Cast Resin Transformers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436676 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Cast Resin Transformers Market Size

The Cast Resin Transformers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.9 Billion by the end of the forecast period in 2033.

Cast Resin Transformers Market introduction

The Cast Resin Transformers Market, often referred to as the Dry-Type Transformer Market, encompasses electrical devices utilized to change voltage levels in distribution systems. Unlike traditional oil-filled transformers, cast resin variants employ epoxy resin insulation to encapsulate the primary and secondary windings, offering superior fire safety, reduced environmental risk, and minimal maintenance requirements. This technology is increasingly vital in environments where fire hazard mitigation is paramount, such as high-density urban areas, commercial complexes, transportation hubs, and specialized industrial facilities.

The core product description centers on transformers that use solid insulating material, primarily epoxy resin, which is molded under vacuum around the coils. This robust construction provides high mechanical strength, resistance to short-circuit forces, and exceptional thermal stability. Major applications span across industrial manufacturing, power utilities, renewable energy integration (especially solar and wind farms requiring reliable, low-maintenance equipment), and infrastructure projects like metros and tunnels. The inherent benefits, including non-flammability, low noise emission, and high operational reliability, solidify their position as preferred equipment in critical power distribution networks.

Driving factors for sustained market growth include stringent global safety regulations, particularly in Europe and Asia Pacific, mandating the use of dry-type transformers in indoor installations. Furthermore, the rapid expansion of smart grid initiatives and the proliferation of renewable energy infrastructure necessitates transformers capable of handling variable loads and high short-circuit withstand capabilities. The continuous push toward energy efficiency and reduction of lifecycle costs further accelerates the adoption of these modern, reliable power components.

Cast Resin Transformers Market Executive Summary

The global Cast Resin Transformers Market demonstrates robust expansion driven primarily by critical business trends focusing on infrastructure modernization, enhanced energy safety standards, and the integration of decentralized renewable energy sources. Key business trends include the shift toward higher voltage class transformers (up to 36 kV) for demanding industrial and utility applications, and the implementation of smart features such as embedded sensors for condition monitoring and predictive maintenance. Companies are investing heavily in automation during the casting process to ensure consistency and reduce manufacturing lead times, improving supply chain efficiency and product quality.

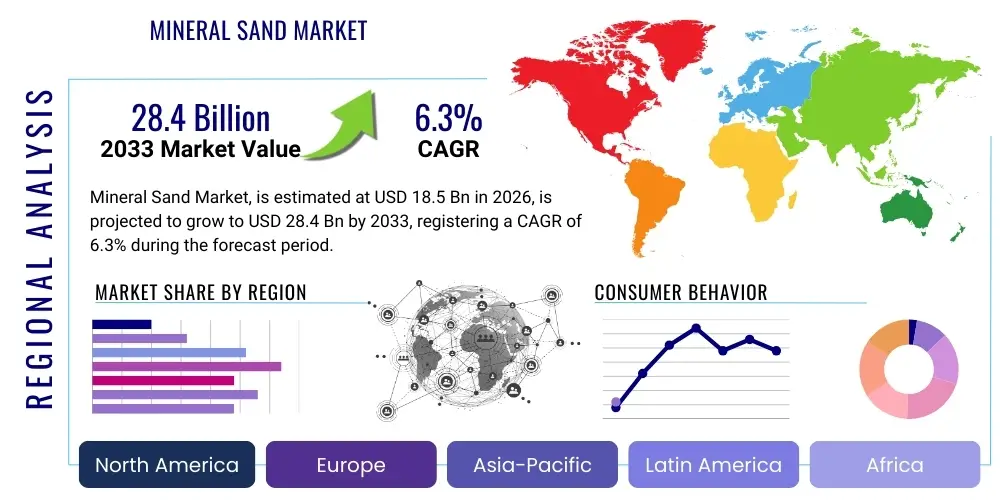

Regional trends indicate that the Asia Pacific (APAC) region remains the dominant market, fueled by massive urbanization, industrialization in economies like China and India, and large-scale infrastructure investments in power generation and distribution capacity. North America and Europe show steady growth, characterized by significant expenditures on grid infrastructure upgrades, replacing aging oil-filled units with safer, more efficient cast resin alternatives, and adhering to strict environmental and fire safety mandates. Latin America and the Middle East and Africa (MEA) represent emerging high-growth opportunities, spurred by investments in oil and gas facilities, data centers, and new smart city developments requiring resilient power systems.

Segmentation trends highlight the increasing demand for high-voltage and medium-voltage cast resin units, reflecting their adoption in primary distribution networks and large industrial complexes. The end-user segment is dominated by the Industrial sector and Power Utilities, although the commercial and residential segment is rapidly gaining traction due to the installation of smaller capacity units in high-rise buildings and commercial facilities. Furthermore, the market is seeing innovation in insulating materials, including hybrid or advanced epoxy resins designed for even greater thermal cycling stability and extended operational lifespan, catering specifically to volatile environmental conditions and demanding operational cycles.

AI Impact Analysis on Cast Resin Transformers Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) can improve the reliability and operational efficiency of cast resin transformers, especially concerning failure prediction and optimal load management. Key user concerns revolve around the integration of IoT sensors within the epoxy enclosure, the complexity of data processing, and the return on investment for implementing sophisticated AI-driven predictive maintenance platforms. Users seek confirmation that AI can genuinely extend the lifespan of these assets, optimize energy consumption by dynamic voltage control, and reduce unscheduled downtime, thereby maximizing the inherent benefits of dry-type technology. The consensus theme is the expectation that AI will transform transformers from static components into intelligent assets capable of self-diagnosis and autonomous optimization within a smart grid framework.

The primary impact of AI centers on shifting maintenance strategies from time-based or reactive approaches to highly accurate predictive models. Embedded sensors collect real-time data on temperature, vibration, partial discharge, and load fluctuations. AI algorithms analyze these large datasets to detect subtle anomalies that precursors to insulation degradation or coil failure, allowing utilities and industrial operators to schedule maintenance precisely when necessary, maximizing asset uptime and reducing maintenance costs significantly. This proactive approach enhances the overall reliability of the distribution network, a critical factor given the high cost and long lead times associated with transformer replacement.

Furthermore, AI plays a crucial role in optimizing the operation of cast resin transformers within complex smart grid environments. ML models can forecast load demands with greater accuracy than traditional statistical methods, enabling dynamic adjustment of transformer tap changers (where applicable) or load shifting to prevent overloading and minimize thermal stresses. This capability is essential for managing the intermittent and variable power supply from renewable energy sources integrated into the grid. The development of digital twins for cast resin transformers, powered by AI, allows engineers to simulate various operational scenarios and potential fault conditions, leading to improved design validation and more efficient installation protocols, thus accelerating market adoption.

- AI-driven Predictive Maintenance (PdM) based on real-time sensor data analysis.

- Optimized load management and dynamic voltage control through Machine Learning algorithms.

- Enhanced thermal monitoring and prognostics to prevent winding failure and epoxy degradation.

- Development of digital twins for simulation and performance optimization throughout the asset lifecycle.

- Improved fault detection and classification, reducing diagnostic time and increasing safety.

DRO & Impact Forces Of Cast Resin Transformers Market

The market dynamics are defined by a strong convergence of regulatory demands and technological advancements, categorized by significant drivers, inherent restraints, and compelling opportunities that collectively determine the impact forces on market trajectory. Key drivers include rigorous fire safety standards imposed globally, which strongly favor the non-flammable nature of cast resin units, especially in densely populated urban infrastructure and sensitive industrial environments. Alongside this, the global push for decarbonization necessitates grid modernization and the integration of highly reliable dry-type transformers to support volatile renewable energy sources. These drivers exert a strong, positive impact force, ensuring sustained demand growth across utilities and industrial sectors.

However, the market faces several restraining factors, primarily the substantially higher initial procurement cost of cast resin transformers compared to conventional oil-filled alternatives, which can deter adoption in price-sensitive markets or projects with limited capital expenditure budgets. Furthermore, the sensitivity of epoxy insulation to extreme temperature variations and improper installation practices requires specialized handling and expertise, posing a technical restraint in regions lacking adequate skilled labor or quality control standards. These restraints act as friction points, slightly decelerating the rate of replacement for existing infrastructure, particularly in developing economies.

Opportunities for growth are concentrated in the rapidly expanding sectors of electric vehicle (EV) charging infrastructure and large-scale data center construction, both of which require reliable, high-efficiency, and compact power solutions where fire safety is non-negotiable. Another significant opportunity lies in the development of modular and prefabricated substations incorporating cast resin technology, streamlining installation processes and deployment in remote or temporary setups. These strategic opportunities, coupled with ongoing material science innovations to reduce manufacturing costs and enhance thermal performance, represent the most powerful long-term impact forces driving market value and competitive strategy.

Segmentation Analysis

The Cast Resin Transformers Market is comprehensively segmented based on Insulation Type, Voltage Level, End-User application, and Capacity. Analyzing these segments provides a granular view of market dynamics and identifies specific demand trends across various industrial and commercial landscapes. The primary division is often based on insulation class and voltage rating, which dictates the suitability of the transformer for deployment in specific segments, ranging from distribution networks to high-power industrial furnace operations. The high reliability and safety profile of the technology allows it to penetrate specialized markets requiring bespoke solutions.

Voltage level segmentation is crucial, distinguishing between medium voltage (MV) and high voltage (HV) units. MV units (typically up to 36 kV) constitute the largest market share, predominantly used in commercial buildings, power substations, and industrial plants. The rapidly growing HV segment (above 36 kV) is gaining momentum due to utilities requiring dry-type safety benefits in large-scale transmission substations and integration points for massive renewable energy farms. Capacity segmentation (Small, Medium, Large) directly correlates with the scale of the end-user application, with medium capacity units (2501 kVA to 10 MVA) being highly demanded for heavy industrial use.

End-user segmentation clearly illustrates the strong alignment of cast resin technology with sectors where uninterrupted operation and fire safety are critical. Power utilities, industrial manufacturing, and infrastructure segments, including transportation and data centers, are the largest consumers. The infrastructure segment is expected to show the highest CAGR due to unprecedented global investment in rapid transit systems, smart city development, and large-scale renewable energy projects requiring specialized, weather-resistant dry-type transformers for remote and decentralized power generation sites. This diverse application base ensures market resilience against economic fluctuations in any single industrial sector.

- By Insulation Type:

- Fiber Reinforced Plastic (FRP)

- Cast Epoxy Resin

- By Voltage Level:

- Medium Voltage (MV) (1 kV to 36 kV)

- High Voltage (HV) (Above 36 kV)

- By Capacity:

- Small Capacity (Up to 2500 kVA)

- Medium Capacity (2501 kVA to 10 MVA)

- Large Capacity (Above 10 MVA)

- By End-User:

- Power Utilities

- Industrial (Manufacturing, Oil & Gas, Mining)

- Commercial & Residential

- Infrastructure & Transportation (Data Centers, Railways, Ports)

Value Chain Analysis For Cast Resin Transformers Market

The value chain for the Cast Resin Transformers Market begins with the upstream sourcing of specialized raw materials, primarily high-grade magnetic steel cores (silicon steel), copper or aluminum conductors, and crucially, electrical-grade epoxy resin and fillers used for the casting process. The quality and stable pricing of these raw materials directly impact the final product cost and manufacturing margin, placing emphasis on robust supplier relationships. Manufacturers focus heavily on optimizing the core assembly and coil winding processes, followed by the vacuum encapsulation process, which is highly technical and critical to the transformer's insulation integrity and long-term reliability.

The middle segment involves manufacturing, where firms leverage advanced automated vacuum casting systems to ensure the coils are perfectly encapsulated without voids, which could lead to partial discharge failures. Distribution channels are varied, including direct sales to large power utilities and major industrial clients (direct channel), and reliance on specialized electrical distributors, system integrators, and engineering procurement and construction (EPC) firms (indirect channel). The complexity of installation and commissioning often requires manufacturers or their certified partners to provide post-sales services, making technical support a critical component of the distribution strategy.

Downstream analysis focuses on the end-user deployment and the aftermarket service components. Cast resin transformers typically have a long operational lifespan (30+ years) but require periodic inspection, testing, and potential repair, especially concerning temperature and insulation monitoring. The rise of smart transformers has enhanced the aftermarket value, driven by maintenance contracts leveraging AI and IoT solutions. The efficiency of the downstream network, particularly the responsiveness of certified service providers, is key to maintaining customer satisfaction and loyalty in the high-stakes environment of power distribution.

Cast Resin Transformers Market Potential Customers

Potential customers for Cast Resin Transformers span a diverse range of industries where safety, resilience, and minimal environmental impact are prioritized over initial capital cost. Power Utilities represent a foundational customer base, consistently requiring dry-type units for urban substations, secondary distribution networks, and renewable energy integration points where oil containment is impractical or prohibited. Utilities value the reduced fire risk and high reliability offered by these units, especially in densely populated areas.

The Industrial sector, encompassing heavy manufacturing, oil and gas, petrochemicals, and mining operations, forms another significant customer segment. These operations often involve harsh, dusty, or hazardous environments where the mechanical strength and non-flammable characteristics of cast resin transformers are essential. Customers in this segment prioritize customized solutions, high short-circuit withstand capabilities, and superior thermal cycling performance to ensure operational continuity in critical processes.

Rapidly growing customer bases include the Infrastructure segment, dominated by data centers, hospitals, financial institutions, and mass transit systems (railways and metros). Data centers, in particular, require massive, highly reliable power distribution within confined spaces, making the safety and compactness of cast resin transformers indispensable. Moreover, commercial developers installing power infrastructure in high-rise commercial and residential buildings are increasingly adopting dry-type units to comply with modern fire codes and insurance requirements, broadening the customer landscape significantly.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.9 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., Siemens AG, Schneider Electric SE, General Electric Company (GE), WEG S.A., TBEA Co., Ltd., Crompton Greaves Power and Industrial Solutions Ltd. (CG Power), Hyosung Heavy Industries, Toshiba Corporation, Eaton Corporation, L&T Electrical & Automation, Meidensha Corporation, EuroGroup Spa, Legrand, Efacec Power Solutions. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cast Resin Transformers Market Key Technology Landscape

The technological landscape of the Cast Resin Transformers Market is evolving rapidly, moving beyond basic insulation advancements towards integration with digital technologies and focusing intensely on optimizing core and coil materials for enhanced efficiency. A critical area of innovation is the development of advanced epoxy resin formulations, including those with higher filler content and improved heat dissipation properties, which allows the transformers to operate reliably at higher temperatures and handle greater power densities without thermal degradation. Furthermore, manufacturers are employing sophisticated vacuum pressure impregnation (VPI) techniques and automated casting processes to eliminate micro-voids in the resin structure, ensuring higher insulation integrity, significantly reducing the risk of partial discharge, and extending the operational life of the unit.

Another significant technological advancement involves the integration of smart features, transforming the traditional transformer into an active component of the smart grid. This includes embedding IoT sensors (temperature, humidity, vibration, and partial discharge sensors) directly into the resin enclosure or core structure. This sensor array facilitates real-time condition monitoring, allowing operators to assess the health of the asset remotely. This digitalization enables the implementation of advanced diagnostic tools and predictive maintenance systems, reducing the reliance on manual inspections and contributing to enhanced grid reliability and operational efficiency. The use of amorphous metal cores, although higher in initial cost, is also gaining traction, particularly in applications where minimizing no-load losses is a critical performance requirement, aligning with global energy efficiency mandates.

Furthermore, research and development are concentrated on modular design architectures and miniaturization techniques. Modular cast resin units offer faster installation and easier scalability, particularly valuable for temporary power setups or rapidly expanding infrastructure projects like data centers. Designers are also focusing on optimizing cooling channel design within the resin casting to improve thermal performance without increasing overall transformer size, leading to higher power-to-volume ratios. The increasing demand for specialized low-noise transformers, achieved through optimized core clamping mechanisms and vibration isolation techniques, is crucial for installations in sensitive urban and commercial environments, further defining the competitive technology edge.

Regional Highlights

The Cast Resin Transformers Market exhibits distinct regional consumption patterns and growth drivers, heavily influenced by local regulatory frameworks, infrastructure spending cycles, and the maturity of the electrical grid.

- Asia Pacific (APAC): APAC is the global epicenter for market growth, driven primarily by unprecedented infrastructure spending, rapid urbanization, and massive industrial expansion across China, India, and Southeast Asian nations. Governments are investing heavily in new power generation capacity, including large-scale renewable projects, and modernizing existing transmission and distribution networks. Strict mandates on fire safety, particularly in metropolitan high-rise construction and transportation systems (like China's extensive railway network), heavily favor the adoption of dry-type cast resin technology over conventional oil-filled counterparts. The region's need for high-capacity units to support burgeoning manufacturing hubs ensures sustained demand.

- North America: This region demonstrates stable growth, fundamentally supported by aggressive grid modernization efforts, particularly in the US and Canada. The primary driver is the need to replace aging infrastructure (many units dating back to the mid-20th century) with safer, more energy-efficient alternatives compliant with modern energy standards (e.g., Department of Energy efficiency regulations). The proliferation of data centers, combined with significant investment in localized microgrids and EV charging station infrastructure, creates high demand for reliable, fire-resistant cast resin transformers, especially medium-voltage units for commercial applications.

- Europe: Europe is characterized by mature market penetration and growth driven by stringent environmental and safety regulations, notably concerning environmental impact (no oil contamination risk) and fire protection (IEC standards). Key growth vectors include the ongoing integration of offshore wind and solar power into continental grids, requiring specialized, robust dry-type transformers, and the retrofit market where older substations in urban centers are upgraded. Germany, the UK, and France remain central markets, leading in technological adoption of smart monitoring and high-efficiency models due to strong governmental commitments to energy transition and efficiency mandates.

- Latin America (LATAM): Growth in LATAM is emerging, focused on infrastructure development in countries like Brazil and Mexico, driven by industrial projects (mining, oil & gas) and increasing electrification rates. While price sensitivity remains a factor, increasing regulatory awareness regarding fire safety in major cities is slowly accelerating the shift toward cast resin technology, particularly in new commercial construction and public utilities projects funded through private-public partnerships focused on long-term operational costs.

- Middle East and Africa (MEA): MEA exhibits high potential, largely driven by large-scale government-backed infrastructure projects, including mega smart city developments (like NEOM in Saudi Arabia) and expansion of oil and gas processing facilities. The need for robust transformers capable of operating reliably in high ambient temperatures, combined with a strong focus on safety and reducing environmental footprint in critical industrial operations, makes cast resin transformers highly attractive in these high-investment economies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cast Resin Transformers Market.- ABB Ltd.

- Siemens AG

- Schneider Electric SE

- General Electric Company (GE)

- WEG S.A.

- TBEA Co., Ltd.

- Crompton Greaves Power and Industrial Solutions Ltd. (CG Power)

- Hyosung Heavy Industries

- Toshiba Corporation

- Eaton Corporation

- L&T Electrical & Automation

- Meidensha Corporation

- EuroGroup Spa

- Legrand

- Efacec Power Solutions

- Mitsubishi Electric Corporation

- JST Transformateurs

- Vaupell Holding GmbH

- Hammond Power Solutions Inc. (HPS)

- Brush Group

Frequently Asked Questions

Analyze common user questions about the Cast Resin Transformers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of a Cast Resin Transformer over an Oil-Filled Transformer?

The primary advantage is superior fire safety and reduced environmental risk. Cast resin transformers are dry-type, non-flammable, and self-extinguishing due to their epoxy insulation, eliminating the risk of oil leakage, explosions, and catastrophic fires associated with traditional oil-filled units. This makes them essential for indoor installations and high-density urban areas.

In which applications are Cast Resin Transformers most commonly used?

They are most commonly used in applications requiring high fire safety and minimal maintenance, including commercial high-rise buildings, data centers, hospitals, schools, underground transportation systems (metros/railways), large industrial plants (e.g., petrochemicals), and integrated renewable energy substations.

What is the typical lifespan and maintenance requirement for a Cast Resin Transformer?

A typical cast resin transformer has an operational lifespan exceeding 30 years, often with minimal routine maintenance. Maintenance primarily involves visual checks, cleaning of cooling ducts, and periodic electrical testing (e.g., insulation resistance). Modern units often incorporate smart sensors for predictive maintenance, further reducing manual intervention.

What voltage levels are most prevalent in the Cast Resin Transformers Market?

Medium Voltage (MV) units, typically ranging from 1 kV to 36 kV, are the most prevalent and widely deployed in distribution networks and commercial infrastructure. However, the High Voltage (HV) segment, above 36 kV, is a significant growth area, driven by utility-scale renewable energy integration projects.

How does the high initial cost of Cast Resin Transformers impact market adoption?

The higher initial cost serves as a primary restraint, particularly in developing economies. However, this restraint is increasingly offset by lower total cost of ownership (TCO) over the unit's lifespan due to reduced maintenance costs, elimination of oil disposal fees, and substantial savings realized from minimized fire insurance premiums and enhanced operational safety.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager