Case Sealers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435966 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Case Sealers Market Size

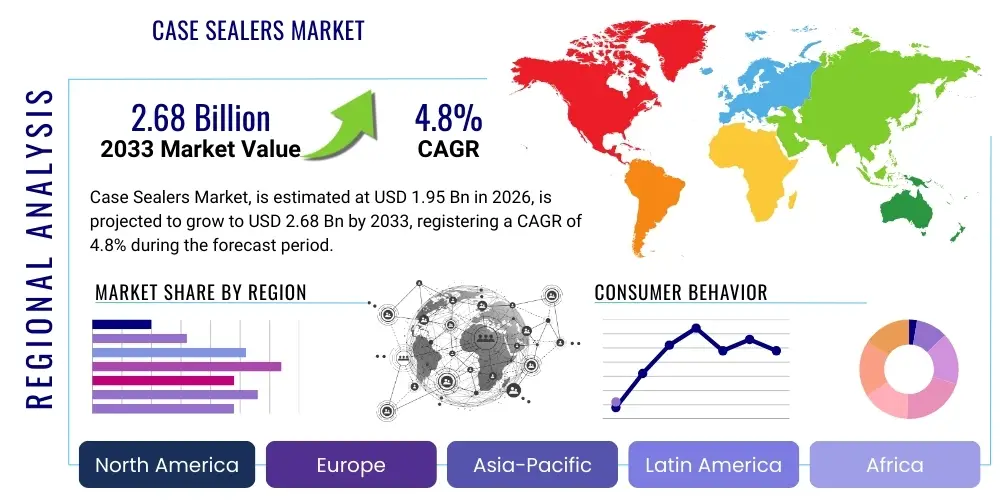

The Case Sealers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $1.95 Billion in 2026 and is projected to reach $2.68 Billion by the end of the forecast period in 2033.

Case Sealers Market introduction

The Case Sealers Market encompasses machinery designed for automatically or semi-automatically closing and sealing corrugated cardboard boxes or cases, primarily used in end-of-line packaging processes. These machines utilize various sealing methods, predominantly tape or hot melt adhesive (glue), ensuring product integrity, tamper-evidence, and efficiency in the supply chain. Critical applications span across fast-moving consumer goods (FMCG), pharmaceuticals, food and beverage processing, and increasingly, high-volume e-commerce fulfillment centers. The underlying demand for case sealers is intrinsically linked to global industrial output and the continuous pressure on manufacturers to optimize operational throughput, reduce manual labor costs, and maintain consistent package quality under stringent regulatory environments.

Key benefits derived from the implementation of advanced case sealing equipment include enhanced packaging speed, consistent application of sealing materials, and significant reduction in repetitive strain injuries associated with manual sealing operations. Furthermore, modern case sealers are designed for integration into fully automated production lines, supporting Industry 4.0 initiatives through data connectivity and modular design. The current market trajectory is heavily influenced by the rise of flexible packaging solutions requiring varied case sizes and the overwhelming growth of the e-commerce sector, which necessitates rapid and reliable packaging solutions capable of handling massive order volumes efficiently across multiple geographic distribution points.

Driving factors propelling market expansion include the globalization of supply chains, necessitating robust packaging standards; escalating labor costs across industrialized nations, making automation an economic imperative; and the continuous technological evolution leading to machines that offer quicker changeovers, higher energy efficiency, and predictive maintenance capabilities. The versatility of contemporary case sealers, adaptable to different case sizes (Random Case Sealers) and varying product weight limits, ensures their indispensable role in modern high-speed manufacturing and logistics operations, securing their growth trajectory throughout the forecast period.

Case Sealers Market Executive Summary

The Case Sealers Market demonstrates robust growth driven primarily by structural shifts in global retail and logistics, notably the explosive expansion of e-commerce necessitating high-speed, reliable end-of-line packaging automation. Business trends indicate a strong move towards fully automatic, random-sized case sealers utilizing hot melt adhesive (glue) due to superior sealing strength, presentation quality, and reduced material costs compared to traditional tape systems over the long term. Companies are strategically investing in modular equipment capable of seamless integration with upstream machinery and down-stream palletizing robotics, focusing on optimizing overall equipment effectiveness (OEE). Regional trends show Asia Pacific (APAC) emerging as the fastest-growing market, propelled by massive industrialization, establishment of large-scale manufacturing hubs, and rapidly modernizing food processing and pharmaceutical sectors in countries like China and India, while North America and Europe maintain strong demand for replacement and advanced smart systems integrating IoT capabilities for real-time diagnostics.

AI Impact Analysis on Case Sealers Market

User inquiries regarding AI's impact on case sealers frequently revolve around the feasibility of predictive failure analysis, integration with complex vision systems for quality control, and the potential for AI algorithms to optimize machine settings for efficiency and material usage based on real-time production variables. Users seek assurance that AI implementation will extend equipment lifespan, minimize unscheduled downtime, and allow for adaptive packaging methodologies without requiring constant human intervention. Key concerns often focus on data privacy within manufacturing environments, the cost of implementing AI infrastructure (edge computing), and the requirements for training personnel to manage increasingly complex, autonomous packaging lines.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming case sealing operations from simple mechanical actions into intelligent packaging processes. AI algorithms analyze extensive datasets generated by sensors monitoring motor performance, tape tension, glue viscosity, and case throughput. This analysis allows for highly accurate prediction of component wear or process deviations before they result in equipment failure or packaging defects, drastically improving equipment uptime and reducing maintenance costs. Furthermore, AI-driven vision systems are used for real-robotics guidance and instant, sub-millisecond inspection of the sealed case, ensuring flap alignment, label placement, and seal integrity meet rigorous quality standards, thereby eliminating defective products from entering the supply chain.

A crucial area where AI demonstrates high utility is in dynamic line optimization. In environments handling variable packaging runs (common in e-commerce), AI models can instantly adjust sealing parameters, speed, and timing based on the current product flow and case dimensions, minimizing changeover time losses and optimizing material consumption (tape length or glue application pattern). This adaptive capability ensures that packaging lines maintain peak efficiency even when facing highly diversified throughput requirements. The ultimate goal of AI implementation in case sealing is to facilitate autonomous operations, where the machine itself learns and adapts to maintain optimal performance parameters throughout its operational cycle without continuous manual tuning.

- AI enables predictive maintenance scheduling by analyzing vibration, temperature, and current draw data, minimizing unscheduled downtime.

- Machine Learning algorithms optimize sealing parameters (e.g., pressure, temperature, speed) in real-time based on fluctuating production throughput and ambient conditions.

- AI-powered vision systems conduct high-speed, non-contact quality inspection of seal integrity and case squareness, ensuring adherence to carrier specifications.

- Integration with Enterprise Resource Planning (ERP) systems allows AI to forecast adhesive or tape consumption accurately, optimizing inventory management.

- AI facilitates automated fault detection and root cause analysis, accelerating troubleshooting and reducing reliance on specialized technicians.

DRO & Impact Forces Of Case Sealers Market

The Case Sealers Market is strongly influenced by critical Dynamics, Restraints, and Opportunities (DRO). Drivers include the overwhelming requirement for cost efficiency in packaging, the need for enhanced throughput rates driven by e-commerce, and mandatory labor cost reductions through automation. Restraints involve the high initial capital expenditure required for advanced, automated systems, specific customization requirements for complex case types (e.g., corrugated shipper boxes vs. retail-ready packaging), and the integration challenges associated with legacy packaging infrastructure. Opportunities center around the adoption of Industry 4.0 standards, the rise of rental or equipment-as-a-service models, and the expanding demand for environmentally sustainable packaging materials requiring specialized sealing techniques, all contributing to the strong positive impact force sustaining market growth.

Segmentation Analysis

The Case Sealers Market is segmented across multiple dimensions to reflect the diversity in operational needs, technological preference, and industry application. Key segmentation factors include the level of automation (Semi-Automatic and Automatic), the mechanism used for closure (Tape Sealing and Glue/Hot Melt Sealing), the manner in which cases are fed (Uniform vs. Random), and the primary end-user industry (Food & Beverage, Pharmaceutical, E-commerce, Consumer Goods, and Others). The automatic segment, particularly utilizing hot melt adhesive for sealing uniform cases, currently dominates the market share due to its superior speed and reliability in high-volume settings, while the e-commerce sector represents the fastest-growing application segment, driving demand for flexible, random-case sealing solutions.

- By Type:

- Semi-Automatic Case Sealers

- Automatic Case Sealers

- By Operation:

- Uniform Case Sealers

- Random Case Sealers

- By Sealing Method:

- Tape Sealing

- Glue/Hot Melt Sealing

- By End-User Industry:

- Food & Beverage

- Pharmaceuticals & Medical Devices

- E-commerce & Logistics

- Consumer Goods (FMCG)

- Industrial Manufacturing

Value Chain Analysis For Case Sealers Market

The value chain for the Case Sealers Market begins with upstream activities involving the sourcing of raw materials, primarily specialized steel and aluminum for machine frames, and advanced electronic components such as Programmable Logic Controllers (PLCs), sensors, and variable frequency drives. Key suppliers also include manufacturers of specialized dispensing equipment for hot melt systems and precision cutting mechanisms for tape sealers. The efficiency and quality of the final product are heavily reliant on the integration capabilities provided by specialized software and automation component suppliers. Upstream complexity is increasing due to the shift towards high-grade, food-safe stainless steel materials required by the pharmaceutical and food processing industries, demanding higher procurement and quality assurance standards.

The manufacturing phase represents the core value addition, where specialized engineering and assembly occur. Original Equipment Manufacturers (OEMs) focus on modular design, ease of maintenance, and compliance with global safety standards (e.g., CE, UL). Design differentiation often centers on speed optimization, energy efficiency, and the introduction of advanced human-machine interfaces (HMIs). The distribution channel is bifurcated: Direct sales are common for highly customized, integrated automatic lines purchased by large multinational corporations, ensuring deep technical support and installation expertise. Indirect channels, involving third-party distributors, system integrators, and local representatives, cater effectively to small and medium enterprises (SMEs) requiring off-the-shelf semi-automatic or standardized uniform sealers, offering broader market reach and local service support.

Downstream activities involve installation, commissioning, training, and critical after-sales support, including spare parts supply and maintenance contracts. The profitability of OEMs is increasingly tied to long-term service agreements (LSAs) and the monetization of operational data derived from connected machines (IoT). End-users prioritize total cost of ownership (TCO), machine longevity, and quick access to replacement parts, especially consumables like tape heads and glue nozzles. The evolution towards predictive maintenance models, leveraging data collected downstream, is fundamentally altering the service landscape, enabling manufacturers to provide proactive support and reducing reliance on reactive, break-fix maintenance protocols, thereby solidifying customer retention and maximizing equipment operational availability.

Case Sealers Market Potential Customers

The primary end-users and buyers of case sealing equipment span multiple high-volume manufacturing and fulfillment sectors where product protection and supply chain efficiency are paramount. The largest segment remains the Food & Beverage industry, where case sealers are integral to processing lines for packaging items ranging from packaged snacks and ready meals to beverages. These customers prioritize sanitation standards (washdown capabilities), high throughput for perishable goods, and reliability across multi-shift operations. Demand in this sector is continuous, driven by consumer trends requiring diverse packaging formats and faster speed-to-market.

The Pharmaceutical and Medical Devices sector constitutes another major customer base, driven by stringent regulatory requirements for validation, traceability, and tamper-evident packaging. For these customers, equipment uptime is critical, and they typically opt for high-precision, automatic hot melt sealers that provide a superior, verifiable seal. The purchasing decision here is heavily influenced by compliance adherence, documentation, and the ability of the machinery to integrate seamlessly with serialization and aggregation systems essential for supply chain security and regulatory reporting mandated globally.

Crucially, the E-commerce and Logistics sector has emerged as the fastest-growing customer group. E-commerce fulfillment centers require highly flexible, random case sealers capable of handling a chaotic mix of box sizes and weights at extreme speeds. These users seek solutions that minimize labor and maximize adaptability, often favoring modular, scalable systems that can be rapidly deployed and reconfigured to address fluctuating peak demands (e.g., holiday seasons). The core demand here is not just for sealing speed, but for the machine's intelligence in measuring, communicating, and verifying the sealing process to prevent shipping delays and damage, making automation an economic necessity rather than a choice.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.95 Billion |

| Market Forecast in 2033 | $2.68 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, A-B-C Packaging Machine Corporation, Lantech, Wexxar/BEL Packaging (ProMach), SICK AG, ARPAC LLC (Duravant), Krones AG, Gebo Cermex (Sidel Group), Schneider Packaging Equipment, Combi Packaging Systems, ProSystem Sp. z o.o., Premier Tech Chronos, BestPack Packaging Systems, Loveshaw Corporation, PAC Machinery, Affeldt Verpackungsmaschinen GmbH, M. J. Maillis S.A., Eastey Enterprises, Shing-Shiuh Machine Industry, and Highlight Industries. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Case Sealers Market Key Technology Landscape

The technological landscape of the Case Sealers Market is rapidly evolving, moving beyond purely mechanical operations toward intelligent, interconnected systems aligned with Industry 4.0 principles. A major trend involves the sophisticated integration of advanced sensor technology and robotics. Modern case sealers utilize highly precise sensors, including ultrasonic and laser detectors, to accurately measure case dimensions in real-time for random sealers, ensuring optimal material application and minimizing waste. Furthermore, collaborative robots (cobots) are being incorporated, especially in semi-automatic environments, assisting operators with precise case placement or pallet loading post-sealing, enhancing ergonomic safety and optimizing labor allocation without requiring extensive safety guarding.

Another significant technological advancement centers on sealing methodologies and sustainability. The hot melt adhesive segment is seeing innovation through precision electric glue guns that offer faster response times, reduced energy consumption, and highly consistent application patterns, crucial for maintaining high line speeds while using less adhesive material. Simultaneously, there is an industry push toward handling complex, thinner corrugated materials and specialized coated boxes designed for sustainable packaging initiatives. This necessitates highly adaptable sealing heads and improved material handling systems to prevent case distortion during the sealing process. The challenge of sealing recycled or bio-degradable materials, which often have different surface properties than virgin corrugated board, is driving innovation in adhesive chemistry and application control.

Crucially, the shift towards connectivity and data analytics defines the leading edge of technology implementation. New case sealers are invariably equipped with Industrial IoT (IIoT) capabilities, enabling Machine-to-Machine (M2M) communication and centralized monitoring via cloud platforms. This functionality allows manufacturers and end-users to gather detailed operational data on OEE, throughput rates, maintenance alerts, and consumable usage. This real-time data is critical for driving continuous process improvement, remote diagnostics, and enabling the predictive maintenance models necessary to achieve ultra-high levels of operational availability, fundamentally transforming the ownership experience and maximizing return on investment (ROI) for advanced automation.

The implementation of advanced servo motor technology has replaced traditional pneumatic and mechanical components in high-speed sealers, offering superior motion control, faster acceleration/deceleration, and significantly reduced noise pollution. Servo systems allow for quick, repeatable adjustments to machine speed and case size handling, dramatically cutting changeover times from hours to mere minutes or even seconds in fully automated setups. This precision control is essential for managing product queues effectively in complex, synchronized packaging lines. Furthermore, simplified, intuitive Human-Machine Interfaces (HMIs) featuring touchscreen controls and graphical diagnostics are standard, enhancing ease of use, reducing the training required for line operators, and streamlining troubleshooting procedures, which contributes directly to higher productivity metrics across all industry applications.

In terms of materials handling, the focus is on optimizing belt and guiding systems to manage the transition of cases smoothly, especially at high speeds where minor misalignment can cause jams. Enhanced conveyor technologies incorporate automatic speed matching and buffering capabilities, ensuring a steady, gap-free flow of cases into the sealing mechanism, regardless of upstream fluctuations. This holistic approach, treating the case sealer not as an isolated unit but as an integrated node within a larger ecosystem of material flow, leverages advanced control systems to maintain synchronous operation across the entire end-of-line packaging cell, including case erecting and palletizing stages. Future advancements will likely involve greater standardization of communication protocols, allowing machines from different vendors to exchange real-time status and operational parameters effortlessly.

Finally, safety technology has undergone a major transformation, moving beyond basic mechanical guarding. Modern case sealers incorporate sophisticated light curtains, pressure mats, and integrated safety PLCs (Programmable Logic Controllers) that enable safe, monitored stop functions and reduce the machine footprint. The push towards ergonomic design means minimizing manual interaction, particularly in the loading and unloading of consumables (tape rolls or adhesive pellets), often facilitated by automated loading mechanisms or improved accessibility. This comprehensive approach to technology integration, spanning from material science and motion control to connectivity and safety, positions case sealing equipment as a critical investment for maintaining competitive advantage in high-volume manufacturing sectors worldwide.

Regional Highlights

- North America (NA): Characterized by high labor costs and stringent regulatory standards, driving strong demand for fully automatic, high-speed case sealing systems, particularly those integrated with IoT for predictive maintenance. The massive penetration of e-commerce necessitates continuous investment in random case sealing technology. The U.S. remains the largest market, focusing heavily on technology refresh cycles and adoption of hot melt sealing for superior package security.

- Europe: Focuses heavily on sustainability and compliance. Demand is strong for energy-efficient sealers capable of handling recyclable and thin-wall packaging materials. Western European nations (Germany, UK, France) emphasize precision engineering and integrated end-of-line solutions, often favoring modular designs that offer flexibility in diverse production environments, driven by robust pharmaceutical and food export industries.

- Asia Pacific (APAC): The fastest-growing region, fueled by rapid industrialization, massive manufacturing expansion (especially in China, India, and Southeast Asia), and rising domestic consumption. While semi-automatic systems initially dominate in emerging markets due to lower upfront cost, the trend is quickly shifting toward automatic sealers as labor wages increase and export requirements demand higher throughput and quality consistency.

- Latin America: Exhibits moderate growth, primarily driven by expanding food and beverage processing sectors and increasing foreign investment in consumer goods manufacturing. The market often utilizes a mix of semi-automatic and lower-cost automatic systems, with Brazil and Mexico serving as key regional hubs for packaging technology adoption and investment in standardized uniform case sealers.

- Middle East and Africa (MEA): Growth is concentrated in Gulf Cooperation Council (GCC) countries due to massive infrastructure projects and diversification efforts in logistics and food processing. Investments are often focused on modern, reliable equipment necessary to support growing regional distribution and reduce reliance on manual labor, with demand primarily for standardized tape sealing solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Case Sealers Market.- 3M Company

- A-B-C Packaging Machine Corporation

- Lantech

- Wexxar/BEL Packaging (ProMach)

- SICK AG

- ARPAC LLC (Duravant)

- Krones AG

- Gebo Cermex (Sidel Group)

- Schneider Packaging Equipment

- Combi Packaging Systems

- ProSystem Sp. z o.o.

- Premier Tech Chronos

- BestPack Packaging Systems

- Loveshaw Corporation

- PAC Machinery

- Affeldt Verpackungsmaschinen GmbH

- M. J. Maillis S.A.

- Eastey Enterprises

- Shing-Shiuh Machine Industry

- Highlight Industries

Frequently Asked Questions

Analyze common user questions about the Case Sealers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Uniform and Random Case Sealers?

Uniform Case Sealers are engineered to handle continuous runs of cases that are all the same height and width, maximizing speed and efficiency. Random Case Sealers, conversely, utilize advanced measurement and adjustment technology to automatically adjust to varying case sizes sequentially, making them essential for high-mix, high-volume logistics and e-commerce operations.

Is Hot Melt (Glue) sealing better than Tape sealing for automation?

Hot Melt sealing generally offers higher speeds, superior tamper-evidence, and better aesthetic appearance, often resulting in lower consumable costs over the long term. While Tape sealing is cost-effective and easier to implement initially, Hot Melt is preferred for full automation in regulated industries like pharmaceuticals or high-speed beverage lines due to enhanced seal integrity and efficiency.

How does Industry 4.0 integration benefit case sealing operations?

Industry 4.0 integration, through IoT sensors and data connectivity, allows case sealers to communicate performance data in real-time. This enables centralized monitoring, precise consumption tracking, and implementation of predictive maintenance, drastically reducing unscheduled downtime and optimizing Overall Equipment Effectiveness (OEE).

Which end-user segment is driving the greatest demand for advanced case sealing technology?

The E-commerce and Logistics segment is currently the most significant driver for advanced, high-flexibility case sealing technology. The rapid growth in online order fulfillment necessitates reliable, ultra-fast random case sealers capable of handling highly variable packaging sizes without compromising throughput or seal quality.

What is the typical ROI period for investing in a fully automatic case sealer?

The Return on Investment (ROI) for a fully automatic case sealer typically ranges from 18 to 36 months, depending heavily on the reduction in labor costs, the scale of operational throughput improvement, and the decreased incidence of product damage due to consistent sealing quality. Higher labor cost environments often see quicker ROI realization.

The strategic imperative for manufacturers globally is to achieve maximum operational efficiency with minimal human intervention. Case sealers provide a critical bottleneck solution at the end-of-line packaging process. The continued market evolution is not simply about faster machinery, but about smarter machinery capable of self-diagnosis, self-adjustment, and seamless communication within the wider factory ecosystem. This technological convergence ensures that the case sealers market remains a dynamic and necessary component of modern industrial infrastructure, providing reliable closure solutions that uphold product integrity across complex supply chains worldwide. Future market resilience will be determined by the ability of OEMs to offer solutions that effectively marry high speed with sustainability requirements, particularly concerning alternative packaging materials and reduced energy consumption profiles. This focus on performance and environmental responsibility will define competitive differentiation in the upcoming forecast period.

In response to increasing global competition, market participants are adopting aggressive strategies focused on geographical expansion and product diversification. This includes developing compact, modular sealing solutions specifically tailored for high-cost urban warehouse environments and small-scale operations, thereby addressing the needs of emerging and decentralized fulfillment models. Furthermore, leasing and managed services models are gaining traction, allowing smaller businesses to access high-end automatic sealing technology without prohibitive upfront capital outlay. This strategic shift towards service-oriented business models ensures sustained demand growth by widening the accessibility of automated packaging solutions beyond established major corporations. Technological partnerships focused on integrating robotics for case handling and secondary packaging are also becoming commonplace, enhancing the overall value proposition of the end-of-line solution suite offered by key market players.

The regulatory landscape, particularly regarding food safety (e.g., FDA requirements) and pharmaceutical traceability (e.g., serialization mandates), continues to exert significant influence on equipment design. Case sealers serving these sectors must not only guarantee a strong, reliable seal but also offer validated processes and construction materials (e.g., stainless steel frames, hygienic design). Compliance complexity mandates that OEMs invest heavily in research and development to maintain certifications and provide detailed validation support documentation, elevating the barrier to entry for new competitors and reinforcing the position of established, specialized manufacturers. This focus on compliance and verifiable performance metrics further solidifies the market's trajectory towards high-precision, data-driven sealing solutions that meet global standards for safety and product integrity, underpinning the positive market forecast through 2033.

The expansion of global cold chain logistics also presents a specialized opportunity and technical challenge for case sealer manufacturers. Packaging destined for refrigerated or frozen environments requires adhesives and sealing techniques that perform reliably under extreme temperature variations and high humidity levels. This niche demand drives innovation in specialized hot melt applicators and resilient tape materials, requiring manufacturers to provide dedicated cold storage models. Addressing these critical environmental constraints allows companies to tap into the lucrative segments of perishable foods and temperature-sensitive pharmaceuticals, ensuring that case sealing technology remains robust enough to support the evolving complexities of global supply chain demands, thereby securing diverse revenue streams across various industrial applications and climatic regions.

Moreover, the aftermarket for spare parts, consumables (tape, glue), and service contracts represents a stable and crucial revenue stream for OEMs. Given the high throughput requirements of automatic sealers, rapid access to precision-engineered replacement parts is essential for minimizing downtime. Companies that establish robust global service networks and digital spare parts ordering platforms are better positioned to capture this recurring revenue. The shift towards proprietary consumables, especially specific hot melt formulations optimized for particular sealing machines, creates a sticky customer relationship and ensures long-term operational revenue, often stabilizing profitability even amidst cyclical capital equipment purchasing patterns. This reliance on the aftermarket strengthens the overall financial health of the leading players in the Case Sealers Market.

Labor shortages worldwide, particularly affecting manufacturing and logistics sectors, reinforce the structural driver for automation. While semi-automatic sealers still require significant operator input, the economic justification for fully automatic solutions is becoming overwhelming in developed economies. By automating the case sealing function, companies can reallocate personnel to higher-value tasks, addressing labor constraints and improving overall plant productivity. This macro-economic pressure on labor availability acts as a constant catalyst for technological investment, ensuring continuous demand for the most sophisticated, high-throughput case sealing systems capable of running unattended for extended periods, further solidifying the optimistic CAGR projections for the automatic segment.

Finally, the competitive strategy among major players is increasingly focused on offering integrated systems rather than standalone sealers. By bundling case erectors, sealers, labelers, and palletizers into a single, synchronized end-of-line solution, manufacturers provide enhanced system performance, simplified maintenance, and a single point of responsibility for the entire packaging process. This holistic approach simplifies procurement for end-users and increases the total contract value for OEMs. Strategic acquisitions and mergers among packaging machinery providers are common, aimed at consolidating technical expertise and expanding the scope of integrated offerings, ultimately benefiting customers seeking complete, turnkey packaging automation lines.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager