Cat Diapers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432633 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Cat Diapers Market Size

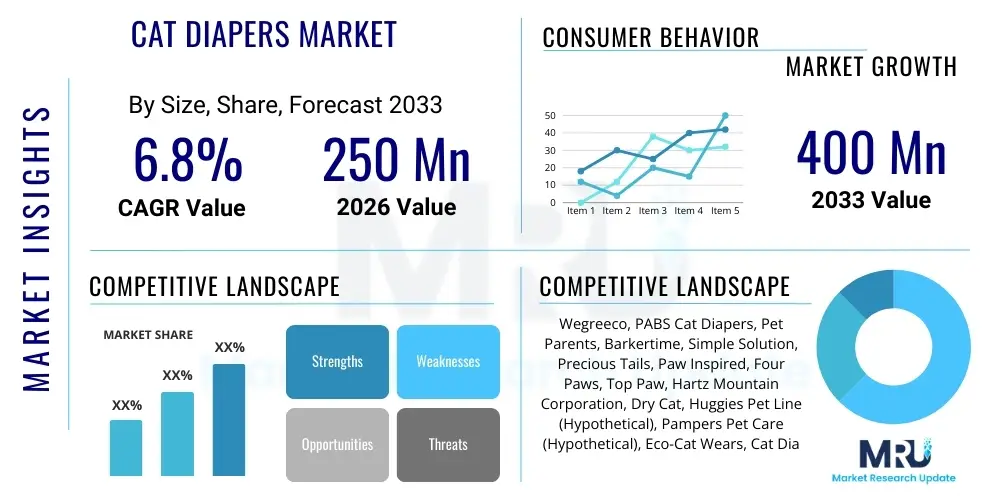

The Cat Diapers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $250 Million in 2026 and is projected to reach $400 Million by the end of the forecast period in 2033. This consistent expansion is primarily fueled by the increasing trend of pet humanization, growing awareness regarding senior cat care, and the rising prevalence of urinary incontinence and chronic health issues in the aging feline population globally. The market growth is also supported by continuous product innovations focusing on enhanced absorbency, comfort, and eco-friendly materials, making cat diapers a mainstream solution for managing pet hygiene.

Cat Diapers Market introduction

The Cat Diapers Market encompasses disposable and reusable absorbent garments specifically designed for domestic cats, primarily addressing issues related to urinary incontinence, territorial spraying, post-operative care, and managing hygiene for senior or disabled pets. These products are crucial for maintaining sanitary conditions within households and improving the quality of life for cats facing mobility limitations or medical conditions that impair bladder control. Modern cat diapers feature tailored fits, adjustable waistbands, and superior leak protection, often incorporating odor-neutralizing technology to meet the demanding needs of pet owners seeking reliable and comfortable solutions for their feline companions.

The primary applications of cat diapers span medical management, behavioral control, and general hygiene maintenance. Medically, they are indispensable for cats recovering from surgery, suffering from neurological disorders affecting mobility, or those with chronic kidney disease leading to increased urination. Behaviorally, they are sometimes employed temporarily to manage inappropriate elimination or spraying issues, particularly in multi-cat households, although this use requires veterinary consultation. The undeniable benefit of these products lies in preventing house soiling, reducing the stress associated with frequent cleanup, and allowing owners to integrate special-needs pets fully into their family environment without compromising household sanitation standards.

Driving factors propelling market expansion include significant demographic shifts, such as the increasing life expectancy of domestic cats due to improved veterinary care, leading to a larger senior pet population segment prone to age-related health issues. Furthermore, the robust global trend of pet humanization encourages owners to invest heavily in premium products that ensure the comfort, dignity, and specialized care of their pets. Enhanced product accessibility through e-commerce platforms and veterinary clinic recommendations also plays a crucial role in disseminating awareness and driving the adoption rate of these specialized hygiene solutions across developed and emerging economies.

Cat Diapers Market Executive Summary

The Cat Diapers Market exhibits strong commercial dynamics driven by persistent business trends centered on sustainability, premiumization, and technological integration. Key manufacturers are increasingly focused on developing biodegradable or compostable diaper options, responding to rising consumer demand for environmentally responsible pet products. Business strategies emphasize direct-to-consumer models supported by targeted digital marketing, leveraging educational content to normalize the use of pet diapers for chronic conditions. Innovation in material science, such as hypoallergenic linings and highly efficient super-absorbent polymers (SAPs), remains a critical competitive differentiator, allowing brands to command higher price points in the premium segment and secure market leadership by prioritizing pet comfort and owner convenience.

Regionally, North America and Europe dominate the market, characterized by high pet ownership rates, advanced veterinary infrastructure, and substantial disposable income levels dedicated to specialized pet care. The Asia Pacific (APAC) region is poised for the fastest growth, primarily fueled by rapid urbanization, increasing awareness of senior pet health in countries like Japan and South Korea, and the burgeoning organized retail sector dedicated to pet supplies. Regional trends also reflect variations in product preference, with North America showing a stronger inclination towards disposable convenience, while parts of Europe and Asia are exploring durable, reusable cloth options due to environmental and cost considerations, necessitating localized supply chain flexibility.

Segmentation analysis reveals that the Disposable Diapers segment holds the largest market share due to unparalleled convenience, ease of use, and quick disposal, making it the preferred choice for busy pet owners and veterinary settings. However, the Reusable/Washable segment is projected to experience accelerated growth, appealing strongly to eco-conscious consumers and those seeking long-term cost-effective solutions. By distribution channel, E-commerce platforms maintain superiority, offering extensive product ranges, discrete delivery, and user reviews that facilitate informed purchase decisions, overshadowing traditional brick-and-mortar pet stores, though specialized veterinary clinics remain important channels for medically necessary purchases, offering professional recommendations.

AI Impact Analysis on Cat Diapers Market

Users frequently inquire about how Artificial Intelligence (AI) can enhance product personalization, optimize supply chain logistics for niche pet supplies, and improve diagnostic accuracy related to feline incontinence, thereby impacting the Cat Diapers Market. Key themes revolve around leveraging AI-driven data analytics to forecast demand patterns more accurately, especially concerning regional disease prevalence or seasonal changes affecting pet health needs. Consumers are particularly interested in AI applications that lead to 'smart' products, such as intelligent monitoring systems integrated into diapers to track hydration, urinary output frequency, and early detection of infections, offering proactive health management. Concerns often center on data privacy regarding pet health monitoring and the potential displacement of smaller, non-tech-savvy manufacturers unable to adopt sophisticated AI-driven manufacturing or personalization tools, creating a potential barrier to entry.

- AI-driven demand forecasting optimizes inventory management for specialized diaper sizes and materials, minimizing waste and stockouts in regional distribution centers.

- AI algorithms enhance e-commerce personalization, recommending specific diaper types (e.g., disposable vs. washable, size, absorbency level) based on the cat's age, breed, and diagnosed medical condition history.

- Integration of AI-powered sensors into cat diapers allows real-time monitoring of urinary output, pH levels, and temperature, enabling early detection of UTIs or kidney issues.

- AI assists in optimizing manufacturing processes, reducing material wastage during the production of intricate, specialized diaper designs, leading to cost efficiency.

- Natural Language Processing (NLP) is utilized in customer service to quickly address complex product inquiries related to usage, fitting, and sizing guides, enhancing consumer satisfaction.

- Machine learning models analyze clinical data to identify high-risk feline populations, allowing targeted marketing campaigns for preventive or specialized cat care products, including premium medical diapers.

- AI optimizes last-mile delivery logistics, crucial for recurring subscription models popular in the specialty pet supplies market, ensuring timely replenishment for chronic conditions.

DRO & Impact Forces Of Cat Diapers Market

The market is significantly influenced by a blend of powerful drivers, structural restraints, and emerging opportunities, collectively shaping the competitive landscape. Primary drivers include the global increase in the geriatric cat population and the intensifying trend of pet humanization, where owners prioritize the quality of life for their senior or sick pets, readily adopting specialized hygiene products. However, the market faces restraints such stemming from the high unit cost of premium, high-absorbency cat diapers compared to traditional litter box supplies, coupled with the ongoing challenge of achieving perfect fit and comfort across diverse cat breeds and body shapes. Opportunities mainly reside in technological advancements, particularly developing smart diaper solutions and expanding biodegradable product lines, catering to both convenience and environmental consciousness.

The key impact forces acting upon the Cat Diapers Market are multifaceted, ranging from supply chain reliability to shifting consumer attitudes toward animal hygiene. Technological innovation acts as a force multiplier, creating competitive advantages for firms that successfully integrate superior leak-proof designs and odor control technologies. Regulatory compliance, while currently less stringent than for human products, constitutes a latent force, particularly regarding material safety and claims substantiation for eco-friendly products. Societal acceptance and normalization of using diapers for aging or disabled pets, driven by effective consumer education and endorsements by veterinary professionals, also significantly influence the speed of market penetration and overall demand elasticity.

In terms of specific drivers, the proliferation of veterinary telemedicine and remote consultation services has increased diagnosis rates for chronic feline conditions, directly leading to increased prescriptions or recommendations for cat diapers. Conversely, a major restraint is the lack of standardized sizing across manufacturers, which often leads to consumer confusion, returns, and dissatisfaction, acting as a frictional force slowing wider adoption. The clearest opportunity remains market expansion into developing regions where specialized pet care is still nascent but rapidly gaining traction, driven by rising middle-class disposable income and heightened pet health awareness campaigns, enabling first-mover advantages for global brands positioning high-quality, specialized products.

Segmentation Analysis

Segmentation of the Cat Diapers Market provides a granular understanding of consumer behavior and product utilization across various demographics and use cases. The market is primarily segmented based on product type, distinguishing between disposable (one-time use) and reusable (washable cloth) options, which appeal to different consumer values regarding convenience versus sustainability and cost-effectiveness. Further segmentation by application highlights the distinct needs of consumers utilizing diapers for urinary incontinence, spraying/marking management, post-operative recovery, or managing female cats in heat. Analyzing these segments helps manufacturers tailor product features, marketing messages, and distribution strategies effectively to maximize market penetration across diverse end-user requirements, ensuring optimized product portfolios that align with specific feline needs.

- Product Type:

- Disposable Cat Diapers

- Reusable/Washable Cat Diapers

- Application:

- Urinary Incontinence Management

- Feline Spraying/Marking

- Post-Operative Care

- Cats in Heat (Estrus)

- Travel and Anxiety Management

- Size:

- Small (Kittens, Small Breeds)

- Medium (Standard Domestic Cats)

- Large/Extra Large (Maine Coons, Obese Cats)

- Distribution Channel:

- Online Retail (E-commerce, Company Websites)

- Offline Retail (Pet Specialty Stores, Hypermarkets, Veterinary Clinics)

Value Chain Analysis For Cat Diapers Market

The value chain for the Cat Diapers Market begins with upstream activities involving the sourcing of raw materials, predominantly super-absorbent polymers (SAPs), non-woven fabrics, adhesive components, and elastic materials. Key challenges in this stage include maintaining supply chain stability for specialized, skin-safe materials and ensuring sustainability credentials for eco-friendly fibers. Manufacturers must manage complex relationships with chemical suppliers and textile producers, focusing on optimizing material costs while adhering to strict quality control standards necessary for pet safety and product performance, especially regarding leak protection and odor neutralization.

Downstream analysis focuses on packaging, marketing, and distribution. Packaging plays a vital role in educating consumers about sizing and fitting, which is crucial for product efficacy. The distribution channel is heavily bifurcated between direct and indirect sales. Direct distribution leverages dedicated e-commerce platforms and subscription services, offering maximum margin control and direct customer interaction. Indirect distribution relies on established retail networks, including large pet specialty chains, veterinary clinics, and general merchandise stores, which provide broad geographical reach and consumer trust.

Veterinary clinics constitute a high-value indirect channel, as professionals often provide the initial recommendation and education regarding medically necessary diaper usage, influencing significant purchase decisions. E-commerce platforms, however, dominate market volume, offering convenience, competitive pricing, and extensive user reviews which drive repeat purchases and facilitate subscription model adoption. Strategic alignment across the entire value chain—from sourcing sustainable, high-performance materials (upstream) to offering seamless online ordering and robust veterinary partnerships (downstream)—is essential for achieving market prominence and sustaining profitability in this specialized niche.

Cat Diapers Market Potential Customers

The primary consumers and end-users of cat diapers are discerning pet owners who prioritize the welfare and hygiene of their special needs or geriatric cats. This demographic typically exhibits higher disposable income and is highly invested in pet humanization trends, viewing specialized products as necessary investments in their pet’s health and comfort. Customers are often categorized into specific subgroups based on the underlying need: owners managing chronic conditions (e.g., kidney disease, mobility issues), owners of intact female cats requiring hygiene solutions during heat cycles, and owners seeking post-surgical recovery aids recommended by veterinary professionals. These buyers are deeply motivated by solutions that reduce stress, maintain a clean home environment, and ensure their pet maintains dignity and mobility.

Veterinary clinics and specialized animal care facilities represent significant institutional buyers. These entities purchase cat diapers in bulk for use in post-operative recovery wards, specialized geriatric care units, and for dispensing recommendations to clients whose pets are diagnosed with conditions like Feline Lower Urinary Tract Disease (FLUTD) or age-related cognitive decline leading to incontinence. The purchase decision in this segment is driven by clinical effectiveness, reliability, and cost-efficiency for high-volume usage, often favoring highly absorbent, medical-grade disposable options that meet strict hygiene protocols.

Moreover, the market is expanding to include proactive pet travelers and owners of intact male cats prone to territorial spraying, seeking temporary, non-medical solutions to manage behavioral or situational hygiene challenges. These users require diapers that are easy to fit, comfortable for short durations, and highly effective in preventing marking accidents in unfamiliar environments. Effective marketing targeting these diverse end-user groups requires precise messaging tailored to the specific pain points and usage scenarios—whether medical necessity, behavioral control, or situational convenience.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $250 Million |

| Market Forecast in 2033 | $400 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Wegreeco, PABS Cat Diapers, Pet Parents, Barkertime, Simple Solution, Precious Tails, Paw Inspired, Four Paws, Top Paw, Hartz Mountain Corporation, Dry Cat, Huggies Pet Line (Hypothetical), Pampers Pet Care (Hypothetical), Eco-Cat Wears, Cat Diapers Inc., Comfort Fit Pet, Belly Bands for Cats, VetOne, Carefresh Pet Products, Pet Safe. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cat Diapers Market Key Technology Landscape

The technology landscape in the Cat Diapers Market is predominantly centered on material science and design engineering aimed at maximizing absorption, minimizing leaks, and ensuring feline comfort. Key material innovations include the use of advanced Super-Absorbent Polymers (SAPs) that can lock away large volumes of liquid while maintaining a dry surface layer, crucial for preventing skin irritation and pressure sores in immobile cats. Furthermore, the development of specialized leak-proof barriers, often utilizing heat-sealed or ultrasonic bonding techniques instead of traditional adhesives, improves durability and structural integrity, especially for reusable options that undergo frequent washing. The technology driving odor control, typically integrated via activated carbon layers or specialized neutralizing agents, is also paramount, directly influencing consumer satisfaction and repurchase rates.

A significant technological advancement involves design morphology, moving towards ergonomic shapes that accommodate the unique feline anatomy, specifically focusing on the tail hole and waist fit to prevent slippage and chafing, which are common complaints. Manufacturers employ sophisticated CAD modeling and 3D prototyping to develop highly customized fits across different size categories, enhancing the overall user experience. This focus on tailored design engineering ensures the product remains securely in place even during limited movement, maximizing effectiveness against leakage, a critical technical hurdle in cat diaper production given the cat's flexibility and sensitivity to foreign objects.

The emerging technological frontier involves the integration of 'smart' elements. This includes incorporating flexible, low-power electronic sensors—often utilizing NFC or Bluetooth capabilities—embedded within the diaper's absorbent core. These sensors are designed to monitor saturation levels, urinary pH, and potentially glucose or protein levels, transmitting data to a mobile application for owners and veterinarians. This IoMT (Internet of Medical Things) approach transforms the diaper from a simple containment product into a proactive health monitoring device, offering significant value to owners managing complex chronic conditions and representing the leading edge of innovation in the feline care technology space.

Regional Highlights

Regional dynamics significantly influence market development, driven by differing rates of pet ownership, disposable income, and the maturity of veterinary care systems.

- North America: This region holds the dominant market share due to high pet expenditure, a large aging cat population, and strong consumer acceptance of convenience-driven disposable products. The U.S. and Canada are characterized by mature e-commerce infrastructure supporting subscription services for pet essentials, facilitating easy access to specialized products like cat diapers. Intensive marketing and high rates of veterinary specialization further drive product recommendation and adoption.

- Europe: Europe is a substantial market, driven by strict animal welfare standards and a strong consumer preference for eco-friendly and reusable options, particularly in Western European nations like Germany, the UK, and France. While disposable diaper sales are robust, the market exhibits a higher uptake of sustainable, washable cat diaper solutions, often featuring organic or highly durable textile components, reflecting stronger environmental consciousness among European pet owners.

- Asia Pacific (APAC): APAC represents the fastest-growing market, primarily fueled by rising disposable incomes in urban centers of China, Japan, and South Korea, coupled with rapidly improving standards of companion animal healthcare. Japan, with its historically high average age of pets and sophisticated pet product market, is a key innovator. Market growth is also boosted by the increasing penetration of organized pet retail chains and the growing humanization of pets across the region.

- Latin America (LATAM): This region is an emerging market, where growth is driven by increasing awareness of specialized pet care and the gradual shift from traditional pet care methods to specialized, imported hygiene solutions. Economic volatility can constrain high-cost specialized purchases, yet the growing middle class in countries like Brazil and Mexico presents a viable long-term growth opportunity, particularly for affordable and entry-level reusable diaper solutions.

- Middle East and Africa (MEA): The MEA market is currently nascent, characterized by low penetration of specialized pet hygiene products. Market expansion is concentrated in affluent urban centers within the GCC countries, where high-end, imported pet products are increasingly accessible. Future growth relies heavily on infrastructural development in organized retail and the professionalization of veterinary services, alongside increasing overall pet ownership rates.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cat Diapers Market.- Wegreeco

- PABS Cat Diapers

- Pet Parents

- Barkertime

- Simple Solution

- Precious Tails

- Paw Inspired

- Four Paws

- Top Paw

- Hartz Mountain Corporation

- Dry Cat

- Huggies Pet Line (Hypothetical)

- Pampers Pet Care (Hypothetical)

- Eco-Cat Wears

- Cat Diapers Inc.

- Comfort Fit Pet

- Belly Bands for Cats

- VetOne

- Carefresh Pet Products

- Pet Safe

Frequently Asked Questions

Analyze common user questions about the Cat Diapers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Cat Diapers Market?

The market is primarily driven by the significant increase in the global geriatric (senior) cat population combined with the strong global trend of pet humanization, prompting owners to invest in specialized care products for feline incontinence and chronic health management.

Are reusable or disposable cat diapers more popular?

Disposable cat diapers currently hold the largest market share due to their convenience and superior leak protection, especially in clinical settings. However, the reusable segment is experiencing faster growth, driven by eco-conscious consumers seeking sustainable and cost-effective long-term options.

What technological advancements are impacting cat diaper design?

Key technological advancements include the use of advanced Super-Absorbent Polymers (SAPs) for maximum liquid retention, ergonomic design modifications for better feline fit and comfort, and emerging integration of smart sensors for real-time monitoring of saturation and health indicators.

Which geographical region dominates the cat diaper sales?

North America currently dominates the Cat Diapers Market, attributable to high per capita expenditure on pet health, mature e-commerce distribution channels, and high rates of specialized veterinary consultation leading to product recommendation.

Who are the main end-users of cat diapers?

The main end-users are owners of geriatric or special needs cats suffering from urinary incontinence or mobility issues. Secondary users include veterinary clinics for post-operative care and owners managing behavioral spraying or female cats during their heat cycle.

What are the primary challenges restraining market growth?

Major restraints include the relatively high unit cost of premium cat diapers compared to standard litter supplies, difficulties in ensuring a perfect, non-irritating fit across all cat sizes and breeds, and limited consumer awareness in developing regions.

How does the e-commerce channel influence the distribution of cat diapers?

E-commerce is the dominant distribution channel, offering convenience, subscription model availability, discrete shipping for sensitive medical products, and comprehensive sizing information and user reviews, accelerating market penetration globally.

What is the role of AI in the future of the Cat Diapers Market?

AI is expected to optimize supply chains via demand forecasting, enhance consumer personalization in product recommendations, and potentially enable 'smart' diapers with integrated sensors for proactive feline health monitoring and early disease detection.

Are cat diapers used for managing territorial spraying?

Yes, while primarily medical, cat diapers are sometimes used temporarily to manage and reduce territorial spraying (marking) behavior, particularly when combined with behavioral modification strategies or during transport to prevent accidents.

What materials are prioritized for sustainable cat diapers?

Manufacturers prioritize materials such as biodegradable plant-based fibers (like bamboo), compostable linings, and recycled plastics for packaging to appeal to the growing segment of environmentally conscious pet owners, especially in European markets.

How significant is the veterinary sector in driving demand?

The veterinary sector is highly significant. Vets provide essential diagnoses, prescribe or recommend specific medical-grade diapers for post-operative and chronic care, and lend crucial professional credibility that influences consumer purchase decisions for specialized products.

What is the importance of odor control technology in cat diapers?

Odor control is a critical feature, often achieved using activated charcoal or neutralizing agents. High-performance odor control is essential for maintaining household hygiene and maximizing consumer acceptance, directly impacting satisfaction with the product.

Which sub-segment by application shows the highest sales volume?

The Urinary Incontinence Management sub-segment generates the highest sales volume, driven by the irreversible need for continuous hygiene solutions among the large and growing population of cats suffering from age-related or chronic medical conditions affecting bladder control.

How do manufacturers address sizing complexity?

Manufacturers address sizing complexity by offering extensive size ranges (Small, Medium, Large) often based on weight and waist circumference, accompanied by detailed, easy-to-use sizing charts and instructional videos on fitting to ensure effective, leak-proof application.

What is the predicted Compound Annual Growth Rate (CAGR) for the market?

The Cat Diapers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between the forecast years of 2026 and 2033, indicating robust and sustained expansion driven by specialized pet care investments.

Why is the Asia Pacific region expected to exhibit the fastest growth?

The APAC region is expected to lead growth due to rapid urbanization, increasing levels of disposable income dedicated to premium pet products, and the swift adoption of Western standards of specialized animal healthcare, particularly in East Asian economies.

What distinguishes reusable diapers in terms of market appeal?

Reusable diapers appeal to consumers primarily through two factors: long-term cost savings compared to continuous purchases of disposables, and their environmental friendliness, resonating strongly with eco-conscious consumers in developed markets like Europe.

What is the key technological challenge in cat diaper manufacturing?

The primary technological challenge is engineering a secure, comfortable, and leak-proof fit that accommodates the cat's highly flexible spine and sensitive skin, especially around the unique anatomical requirement of the tail hole, without compromising mobility.

Do pet insurance trends affect the Cat Diapers Market?

Yes, the increasing adoption of pet insurance, particularly policies covering chronic conditions and geriatric care, indirectly boosts the market by making specialized, high-cost products like medical cat diapers more financially accessible to pet owners.

How are companies using marketing to overcome consumer hesitancy?

Companies utilize educational content, endorsements from veterinary professionals, and visually clear demonstrations of product use and fit to normalize the concept of pet diapers, targeting psychological barriers and emphasizing improved quality of life for the pet.

What impact does the life expectancy of cats have on market demand?

Improved veterinary care has increased the average life expectancy of cats, leading to a larger demographic of senior cats prone to age-related health issues, directly correlating with a higher demand for specialized incontinence and mobility aids, including cat diapers.

What are the key raw materials required in the production process?

Essential raw materials include Super-Absorbent Polymers (SAPs), high-quality non-woven fabrics for the inner and outer layers, specialized elastic waistbands and leg gathers, and hypoallergenic adhesives or bonding materials for construction.

How does the market address post-operative recovery needs?

For post-operative recovery, the market offers highly sterile and absorbent disposable diapers designed to manage immediate post-surgical drainage while preventing contamination, often recommended as a necessary temporary measure by veterinary hospitals.

Is there a trend towards customization in cat diaper design?

Yes, there is a strong trend toward customization, particularly in specialized fits for specific breeds (like larger Maine Coons) and the integration of diverse aesthetic designs and colors to appeal to the pet humanization trend, offering products that are both functional and visually appealing.

What influence do pet specialty retailers have on the market?

Pet specialty retailers, both large chains and independent stores, are vital indirect channels. They provide physical accessibility, allow consumers to inspect product quality, and offer in-person assistance for difficult decisions regarding sizing and absorbency levels.

What is the role of subscription models in sales?

Subscription models are crucial, particularly for managing chronic conditions requiring continuous supply. They offer convenience, guaranteed replenishment, and often cost savings, enhancing customer loyalty and providing stable revenue streams for manufacturers.

How do behavioral issues drive the use of cat diapers?

Behavioral issues, primarily territorial spraying or temporary house soiling due to stress or anxiety, drive situational demand for cat diapers as a containment and management tool, especially when conventional training methods are not immediately effective.

What is the significance of the Base Year 2025 in the report?

The Base Year 2025 serves as the foundational reference point for economic data and market calculations. It represents the most recently completed period used for comprehensive analysis and for projecting the subsequent seven-year forecast period (2026-2033).

How is product quality ensured in the market?

Product quality is ensured through rigorous testing focused on absorption capacity, leakage prevention, and material safety (hypoallergenic testing). Manufacturers often adhere to stringent internal quality control standards exceeding basic regulatory requirements to maintain consumer trust in specialized pet hygiene.

What opportunities exist in emerging markets like Latin America?

Opportunities in Latin America center on the rising middle class's increasing willingness to spend on premium pet care. Focus should be on establishing strong distribution networks and introducing entry-level, cost-effective reusable products to build market presence.

How does the segment of 'Cats in Heat' contribute to market demand?

The 'Cats in Heat' segment contributes to non-medical demand for female cats (queens) requiring hygiene management during their estrus cycle to contain discharges and maintain household cleanliness, often favoring smaller, lighter-weight protective garments.

What is the impact of global supply chain challenges on manufacturing?

Global supply chain volatility, particularly concerning specialized non-woven textiles and polymer components, can impact production costs and lead times, pushing manufacturers to regionalize sourcing where possible and focus on robust inventory planning to mitigate risks.

How do cat diapers compare to belly bands in function?

Cat diapers are full-coverage garments designed for both urine and fecal containment, typically used for incontinent or mobility-impaired cats. Belly bands, primarily used for male cats, are simpler wraps designed only to contain urine associated with territorial spraying or minor leakage, offering less comprehensive protection.

What role does aesthetic appeal play in product design?

Aesthetic appeal, including bright colors and patterns, plays an increasingly important role, driven by the pet humanization trend. Owners view diapers not merely as medical necessities but as part of their pet’s wardrobe, encouraging companies to diversify designs.

How are environmental concerns influencing product development?

Environmental concerns are driving product development towards sustainable materials, including biodegradable plastic backsheets, bamboo fibers, and compostable packaging, appealing to consumers seeking to minimize their ecological footprint while caring for their pets.

What is the projected size of the Cat Diapers Market by 2033?

The Cat Diapers Market is projected to reach an estimated value of $400 Million by the end of the forecast period in 2033, reflecting substantial growth from the 2026 valuation of $250 Million.

How do mobility issues relate to diaper usage in cats?

Cats with mobility issues, often due to arthritis or neurological conditions, struggle to access or position themselves in the litter box, making diapers essential for managing inevitable accidents and maintaining overall hygiene and quality of life.

What is the upstream focus in the value chain?

The upstream focus involves securing high-quality, specialized raw materials like skin-safe non-wovens and high-performance Super-Absorbent Polymers (SAPs), emphasizing cost optimization and securing stable, ethically sourced supply lines.

Why is fitting essential for product efficacy?

Proper fitting is critically essential because an ill-fitting cat diaper will leak, cause discomfort, or be easily removed by the cat, negating the product's intended function and potentially causing skin irritation or consumer dissatisfaction.

Does the report cover both domestic and international markets?

Yes, the report provides comprehensive coverage of the market across key geographies, including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa, analyzing regional consumption patterns and growth drivers.

What are the limitations of using diapers for behavioral spraying?

While diapers contain spraying, they do not resolve the underlying behavioral or territorial anxiety. Their use for spraying is generally viewed as a temporary management tool, requiring simultaneous consultation with a veterinarian or animal behaviorist for long-term resolution.

How does competitive intensity manifest in the market?

Competitive intensity is high, focusing primarily on product differentiation through superior design (better fit, anti-leakage systems), innovative materials (odor control, comfort), and strategic dominance in the e-commerce distribution space via targeted digital marketing and subscription services.

What distinguishes medical-grade cat diapers?

Medical-grade cat diapers feature exceptionally high absorbency, often include antibacterial or antifungal properties to prevent infection, and utilize materials designed to minimize skin irritation, making them suitable for prolonged use in post-operative or chronic care settings.

How do regulatory environments affect market entry?

While regulations are lighter than for human products, new market entrants must comply with safety standards for materials and ensure accurate labeling, particularly regarding claims about biodegradability or hypoallergenic properties, affecting product approval and consumer trust.

Which distribution channel offers the highest margin opportunity?

The Direct-to-Consumer (D2C) model, typically executed via specialized e-commerce platforms, offers manufacturers the highest margin potential by bypassing traditional retail intermediaries and establishing a direct, profitable relationship with the end-user.

What is the significance of the term 'Pet Humanization'?

Pet Humanization signifies the trend where owners treat their pets as family members, leading to increased willingness to spend on specialized, high-quality, premium products that enhance their pet's health, comfort, and longevity, thereby fueling demand for cat diapers.

What types of segments are crucial for strategic planning?

Key segments crucial for strategic planning include Product Type (Disposable vs. Reusable) to address sustainability concerns, and Application (Incontinence vs. Post-Op) to tailor specific material and design attributes to meet distinct medical or hygiene needs.

How are small businesses innovating in this niche market?

Small businesses often innovate by focusing intensely on niche product categories, such as custom-sized diapers for rare breeds or handmade, highly durable reusable options, gaining traction through targeted social media marketing and superior customer service.

What is the primary constraint related to cost in the market?

The primary cost constraint is the high unit price of specialized, high-performance diapers, which can become prohibitively expensive for owners managing chronic, long-term incontinence, prompting many to seek more affordable, albeit less effective, alternatives.

How is consumer education vital for adoption?

Consumer education is vital because many owners are initially unfamiliar with or hesitant about using cat diapers. Effective educational content provided by brands and veterinarians must clearly explain fitting, usage protocols, and the benefits for pet welfare and household hygiene, normalizing adoption.

What are the key differences between disposable and reusable product technologies?

Disposable technology focuses on maximizing the capacity and quick wicking properties of SAPs and non-woven layers. Reusable technology focuses on highly durable, moisture-wicking synthetic or natural fibers and specialized waterproofing layers that withstand repeated high-temperature washing without degradation.

What are the projected growth trends for the Reusable Diapers segment?

The Reusable Diapers segment is projected to show above-average growth, driven by growing environmental awareness, consumer demand for sustainability, and the long-term cost-effectiveness offered by washable products for non-clinical, long-term use.

How does the market cater to large cat breeds?

The market caters to large breeds (e.g., Maine Coons, Ragdolls) by offering specialized Large/Extra Large size segments that feature robust elastic components, wider waist dimensions, and enhanced overall absorbency capacity to accommodate their greater mass and excretion volumes.

What is the overall goal of using AEO/GEO in this report?

The overall goal is to structure the report content in a highly searchable, concise, and definitive manner (using HTML, detailed lists, and FAQs) to ensure maximum visibility and direct snippet extraction by search engines and generative AI platforms, enhancing content authority and reach.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager