Cash Management Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431376 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Cash Management Market Size

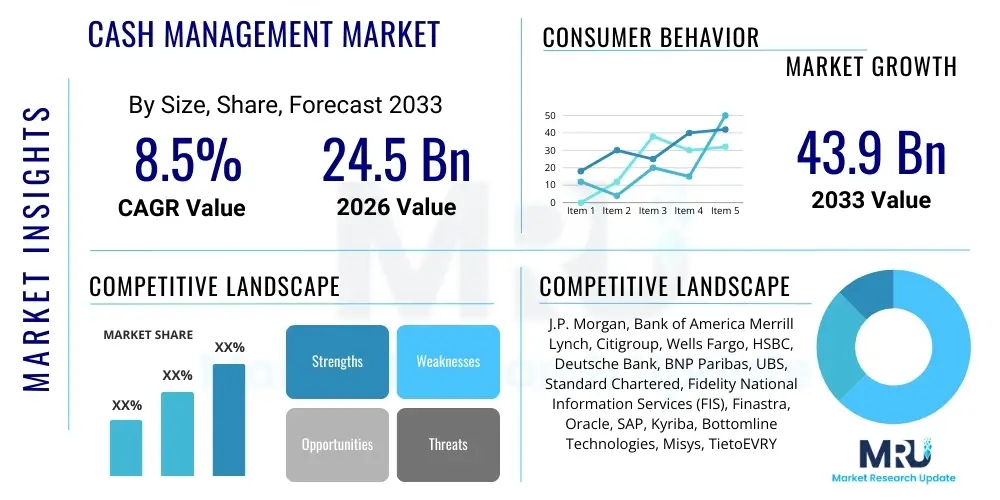

The Cash Management Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $24.5 Billion in 2026 and is projected to reach $43.9 Billion by the end of the forecast period in 2033.

Cash Management Market introduction

The Cash Management Market encompasses a suite of services and technological solutions designed to optimize the handling of cash inflows and outflows for businesses, ensuring efficient liquidity management, reduction of financial risk, and maximization of returns on cash reserves. These comprehensive solutions typically include tools for automated reconciliation, sophisticated cash flow forecasting, payment processing, pooling, and intercompany lending. The primary objective is to provide corporate treasurers with real-time visibility into their global cash positions, enabling proactive decision-making regarding working capital management and investment strategies. The shift towards digitization and the increasing complexity of multinational corporate finance structures mandate the adoption of robust, integrated cash management platforms over traditional, fragmented systems.

Major applications of cash management systems span across large multinational corporations, financial institutions, and Small and Medium Enterprises (SMEs), addressing critical functions such as optimizing cross-border payments, mitigating foreign exchange risks, and streamlining regulatory compliance reporting. The inherent benefits derived from utilizing these systems include significant improvements in operational efficiency, lowered overall transaction costs, enhanced security through centralized controls, and superior control over liquidity buffers. The key driving factors propelling market growth are the pervasive adoption of immediate payment mechanisms (such as RTPs), the continuous need for corporations to optimize working capital in volatile economic climates, and the technological evolution allowing for seamless integration with Enterprise Resource Planning (ERP) systems and core banking platforms via Application Programming Interfaces (APIs).

The market is characterized by intense competition among global banking giants and specialized Fintech providers, all vying to offer integrated, end-to-end digital experiences. Services offered range from basic account management and deposit services to highly complex treasury solutions incorporating Artificial Intelligence (AI) for predictive modeling. The demand for cloud-based deployment models is witnessing accelerated growth, as they offer scalability, reduced infrastructure overhead, and faster time-to-market compared to traditional on-premise installations, making advanced cash management accessible to a broader range of enterprise sizes, particularly those operating with lean treasury departments.

Cash Management Market Executive Summary

The Cash Management Market is experiencing a rapid evolution driven primarily by global digitalization and the imperative for real-time financial transparency. Key business trends indicate a strong move toward API-driven open banking architectures, facilitating seamless data exchange between corporate treasuries and multiple banking partners, thereby breaking down traditional siloed cash management structures. Furthermore, the increasing adoption of embedded finance solutions is blurring the lines between core banking services and treasury functions. From a strategic perspective, companies are prioritizing solutions that offer superior compliance capabilities related to anti-money laundering (AML) and know-your-customer (KYC) regulations, alongside robust cybersecurity features, which is essential given the sensitive nature of financial data handled.

Regionally, North America maintains its dominance due to the presence of major financial hubs, high technological infrastructure maturity, and significant spending on financial technology innovation by large corporations. However, the Asia Pacific (APAC) region is poised for the highest growth trajectory, fueled by rapid industrialization, increasing cross-border trade activity, and governmental push towards digital payment ecosystems, particularly in emerging economies like India and Southeast Asia. Segment trends highlight the clear ascendancy of cloud deployment, favored for its flexibility and lower initial capital expenditure, especially in the SME segment. Moreover, the Solutions component, specifically specialized software platforms focusing on liquidity forecasting and risk mitigation, is expected to capture the largest market share as enterprises move away from manual processes toward automation and advanced predictive analytics.

The competitive landscape is defined by the convergence of established transaction banking providers leveraging their extensive global network and innovative specialized software vendors offering highly scalable, modular treasury management systems (TMS). Successful market penetration hinges on the ability to deliver hyper-personalized services, integrate diverse payment rails (e.g., SWIFT, SEPA, blockchain-based networks), and provide robust business intelligence capabilities. The ongoing consolidation within the Fintech sector and strategic partnerships between banks and technology firms are shaping the future service delivery models, ultimately driving efficiency improvements and redefining corporate liquidity management standards globally.

AI Impact Analysis on Cash Management Market

Common user inquiries concerning AI’s role in cash management center on its practical application in mitigating forecast volatility, ensuring data integrity within predictive models, and the perceived barriers to integrating complex AI/ML tools with legacy ERP and treasury systems. Users are deeply concerned with the ‘black box’ nature of certain algorithms and demand explainability (XAI) for strategic liquidity decisions. The prevailing expectation is that AI will automate mundane tasks, freeing up treasury staff, but simultaneously users are seeking validation on AI's capability to deliver accurate, instantaneous insights essential for real-time funding and investment choices across geographically dispersed units. The core theme is transformation from historical data-driven reporting to predictive, real-time strategic execution.

Artificial Intelligence (AI) and Machine Learning (ML) are acting as pivotal disruptors in the Cash Management Market by fundamentally enhancing operational accuracy and strategic foresight. These technologies are primarily deployed to refine cash flow forecasting, moving beyond simple time-series analysis to incorporate vast external data sets, such as economic indicators, geopolitical events, and supply chain health, resulting in significantly higher forecast accuracy and reduced buffer cash requirements. Furthermore, AI automates the complex process of reconciliation by matching high volumes of transactions across various accounts and currencies, dramatically cutting down processing time and human error rates, thereby ensuring treasury systems have continuous, clean data inputs for modeling and decision-making.

Strategically, AI facilitates dynamic liquidity optimization through algorithmic allocation models. These models continuously analyze real-time account balances, interest rates, and counterparty risks to automatically sweep and pool funds, ensuring regulatory compliance while maximizing interest earnings or minimizing borrowing costs. This shift enables treasury departments to optimize their daily liquidity position instantaneously, a feat impossible with traditional systems. The application of sophisticated anomaly detection algorithms also enhances fraud prevention and operational risk management, identifying unusual transaction patterns that signal potential security breaches or operational failures, establishing AI as an essential component of modern risk-mitigation frameworks.

- AI enhances cash flow forecasting accuracy by integrating unstructured and external economic data.

- Machine Learning automates complex transaction reconciliation, drastically reducing manual effort and errors.

- Predictive analytics enables real-time dynamic liquidity pooling and optimization across global accounts.

- AI-driven anomaly detection strengthens fraud prevention and operational risk surveillance.

- Intelligent algorithms assist in optimizing foreign exchange hedging strategies by predicting currency volatility.

DRO & Impact Forces Of Cash Management Market

The Cash Management Market is propelled forward by several potent drivers, primarily the globalization of business operations leading to increasingly complex cross-border financial requirements and the rising adoption of real-time and instant payment systems (e.g., SEPA Instant, FedNow), which necessitate immediate cash visibility and control. Furthermore, stringent regulatory mandates, particularly those governing liquidity management (like Basel III and Dodd-Frank), compel corporations and financial institutions alike to invest in advanced, robust reporting and forecasting systems. These factors, combined with the corporate imperative to minimize idle cash and maximize working capital efficiency amidst global economic uncertainty, generate consistent demand for sophisticated, integrated cash management solutions.

However, the market faces notable restraints, chiefly the substantial initial capital investment required for implementing sophisticated Treasury Management Systems (TMS) or integrated cash management platforms, which can be prohibitive for SMEs or companies with limited IT budgets. The challenge of integrating these new digital solutions with deeply entrenched legacy Enterprise Resource Planning (ERP) and existing banking systems poses a significant technical and operational hurdle, often causing implementation delays and data synchronization issues. Furthermore, the inherent risk associated with data security and compliance in cloud-based environments remains a persistent concern for highly regulated industries, restraining the full-scale adoption of purely digital solutions in some sectors.

Opportunities within this domain are concentrated around the development of specialized microservices architecture, allowing clients to select and implement only the necessary modular components, thus reducing complexity and cost. A significant opportunity lies in leveraging Distributed Ledger Technology (DLT) or blockchain for secure, transparent, and low-cost cross-border cash movement and reconciliation, bypassing traditional correspondent banking networks. Additionally, the increasing focus on embedded finance—integrating cash management capabilities directly into corporate procurement and accounting platforms—presents a major avenue for non-traditional providers and Fintechs to expand their service offering and capture market share by offering contextual financial services at the point of need. The overall impact force resulting from these dynamics is intensely disruptive, pushing banks to innovate rapidly to maintain relevance against agile technological competitors.

Segmentation Analysis

The Cash Management Market segmentation provides a granular view of diverse service offerings and deployment methodologies catering to varied organizational needs and sizes. The core segmentation is typically structured across Deployment Type (Cloud vs. On-Premise), Component (Solutions/Software vs. Services), Enterprise Size (Large Enterprises vs. SMEs), and Application (Liquidity, Treasury, Payment Management). This structured analysis helps in understanding specific growth pockets, such as the rapid transition toward Cloud-based Software-as-a-Service (SaaS) models, which have democratized access to advanced treasury tools previously only available to large multinational corporations.

The Solutions segment, covering specialized software for forecasting, risk management, and automated reconciliation, continues to dominate the market share, driven by the persistent need for efficiency and regulatory compliance. Simultaneously, the Services component, which includes professional consulting, implementation support, and managed treasury services, is growing steadily, reflecting the complexity of modern integrations and the outsourcing trend among businesses seeking specialized expertise. Geographically, while mature markets like North America focus on optimization and AI integration, emerging markets prioritize fundamental digitalization, driving demand for scalable, easy-to-implement solutions tailored for mobile or regional banking environments, further diversifying market offerings.

Understanding these segments is crucial for strategic planning. For instance, Large Enterprises often require highly customized, robust on-premise or private cloud solutions capable of handling massive transaction volumes and global subsidiary structures, with a high emphasis on advanced treasury functions like hedging and intercompany financing. Conversely, SMEs are heavily skewed toward subscription-based, public cloud models that require minimal IT overhead and focus on core services like automated payment processing and short-term liquidity visualization. This divergence necessitates providers to offer flexible, tiered product suites that address specific pain points related to scale, regulatory burden, and technological infrastructure maturity across different customer tiers.

- By Component:

- Solutions (Software)

- Services (Consulting, Integration, Maintenance)

- By Deployment Type:

- On-Premise

- Cloud (Public, Private, Hybrid)

- By Enterprise Size:

- Large Enterprises

- Small and Medium Enterprises (SMEs)

- By Application:

- Liquidity Management

- Treasury and Risk Management

- Payment Management and Reconciliation

- Working Capital Management

- Intercompany Funding

- By End-User:

- Financial Institutions (Banks, Non-Banking Financial Companies)

- Corporates (Manufacturing, Retail, Healthcare, IT & Telecom)

Value Chain Analysis For Cash Management Market

The value chain for the Cash Management Market begins with upstream activities focused on technology development and core infrastructure provision. This stage involves software developers and Fintech firms creating specialized treasury management software (TMS), AI/ML algorithms for forecasting, and secure communication protocols (like API interfaces and blockchain technology). Key inputs at this stage include deep financial expertise, specialized coding capabilities, and access to regulatory compliance knowledge. Continuous research and development are essential upstream activities to ensure systems remain competitive, resilient against evolving cyber threats, and compliant with dynamic global financial regulations such as ISO 20022 messaging standards.

The core midstream stage involves the delivery and integration of these solutions, primarily carried out by global transaction banks and specialized system integrators. Banks leverage their established deposit network, clearing capabilities, and credit facilities to offer bundled services, acting as the primary hub for cash flows. Fintech vendors and system integrators focus on customizing and deploying the software components, ensuring seamless integration with the client’s existing ERP and accounting systems. Distribution channels are predominantly direct, involving close consultation and sales teams interfacing directly with corporate treasurers, particularly for complex multinational mandates. Indirect channels, such as partnerships with accounting firms or ERP providers, also serve as effective routes for penetrating the SME segment.

Downstream activities center on continuous client support, maintenance, and the strategic utilization of the cash management outputs. Once implemented, the systems provide critical outputs such as real-time cash position reports, automated fraud detection alerts, and optimized investment recommendations. The downstream value is realized when corporate users leverage these insights for strategic decision-making, such as optimizing intercompany funding and making timely investment decisions. Post-implementation support, including software upgrades and regulatory compliance advisories, forms a crucial part of the downstream value chain, ensuring the long-term effectiveness and relevance of the cash management platform within the corporate financial ecosystem.

Cash Management Market Potential Customers

Potential customers for cash management solutions span a broad spectrum, fundamentally including any organization that handles significant volumes of transactions, manages complex multi-currency operations, or requires stringent control over working capital. The largest consumer segment consists of large multinational corporations (MNCs) operating across multiple jurisdictions. These entities necessitate sophisticated, centralized treasury management systems to manage global liquidity, mitigate foreign exchange risk, and execute complex intercompany transactions efficiently. Within this segment, sectors like Manufacturing, Retail, and Oil & Gas, characterized by extensive supply chains and high capital expenditure, are primary adopters of comprehensive treasury solutions.

Financial Institutions (FIs), including commercial banks, non-banking financial companies (NBFCs), and insurance firms, represent another critical customer base. FIs use advanced cash management software not only to manage their own corporate liquidity and regulatory reserve requirements but also as a core product offering to their corporate clients. Their demand is focused on highly secure, high-volume processing systems capable of integrating various payment infrastructures (e.g., ACH, wire transfers, RTPs) and delivering robust compliance reporting, particularly regarding regulatory liquidity coverage ratios and network stability under stress scenarios.

The Small and Medium Enterprises (SMEs) sector is rapidly emerging as a high-growth customer segment. While SMEs typically require less complexity than MNCs, they are increasingly seeking easy-to-use, cost-effective, cloud-based solutions to automate basic functions like invoice processing, payment initiation, and short-term cash flow forecasting. The accessibility provided by SaaS models is lowering the barrier to entry, allowing SMEs to gain professional cash visibility crucial for sustaining growth and navigating unexpected economic downturns. Additionally, specialized segments such as Healthcare providers, Educational institutions, and Government bodies also represent viable potential customers, driven by the need for secure disbursement management and transparent fund utilization tracking.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $24.5 Billion |

| Market Forecast in 2033 | $43.9 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | J.P. Morgan, Bank of America Merrill Lynch, Citigroup, Wells Fargo, HSBC, Deutsche Bank, BNP Paribas, UBS, Standard Chartered, Fidelity National Information Services (FIS), Finastra, Oracle, SAP, Kyriba, Bottomline Technologies, Misys, TietoEVRY, Infosys, Wipro, Tata Consultancy Services (TCS) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cash Management Market Key Technology Landscape

The technological landscape of the Cash Management Market is rapidly being redefined by the integration of sophisticated digital tools focused on automation, connectivity, and data intelligence. The fundamental shift is driven by the necessity for real-time processing and global interoperability. Application Programming Interfaces (APIs) represent a crucial technological advancement, enabling open banking functionality and allowing corporate treasuries to connect directly and securely with various banks, fintech providers, and internal ERP systems instantaneously. This API layer facilitates highly efficient, real-time data flows, replacing traditional batch processes and enabling genuine 24/7 liquidity management and payment execution globally, essential for multinational operations leveraging Follow-the-Sun models.

The adoption of advanced data analytics, including Artificial Intelligence (AI) and Machine Learning (ML), is transforming forecasting from a historical exercise into a predictive science. These technologies process massive datasets—both internal transaction records and external market variables—to generate high-fidelity, scenario-based cash flow forecasts that significantly reduce liquidity uncertainty. Concurrently, security technologies are paramount; the use of advanced encryption, multi-factor authentication, and blockchain technology (Distributed Ledger Technology) for cross-border payment rails is gaining traction. Blockchain promises enhanced transaction security, reduced settlement times, and lower correspondent banking fees, challenging the dominance of legacy messaging systems like SWIFT for specific use cases, though widespread adoption still faces regulatory and standardization hurdles.

Furthermore, the move toward modular, cloud-native Treasury Management Systems (TMS) delivered via Software-as-a-Service (SaaS) platforms is democratizing access to professional-grade cash management. This architectural shift ensures high scalability, continuous deployment of updates, and operational resilience, while reducing the burden on client IT departments. Modern TMS solutions often feature embedded robotic process automation (RPA) tools to handle repetitive tasks such such as data entry and compliance checks, further enhancing straight-through processing (STP) rates. The synergy between robust cloud infrastructure, intelligent analytics, and standardized communication protocols (like ISO 20022) forms the backbone of the next generation of resilient and efficient cash management platforms.

Regional Highlights

Geographic market dynamics reflect varying levels of technological maturity, regulatory environments, and corporate financial complexity.

- North America (NA): Dominates the market share due to the early adoption of advanced financial technologies, the large concentration of global corporations, and substantial R&D investment in financial services. Demand is primarily driven by the need for advanced regulatory reporting systems and sophisticated liquidity optimization tools utilizing AI/ML, especially in the US and Canada. The region leads in deploying sophisticated cloud-based TMS solutions and embracing real-time payment infrastructures like FedNow, pushing providers toward high integration capabilities.

- Europe: Characterized by stringent regulatory frameworks (e.g., PSD2, GDPR) driving the push towards open banking and API standardization. The region exhibits high adoption of centralized cash pooling and cross-border payment systems (SEPA). Western Europe, particularly the UK, Germany, and France, shows mature demand for cash forecasting and risk management solutions, while Eastern European countries are rapidly digitalizing their banking infrastructure, creating strong growth opportunities for cloud-based payment services.

- Asia Pacific (APAC): Expected to register the highest Compound Annual Growth Rate (CAGR) due to rapid economic expansion, increasing foreign direct investment, and massive digitalization initiatives, especially in China, India, and Southeast Asia. The region is driven by complex requirements for managing diverse currencies and regulatory landscapes. Demand is high for mobile-centric cash management solutions and systems capable of handling high-volume, low-value transactions efficiently across fragmented local payment systems.

- Latin America (LATAM): Growth is accelerating, spurred by high inflation rates and currency volatility, which increases corporate demand for strong risk management and accurate forecasting tools. Market growth is also supported by governmental efforts to modernize banking infrastructure and reduce the reliance on cash, creating opportunities for payment gateway and automated reconciliation services, particularly in Brazil and Mexico.

- Middle East and Africa (MEA): This region is witnessing significant infrastructure investment, particularly in the Gulf Cooperation Council (GCC) countries, focusing on establishing global financial hubs. The market demand is concentrated around corporate payment centralization, international trade finance support, and secure Islamic finance compliant cash management solutions. The adoption of robust cybersecurity and fraud detection tools is critical due to increasing digital transaction volumes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cash Management Market.- J.P. Morgan

- Bank of America Merrill Lynch

- Citigroup

- Wells Fargo

- HSBC

- Deutsche Bank

- BNP Paribas

- UBS

- Standard Chartered

- Fidelity National Information Services (FIS)

- Finastra

- Oracle

- SAP

- Kyriba

- Bottomline Technologies

- Misys

- TietoEVRY

- Infosys

- Wipro

- Tata Consultancy Services (TCS)

Frequently Asked Questions

Analyze common user questions about the Cash Management market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of Cash Management Systems?

The primary driver is the necessity for real-time visibility and control over global cash positions, mandated by increasing cross-border transactions, market volatility, and the widespread implementation of instant payment infrastructures requiring continuous liquidity monitoring and optimization.

How are cloud-based solutions transforming the Cash Management Market?

Cloud-based (SaaS) solutions lower implementation costs, provide superior scalability, and enable faster updates compared to on-premise systems. They are crucial for democratizing access to advanced treasury tools, making sophisticated forecasting and payment automation affordable for Small and Medium Enterprises (SMEs).

What role does Artificial Intelligence play in modern Cash Management?

AI, through Machine Learning, significantly enhances cash management by improving the accuracy of cash flow forecasting, automating complex transaction reconciliation, and enabling real-time liquidity optimization across multi-bank and multi-currency environments to minimize operational and liquidity risk.

Which geographical region is expected to show the fastest growth in this market?

The Asia Pacific (APAC) region is projected to exhibit the highest growth rate, driven by rapid economic development, massive digitalization efforts by local governments, and increasing complexity associated with intra-regional cross-border trade and varied regulatory landscapes.

What are the key differences between Liquidity Management and Treasury Management solutions?

Liquidity Management focuses specifically on optimizing daily cash balances, funding gaps, and surplus placement (pooling and sweeping). Treasury Management is a broader category that encompasses liquidity management along with strategic functions like risk management, debt, investment, and foreign exchange hedging.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Security Safes Market Statistics 2025 Analysis By Application (Home Use, Office, Hotels, Entertainment Centers), By Type (Cash Management Safes, Gun Safes, Media Safes), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Safes and Vaults Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Cash Management Safes, Depository Safes, Gun Safes And Vaults, Media Safes, Others), By Application (Residential & Private, Commercial), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager