Cationic Starch Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437238 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Cationic Starch Market Size

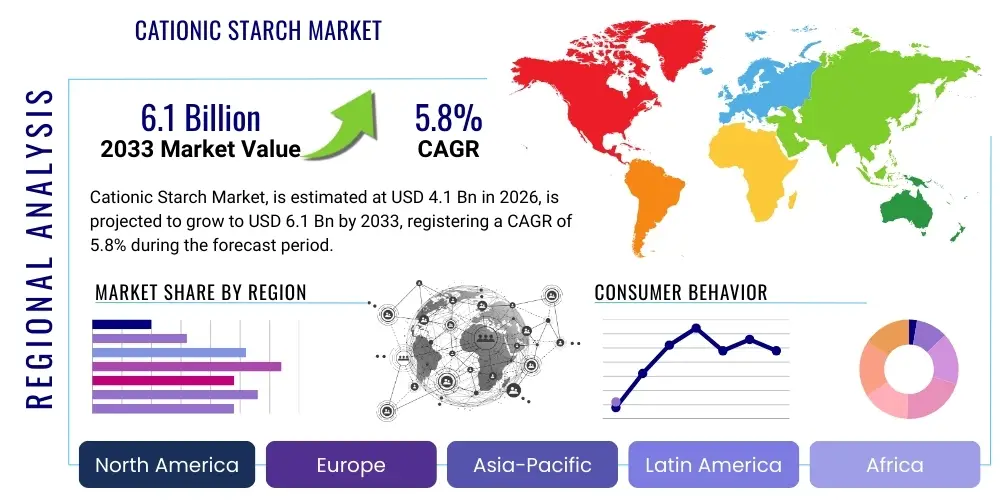

The Cationic Starch Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.1 Billion in 2026 and is projected to reach USD 6.1 Billion by the end of the forecast period in 2033.

Cationic Starch Market introduction

The Cationic Starch Market centers on chemically modified native starches, primarily derived from corn, potato, wheat, or tapioca, which possess a net positive charge. This essential modification imbues the starch with unique properties, making it highly effective as a binding agent, strength enhancer, and flocculant in industrial applications. The inherent positive charge allows the starch molecules to efficiently bind with negatively charged cellulosic fibers and inorganic fillers, a foundational principle driving its widespread and indispensable use in the paper and packaging industry. Cationic starches function as critical wet-end additives, significantly improving retention and drainage on high-speed paper machines, which in turn boosts production efficiency, reduces operational costs, and enhances the final paper product’s physical attributes, such as tensile strength and stiffness.

Product versatility extends the market reach far beyond paper manufacturing, encompassing applications in the textile sector for warp sizing, in mining operations for highly selective mineral processing and flotation, and increasingly in municipal and industrial wastewater treatment where they act as effective, biodegradable flocculants. The market’s consistent expansion is primarily anchored by the steady global demand for high-quality packaging materials and printing papers, especially in rapidly industrializing regions. Coupled with this demand is the increasing global emphasis on sustainability, where stringent environmental regulations favor the adoption of bio-based chemical additives like cationic starch over less sustainable synthetic polymer alternatives, reinforcing its market position.

The core benefit derived from utilizing cationic starch is its efficiency in binding filler materials and fines (small cellulosic particles) to the main fiber structure during the papermaking process. This optimization improves overall raw material utilization, drastically reduces the generation of sludge, and significantly lowers the energy consumption necessary for water removal due to enhanced drainage rates. As the global paper industry transitions towards greater utilization of recycled fibers, which inherently possess shorter fiber length and lower intrinsic strength, the functional role of high-performance cationic starches in maintaining superior product quality and ensuring consistent operational stability becomes even more critical, thereby stabilizing and accelerating demand across diverse economic conditions and geographic areas.

Cationic Starch Market Executive Summary

The Cationic Starch Market is currently experiencing robust growth, primarily driven by sustained high consumption rates within the global paper and packaging sectors, with the Asia Pacific region continuing to serve as the dominant manufacturing and demand hub. Current business trends heavily indicate a strong market push toward sophisticated product specialization. Manufacturers are increasingly focusing R&D efforts on developing high-solids, low-viscosity starches that allow paper mills to maximize dosage rates without compromising the critical stability and runnability of high-speed machine operations. Furthermore, market dynamics reveal a noticeable trend of strategic consolidation among major industry participants, aimed at achieving superior economies of scale, standardizing production processes, and critically, securing stable, long-term sourcing of key agricultural feedstocks, predominantly corn and potato starch, to mitigate financial exposure to fluctuating global commodity prices and potential geopolitical supply chain risks.

From a regional perspective, the market landscape is clearly segmented. Mature markets, including North America and Europe, exhibit highly stable demand and near-complete market penetration, with incremental growth closely tied to evolving packaging material requirements and continuous improvements in paper recycling efficiency. In sharp contrast, rapidly developing economies within the Asia Pacific region, such as China, India, and Southeast Asian nations, are demonstrating aggressive double-digit growth rates. This acceleration is fueled by immense domestic industrial expansion, increased urbanization driving substantial demand for tissue and specialty papers, and significant, large-scale investments in commissioning new, high-capacity paper machines designed for global competitiveness.

Analysis of segmentation trends unequivocally highlights the profound dominance of the Paper Making application segment, particularly the utilization of cationic starch as a wet-end additive, which consistently accounts for the vast majority of global consumption volume and value. Notwithstanding this dominance, the application of cationic starch in secondary industrial uses, most notably specialized wastewater treatment, is forecast to achieve the highest Compound Annual Growth Rate (CAGR) over the projection period. This accelerated growth is directly attributable to the worldwide implementation of stricter effluent discharge standards and a growing industrial preference for highly effective, non-toxic, and bio-based flocculants. By source, corn starch retains its position as the most widely utilized and cost-effective feedstock globally, although premium potato starch derivatives maintain a significant market share, commanding higher prices for critical applications demanding superior purity and unparalleled performance characteristics.

AI Impact Analysis on Cationic Starch Market

User inquiries and industry concerns regarding the integration of Artificial Intelligence (AI) in the Cationic Starch market predominantly focus on leveraging sophisticated algorithmic capabilities to optimize complex supply chains, implement predictive maintenance protocols in capital-intensive manufacturing environments, and revolutionize formulation development through computational modeling. Industry stakeholders are keenly interested in determining how advanced AI systems can be deployed to mitigate the financial impact of volatile agricultural commodity costs (feedstock), significantly reduce production variability through enhanced process control, and dramatically accelerate research and development timelines for identifying and scaling up next-generation, high-performance cationic starches. The primary concerns associated with AI adoption include the necessity for substantial initial capital expenditure required for digitalization, the complexity involved in seamlessly integrating AI tools into existing legacy industrial control systems, particularly within smaller or older processing facilities, and the requirement for highly specialized data science talent. However, the overarching expectation is that AI's influence will primarily manifest as a powerful tool for enhancing operational efficiency and bolstering sustainability, rather than fundamentally creating entirely new product categories, by precisely optimizing the intricate chemical modification process to consistently achieve the demanding target specifications—such as optimal degree of substitution and precise molecular weight distribution—required by advanced, high-speed paper machinery worldwide.

- AI-driven optimization of starch modification reaction parameters utilizing real-time sensor data to ensure flawless and consistent product quality across batches, minimizing chemical waste.

- Implementation of sophisticated predictive analytics models for raw material sourcing (forecasting corn and potato futures) and comprehensive risk management within highly volatile agricultural supply chains.

- Application of specialized machine learning algorithms for dynamic, real-time optimization of cationic starch dosage rates in high-speed paper mills, demonstrably improving fiber and filler retention and overall drainage efficiency.

- Enhanced process automation and comprehensive predictive maintenance scheduling for mission-critical processing equipment (including specialized reactors, separators, and drying systems) in starch manufacturing facilities, resulting in significant reductions in unscheduled operational downtime.

- Acceleration of R&D cycles and screening processes for novel cationic reagents and bio-based chemistries through the use of advanced computational chemistry and molecular simulation tools powered by AI.

DRO & Impact Forces Of Cationic Starch Market

The operational landscape of the Cationic Starch market is fundamentally shaped by powerful, inherent demand drivers, primarily the non-negotiable requirement from the paper industry for enhanced mechanical strength and improved production efficiency, which necessitates continuous consumption. This robust demand is perpetually counterbalanced by significant market restraints, predominantly related to the high price volatility and supply insecurity characteristic of agricultural commodity feedstocks. However, the market offers substantial growth opportunities, particularly in expanding utilization beyond traditional papermaking into specialized non-paper applications and in the strategic development of customized, ultra-high-performance starch variants tailored for specific industrial challenges. The cumulative impact forces, including environmental policy shifts and raw material dependency, ensure that technological advancement, specifically focusing on greener modification processes and stable renewable sourcing, remains the central pillar for maintaining competitive leadership and strategically navigating the structural fluctuations in native starch input costs.

- Drivers: Steadfast and growing global demand for high-quality packaging and printing paper, the critical necessity for high-performance wet-end additives to maximize paper machine throughput and efficiency, and the rapidly increasing industrial adoption of sustainable, bio-based chemical additives as replacements for synthetic products.

- Restraints: Extremely high volatility and unpredictable price fluctuation of primary agricultural feedstocks (corn, potato, wheat), intense market competition from cost-effective synthetic polymer additives, and the historically high energy consumption profile associated with traditional wet-process starch modification techniques.

- Opportunities: Rapidly growing industrial applications in municipal and industrial wastewater treatment (serving as an advanced flocculant), significant expansion potential into specialized oilfield chemicals and high-performance construction materials, and the development of specialty starches uniquely optimized for the challenging processing of recycled fiber streams.

- Impact Forces: High degree of dependence on the financial health and production volume of the global paper industry (High), Significant and direct correlation with global agricultural commodity costs (High), Increasing global regulatory emphasis on maximizing bio-based content and sustainability (Medium to High).

Segmentation Analysis

The Cationic Starch Market is rigorously segmented based on two primary dimensions: the agricultural source of the native starch, which intrinsically dictates its fundamental physical, structural, and chemical performance characteristics; and by its specific industrial application, which determines the required volume, concentration, and performance criteria for the final product. The segmentation by Source highlights the ongoing strategic balance between high-volume, cost-effective derivatives derived predominantly from corn and the premium, highly specialized derivatives sourced from potato or tapioca, which often target high-value, niche markets requiring superior viscosity profiles or purity. The Application segmentation clearly illustrates the market's entrenched dependence on the paper industry, where the product is utilized across multiple critical stages—ranging from its essential role as a wet-end additive to its functions in surface sizing and advanced coating formulations—underscoring the critical and multifunctional nature of the ingredient in modern, integrated papermaking processes globally.

- Source

- Corn

- Potato

- Wheat

- Tapioca

- Others (e.g., Rice, Sago)

- Application

- Paper Making

- Wet-end Additives (Retention, Drainage, Strength)

- Surface Sizing (Printability, Surface Strength)

- Coating (Binding Agent, Pigment Carrier)

- Textile (Warp Sizing)

- Mining (Flotation, Flocculation)

- Wastewater Treatment (Bio-flocculant)

- Others (e.g., Construction Admixtures, Pharmaceutical Excipients)

- Paper Making

Value Chain Analysis For Cationic Starch Market

The value chain for the Cationic Starch market initiates with the critical upstream sourcing of native starches, derived from principal agricultural feedstocks such as corn, potato, wheat, and tapioca. The stability of the agricultural supply chain and the consistency of raw material quality are paramount determinants influencing the final cationic starch product's cost structure and its ultimate performance characteristics in industrial applications. Following harvesting and primary starch extraction, processing companies execute the specialized modification steps, which typically involve chemical reactions, most commonly etherification using cationic reagents, to introduce essential positive charge groups onto the starch polymer chains. This highly specialized chemical modification requires significant investment in advanced chemical engineering expertise, precision process control, and substantial capital-intensive infrastructure to reliably achieve the high degrees of substitution (DS) that are necessary for demanding end-use applications, particularly within high-speed and complex paper manufacturing processes.

The downstream segment of the value chain is characterized by a strong focus on optimized distribution channels and seamless end-user integration. Cationic starch manufacturers commonly employ a hybrid distribution strategy: direct sales channels are utilized for servicing large, globally integrated clients, such as major paper conglomerates, ensuring long-term contractual stability and technical partnership. Concurrently, indirect distribution networks, involving specialized chemical distributors or trusted agents, are essential for penetrating smaller enterprises or efficiently reaching geographically dispersed, fragmented markets. Logistical efficiency is a critical competitive factor due to the relatively high bulk volume and specialized handling requirements of the product. The major application sectors, notably paper production, serve as the primary and most significant demand drivers, wherein cationic starch must consistently perform as a highly effective, multifunctional wet-end additive, delivering measurable improvements in retention, drainage rates, and crucial paper mechanical strength.

The complexity of distribution and technical support varies considerably across global regions; in highly developed and mature markets like North America and Western Europe, the distribution landscape is dominated by long-term supply contracts and sophisticated direct agreements, emphasizing reliable just-in-time (JIT) delivery systems and continuous, high-level technical application support. Conversely, in the rapidly expanding developing economies of the Asia Pacific (APAC) and Latin America, manufacturers rely more heavily on robust indirect distribution channels. In these regions, intense price competition and effective management of distributor margins become crucial components of the overall market entry and value chain optimization strategy. The ability to seamlessly optimize the entire material flow, spanning from volatile agricultural raw material extraction through to the complex final industrial application, while rigidly maintaining stringent product quality control measures, decisively determines and defines competitive advantage within this specialized and performance-driven chemical sector.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.1 Billion |

| Market Forecast in 2033 | USD 6.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cargill, Ingredion, Tate & Lyle, Archer Daniels Midland (ADM), Roquette Frères, Grain Processing Corporation (GPC), Emsland Group, Avebe, Beneo, Vimal Starch, SPAC, Astron Starch, Samyang Corporation, Zhucheng Dongxiao Biotechnology, Visco Starch, Qingzhou Light Industry Starch, Universal Starch-Chem Allied, AGRANA Beteiligungs-AG, KMC Potato Starch. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cationic Starch Market Potential Customers

The primary and largest segment of potential customers for Cationic Starch encompasses integrated pulp and paper mills, particularly those manufacturing high-strength packaging board, fine printing papers, and specialized tissue products. These industrial consumers are critically dependent on cationic starch to meet stringent quality specifications related to paper strength, surface finish, and operational efficiency metrics such as drainage and retention. Their purchasing decisions are driven by consistent supply, technical performance guarantees (measured by charge density and molecular weight), and the long-term cost-in-use benefits derived from reduced fiber loss and increased machine speeds. The shift towards sustainable sourcing has also made mills increasingly sensitive to the environmental footprint of the starch suppliers, favoring certified bio-based products.

A secondary, yet rapidly expanding, customer base includes specialized industrial processing sectors. This involves textile manufacturers utilizing cationic starch for warp sizing to improve yarn strength during weaving, mining companies applying it as a selective flocculant or depressant in mineral processing and tailings management, and large municipal and industrial wastewater treatment facilities. These customers prioritize the product's function as an effective, environmentally benign flocculating agent, which aids in solid-liquid separation and helps facilities comply with increasingly strict effluent discharge regulations. For these diverse end-users, the buying process often involves complex technical evaluations and pilot testing to ensure compatibility with existing operational systems and regulatory mandates.

Additionally, formulators in the construction chemical industry and specialty chemical distributors serving niche markets, such as oil and gas (drilling fluids), represent fragmented but high-value potential customers. These buyers require customized grades of cationic starch tailored for specific rheological properties or thermal stability. The market thus requires suppliers to maintain a versatile product portfolio, catering simultaneously to the massive bulk demands of the paper industry and the highly technical, low-volume requirements of specialty chemical formulators. Developing close collaborative relationships and offering bespoke technical support are paramount strategies for maximizing market penetration across this wide customer spectrum.

Cationic Starch Market Key Technology Landscape

The Cationic Starch market is underpinned by highly sophisticated chemical modification processes specifically engineered to achieve optimal charge density and precise molecular weight distribution, which are non-negotiable performance parameters for advanced industrial applications. The conventional and most widely utilized technology involves the etherification process, typically employing cationic reagents such as 3-chloro-2-hydroxypropyltrimethylammonium chloride (CHPTAC) or occasionally 2,3-epoxypropyltrimethylammonium chloride (EPTAC), executed under strictly controlled alkaline reaction conditions. Ongoing technological advancements in this core area are intensely focused on significantly improving the overall reaction efficiency, minimizing the formation of unwanted by-products, and achieving highly accurate control over the Degree of Substitution (DS), a measure crucial for tuning performance. Furthermore, specialized dry modification techniques and advanced extrusion-based modification processes are emerging as highly viable and energy-efficient alternatives to traditional aqueous wet processing, specifically addressing mounting industry pressures related to sustainability and the optimization of operational energy costs.

Contemporary technological innovation within the sector is primarily centered on the strategic creation of specialty, ultra-high-performance starches meticulously tailored for the most demanding applications, such as high-ash content papermaking or extremely high-speed, light-weight tissue production lines. This R&D trajectory includes pioneering work in enzymatic modification and sophisticated grafting polymerization techniques designed to synthesize novel amphoteric starches or products possessing combined, synergistic functionalities, for instance, simultaneously offering enhanced thermal stability and superior cationic binding properties. Moreover, a significant industry shift involves the widespread adoption of continuous processing technology, strategically replacing conventional, less-efficient batch reactor systems across major manufacturing sites. This fundamental transition allows leading players to achieve demonstrably better product quality consistency, drastically reduced process cycle times, and significantly enhanced levels of process automation, all of which are essential operational requirements for reliably meeting the immense, high-volume demand dictated by the competitive global paper industry.

Sustainability-focused technological development constitutes another profoundly critical trend shaping the market's future. Research efforts are heavily invested in exploring and implementing green chemistry methodologies, focusing on identifying and utilizing greener cationic reagents or entirely new reaction media, such as supercritical carbon dioxide or advanced water-based solvent systems, with the explicit goal of minimizing the environmental impact and reducing the chemical footprint associated with large-scale industrial manufacturing. The concurrent integration of advanced process analytical technologies (PAT), exemplified by online Near-Infrared (NIR) spectroscopy and highly accurate sophisticated rheometers, directly into high-volume production lines enables unprecedented levels of real-time quality monitoring and dynamic, instantaneous process adjustments. This technological confluence guarantees that the final manufactured cationic starch product consistently meets the exceptionally exacting specifications demanded by modern end-users for ensuring optimal machine runnability, maximum efficiency, and predictable, superior product quality.

Regional Highlights

The Asia Pacific (APAC) region stands out as the undisputed leader in the Cationic Starch market, accounting for the largest share in terms of both consumption volume and market value. This dominance is primarily driven by the region's massive manufacturing base, particularly the significant output from China and India in paper, board, and packaging materials. Rapid industrialization, coupled with soaring domestic consumption of consumer goods, packaging, and tissue products, sustains high demand for efficient retention aids and strength additives. Moreover, substantial ongoing government and private sector investment in wastewater treatment infrastructure across Southeast Asia further fuels the market for bio-based flocculants, ensuring APAC’s projected growth rate remains the highest globally.

North America and Europe represent mature, highly specialized markets characterized by stable, yet slower, growth rates. In these regions, growth is less driven by volume expansion and more by the premiumization of products, focusing on high-performance starches tailored for highly efficient recycling operations and specialized packaging grades. Strict environmental legislation in the European Union strongly favors the adoption of natural, biodegradable additives like cationic starch over synthetic chemical alternatives. The emphasis here is on technical performance, consistency, and compliance with stringent environmental standards (REACH), driving demand for potato and specialty corn starch derivatives.

Latin America (LATAM) and the Middle East and Africa (MEA) currently hold smaller, yet strategically significant, market shares. In LATAM, growth is strongly linked to the expansion of regional pulp and paper industries, particularly in Brazil and Chile, alongside emerging demand from the rapidly developing mining sector which uses cationic starches for flotation processes. The MEA region, while having lower overall consumption, shows nascent but steady growth, largely dependent on infrastructure projects, localized paper production, and the increasing need for advanced water management and treatment solutions in water-scarce economies. Investment in local starch processing facilities remains a critical factor for unlocking the full market potential in these developing regions.

- Asia Pacific (APAC): Dominant market share fueled by expansive paper production in China and India, rapid urbanization, and increasing regulatory pressure for eco-friendly flocculants in wastewater treatment.

- North America: Stable demand focused on high-performance starches for enhanced recycling processes and high-quality specialty paper and board production.

- Europe: Driven by strong sustainability mandates (EU Green Deal), favoring bio-based additives, with significant market concentration in specialty packaging and high-tech paper grades.

- Latin America (LATAM): Growth anchored by the pulp and paper industry in Brazil and the burgeoning demand from the regional mining sector for mineral processing aids.

- Middle East and Africa (MEA): Emerging market with consumption primarily tied to essential water treatment projects and infrastructure development requiring chemical specialty additives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cationic Starch Market.- Cargill, Incorporated

- Ingredion Incorporated

- Tate & Lyle PLC

- Archer Daniels Midland (ADM) Company

- Roquette Frères

- Grain Processing Corporation (GPC)

- Emsland Group

- Avebe U.A.

- Beneo GmbH (Südzucker Group)

- Vimal Starch & Chemicals Pvt. Ltd.

- SPAC Starch Products (India) Ltd.

- Astron Starch Private Limited

- Samyang Corporation

- Zhucheng Dongxiao Biotechnology Co., Ltd.

- Visco Starch

- Qingzhou Light Industry Starch Co., Ltd.

- Universal Starch-Chem Allied Ltd.

- AGRANA Beteiligungs-AG

- KMC Potato Starch

- Penford Corporation (now part of Ingredion)

Frequently Asked Questions

Analyze common user questions about the Cationic Starch market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of cationic starch in the paper industry?

Cationic starch primarily functions as a wet-end additive, enhancing fiber and filler retention, significantly improving water drainage rates, and increasing the overall mechanical strength and stiffness of the final paper product.

Which feedstock source dominates the production of cationic starch globally?

Corn starch is the dominant global feedstock source due to its abundant availability, cost-effectiveness, and suitability for high-volume modification, although potato starch derivatives are favored for premium, high-performance applications.

How does the use of cationic starch improve the sustainability of industrial processes?

It improves sustainability by being a bio-based, biodegradable chemical, replacing non-renewable synthetic polymers, and by enhancing paper machine efficiency which reduces energy consumption and minimizes fiber loss and waste sludge generation.

What is the key technological process used to manufacture cationic starch?

The key technological process is chemical modification, specifically etherification, where cationic reagents (like CHPTAC) are introduced under controlled conditions to impart a permanent positive charge onto the starch molecule.

Which geographical region is projected to experience the fastest growth in this market?

The Asia Pacific (APAC) region is projected to witness the fastest growth, driven by massive expansion in packaging demand, industrialization, and substantial investments in the regional paper and water treatment sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Cationic Starch Market Statistics 2025 Analysis By Application (Paper Making Performance, Textile Industry, Mining and Sewage Treatment Industries), By Type (Corn Cationic Starch, Tapioca Cationic Starch, Potato Cationic Starch, Wheat And Other Cationic Starch), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Cationic Starch Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Starch Tertiary Aminoalkyl Ether, Quaternary Ammonium Starch Ether), By Application (Papermaking, Textile Industry, Mining, Sewage Treatment Industry), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager