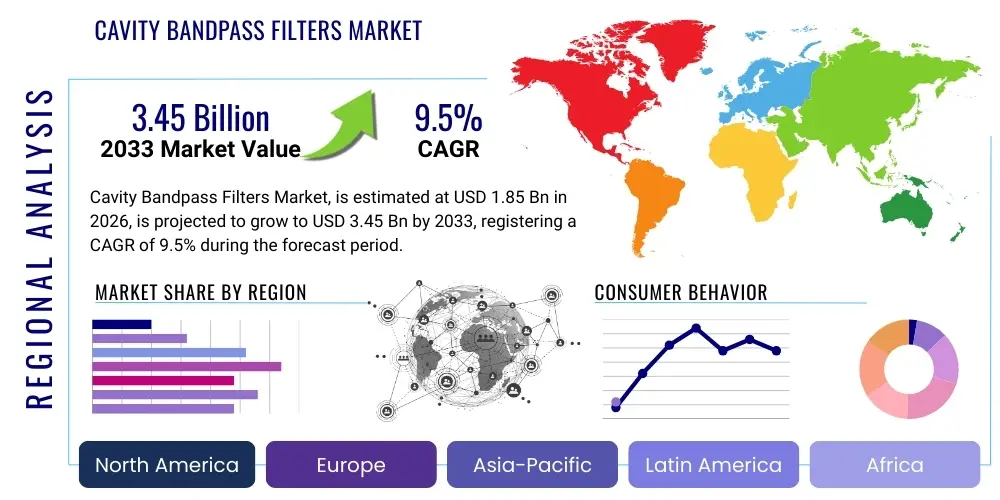

Cavity Bandpass Filters Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438537 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Cavity Bandpass Filters Market Size

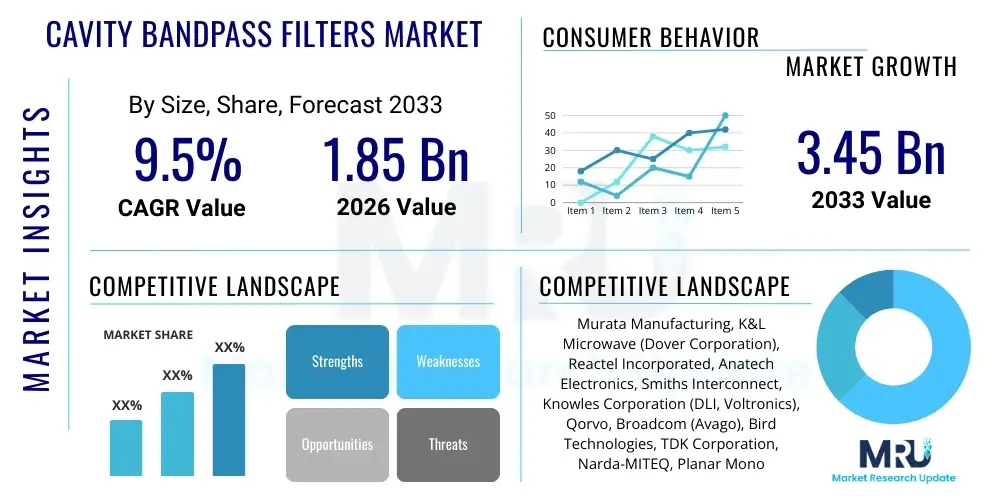

The Cavity Bandpass Filters Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at $1.85 Billion in 2026 and is projected to reach $3.45 Billion by the end of the forecast period in 2033.

The substantial growth trajectory is underpinned by the aggressive global deployment of 5G and 6G network infrastructure, which necessitates high-performance filtering solutions to manage increasingly congested and complex radio frequency (RF) spectrums. Cavity bandpass filters, known for their superior performance characteristics such as low insertion loss, high power handling capacity, and excellent selectivity, are indispensable components in macro base stations, small cells, and massive MIMO (Multiple-Input Multiple-Output) systems. Market size expansion is highly correlated with capital expenditure investments made by Mobile Network Operators (MNOs) in developed economies, particularly North America and key parts of Asia Pacific.

Furthermore, the increased complexity and demand for higher data throughput in satellite communication systems (Low Earth Orbit constellations) and advanced radar applications within the defense sector are significantly contributing to the market valuation. These high-reliability applications require filters that can withstand extreme environmental conditions while maintaining stringent performance parameters. The push towards miniaturization and integration of these filters without compromising quality remains a key technical challenge and a primary driver for investment in advanced manufacturing techniques, which further stabilizes the pricing structure and overall market value. As spectrum reallocation continues globally, the demand for highly precise, customized cavity filters is expected to accelerate, pushing the market toward the higher end of the forecast valuation.

Cavity Bandpass Filters Market introduction

Cavity Bandpass Filters (CBPs) are essential passive RF components designed to selectively pass signals within a specific frequency band while severely attenuating signals outside that band. They operate based on the principles of resonant electromagnetic cavities, providing exceptional spectral purity, low insertion loss, high Q factor, and excellent rejection capabilities. These devices are typically constructed using high-conductivity materials (like copper or silver-plated aluminum) and precision machining to form internal resonant chambers (cavities), making them suitable for high-power, high-frequency applications, particularly in the microwave and millimeter-wave regimes. Their robustness and performance stability make them critical enablers for modern wireless communication and surveillance systems.

The major applications driving the deployment of CBPs are concentrated within the telecommunications, aerospace and defense, and test and measurement industries. In telecommunications, they are fundamental in filtering uplink and downlink signals in base stations, ensuring minimal interference and optimal spectral efficiency for 4G, 5G, and emerging 6G networks. Their benefits include enhanced system capacity, reduced out-of-band noise, and improved signal integrity, which are crucial for maintaining Quality of Service (QoS) in dense urban environments. The transition to higher frequency bands (e.g., mmWave for 5G) intensifies the need for the high precision and thermal stability offered by cavity filters.

The primary driving factors for this market growth include the exponential increase in global mobile data traffic, necessitating continuous network upgrades and densification. Additionally, global political instability is fueling increased defense spending on advanced electronic warfare (EW) systems, radar technologies, and precision-guided munitions, all of which rely on high-performance filtering. The continuous launch of mega-constellations of communication satellites requiring space-qualified, radiation-tolerant filter components also provides a robust demand stream, positioning cavity bandpass filters as a cornerstone technology for modern high-frequency electronic systems.

Cavity Bandpass Filters Market Executive Summary

The Cavity Bandpass Filters market is characterized by rapid technological advancement focusing on miniaturization, enhanced power handling, and wider tunability, primarily driven by the transition to millimeter-wave frequencies for 5G and satellite communications. Business trends indicate a strong move toward strategic partnerships between specialized filter manufacturers and large telecommunication equipment providers (OEMs) to ensure supply chain stability and co-design tailored solutions for unique spectral requirements. Furthermore, sustainability and lifecycle management are gaining traction, with increasing emphasis on materials that offer high performance while adhering to environmental regulations. The competitive landscape remains fragmented but highly specialized, with market share concentrating among firms capable of high-precision CNC machining and proprietary plating processes.

Regional trends highlight the Asia Pacific (APAC) region, particularly China, South Korea, and Japan, as the primary engine of demand, driven by massive domestic 5G rollouts and significant defense modernization programs. North America and Europe, while having more mature infrastructure markets, demonstrate sustained, stable growth fueled by aerospace, stringent defense procurement cycles, and investment in cutting-edge radar and electronic warfare systems. The Middle East and Africa (MEA) are emerging markets, showing high growth potential linked to new satellite connectivity projects and early-stage 5G deployments in key urban centers. Government regulations concerning spectrum allocation and national security requirements profoundly influence regional purchasing patterns and market accessibility.

Segment trends reveal that the Telecom sector remains the largest consumer by volume, though the Aerospace & Defense segment commands higher average selling prices (ASPs) due to rigorous qualification requirements and lower volume custom orders. Among material types, filters leveraging advanced ceramic and superconducting materials are gaining prominence for applications requiring ultra-low loss characteristics, particularly in high-sensitivity scientific and space applications. The frequency segmentation shows the fastest proportional growth in the millimeter-wave band (above 24 GHz), reflecting the ongoing global effort to unlock higher bandwidth capacity required by next-generation wireless standards. Successful market participants are those diversifying their offerings across frequency bands and optimizing production to balance high-volume telecom needs with low-volume, high-margin defense contracts.

AI Impact Analysis on Cavity Bandpass Filters Market

User queries regarding the impact of Artificial Intelligence (AI) on the Cavity Bandpass Filters Market primarily revolve around how AI can accelerate complex design cycles, optimize manufacturing efficiency, and enhance filter performance predictability. Users are specifically concerned with whether AI can manage the highly non-linear and computationally intensive electromagnetic simulations required for optimizing cavity geometries, thereby drastically reducing the time-to-market for custom high-Q filters. Another key theme involves AI's role in predictive maintenance within telecommunications infrastructure, where algorithms analyze performance data from base stations to anticipate filter degradation or failure, ensuring proactive replacement and minimizing costly network downtime. The expectation is that AI will democratize high-level RF engineering, making specialized filter design more accessible and cost-effective.

AI's influence is transforming the product lifecycle, moving beyond simple data analysis into direct assistance in parameter optimization. Traditional design methods rely heavily on expert experience and repetitive iterative simulations. AI, utilizing machine learning algorithms, can quickly sift through vast datasets of previous designs and simulation results to suggest optimal cavity dimensions, coupling mechanisms, and material selection based on desired performance metrics (e.g., Q-factor, bandwidth, rejection). This shift allows manufacturers to offer highly customized filters rapidly, perfectly tailored to specific spectral masks, a critical advantage in the fast-paced 5G and beyond ecosystem.

In the operational domain, AI-driven process control systems are being integrated into the manufacturing of these filters, particularly in precision CNC machining and proprietary metal plating processes. AI monitors real-time parameters such as temperature, pressure, and deposition rates, automatically compensating for minor variations to ensure uniform quality and tight tolerances, which are paramount for maintaining high filter performance. The successful integration of AI is expected to significantly reduce manufacturing waste, increase yield rates for complex designs, and provide a competitive edge to companies that successfully transition from traditional fabrication to digitally optimized production flows.

- AI-driven electromagnetic simulation and optimization reduces design cycles by up to 40%.

- Predictive maintenance algorithms minimize network downtime by anticipating filter failure in base stations.

- Machine learning models enhance manufacturing process control, improving yield rates and tolerance adherence.

- Generative design techniques facilitate the creation of novel, miniaturized cavity structures with equivalent or superior Q-factors.

- AI-based demand forecasting optimizes inventory management for standard filter components used in mass-produced telecom equipment.

DRO & Impact Forces Of Cavity Bandpass Filters Market

The dynamics of the Cavity Bandpass Filters market are governed by a robust interplay of drivers, restraints, and opportunities, culminating in significant impact forces shaping strategic direction. The primary driver is the pervasive global upgrade cycle of wireless infrastructure, particularly the rollout of 5G and preparations for 6G, which inherently requires highly selective and high-Q filtering solutions to manage interference in densely packed frequency bands. Opportunities arise from nascent but high-value markets like Low Earth Orbit (LEO) satellite communications and the integration of highly sensitive filters into quantum computing and advanced scientific instrumentation. However, these factors are balanced by stringent restraints, chiefly the extremely high capital expenditure required for precision manufacturing equipment and the persistent scarcity of highly skilled RF engineering talent capable of designing and testing these complex components.

The key drivers fueling demand center on the exponential growth of data traffic and the need for spectral efficiency. Cavity filters provide the necessary performance edge over cheaper, less selective alternatives (like surface acoustic wave or ceramic filters) in scenarios demanding high power linearity and minimal noise contribution. Impact forces are strong, primarily manifesting through increased regulatory pressure on spectrum usage, forcing manufacturers to innovate rapidly to meet tighter specifications. Another significant driver is the geopolitical landscape, which necessitates continuous investment in defense radar, electronic countermeasures (ECM), and advanced weapon systems, securing a reliable, high-margin revenue stream for manufacturers with defense certifications.

Restraints largely stem from the technological complexity and the cost structure. Cavity filters require precise mechanical engineering; even minor dimensional deviations can significantly alter performance. This reliance on high-tolerance CNC machining translates into high manufacturing costs and reduced scalability compared to printed circuit board components. The opportunity space, however, is expansive, particularly in developing technologies such as tunable filters, which utilize microelectromechanical systems (MEMS) or varactor diodes to adjust their center frequency electronically. This innovation allows for dynamic spectrum access and adaptive interference mitigation, promising a significant revenue uplift for pioneering firms. The overarching impact force pushes the market toward vertical integration, where companies seek control over both design, manufacturing, and high-frequency testing facilities to maintain quality control and proprietary knowledge.

Segmentation Analysis

The Cavity Bandpass Filters market is comprehensively segmented based on several critical dimensions including frequency range, application, and material used for construction. Understanding these segments is vital for stakeholders to identify high-growth niches and tailor product development strategies. The market exhibits significant variation in pricing, performance requirements, and volume across these segments. For instance, filters operating in the Sub-6 GHz band (primarily used for traditional 4G/5G mid-band communication) represent the largest volume segment, optimized for cost-efficiency and mass deployment, whereas millimeter-wave (mmWave) filters command premium pricing due to the complexity of achieving tight tolerances at extremely high frequencies.

Segmentation by application clearly delineates the demand characteristics. The Telecommunication segment, encompassing base stations, repeater systems, and wireless backhaul, drives the overall market volume, characterized by stringent performance standards but high price sensitivity. Conversely, the Aerospace and Defense segment, including radar, satellite payloads, and electronic warfare systems, demands extreme reliability, thermal stability, and low probability of intercept (LPI) features, often resulting in customized, low-volume, high-margin contracts. The increasing proliferation of IoT and connected devices is also creating a growing demand for specialized intermediate frequency (IF) filters for gateways and industrial controls, forming a dynamic sub-segment.

Material segmentation, though less discussed, dictates filter performance boundaries. Traditional waveguide and coaxial cavity filters utilize metallic materials (aluminum, copper) for high power handling, while ceramic-loaded cavity filters are favored for smaller size and weight in space-constrained applications like small cells. Innovations in materials, such as the use of high-temperature superconducting (HTS) materials, though niche, offer unparalleled Q-factors for extremely sensitive applications like radio astronomy and advanced medical imaging, illustrating the technical depth and diversification within the overall market structure.

- By Frequency Range:

- Sub-6 GHz (Low-Band, Mid-Band)

- C-Band and X-Band

- Ku/Ka-Band

- Millimeter Wave (mmWave) (e.g., 24 GHz, 28 GHz, 39 GHz)

- By Application:

- Telecommunication Infrastructure (Base Stations, Repeaters, Backhaul)

- Aerospace and Defense (Radar Systems, Electronic Warfare, Satellite Communications)

- Test and Measurement Equipment

- Scientific Research and Radio Astronomy

- Industrial and Automotive

- By Material/Technology:

- Metallic Cavity Filters (Coaxial, Waveguide)

- Ceramic-Loaded Cavity Filters

- Microelectromechanical Systems (MEMS) Tunable Filters

- High-Temperature Superconducting (HTS) Filters (Niche)

Value Chain Analysis For Cavity Bandpass Filters Market

The value chain for the Cavity Bandpass Filters market is characterized by a high degree of specialization and technical complexity spanning from raw material procurement to final system integration. The upstream segment involves the sourcing of high-purity, specialized materials, notably high-conductivity metals (aluminum, brass, copper) and specialized ceramics (for dielectric loading), which are crucial for achieving the required Q-factor and thermal stability. Suppliers in this phase must adhere to stringent quality control standards as material inconsistencies directly translate into filter performance degradation. Precision metalworking and plating services form the core manufacturing step, requiring significant capital investment in high-precision Computer Numerical Control (CNC) machinery and chemical processing facilities.

The midstream phase focuses on design, simulation, and fabrication. Sophisticated electromagnetic simulation software (like HFSS or CST Studio) is essential for rapid prototyping and optimization. Due to the custom nature of high-performance filters, design expertise is a primary value-add. The complexity of the manufacturing process—involving precision milling, surface preparation, silver or gold plating for enhanced conductivity, and finally, tuning and testing—makes this stage capital and knowledge-intensive. Quality assurance, particularly rigorous thermal and vibration testing for space and military applications, is a non-negotiable step before filters proceed to distribution.

Downstream distribution channels vary significantly based on the end-user. Direct distribution is common for high-value, custom contracts with major defense contractors or Tier 1 telecommunications OEMs, allowing for closer collaboration on specifications and integration support. Indirect distribution utilizes specialized electronic components distributors or manufacturer representatives for smaller, standardized components sold to the test and measurement sector or smaller system integrators. The final link in the chain involves system integration, where the filter is embedded into the larger RF system (e.g., base station, radar array, or satellite payload), highlighting the critical relationship between filter manufacturers and system integrators for market success.

Cavity Bandpass Filters Market Potential Customers

The potential customers for Cavity Bandpass Filters represent highly demanding, technology-driven sectors where signal integrity and reliable communication are paramount. The primary end-users are Mobile Network Operators (MNOs) and their equipment suppliers (Tier 1 OEMs like Ericsson, Huawei, Nokia), who constitute the largest volume buyers. These customers require thousands of standard and customized filters annually for network densification, capacity upgrades, and migration to 5G and 6G standards. Their purchasing decisions are heavily influenced by performance-to-cost ratio, volume capacity of the supplier, and adherence to telecom industry standards.

A second crucial segment comprises government defense organizations and prime defense contractors (e.g., Lockheed Martin, Raytheon, BAE Systems). These buyers procure filters for high-reliability applications such as missile guidance systems, surveillance and fire control radars, and advanced electronic warfare platforms. For these customers, performance criteria revolve around environmental ruggedness, wide temperature operation, survivability, and proprietary military specifications. While volumes are typically lower than telecom, the specialized nature and long product lifecycle of defense programs lead to significantly higher margins and recurring service opportunities.

Further potential customers include commercial space operators running large satellite constellations (LEO/MEO), seeking lightweight, radiation-hardened cavity filters for their payloads and ground stations. Additionally, specialized test and measurement equipment manufacturers (like Keysight, Rohde & Schwarz) require ultra-high-performance cavity filters as reference standards or built-in components for their high-frequency analyzers and signal generators. These buyers prioritize stability, accuracy, and broad frequency coverage, often driving innovation in tunable and ultra-broadband filter designs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.85 Billion |

| Market Forecast in 2033 | $3.45 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Murata Manufacturing, K&L Microwave (Dover Corporation), Reactel Incorporated, Anatech Electronics, Smiths Interconnect, Knowles Corporation (DLI, Voltronics), Qorvo, Broadcom (Avago), Bird Technologies, TDK Corporation, Narda-MITEQ, Planar Monolithics Industries (PMI), Pasternack Enterprises, Mini-Circuits, Filtronic PLC, Microlab/FXR, Renaissance Electronics, Echo Microwave. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cavity Bandpass Filters Market Key Technology Landscape

The technological landscape of the Cavity Bandpass Filters market is rapidly evolving, driven by the imperative to achieve higher performance in smaller form factors and at higher frequencies, particularly in the millimeter-wave spectrum. A key trend involves the advanced application of computational electromagnetic (CEM) simulation tools, allowing designers to precisely model complex cavity geometries and predict performance variations before physical prototyping. This reduces the development cycle and optimizes filter parameters, such as Q-factor and spurious response, critical for performance in congested urban environments. Furthermore, surface treatment technologies, including proprietary silver and gold plating techniques, are continuously refined to minimize insertion loss and maximize power handling capacity, maintaining filter reliability under peak load conditions.

Miniaturization techniques represent another critical technological frontier. While traditional cavity filters are inherently bulky, innovations such as ceramic-loaded cavities and filters built using Low-Temperature Co-fired Ceramic (LTCC) technology are gaining traction. Ceramic-loaded filters utilize high-dielectric materials to reduce the physical size of the resonant structure while maintaining an adequate Q-factor, making them ideal for small cell deployments and portable communication equipment. The integration of high-Q resonators onto a planar substrate using LTCC allows for mass production and easier integration with other RF circuitry, addressing the scalability challenge often associated with conventional cavity filters, especially in consumer-facing infrastructure.

Furthermore, the development of tunable cavity filters is a major focus area for future networks. Tunable filters employ technologies such as Microelectromechanical Systems (MEMS) or magnetically tunable ferrite materials to allow the filter's passband to be electronically shifted, providing unparalleled flexibility in dynamic spectrum sharing and cognitive radio applications. This capability is paramount for future military and commercial systems that need to adapt instantly to changing interference environments. Research into superconducting materials, though currently niche, continues to push the boundaries of achievable Q-factors, promising near-zero loss filters for highly sensitive applications like advanced medical imaging and cryo-electronics.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant market in terms of volume and growth rate, primarily due to the massive scale and speed of 5G infrastructure rollout across China, India, and Southeast Asia. Government initiatives supporting indigenous telecommunication equipment manufacturing and significant defense spending in countries like Japan and South Korea further solidify its lead.

- North America: Characterized by high-value, high-performance demand, North America is a leader in technology adoption, particularly in mmWave 5G deployment and critical defense applications (radar, EW, and space programs). The presence of major aerospace contractors and specialized filter manufacturers ensures steady, high-margin market growth.

- Europe: Europe maintains a strong market position driven by investments in defense modernization (e.g., Eurofighter program upgrades), sophisticated public safety networks, and pioneering research into 6G technologies. Demand is segmented, focusing heavily on custom solutions for industrial IoT and advanced scientific instruments (e.g., CERN).

- Latin America: This region presents a growing, though lower-volume, market opportunity driven by essential upgrades to 4G networks and the nascent stages of 5G commercialization in major economies like Brazil and Mexico. Price sensitivity is higher, favoring cost-effective ceramic or standard metallic cavity solutions.

- Middle East and Africa (MEA): Growth is tied to substantial oil-funded infrastructure projects, particularly in the GCC states, which are rapidly rolling out 5G networks and investing heavily in advanced surveillance and defense capabilities. LEO satellite ground station deployment is also a significant driver in this region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cavity Bandpass Filters Market.- Murata Manufacturing Co., Ltd.

- K&L Microwave (Dover Corporation)

- Reactel Incorporated

- Smiths Interconnect

- Knowles Corporation (DLI, Voltronics)

- Qorvo, Inc.

- Broadcom (Avago Technologies)

- Bird Technologies

- TDK Corporation

- Narda-MITEQ (L3Harris Technologies)

- Planar Monolithics Industries (PMI)

- Pasternack Enterprises, Inc.

- Mini-Circuits

- Filtronic PLC

- Microlab/FXR (Noisecom)

- Echo Microwave

- Renaissance Electronics Corporation

- RF360 (Qualcomm and TDK joint venture)

- API Technologies Corp.

- Polyflon Company

Frequently Asked Questions

Analyze common user questions about the Cavity Bandpass Filters market and generate a concise list of summarized FAQs reflecting key topics and concerns.What performance metrics define the quality of a Cavity Bandpass Filter?

The quality of a cavity bandpass filter is primarily determined by its Q-factor (quality factor), which measures energy storage efficiency; insertion loss, representing signal attenuation in the passband; and selectivity, which defines the sharpness of the transition between the passband and stopband frequencies. Low insertion loss and high Q-factor are essential for high-performance communication systems.

How does the shift to 5G and mmWave technology influence the design of cavity filters?

The shift to 5G, particularly in the millimeter-wave (mmWave) band (above 24 GHz), requires cavity filters to be significantly more compact while maintaining extremely tight frequency tolerances. This necessitates highly precise machining (sub-micron level) and advanced materials like ceramics to minimize size and maintain high Q-factors necessary for high data throughput and minimal interference at ultra-high frequencies.

Are tunable cavity bandpass filters replacing fixed-frequency filters in modern systems?

Tunable cavity bandpass filters are not entirely replacing fixed-frequency filters but are rapidly gaining adoption in dynamic spectrum environments, such as military cognitive radio and flexible commercial satellite links. Tunable filters offer frequency agility but often carry higher cost and complexity than optimized fixed-frequency filters, which remain the standard for high-volume, static network infrastructure like traditional 5G base stations.

What is the primary material used in high-power handling cavity bandpass filters?

High-power handling cavity bandpass filters primarily utilize metallic construction, often aluminum or brass, which is typically plated internally with high-conductivity metals like silver or gold. These materials offer superior thermal dissipation capabilities and minimal resistive losses, essential for applications such as high-power radar and satellite uplinks.

Which application segment drives the largest market revenue for cavity bandpass filters?

While the Telecommunication Infrastructure segment drives the largest overall unit volume due to global network expansion, the Aerospace and Defense segment often generates the highest overall revenue and margin per unit. Defense applications require custom-designed, extremely rugged, and highly specialized filters that command significantly higher average selling prices (ASPs) compared to mass-produced telecom components.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager