Carvone Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438390 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Carvone Market Size

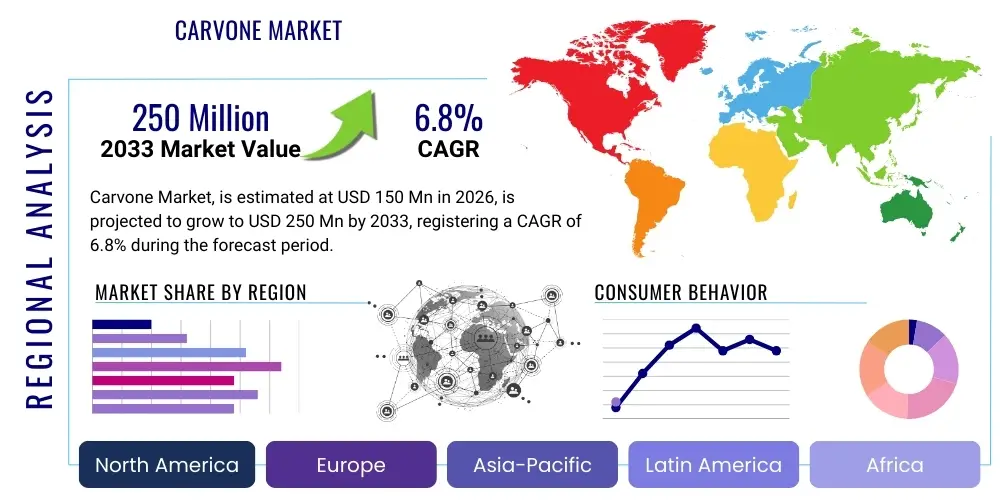

The Carvone Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $150 Million in 2026 and is projected to reach $250 Million by the end of the forecast period in 2033.

Carvone Market introduction

Carvone is a naturally occurring terpenoid, specifically a ketone, renowned for its distinct aromatic profile. It exists primarily as two enantiomers: (S)-(+)-Carvone, which gives spearmint oil its characteristic scent, and (R)-(-)-Carvone, found predominantly in caraway and dill seed oils. This structural dichotomy allows Carvone to serve diverse sensory functions, making it a critical component in the flavors and fragrances (F&F) industry. The market is driven by increasing consumer demand for natural ingredients, particularly in food, beverages, and cosmetic formulations where mint and spicy notes are highly valued. Furthermore, its biological properties, including antifungal and insecticidal potential, are expanding its utility into agricultural and pharmaceutical sectors.

The product is commercially sourced through two primary methods: natural extraction, typically steam distillation of essential oils from plants like Mentha spicata or Carum carvi, and synthetic production, often starting from limonene derived from citrus peels. The choice between natural and synthetic Carvone hinges on cost-effectiveness, scalability, and specific regulatory requirements of the end-use application. Natural Carvone commands a significant price premium due to the complexity and variability associated with agricultural yield and extraction efficiency. The rising global focus on clean label products and sustainability significantly favors the naturally sourced variant, despite its higher production costs.

Major applications of Carvone span across confectionery, chewing gum, personal care products, and oral hygiene products, owing to its potent flavoring and refreshing properties. Beyond sensory applications, Carvone is recognized for its potential therapeutic benefits, including antioxidant and antimicrobial activity, fueling research in drug development and functional food formulations. The market expansion is intrinsically linked to the robust growth of the global F&F sector and the continuous efforts by manufacturers to substitute synthetic ingredients with nature-derived, proven alternatives that meet stringent safety and efficacy standards across international jurisdictions. This shift underscores Carvone’s importance as a versatile and high-value chemical intermediate.

Carvone Market Executive Summary

The Carvone market exhibits dynamic business trends characterized by a bifurcated supply strategy, balancing the premium segment demanding natural extracts against the bulk industrial segment utilizing cost-effective synthetic production pathways, primarily from limonene. Key business drivers include the stringent regulations governing food and cosmetic safety, pushing manufacturers towards high-purity, well-characterized enantiomers. A significant trend involves the adoption of sustainable sourcing practices and advanced biotechnology, such as fermentation-based production, to mitigate the volatility inherent in agricultural raw material supply and address environmental concerns. Companies are heavily investing in R&D to unlock Carvone's potential in novel applications beyond traditional flavorings, specifically targeting its role as an environmentally friendly biopesticide and a pharmaceutical excipient, thereby diversifying revenue streams and stabilizing market growth.

Regionally, Asia Pacific (APAC) is emerging as the fastest-growing market, driven by rapidly expanding domestic consumption in the food and beverage industry, coupled with increasing manufacturing capacity in countries like China and India, which serve as global hubs for essential oil processing and chemical synthesis. North America and Europe currently represent the largest consumption bases, dominating demand for high-grade natural Carvone due to high consumer awareness regarding clean labels and strong regulatory frameworks supporting the use of natural ingredients in consumer goods. European regulations, particularly REACH compliance, significantly shape market entry and product formulation strategies, emphasizing rigorous toxicological data and safety assessments, which often favor established natural routes or high-purity synthetic routes.

In terms of segmentation, the Application segment focusing on Flavors and Fragrances (F&F) remains the dominant category, sustaining the highest market share. However, the Agrochemicals segment, driven by the need for safer, less toxic crop protection alternatives, is projected to record the highest Compound Annual Growth Rate (CAGR) over the forecast period. The Type segment confirms that S-Carvone (Spearmint) holds a larger volume share due to its ubiquitous use in mass-market products like chewing gum and toothpaste, while R-Carvone (Caraway/Dill) maintains a steady niche market, highly valued in specialty food and artisan fragrance compositions. The strategic shift towards bio-based and enzymatic synthesis routes is expected to stabilize supply and potentially reduce the cost differential between the natural and synthetic segments in the long term.

AI Impact Analysis on Carvone Market

User inquiries regarding AI's impact on the Carvone market frequently revolve around questions of optimizing molecular synthesis efficiency, enhancing quality control and authenticity verification of natural extracts, and accelerating the discovery of novel therapeutic or agrochemical applications. Users are concerned about how machine learning can differentiate between natural and synthetic Carvone, how computational chemistry can predict optimal reaction conditions for sustainable synthesis from limonene, and whether AI platforms can streamline supply chain logistics for highly volatile essential oil raw materials. The consensus expectation is that AI will primarily serve as an optimization tool, reducing waste, increasing purity, and securing the supply chain against counterfeiting, rather than fundamentally altering the end-product formulation itself. This integration points towards a future where data-driven decisions underpin sourcing, processing, and application development in the specialized chemicals sector.

- AI-driven optimization of essential oil distillation processes, predicting optimal temperature and pressure to maximize Carvone yield and purity.

- Machine Learning algorithms deployed for spectral analysis (e.g., GC-MS data) to authenticate natural Carvone and detect adulteration or mixing with cheaper synthetic alternatives.

- Computational chemistry simulating novel biocatalytic pathways, accelerating the development of highly selective, environmentally friendly enzymatic synthesis of specific Carvone enantiomers.

- Predictive supply chain analytics using AI to forecast raw material demand (spearmint/caraway cultivation) based on climate data and market trends, mitigating supply volatility.

- AI assisting in structure-activity relationship (SAR) studies to identify and screen Carvone derivatives for enhanced insecticidal or antimicrobial efficacy, speeding up agrochemical R&D.

DRO & Impact Forces Of Carvone Market

The Carvone market dynamics are governed by a complex interplay of drivers, restraints, and opportunities, collectively forming potent impact forces. A primary driver is the accelerating global trend favoring natural and clean-label ingredients, particularly within the food, beverage, and personal care industries, where consumers actively seek naturally derived flavors and fragrances over synthetic chemicals. Furthermore, the growing recognition of Carvone's biological efficacy, including its use as a sprout inhibitor for potatoes and its antimicrobial properties, generates substantial opportunities for market penetration in specialized agrochemical and pharmaceutical niches. However, the market faces significant restraints, chiefly stemming from the high cost and volatile supply chain associated with natural extraction, dependent on successful agricultural yields, alongside the competitive pricing pressure exerted by mass-produced synthetic limonene-derived Carvone.

The impact forces influencing Carvone adoption are heavily weighted towards regulatory mandates and consumer preference shifts. Increasing governmental oversight concerning residual chemical levels in crops and consumer products fuels the demand for biopesticides like Carvone, thereby acting as a strong growth catalyst. Conversely, technical challenges related to the enantiomeric purity required for certain specialized applications, and the complexity of large-scale, sustainable extraction methods, serve as substantial barriers to entry for smaller manufacturers. Opportunities are particularly pronounced in emerging biotechnological advancements, such as precision fermentation, which promise to decouple Carvone production from agricultural seasonality, potentially offering a sustainable, scalable, and cost-competitive route that retains the 'natural' designation favored by consumers.

Ultimately, the market trajectory is determined by the industry's ability to balance the cost-efficiency of synthetic production with the premium value and regulatory preference afforded to natural sourcing. The crucial opportunity lies in refining purification technologies and scaling up bioconversion processes to bridge this gap. Strategic alliances between essential oil producers and biotech firms will be vital to capitalize on the opportunity presented by Carvone’s versatility across F&F, crop protection, and health supplements, ensuring consistent, high-purity supply while navigating the inherent volatility in raw material sourcing and the high capital expenditure required for advanced synthetic facilities.

Segmentation Analysis

The Carvone market is comprehensively segmented based on its source of origin, the specific enantiomeric type produced, and its diverse end-use applications across multiple industries. This stratification provides a detailed view of market demand patterns, pricing differentials, and growth trajectories within specific niches. The distinction between natural and synthetic sources is fundamental, influencing both regulatory compliance and consumer perception, with naturally derived Carvone commanding higher prices and dominating the premium food and cosmetic segments. Furthermore, the specific enantiomer, S-(+)-Carvone or R-(-)-Carvone, dictates the application, separating the bulk flavor market (S-Carvone, mint flavor) from specialty aroma and therapeutic markets (R-Carvone, caraway/dill flavor and potential pharmaceutical uses).

- Source

- Natural (Extraction from essential oils like spearmint, caraway, or dill)

- Synthetic (Chemical synthesis, primarily from limonene)

- Type

- S-(+)-Carvone (Spearmint flavor)

- R-(-)-Carvone (Caraway/Dill flavor)

- Application

- Flavors and Fragrances (F&F)

- Food and Beverages

- Oral Care and Personal Care

- Cosmetics and Perfumes

- Agrochemicals (Pesticides, Sprout Inhibitors)

- Pharmaceuticals and Nutraceuticals

- Flavors and Fragrances (F&F)

Value Chain Analysis For Carvone Market

The Carvone value chain begins upstream with the cultivation and harvesting of source crops, primarily spearmint and caraway. This initial phase is highly vulnerable to climatic changes, agricultural practices, and labor costs, significantly influencing the quality and cost of the raw essential oil. Midstream activities involve crucial processing steps: either steam distillation/Supercritical Fluid Extraction (SFE) for natural Carvone or chemical synthesis/biocatalysis for synthetic or bio-based Carvone, followed by rigorous purification steps like fractional distillation or chromatography to achieve the required enantiomeric purity. Efficiency and technological sophistication in the midstream determine the final product quality and yield. Robust relationships between agricultural producers and essential oil processors are essential for mitigating supply risk.

The downstream segment involves specialized chemical distributors and traders who manage the bulk storage, quality testing, and international logistics, ensuring the product reaches diverse end-user industries globally. Distribution channels are bifurcated: direct sales channels involve large flavor houses or agrochemical formulators purchasing directly from major manufacturers, especially for high-volume synthetic products. Indirect channels utilize specialized chemical distributors and agents, particularly crucial for supplying small-to-medium enterprises (SMEs) in regional markets, and for premium, low-volume natural extracts requiring specialized handling and certification. The increasing need for traceability and certified organic labeling adds complexity and cost throughout the entire distribution network.

The effectiveness of the value chain is increasingly measured by sustainability metrics and transparency. End-users, especially global F&B companies, demand verifiable proof of ethical sourcing and processing, driving manufacturers to invest in blockchain technology for enhanced traceability from farm to formulation. Key stakeholders at the downstream level, such as multinational flavor corporations, exert significant influence over product specifications and pricing, prompting upstream producers to adopt standardized quality control protocols. Optimization efforts across the chain focus on reducing energy consumption during extraction and purification, and minimizing solvent use in synthetic pathways, aligning with global environmental, social, and governance (ESG) reporting standards.

Carvone Market Potential Customers

The primary consumers and buyers of Carvone are concentrated within several high-growth, high-volume manufacturing sectors globally. The largest segment of potential customers includes multinational Flavor and Fragrance houses (F&F), which utilize Carvone as a foundational ingredient for creating proprietary blends and finished consumer products. These large customers demand consistent supply, stringent quality control, and often enter into long-term supply contracts for both S-Carvone (for mint flavors) and R-Carvone (for specialty spice notes). The secondary large customer base resides within the Oral Care and Personal Care industry, specifically manufacturers of toothpaste, mouthwash, chewing gum, and specialized dermatological preparations, leveraging Carvone’s refreshing aroma and mild antimicrobial properties.

A rapidly expanding customer segment is found within the Agrochemical formulation industry. Companies specializing in crop protection and post-harvest technology are keen buyers of Carvone due to its confirmed efficacy as a natural sprouting inhibitor for stored vegetables, notably potatoes, offering a clean, residue-free alternative to traditional chemical treatments. Furthermore, its profile as a biopesticide makes it attractive to organic farming supply chains and regions implementing stricter limits on synthetic chemical usage. These customers require products registered for agricultural use, often necessitating specific purity levels and regulatory documentation tailored to national agricultural bodies.

Beyond these major industrial buyers, potential customers include pharmaceutical and nutraceutical manufacturers. While the volume is currently smaller compared to F&F, the potential value is high. Carvone is researched for inclusion in specific drug formulations due to its anti-inflammatory, antioxidant, and potential cancer-chemopreventive properties. These customers require the highest standards of purity, often United States Pharmacopeia (USP) or European Pharmacopeia (EP) grade material, alongside extensive certification and batch traceability. The demand from these sectors drives innovation in high-purity, enantiomerically pure synthesis methods, ensuring that the final product meets the rigorous standards necessary for human ingestion and therapeutic use.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $150 Million |

| Market Forecast in 2033 | $250 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | IFF (International Flavors & Fragrances), Symrise AG, Givaudan SA, BASF SE, Takasago International Corporation, Robertet Group, Mane Group, Penta Manufacturing Company, Mentha & Allied Products Pvt. Ltd., Hindustan Mint & Agro Products Pvt. Ltd., Shanghai Freemen, Treatt PLC, BOC Sciences, Vigon International, Ernesto Ventós SA, Xiamen Bestwills Chemical, Firmenich SA, Emerald Kalama Chemical, P&G Chemicals, Sigma-Aldrich (Merck KGaA) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Carvone Market Key Technology Landscape

The technological landscape in the Carvone market is characterized by ongoing innovation aimed at improving extraction efficiency, achieving higher enantiomeric purity, and developing sustainable, non-petrochemical-based production methods. Traditional methods rely heavily on steam distillation for essential oil extraction, which is energy-intensive and can sometimes result in degradation of heat-sensitive components. However, advanced extraction technologies such as Supercritical Fluid Extraction (SFE), particularly using carbon dioxide, are gaining traction. SFE offers superior selectivity and high yield extraction of Carvone from plant material under milder conditions, resulting in a purer, solvent-free product highly prized by the premium natural segment, justifying the higher capital investment required for SFE units.

In the synthetic domain, the transition towards greener chemistry is paramount. The traditional synthesis of Carvone from limonene involves several chemical steps. Modern technological focus is shifting towards biocatalysis and white biotechnology, leveraging engineered microorganisms or isolated enzymes to convert readily available, inexpensive substrates (like renewable sugars or limonene) into specific Carvone enantiomers with extremely high selectivity and reduced environmental footprint. This fermentation-based approach offers the promise of consistent supply, scalability, and the ability to produce 'natural identical' Carvone, which is critical for meeting growing regulatory and consumer demands for sustainable sourcing and reducing reliance on traditional chemical synthesis routes involving harsh reagents.

Furthermore, analytical technologies are crucial for market competitiveness. High-Performance Liquid Chromatography (HPLC) and Gas Chromatography-Mass Spectrometry (GC-MS) are indispensable for quality control, verifying the authenticity (natural versus synthetic origin), and determining the precise enantiomeric ratio required by specialized applications. The development of portable, rapid analytical devices incorporating spectroscopic techniques (like Near-Infrared or Raman Spectroscopy) is an emerging technology trend, enabling swift quality checks throughout the supply chain, from the farm gate to the final processing stage. Continuous process improvement through modular chemical reactors and flow chemistry techniques is also being explored to enhance safety and efficiency in large-scale synthetic Carvone production, optimizing reaction parameters for maximal yield.

Regional Highlights

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Italy, Spain)

- Asia Pacific (China, India, Japan, South Korea)

- Latin America (Brazil, Argentina)

- Middle East and Africa (South Africa, GCC Countries)

North America represents a mature and dominant market for Carvone, characterized by high consumer spending power and a deep-rooted preference for premium, natural ingredients in food, personal care, and oral hygiene products. The United States, in particular, is a significant consumer of S-Carvone, driving large-scale usage in the chewing gum and confectionery sectors. Regulatory frameworks, particularly those managed by the FDA, emphasize safety and clear labeling, which reinforces the demand for high-purity, often naturally derived Carvone extracts. The regional market is technologically advanced, featuring early adoption of Supercritical Fluid Extraction (SFE) and utilizing sophisticated analytical testing to ensure product authenticity. Growth in this region is less volume-driven and more value-driven, focusing on innovations in nutraceutical and pharmaceutical applications.

Europe is a leading consumer of both R- and S-Carvone, influenced heavily by stringent regulatory bodies like the European Union’s REACH framework, which demands extensive safety data and promotes environmentally conscious production. Germany, France, and the UK are major consumption hubs, powered by large flavor houses and a highly developed cosmetics industry emphasizing botanical extracts. The European market shows a strong, sustained demand for R-Carvone in traditional specialty foods (caraway breads and liqueurs) and high-end fragrance applications. Sustainability and traceability are critical purchasing criteria here; thus, manufacturers sourcing natural Carvone often require certifications proving ethical and low-impact farming practices, making high-quality European suppliers highly competitive.

Asia Pacific (APAC) is the fastest-growing market globally for Carvone, attributed to rapid urbanization, increasing disposable incomes, and the consequent expansion of the processed food, beverage, and personal care industries, especially in China and India. China is not only a massive consumer market but also a major global producer of synthetic Carvone and a key source of raw materials for essential oils. The affordability of synthetic Carvone stimulates its uptake in price-sensitive, mass-market consumer goods across the region. However, mirroring Western trends, premium segments in countries like Japan and South Korea are demonstrating a robust shift towards natural and organic ingredients, spurring investment in local extraction and purification capabilities. Regulatory landscapes are evolving rapidly across APAC, gradually aligning with international standards, which is expected to boost demand for certified, higher-grade materials.

Latin America (LATAM) exhibits strong growth potential, driven primarily by Brazil and Mexico, due to their large and rapidly expanding food and beverage manufacturing sectors. The region benefits from abundant natural resources, making it a viable source for some essential oils, although it is also a significant importer of specialty chemicals. Demand for Carvone is largely concentrated in flavor applications, catering to regional tastes and the growing market for functional beverages and confectionery. The increasing influence of global consumer product manufacturers operating within LATAM is raising quality standards and boosting the adoption of both natural and high-purity synthetic Carvone, driven by competitive pricing strategies and localized production capacity expansion.

The Middle East and Africa (MEA) represent a niche yet developing market for Carvone. Consumption in the Gulf Cooperation Council (GCC) countries is bolstered by high imports of luxury perfumes and high-end personal care products, where Carvone is valued as a constituent of sophisticated fragrance compositions. In the agricultural sector, particularly in South Africa and parts of the Middle East, there is burgeoning interest in Carvone’s application as a natural post-harvest treatment and biopesticide, aligning with efforts to improve food security and reduce dependence on conventional chemicals. Market growth, while constrained by geopolitical factors and diverse economic conditions, is expected to accelerate with increased foreign investment in local manufacturing and processing capabilities, particularly targeting the F&F industry.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Carvone Market.- IFF (International Flavors & Fragrances)

- Symrise AG

- Givaudan SA

- BASF SE

- Takasago International Corporation

- Robertet Group

- Mane Group

- Penta Manufacturing Company

- Mentha & Allied Products Pvt. Ltd.

- Hindustan Mint & Agro Products Pvt. Ltd.

- Shanghai Freemen

- Treatt PLC

- BOC Sciences

- Vigon International

- Ernesto Ventós SA

- Xiamen Bestwills Chemical

- Firmenich SA

- Emerald Kalama Chemical

- P&G Chemicals

- Sigma-Aldrich (Merck KGaA)

Frequently Asked Questions

Analyze common user questions about the Carvone market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between S-Carvone and R-Carvone, and how does this affect market demand?

S-(+)-Carvone and R-(-)-Carvone are enantiomers, meaning they are non-superimposable mirror images. S-Carvone has a distinct spearmint aroma and dominates the bulk F&F market (e.g., chewing gum, toothpaste). R-Carvone possesses a caraway/dill scent and is used in specialty food, fragrances, and is preferred for specific pharmaceutical and agrochemical applications due to differential biological activity.

Is natural Carvone supply stable, and how do manufacturers address price volatility?

Natural Carvone supply, derived from essential oils, is inherently unstable and subject to agricultural variables, leading to price volatility. Manufacturers address this through forward contracting, diversification of sourcing locations, and increasingly by investing in sustainable biotechnological methods like fermentation to create natural-identical alternatives that mitigate reliance on fluctuating crop yields.

What are the fastest-growing application segments for Carvone outside of the Flavor and Fragrance industry?

The fastest-growing application segments are Agrochemicals and Pharmaceuticals. In Agrochemicals, Carvone is utilized as an environmentally friendly biopesticide and a sprout inhibitor for stored produce, offering non-toxic alternatives. In Pharmaceuticals, its antioxidant and antimicrobial properties are being leveraged for development in new nutraceutical and therapeutic formulations.

What role do advanced technologies like Supercritical Fluid Extraction (SFE) play in the Carvone market?

SFE plays a vital role in enhancing product quality for the premium segment. It is a highly selective, solvent-free extraction method that yields high-purity Carvone from plant materials under mild conditions, preserving the integrity of the natural extract and meeting stringent regulatory requirements for clean-label consumer products.

Which geographical region is expected to demonstrate the highest growth rate for Carvone consumption?

The Asia Pacific (APAC) region, driven primarily by the rapid expansion of the food processing, cosmetics, and domestic consumption markets in countries like China and India, is projected to exhibit the highest Compound Annual Growth Rate (CAGR) for Carvone consumption during the forecast period.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Carvone Market Size Report By Type (L-Carvone, D-Carvone), By Application (Daily Use Chemical Essence, Food Additive, Pharmaceutical, Agricultural, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Carvone Market Statistics 2025 Analysis By Application (Daily Use Chemical Essence, Food Additive, Pharmaceutical, Agricultural), By Type (L-Carvone, D-Carvone), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager