Cashew Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432638 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Cashew Market Size

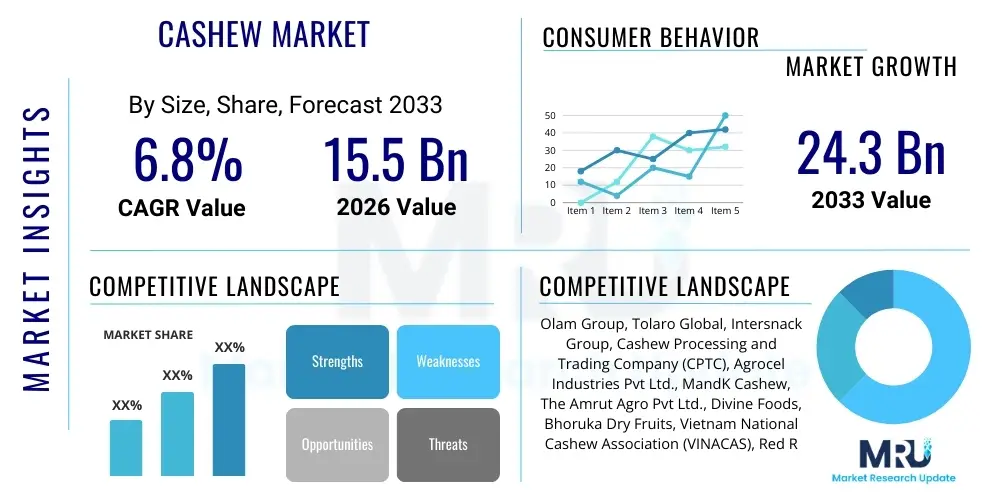

The Cashew Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 15.5 Billion in 2026 and is projected to reach USD 24.3 Billion by the end of the forecast period in 2033.

Cashew Market introduction

The Cashew Market encompasses the global production, processing, trade, and consumption of cashew nuts (Anacardium occidentale) and their by-products, including Cashew Nut Shell Liquid (CNSL). Cashews are highly valued globally, not only for their nutritional profile—rich in healthy fats, protein, vitamins, and minerals—but also for their versatile applications across the food and industrial sectors. The market is fundamentally driven by increasing consumer awareness regarding plant-based nutrition and the substitution of conventional snack options with healthier alternatives. Furthermore, the rising demand for cashew derivatives in pharmaceutical and chemical industries contributes significantly to market expansion, establishing cashews as a vital commodity in global agribusiness.

The primary product forms traded include raw cashew nuts, processed kernels (whole, broken, splits), and processed derivatives like cashew butter, milk, and CNSL. Major applications of cashew kernels are concentrated within the snacking segment, confectionery, baked goods, and as an ingredient in savory dishes and specialized diets, notably vegan and paleo diets. The inherent functional properties of cashews, such as their creamy texture and mild flavor, make them an indispensable component in plant-based dairy substitutes, including cashew milk and cheese alternatives, catering to the growing demographic of lactose-intolerant and vegan consumers.

Key benefits driving market adoption include the high antioxidant content, cholesterol-free composition, and ability to support heart health. Major driving factors propelling market growth involve rapid urbanization, particularly in Asia Pacific, leading to increased discretionary spending on premium food products, coupled with robust export infrastructure development in major producing countries like Vietnam, India, and Côte d’Ivoire. Sustained innovation in processing technologies aimed at improving kernel quality, reducing processing time, and minimizing wastage also plays a critical role in optimizing the supply chain and ensuring stable market supply, thereby underpinning long-term market sustainability.

Cashew Market Executive Summary

The global Cashew Market exhibits robust growth, primarily propelled by shifting global dietary preferences towards nutritious, plant-based foods and expanding applications beyond traditional snacking. Business trends indicate a marked shift towards automated processing facilities to enhance efficiency and maintain stringent quality standards necessary for premium export markets. Furthermore, major market players are focusing on backward integration, securing raw material supply chains through contract farming and investing in larger processing capacities in African countries, which are emerging as significant sources of raw cashew nuts (RCNs). Sustainability and ethical sourcing are becoming non-negotiable business imperatives, influencing procurement strategies and consumer purchasing decisions, driving demand for certified and traceable cashew products.

Regionally, Asia Pacific continues to dominate the processing and consumption landscape, led by processing hubs in Vietnam and India, which account for the majority of global processed kernel exports. However, Africa, particularly West Africa (e.g., Côte d’Ivoire, Tanzania, Nigeria), is witnessing substantial growth in raw cashew nut production and is increasingly attracting foreign direct investment (FDI) aimed at developing local processing capabilities. This shift is crucial as it addresses historical inefficiencies related to shipping RCNs to Asia for processing and subsequently exporting the kernels back to consumer markets. North America and Europe remain the highest value consumer markets, characterized by high demand for organic, flavored, and value-added cashew products like cashew butter and energy bars.

Segment trends reveal that the consumption of roasted and flavored cashews is growing faster than that of raw kernels, reflecting consumer preference for convenience and ready-to-eat options. By form, whole kernels command a premium price and remain the largest revenue generator, although the market for broken kernels is expanding rapidly due to their utilization in the expanding industrial food sector (confectionery and bakery). In terms of application, the utilization of cashews in the dairy alternatives segment is showcasing exponential growth. The Cashew Nut Shell Liquid (CNSL) segment is experiencing revival due to its utility in friction materials, coatings, and specialized resins, offering an additional dimension to the market’s overall profitability and resource utilization.

AI Impact Analysis on Cashew Market

Common user questions regarding AI's impact on the Cashew Market typically revolve around enhancing agricultural productivity, optimizing supply chain logistics, and improving quality control during processing. Users are deeply interested in how AI can predict yield fluctuations based on weather patterns and soil health, thereby stabilizing volatile raw material prices. Furthermore, there is significant interest in utilizing machine vision systems powered by AI for defect detection and grading of cashew kernels, ensuring higher quality compliance for export. Concerns often center on the accessibility and affordability of these advanced technologies for smallholder farmers and traditional processing units, alongside the requisite need for specialized digital infrastructure and workforce training to maximize the benefits of AI integration in this traditionally manual agricultural commodity market.

- AI-driven predictive analytics for cashew yield forecasting, optimizing harvesting schedules.

- Machine vision systems utilizing deep learning for automated cashew kernel grading and defect detection, ensuring stringent quality standards.

- Optimization of supply chain routes and warehousing efficiency using AI algorithms to minimize spoilage and reduce logistical costs from farm to processor.

- Implementation of smart farming techniques (IoT sensors and AI) for precise irrigation and nutrient management in cashew plantations, improving input efficiency.

- Enhanced traceability systems leveraging blockchain and AI to provide verifiable provenance data, addressing growing consumer demand for ethical sourcing.

DRO & Impact Forces Of Cashew Market

The Cashew Market is simultaneously shaped by powerful growth drivers, persistent operational restraints, and compelling future opportunities, all interacting to create dynamic impact forces. A primary driver is the accelerating shift towards vegan and plant-based diets globally, positioning cashews as a versatile, nutrient-dense ingredient for both snacking and industrial food production. However, a significant restraint remains the high vulnerability of cashew production to erratic climatic conditions and pests, leading to substantial yield variability and subsequent price volatility in the raw material market. The opportunity landscape is vast, centered on value-added product innovation, particularly in the form of specialized flavors, organic certifications, and functional food development, which command premium pricing and expand market reach beyond traditional channels. These factors exert a complex set of impact forces on pricing, procurement strategies, and global trade flows.

The increasing focus on sustainable and ethical sourcing acts as both a driver and a differentiating force. As consumers demand transparency, companies investing in fair trade certifications and supporting local African processing initiatives gain a competitive advantage, driving market segmentation based on ethical attributes. Conversely, the lack of standardized global processing infrastructure, particularly in emerging producing regions, limits the overall processing efficiency and increases reliance on manual labor, posing a substantial economic restraint. This dynamic pushes processors toward automation but requires significant capital investment, further segmenting the market based on technological adoption levels.

The key impact forces fundamentally center on supply chain risk mitigation and margin protection. Global demand elasticity for premium nuts ensures that despite price increases, high-value consumer markets remain stable, allowing exporters to maintain healthy profit margins. The geopolitical stability in major producing regions also acts as a critical force; disruptions in countries like Côte d’Ivoire or Vietnam can instantaneously ripple through the global supply chain, causing price spikes. Opportunities arising from the industrial applications of CNSL (e.g., in automotive brake linings and insulating varnishes) offer market diversification, insulating the overall industry from fluctuations solely dependent on kernel consumption, thereby stabilizing long-term revenue potential.

Segmentation Analysis

The Cashew Market is extensively segmented based on key criteria including product type, form, application, and distribution channel, reflecting the varied usage patterns and consumer preferences across different geographical areas. Understanding these segments is crucial for stakeholders to tailor their product offerings and market entry strategies effectively. The raw cashew nut segment, for instance, is distinct from the processed kernel segment, appealing to different buyer groups—large-scale processors versus end-users and retailers. Detailed segmentation allows market players to identify niche areas of high growth, such as organic cashew butter or specialized CNSL derivatives for high-performance industrial applications, maximizing return on investment.

Segmentation by form, encompassing whole, broken, and powdered cashews, highlights the differences in pricing and end-use applications. Whole kernels are predominantly sold as premium snacks or decorative toppings, whereas broken kernels are primarily utilized in industrial applications like baking, confectionery, and ingredient mixtures where visual appeal is secondary to functionality and cost efficiency. The emerging segment of cashew-derived products, such as cashew milk and cheese, is segmented within the application category, demonstrating the commodity’s versatility beyond its traditional dry fruit identity and capitalizing on the booming dairy alternative sector.

Furthermore, segmentation by distribution channel—spanning direct sales to industrial buyers, supermarkets/hypermarkets, convenience stores, and the rapidly growing e-commerce platforms—reflects the evolution of consumer purchasing habits. E-commerce platforms are increasingly critical for premium, branded, and specialty cashew products, offering wider reach and direct engagement with niche consumer groups interested in ethically sourced or specialty flavored variants. Geographical segmentation, differentiating between high-production regions and high-consumption markets, underscores the global trade dynamics and necessary logistical investments required for successful market participation.

- By Product Type:

- Raw Cashew Nut (RCN)

- Cashew Kernel (Processed)

- Cashew Nut Shell Liquid (CNSL)

- By Form:

- Whole

- Broken/Splits

- Paste/Butter

- Powder

- By Grade:

- W-180 (King of Cashew)

- W-210 (Jumbo)

- W-240 (Standard)

- W-320 (Most Popular)

- W-450 (Economy)

- Scorched Pieces

- By Application:

- Snacking and Confectionery

- Bakery and Desserts

- Dairy Alternatives (Milk, Cheese)

- Prepared Foods and Meals

- Industrial Use (CNSL for Paints, Coatings, Friction Materials)

- By Distribution Channel:

- Offline (Supermarkets/Hypermarkets, Convenience Stores)

- Online (E-commerce Platforms)

Value Chain Analysis For Cashew Market

The Cashew Market value chain is complex and highly fragmented, starting with upstream activities involving smallholder farming, aggregation, and initial drying of raw cashew nuts (RCNs). The upstream segment is often characterized by low yields, manual harvesting, and reliance on traditional agricultural methods, particularly in West Africa, the primary source of RCNs. Key challenges in this phase include infrastructure deficits, limited access to modern farming inputs, and vulnerability to price manipulation by middlemen. The efficiency of the upstream segment dictates the quality and cost of RCN supply, profoundly impacting the profitability of subsequent stages. Improving farmer access to finance and training is crucial for stabilizing this foundational segment of the value chain.

The midstream segment involves the critical and capital-intensive process of shelling, peeling, grading, and packaging the cashew kernels. Historically, a significant portion of RCNs produced in Africa was shipped to Asia (primarily Vietnam and India) for processing due to advanced technology and established infrastructure in those regions. However, there is a global trend towards localization, with producing countries striving to increase local processing capacity to capture higher value addition. The processing stage is highly dependent on technology—ranging from manual labor to fully automated shelling and peeling machines—which determines efficiency, kernel quality (minimizing broken pieces), and occupational health standards. Direct processing investments in Africa are transforming the trade dynamics by shortening the supply chain and reducing carbon footprint.

The downstream segment includes distribution and sales channels, moving the processed kernels to end-users, either industrial buyers (food manufacturers) or consumer markets (retailers). Distribution channels are highly varied, involving direct export contracts, large commodity traders, and domestic wholesale networks. Direct sales offer maximum control and margin, while indirect channels leverage the extensive reach of global logistics providers and retail chains. E-commerce has emerged as a crucial indirect channel, particularly for high-margin, branded products. Effective logistics, cold storage, and efficient inventory management are essential downstream activities to maintain product freshness and prevent rancidity before reaching the final consumer.

Cashew Market Potential Customers

Potential customers for the Cashew Market span a diverse range of industries and consumer demographics, extending far beyond the traditional dry fruit segment. The primary end-users are concentrated within the food manufacturing sector, especially companies specializing in packaged snacks, breakfast cereals, energy bars, and high-protein supplements. The increasing consumer demand for healthy, convenient food options drives the procurement volume from these large industrial buyers. Furthermore, the burgeoning plant-based food industry represents a rapid growth area, with manufacturers of non-dairy beverages (cashew milk), vegan cheese, and dairy-free desserts being significant bulk purchasers of processed cashew kernels and paste, seeking their superior texture and nutritional profile as dairy substitutes.

The retail consumer segment remains vital, categorized by geography and income level. In North America and Europe, consumers prioritize organic, ethically sourced, and premium roasted/flavored cashews sold through supermarkets and specialized health food stores. Conversely, in developing regions, the focus is often on affordability and basic raw or lightly roasted kernels sold via local markets. The rise of sophisticated culinary trends globally also positions high-end restaurants and catering services as potential customers demanding high-quality, whole kernels for use in gourmet dishes and high-end confectionery applications, reflecting a focus on both presentation and flavor quality.

Beyond edible applications, the industrial sector constitutes a specialized but significant customer base, primarily for Cashew Nut Shell Liquid (CNSL). Buyers include companies involved in manufacturing specialized chemicals, friction materials (like brake pads and clutch facings), protective coatings, varnishes, and insulating materials. These customers require highly processed CNSL derivatives tailored to specific technical specifications, indicating a niche, business-to-business market that is less sensitive to agricultural price volatility but highly dependent on industrial output and infrastructure spending. The diversification of CNSL applications, particularly in green chemistry, is attracting new industrial buyers focused on bio-based raw materials.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.5 Billion |

| Market Forecast in 2033 | USD 24.3 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Olam Group, Tolaro Global, Intersnack Group, Cashew Processing and Trading Company (CPTC), Agrocel Industries Pvt Ltd., MandK Cashew, The Amrut Agro Pvt Ltd., Divine Foods, Bhoruka Dry Fruits, Vietnam National Cashew Association (VINACAS), Red River Foods, Uren Food Group, Prime Nuts Inc., Aryan International, Valency International, Alphonsa Cashew Industries, CBL Natural Foods, WWV Cashew, Kalim Cashew Products, KNC Agro. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cashew Market Key Technology Landscape

The processing sector of the Cashew Market is undergoing a rapid technological transformation, moving away from labor-intensive manual shelling to sophisticated, automated systems to improve kernel quality, reduce labor costs, and enhance food safety. Key technologies revolve around mechanical cashew nut shelling and peeling systems, which include steam cooking and centrifugal shelling machines. Steam treatment is vital for making the shell brittle and detoxifying the kernel surface, maximizing extraction rates while minimizing breakage. Advanced grading technologies, often utilizing laser sorting and machine vision (as mentioned in the AI section), are increasingly deployed to sort kernels based on color, size, and defect levels with high precision, which is crucial for meeting rigorous international quality standards and achieving premium pricing for superior grades.

In the upstream agricultural segment, the adoption of precision agriculture techniques is nascent but accelerating, particularly in large-scale commercial farms. This includes the use of satellite imagery, drone mapping, and IoT sensors to monitor soil moisture, nutrient levels, and canopy health. These technologies enable precise application of irrigation and fertilizers, optimizing resource use, and improving overall yield predictability. Furthermore, research focused on developing hybrid cashew varieties resistant to pests and diseases, alongside innovative grafting techniques, represents a biological technology focus aimed at improving tree productivity and resilience against climate change impacts, which remains a primary structural risk to the global supply.

For high-value by-products, the technology landscape involves advanced chemical processing for refining Cashew Nut Shell Liquid (CNSL). New extraction methods, such as supercritical fluid extraction and molecular distillation, are being researched and implemented to produce highly pure cardanol and other CNSL derivatives for specialized industrial uses (e.g., green polymers and specialized epoxy resins). This technological evolution is crucial for unlocking the full economic potential of the cashew value chain beyond the kernel itself. Overall, the market's technological trajectory emphasizes automation for consistency and efficiency, and bio-science research for raw material stability and sustainability.

Regional Highlights

-

Asia Pacific (APAC): APAC is the epicenter of the global cashew market, dominating both the processing capacity and consumption volume. Vietnam and India are the undisputed leaders, primarily serving as global processing hubs. Vietnam has leveraged massive investment in state-of-the-art processing technology and efficient logistics to become the world's largest exporter of processed cashew kernels. India, while also a major processor, has a large domestic consumption market, absorbing a significant portion of its production. The region's growth is driven by increasing population, rising middle-class income, and strong domestic demand for nutritious snacks and traditional cuisine ingredients. Processing advancements in APAC are setting global benchmarks for efficiency and quality.

The strategic importance of APAC lies in its capacity for scale and established trade networks. India’s market is further diversified by the cultural significance of cashews in festive foods and traditional sweets. China is emerging as a critical growth market for both raw and processed kernels, driven by changing dietary habits favoring western-style convenience and snack foods. The market dynamics in APAC are intensely competitive, necessitating continuous innovation in packaging and branding to capture consumer attention and maintain market share against global competitors.

Government initiatives in countries like India, focusing on enhancing farmer productivity and investing in cashew processing parks, aim to reduce reliance on RCN imports and boost export competitiveness. The rapid growth of e-commerce across Southeast Asia further amplifies market accessibility, especially for branded and value-added cashew products, such as flavored nuts and specialty cashew powders used in health supplements.

-

North America: North America, particularly the United States, represents one of the largest and most valuable end-consumer markets for cashews globally. Market growth is primarily fueled by the strong demand for premium, organic, and ethically sourced nuts, driven by health-conscious consumer trends and the rapid expansion of specialized diets (vegan, keto, paleo). Cashews are highly utilized not only as a snack but also as a foundational ingredient in sophisticated food categories like non-dairy milks, protein powders, and high-end confectionery products.

The market is characterized by high price sensitivity but also strong brand loyalty towards products that emphasize sustainability and transparency. Major processors and importers focus heavily on stringent quality control and achieving certifications like USDA Organic and Fair Trade. Innovation is key in this region, with new product launches often focusing on unique flavors (e.g., spicy, smoky, honey-roasted) and convenient packaging formats suitable for on-the-go consumption, maximizing retail shelf appeal and consumer engagement.

Distribution in North America is highly sophisticated, leveraging established partnerships with major grocery chains, specialized health food retailers (like Whole Foods), and extensive online platforms. The steady rise in disposable income and a cultural emphasis on preventive health measures ensure continuous high demand for high-value nut products, positioning the region as a critical revenue generator for global cashew suppliers.

-

Europe: The European market demonstrates significant consumption growth, focusing intensely on food safety, traceability, and sustainability standards. Countries like Germany, the UK, and the Netherlands are major importers, driven by robust industrial demand for ingredient inclusion in breakfast cereals, baked goods, and plant-based alternatives. European consumers are among the most demanding globally regarding ethical sourcing, pushing suppliers to adopt rigorous social and environmental compliance protocols.

Regulatory frameworks, such as the EU's strict guidelines on maximum residue limits (MRLs) for pesticides, heavily influence the sourcing strategies of European processors and retailers, often favoring suppliers who invest in advanced processing and quality assurance technologies. The market for organic cashews is particularly strong, reflecting a broader commitment to sustainable agriculture and clean label products across the continent. Value-added processing in Europe, though smaller than in Asia, focuses on roasting, flavoring, and packaging premium branded goods.

Market expansion is also supported by the proliferation of private labels and discount retailers incorporating cashew products into their affordable range, thereby increasing market penetration across various socioeconomic groups. Furthermore, the rising popularity of veganism and flexitarian diets across Central and Western Europe ensures a stable and expanding baseline demand for cashew kernels utilized in formulating diverse dairy and meat substitutes.

-

Middle East and Africa (MEA): MEA is structurally divided between being the dominant source of raw cashew nuts (Africa) and an increasingly wealthy consumer market (Middle East). West African nations, notably Côte d’Ivoire, Tanzania, and Nigeria, are critical to the global supply chain, accounting for a majority of RCN production. The major trend in this sub-region is the push for local value addition, shifting from exporting RCNs to developing domestic processing facilities, supported by government policies and international development aid.

The Middle Eastern countries, driven by high per capita income and a preference for exotic and premium dry fruits, are significant importers of processed kernels, especially during festive seasons. Consumption patterns in this region favor high-grade, whole kernels presented in luxurious packaging. The growth in tourism and hospitality sectors further boosts demand for cashews used in high-end culinary applications and hotel amenity offerings, reflecting a sophisticated consumer profile that prioritizes quality and presentation.

The challenge in Africa remains infrastructure development, including efficient logistics, cold chain management, and reliable energy supply necessary to sustain modern processing operations. Successful local processing requires overcoming hurdles like securing long-term financing and achieving consistency in quality to compete effectively with established Asian processors. The development trajectory in Africa is crucial as it promises to revolutionize the global cashew supply equilibrium by reducing logistical costs and empowering local economies.

-

Latin America: The Latin American market exhibits moderate growth, driven by key producing nations like Brazil, which historically held dominance but has seen production shift towards West Africa. Brazil remains an important regional processor and consumer, utilizing cashews in both traditional local cuisine and as an export commodity. Consumption growth is steady, influenced by health and wellness trends similar to those in North America, particularly among urban populations seeking nutritious snacking alternatives.

Regional market dynamics are heavily influenced by intra-regional trade agreements and local agricultural policies aimed at reviving cashew cultivation. The market for cashew derivatives, including specialized snacks and flavored products, is expanding, albeit at a slower pace compared to Asia or Europe. Investments in sustainable farming practices and certifications are gradually increasing to meet the export demands of the US and EU markets, positioning Latin America as a niche supplier focusing on unique varietals and certified sustainable production.

The potential for growth is substantial, linked to increased domestic market organization, improved logistics infrastructure, and greater emphasis on value-added processing before export. Local manufacturers are exploring greater utilization of cashew by-products, including the fibrous pseudo-fruit, in juices and jams, adding depth to the regional value chain beyond the kernel trade.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cashew Market.- Olam Group

- Tolaro Global

- Intersnack Group

- Cashew Processing and Trading Company (CPTC)

- Agrocel Industries Pvt Ltd.

- MandK Cashew

- The Amrut Agro Pvt Ltd.

- Divine Foods

- Bhoruka Dry Fruits

- Vietnam National Cashew Association (VINACAS)

- Red River Foods

- Uren Food Group

- Prime Nuts Inc.

- Aryan International

- Valency International

- Alphonsa Cashew Industries

- CBL Natural Foods

- WWV Cashew

- Kalim Cashew Products

- KNC Agro

- Khimji Damodar Shah (KDS)

- Tradevico Cashew

- Duy Linh Cashew

- Mai Anh Export & Import

Frequently Asked Questions

Analyze common user questions about the Cashew market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Cashew Market?

The primary growth factors are the global shift towards plant-based and vegan diets, increasing consumer preference for healthy and convenient snack options, and the rising industrial application of cashew derivatives like Cashew Nut Shell Liquid (CNSL) in specialized chemical and materials industries.

Which geographical region dominates the global processing and export of cashew kernels?

Asia Pacific, particularly Vietnam and India, dominates the global processing and export of finished cashew kernels due to substantial investments in advanced automation technology, established export infrastructure, and competitive operational efficiencies.

What is the most significant restraint affecting the stability of the raw cashew nut supply?

The most significant restraint is the high dependency of raw cashew nut (RCN) production on favorable climatic conditions, leading to substantial yield volatility, which in turn causes significant price fluctuations and supply chain instability across the market.

How is technological innovation impacting the efficiency of cashew processing?

Technological innovation is impacting efficiency through the adoption of automated shelling and peeling systems, steam treatment methods for quality improvement, and AI-powered machine vision for precise kernel grading, significantly reducing labor intensity and minimizing kernel breakage.

Beyond food consumption, what are the major non-food applications of cashew by-products?

The major non-food applications primarily involve Cashew Nut Shell Liquid (CNSL), which is extensively used in the manufacturing of high-performance friction materials (e.g., brake linings), specialized resins, protective coatings, and insulating varnishes in the chemical and automotive sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Analog Cheese Market Size Report By Type (Soy Cheese, Cashew Cheese, Other), By Application (Catering, Ingredients, Retail), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Cashew Nut Shell Liquid (Cnsl) Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Raw Cashew Nut Shell Liquid (CNSL), Technical Cashew Nut Shell Liquid (TCNSL)), By Application (Coating Industry, Automotive Industry, Fuel Industry), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Non-Peanut Nut Butters Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Almond butter, Hazelnut butter, Cashew butter, Acorn butter, Pistachio butter, Walnut butter, Other), By Application (Supermarket, Hypermarket, Convenience store, Online shopping mall, Specific retailers, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Raw Cashew Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Broken, Whole), By Application (Daily Food, Cooking, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Dry Fruit Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Dates, Cashew Nuts, Almond, Pistachios, Raisins, Others), By Application (Household, Commercial), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager