Casual Dining Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432333 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Casual Dining Market Size

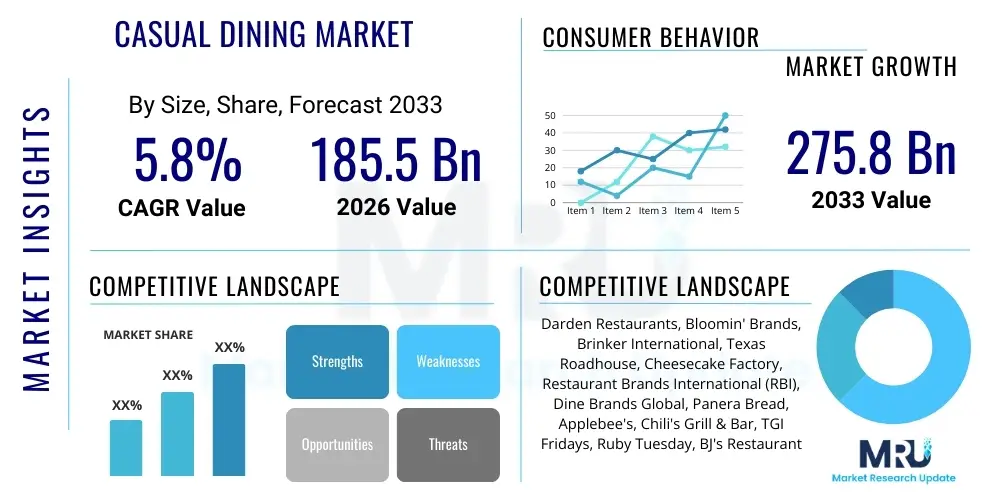

The Casual Dining Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $185.5 Billion USD in 2026 and is projected to reach $275.8 Billion USD by the end of the forecast period in 2033. This robust expansion is fueled primarily by shifting consumer lifestyles, which increasingly favor dining experiences over mere sustenance, coupled with aggressive digital transformation efforts undertaken by major restaurant groups. Furthermore, the market is characterized by high levels of innovation focused on optimizing operational efficiency, particularly concerning labor management and supply chain resilience, which are critical factors influencing profitability margins within the sector.

The valuation reflects a significant rebound and sustained growth trajectory following global economic adjustments. Market maturation in developed regions, such as North America and Western Europe, is balanced by explosive growth opportunities in emerging economies across Asia Pacific and Latin America, where rapid urbanization, rising disposable incomes, and an expanding middle class are driving demand for experiential and affordable dining options. The strategic deployment of technology, including advanced Point of Sale (POS) systems, customer relationship management (CRM) tools, and sophisticated kitchen automation, serves as a foundational layer supporting this forecasted market expansion and improving customer throughput while maintaining service quality standards expected in the casual dining segment.

Casual Dining Market introduction

The Casual Dining Market encompasses establishments offering sit-down service that falls strategically between fast-casual (self-service) and fine dining (premium experience and price). These restaurants typically provide full table service, a comprehensive menu, and an ambiance conducive to extended social interaction, all at a mid-range price point. The core product offering revolves around a complete dining experience, blending quality ingredients and prepared dishes with efficient, professional service, often featuring themed concepts or specialized cuisine types, such as American comfort food, Italian, or Tex-Mex. Major applications include social gatherings, family meals, business lunches, and celebrations, positioning casual dining as a highly versatile segment appealing to a broad demographic seeking value for money and a superior dining environment compared to quick-service options. This market segment is crucial to the overall food service industry, acting as a primary driver of employment and local economic activity, while continually adapting its operational models to meet evolving consumer expectations regarding convenience, transparency, and sustainability.

Key benefits driving consumer adoption of casual dining establishments include the balance of quality and affordability, the consistency of food preparation, and the convenience offered by standardized operational procedures across chains. Furthermore, the experiential aspect—the opportunity to dine out without the financial commitment of fine dining—is a major draw. Driving factors for market growth are multifaceted and include the sustained rise in global urbanization, leading to decreased frequency of home cooking; the increasing preference among millennials and Gen Z for experiential consumption over material goods; and the effective leveraging of digital platforms for reservations, loyalty programs, and third-party delivery services, significantly expanding the market's reach and accessibility. The industry's ability to quickly pivot its menu and service models in response to shifting dietary trends, such as increased demand for plant-based options and clean-label ingredients, also maintains its relevance and attractiveness to the modern consumer base.

The competitive landscape of the casual dining sector is intense, necessitating continuous innovation in menu engineering, operational efficiency, and customer engagement strategies. Operators are heavily investing in restaurant redesigns that prioritize comfortable seating, integrated technology (like tableside ordering), and enhanced kitchen layouts to support high-volume output and complicated menu preparation with minimal error. The successful integration of technology not only enhances the customer journey but also provides valuable data insights into peak hours, popular menu items, and customer lifetime value, enabling highly targeted marketing campaigns and optimized labor scheduling. This commitment to data-driven decision-making and continuous operational refinement is essential for maintaining competitive advantage and capturing market share in this highly consumer-centric industry segment.

Casual Dining Market Executive Summary

The Casual Dining Market is currently experiencing transformative business trends characterized by aggressive digital integration and a strategic shift towards omnichannel operations. Major business developments include the widespread adoption of advanced data analytics to personalize customer experiences and optimize inventory management, drastically reducing food waste and improving profitability. Furthermore, high labor costs and persistent staffing shortages are accelerating the integration of automation technologies, particularly in back-of-house operations, such as robotic fryers and automated inventory tracking systems, which enhance efficiency and reliability. The focus remains on striking a delicate balance between maintaining the human element of full-service dining and leveraging technology to streamline transactions and preparation processes. Successful operators are those who have effectively monetized their digital channels, including proprietary apps and robust loyalty ecosystems, ensuring high customer retention rates in a highly saturated market environment.

Regionally, the market exhibits divergent growth patterns. North America and Europe, representing mature casual dining markets, are primarily driven by renovation cycles, menu innovation centered on sustainability and local sourcing, and market consolidation among major chains. In contrast, the Asia Pacific (APAC) region stands out as the primary engine of volume growth, powered by rapid economic development, changing dietary habits influenced by Western culture, and significant investments in food service infrastructure, particularly in rapidly urbanizing countries like India, China, and Southeast Asian nations. Latin America and the Middle East show promising potential, driven by strong youth demographics and increasing demand for international, branded casual dining concepts, often facilitated through franchising models that ensure rapid market penetration while mitigating direct investment risks for international operators. Regulatory environments related to food safety and sourcing continue to shape operational strategies across all geographies, demanding localized compliance efforts.

Segment trends reveal a pronounced shift in consumer preference towards specialized casual dining concepts over generic, traditional models. The limited-service casual dining segment, which bridges the gap between fast-casual and full-service with faster turnaround times and often counter service for ordering, is demonstrating superior growth, catering to time-constrained consumers who still prioritize quality ingredients and a curated atmosphere. Moreover, concepts emphasizing transparency, locally sourced ingredients, and adherence to specific dietary needs (e.g., gluten-free, keto-friendly) are outperforming traditional competitors. Ownership trends indicate that large, established chains continue to leverage their scale for better purchasing power and technological integration, driving the consolidation of smaller, independent operators. However, independent restaurants focused on unique, hyper-local offerings continue to thrive by providing highly differentiated experiential dining that national chains often struggle to replicate, maintaining a vital, albeit smaller, segment of the overall market.

AI Impact Analysis on Casual Dining Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Casual Dining Market frequently center on themes of job displacement, hyper-personalization of the dining experience, and the ethical implications of data collection. Users are keen to understand how AI will reshape the role of front-of-house staff, particularly concerning order taking and service delivery, fearing that robots or automated systems might diminish the social aspect of dining out. Simultaneously, there is a strong interest in AI’s capability to enhance operational efficiency, specifically through demand forecasting for inventory management, optimizing kitchen workflows to reduce cooking times, and automating routine administrative tasks like scheduling and payroll. The key expectations revolve around AI enabling faster service, reducing human error, and creating bespoke marketing offers based on historical dining preferences, ultimately leading to a more streamlined and customized customer journey while addressing persistent labor challenges in the sector.

- AI-driven demand forecasting optimizes inventory levels, drastically reducing food waste and lowering procurement costs by accurately predicting peak demand cycles and necessary ingredient volumes.

- Personalized menu recommendations and dynamic pricing models utilize AI algorithms to analyze past orders and real-time behavioral data, enhancing customer satisfaction and maximizing check averages.

- Automated conversational AI systems handle reservations, common customer inquiries, and even initial order placement via chatbots or voice assistants, freeing human staff to focus on high-touch service elements.

- Kitchen automation, including robotic food preparation and quality control checks, uses AI vision systems to ensure consistency, speed up output during rush hours, and maintain strict food safety standards.

- Advanced data analytics powered by machine learning identify operational bottlenecks, predict equipment failures, and optimize staffing schedules based on anticipated foot traffic and kitchen workload patterns.

- AI-enhanced security and surveillance systems monitor restaurant environments for potential hazards, ensuring compliance with health regulations and providing real-time alerts on safety incidents.

DRO & Impact Forces Of Casual Dining Market

The dynamics of the Casual Dining Market are dictated by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming the Impact Forces that shape strategic decision-making. Key drivers include the global shift towards convenience and experiential consumption, where consumers increasingly prioritize high-quality dining experiences outside the home, supported by rising discretionary spending and stable economic growth in key markets. The rapid proliferation of digital ordering channels—including third-party aggregators and proprietary apps—has fundamentally expanded the addressable market, allowing casual dining establishments to service consumers beyond their physical seating capacity. However, these positive forces are counteracted by significant restraints, primarily soaring operational costs, encompassing minimum wage hikes, high volatility in commodity prices affecting food costs, and intense competition from both fast-casual and premium dining segments, squeezing profit margins and demanding continuous menu innovation and operational austerity.

Opportunities within the market largely center on technological leverage and demographic shifts. The push for sustainability, transparency, and ethical sourcing presents a massive opportunity for operators willing to invest in traceable supply chains and communicate their efforts authentically to environmentally conscious consumers. Furthermore, the expansion of hybrid dining models, merging dine-in service with highly efficient take-out and delivery operations, allows chains to maximize revenue generation from existing kitchen infrastructure. Investing in enhanced customer relationship management (CRM) technologies and loyalty programs provides a pathway to capturing deeper consumer data, enabling unparalleled personalization which is vital for long-term retention. These opportunities require substantial initial capital outlay but promise significant returns through improved efficiency and customer loyalty, positioning early adopters for market leadership.

The impact forces are profoundly shaping the operational landscape, forcing operators to prioritize capital investment in technology over physical expansion in many mature markets. The immediate impact of labor challenges has necessitated a strong focus on automation and streamlining repetitive tasks, fundamentally altering the traditional front-of-house and back-of-house labor roles. Additionally, consumer demand for healthier, customized, and culturally diverse menu options requires dynamic supply chain management capable of sourcing a broader array of ingredients globally. Ultimately, market success hinges on the agility of casual dining brands to manage these cost pressures while simultaneously elevating the consumer experience through seamless integration of digital and physical touchpoints, ensuring that value proposition remains compelling against proliferating alternatives.

Segmentation Analysis

The Casual Dining Market is meticulously segmented based on several critical dimensions, allowing for granular analysis of consumer behavior, operational models, and growth potential across various niches. Key segmentation criteria include the type of service offered (Full-Service vs. Limited-Service Casual Dining), the ownership structure (Chained Restaurants vs. Independent Operators), the predominant cuisine type (e.g., Italian, American, Asian, Tex-Mex), and the primary distribution channel utilized (Dine-in, Takeaway, Drive-Thru, and Delivery). Analyzing these segments helps stakeholders understand market penetration levels, identify underserved geographical areas, and tailor marketing strategies to specific consumer cohorts based on their dining preferences and spending habits. The segmentation reveals dynamic shifts, particularly the increasing overlap between traditional segments as operators adopt hybrid models to capture maximum revenue throughout the day.

- By Service Type:

- Full-Service Casual Dining

- Limited-Service Casual Dining (Hybrid models emphasizing speed)

- By Ownership:

- Chained Restaurants (National and international brands leveraging standardization and scale)

- Independent Restaurants (Focusing on unique concepts and local appeal)

- By Cuisine:

- American Casual Dining

- Italian Casual Dining

- Mexican/Tex-Mex Casual Dining

- Asian Casual Dining (Japanese, Chinese, Korean)

- International/Specialty Cuisine

- By Distribution Channel:

- Dine-in (Traditional revenue stream)

- Takeaway/To-Go (Increasingly important post-pandemic)

- Third-Party Delivery (Aggregators)

- Proprietary App/Website Delivery

- By Consumer Age Group:

- Millennials and Gen Z (High tech adoption, experiential focus)

- Gen X and Baby Boomers (Focus on quality service and comfort)

Value Chain Analysis For Casual Dining Market

The value chain for the Casual Dining Market commences with upstream activities centered around the meticulous sourcing and procurement of raw materials, including perishable goods, processed foods, beverages, and operational supplies. This stage is dominated by large-scale food distributors, specialized suppliers, and increasingly, direct relationships with local farms and producers, driven by consumer demand for freshness and transparency. The critical component of the upstream phase is effective supply chain management, involving cold storage logistics, quality assurance checks, and establishing long-term contracts to stabilize volatile commodity prices. Operational excellence in the upstream stage directly impacts the restaurant’s ability to control costs and maintain menu consistency, necessitating advanced forecasting and supplier relationship management tools to ensure reliable delivery of high-quality ingredients that meet complex menu requirements.

The core midstream activities involve the preparation, cooking, and service delivery within the restaurant premises. This operational phase incorporates kitchen management (inventory rotation, preparation standardization, waste reduction), technology integration (POS systems, kitchen display screens, reservation software), and human capital management (training, scheduling, quality service delivery). The casual dining segment heavily relies on efficient workflow design to minimize preparation time and maximize table turnover, blending skilled labor with technological aids like automated beverage dispensers and advanced cooking equipment. The efficiency of the service process, from order placement to payment, is a primary determinant of customer satisfaction and overall brand perception in this highly competitive environment, driving investment in seamless digital ordering platforms and robust training programs for front-of-house staff.

Downstream activities focus on reaching the end consumer through various distribution channels, which now encompass direct dining (on-premise), off-premise services (takeout and proprietary delivery), and partnerships with indirect channels such as third-party food delivery aggregators (e.g., DoorDash, Uber Eats). The shift towards off-premise dining has necessitated significant investments in specialized packaging, optimized delivery logistics, and dedicated ghost kitchens or designated pick-up areas to handle high volumes without disrupting the dine-in experience. Direct distribution via proprietary channels offers greater control over the customer relationship and reduced commission costs, while indirect channels provide unparalleled reach and volume access. Maximizing profitability requires a carefully calibrated strategy balancing the exposure offered by aggregators with the profitability and data ownership of direct consumer relationships.

Casual Dining Market Potential Customers

The potential customer base for the Casual Dining Market is broad, predominantly consisting of middle to upper-middle-income families, young professionals, and older adults seeking a convenient, comfortable, and reliable dining experience that strikes an optimal balance between quality and cost. Families represent a cornerstone demographic, utilizing casual dining for routine weekly meals and celebrations due to the accommodating atmosphere, diverse menu options suitable for various ages, and the perceived safety and familiarity of established chains. Young professionals, including Millennials and Gen Z, are critical buyers due to their high frequency of dining out, propensity for ordering delivery/takeout, and keen interest in establishments that offer unique, shareable menu items and highly Instagrammable, experience-focused environments. This demographic also highly values sustainability efforts and digital convenience, prioritizing brands that offer seamless app-based ordering and personalized loyalty rewards.

Older adults and empty nesters also constitute a significant segment, valuing the predictable service standards, comfortable seating, and perceived value offered by casual dining concepts, often preferring earlier dining times and traditional menu items. Furthermore, business travelers and tourists frequently utilize casual dining establishments due to their widespread availability near hotels and commercial centers, relying on brand recognition for consistent quality when away from home. The shift in dining habits driven by macroeconomic factors means that price sensitivity remains a factor for a large portion of the market, positioning casual dining concepts successfully against more expensive fine dining options and more limited fast-casual outlets. Operators continuously segment these potential customers based on visit frequency and average transaction value to tailor menu promotions and service enhancements effectively.

The identification of potential customers is increasingly reliant on sophisticated digital footprint analysis, moving beyond traditional demographic profiling to include psychographic and behavioral data derived from loyalty program participation and social media engagement. This granular data allows casual dining brands to identify high-value "Super Users"—customers who dine frequently and spend above the average transaction value—and focus targeted marketing efforts to maximize their customer lifetime value. By analyzing potential buyers' responses to menu innovation, pricing adjustments, and localized promotions, restaurants can ensure their offerings remain aligned with evolving consumer tastes, such as the rising demand for specialty dietary accommodations (e.g., vegan, low-carb) and global flavors. The ultimate potential customer is one who perceives the casual dining establishment as offering superior value, merging high-quality food with an enjoyable, hassle-free social experience.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $185.5 Billion USD |

| Market Forecast in 2033 | $275.8 Billion USD |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Darden Restaurants, Bloomin' Brands, Brinker International, Texas Roadhouse, Cheesecake Factory, Restaurant Brands International (RBI), Dine Brands Global, Panera Bread, Applebee's, Chili's Grill & Bar, TGI Fridays, Ruby Tuesday, BJ's Restaurants, The Cheesecake Factory, Red Robin Gourmet Burgers, Cracker Barrel Old Country Store, Olive Garden, Carrabba's Italian Grill, LongHorn Steakhouse, P.F. Chang's. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Casual Dining Market Key Technology Landscape

The technological evolution of the Casual Dining Market is focused on creating a frictionless customer journey while simultaneously optimizing back-of-house operations to combat rising costs and labor shortages. Modern Point of Sale (POS) systems serve as the central nervous system, integrating diverse functions such as table management, inventory control, staff scheduling, and payment processing into a single, cohesive platform. These advanced systems are cloud-based, offering real-time data analytics that enable managers to make swift, data-driven decisions regarding pricing, promotions, and staffing levels based on historical and predictive modeling. The adoption of mobile POS tablets for tableside ordering and payment is rapidly growing, improving order accuracy, speeding up service turnaround times, and enhancing the overall professionalism of the dining experience, directly addressing key customer pain points related to wait times.

Beyond the core POS infrastructure, significant investment is concentrated on customer-facing technology designed to enhance personalization and convenience. This includes sophisticated Customer Relationship Management (CRM) platforms that power loyalty programs, track dining preferences, and facilitate highly targeted marketing communications via email or proprietary apps. Furthermore, the integration of Artificial Intelligence (AI) and Machine Learning (ML) is becoming prevalent in demand forecasting, helping restaurants minimize perishable inventory waste by predicting daily needs with high accuracy. Automated kitchen management systems, including sophisticated Kitchen Display Systems (KDS) and integration with robotic food preparation tools for repetitive tasks, are reducing reliance on manual labor, ensuring consistency, and allowing human staff to concentrate on complex or high-value food preparation stages.

The growing reliance on off-premise dining necessitates robust technological solutions for managing the complex logistics of delivery and takeout operations. This includes optimized order aggregation platforms that seamlessly pull orders from proprietary apps, third-party delivery services, and phone calls into a single workflow, ensuring efficient preparation and hand-off. Furthermore, geo-location tracking and thermal packaging innovations, often monitored by technology, ensure that food quality is maintained during transit, preserving the casual dining experience even when consumed off-site. Overall, the technological landscape is transitioning the casual dining experience from a purely physical transaction to a fully integrated omnichannel service ecosystem, where the brand interacts with the customer across multiple digital touchpoints before, during, and after their meal, solidifying customer loyalty and driving incremental revenue streams.

Regional Highlights

North America, particularly the United States, represents the largest and most mature market for casual dining globally, characterized by high market saturation and dominance by large national chains. Growth in this region is driven primarily by menu innovation, technological upgrades, and competitive differentiation based on concept themes and value propositions. US operators are heavily focused on leveraging ghost kitchens and virtual brands to optimize delivery reach and utilization of existing kitchen capacity without incurring high real estate costs associated with new physical locations. The competitive environment dictates that successful chains must constantly refresh their offerings to meet shifting consumer demands for plant-based options, specialty beverages, and highly personalized dining experiences, while simultaneously navigating acute labor market pressures through efficiency gains.

Europe presents a diverse market, with Western Europe showing slower, stability-driven growth focused on quality and regional culinary traditions, while Central and Eastern Europe offer higher expansion potential due to lower market penetration and rising disposable incomes. Regulatory complexity concerning sourcing, labor laws, and environmental standards significantly influences operational models across the continent. Key trends involve the localization of menus by international chains to appeal to distinct national palates and a strong consumer emphasis on sustainability, leading to widespread adoption of local sourcing and waste reduction initiatives. European consumers demonstrate a high appreciation for authenticity, compelling operators to invest heavily in creating unique, experiential dining concepts that differentiate them from mass-market offerings and maintain competitive edge.

Asia Pacific (APAC) stands out as the highest growth region for the casual dining market, fueled by explosive urbanization, the rapid expansion of the middle class, and the strong cultural adoption of eating out as a social norm. Key countries like China, India, and Southeast Asian nations are seeing immense investment from both local and international brands, often adapting menus and service models to cater to hyper-local tastes and preferences, such as integrating high-tech digital ordering via popular local social platforms. Challenges include complex logistical infrastructure and navigating varied cultural expectations regarding service speed and dining customs. However, the sheer population density and increasing spending power solidify APAC's position as the primary engine for new market volume and large-scale expansion opportunities over the forecast period.

Latin America (LATAM) and the Middle East & Africa (MEA) represent emerging casual dining markets characterized by strong growth potential. In LATAM, factors such as youth demographics and increased exposure to global food trends are driving demand, often through successful franchising of established North American and European brands, while local chains simultaneously innovate to capture patriotic consumer sentiment. MEA markets, particularly the Gulf Cooperation Council (GCC) countries, benefit from high per capita income, a sophisticated consumer base, and significant international tourism, leading to the rapid introduction of premium casual dining concepts. Infrastructure development and a focus on luxurious, high-service environments define success in these regions, where dining out is frequently integrated into high-end leisure and shopping complexes, catering to discerning consumers prioritizing both quality and social status associated with dining choice.

- North America: Highest market value, driven by high technology adoption, omnichannel integration, and intense competition among established national chains. Focus on ghost kitchens and labor efficiency.

- Europe: Diverse landscape; Western Europe focuses on quality and sustainability; Eastern Europe offers higher growth potential. Strong regulatory compliance focus on food traceability and labor.

- Asia Pacific (APAC): Fastest growing region, powered by urbanization and middle-class expansion, massive volume growth in China and India. High adaptation of international concepts to local tastes.

- Latin America: High growth trajectory, driven by franchising of international brands and strong demand from young demographics for experiential dining and Westernized food concepts.

- Middle East & Africa (MEA): Growth fueled by high disposable incomes (especially in GCC), tourism, and rapid development of modern retail and dining infrastructure supporting premium casual concepts.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Casual Dining Market.- Darden Restaurants (Olive Garden, LongHorn Steakhouse)

- Bloomin' Brands (Outback Steakhouse, Carrabba's Italian Grill)

- Brinker International (Chili's Grill & Bar, Maggiano's Little Italy)

- Texas Roadhouse

- The Cheesecake Factory

- Dine Brands Global (Applebee's, IHOP)

- Restaurant Brands International (RBI) (Tim Hortons, Burger King, Popeyes) - Note: Included due to ownership overlaps and hybrid operational models

- TGI Fridays

- Ruby Tuesday

- Red Robin Gourmet Burgers

- BJ's Restaurants

- Cracker Barrel Old Country Store

- P.F. Chang's

- California Pizza Kitchen

- Denny's Corporation

- Panera Bread (Often crosses into Fast-Casual, but operational scale is significant)

- Wagamama (UK/International)

- The White Spot (Canada)

- Grupo Alsea (Mexico/LATAM operator)

- Casual Dining Group (UK)

Frequently Asked Questions

Analyze common user questions about the Casual Dining market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary technological trends driving market growth in the Casual Dining sector?

The primary technological trends involve the integration of AI for demand forecasting and operational efficiency, the widespread adoption of cloud-based POS systems for real-time data analytics, and the expansion of mobile ordering and payment solutions (AEO focus: frictionless customer experience, operational automation, cloud technology).

How are casual dining restaurants adapting to increased consumer demand for sustainability and transparency?

Casual dining operators are responding by prioritizing local sourcing, reducing food waste through AI-driven inventory management, implementing certified sustainable packaging for off-premise orders, and transparently communicating ethical sourcing practices to environmentally conscious customers (AEO focus: sustainable sourcing, food waste reduction, ethical supply chain).

Which geographical region offers the most significant growth opportunities for new casual dining concepts?

Asia Pacific (APAC), particularly emerging economies like China and India, offers the most significant growth opportunities due to rapid urbanization, expanding middle-class populations, and increasing consumer willingness to spend on experiential dining (AEO focus: APAC market growth, emerging economies, urbanization effects).

What key strategies are casual dining chains using to mitigate rising labor costs and staff shortages?

Chains are mitigating rising labor costs through strategic investment in automation technologies (e.g., robotic fryers, automated dishwashers), streamlining front-of-house tasks with mobile ordering kiosks and tableside tablets, and optimizing staffing schedules using advanced AI-driven analytical tools (AEO focus: labor automation, operational efficiency, AI scheduling).

What is the current outlook regarding the balance between dine-in versus off-premise sales channels?

The market is shifting towards a hybrid model, where off-premise sales (delivery and takeout) remain critical supplementary revenue streams, requiring dedicated operational layouts (ghost kitchens, specialized pick-up areas). While dine-in remains the core experience driver, profitability relies on maximizing both channels simultaneously (AEO focus: hybrid dining model, off-premise profitability, omnichannel strategy).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Restaurant Point of Sale POS Terminal Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Fixed POS terminal, Self-serve kiosks, Cash counters terminal, Vending machine, Mobile POS terminal), By Application (Fast food restaurants, Casual dining restaurants, Fine dining restaurants, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Coffee and Desserts Machine Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (HoReCa Drip Coffee, Ice Cream, Gelato, Desserts), By Application (Quick Service Restaurants, Fast Food Restaurants, Cafeterias, Carryout Restaurants, Full Service Restaurants, Fine Dining Restaurants, Casual Dining Restaurants, Hotel & Club Foodservice), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Fast-casual Dining Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Burgers/Sandwiches, Chicken, Pasta/Pizza, Asian/Latin American Food, Sea-Food, Others), By Application (Online, In-store), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager