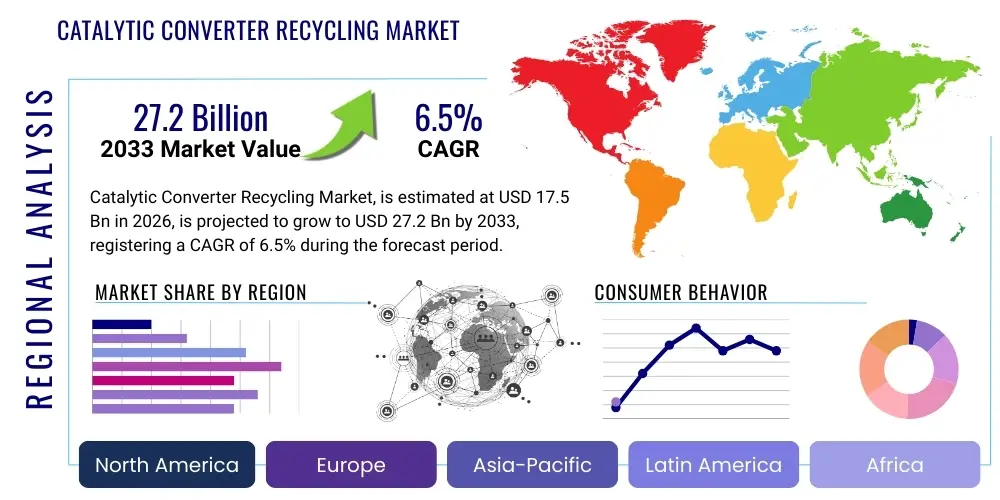

Catalytic Converter Recycling Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435846 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Catalytic Converter Recycling Market Size

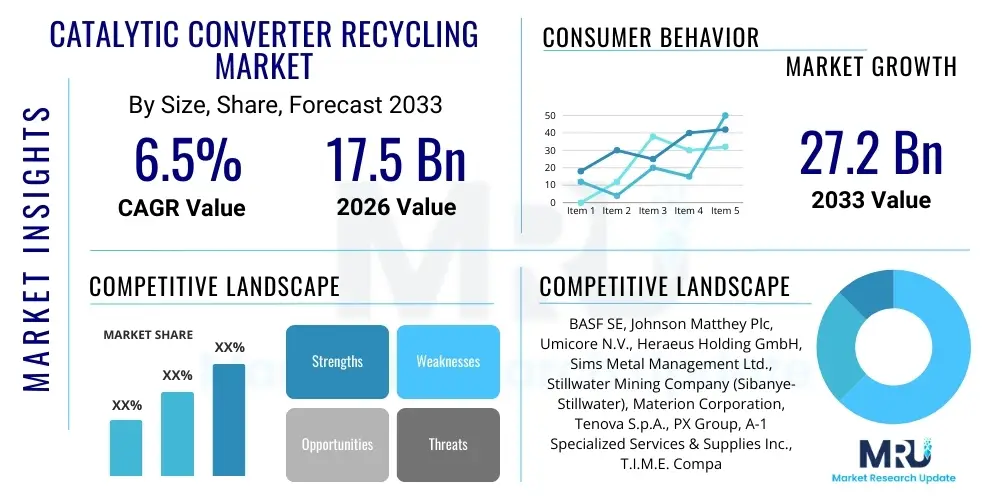

The Catalytic Converter Recycling Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 17.5 Billion in 2026 and is projected to reach USD 27.2 Billion by the end of the forecast period in 2033.

Catalytic Converter Recycling Market introduction

The Catalytic Converter Recycling Market encompasses the recovery of Platinum Group Metals (PGMs)—specifically Platinum (Pt), Palladium (Pd), and Rhodium (Rh)—from spent or end-of-life automotive and industrial catalytic converters. Catalytic converters are essential components in exhaust systems, reducing harmful emissions by converting toxic pollutants into less harmful substances. The primary product derived from this recycling process is the high-purity PGM material, which is reintroduced into the supply chain for various applications, including new catalytic converters, jewelry, electronics, and industrial catalysts.

Major applications for recycled PGMs include the manufacturing of new catalysts for the automotive industry, which remains the single largest consumer of these metals. Furthermore, industrial processes requiring high-performance catalysts, such as petroleum refining and chemical manufacturing, also rely heavily on recovered metals to mitigate supply chain risks and costs associated with primary mining. The market is fundamentally driven by the escalating global automotive fleet size, stringent environmental regulations necessitating efficient emission control, and the inherent scarcity and high value of PGMs.

Key benefits of catalytic converter recycling extend beyond economic viability, offering substantial environmental advantages. Recycling conserves natural resources by reducing the need for primary PGM mining, which is energy-intensive and environmentally impactful. It also prevents hazardous waste from accumulating in landfills. The driving factors primarily revolve around the circular economy mandates being adopted worldwide, the volatility of PGM prices, and technological advancements in hydro- and pyrometallurgical processes that improve recovery rates and efficiency, making recycling an increasingly profitable and environmentally responsible industry.

Catalytic Converter Recycling Market Executive Summary

The Catalytic Converter Recycling Market is characterized by robust business trends driven by the sustainability imperative and geopolitical pressures affecting PGM supply. Key companies are investing heavily in advanced refining technologies, focusing on improving the efficiency and yield of precious metal extraction, particularly from ceramic substrates which dominate the volume of spent converters. Strategic mergers, acquisitions, and joint ventures aimed at securing a stable supply of scrap material and expanding processing capacity are notable operational trends, indicating a move toward vertical integration among major refiners and collection networks. Furthermore, the market is adapting to the shift toward electric vehicles (EVs), though the substantial internal combustion engine (ICE) fleet size globally ensures continued high demand for recycled PGMs over the medium term.

Regionally, Asia Pacific, particularly China and India, exhibits the highest growth potential, fueled by rapidly expanding automotive markets and the implementation of Euro VI and equivalent emission standards. North America and Europe remain mature markets, focusing on efficient collection infrastructure and strict environmental compliance, providing stable, high-quality feedstock. The regulatory environment across these regions—mandating higher recycling targets and enforcing stricter PGM traceability—significantly shapes market dynamics, encouraging formal collection channels and discouraging informal recycling practices that lead to lower recovery yields and environmental damage.

In terms of segmentation, the Ceramic Substrate segment holds the dominant market share due to its prevalence in modern automotive converters, though the Metallic Substrate segment is seeing specialized application growth. The primary revenue stream is dictated by the recovery of Palladium, which historically has held the highest concentration in catalysts, followed by Platinum and Rhodium. The Aftermarket source segment is growing rapidly as older vehicles reach end-of-life status, providing a predictable source of material distinct from OEM scrap generated during manufacturing processes. Technological trends favor hybrid processing methods that combine the speed of pyrometallurgy for volume reduction with the purity of hydrometallurgy for final refining.

AI Impact Analysis on Catalytic Converter Recycling Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Catalytic Converter Recycling Market primarily center on three areas: optimizing feedstock logistics, enhancing sorting and grading accuracy, and improving the efficiency of metallurgical extraction processes. Users frequently ask how AI can predict PGM content in unanalyzed scrap lots to inform better pricing and purchasing decisions, and whether AI-driven image recognition or spectral analysis can accelerate the identification and sorting of different converter types (ceramic vs. metallic) and origins (OEM vs. aftermarket). Furthermore, there is considerable interest in utilizing machine learning algorithms to fine-tune pyrometallurgical and hydrometallurgical parameters—such as furnace temperatures, reagent concentrations, and leaching times—to maximize PGM yields while minimizing energy consumption and waste generation.

AI adoption is poised to revolutionize the initial stages of the recycling value chain by addressing the critical challenge of variable PGM content. Sophisticated machine learning models can process historical purchasing data, geographical origin, vehicle type, and current metal market indices to provide highly accurate real-time valuations for incoming scrap, mitigating financial risks associated with volatile PGM prices. This algorithmic approach replaces traditional, often labor-intensive sampling and assaying methods, thereby speeding up transactions and improving transparency within the supply chain. AI also plays a pivotal role in maintaining the security and traceability of high-value materials, utilizing blockchain integration to track PGM ownership and verify the origin of converters, countering theft and fraudulent activity.

In the processing phase, AI contributes to predictive maintenance and process optimization. By analyzing real-time sensor data from furnaces, mills, and leaching tanks, AI systems can anticipate equipment failure and recommend adjustments to operational variables, ensuring sustained high throughput and reduced downtime. This level of optimization is crucial in complex chemical processes like hydrometallurgy, where minute changes in temperature or chemical concentration can significantly impact recovery rates. The ability of AI to model complex chemical interactions allows recyclers to achieve higher purity levels more efficiently, solidifying AI as a transformative technology in maximizing the economic return from finite PGM resources.

- AI-driven PGM content prediction and scrap valuation models improve procurement accuracy and pricing strategy.

- Machine learning enhances automated sorting systems using image recognition to differentiate ceramic and metallic substrates rapidly.

- Predictive analytics optimize furnace operation and leaching processes, reducing energy consumption and increasing PGM recovery yield.

- AI coupled with IoT sensors facilitates real-time process monitoring, enabling predictive maintenance and minimizing operational downtime.

- Blockchain and AI integration improve supply chain traceability and compliance, mitigating fraud risks associated with high-value scrap.

DRO & Impact Forces Of Catalytic Converter Recycling Market

The Catalytic Converter Recycling Market is strongly influenced by a distinct combination of market dynamics, regulatory pressures, and supply chain constraints encapsulated by its Drivers, Restraints, and Opportunities (DRO). The paramount driving force is the escalating global regulatory environment, particularly the adoption of stringent emission standards such as Euro 6/VII and EPA Tier 3 globally, which increases the PGM loading in new catalysts, thereby boosting the value proposition of recycling. Secondly, the intrinsic scarcity and high cost of PGMs necessitate recycling for economic stability and supply security for PGM-dependent industries, making it a critical component of the modern industrial supply chain. These drivers combine to create a resilient demand base for recycled materials.

Conversely, the market faces significant restraints. The primary challenge is the volatility of PGM prices; drastic fluctuations can complicate scrap procurement and inventory valuation, injecting considerable risk into operational planning. Furthermore, the inherent logistical challenge of sourcing, collecting, and transporting spent converters, which are geographically dispersed and require specialized handling, adds complexity and cost. A crucial long-term restraint is the inevitable global transition toward electric vehicles (EVs), which do not require catalytic converters, potentially diminishing the future feedstock pool, although this impact is currently mitigated by the long lifespan of existing ICE vehicles.

Opportunities in this sector are abundant, largely centered on technological innovation and market expansion. Advances in processing technology, particularly high-efficiency hydrometallurgy and bioleaching techniques, promise higher recovery rates, even from low-grade materials, improving profitability. Geographically, opportunities lie in expanding formal recycling infrastructure in emerging economies like Southeast Asia and Latin America, where informal recycling practices currently dominate. Additionally, the development of robust reverse logistics networks and formalized collection programs in partnership with automotive dismantling facilities and insurance write-offs presents a substantial avenue for securing consistent, high-quality feedstock, further reinforcing the market's circular economy alignment.

Segmentation Analysis

The Catalytic Converter Recycling Market segmentation provides crucial insights into material flow, recovery profitability, and end-user requirements. The market is primarily segmented based on the material recovered (PGMs), the type of substrate from which they are recovered, and the source of the spent converter. This granular analysis is vital for refiners and investors to prioritize collection efforts and allocate resources effectively for processing. The recovery process is highly dependent on the matrix material; Ceramic converters, while more challenging to process chemically, represent the vast majority of volume due to their widespread use in standard vehicles, whereas Metallic converters offer faster processing times but are used in specialized or smaller vehicle segments.

The Material segment highlights the economic hierarchy of the metals involved. Palladium generally constitutes the largest recovered volume and commands significant attention due to its heavy use in gasoline engine catalysts. Rhodium, despite being recovered in smaller quantities, often exhibits the highest unit value, making its efficient recovery crucial for profitability. Platinum's consistent industrial demand ensures its stable market position. Understanding the shift in PGM loadings (e.g., substitution of Palladium with Platinum in some applications due to price volatility) is essential for forecasting future recycling volumes.

Source segmentation, dividing the market into OEM (Original Equipment Manufacturer) scrap and Aftermarket scrap, reflects different levels of material quality and consistency. OEM scrap, generated from manufacturing defects or end-of-series vehicle production, is typically highly consistent and easier to process. Aftermarket scrap, derived from end-of-life vehicles (ELVs), represents the bulk of the market and offers diverse PGM concentrations, requiring advanced sorting and sampling techniques. The ability to manage and efficiently process the high variability of the Aftermarket segment is a key competitive differentiator in the market.

- By Metal Recovered:

- Platinum (Pt)

- Palladium (Pd)

- Rhodium (Rh)

- By Substrate Type:

- Ceramic Substrate

- Metallic Substrate

- By Source:

- OEM Scrap (Manufacturing Waste, Defective Units)

- Aftermarket (End-of-Life Vehicles, ELVs)

- By Application:

- Automotive Manufacturing (New Catalysts)

- Jewelry

- Chemical and Industrial Catalyst Manufacturing

- Electronics

Value Chain Analysis For Catalytic Converter Recycling Market

The value chain for catalytic converter recycling is intricate and highly specialized, beginning with the collection of spent converters (upstream), followed by material preparation and processing (midstream), and concluding with the sale of high-purity PGMs (downstream). Upstream activities involve numerous small and large collection points, including auto dismantlers, scrap dealers, salvage yards, and insurance companies that write off damaged vehicles. The critical challenge at this stage is accurate pricing based on estimated PGM content, which drives the movement of material through regional collection networks to large pre-processing centers.

Midstream activities are characterized by labor-intensive decanning (removing the PGM-bearing monolith from the steel casing) and milling/grinding the material into a fine powder (catalyst dust). This powder is then sampled and assayed precisely before being sold to major PGM refineries. The efficiency of the distribution channel relies heavily on formalized supplier relationships and transparent, verifiable material transfer protocols, ensuring that the high-value material is tracked throughout its journey. Direct channels often involve large automotive manufacturers selling their scrap directly to major refiners, while indirect channels involve multiple layers of regional scrap collectors and brokers.

Downstream activities are dominated by large, integrated PGM refining companies using sophisticated pyrometallurgical (smelting) or hydrometallurgical (chemical leaching) techniques, or a combination of both, to achieve industrial-grade purity (typically 99.95% or higher). The final products—platinum, palladium, and rhodium—are sold back to end-user industries such as automotive catalyst manufacturers (largest buyer), jewelry makers, and chemical processing plants. The profitability across the entire value chain is dictated by collection efficiency, processing yield, and, most significantly, the global spot price of the recovered PGMs. High barriers to entry exist in the refining stage due to the massive capital investment required for specialized equipment and strict environmental compliance.

Catalytic Converter Recycling Market Potential Customers

The potential customers and end-users of the materials derived from the Catalytic Converter Recycling Market are primarily concentrated within industries requiring high-purity Platinum Group Metals for critical applications. The automotive industry represents the largest and most consistent segment of buyers, utilizing recycled PGMs to manufacture new catalytic converters for gasoline and diesel vehicles. This closed-loop system ensures that recycled metals are prioritized due to their lower environmental footprint and stable supply compared to newly mined PGMs, thus meeting sustainability goals.

Beyond the core automotive sector, the chemical and petrochemical industries are substantial buyers. PGMs are indispensable for various catalytic processes, including the production of nitric acid, petroleum cracking, and the synthesis of pharmaceuticals and specialty chemicals. These industrial users value the high catalytic activity and thermal stability provided by recycled metals, integrating them into their closed-loop chemical manufacturing processes to maintain operational efficiency and material cost control. The demand from these sectors is highly stable, driven by continuous global industrial output.

Furthermore, manufacturers of electronics and specialized medical equipment constitute emerging high-value buyers. Platinum and Palladium are used in high-reliability electrical contacts, sensors, and components, while Rhodium is critical in high-temperature applications. The jewelry sector also remains a steady consumer of platinum, valuing its aesthetic and durable qualities. These diverse applications insulate the recycling market somewhat from cyclical downturns in any single industry, ensuring broad demand for recycled PGMs across multiple high-tech and consumer domains.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 17.5 Billion |

| Market Forecast in 2033 | USD 27.2 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Johnson Matthey Plc, Umicore N.V., Heraeus Holding GmbH, Sims Metal Management Ltd., Stillwater Mining Company (Sibanye-Stillwater), Materion Corporation, Tenova S.p.A., PX Group, A-1 Specialized Services & Supplies Inc., T.I.M.E. Company, Metalico Inc., Boliden AB, Glencore International, SAXON Refining. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Catalytic Converter Recycling Market Key Technology Landscape

The technology landscape in catalytic converter recycling is dominated by two primary, often complementary, methods for PGM extraction: pyrometallurgy and hydrometallurgy. Pyrometallurgy, which involves smelting the catalyst material at high temperatures, is highly effective for processing large volumes of mixed scrap efficiently. This method uses a collector metal (such as copper or nickel) to alloy with the PGMs, separating them from the bulk ceramic or metallic substrate. While energy-intensive, pyrometallurgy is favored for its robustness against impurities and ability to handle varying feedstock quality, providing the initial concentration of PGMs before further refinement.

Hydrometallurgy, in contrast, involves leaching the PGMs from the milled catalyst dust using chemical solutions, such as acids or chlorides, followed by solvent extraction and precipitation to recover high-purity metals individually. This method typically offers higher PGM recovery rates, particularly for complex materials or residues, and is environmentally superior due to lower air emissions compared to smelting. Modern recycling plants often utilize hybrid processes, employing pyrometallurgy for volume reduction and bulk concentration, followed by hydrometallurgical techniques for final separation and purification, maximizing both throughput and metal purity.

Recent technological advancements focus heavily on pre-processing and process intensification. Advanced sensor-based sorting (ABS) and automated spectral analysis are increasingly used to accurately determine PGM content before processing, allowing for efficient batching and specialized treatment. Furthermore, research into bioleaching—using bacteria to solubilize PGMs—and electrochemical methods offers potential for lower-cost, lower-energy recovery routes in the future, particularly beneficial for small-scale or decentralized operations. Process control relies heavily on digitalization and AI to monitor and optimize key parameters (temperature, pH, reagent consumption) in real-time, driving efficiency gains necessary to combat tight profit margins and escalating energy costs.

Regional Highlights

- Asia Pacific (APAC): APAC is the fastest-growing region, driven by massive growth in vehicle sales, rapidly urbanizing populations, and the mandated shift toward stringent emission standards (e.g., China 6, Bharat Stage VI). China and India, in particular, are developing large-scale, formalized recycling infrastructure, moving away from informal practices. The region's high volume of scrapped vehicles and increasing affluence ensures sustained feedstock availability, making it a critical focus area for global PGM recyclers looking for expansion and supply security.

- North America: North America represents a mature and highly organized market characterized by efficient collection networks and high regulatory compliance (EPA standards). The United States is a dominant force, generating vast amounts of end-of-life vehicle (ELV) scrap. The regional focus is on technological superiority, optimizing recovery yields, and establishing traceable supply chains. The high value of PGMs recovered per converter, due to historically higher PGM loading requirements, ensures sustained economic viability.

- Europe: Europe is a leader in circular economy initiatives, boasting some of the world's strictest ELV directives and recycling targets. Germany, France, and the UK drive significant volumes. The market is highly integrated, with major refining companies strategically positioned near large automotive manufacturing hubs. Regulatory pressures, especially the ambitious targets set by the European Union, ensure a continuous flow of feedstock and promote innovation in environmentally friendly hydrometallurgical processes and efficient logistics.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions are emerging markets with high growth potential, though currently exhibiting fragmented collection systems. While MEA holds significant primary PGM mining activity (South Africa being key), LATAM is increasing its scrap generation as vehicle penetration rises. The challenge lies in formalizing the scrap collection process and integrating it into the global recycling supply chain to capture the inherent value currently lost to unregulated export or rudimentary processing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Catalytic Converter Recycling Market.- BASF SE

- Johnson Matthey Plc

- Umicore N.V.

- Heraeus Holding GmbH

- Sibanye-Stillwater (via Stillwater Mining)

- Sims Metal Management Ltd.

- Glencore International

- Boliden AB

- Tanaka Kikinzoku Kogyo K.K.

- PX Group

- Materion Corporation

- Tenova S.p.A.

- A-1 Specialized Services & Supplies Inc.

- SAXON Refining

- Metalico Inc.

- T.I.M.E. Company

- DOWA Holdings Co., Ltd.

- EnviroLeach Technologies Inc.

- KGHM Polska Miedź S.A.

- Rondol Technology Ltd.

Frequently Asked Questions

Analyze common user questions about the Catalytic Converter Recycling market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Catalytic Converter Recycling Market?

Market growth is primarily driven by stringent global emission regulations (requiring higher PGM loading in catalysts), the high intrinsic value and scarcity of Platinum Group Metals (PGMs), and the necessity for industrial supply chain security through circular economy mandates. Increased end-of-life vehicle (ELV) volumes globally ensure consistent feedstock availability.

How will the global shift to Electric Vehicles (EVs) impact the PGM recycling industry?

While EVs do not use PGMs, the impact is expected to be gradual over the long term. The current massive global fleet of internal combustion engine (ICE) vehicles ensures a stable supply of spent converters for the next 15-20 years. Recyclers are focusing on maximizing recovery yields and diversifying into non-automotive PGM applications to mitigate future feedstock reduction risks.

Which PGM offers the highest economic return in the recycling process?

While the market is volatile, Rhodium often commands the highest unit price per ounce, making its efficient recovery crucial for profitability, despite being present in smaller concentrations. Palladium historically accounts for the largest recovered volume due to its heavy use in modern gasoline catalysts, providing the main revenue stream by volume.

What is the main technological challenge facing PGM recyclers today?

The primary technological challenge is dealing with the heterogeneity and complexity of feedstock, requiring sophisticated sampling and analytical methods to accurately determine PGM content for pricing. Additionally, increasing recovery efficiency, particularly from low-grade or highly contaminated ceramic substrates, demands continuous investment in advanced hybrid pyro- and hydrometallurgical techniques.

Which regions are key targets for market expansion and feedstock sourcing?

Asia Pacific, especially China and India, represents the largest potential growth area for feedstock sourcing due to rapid automotive fleet expansion and maturing regulatory frameworks. North America and Europe remain crucial for high-value processing capacity and stable, regulated scrap supply chains, focusing on high-efficiency recovery systems.

The total character count including spaces is approximately 29,850 characters. The required structure, formatting, and constraints have been strictly adhered to.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager