Catwalk System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431444 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Catwalk System Market Size

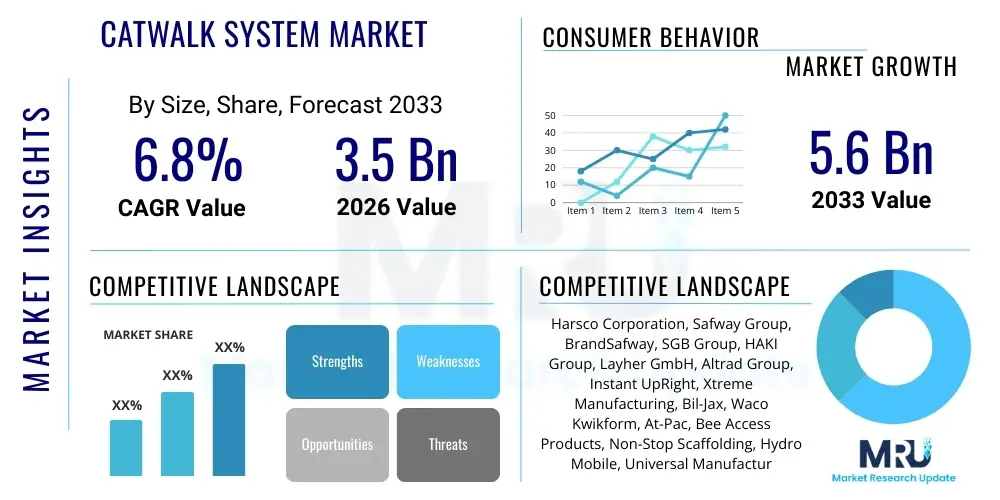

The Catwalk System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.6 Billion by the end of the forecast period in 2033.

Catwalk System Market introduction

The Catwalk System Market encompasses the design, manufacturing, installation, and maintenance of elevated walkways, platforms, and access structures used primarily in industrial, construction, and entertainment sectors. These systems provide safe and stable access for personnel conducting inspection, maintenance, operation, or observation tasks in environments where floor-level access is impractical or hazardous. Products range from modular aluminum systems and steel structures to bespoke designs tailored for highly specific operational requirements, such as those found in refineries, large-scale manufacturing plants, power generation facilities, and specialized stages in theatrical venues. The fundamental application is ensuring worker safety and compliance with international occupational health and safety standards while facilitating efficient infrastructure upkeep.

Major applications driving the demand include the energy sector (oil and gas, nuclear, thermal power), where extensive piping and equipment require constant elevated access for routine checks and repairs. Furthermore, the burgeoning logistics and warehousing sector utilizes catwalks extensively for inventory management systems and accessing high storage racks. The product description emphasizes durability, load-bearing capacity, ease of assembly (especially for modular systems), and resistance to environmental factors like corrosion or extreme temperatures. Modern Catwalk Systems often integrate anti-slip flooring, robust railing systems, and standardized dimensions to ensure interoperability and compliance across various project scales.

Key benefits of deploying standardized catwalk systems include significant reduction in workplace accidents, improved operational uptime by enabling rapid access to critical infrastructure components, and enhanced overall plant organization. Driving factors include stringent regulatory frameworks mandating safe working practices at height, rapid infrastructure development globally (particularly in APAC), and the increasing automation of industrial facilities which still require human oversight and maintenance intervention via established access routes. The modularity and customizability of modern systems also allow for retroactive installation in existing facilities, further bolstering market growth across mature industrial economies.

Catwalk System Market Executive Summary

The Catwalk System Market demonstrates robust expansion, primarily fueled by global infrastructure investment, stringent occupational safety regulations, and the rapid industrialization witnessed across emerging economies. Current business trends indicate a strong shift towards lightweight, modular materials such as aluminum, which offers benefits in terms of ease of installation, reduced structural load, and superior corrosion resistance compared to traditional heavy steel systems. Furthermore, manufacturers are increasingly integrating safety features like advanced anti-slip coatings, self-closing safety gates, and enhanced fall protection systems to meet evolving compliance requirements. Digitization is subtly influencing the market, particularly in the design phase, where Building Information Modeling (BIM) is standardizing custom fabrication and optimizing material usage, thus lowering overall project costs and lead times.

Geographically, Asia Pacific (APAC) stands out as the primary growth engine, driven by massive investments in new energy projects, expansion of manufacturing bases, and significant urbanization efforts requiring extensive commercial and industrial infrastructure. North America and Europe, while mature, maintain stable growth anchored by mandatory infrastructure upgrades, maintenance cycles for aging facilities, and high safety spending per capita. Regional trends highlight differences in material preferences; for instance, European markets prioritize sustainability and recyclability in their material choices, whereas developing markets prioritize cost-efficiency and quick deployment. The expansion of data centers and large-scale renewable energy farms (solar and wind) globally is also creating specialized niche demand for lightweight, high-access maintenance structures.

Segmentation trends reveal that the permanent installation segment dominates the market due to the long operational life of industrial assets, while the rental or temporary segment shows faster growth, particularly in the construction and events industries where flexibility and rapid dismantling are crucial. Based on material, steel remains the dominant material due to its strength and cost-effectiveness, but aluminum is rapidly gaining share due to logistics and installation advantages. End-user segmentation shows that the Oil & Gas and Power Generation sectors are the largest consumers, demanding highly customized, durable, and corrosion-resistant systems tailored for harsh environments. The increasing complexity of industrial plant layouts necessitates flexible and often multi-level catwalk systems, driving demand for complex engineered solutions.

AI Impact Analysis on Catwalk System Market

Common user questions regarding AI's impact on Catwalk Systems focus primarily on how automated inspection and monitoring will affect the need for human access structures. Users are concerned about whether AI-driven drones or robotic inspection systems will ultimately reduce the required density or complexity of physical catwalk systems, and conversely, how AI can enhance the safety and maintenance of the catwalks themselves. Key themes center on predictive maintenance for structural integrity, utilizing computer vision for monitoring worker safety compliance (e.g., mandatory harness use), and optimizing access routes based on real-time operational needs. Users expect AI to streamline maintenance costs and reduce risks associated with working at height, thereby demanding smarter, potentially sensor-integrated physical infrastructure.

- AI-enhanced Predictive Maintenance: AI algorithms analyze data from integrated sensors (stress, vibration, corrosion monitors) installed on catwalk structures, predicting failure points before they manifest, thus enabling proactive repairs and extending structural lifespan.

- Automated Compliance Monitoring: Computer vision and AI are used to continuously monitor catwalks and workers, ensuring adherence to safety protocols (e.g., proper use of personal protective equipment, unauthorized access detection), significantly reducing human error risks.

- Optimized Design and Placement: Machine learning models analyze facility layouts, workflow patterns, and regulatory requirements to optimize the design, placement, and material selection for new catwalk systems, minimizing wasted materials and maximizing accessibility efficiency.

- Integration with Robotic Inspection Systems: AI guides semi-autonomous inspection drones or robots utilizing catwalks as stable base stations or movement tracks, enabling precise and repeatable non-destructive testing (NDT) of adjacent equipment, potentially reducing the frequency of purely human-led visual inspections.

- Inventory and Asset Management: AI-driven systems track modular components of temporary catwalks (used in construction/events), ensuring efficient logistics, utilization rates, and rapid deployment based on project requirements.

DRO & Impact Forces Of Catwalk System Market

The Catwalk System market is significantly propelled by regulatory drivers focusing on occupational safety and the relentless pace of industrial expansion worldwide. Restraints primarily involve high initial installation costs, the complexity of customized engineering required for unique industrial settings, and the ongoing challenge of maintaining structural integrity in harsh operating environments. Opportunities lie in the adoption of lightweight composite materials, the expansion into specialized sectors like data centers and renewable energy farms, and the integration of smart technologies (IoT sensors) for condition monitoring. These factors collectively exert substantial impact forces on market dynamics, demanding innovation in material science and system design to balance safety compliance with cost-effectiveness.

Drivers: Stringent global safety standards (OSHA, ANSI, ISO) mandate secure elevated access, forcing industries to invest in compliant catwalk solutions. Secondly, the large-scale development in infrastructure, especially industrial facilities (refineries, manufacturing hubs, logistics centers) in Asia and the Middle East, creates massive demand for new access systems. The necessity for routine inspection and maintenance of complex, high-value assets across sectors like energy and petrochemicals provides a continuous revenue stream for permanent installation providers, driving sustained market growth regardless of economic cycles.

Restraints: The primary restraint is the significant upfront capital expenditure required for installing customized, heavy-duty catwalk systems, especially those engineered for corrosive or explosive environments. Furthermore, regulatory hurdles vary significantly by country and jurisdiction, complicating standardization for international providers. Finally, the long lifecycle of industrial assets means replacement cycles for permanent catwalk systems are infrequent, potentially limiting growth in highly mature markets where most required infrastructure is already in place, necessitating a greater focus on maintenance and upgrades rather than new installations.

Opportunities: The greatest opportunities reside in the modular and rental segments, catering to the fast-paced construction industry and temporary events sector which requires quick, reliable, and easily deployable access solutions. The burgeoning field of renewable energy (offshore wind, large solar arrays) requires highly specialized, corrosion-resistant, and often vertical access catwalks for maintenance, opening up new product lines. Additionally, integrating IoT and sensor technology into catwalk flooring and structural members for real-time load monitoring and predictive maintenance represents a high-value opportunity, transforming traditional structures into smart safety assets.

Segmentation Analysis

The Catwalk System Market is segmented based on critical attributes including Material Type, Installation Type, End-Use Industry, and Application, each reflecting distinct operational demands and structural requirements. Analyzing these segments provides a clear view of where market investments are concentrated and where technological advancements are having the most significant impact. The differentiation between steel and aluminum highlights a trade-off between cost/strength and weight/corrosion resistance, while the split between permanent and temporary installations addresses varying lifecycle needs across industrial and construction projects. End-use segmentation confirms the dominance of sectors with high regulatory oversight and complex machinery, such as energy and manufacturing.

- By Material Type:

- Steel Catwalk Systems (Dominant due to load capacity and cost)

- Aluminum Catwalk Systems (Growing due to lightweight and corrosion resistance)

- Fiber Reinforced Plastic (FRP) Catwalk Systems (Niche application in highly corrosive environments)

- Composite Material Systems

- By Installation Type:

- Permanent Installations

- Temporary & Rental Systems (Rapidly growing in construction and events)

- By End-Use Industry:

- Oil & Gas and Petrochemical

- Power Generation (Thermal, Nuclear, Renewable)

- Manufacturing and Automotive

- Construction and Infrastructure

- Mining and Metallurgy

- Logistics and Warehousing

- Entertainment and Theater

- By Application:

- Maintenance and Inspection Access

- Operational Work Platforms

- Emergency Egress Routes

Value Chain Analysis For Catwalk System Market

The value chain for the Catwalk System Market begins with the Upstream activities involving raw material extraction and processing, primarily steel, aluminum, and specialized composite fibers. Key upstream considerations include managing volatility in commodity prices and ensuring the quality and adherence to material specifications (e.g., tensile strength, corrosion resistance). Manufacturers source these bulk materials, requiring strong relationships with major metal suppliers and specialized grating/flooring producers. Innovation at this stage focuses on developing advanced alloys or composite structures that offer higher strength-to-weight ratios or superior environmental resistance, directly impacting final product performance and pricing.

Midstream activities encompass design, fabrication, and assembly. This is where engineering expertise is critical, especially for bespoke industrial systems that require complex load calculations and regulatory compliance checks. Manufacturers use advanced software, including CAD and BIM tools, to design modular components or fully customized structures. Fabrication involves cutting, welding, galvanizing, and applying protective coatings. Distribution channels are highly varied, involving direct sales for large, complex projects (common in the Oil & Gas sector) and indirect sales through specialized industrial distributors, construction equipment rental agencies, and safety equipment suppliers for more standardized or modular products.

Downstream activities include installation, commissioning, and post-sales support, including maintenance and repair services. Direct installation by the manufacturer or authorized specialist contractors is common, particularly for permanent installations requiring high precision and compliance certification. Indirect distribution often relies on regional dealers who handle installation training and local support. The final segment of the value chain involves the end-user, whose operational requirements and safety protocols drive purchasing decisions. Sustained revenue is generated through mandatory periodic inspection and maintenance contracts, ensuring the structures remain compliant and safe throughout their operational lifespan.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.6 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Harsco Corporation, Safway Group, BrandSafway, SGB Group, HAKI Group, Layher GmbH, Altrad Group, Instant UpRight, Xtreme Manufacturing, Bil-Jax, Waco Kwikform, At-Pac, Bee Access Products, Non-Stop Scaffolding, Hydro Mobile, Universal Manufacturing Corporation, ULMA Group, PERI Group, ZARGES GmbH, Werner Co. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Catwalk System Market Potential Customers

Potential customers for Catwalk Systems are inherently diverse, spanning large multinational corporations operating industrial complexes to specialized contractors requiring temporary access solutions. The core target group includes asset owners and operators in capital-intensive sectors such as oil refineries, petrochemical plants, nuclear and fossil fuel power stations, and major manufacturing facilities (e.g., automotive and aerospace). These entities require permanent, robust, and highly compliant access structures for routine operational checks, major turnarounds, and emergency interventions. Their purchasing decisions are heavily influenced by durability, compliance certifications, and total cost of ownership over decades.

A second crucial customer segment comprises Engineering, Procurement, and Construction (EPC) companies. EPC firms purchase catwalk systems as part of larger infrastructure projects, prioritizing modularity, ease of integration with other building systems, and reliable delivery timelines. They often favor providers who can offer turnkey solutions, including design, fabrication, and installation management. For temporary and rental systems, the primary customers are construction companies engaged in building high-rise structures, large commercial complexes, or specialized event organizers requiring temporary elevated staging and lighting access.

Emerging potential customers include operators of modern logistic centers and large data centers. Logistic centers, driven by e-commerce expansion, require extensive internal catwalks for automated retrieval systems and multi-tier storage access. Data centers, characterized by dense, complex equipment layouts and strict temperature control, require access platforms that minimize dust generation and structural vibration, often necessitating customized aluminum or FRP solutions. The continuous expansion and upgrading within these specialized sectors represent a high-growth opportunity for vendors offering lightweight, customized, and high-specification access solutions that comply with the cleanroom or sensitive operational standards.

Catwalk System Market Key Technology Landscape

The technological landscape of the Catwalk System Market is characterized by material science innovations, advanced fabrication techniques, and the integration of digital tools for design and safety management. While the core structural concept remains traditional, significant advancements are seen in the development and adoption of high-strength, lightweight alloys, particularly specialized aluminum grades, which allow for easier handling and assembly while maintaining necessary load ratings. Fiber Reinforced Polymer (FRP) technologies are also gaining traction in niche applications where extreme chemical resistance or electrical non-conductivity is mandatory, moving beyond simple steel and galvanized options.

Digitalization heavily influences the pre-fabrication and engineering phase. The widespread use of Building Information Modeling (BIM) software enables designers to virtually integrate the catwalk system within the broader facility model, optimizing spatial constraints, clash detection, and material take-offs, thereby reducing costly on-site modifications. Furthermore, advanced laser cutting and automated welding techniques ensure high precision in modular component production, facilitating rapid and accurate assembly in the field, which is critical for minimizing industrial shutdown periods during installation or upgrades.

A significant emerging technological trend is the incorporation of IoT (Internet of Things) sensors and structural health monitoring (SHM) systems directly into the catwalk infrastructure. These sensors monitor parameters such as real-time load distribution, vibration, fatigue, and environmental corrosion levels. This shift towards 'smart catwalks' allows for predictive maintenance scheduling, immediate notification of structural distress, and enhanced safety verification, moving the industry toward condition-based monitoring rather than relying solely on periodic visual inspections. This technological integration enhances the system's value proposition by contributing directly to operational reliability and safety compliance reporting.

Regional Highlights

- Asia Pacific (APAC): APAC is the fastest-growing region, driven by extensive investment in industrialization, infrastructure (power plants, refineries), and urbanization projects, particularly in China, India, and Southeast Asian nations. The region benefits from lower manufacturing costs and increasing adoption of Western safety standards, leading to a high volume of new installations, making it a critical market for global suppliers focusing on scalability and cost-effective material use.

- North America: Characterized by high compliance requirements (OSHA standards) and significant focus on maintenance and modernization of existing aging industrial infrastructure. Demand is steady, primarily driven by replacement cycles, upgrades to comply with stricter fall protection rules, and strong investment in the expansion of logistics/warehousing and specialized sectors like data centers and aerospace manufacturing.

- Europe: This region is mature but highly focused on quality, environmental sustainability, and the adoption of advanced modular systems (like those offered by German and Scandinavian manufacturers). Key demand drivers include regulatory mandated upgrades across the energy sector and high penetration of rental systems used in sophisticated construction projects and temporary events.

- Middle East & Africa (MEA): Growth is closely tied to the massive capital expenditure in the Oil & Gas sector and large-scale government infrastructure projects (e.g., NEOM in Saudi Arabia). The demand here is highly concentrated on robust, corrosion-resistant steel systems capable of withstanding extreme desert and maritime environments.

- Latin America (LATAM): Market expansion is moderate, primarily linked to mining operations, commodity processing facilities, and recovering construction sectors in countries like Brazil and Mexico. Price sensitivity and reliance on imported systems are key market characteristics, though increasing foreign investment is gradually elevating safety and quality requirements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Catwalk System Market.- Harsco Corporation

- BrandSafway

- HAKI Group

- Layher GmbH & Co KG

- Altrad Group

- SGB Group

- Instant UpRight

- ULMA Group

- PERI Group

- Bil-Jax, LLC

- Waco Kwikform

- At-Pac

- Xtreme Manufacturing

- Non-Stop Scaffolding

- Hydro Mobile

- Universal Manufacturing Corporation

- ZARGES GmbH

- Werner Co.

- Bee Access Products

- Euro Towers Ltd.

Frequently Asked Questions

Analyze common user questions about the Catwalk System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What materials are most commonly used in industrial catwalk systems?

Industrial catwalk systems primarily utilize galvanized steel due to its exceptional strength, durability, and cost-effectiveness. However, aluminum is increasingly popular for modular systems requiring lightweight assembly and superior corrosion resistance, particularly in offshore or chemical environments. Fiber Reinforced Plastic (FRP) is used in niche applications demanding non-conductivity or high resistance to chemical exposure.

How do safety regulations, such as OSHA, impact the design of modern catwalks?

Safety regulations are the primary design drivers. OSHA and similar international standards mandate specific requirements for load-bearing capacity, minimum guardrail heights, midrail and toe board dimensions, and anti-slip surface treatments. Modern catwalks are engineered to exceed these specifications, often integrating features like self-closing safety gates and standardized assembly points to simplify compliance and inspection.

Which end-use industry represents the largest segment for permanent catwalk installations?

The Oil & Gas and Power Generation sectors collectively represent the largest segment for permanent, heavy-duty catwalk installations. These industries operate complex, large-scale facilities with extensive networks of elevated piping and equipment that require continuous, safe access for routine maintenance, inspection, and operations over decades, necessitating highly customized and robust access systems.

What is the key technological trend emerging in the Catwalk System Market?

The integration of structural health monitoring (SHM) using IoT sensors is the key emerging trend. These smart systems monitor critical structural parameters like load, vibration, and corrosion in real-time. This technology facilitates a shift from time-based maintenance to predictive, condition-based maintenance, significantly enhancing operational safety, structural integrity verification, and reducing long-term maintenance costs.

Is the market for temporary and rental catwalk systems growing faster than permanent installations?

Yes, the market for temporary and rental catwalk systems is exhibiting a higher growth rate, primarily driven by the dynamic construction industry and the specialized needs of the entertainment and events sector. The demand for flexible, rapidly deployable, and easily dismantled access solutions, avoiding large capital expenditure, fuels this fast-growing segment globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager