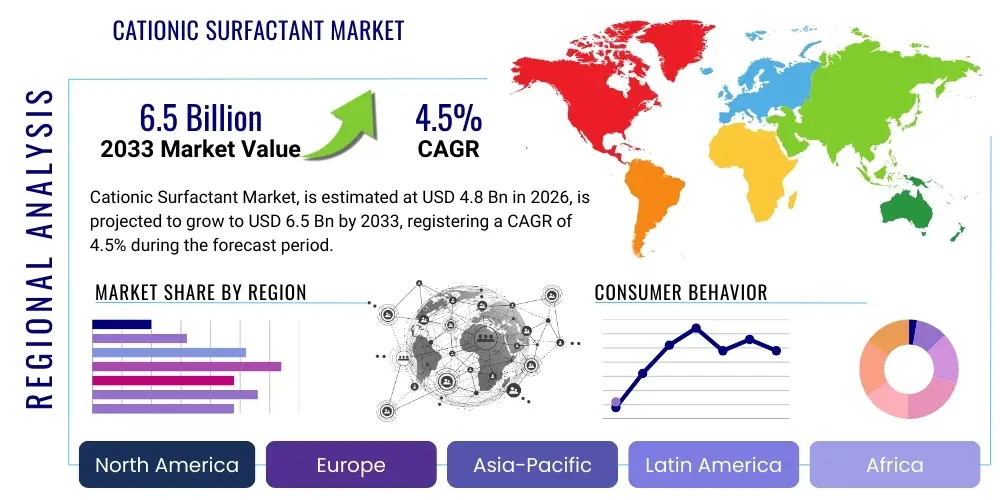

Cationic Surfactant Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435329 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Cationic Surfactant Market Size

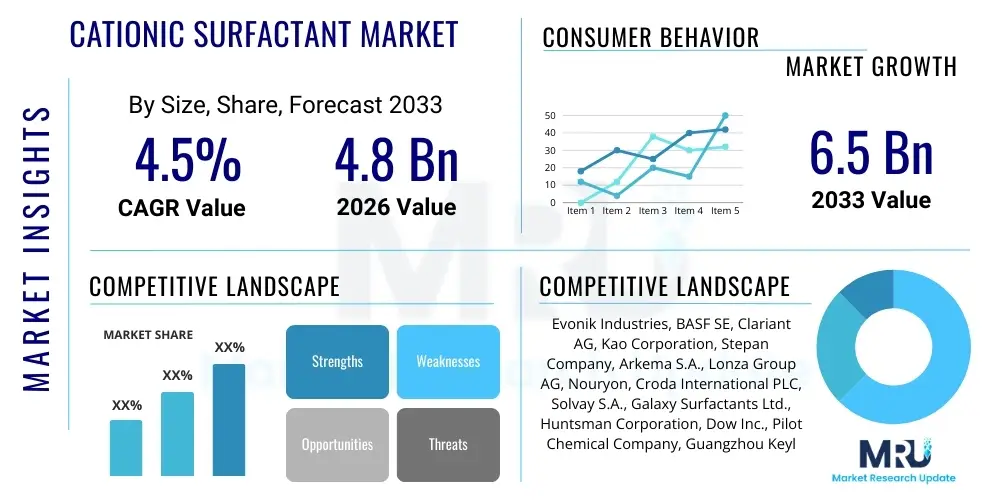

The Cationic Surfactant Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 6.5 Billion by the end of the forecast period in 2033.

Cationic Surfactant Market introduction

Cationic surfactants, defined by their positively charged head group when dissolved in water, are essential chemical compounds widely utilized across diverse industrial and consumer applications. These amphiphilic molecules are primarily derived from fatty acids, fatty alcohols, or petrochemical precursors, forming structures such as quaternary ammonium compounds (Quats) or imidazolines. Unlike anionic or nonionic surfactants, cationic agents are prized for their substantive properties, meaning they readily adhere to negatively charged surfaces like textiles, hair, skin, and metals. This unique characteristic makes them indispensable for applications requiring conditioning, antistatic, antimicrobial, and corrosion inhibition effects, positioning them as high-value additives in modern formulations.

The primary function of cationic surfactants is not cleaning or foaming, but rather surface modification and functional enhancement. In consumer goods, they are the active ingredient in fabric softeners, providing lubrication and reducing static cling, and in hair care products, where they neutralize the negative charges on damaged keratin, leading to smoother, detangled hair. Industrially, their application is crucial in asphalt emulsification, where they promote adhesion between bitumen and aggregate, enhancing road construction durability. Furthermore, their potent antimicrobial activity makes certain Quats foundational components in disinfectants and sanitizers, driving demand particularly in healthcare and institutional cleaning sectors, responding to heightened global hygiene awareness.

Market expansion is significantly driven by robust growth in the personal care industry, especially in emerging economies, coupled with increasing infrastructure investment globally, which boosts demand for asphalt emulsifiers. Key benefits such as superior conditioning, effective germicidal action, and corrosion inhibition solidify their market position. However, ongoing industry evolution focuses heavily on developing bio-based and environmentally benign cationic surfactants to address increasing regulatory scrutiny and consumer preference for sustainable ingredients, ensuring long-term market viability despite feedstock price volatility and environmental challenges associated with conventional petrochemical derivatives. The synergy between high performance and the push for sustainability will define the competitive landscape over the forecast period.

Cationic Surfactant Market Executive Summary

The Cationic Surfactant Market is experiencing dynamic shifts, underpinned by strong business trends centered on sustainability, innovation in high-performance applications, and strategic regional expansion. Globally, manufacturers are prioritizing the shift towards green chemistry, focusing on synthesizing readily biodegradable surfactants derived from natural sources, such as vegetable oils, to mitigate environmental concerns associated with traditional quaternary ammonium compounds. This innovation trajectory is crucial for market stakeholders aiming to comply with stricter regulatory frameworks in North America and Europe. Concurrently, the textile and oilfield chemical sectors are driving demand for specialized, high-heat-tolerant, and performance-optimized cationic surfactants, prompting significant investment in advanced synthesis technology to improve yield and purity, thereby maintaining competitive advantage and addressing sophisticated B2B requirements.

From a regional perspective, Asia Pacific (APAC) remains the undisputed engine of growth, largely propelled by rapidly expanding consumer markets in China, India, and Southeast Asia. The escalating middle-class population in these regions is driving unprecedented demand for personal care products (conditioners, anti-dandruff shampoos) and high-quality home care items (fabric softeners). While North America and Europe represent mature markets characterized by technological sophistication and a focus on premium, certified bio-based products, APAC's growth is volume-driven, fueled by infrastructure development (asphalt emulsifiers) and booming textile production. The regulatory environment in Europe, particularly REACH compliance, continues to influence formulation decisions globally, pushing ingredient transparency and environmental assessment to the forefront of regional strategies.

Segmentation trends highlight the dominance of the Quaternary Ammonium Compounds segment, owing to their versatility, cost-effectiveness, and established efficacy as antimicrobial agents and conditioning agents. However, emerging segments like ester quats are gaining substantial traction due to their superior biodegradability profile, aligning with prevailing environmental concerns. Application-wise, the Fabric Softeners sector commands the largest share, reflecting the sheer volume of laundry care products consumed globally. Nonetheless, high-growth opportunities are increasingly identified in niche industrial applications, such as corrosion inhibitors in oil and gas production and specialized additives for high-performance coatings, where the unique surface-active properties of cationic compounds deliver specialized functional benefits not easily replicated by other surfactant classes. The strategic focus on these high-margin, specialized industrial segments is expected to diversify revenue streams for key market players.

AI Impact Analysis on Cationic Surfactant Market

User queries regarding the impact of Artificial Intelligence (AI) and Machine Learning (ML) on the Cationic Surfactant Market primarily center on optimizing chemical synthesis pathways, accelerating the discovery of novel, sustainable molecular structures, and enhancing supply chain resilience. Users are keen to understand how AI can reduce the lengthy and expensive R&D cycle for bio-based cationic surfactants, particularly concerning toxicity and biodegradability screening. Furthermore, questions frequently arise about AI’s role in optimizing complex manufacturing processes, such as predictive quality control in large-scale polymerization or emulsification plants, aiming to minimize batch failures and ensure product consistency. The overarching expectation is that AI will be a transformative tool, dramatically reducing time-to-market for new, compliant, and high-performing surfactant molecules while simultaneously managing the volatile costs associated with raw material procurement and complex global logistics chains.

- AI-driven molecular modeling accelerates the design and virtual screening of novel, environmentally friendly cationic head groups, bypassing extensive laboratory trials.

- Machine learning algorithms optimize polymerization reaction conditions and synthesis parameters (temperature, pressure, catalyst concentration) to maximize yield and purity of specialty quats.

- Predictive maintenance programs utilizing AI sensors minimize unexpected downtime in high-volume surfactant manufacturing facilities, improving operational efficiency and reducing capital expenditure.

- AI enhances supply chain visibility, forecasting raw material price fluctuations (e.g., fatty amines, coconut oil derivatives) and optimizing inventory levels to mitigate cost volatility.

- Automated toxicity and biodegradability assessment using ML models streamlines regulatory compliance, significantly reducing the R&D timeline for new product approvals.

- Enhanced personalized formulation recommendation systems, powered by AI, help formulators quickly select the ideal cationic surfactant blend for specific end-user product requirements (e.g., pH stability, softening efficacy, textile compatibility).

DRO & Impact Forces Of Cationic Surfactant Market

The dynamics of the Cationic Surfactant Market are governed by a complex interplay of internal growth drivers, stringent external constraints, and significant technological opportunities, collectively shaping the market’s trajectory. A primary driver is the accelerating demand from the personal care and hygiene sectors, particularly the increased global consumption of advanced fabric conditioners and sophisticated hair care products that rely heavily on cationic compounds for their substantive conditioning and antistatic benefits. Additionally, the inherent germicidal and disinfecting properties of Quaternary Ammonium Compounds (QACs) ensure sustained demand in institutional cleaning and healthcare, a trend reinforced by elevated public awareness regarding sanitization protocols globally. These factors are further amplified by infrastructure spending, especially in developing regions, which necessitates high-performance cationic asphalt emulsifiers for road construction, offering excellent road stability and improved water resistance, thus acting as a crucial industrial demand lever.

Conversely, the market faces considerable restraints, notably the increasingly strict environmental regulations imposed by bodies such as the EPA and EU directives concerning the persistence and aquatic toxicity of traditional petrochemical-derived cationic surfactants. The non-biodegradability of some older chemistries poses significant market barriers, compelling manufacturers to invest heavily in costly R&D for compliant alternatives. Furthermore, the volatility and price unpredictability of key raw materials, such as tallow and coconut oil derivatives, which are often tied to global agricultural commodity cycles, severely impact manufacturing costs and profitability margins, creating uncertainty for long-term strategic planning. This price pressure often necessitates complex hedging strategies or the exploration of non-traditional, cost-competitive feedstocks to maintain competitive pricing in high-volume application segments like fabric care.

Opportunities for expansion are abundant, centered predominantly on the development and commercialization of advanced bio-based cationic surfactants, particularly ester quats and amino acid derivatives, which offer comparable performance with significantly improved ecological profiles. The shift toward sustainable chemistry represents a major growth avenue, attracting investment and technological innovation focused on greener synthesis routes and highly concentrated formulations to reduce packaging waste and transportation costs. Moreover, the expanding field of specialized industrial applications, including corrosion inhibition in complex acidic environments (e.g., metal pickling, oilfield chemicals) and specialized flocculation agents for advanced water treatment, presents high-margin opportunities. Leveraging these niche markets, which value performance over cost, allows key players to diversify their product portfolio and insulate themselves from price wars prevalent in the commodity consumer segment, utilizing the unique surface modification capabilities of cationic agents.

Segmentation Analysis

The Cationic Surfactant Market is comprehensively segmented based on its structural type, end-use application, and geographical region, reflecting the highly diverse functional roles these chemicals play. Segmentation by type is fundamental, classifying surfactants primarily based on their chemical structure, which directly dictates their functional properties, stability, and suitability for specific environments. Quaternary Ammonium Compounds (QACs) dominate this category due to their exceptional versatility as conditioning agents, antistatic agents, and highly effective biocides. Understanding this segmentation is critical for producers to tailor their synthesis processes and for end-users to select the optimal ingredient for formulation stability and desired performance outcome.

Application-based segmentation reveals the broad economic footprint of cationic surfactants, ranging from high-volume consumer goods to specialized industrial processes. Fabric softeners remain the largest application area globally, consuming vast quantities of conditioning agents to improve the tactile feel of textiles and reduce static electricity. Simultaneously, the market is characterized by high-growth segments such as asphalt emulsification and corrosion inhibition, driven by capital expenditure and infrastructure development. The performance requirements within these different applications vary dramatically; for instance, fabric softeners require gentle, biodegradable products, whereas industrial uses demand robust, stable compounds capable of withstanding extreme pH and temperature conditions, creating distinct market pockets.

The ongoing trend favors highly specialized, application-specific cationic surfactants that address both performance demands and environmental sustainability. Ester quats are rapidly gaining market share within the conditioning segments owing to their superior environmental profile compared to traditional dialkyl dimethyl ammonium chlorides (DADMACs). This continuous innovation trajectory ensures that while the core chemistry remains foundational, the market is constantly evolving toward enhanced ecological performance and functional sophistication, requiring manufacturers to maintain dynamic R&D pipelines focused on next-generation, compliant chemistries to sustain relevance across all major end-use segments.

- By Type:

- Quaternary Ammonium Compounds (QACs)

- Alkylpyridinium Salts

- Imidazolines

- Amine Oxides (depending on pH)

- Cationic Esters (Ester Quats)

- By Application:

- Fabric Softeners

- Hair Care and Personal Care (Conditioners, Shampoos)

- Disinfectants and Sanitizers

- Asphalt Emulsifiers and Road Construction

- Oilfield Chemicals (Corrosion Inhibitors, Demulsifiers)

- Textile and Leather Processing

- Water Treatment (Flocculants)

- By End-Use Industry:

- Consumer Goods

- Chemical and Material Processing

- Oil and Gas

- Construction

- Textiles

- Pharmaceuticals and Healthcare

Value Chain Analysis For Cationic Surfactant Market

The Cationic Surfactant value chain begins with the upstream sourcing of crucial raw materials, which are broadly categorized into natural and petrochemical derivatives. Natural sources include animal tallow, coconut oil, palm oil, and soybean oil, which are processed into fatty acids and fatty alcohols, acting as key precursors for the hydrophobic tails of the surfactant molecule. Petrochemical inputs primarily supply the hydrophilic head groups, such as ethylene oxide, propylene oxide, and various amines used in the synthesis of quaternary ammonium groups. The volatility in global agricultural commodity markets and crude oil prices directly impacts the cost structure at this initial stage. Efficient procurement, leveraging global supply agreements and managing inventory risk, is crucial for maintaining profitability in the manufacturing segment, which is characterized by capital-intensive chemical processing plants focused on amination and quaternization reactions to produce the final surfactant product, often in high-purity, concentrated forms.

The midstream stage involves the highly specialized manufacturing of the surfactants, where companies execute complex chemical reactions, including the quaternization of tertiary amines with alkylating agents (like methyl chloride or benzyl chloride) to yield the final cationic product. This stage requires rigorous quality control to ensure batch consistency, efficacy (e.g., active matter content), and compliance with industrial standards, especially for biocidal and pharmaceutical-grade Quats. The choice of manufacturing process, such as batch or continuous flow systems, dictates the production scale and energy efficiency, heavily influencing the final unit cost. Sustainability pressures are driving process innovation here, focusing on solvent-free reactions and the incorporation of catalysts to lower energy consumption and waste generation, thereby enhancing the overall environmental and economic profile of the manufactured product.

The downstream segment encompasses distribution channels and end-user engagement, which vary significantly based on the application type. High-volume commodity surfactants, such as those used in fabric softeners, often utilize a dual distribution model involving direct sales to multinational consumer goods corporations (P&G, Unilever) and indirect sales through large chemical distributors for smaller formulators. Specialized products, such as oilfield chemicals or pharmaceutical-grade biocides, typically rely on direct sales and technical consultation due to the high regulatory requirements and the need for application-specific technical support. The proximity of manufacturing facilities to major consumption hubs, particularly in Asia Pacific and North America, is a crucial competitive factor, minimizing logistics costs and improving responsiveness to evolving customer formulation needs, which further strengthens the bond between producers and major industrial and consumer end-users.

Cationic Surfactant Market Potential Customers

The core customer base for cationic surfactants spans a wide spectrum of industries, fundamentally driven by the need for surface conditioning, antistatic functionality, and potent antimicrobial activity. The largest consumers are the Fast-Moving Consumer Goods (FMCG) sector, particularly manufacturers of home care and personal care products. Companies specializing in laundry detergents and fabric softeners constitute the single largest volume purchasers, relying on ester quats and dialkyl derivatives to impart softness, control static cling, and aid in the ironing process. Similarly, the cosmetics industry heavily utilizes these compounds in hair conditioners, rinse-off treatments, and some specialized skin care formulations, valuing their substantive affinity for keratin and their ability to significantly improve hair manageability and texture. The high demand from these consumer-facing giants necessitates large-scale, consistent supply and a continuous drive for biodegradable formulations to meet retail shelf requirements.

Beyond the consumer sphere, several crucial industrial sectors represent high-value, specialized customer segments. The construction industry is a major buyer, utilizing cationic surfactants as asphalt emulsifiers and anti-stripping agents. These compounds are integral to cold-mix asphalt technology, enhancing the adhesion between the aggregate stones and the bitumen binder, which is critical for road durability and performance, especially in varying climatic conditions. Furthermore, the oil and gas industry represents a significant market for specialized cationic compounds, where they function as corrosion inhibitors, protecting metal pipelines and equipment from acidic byproducts, and as demulsifiers, aiding in the separation of crude oil from produced water, processes essential for efficient hydrocarbon extraction and transportation.

Another rapidly expanding customer segment includes institutional cleaning and healthcare providers, where the antimicrobial efficacy of Quaternary Ammonium Compounds (QACs) is non-negotiable. Hospitals, food processing plants, and public sanitation services rely on QAC-based disinfectants to maintain critical hygiene standards and control pathogen spread. These applications demand extremely high purity and consistent performance, often governed by stringent regulatory standards (e.g., FDA, EPA registrations). Therefore, potential customers are highly segmented, ranging from bulk purchasing multinational CPG firms focusing on cost and sustainability, to highly technical industrial clients prioritizing performance stability in harsh environments, necessitating a diversified sales and R&D strategy from surfactant producers to effectively cater to these varied requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 6.5 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Evonik Industries, BASF SE, Clariant AG, Kao Corporation, Stepan Company, Arkema S.A., Lonza Group AG, Nouryon, Croda International PLC, Solvay S.A., Galaxy Surfactants Ltd., Huntsman Corporation, Dow Inc., Pilot Chemical Company, Guangzhou Keylink Chemical Co., Ltd., Colonial Chemical, Inc., PCC Exol SA, Sinopec Group, KAO Chemical GMBH, Sasol Limited. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cationic Surfactant Market Key Technology Landscape

The technology landscape for the Cationic Surfactant Market is rapidly evolving, driven primarily by the twin demands for enhanced performance and mandatory sustainability. A crucial technological focus involves the development of greener synthesis routes, moving away from high-pressure, high-temperature reactions that rely on toxic alkyl halides. Modern synthesis technology is exploring continuous flow chemistry and catalytic processes that minimize energy consumption and reduce the generation of unwanted byproducts, leading to purer and more cost-effective production of key intermediates like tertiary amines and quaternizing agents. Specifically, advancements in microemulsion polymerization techniques are being explored to create highly specialized cationic polymers used as conditioning agents and flocculants, offering superior efficacy and stability compared to simple monomeric surfactants, particularly in complex consumer formulations where stability across varying pH levels is essential.

A second major technological trend is the proliferation of high-performance, biodegradable cationic surfactants, spearheaded by the transition from traditional dialkyl dimethyl ammonium chlorides (DADMACs) to advanced ester quats. Ester quats are structurally similar but contain ester linkages that are readily hydrolyzed, facilitating faster environmental breakdown while maintaining excellent softening and conditioning properties. Technological innovation in this area focuses on selecting optimal natural feedstock precursors, such as specific cuts of refined vegetable oils, and optimizing the transesterification and subsequent quaternization steps to maximize the yield of the desired tri- or tetra-ester products. Furthermore, researchers are leveraging computational chemistry and high-throughput screening technologies to design novel, non-nitrogen-based cationic species that avoid the persistence issues associated with traditional QACs while still delivering effective surface activity, thus pushing the boundaries of sustainable formulation chemistry.

The manufacturing process itself is undergoing significant technological upgrades centered around automation and quality assurance. Advanced spectroscopic techniques, such as Near-Infrared (NIR) and Raman spectroscopy, are being integrated into production lines for real-time monitoring of reaction completion and final product purity, ensuring stringent quality control standards required for sensitive applications like pharmaceuticals and food contact sanitizers. Furthermore, sophisticated mixing and dispersion technologies are essential for creating stable, highly concentrated aqueous formulations, particularly for industrial flocculants and asphalt emulsifiers, where the stability of the emulsion directly translates to product performance and efficacy in the field. These technological enhancements are crucial not only for compliance but also for securing high-margin contracts in the specialized industrial and premium consumer segments, reinforcing the importance of continuous process and molecular innovation.

Regional Highlights

- Asia Pacific (APAC): APAC is the fastest-growing and largest regional market, driven primarily by escalating demand from rapidly expanding consumer bases in China, India, and Southeast Asian nations. The region’s growth is fueled by increased consumption of fabric softeners, hair care products, and high infrastructural investment demanding asphalt emulsifiers and construction chemicals. Government initiatives supporting manufacturing and textile industries further bolster consumption. Manufacturers are increasingly setting up production hubs in this region to minimize logistics costs and capitalize on lower operational overheads, although they must contend with varying regional regulatory standards regarding environmental discharge and biodegradability.

- North America: Characterized as a mature and highly regulated market, North America focuses heavily on high-performance, specialized cationic surfactants. Key drivers include stringent regulatory demands concerning public health, supporting strong demand for EPA-registered biocidal QACs in healthcare and institutional cleaning. The region demonstrates a significant technological trend toward bio-based and sustainable formulations, driven by strong corporate sustainability pledges and consumer preference for eco-friendly products, pushing companies to invest heavily in ester quats and innovative conditioning agents derived from renewable feedstocks.

- Europe: The European market is defined by its rigorous regulatory environment, particularly the influence of REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals), which significantly pressures manufacturers to phase out persistent and potentially toxic cationic chemistries. This regulatory landscape makes Europe a leader in the development and adoption of high-performance, readily biodegradable surfactants, particularly in the personal care and home care sectors. Innovation is concentrated on high-value, niche applications and achieving certification for low environmental impact, resulting in a preference for premium, sustainable ingredients over low-cost alternatives.

- Latin America (LATAM): This region presents substantial growth potential, fueled by improving economic conditions, urbanization, and increasing consumer awareness regarding personal hygiene and specialized cleaning products. Brazil and Mexico are the dominant markets, showing rising demand for mid-range and premium fabric softeners and hair conditioning products. Market challenges include economic volatility and less harmonized regulatory frameworks compared to Europe or North America, necessitating tailored market entry and product strategies focusing on cost-effectiveness alongside satisfactory performance.

- Middle East and Africa (MEA): Growth in MEA is largely dependent on urbanization, infrastructure development, and the oil and gas sector. Cationic surfactants find significant use as corrosion inhibitors and demulsifiers in oilfield operations, representing a high-value industrial application segment. Consumer markets, particularly in the Gulf Cooperation Council (GCC) nations, are showing increasing sophistication, driving demand for premium personal care and specialty cleaning products, though the market size remains smaller compared to APAC or North America, characterized by concentrated demand clusters.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cationic Surfactant Market.- Evonik Industries AG

- BASF SE

- Clariant AG

- Kao Corporation

- Stepan Company

- Arkema S.A.

- Lonza Group AG

- Nouryon

- Croda International PLC

- Solvay S.A.

- Galaxy Surfactants Ltd.

- Huntsman Corporation

- Dow Inc.

- Pilot Chemical Company

- Guangzhou Keylink Chemical Co., Ltd.

- Colonial Chemical, Inc.

- PCC Exol SA

- Sinopec Group

- KAO Chemical GMBH

- Sasol Limited

Frequently Asked Questions

Analyze common user questions about the Cationic Surfactant market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary functions of Cationic Surfactants in consumer products?

Cationic surfactants are crucial functional additives primarily used for conditioning, antistatic, and substantive effects. In consumer goods like fabric softeners and hair conditioners, they adhere to the negatively charged surfaces (textiles, keratin) to neutralize static electricity, improve lubrication, enhance feel, and facilitate detangling. They are also highly effective biocides used in disinfectants and sanitizers.

Which segmentation type dominates the Cationic Surfactant Market, and why?

The Quaternary Ammonium Compounds (QACs) segment dominates the market by type due to their superior versatility, efficacy as antimicrobial agents, and effectiveness as conditioning agents across a wide range of applications, including industrial cleaners, healthcare disinfectants, and personal care products. Their established performance profile supports their high market share.

How do environmental regulations impact the future growth of Cationic Surfactants?

Environmental regulations, particularly those concerning biodegradability and aquatic toxicity (like REACH in Europe), are significantly restraining traditional cationic surfactant growth. This pressure is accelerating the market shift towards sustainable alternatives, such as rapidly biodegradable Ester Quats, which align with regulatory compliance and consumer demand for green chemistry, driving innovation and future market direction.

What are Cationic Surfactants used for in the construction industry?

In the construction industry, cationic surfactants are vital for asphalt emulsification. They act as strong adhesion promoters, ensuring the bond between bitumen (asphalt) and aggregate materials, which is essential for creating durable, cold-mix asphalt used in road paving and maintenance, particularly enhancing water resistance and workability in cold weather.

Which region offers the most significant growth opportunities for Cationic Surfactant manufacturers?

Asia Pacific (APAC) offers the most significant growth opportunities due to its massive, expanding middle-class population driving increased consumption of personal care and home care products, combined with extensive government investment in infrastructure projects, which fuels high demand for industrial applications like asphalt emulsifiers and textile processing aids.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager