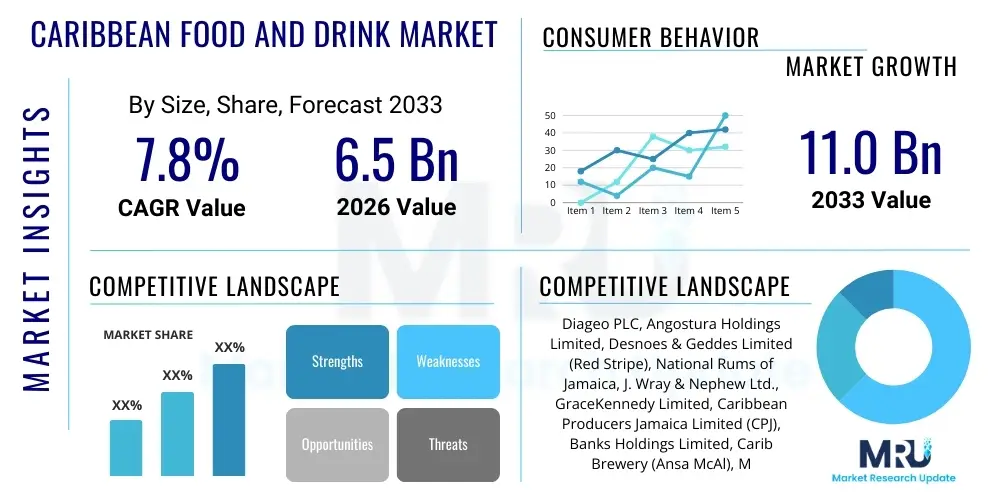

The Caribbean Food and Drink Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 6.5 Billion in 2026 and is projected to reach USD 11.0 Billion by the end of the forecast period in 2033.

Caribbean Food and Drink Market introduction

The Caribbean Food and Drink Market encompasses a diverse and culturally rich array of processed foods, fresh produce, spices, alcoholic and non-alcoholic beverages, catering primarily to local populations, the extensive tourism sector, and a significant international diaspora. This market is intrinsically linked to the region’s agricultural output and robust hospitality industry, serving as a critical pillar of economic stability across many island nations. Key product categories range from staple items like rice, root crops (yam, cassava), and fresh fish, to specialized high-value export commodities such as aged rum, exotic fruit purees, coffee, and globally recognized spice blends, particularly jerk seasoning and hot sauces. The reliance on imports for certain staples presents both structural vulnerabilities and opportunities for domestic value addition.

Major applications of Caribbean food and drink products span various sectors, including local household consumption, institutional catering, and international trade. The pervasive influence of tourism means that hotels, resorts, and cruise lines represent a primary demand source, often requiring high-quality, regionally sourced ingredients to deliver authentic culinary experiences. Furthermore, the market benefits significantly from the cultural resonance of Caribbean cuisine among large diaspora communities in North America and Europe, driving consistent demand for specialty and ethnic food products. The industry is characterized by a blend of traditional small-scale producers and larger multinational corporations operating regional manufacturing facilities, focusing on both domestic distribution and export efficiency.

The primary benefits driving this market include the global recognition of unique Caribbean flavors, increasing consumer demand for exotic and natural food ingredients, and the strategic push for food security within the region. Driving factors include favorable demographic trends, rising disposable incomes in major source markets for tourism, and heightened governmental and private investment aimed at modernizing agricultural supply chains. Moreover, technological advancements in food processing, packaging, and cold chain logistics are enabling longer shelf lives and expanded export reach, transforming local products into internationally viable commodities. These factors collectively solidify the market's trajectory towards sustained growth and increased internationalization.

Caribbean Food and Drink Market Executive Summary

The Caribbean Food and Drink Market is experiencing transformative business trends characterized by intense focus on sustainable sourcing, vertical integration, and brand premiumization, particularly in the beverage and spice sectors. Leading corporations are increasingly investing in localized manufacturing facilities to mitigate volatile import costs and regulatory hurdles, simultaneously catering to the rising demand for 'local' and 'authentic' products from tourists and residents. Mergers and acquisitions are common among smaller, specialty producers seeking capital injection to scale operations and meet stringent export standards, resulting in a more consolidated market structure focused on high-quality niche offerings. The adoption of traceability technologies, particularly in premium segments like single-estate coffee and aged rum, is becoming a non-negotiable standard for establishing brand trust and ensuring supply chain transparency.

Regional trends are highly differentiated, reflecting the varying economic structures and primary export focuses of individual island nations. For instance, countries heavily reliant on tourism, such as Barbados and the Bahamas, exhibit high demand for imported luxury goods and high-end ingredients to service the hospitality sector, while simultaneously boosting local production of fresh produce and artisanal goods. In contrast, larger economies like the Dominican Republic and Jamaica, which possess more diversified manufacturing capabilities, are dominating the export landscape for processed foods, snacks, and alcoholic beverages. Climate change poses a significant regional constraint, necessitating immediate investment in climate-resilient agriculture and robust regional cooperation frameworks to ensure stable intra-regional food trade, which remains underdeveloped despite its potential.

Segment trends highlight a strong shift toward functional and healthy food and drink options, mirroring global health and wellness movements. The demand for naturally sweetened fruit juices, plant-based alternatives derived from local crops (e.g., coconut milk, breadfruit flour), and low-sugar alcoholic beverages is surging. The rum segment, a perennial regional powerhouse, is undergoing a premiumization revolution, moving from standard spirit consumption to sophisticated sipping rums marketed globally as high-end luxury goods, emphasizing heritage and aging processes. Simultaneously, the convenience food segment, driven by urbanization and busy lifestyles in regional capitals, continues to expand, though local brands are competing fiercely with international giants by offering culturally relevant flavors and preparations.

AI Impact Analysis on Caribbean Food and Drink Market

Users frequently inquire about how AI can stabilize the inherently vulnerable Caribbean agricultural supply chain, which is often affected by adverse weather conditions, limited infrastructure, and fragmented production. Key themes revolve around the potential for predictive analytics to improve farm yields, the application of machine learning in optimizing cold chain logistics to reduce spoilage (a major concern in tropical climates), and the role of AI in quality control for exported goods. There is also significant interest in AI's capacity to personalize the tourist food experience and enhance digital marketing targeting the diaspora market. However, concerns persist regarding the accessibility and cost of AI technology for smallholder farmers and traditional producers, along with the potential for labor displacement in basic processing and harvesting operations across the islands.

The influence of Artificial Intelligence (AI) is set to dramatically reshape the upstream agricultural sector by integrating precision farming techniques adapted to the varied Caribbean microclimates. AI-powered sensors and drones are being deployed for real-time monitoring of crop health, soil composition, and pest infestation, enabling targeted intervention that maximizes yield and minimizes input waste, crucial for sustainable small island economies. This transition from traditional, experience-based farming to data-driven decision-making enhances resilience against sudden environmental shifts. Furthermore, AI algorithms are becoming indispensable in forecasting consumer demand, allowing manufacturers to adjust production schedules dynamically, reducing inventory risk associated with highly perishable goods and optimizing capacity utilization in processing plants.

In the midstream and downstream segments, AI is revolutionizing operational efficiencies and customer engagement. Machine learning is utilized to optimize complex logistics routes for inter-island transportation and international shipping, significantly lowering transportation costs and improving delivery reliability for time-sensitive products like seafood and fresh produce. For manufacturers, AI-driven quality assurance systems, such as computer vision technology, ensure compliance with rigorous international food safety standards (HACCP, ISO), facilitating smoother entry into lucrative export markets. On the consumer front, AI personalizes marketing efforts, utilizing sentiment analysis from social media and sales data to tailor product offerings and promotions specifically to the preferences of tourists and the diaspora, thereby driving higher conversion rates and brand loyalty.

- AI optimizes farm resource management (water, fertilizer) through predictive analytics.

- Machine learning improves supply chain resilience and cold chain logistics, minimizing food waste.

- Computer vision systems enhance automated quality control and food safety compliance in processing.

- AI-driven demand forecasting stabilizes production and reduces inventory holding costs for manufacturers.

- Generative AI personalizes consumer experience and marketing outreach to global diaspora communities.

- Automation fueled by AI addresses labor shortages in complex harvesting and sorting tasks.

DRO & Impact Forces Of Caribbean Food and Drink Market

The Caribbean Food and Drink Market is propelled by the structural driver of a deeply ingrained cultural significance attached to local cuisine, amplified by massive global tourism inflows which act as a powerful consumption multiplier. These drivers are complemented by the growing global appreciation for authentic, exotic flavors, sustaining high demand for Caribbean spices, sauces, and premium alcoholic beverages like aged rum and craft beers. However, the market is significantly restrained by the pervasive reliance on food imports, which exposes local economies to global commodity price volatility and currency fluctuations, alongside severe infrastructure deficits in transportation and cold storage, hindering efficient intra-regional trade and increasing post-harvest losses. The complex interplay of climate vulnerability, tourism dependence, and infrastructure limitations summarizes the dynamic forces shaping this market.

Key opportunities center on leveraging the unique biodiversity of the region to develop novel, high-value functional foods and beverages, appealing to health-conscious consumers globally. Investment in Agri-Tech and resilient farming practices (e.g., hydroponics, vertical farming) offers a pathway to significantly enhance domestic food security and reduce import dependency, turning a major restraint into a strategic competitive advantage. Furthermore, the immense, yet largely untapped, potential of e-commerce and direct-to-consumer models, facilitated by improved digital connectivity, allows smaller producers to bypass traditional intermediaries and directly access diaspora markets, securing better margins and broader brand visibility. The push for geographical indications (GIs) for specific regional products (e.g., Jamaican Blue Mountain Coffee, specific rums) further aids premiumization efforts.

Impact forces influencing the market are multifaceted, stemming from macro-economic and socio-political factors. Socio-economic forces, particularly the high unemployment rates in several island nations, necessitate investment in the agriculture and processing sectors to create sustainable jobs, driving governmental support and investment incentives. Regulatory forces, involving trade agreements and international standards (like FDA and EU regulations), dictate the access and competitiveness of Caribbean products in export markets, compelling local businesses to adopt sophisticated quality management systems. Furthermore, environmental impact forces, specifically the increasing frequency and intensity of hurricanes and droughts, compel stakeholders to prioritize climate resilience, supply chain localization, and disaster risk management as central components of their long-term operational strategies.

Segmentation Analysis

The Caribbean Food and Drink Market is segmented based on product type, distribution channel, and application, reflecting the varied consumption patterns and market structures within the region. Product segmentation differentiates between processed foods, fresh produce, and beverages (alcoholic and non-alcoholic), with beverages holding a dominant revenue share driven by the global popularity of Caribbean spirits. Distribution analysis highlights the dominance of traditional retail and the crucial role of the hospitality sector, while the application segment underlines the importance of both domestic consumption and export markets, which often require specialized packaging and regulatory compliance.

- By Product Type:

- Processed Foods (Snacks, Frozen Foods, Canned Goods)

- Fresh Produce (Fruits, Vegetables, Root Crops, Seafood)

- Beverages (Alcoholic - Rum, Beer, Spirits; Non-Alcoholic - Juices, Sodas, Water)

- Ingredients and Spices (Seasonings, Sauces, Extracts)

- By Distribution Channel:

- Supermarkets/Hypermarkets

- Convenience Stores

- Traditional Retail (Wet Markets, Small Grocers)

- Food Service/Hospitality (Hotels, Restaurants, Bars)

- Online Retail/E-commerce

- By Application/End User:

- Household Consumption

- Commercial Use (Food Service Industry)

- Export/International Trade

Value Chain Analysis For Caribbean Food and Drink Market

The upstream segment of the Caribbean Food and Drink market value chain is predominantly characterized by fragmented agriculture, including smallholder farms, fisheries, and commodity producers (sugar, cocoa, coffee). This segment faces challenges related to inconsistent yield quality, outdated farming techniques, and vulnerability to climate shocks, leading to high reliance on imported inputs like feed, fertilizer, and machinery. However, the upstream segment is also the source of the region's unique selling proposition—the endemic fruits, spices, and specific strains of crops that lend authenticity to final products. Efforts are increasingly focused on improving farmer aggregation, providing micro-financing, and introducing resilient farming practices (e.g., certified organic farming) to stabilize supply and enhance the quality required for premium export markets.

The midstream segment involves processing, manufacturing, and packaging. This stage is crucial for converting raw agricultural output into shelf-stable, marketable products. Processing facilities range from large-scale, automated beverage and sugar refineries (especially in the Dominican Republic and Jamaica) to smaller, artisanal processing units for specialty goods like hot sauces and gourmet coffee. The efficiency of this stage is often hampered by high energy costs and limited economies of scale, especially in smaller island nations. Distribution channels are complex, involving both direct and indirect routes. Direct channels involve producers selling directly to large hotels or export brokers. Indirect channels utilize local distributors, wholesalers, and specialized import/export logistics providers who manage the complex regulatory landscape and fragmented infrastructure necessary for moving goods across islands and internationally.

The downstream segment focuses on market access and final sale, dominated by local supermarkets, traditional street vendors, and the ubiquitous hospitality sector. Export is a critical downstream activity, with specialized distribution networks managing the long-haul shipment to major diaspora hubs in the US, UK, and Canada, requiring specialized labeling and cold chain management. For instance, high-value products like aged rum are sold through global spirits distributors and specialized retailers. Successful navigation of the downstream requires strong relationships with large hospitality groups, effective brand management, and robust digital platforms to handle the growing e-commerce demand from international buyers seeking authentic Caribbean goods.

Caribbean Food and Drink Market Potential Customers

The primary domestic customers include the local populace, particularly the middle-class segment in urban centers who demand both affordable staples and access to global brands, alongside the strong desire for traditionally prepared, high-quality local cuisine. This consumer base values authenticity, locally sourced ingredients, and affordability, driving demand for locally manufactured processed foods and fresh produce sold through wet markets and large supermarket chains. Changing demographics, including increasing urbanization and smaller household sizes, are also boosting the market for convenient, ready-to-eat meals and single-serve packaging, influencing product development across all islands.

The most significant commercial customer group is the expansive tourism and hospitality sector, encompassing international resorts, local restaurants, cruise lines, and catering services. These entities require massive volumes of both specialized imported goods (to meet international visitor expectations) and high-quality local ingredients (to deliver an authentic Caribbean experience). This segment is characterized by demanding procurement standards, strict food safety requirements, and seasonality, necessitating flexible and reliable supply chain partners capable of handling large, fluctuating orders, particularly during peak tourist seasons. Suppliers catering to this segment must meet global certifications and guarantee consistent quality.

A globally critical customer segment is the Caribbean diaspora, heavily concentrated in regions such as the United States, Canada, the United Kingdom, and the Netherlands. This segment maintains a strong cultural connection to home through food, driving substantial, consistent export demand for specialty goods, including specific spices, sauces, snacks, and cultural beverage brands. These customers often seek products that are difficult to replicate abroad, such as specific brands of rum, pepper sauces, and unique tropical fruit concentrates, making them a high-margin, loyal customer base accessible largely through ethnic grocery stores, online platforms, and specialized import distributors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 11.0 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Diageo PLC, Angostura Holdings Limited, Desnoes & Geddes Limited (Red Stripe), National Rums of Jamaica, J. Wray & Nephew Ltd., GraceKennedy Limited, Caribbean Producers Jamaica Limited (CPJ), Banks Holdings Limited, Carib Brewery (Ansa McAl), Mount Gay Distilleries, Lascelles deMercado & Co. Ltd., BICO Ltd., Barcardi Limited (Regional Operations), Nestle Caribbean Inc., Seprod Group, DDL (Demerara Distillers Limited), St. Lucia Distillers, PepsiCo (Regional Distributors), Coca-Cola (Regional Bottlers), Trinidad and Tobago National Flour Mills. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Caribbean Food and Drink Market Key Technology Landscape

The adoption of advanced food processing and preservation technologies is crucial for mitigating post-harvest losses, which are notoriously high in tropical climates. Key technologies include High-Pressure Processing (HPP) for extending the shelf life of fresh juices and seafood without relying on chemical preservatives, meeting the rising consumer demand for 'clean label' products. Furthermore, sophisticated aseptic processing and packaging techniques are essential for efficiently exporting sauces, purees, and fruit concentrates, ensuring microbial stability during long transit times. Investment in efficient, energy-saving processing equipment is also pivotal, given the high energy costs prevalent across many Caribbean islands, improving profitability and environmental sustainability.

In the agricultural and supply chain sphere, technology implementation focuses heavily on improving resiliency and traceability. Sensor-based agricultural technology (Agri-Tech), including IoT devices for monitoring soil conditions and microclimate variations, is transforming traditional farming into precision agriculture, optimizing input usage and predicting yield. Critically, the establishment of comprehensive, digitally monitored cold chain logistics is rapidly advancing, utilizing smart temperature monitoring (telematics) and advanced refrigeration systems for shipping perishables both locally and internationally, dramatically reducing spoilage and enhancing product quality upon arrival. Blockchain technology is also being piloted by several major export players, especially in the premium rum and coffee segments, to provide immutable traceability records from farm to consumer, reinforcing brand trust and premium pricing.

Retail and consumer engagement technologies are equally important for driving market growth. E-commerce platforms, optimized for cross-border transactions and capable of handling complex international shipping logistics (including duties and customs clearances), are providing vital direct access to the diaspora market, which was traditionally reliant on intermediary importers. Furthermore, the increasing use of Enterprise Resource Planning (ERP) systems tailored for food manufacturing helps local companies manage inventory, production scheduling, and regulatory compliance efficiently. Digital marketing tools, leveraging data analytics and AI, allow producers to better understand localized tourist and diaspora preferences, enabling targeted marketing campaigns for new product launches and seasonal promotions.

Regional Highlights

- Jamaica: Dominates the spice, jerk seasoning, and premium aged rum segments. Exhibits robust export market activities supported by strong global brand recognition (e.g., specific coffee and spirits). Faces challenges in stabilizing local food security against climate volatility, driving significant investment in modern farming and processing facilities.

- Dominican Republic (DR): Represents the largest market in terms of sheer volume and manufacturing capacity, particularly in packaged staples, beer, and sugar. The DR’s market is characterized by a strong mix of domestic consumption, high tourism demand, and substantial non-traditional food exports to the US and Europe.

- Trinidad and Tobago: A key hub for non-alcoholic beverages, beer (Carib Brewery), and cocoa products. Possesses a sophisticated, though often import-reliant, food processing industry. Strong focus on regional distribution and export of specialty items like Angostura bitters and premium rum brands.

- Puerto Rico (US Territory): Exhibits consumer patterns heavily influenced by US standards, resulting in high demand for international brands alongside local specialties. The market benefits from advanced infrastructure relative to other islands but is also highly price-sensitive and focuses on distribution efficiency for imported goods.

- Barbados: Heavily dependent on the high-end tourism sector, driving robust demand for premium ingredients and spirits (e.g., Mount Gay Rum). The market is small but characterized by high per-capita consumption of quality goods and significant efforts toward achieving national food independence through protected agricultural zones.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Caribbean Food and Drink Market.- Diageo PLC

- Angostura Holdings Limited

- Desnoes & Geddes Limited (Red Stripe)

- National Rums of Jamaica

- J. Wray & Nephew Ltd.

- GraceKennedy Limited

- Caribbean Producers Jamaica Limited (CPJ)

- Banks Holdings Limited

- Carib Brewery (Ansa McAl)

- Mount Gay Distilleries

- Lascelles deMercado & Co. Ltd.

- BICO Ltd.

- Barcardi Limited (Regional Operations)

- Nestle Caribbean Inc.

- Seprod Group

- DDL (Demerara Distillers Limited)

- St. Lucia Distillers

- Trinidad and Tobago National Flour Mills

- Barbados Dairy Industries Ltd. (PINEHILL)

- Sunshine Snacks (Regional)

Frequently Asked Questions

Analyze common user questions about the Caribbean Food and Drink market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the Caribbean Food and Drink Market?

The market growth is primarily driven by expanding tourism inflows, strong, consistent export demand from the global Caribbean diaspora, increasing health consciousness demanding natural products, and continuous innovation in the premium alcoholic beverage sector, particularly aged rum.

How does import dependency affect the Caribbean Food and Drink supply chain?

High import dependency for staple goods and agricultural inputs exposes the supply chain to international commodity price volatility and currency fluctuations, increasing local production costs and hindering regional food security efforts. This creates urgency for developing local agri-tech and domestic sourcing.

Which segments are experiencing the most rapid growth in the Caribbean Food and Drink Market?

The fastest-growing segments include premium and craft alcoholic beverages (sipping rums, artisanal beers), functional non-alcoholic beverages (natural fruit juices, coconut water), and convenient processed foods featuring authentic, culturally specific flavors targeting urban consumers.

What role does technology play in modernizing Caribbean agriculture and food processing?

Technology, including AI-driven precision agriculture, IoT sensors, and advanced cold chain logistics, is vital for increasing crop yields, reducing post-harvest losses, and ensuring compliance with stringent international food safety standards required for high-value exports.

What are the primary opportunities for new entrants in the Caribbean Food and Drink Market?

Opportunities exist in developing climate-resilient farming solutions, implementing modern e-commerce models for direct-to-consumer diaspora sales, and focusing on niche markets such as organic certifications, sustainable seafood sourcing, and functional food development using unique local ingredients.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager