Casino Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432442 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Casino Equipment Market Size

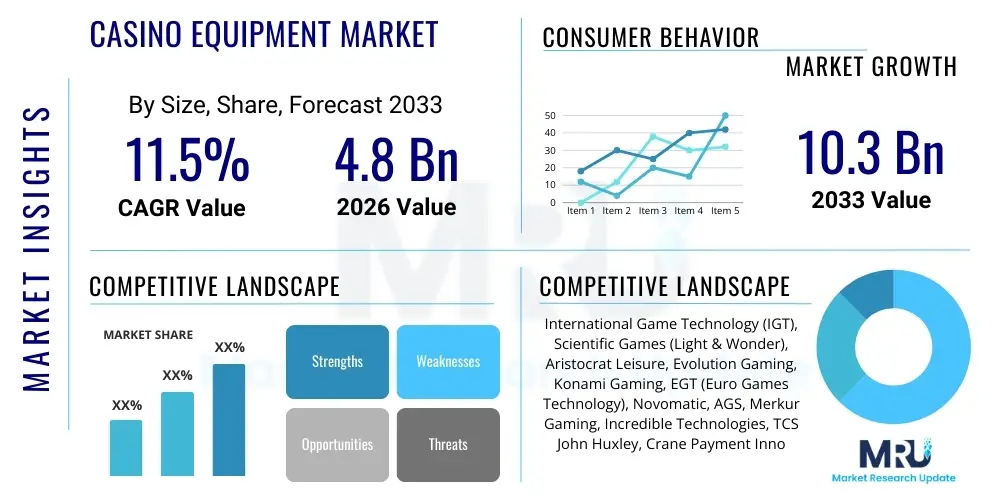

The Casino Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 10.3 Billion by the end of the forecast period in 2033.

Casino Equipment Market introduction

The Casino Equipment Market encompasses the manufacturing, distribution, and maintenance of specialized hardware and software necessary for operating legal gaming establishments and platforms worldwide. This includes physical assets such as sophisticated slot machines, high-precision gaming tables, specialized casino furniture, chip validation systems, and advanced surveillance technologies. Product innovation is driven primarily by the need to enhance player experience through immersive graphics, interactive features, and large-format displays, while simultaneously providing operators with robust, secure, and regulated systems capable of handling high transaction volumes and ensuring fair play. The core function of this equipment is to facilitate gambling activities, maintain operational integrity, and comply with strict governmental regulations specific to each jurisdiction, making reliability and regulatory adherence paramount features of successful equipment designs.

Major applications of casino equipment span across traditional land-based casinos, tribal gaming facilities, luxury cruise ships, and increasingly, specialized hardware supporting hybrid and online gaming platforms. The proliferation of integrated resort concepts, which combine gaming with entertainment, dining, and accommodation, further fuels demand for sophisticated, networked equipment capable of providing comprehensive data analytics and streamlined operational management. Benefits derived from modern casino equipment include optimized floor efficiency, enhanced security protocols through automated verification and surveillance, improved customer loyalty through personalized gaming experiences, and substantial reduction in operational fraud. Furthermore, equipment providers are focusing on modular designs that allow for rapid customization and adaptation to changing market tastes and regulatory environments, ensuring a longer operational lifespan and higher return on investment for casino operators.

The primary driving factors propelling the expansion of this market include the ongoing global trend of gambling legalization and the subsequent establishment of new gaming jurisdictions, particularly in regions like Asia-Pacific and Latin America. Additionally, continuous technological obsolescence of older machines necessitates consistent upgrade cycles, often driven by shifts towards networked gaming systems, cashless transactions, and increased integration of software-defined games. Consumer demand for novel and engaging entertainment experiences, coupled with operator efforts to maximize theoretical win rates through optimized game mechanics and floor layout analysis, contributes significantly to sustained market growth. These dynamics ensure that innovation in display technology, randomness generation (RNG) verification, and central determination systems remains a critical competitive differentiator among equipment manufacturers.

Casino Equipment Market Executive Summary

The global Casino Equipment Market is experiencing robust growth characterized by several interconnected business, regional, and segment trends. Business trends highlight a strong industry pivot toward digital integration, where traditional equipment manufacturers are heavily investing in software development, cloud-based Casino Management Systems (CMS), and incorporating advanced analytics tools to optimize game performance and security. Mergers and acquisitions remain a consistent strategy among top-tier players aiming to consolidate market share, diversify product portfolios across land-based and interactive segments, and gain access to crucial intellectual property related to patented game mechanics and licensed content. Furthermore, the push for enhanced security and regulatory compliance drives sustained demand for tamper-proof hardware, advanced chip tracking technology, and sophisticated biometric verification systems, establishing trust as a primary competitive advantage.

Regionally, the market growth is heavily skewed towards established gaming hubs undergoing modernization alongside rapid expansion in emerging markets. While North America and Europe maintain high market value due to continuous replacement cycles and sophisticated regulatory frameworks, the Asia Pacific region, particularly destinations contemplating or expanding integrated resort development, exhibits the highest anticipated Compound Annual Growth Rate (CAGR). Latin American countries are increasingly reforming legislation to permit or expand regulated casino operations, creating fresh demand for initial installations of high-end equipment. Challenges remain in navigating diverse and complex regulatory landscapes across different countries, necessitating tailored product offerings and certification processes for specific regional requirements.

Segment trends reveal a sustained dominance of the Slot Machines category, particularly video slots, driven by continuous innovation in multimedia capabilities and themed content licensing. However, the fastest growth is observed in the Casino Management Systems (CMS) segment, reflecting the critical need for operators to effectively manage player data, security, financial transactions, and compliance mandates across large, integrated facilities. Within the table games category, the increased adoption of Electronic Table Games (ETGs) is notable, offering lower operational costs, higher game security, and bridging the gap between traditional manual tables and fully electronic gaming devices. This trend indicates a strong shift towards equipment that reduces human error, optimizes labor allocation, and maximizes floor utilization through interconnected network infrastructure.

AI Impact Analysis on Casino Equipment Market

Common user questions regarding AI's impact on the Casino Equipment Market frequently center on how AI can enhance security, personalize the gaming experience, and optimize casino floor operations. Users are deeply interested in the deployment of computer vision for advanced surveillance, specifically asking if AI-driven systems can proactively detect collusion, identify problem gamblers in real-time, or automatically monitor game integrity far more effectively than human staff. There is significant curiosity about AI’s role in developing next-generation slot machines—whether AI algorithms can dynamically adjust game difficulty, payout frequencies, or bonus features based on individual player behavior to maximize engagement and lifetime value. Furthermore, operators often inquire about the expected Return on Investment (ROI) from implementing AI-powered Casino Management Systems (CMS) for predictive maintenance, optimizing staffing levels, and generating highly granular marketing campaigns based on real-time data ingestion and processing, indicating a high expectation for operational efficiency gains.

The integration of Artificial Intelligence and Machine Learning (AI/ML) is fundamentally transforming both the physical hardware and the operational software supporting the casino ecosystem. For equipment manufacturers, AI is moving beyond basic analytics into predictive modeling embedded directly within gaming devices and surveillance hardware. This allows for unparalleled precision in identifying anomalies—whether related to equipment failure, potential security breaches like card counting or device tampering, or unusual player behavior that might signal regulatory risk. The move towards AI-powered personalization ensures that gaming content remains fresh and tailored, extending the lifecycle of floor installations and offering operators a significant competitive advantage in saturated markets by maximizing player retention and spend through deeply customized incentives and game features.

- AI-Enhanced Surveillance: Real-time detection of fraud, collusion, and suspicious activity using computer vision and behavioral analytics integrated into surveillance systems.

- Personalized Gaming Experience: Machine learning algorithms dynamically adjust game content, betting limits, and promotional offers based on individual player profiles and in-game performance.

- Predictive Maintenance: AI tools monitor equipment performance data to forecast potential failures, allowing for proactive servicing and minimizing costly operational downtime of critical machines.

- Optimized Floor Layout: ML models analyze player flow, heat maps, and device performance metrics to recommend optimal placement of equipment, maximizing theoretical win and visitor comfort.

- Responsible Gaming Tools: AI systems identify patterns indicative of problem gambling behavior in real-time, triggering automated interventions or alerts to compliance teams.

- Next-Generation RNG Verification: AI algorithms enhance the verification and certification of Random Number Generators (RNGs) to ensure absolute game fairness and meet stringent regulatory requirements globally.

- Cashless Operations: AI streamlines digital payment processing and anti-money laundering (AML) compliance checks embedded within cashless gaming equipment infrastructure.

DRO & Impact Forces Of Casino Equipment Market

The dynamics of the Casino Equipment Market are shaped by a complex interplay of internal and external forces, categorized as Drivers, Restraints, and Opportunities (DRO), which collectively determine the growth trajectory and market landscape. The primary drivers revolve around the geopolitical expansion of legalized gambling, necessitating substantial capital investment in new facility build-outs and subsequent equipment procurement, particularly in newly regulated territories across Asia-Pacific and Latin America. Simultaneously, the inherent obsolescence cycle of electronic gaming devices (EGDs), driven by advancements in display technology (4K, curved screens), interactive features, and networking capabilities, ensures a consistent replacement demand in mature markets like North America. These forces combine with the imperative for operators to adopt sophisticated Casino Management Systems to achieve regulatory compliance and operational efficiency, thereby sustaining high demand for advanced hardware and integrated software solutions across the global installed base.

Restraints, however, pose significant friction to market acceleration, notably the extremely stringent and heterogeneous regulatory environment that governs equipment manufacturing and deployment. Each jurisdiction imposes unique certification requirements for hardware, software, and fairness protocols, substantially increasing compliance costs, time-to-market, and manufacturing complexity for global vendors. High initial capital expenditure required for equipping modern casinos, especially integrated resorts, acts as a barrier to entry for smaller operators and can temper large-scale expansion plans during periods of economic uncertainty. Furthermore, persistent public and political opposition to gambling in many regions, often fueled by concerns over social costs and addiction, can lead to unpredictable changes in legislation, regulatory moratoria, or imposition of high taxation rates, which directly suppress the profitability and willingness of operators to invest in new equipment.

Opportunities for growth are abundant, chiefly centered on technological breakthroughs and market penetration strategies. The shift towards cashless and digital payment systems integrated directly into slot machines and tables represents a massive opportunity for both enhanced convenience and superior data collection. Emerging markets, especially in Southeast Asia and parts of Africa, represent unsaturated territories where the establishment of regulated gaming sectors offers long-term deployment potential. Moreover, the increasing sophistication of data analytics and the adoption of AI/ML technologies present opportunities for vendors to offer value-added services focused on floor optimization, predictive maintenance, and responsible gaming features, moving the market focus from merely selling hardware to providing comprehensive, data-driven operational partnerships. These factors indicate that strategic focus on regulatory agility and digital innovation will be key determinants of future success.

Segmentation Analysis

The Casino Equipment Market is systematically segmented based on Product Type, End-User, and Geography, providing a granular view of market dynamics and investment pockets. Product segmentation is crucial as it differentiates between the high-volume, continuously updated Electronic Gaming Devices (EGDs), such as slot machines and video poker terminals, and the specialized, often lower-volume but essential operational equipment, like gaming tables and surveillance systems. End-user segmentation distinguishes between the procurement patterns and scale requirements of large commercial casinos versus smaller tribal or cruise ship operations, which affects both pricing models and service requirements. This multi-faceted segmentation allows stakeholders to accurately gauge demand heterogeneity and tailor their marketing and distribution strategies effectively across diverse operational environments.

- Product Type

- Slot Machines (Video Slots, Reel Slots, Progressive Jackpots)

- Gaming Tables (Blackjack, Roulette, Baccarat, Craps, Poker Tables)

- Video Poker Machines

- Electronic Gaming Devices (EGDs) (Multi-Terminal ETGs, Single-Player ETGs)

- Casino Management Systems (CMS) (Software, Hardware, Services)

- Other Equipment (Shufflers, Chip Counters, Surveillance Systems, Signage)

- End-User

- Commercial Casinos

- Tribal Casinos

- Online Gaming Platforms (Hardware Support/Server Infrastructure)

- Cruise Ships

- Integrated Resorts

- Geography

- North America (U.S., Canada, Mexico)

- Europe (UK, Germany, France, Italy, Spain)

- Asia Pacific (China, Japan, South Korea, Macau, Singapore)

- Latin America (Brazil, Argentina, Peru)

- Middle East and Africa (South Africa, UAE)

Value Chain Analysis For Casino Equipment Market

The Value Chain for the Casino Equipment Market is intricate and highly regulated, starting from research and development (R&D) and raw material procurement (Upstream Analysis) through to final deployment and maintenance (Downstream Analysis). Upstream activities involve sophisticated software engineering for Random Number Generators (RNGs) and game mechanics, industrial design for cabinet ergonomics and display technology, and the sourcing of high-grade components like microprocessors, specialized displays, and secure payment modules. Suppliers in this stage must meet stringent quality control standards as the component integrity directly impacts the regulatory compliance of the final equipment. Significant value creation occurs here through intellectual property protection related to patented game mathematics and copyrighted content, which are key differentiators among top manufacturers.

Midstream processes focus on manufacturing, assembly, software integration, and crucially, regulatory certification. Given the global nature of the market, manufacturers must maintain multiple regional facilities or robust international supply chains to handle varying power standards, hardware specifications, and compliance requirements (e.g., GLI or BMM testing). The manufacturing phase is capital-intensive due to the need for advanced robotics and clean-room environments for sensitive components. Post-manufacturing, the distribution channel handles logistics, installation, and financing. Distribution often utilizes a hybrid model: large, established players frequently rely on direct sales and wholly-owned regional subsidiaries to maintain control over service and intellectual property, while smaller, emerging manufacturers might leverage indirect distribution through licensed third-party agents or dedicated casino supply houses.

Downstream activities center on the deployment, operation, and lifecycle management of the equipment within the casino environment. This includes installation, staff training, ongoing technical maintenance, and provision of updates to the Casino Management System (CMS) software. Direct channels are preferred for high-value contracts and proprietary system installations, ensuring vendor accountability and faster resolution of complex technical issues. Indirect channels are more prevalent for replacement parts, accessories, and localized service support in remote or heavily regulated markets where local expertise is essential. Critical value is generated downstream through long-term service contracts and software licensing renewals, which provide consistent recurring revenue streams and solidify the manufacturer-operator relationship through essential technical support and compliance updates.

Casino Equipment Market Potential Customers

The primary consumers of casino equipment are institutions that legally operate regulated gambling activities, ranging from vast, multi-faceted integrated resorts to niche gaming platforms. Commercial casinos represent the largest and most frequent buyer segment, requiring bulk purchases of slot machines, comprehensive CMS solutions, and hundreds of gaming tables for expansive gaming floors. These customers prioritize equipment scalability, integration capabilities with existing infrastructure, and proven historical performance data regarding player appeal and machine efficiency, making them critical targets for high-volume sales and large service contracts. Their purchasing decisions are often highly centralized and driven by metrics focused on maximizing theoretical win and optimizing floor flow.

A second major customer segment includes Tribal Casinos, predominantly in North America, which operate under unique regulatory structures and often focus on regional market dominance. While their purchasing volumes might be lower than global commercial chains, tribal operations frequently demand specialized equipment features, tailored content, and robust technical support to cater to specific local demographics and operational needs. Cruise ships and smaller, regional gaming lounges constitute important niche buyers, requiring durable, space-efficient equipment that meets international maritime safety standards and can operate reliably in environments with limited on-site technical support, often opting for Electronic Table Games (ETGs) for efficiency.

A growing segment consists of Online Gaming Platforms, particularly those requiring server-based hardware, dedicated secure environments, and sophisticated back-end infrastructure to support live dealer games and remote access gaming. While they may not purchase physical slot machine cabinets, they are major consumers of proprietary software licenses, certified Random Number Generator (RNG) systems, and data center equipment essential for delivering a secure, fair, and compliant digital experience. Manufacturers are increasingly recognizing these diverse customer needs by offering hybrid products that seamlessly integrate land-based loyalty programs and physical equipment with their digital offerings.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 10.3 Billion |

| Growth Rate | CAGR 11.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | International Game Technology (IGT), Scientific Games (Light & Wonder), Aristocrat Leisure, Evolution Gaming, Konami Gaming, EGT (Euro Games Technology), Novomatic, AGS, Merkur Gaming, Incredible Technologies, TCS John Huxley, Crane Payment Innovations (CPI), JCM Global, Abbiati Casino Equipment, DLV, Ainsworth Game Technology, Inspired Entertainment, Playtech, BetConstruct, Gaming Partners International. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Casino Equipment Market Key Technology Landscape

The technological landscape of the Casino Equipment Market is defined by rapid convergence of physical hardware innovation and sophisticated digital systems, moving beyond simple mechanics to highly networked, server-based solutions. One of the paramount technologies is Server-Based Gaming (SBG), which allows operators to centrally manage and instantaneously change game content, denominations, and features across an entire floor from a single server. This greatly enhances operational flexibility, minimizes downtime associated with physical chip replacement, and facilitates rapid deployment of new game titles based on real-time performance metrics. Concurrently, advancements in display technology, including curved screens, ultra-high definition (UHD) 4K resolution, and interactive haptic feedback systems, are crucial for creating the immersive experiences demanded by modern players, differentiating new machines from legacy hardware and supporting high-profile intellectual property licensing deals.

Another fundamental technological pillar is the evolution of Casino Management Systems (CMS), which utilize sophisticated networking and cloud infrastructure to integrate all aspects of casino operations. Modern CMS incorporates advanced data analytics, AI-driven security modules, and comprehensive accounting and anti-money laundering (AML) compliance tools. The rise of cashless gaming technology, involving Near Field Communication (NFC) readers, secure digital wallets, and proprietary loyalty card systems integrated directly into the equipment, is rapidly replacing traditional coin handling, improving both security and transaction efficiency. Furthermore, technologies focusing on absolute game integrity, such as highly certified Random Number Generators (RNGs) and sophisticated peripheral components like bill validators (BVs) and ticket-in/ticket-out (TITO) printers equipped with advanced fraud detection features, are essential for maintaining regulatory approval and operational trust globally.

The market is also heavily investing in automation technology, particularly through the use of high-speed electronic shufflers, automated chip recognition systems, and Electronic Table Games (ETGs). ETGs use digital interfaces and centralized determination systems to offer traditional games like roulette and blackjack efficiently, reducing the risk of human error and significantly lowering staffing overheads while appealing to players who prefer faster, less intimidating play environments. The continuous development of responsible gaming technology, leveraging AI to monitor betting patterns and time-on-device metrics, is becoming a mandatory feature for new equipment, driven by increasing societal and regulatory pressure on operators to mitigate gambling-related harm, thereby embedding social responsibility within the core technological offerings of leading manufacturers.

Regional Highlights

The geographical distribution and growth drivers of the Casino Equipment Market vary significantly, reflecting diverse regulatory frameworks, economic conditions, and cultural acceptance of gambling activities. North America, comprising the United States and Canada, remains the largest market in terms of value, driven by established gaming hubs like Nevada and New Jersey, alongside the rapid expansion of tribal gaming operations and legalized sports betting infrastructure. The regional market growth here is predominantly fueled by replacement cycles, necessitating the continuous procurement of technologically superior slot machines and advanced CMS upgrades to maintain competitiveness and comply with evolving state-level regulations. The convergence of land-based and online offerings, often requiring integrated server-based gaming infrastructure, also ensures sustained investment in high-end networking hardware and security software solutions, solidifying the region's position as a technology adopter and high-spending segment.

Asia Pacific (APAC) is projected to exhibit the highest Compound Annual Growth Rate (CAGR) globally, largely attributable to the massive integrated resort complexes in Macau and Singapore, which demand premium, luxury-segment equipment. Furthermore, potential or ongoing legalization efforts in other high-population countries, such as Japan and emerging Southeast Asian nations, represent significant untapped market potential for initial equipment installations and infrastructure build-outs. However, the APAC market demands unique localization strategies, particularly regarding game themes and cultural preferences for table games like Baccarat, often requiring manufacturers to tailor hardware aesthetics and software interfaces specifically for the region. Regulatory complexities, especially in China and surrounding jurisdictions concerning capital flows and anti-corruption measures, necessitate highly compliant and transparent equipment operation, favoring vendors with proven security and auditing features.

Europe represents a highly fragmented but sophisticated market, characterized by a mix of traditional small-to-medium sized casinos and state-controlled monopolies. The demand here is highly diversified, ranging from advanced video slots in Eastern Europe to preference for traditional table games and multi-player roulette terminals in Western European nations. Regulatory standardization across the European Union is minimal, requiring manufacturers to obtain separate certifications for numerous countries like the UK, France, and Germany, which increases complexity but supports a steady demand for certified, regionalized equipment. Latin America and the Middle East & Africa (MEA) are characterized as emerging markets. Latin American growth is volatile but promising, contingent upon legislative progress in large nations like Brazil and Argentina, potentially leading to substantial first-time installations. MEA growth is concentrated around established locations in South Africa and emerging resort developments in the UAE, where demand is high for luxury, high-roller focused gaming equipment and comprehensive surveillance systems.

- North America: Market leader in value; driven by replacement cycles, tribal gaming, and integration of cashless systems and sports betting technology.

- Asia Pacific: Fastest-growing region; powered by integrated resort expansions in Macau and Singapore, and legislative progress in emerging markets like Japan.

- Europe: Highly regulated and fragmented; demand driven by specific country regulations, high adoption of Electronic Table Games (ETGs), and continuous need for certified equipment.

- Latin America: High potential, dependent on regulatory reforms; focus on initial installations of standard and video slot equipment once legalization stabilizes.

- Middle East and Africa (MEA): Niche luxury market focusing on high-end integrated resort development and premium equipment for specific tourism zones.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Casino Equipment Market.- International Game Technology (IGT)

- Scientific Games (Light & Wonder)

- Aristocrat Leisure

- Evolution Gaming

- Konami Gaming

- EGT (Euro Games Technology)

- Novomatic

- AGS (American Gaming Systems)

- Merkur Gaming

- Incredible Technologies

- TCS John Huxley

- Crane Payment Innovations (CPI)

- JCM Global

- Abbiati Casino Equipment

- DLV

- Ainsworth Game Technology

- Inspired Entertainment

- Playtech

- BetConstruct

- Gaming Partners International

Frequently Asked Questions

What is the primary factor driving the high Compound Annual Growth Rate (CAGR) in the Casino Equipment Market?

The leading driver for the significant CAGR is the ongoing global wave of gambling legalization and the construction of new integrated resorts (IRs), particularly across emerging markets in Asia-Pacific and Latin America. This necessitates massive initial investment in high-end electronic gaming devices, comprehensive Casino Management Systems (CMS), and modern surveillance infrastructure, coupled with the mandatory technological replacement cycles in mature markets to maintain competitive edge and regulatory compliance.

How is Artificial Intelligence (AI) fundamentally changing the operational side of casino equipment?

AI is transforming operations by enabling advanced security and optimization features. This includes AI-driven surveillance using computer vision to instantly detect fraud, predictive maintenance systems that forecast equipment failure, and sophisticated AI-powered CMS that personalize player experiences and dynamically optimize floor layout based on real-time performance data, significantly boosting efficiency and responsible gaming measures.

Which product segment dominates the Casino Equipment Market, and which segment is growing the fastest?

The Slot Machines segment, particularly the video slot category, maintains dominance in terms of sheer volume and revenue generation due to continuous multimedia innovation and consumer appeal. However, the Casino Management Systems (CMS) segment is experiencing the fastest growth, reflecting the critical industry need for highly integrated, secure software platforms capable of handling regulatory compliance, player loyalty, and detailed business intelligence across expanding global operations.

What are the most significant restraints affecting market expansion for equipment manufacturers?

The primary restraint is the complex and highly varied regulatory landscape across different global jurisdictions. Manufacturers must invest heavily in obtaining specific, often expensive, certifications (like GLI or BMM testing) for every piece of hardware and software deployed in each country, dramatically increasing compliance costs, development timelines, and administrative overhead, thus slowing down market penetration.

What role does Server-Based Gaming (SBG) technology play in the future equipment demand?

Server-Based Gaming (SBG) is pivotal as it allows casinos to manage and modify game content, themes, and payout structures instantaneously from a central server, eliminating physical changes. This technological shift enables rapid adaptation to player preferences, simplifies floor management, and is essential for implementing personalized gaming experiences and cashless payment solutions, driving high demand for networked, smart equipment infrastructure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager