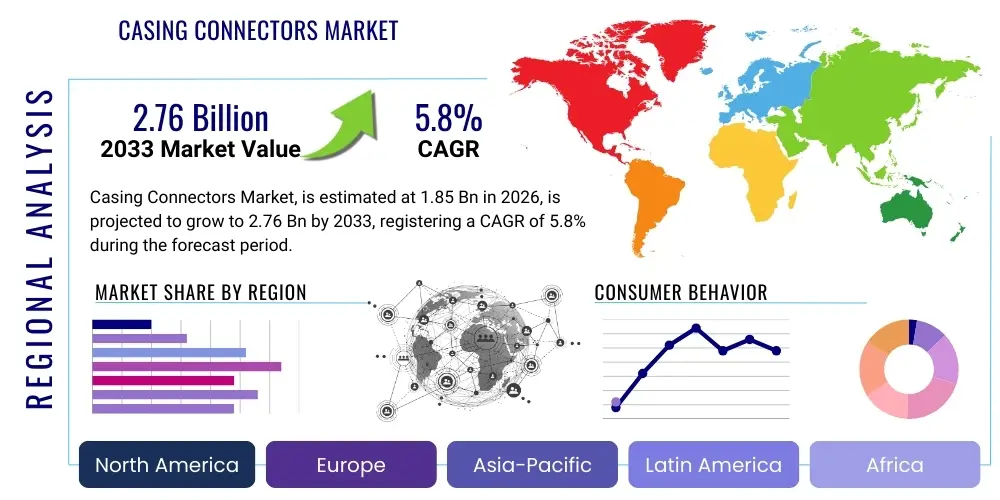

Casing Connectors Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439266 | Date : Jan, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Casing Connectors Market Size

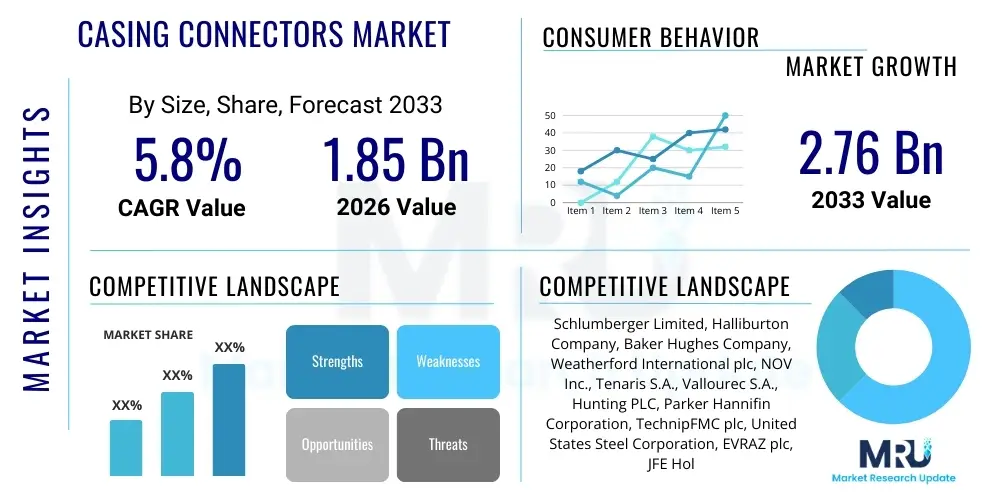

The Casing Connectors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.76 Billion by the end of the forecast period in 2033.

Casing Connectors Market introduction

The Casing Connectors Market represents a critically important and specialized segment within the broader oil and gas as well as geothermal energy industries. Casing connectors are precision-engineered threaded components used to securely join individual sections of casing pipe, which are subsequently run into a wellbore to form a protective and structural lining. This lining, known as the casing string, is essential for maintaining wellbore stability, preventing uncontrolled fluid migration between geological formations, and isolating different pressure zones. These robust connections are engineered to withstand extreme downhole conditions, including high pressures, elevated temperatures, corrosive environments, and significant axial and torsional stresses encountered during drilling and production.

The primary applications for casing connectors are extensive, encompassing a wide array of drilling and completion operations. This includes conventional onshore and offshore oil and gas exploration and production wells, deepwater and ultra-deepwater projects, and increasingly, complex unconventional resource developments such as shale gas and tight oil. Furthermore, the growing global emphasis on renewable energy sources has expanded their application into geothermal energy wells, which often present unique challenges due to extremely high temperatures and highly corrosive fluids. The core benefits derived from high-quality casing connectors are multifaceted, featuring enhanced well integrity, superior gas-tight sealing capabilities that prevent leaks and ensure environmental compliance, extended well lifespan, and significantly reduced operational risks and associated costs. These components are non-negotiable for safe, efficient, and environmentally responsible energy extraction.

Several key factors are driving the sustained growth of this market. Foremost among these is the unwavering global demand for energy, which continuously fuels investment in new exploration and production projects across diverse geographical regions. The increasing complexity of modern drilling operations, which venture into deeper, hotter, and more challenging geological formations, necessitates the use of advanced, high-performance casing connectors capable of enduring severe operational stresses. Furthermore, continuous technological advancements in metallurgy, thread design, and manufacturing processes are consistently improving connection performance and reliability, allowing for the development of innovative solutions that meet evolving industry standards and operator demands for superior well construction.

Casing Connectors Market Executive Summary

The Casing Connectors Market is experiencing a period of dynamic growth, underpinned by resilient global energy demand and strategic investments in upstream activities. A prominent business trend is the persistent drive towards technological innovation, particularly in the development of proprietary premium connection designs. These advanced connections offer superior sealing integrity, enhanced torque capabilities, and exceptional fatigue resistance, which are critical for navigating the increasingly complex well architectures found in deepwater, HPHT (High-Pressure/High-Temperature), and horizontal drilling environments. Market participants are also increasingly focused on optimizing their supply chains and leveraging digital solutions to improve manufacturing efficiency and reduce lead times, responding to a heightened industry demand for both performance and rapid deployment.

Regional trends reveal distinct growth patterns and areas of significant activity. North America remains a powerhouse, primarily due to the extensive and technologically advanced shale plays in the United States and Canada, where unconventional resource development continues to demand high volumes of sophisticated casing connectors. The Middle East, with its vast conventional oil and gas reserves and ongoing capacity expansion projects, also stands as a foundational market, characterized by large-scale investments. Meanwhile, the Asia Pacific region is rapidly emerging as a high-growth market, propelled by escalating energy consumption, particularly in China and India, and increasing offshore exploration activities in Southeast Asia. These regional dynamics highlight the global nature of demand, requiring manufacturers to maintain a widespread operational footprint and adaptive product offerings.

Segmentation trends within the market underscore a clear shift towards higher-performance and specialized connection types. There is an accelerating adoption of premium connections over standard API connections, especially in critical applications where well integrity is paramount, and operational risks are high. This includes scenarios involving high-pressure, high-temperature wells, corrosive fluid environments, and complex directional or horizontal drilling profiles. Material science advancements are also shaping segment trends, with an increasing demand for Corrosion-Resistant Alloy (CRA) connectors and specialized alloy steels, which offer enhanced durability and longer service life in aggressive downhole chemistries. This strategic evolution across product types and materials reflects the industry's continuous pursuit of improved well reliability, reduced environmental impact, and optimized lifecycle costs for drilling and production assets.

AI Impact Analysis on Casing Connectors Market

The advent of Artificial Intelligence (AI) is poised to exert a transformative influence across the entire value chain of the Casing Connectors Market, from initial design and manufacturing processes to field deployment and long-term asset management. Users frequently express interest in understanding how AI can significantly enhance the reliability and overall performance characteristics of casing connectors, especially under increasingly demanding operational conditions. Specific inquiries often center on the potential of AI to optimize complex supply chain logistics, thereby reducing lead times and improving inventory management, and to mitigate operational downtime through proactive maintenance strategies. Stakeholders are keen to explore how AI-driven analytics can leverage vast quantities of real-world drilling data, material science properties, and detailed design parameters to pinpoint optimal connection geometries, select superior material compositions, and even predict potential failure modes with unprecedented accuracy, ultimately bolstering gas-tightness and structural integrity.

However, alongside the enthusiasm for AI's potential, there are also common concerns and expectations that users voice. The initial capital investment required for AI infrastructure, including advanced sensors, data collection systems, and specialized analytical platforms, is a notable hurdle. Data security and privacy, particularly when dealing with proprietary drilling information, represent another significant area of concern. Furthermore, the necessity for a highly skilled workforce capable of developing, implementing, and interpreting AI-driven insights is a critical expectation and a potential bottleneck. Despite these challenges, there is a strong collective expectation that AI will play a pivotal role in streamlining quality control processes through highly automated visual inspection systems, predicting equipment failures before they manifest, and thereby contributing substantially to safer, more efficient, and environmentally sustainable drilling operations globally. This adoption of AI is anticipated to extend the operational lifespan and enhance the performance attributes of critical well components, leading to long-term gains in productivity and safety across the energy sector.

- AI-driven predictive maintenance systems optimize the operational lifespan of casing connectors, mitigating unexpected failures and reducing costly downtime by forecasting potential issues based on real-time and historical performance data.

- Automated quality inspection leveraging machine vision and deep learning algorithms significantly enhances manufacturing precision and consistency, identifying microscopic defects that human inspectors might miss, ensuring stringent quality control.

- Advanced AI algorithms analyze extensive drilling and geological data to recommend optimal casing connector types and precise torque settings for specific well conditions, thereby improving installation accuracy and operational efficiency.

- Supply chain optimization through AI-powered analytics enhances inventory management, forecasts demand fluctuations, and streamlines logistics, ensuring timely delivery of connectors to remote drilling sites while minimizing waste.

- Material science research and development is accelerated by AI, which rapidly screens and simulates new alloy compositions, leading to the creation of advanced corrosion-resistant and high-strength materials specifically tailored for extreme downhole environments.

- Enhanced wellbore integrity monitoring is achieved via AI's ability to process and interpret sensor data from downhole tools, providing real-time insights into the performance and stress levels of installed connectors, preventing potential breaches.

- Simulation and design optimization processes benefit immensely from AI, allowing engineers to rapidly iterate and refine connector designs, testing virtual prototypes against a multitude of stress scenarios to achieve superior performance and reliability before physical production.

DRO & Impact Forces Of Casing Connectors Market

The Casing Connectors Market operates within a dynamic framework influenced by a complex interplay of Drivers, Restraints, and Opportunities, which collectively dictate its growth trajectory and competitive landscape. A primary driver for market expansion is the persistent and increasing global demand for energy, predominantly from conventional and unconventional hydrocarbons. This demand necessitates continuous investment in upstream oil and gas exploration and production activities worldwide, particularly in challenging deepwater, ultra-deepwater, and high-pressure/high-temperature (HPHT) environments where specialized, high-performance casing connectors are indispensable for well integrity and operational safety. Concurrently, ongoing technological advancements in drilling techniques, such as extended-reach directional and horizontal drilling, further amplify the demand for innovative connector solutions capable of enduring severe operational stresses and corrosive downhole conditions, ensuring longer well lifespans and enhanced recovery rates from complex reservoirs.

Conversely, the market faces several significant restraints that can temper its growth. The most prominent restraint is the inherent volatility of crude oil and natural gas prices, which directly impacts the capital expenditure decisions of upstream operators. Prolonged periods of low commodity prices often lead to reduced drilling activity, project delays, and a subsequent decrease in demand for drilling equipment, including casing connectors. Furthermore, increasingly stringent global environmental regulations aimed at reducing carbon emissions and mitigating the environmental impact of fossil fuel extraction pose long-term challenges, potentially constraining new exploration licenses and encouraging a shift towards renewable energy sources. Geopolitical instability in key producing regions and supply chain disruptions can also create unpredictable market conditions, affecting material costs and delivery timelines for manufacturers.

Despite these challenges, substantial opportunities exist for market participants. The most significant opportunities lie in the continuous innovation and development of advanced connection technologies, specifically those engineered to perform reliably in extreme operating conditions such as ultra-deepwater, high-pressure, high-temperature (HPHT) applications, and highly corrosive downhole environments that demand specialized materials like Corrosion-Resistant Alloys (CRAs). The burgeoning global interest in geothermal energy also presents a unique and growing market niche, as geothermal wells, with their characteristic high temperatures and often aggressive fluid chemistries, require robust and highly durable casing connector solutions. Additionally, the expansion of natural gas infrastructure, including liquefied natural gas (LNG) projects and associated gas-fired power generation, creates a stable demand segment for specialized tubular goods and connectors. These opportunities encourage investment in research and development, fostering a competitive environment focused on delivering superior, application-specific products.

Beyond these internal factors, external impact forces profoundly shape the Casing Connectors Market. The bargaining power of buyers, primarily large oil and gas operators, is high due to their significant purchasing volumes and their capability to demand customized, high-performance, and cost-effective solutions. Conversely, the bargaining power of suppliers, particularly specialized steel and alloy producers, can also be considerable, especially for proprietary or high-grade materials, influencing manufacturing costs. The threat of new entrants is relatively low due to the substantial capital investment required for advanced manufacturing facilities, the necessity for extensive R&D, stringent quality certifications, and established relationships within a conservative industry. However, the intensity of competitive rivalry among existing, well-established players is high, driving innovation and pricing strategies. The threat of substitutes for casing connectors themselves is inherently low due to their critical function in well integrity, although very long-term shifts towards entirely different energy sources could present an indirect substitution threat to the entire upstream equipment market.

Segmentation Analysis

The Casing Connectors Market is comprehensively segmented to provide a granular understanding of its diverse components, allowing for in-depth analysis of market dynamics, emerging technological trends, and regional specificities. This meticulous segmentation is vital for identifying precise growth opportunities, understanding customer preferences, and addressing the unique technical requirements across various operational environments within the global energy sector. By dissecting the market into distinct categories, manufacturers, service providers, and investors can formulate highly targeted strategies, optimize their product development roadmaps, and allocate resources more efficiently to capitalize on specific demand pockets.

Each segment within the market reflects critical differentiations based on technical specifications, performance attributes, application areas, and sales modalities. For instance, the distinction between API and Premium connections highlights the varying levels of performance and cost, directly correlating with the complexity and criticality of the well being drilled. Similarly, segmentation by material choice underscores the diverse geological and chemical environments encountered downhole, from standard sweet gas wells to highly corrosive sour gas wells or high-temperature geothermal applications. These differentiations are not merely descriptive; they inform strategic decisions regarding product design, manufacturing processes, marketing approaches, and distribution networks, ensuring that market offerings are precisely aligned with the evolving demands of modern drilling and well completion operations, thereby providing robust intelligence for competitive positioning and future growth.

- By Type:

- Premium Connections: Advanced, proprietary threaded connections designed to exceed API standards, offering superior gas-tight sealing, higher torque capacities, and enhanced fatigue resistance, crucial for HPHT, deepwater, and corrosive environments.

- API Connections (e.g., BTC, LTC, STC): Standardized connections conforming to American Petroleum Institute specifications (Buttress Thread Casing, Long Thread Casing, Short Thread Casing), widely used in less demanding or conventional well applications due to their proven reliability and cost-effectiveness.

- Standard Connections: Generic or less specialized connections primarily utilized in conventional, shallow, or less critical well applications where extreme pressure or temperature resistance is not the primary requirement.

- By Material:

- Carbon Steel Connectors: Most common and cost-effective, suitable for standard wells with moderate pressures and temperatures, offering good strength and ductility.

- Alloy Steel Connectors (e.g., Chrome, Nickel Alloys): Enhanced strength and toughness, often with improved corrosion resistance compared to carbon steel, used in moderately severe applications.

- Corrosion-Resistant Alloy (CRA) Connectors: High-performance alloys like duplex stainless steels, nickel-based alloys, and titanium, specifically engineered for highly corrosive (e.g., H2S, CO2 rich) and high-temperature environments, ensuring long-term well integrity.

- By Application:

- Onshore Drilling: Wells drilled on land, ranging from conventional to unconventional (shale, tight gas), requiring various connection types depending on depth and geological complexity.

- Offshore Drilling (Shallow Water, Deepwater, Ultra-Deepwater): Operations conducted at sea, demanding highly robust and reliable connectors due to extreme pressures, temperatures, and dynamic stresses, with ultra-deepwater being the most technically challenging.

- Exploration Wells: Initial wells drilled to identify and evaluate potential hydrocarbon reservoirs, requiring adaptable and sometimes exploratory connection solutions.

- Production Wells: Wells designed for the long-term extraction of oil and gas, where connection reliability and longevity are paramount for sustained production and minimal downtime.

- Geothermal Wells: Specialized applications in geothermal energy extraction, characterized by extremely high temperatures and often highly corrosive fluids, necessitating CRAs and high-temperature resistant connections.

- Directional and Horizontal Wells: Complex well trajectories requiring connectors capable of withstanding significant bending and torsional stresses during installation and operation, often utilizing premium connections.

- By Sales Channel:

- Direct Sales: Manufacturers selling directly to major oil and gas operators or large drilling contractors, fostering strong client relationships and offering customized solutions.

- Distributors: Third-party companies that stock and sell casing connectors, providing logistics, local presence, and support to a broader range of smaller operators and service companies.

- Aftermarket Sales: Sales related to replacement components, repair services, or upgrades for existing well infrastructure, driven by maintenance requirements and operational lifespan extension.

Value Chain Analysis For Casing Connectors Market

The value chain for the Casing Connectors Market is a meticulously structured sequence of activities that transforms raw materials into highly specialized components essential for wellbore construction. This intricate network commences with the upstream segment, which is primarily focused on the sourcing and supply of foundational raw materials. Key inputs include various grades of steel, such as carbon steel, alloy steel, and stainless steel, alongside more advanced corrosion-resistant alloys (CRAs). These materials are specifically selected for their metallurgical properties, including high strength, superior ductility, and resistance to corrosion and fatigue, which are critical for enduring the severe operational conditions encountered downhole. Major players in this initial phase are large-scale metallurgical companies and specialized alloy producers who supply their products to the subsequent stages of the value chain, ensuring the foundational quality of the casing connectors.

The midstream activities constitute the core manufacturing and processing stages, where raw materials are transformed into finished casing connectors. This phase begins with the production of seamless or welded casing pipes, followed by highly specialized machining and threading operations. Precision engineering is paramount here, utilizing advanced Computer Numerical Control (CNC) machining centers to create the intricate thread profiles and sealing surfaces characteristic of both API and proprietary premium connections. This stage also involves rigorous heat treatment processes to achieve desired mechanical properties and surface finishes. Quality control and inspection, often incorporating non-destructive testing (NDT) methods, are intensively applied throughout this phase to ensure that each connector meets stringent industry standards and performance specifications, making this segment technology-intensive and requiring significant capital investment and specialized expertise.

The downstream segment of the value chain focuses on the distribution, sales, and end-use of the manufactured casing connectors. Finished products are supplied to a diverse customer base, predominantly comprising global oil and gas exploration and production (E&P) companies, independent operators, drilling contractors, and well service providers. Distribution channels are typically dual-pronged: direct sales often characterize transactions with major international and national oil companies, where manufacturers leverage established relationships and provide comprehensive technical support and custom solutions. Indirect sales, on the other hand, occur through a network of authorized distributors, agents, and supply chain partners who offer localized inventory, logistics services, and technical assistance, particularly for smaller operators or regional projects. The efficiency of these distribution channels is critical for ensuring timely delivery to often remote and challenging drilling locations.

Post-sales support and aftermarket services also play a significant role, ensuring the long-term performance and integrity of the installed connectors. This includes technical assistance, field support during installation, and the supply of replacement parts. The entire value chain is characterized by a high degree of specialization and technical expertise at each stage, from material science and manufacturing precision to logistics and field application. The direct and indirect nature of the distribution channels reflects the industry's need for both deeply integrated partnerships with major clients and broad market reach through regional networks. The effectiveness of this value chain directly impacts the safety, efficiency, and environmental performance of well construction projects globally, making robust integration and collaboration among participants essential for market success.

Casing Connectors Market Potential Customers

The potential customers for products within the Casing Connectors Market are fundamental entities across the global energy ecosystem, representing a broad spectrum of organizations actively engaged in the exploration, drilling, completion, and ongoing production of both hydrocarbon and geothermal resources. These end-users share a critical requirement for reliable, high-performance tubular connections that are capable of withstanding the most severe downhole conditions, thereby ensuring the absolute integrity of the wellbore and the uninterrupted safety of operations. The demand for such robust components is driven by the imperative to maximize resource recovery while minimizing environmental risks and operational costs, making casing connectors an indispensable part of well construction.

Among the most significant potential customer segments are the major International Oil Companies (IOCs), which include industry giants such as ExxonMobil, Shell, Chevron, BP, and TotalEnergies. These companies operate extensive and geographically diverse portfolios, spanning from conventional onshore fields to complex deepwater and ultra-deepwater projects across multiple continents. Their continuous global exploration and production efforts necessitate a consistent and high-volume supply of advanced casing connectors, particularly premium connections designed for challenging applications. National Oil Companies (NOCs), exemplified by Saudi Aramco, ADNOC, Petrobras, Gazprom, and CNPC, also constitute a formidable customer base. These state-owned entities often spearhead large-scale national energy development initiatives, investing heavily in infrastructure and drilling programs that demand vast quantities of high-quality, dependable casing connector solutions to secure their strategic energy reserves.

Independent oil and gas exploration and production (E&P) companies form another crucial customer segment. These firms typically focus on specific basins, unconventional plays (like shale gas or tight oil), or niche resource types, often employing innovative drilling techniques that require specialized connector solutions tailored to their particular operational environments. Drilling contractors, who are responsible for executing drilling programs on behalf of operators, also function as direct purchasers. They integrate casing connectors into their comprehensive service packages, relying on manufacturers to provide equipment that meets precise project specifications and rigorous performance standards. Furthermore, specialized well service companies, offering cementing, completion, and intervention services, frequently procure casing connectors as part of their integrated service offerings to ensure seamless well construction.

An increasingly vital and growing customer segment is emerging from the renewable energy sector, specifically within the geothermal energy industry. Geothermal wells, designed to harness the Earth's internal heat, are often characterized by extremely high temperatures, corrosive geological fluids, and demanding operational pressures. These conditions mandate the use of highly specialized and robust casing connector solutions, frequently incorporating corrosion-resistant alloys (CRAs) and premium designs, to ensure long-term well integrity, prevent environmental contamination, and optimize the efficiency of energy extraction. This diversification of the customer base underscores the adaptability and essential nature of casing connector technology across both traditional and evolving energy landscapes, highlighting the industry's continuous need for reliable tubular connections to support a wide array of energy projects globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.76 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schlumberger Limited, Halliburton Company, Baker Hughes Company, Weatherford International plc, NOV Inc., Tenaris S.A., Vallourec S.A., Hunting PLC, Parker Hannifin Corporation, TechnipFMC plc, United States Steel Corporation, EVRAZ plc, JFE Holdings, Inc., Nippon Steel Corporation, TMK PJSC, Sumitomo Corporation, Tata Steel Limited, RPC Inc., Forum Energy Technologies, Inc., Oil States International, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Casing Connectors Market Key Technology Landscape

The Casing Connectors Market is characterized by an intensely competitive and continuously advancing technological landscape, driven by the critical need to enhance well integrity, optimize operational efficiency, and ensure paramount safety standards in increasingly arduous drilling and production environments. A central pillar of this technological evolution is the relentless development of proprietary premium connections. These advanced designs are engineered to significantly surpass the performance benchmarks set by standard API (American Petroleum Institute) specifications, particularly concerning crucial attributes such as gas-tight sealing capabilities, superior torque performance, and exceptional fatigue resistance, which are indispensable for operations in high-pressure, high-temperature (HPHT) and highly corrosive downhole conditions.

These premium connections frequently incorporate sophisticated features, including specialized thread profiles with optimized taper and clearance designs, precision-machined metal-to-metal sealing surfaces, and innovative shoulder designs. These elements collectively contribute to a robust, gas-tight seal that can withstand extreme internal and external pressures, preventing fluid leakage and ensuring long-term wellbore isolation. Complementing these design innovations, advanced material science plays a pivotal role. Ongoing research and development efforts are focused on high-strength low-alloy steels, various grades of duplex and super duplex stainless steels, and a wide array of specialized corrosion-resistant alloys (CRAs). These materials are specifically tailored to significantly prolong the operational life of connectors in aggressive downhole chemistries, including environments rich in hydrogen sulfide (H2S), carbon dioxide (CO2), and chlorides, thereby mitigating material degradation and enhancing reliability.

Furthermore, the adoption of state-of-the-art manufacturing processes is crucial for achieving the stringent performance requirements of modern casing connectors. This includes the widespread implementation of precision Computer Numerical Control (CNC) machining, which enables the creation of highly accurate thread forms and sealing surfaces with extremely tight tolerances. Advanced heat treatment techniques are also employed to impart desired mechanical properties, such as enhanced toughness and yield strength, to the connector materials. Digital technologies are increasingly integrating into the design and analysis phases, with tools such as Finite Element Analysis (FEA) used extensively for rigorous design validation and stress simulation. Computational Fluid Dynamics (CFD) is applied to better understand sealing mechanisms under dynamic conditions, while the integration of sensor technology and data analytics is paving the way for real-time monitoring of connection integrity during installation and throughout the well's entire operational lifespan.

Further innovations encompass integrated torque-turn systems and advanced connection integrity verification tools. These digital solutions ensure the proper make-up of connections in the field, providing immediate feedback and minimizing the risks associated with improper installation, which can lead to costly non-productive time or, more critically, well integrity failures. This holistic approach, combining advanced metallurgy, precision engineering, digital simulation, and field verification technologies, underscores the industry's commitment to continuous improvement. The goal is to deliver casing connectors that not only meet but exceed the evolving demands for safety, reliability, and environmental performance in the most challenging and complex drilling projects globally, thereby contributing directly to the overall integrity and efficiency of the wellbore system.

Regional Highlights

- North America: This region stands as a dominant force in the Casing Connectors Market, primarily propelled by the extensive and technologically advanced shale gas and tight oil developments across the United States and Canada. The prevalence of horizontal and unconventional drilling operations in these areas necessitates the widespread adoption of highly specialized and robust casing connectors capable of withstanding severe stresses. Moreover, the region's stringent safety and environmental regulations drive a strong demand for premium connection technologies, ensuring superior well integrity and performance in complex well designs. The robust infrastructure and continuous investment in E&P activities further solidify North America's leading position.

- Europe: The European market for casing connectors is characterized by the mature oil and gas fields, particularly in the North Sea region, where the focus is on optimizing production from existing assets and developing new, technically challenging deepwater gas reserves. The region's emphasis on maximizing recovery and ensuring long-term well integrity in aging infrastructure contributes to a steady demand for high-performance tubulars and connections. Furthermore, Europe is at the forefront of the global energy transition, with increasing investments in geothermal energy projects. This growing sector significantly contributes to the demand for specialized, high-temperature and corrosion-resistant casing connectors designed to withstand the unique and aggressive environments found in geothermal wells.

- Asia Pacific (APAC): The Asia Pacific region is rapidly emerging as a high-growth market for casing connectors, driven by an escalating energy demand from its rapidly developing economies, particularly China, India, and Indonesia. These nations are heavily investing in both onshore and offshore exploration and production activities to meet their growing energy requirements. Significant capital expenditures are being directed towards new deepwater and conventional offshore projects, especially in Southeast Asia, which in turn fuels a substantial need for robust and reliable casing connector solutions. The expansion of regional refining capacities and power generation also indirectly contributes to the demand for efficient energy extraction technologies.

- Middle East and Africa (MEA): This region serves as a major global hub for conventional oil and gas production, holding vast reserves and undertaking large-scale, long-term development projects. Countries like Saudi Arabia, the UAE, and Qatar are leading the demand, characterized by significant capital expenditures aimed at expanding production capacity and enhancing recovery from existing mega-fields. The focus here is on utilizing high-performance tubulars and specialized casing connectors to ensure the integrity and longevity of wells in often high-pressure and corrosive environments. Africa also presents substantial growth potential with new discoveries and ongoing development in countries such as Nigeria, Angola, and Mozambique, driving demand for robust drilling and completion equipment.

- Latin America: The Casing Connectors Market in Latin America is primarily driven by significant deepwater exploration and production activities, notably in Brazil's pre-salt basins, and the increasing investment in both conventional and unconventional onshore plays in countries like Argentina (Vaca Muerta shale formation) and Colombia. While the region offers substantial long-term growth potential due to its abundant hydrocarbon resources, market dynamics can be influenced by volatility in political and economic landscapes, which may impact project timelines and investment flows. Nevertheless, the ongoing development of complex offshore projects and the expansion of unconventional resource exploitation ensure a steady requirement for advanced casing connector technologies capable ofwithstanding challenging geological and operational conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Casing Connectors Market.- Schlumberger Limited

- Halliburton Company

- Baker Hughes Company

- Weatherford International plc

- NOV Inc.

- Tenaris S.A.

- Vallourec S.A.

- Hunting PLC

- Parker Hannifin Corporation

- TechnipFMC plc

- United States Steel Corporation

- EVRAZ plc

- JFE Holdings, Inc.

- Nippon Steel Corporation

- TMK PJSC

- Sumitomo Corporation

- Tata Steel Limited

- RPC Inc.

- Forum Energy Technologies, Inc.

- Oil States International, Inc.

Frequently Asked Questions

What are casing connectors and what is their primary function in energy wells?

Casing connectors are precision-engineered threaded components used to securely join segments of casing pipe, forming the structural lining of an energy wellbore (oil, gas, or geothermal). Their primary function is to provide wellbore integrity, prevent fluid communication between geological layers, and maintain a pressure-tight seal, ensuring safe and efficient drilling, completion, and production operations under various downhole conditions.

What are the key factors driving growth in the Casing Connectors Market?

The key factors driving market growth include sustained global demand for energy, necessitating continuous exploration and production efforts; the increasing complexity of drilling operations in challenging environments like deepwater and HPHT wells; and ongoing technological advancements in thread design, metallurgy, and manufacturing processes that enhance connector performance and reliability.

How do premium connections differ from standard API connections?

Premium connections are proprietary designs that offer superior performance compared to standard API (American Petroleum Institute) connections. They feature advanced thread profiles, metal-to-metal seals, and enhanced fatigue resistance, making them ideal for high-pressure, high-temperature, and corrosive environments where gas-tightness and structural integrity are paramount, while API connections are widely used in more conventional applications.

What role does Artificial Intelligence (AI) play in the Casing Connectors Market?

AI is increasingly being utilized to optimize various aspects, including predictive maintenance for extended connector lifespan, automated quality inspection for enhanced manufacturing precision, and data-driven design optimization for improved performance. It also contributes to supply chain efficiency and advanced real-time monitoring of wellbore integrity, ultimately leading to safer and more cost-effective operations.

Which geographical regions are most significant for the Casing Connectors Market?

North America is a leading market due to extensive unconventional resource development. The Middle East and Africa are major conventional oil and gas production hubs. Asia Pacific is a high-growth region driven by increasing energy demand and offshore exploration. Europe focuses on mature fields and growing geothermal applications. Latin America shows strong potential from deepwater and unconventional plays.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager