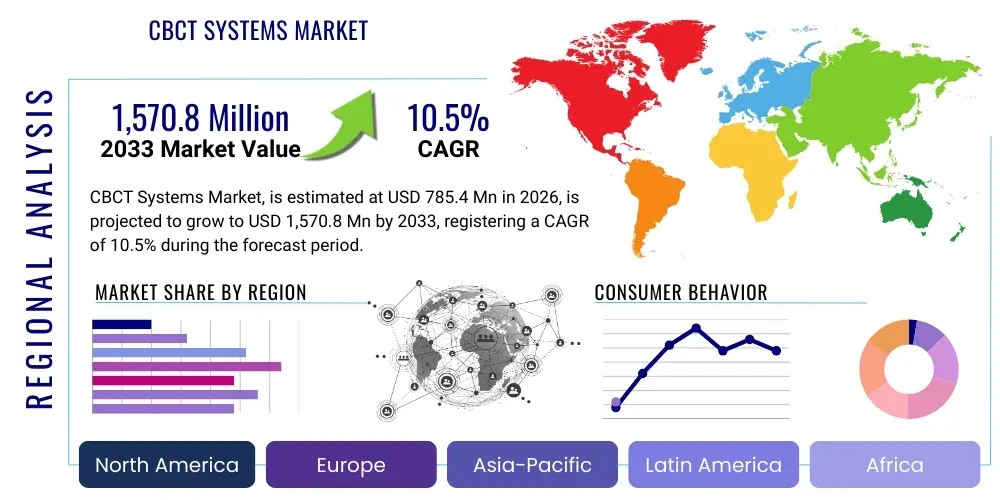

CBCT Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436977 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

CBCT Systems Market Size

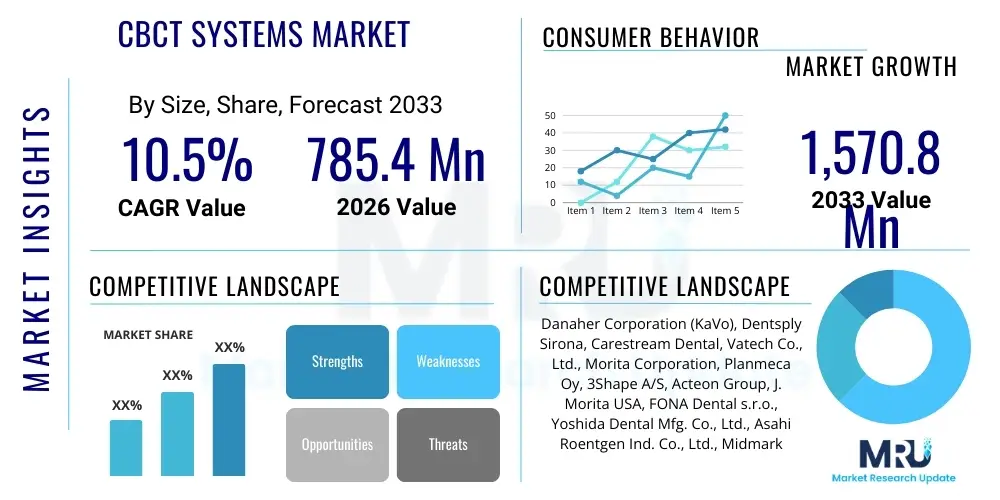

The CBCT Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at $785.4 Million in 2026 and is projected to reach $1,570.8 Million by the end of the forecast period in 2033.

This robust expansion is primarily driven by the increasing global prevalence of dental disorders requiring advanced diagnostic imaging, coupled with the rapid adoption of minimally invasive procedures in dentistry and orthopedics. Cone Beam Computed Tomography (CBCT) systems offer high-resolution, three-dimensional imaging capabilities at significantly lower radiation doses compared to traditional medical CT scanners, positioning them as the preferred standard of care for complex surgical planning, endodontics, orthodontics, and implantology. The growing awareness among dental professionals regarding the superior diagnostic accuracy provided by 3D imaging over conventional 2D radiography is fundamentally fueling market penetration across established and emerging economies.

CBCT Systems Market introduction

The Cone Beam Computed Tomography (CBCT) Systems Market encompasses sophisticated medical imaging devices utilizing a cone-shaped X-ray beam and a two-dimensional detector to generate high-resolution, volumetric data of skeletal structures, predominantly used in maxillofacial, dental, and increasingly, extremity orthopedic applications. CBCT is distinguished by its compact size, rapid scanning time, and ability to reconstruct images with isotropic voxels, providing clinicians with detailed anatomical information crucial for precise diagnosis and treatment planning. Major applications include complex oral surgery, dental implant placement, orthodontic assessments, root canal treatment planning, and detection of temporomandibular joint (TMJ) disorders.

The core benefit of CBCT technology lies in its ability to mitigate image superposition, geometric distortion, and magnification limitations inherent in traditional panoramic or periapical radiography. This improvement in visualization accuracy directly contributes to enhanced patient outcomes, reduced procedure times, and minimization of surgical risks. Furthermore, the localized field of view (FOV) options available in modern CBCT systems allow practitioners to select the precise anatomical region necessary for examination, optimizing radiation hygiene by restricting exposure only to the area of interest, which is a major factor driving widespread clinical acceptance and patient preference.

Key driving factors propelling the market forward include the rising global geriatric population, which necessitates increased dental restorative procedures; the technological advancements leading to multi-field-of-view (FOV) capabilities and improved image resolution; and the increasing integration of CBCT data with CAD/CAM systems for guided surgery. Governments and regulatory bodies are also encouraging the adoption of lower-dose imaging technologies, further stimulating demand. The seamless workflow integration offered by contemporary CBCT units within dental and specialty clinics, combined with falling equipment costs compared to earlier generations, establishes a compelling value proposition for healthcare providers seeking diagnostic excellence and operational efficiency.

CBCT Systems Market Executive Summary

The global CBCT Systems Market is characterized by robust competitive intensity and significant technological innovation, focusing heavily on enhancing image quality while simultaneously reducing radiation exposure and scan times. Current business trends indicate a strong move toward consolidated systems that integrate multiple diagnostic functions, such as panoramic and cephalometric capabilities alongside CBCT, providing a versatile and cost-effective solution for dental practices. Strategic partnerships and mergers among leading device manufacturers and software providers are common, aimed at developing integrated digital dentistry platforms that connect imaging data directly with treatment planning and prosthetic fabrication workflows. Furthermore, pricing pressures in established markets are compelling manufacturers to focus on mid-range, highly efficient systems designed for the general dental practitioner, rather than exclusively high-end specialized units.

Regional trends reveal that North America and Europe remain the dominant revenue contributors, driven by high disposable incomes, established healthcare infrastructure, and early adoption of advanced dental technologies. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, spurred by increasing investment in healthcare infrastructure, rapidly expanding dental tourism, and a burgeoning middle-class population demanding sophisticated cosmetic and restorative dentistry services. Governments in countries like China, India, and South Korea are actively promoting oral health initiatives, which indirectly boosts the demand for advanced diagnostic equipment. Latin America and the Middle East & Africa (MEA) are emerging as significant secondary markets due to increasing awareness and improvements in local dental training and clinic modernization efforts.

Segmentation trends indicate that the market for high Field of View (FOV) systems remains critical for oral and maxillofacial surgeons, while the low to medium FOV segment is experiencing mass adoption among general dentists and endodontists due to its localized accuracy and radiation control. In terms of application, implantology continues to be the largest revenue generator, but the adoption of CBCT for orthodontic treatment planning and airway analysis is witnessing accelerated growth. The preference for standalone CBCT units is gradually being challenged by the increasing popularity of integrated systems that offer streamlined functionality and space efficiency within smaller clinic settings, reflecting a holistic digital approach to patient care.

AI Impact Analysis on CBCT Systems Market

User queries regarding the impact of Artificial Intelligence (AI) on the CBCT Systems Market frequently revolve around improved diagnostic accuracy, workflow automation, and the future role of the radiologist or dental practitioner. Users are primarily concerned with how AI can enhance image processing and reconstruction quality, reduce the subjective variability in diagnostic interpretation, and automatically segment complex anatomical structures such as nerve canals, sinuses, and dental roots. Expectations are high concerning AI's capability to screen large datasets for subtle pathologies, predict treatment outcomes, and optimize radiation parameters autonomously, leading to personalized imaging protocols.

AI is fundamentally transforming the operational efficiency and clinical utility of CBCT systems by integrating sophisticated algorithms for image enhancement and noise reduction, which is crucial for low-dose protocols. AI algorithms are now deployed for automatic registration of pre- and post-operative scans, allowing for precise comparison and monitoring of treatment progress without manual intervention. Furthermore, the technology is moving beyond simple detection; advanced machine learning models are being developed to quantify bone density, assess periodontal disease progression, and assist in airway measurement for sleep apnea analysis, thereby expanding the diagnostic spectrum of CBCT from purely anatomical imaging to functional assessment.

The long-term influence of AI on the CBCT market involves enabling predictive maintenance and remote diagnostics for the hardware itself, optimizing machine performance and minimizing downtime. For clinicians, AI acts as an invaluable decision support system, flagging potential issues in complex cases (e.g., proximity of dental implants to critical nerve pathways) and streamlining the entire workflow from acquisition to final report generation. This integration of cognitive computing into imaging hardware enhances the value proposition of modern CBCT units, positioning them as intelligent diagnostic tools essential for high-quality, efficient digital healthcare delivery.

- Automated segmentation of anatomical structures (nerves, teeth, bone).

- Enhanced image noise reduction and artifact suppression for superior clarity.

- Optimized low-dose protocols through intelligent exposure control.

- AI-driven diagnostic assistance and pathology detection support.

- Predictive treatment planning and outcome forecasting in implantology and orthodontics.

- Streamlined workflow automation in report generation and measurement extraction.

DRO & Impact Forces Of CBCT Systems Market

The market for CBCT systems is substantially driven by the rising demand for sophisticated 3D imaging in dental specialty procedures, particularly implant placement and complex endodontic treatments, where high anatomical accuracy is paramount. Technological innovation, specifically the introduction of multi-FOV systems and integration with digital dentistry workflows (CAD/CAM, 3D printing), acts as a primary catalyst, enabling practitioners to deliver highly personalized and precise patient care. These market drivers are strongly supported by global shifts toward cosmetic dentistry and preventive health screening, where CBCT provides foundational diagnostic data necessary for modern treatment protocols. The increasing adoption rate in emerging economies, driven by improving healthcare expenditure and infrastructure development, further amplifies market expansion potential, creating significant demand forces.

However, the market faces notable restraints, chiefly the substantial initial cost associated with acquiring CBCT equipment, which presents a significant barrier to entry, particularly for smaller private dental practices and clinics in low-resource settings. Furthermore, concerns regarding radiation exposure, although significantly lower than traditional CT, still necessitate rigorous adherence to safety protocols (ALARA principle), which can sometimes deter general practitioners. Reimbursement policies for advanced imaging procedures vary widely across different geographical regions and insurance providers, creating financial uncertainty for patients and limiting the consistent adoption of CBCT technology as a primary diagnostic tool.

Significant opportunities exist in the expansion of CBCT applications beyond traditional dental use into niche areas such as otolaryngology (sinus and ear pathology), musculoskeletal imaging of extremities, and forensic analysis. The development of portable or handheld CBCT units could revolutionize primary care settings and expand access in remote areas, opening up entirely new customer segments. Investment in R&D focusing on ultra-low dose imaging and the integration of functional imaging capabilities (e.g., flow dynamics) alongside anatomical structure will define the competitive landscape and unlock lucrative future growth avenues, capitalizing on the broader push for comprehensive digital diagnostic solutions.

Segmentation Analysis

The CBCT Systems Market is strategically segmented based on several critical dimensions, including product type, field of view (FOV), application, and end-user. This segmentation helps in targeting specific clinical needs and understanding varied purchasing behaviors across different healthcare settings. Product type segmentation typically differentiates between high-end standalone dedicated CBCT units and integrated panoramic/cephalometric systems, reflecting the varied needs of specialized surgical centers versus general dental clinics. The choice between these systems often depends on space constraints, budget, and the primary scope of clinical practice, with integrated units gaining traction due to their multipurpose utility and efficiency.

The Field of View (FOV) segmentation is arguably the most clinically relevant parameter, dividing the market into small, medium, and large FOV systems. Small FOV units are optimized for highly focused procedures like endodontics and single implant planning, offering the lowest possible radiation dose. Medium FOV systems balance diagnostic breadth and dose reduction, making them ideal for multi-quadrant evaluations and surgical guidance. Large FOV systems are essential for comprehensive maxillofacial surgery, TMJ analysis, and airway studies, capturing the entire craniofacial region. This granular distinction allows manufacturers to develop systems precisely tailored to the diagnostic requirements of specialty practitioners.

In terms of application, dental implantology consistently holds the dominant market share due to the necessity of accurate 3D bone volume assessment prior to surgery. However, orthodontics and endodontics are witnessing exponential growth, fueled by the superior precision CBCT offers over traditional 2D images in root canal morphology assessment and malocclusion planning. End-user segmentation highlights that Dental Hospitals and Academic & Research Institutes are major purchasers of high-throughput, advanced systems, while Dental Clinics, particularly large DSOs (Dental Support Organizations), are increasingly adopting medium FOV units to standardize advanced diagnostic protocols across their networks, driving volume growth.

- By Product Type:

- Standalone CBCT Systems

- Integrated CBCT Systems (Combined with Panoramic/Cephalometric)

- By Field of View (FOV):

- Small Field of View (FOV)

- Medium Field of View (FOV)

- Large Field of View (FOV)

- By Application:

- Dental Implantology

- Orthodontics

- Endodontics

- Oral & Maxillofacial Surgery

- Periodontics and General Dentistry

- By End User:

- Dental Hospitals and Academic Institutions

- Dental Clinics (Individual and Group Practices)

- Ambulatory Surgical Centers

Value Chain Analysis For CBCT Systems Market

The value chain for the CBCT Systems Market begins with upstream activities focused on the procurement and manufacturing of specialized components, including high-frequency X-ray sources, flat-panel detectors (FPDs), gantry systems, and advanced proprietary reconstruction software. Key upstream suppliers include providers of high-precision mechanics and specialized sensor technology, which are critical determinants of image quality and equipment reliability. Research and Development (R&D) activities at this stage are heavily focused on material science to improve detector efficiency and computational algorithms to reduce image acquisition time and dose. Maintaining strict quality control over complex hardware and proprietary software licensing agreements are vital components of upstream market positioning.

Midstream activities involve the primary manufacturing, assembly, and integration of the complex hardware and software components into the final CBCT system. This phase requires highly specialized engineering expertise and compliance with rigorous medical device regulations (e.g., FDA, CE mark). Marketing, professional education, and clinical trials form a crucial part of the midstream value chain, ensuring that the devices are effectively positioned to meet clinical needs and that practitioners are adequately trained on their advanced capabilities. Manufacturers often invest heavily in clinical training centers and educational partnerships to drive product adoption and ensure optimal utilization.

Downstream activities center around distribution, installation, post-sales service, and ongoing technical support, which are critical differentiators in this market. Distribution channels are typically a mix of direct sales forces (especially for high-volume, established markets or high-value contracts with hospitals) and indirect distribution networks through certified regional dealers and third-party medical equipment suppliers. Since CBCT systems require highly specialized installation and calibration, robust post-sales support and maintenance contracts are integral revenue streams. The efficiency of the distribution network, combined with prompt technical servicing, significantly influences customer satisfaction and repeat purchasing decisions, especially in geographically dispersed markets.

CBCT Systems Market Potential Customers

The primary end-users and potential buyers of CBCT systems are predominantly specialized dental practitioners and institutions seeking highly accurate volumetric data for complex surgical and restorative procedures. Dental clinics, ranging from single-chair private practices to large multi-specialty group practices, form the largest volume customer segment. Within these clinics, specialists such as oral and maxillofacial surgeons, implantologists, endodontists, and orthodontists are the core purchasers, utilizing the technology for precise treatment planning, bone grafting assessment, nerve canal mapping, and orthodontic movement simulations. Their purchasing decisions are heavily influenced by image resolution, FOV flexibility, and the system’s seamless integration capability with existing digital platforms.

Another significant customer segment includes large Dental Hospitals and Academic & Research Institutions. These entities often require top-tier, large-FOV CBCT systems suitable for complex trauma cases, advanced surgical procedures, resident training, and clinical research. These buyers prioritize systems offering research capabilities, superior image processing speeds, and robust archival and networking features that comply with institutional IT standards. The purchasing cycle for these large institutions is typically longer, involving detailed technical specifications and competitive procurement processes, focusing on long-term service agreements and total cost of ownership (TCO).

Emerging potential customers are Ambulatory Surgical Centers (ASCs) specializing in outpatient procedures, and general practitioners (GPs) who are increasingly adopting small-FOV systems for initial diagnostics and standard implant cases, recognizing the medicolegal and clinical benefits of 3D verification. Furthermore, forensic science departments and veterinary medical centers represent niche but growing customer bases, leveraging CBCT's non-destructive, high-resolution imaging capabilities for non-dental applications such as small bone pathology assessment and specimen analysis. Manufacturers must tailor financing options and system complexity to address the varied budgetary and technical needs of these diverse end-user profiles.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $785.4 Million |

| Market Forecast in 2033 | $1,570.8 Million |

| Growth Rate | CAGR 10.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Danaher Corporation (KaVo), Dentsply Sirona, Carestream Dental, Vatech Co., Ltd., Morita Corporation, Planmeca Oy, 3Shape A/S, Acteon Group, J. Morita USA, FONA Dental s.r.o., Yoshida Dental Mfg. Co., Ltd., Asahi Roentgen Ind. Co., Ltd., Midmark Corporation, 3D Systems Corporation, Gendex Dental Systems, Sirona Dental Systems, Owandy Radiology, Curve Beam LLC, PreXion Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

CBCT Systems Market Key Technology Landscape

The technology landscape of the CBCT Systems Market is defined by continuous innovation focused primarily on enhancing image acquisition and processing efficiencies while minimizing patient exposure. A core technological advancement involves the shift toward more sophisticated flat-panel detectors (FPDs), replacing older image intensifiers. These FPDs offer superior dynamic range, higher quantum efficiency, and provide the foundational input necessary for ultra-high-resolution imaging with reduced radiation dose. Furthermore, advanced iterative reconstruction algorithms, often leveraging graphics processing unit (GPU) acceleration, are critical for rapidly converting raw cone beam data into high-fidelity 3D volumes while effectively mitigating artifacts, especially those caused by metal restorations (e.g., scatter reduction technology).

Another major trend is the integration of proprietary software platforms that extend the utility of the raw CBCT data far beyond basic visualization. Modern CBCT units are delivered with comprehensive treatment planning software packages that enable guided surgical template design (integrating CAD/CAM), virtual implant placement, orthodontic movement simulations, and precise cephalometric analysis. This software integration facilitates a closed-loop digital workflow, connecting diagnostics directly to the manufacturing of prosthetics and surgical guides, which is paramount for promoting efficiency in the modern dental practice. Interoperability standards (like DICOM) are non-negotiable, ensuring seamless data transfer between the CBCT unit, intraoral scanners, and practice management software.

Emerging technologies, specifically related to AI and machine learning, are rapidly becoming standard features in high-end CBCT systems. These AI tools are used to automate the crucial tasks of segmentation (delineating critical structures like the inferior alveolar nerve), noise suppression, and automatic image alignment. Future technological progress is expected to focus on dynamic CBCT, allowing for real-time, low-dose visualization of joint movement (e.g., TMJ kinematics) and potentially functional assessments, moving the technology closer to truly dynamic volumetric imaging. The ongoing miniaturization of components also promises the future feasibility of compact, mobile units suitable for diverse clinical environments.

Regional Highlights

Geographically, the CBCT Systems Market exhibits distinct consumption and growth patterns influenced by healthcare expenditure, regulatory frameworks, and adoption rates of digital dentistry. North America remains a highly lucrative market segment, dominating revenue share primarily due to the high density of dental specialists, early and widespread adoption of advanced imaging technologies, and favorable reimbursement structures for complex procedures like implantology. The United States, in particular, drives significant market activity through large Dental Support Organizations (DSOs) and a robust private practice segment continually upgrading equipment to maintain a competitive edge and optimize patient care standards.

Europe represents another mature market, characterized by stringent regulatory standards for medical devices and patient safety, which drives demand for systems offering ultra-low dose imaging and superior image quality (AEO/GEO focus: European compliance, advanced diagnostics). Western European countries (Germany, France, UK) show high penetration, driven by government focus on oral health and the integration of CBCT data into national health records. However, the Asia Pacific (APAC) region is forecasted to register the fastest CAGR over the forecast period. This acceleration is fueled by rising dental tourism, massive infrastructure investment in healthcare across populous countries like China and India, and the increasing affordability of mid-range CBCT systems, making them accessible to a rapidly expanding base of newly trained dentists and specialty clinics.

Latin America (LATAM) and the Middle East & Africa (MEA) are defined as high-potential emerging markets. LATAM growth is supported by a growing affluent population seeking cosmetic dental treatments and local investments in specialized dental training centers. The MEA region is witnessing infrastructure modernization, particularly in the Gulf Cooperation Council (GCC) countries, where healthcare budgets are substantial. These regions present key opportunities for market penetration through strategic partnerships with local distributors and the provision of targeted educational resources focused on the clinical benefits of 3D imaging over conventional methods, thus gradually overcoming initial cost barriers.

- North America: Dominance in revenue share due to advanced infrastructure, high adoption rates in DSOs, and extensive clinical application across specialties.

- Europe: High demand driven by strict regulatory emphasis on low radiation dose and high standards in surgical planning; mature market penetration.

- Asia Pacific (APAC): Highest projected CAGR, fueled by rapid expansion of dental clinics, rising medical tourism, and increasing government investment in public health systems.

- Latin America (LATAM): Emerging market characterized by increasing demand for aesthetic dentistry and modernization of private dental clinics.

- Middle East and Africa (MEA): Growth stimulated by significant healthcare infrastructure projects and high per capita expenditure on specialized medical services in oil-rich economies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the CBCT Systems Market.- Danaher Corporation (KaVo Imaging)

- Dentsply Sirona

- Carestream Dental LLC

- Vatech Co., Ltd.

- Morita Corporation

- Planmeca Oy

- 3Shape A/S

- Acteon Group

- J. Morita USA Inc.

- FONA Dental s.r.o.

- Yoshida Dental Mfg. Co., Ltd.

- Asahi Roentgen Ind. Co., Ltd.

- Midmark Corporation

- 3D Systems Corporation

- Gendex Dental Systems

- Sirona Dental Systems

- Owandy Radiology

- Curve Beam LLC

- PreXion Inc.

Frequently Asked Questions

Analyze common user questions about the CBCT Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key differences between CBCT systems and traditional medical CT scanners?

CBCT systems utilize a cone-shaped X-ray beam, resulting in significantly lower radiation exposure and higher spatial resolution optimized for bone and dental structures, whereas medical CT uses a fan beam and is optimized for soft tissue contrast and whole-body imaging. CBCT offers quicker scan times and compact size, making it suitable for clinical environments.

Which Field of View (FOV) segment holds the largest market share and why is this significant?

The Medium Field of View (FOV) segment typically holds a substantial market share. This is significant because medium FOV systems offer the best balance between diagnostic coverage (covering multiple quadrants for implant planning) and patient radiation dose minimization, making them the preferred choice for general dental specialists and mid-sized clinics.

How is Artificial Intelligence (AI) enhancing the functionality of modern CBCT systems?

AI is primarily used to enhance image quality through advanced noise and artifact reduction, automate the tedious tasks of anatomical segmentation (like nerve paths and tooth roots), and provide decision support for diagnostic analysis, thereby improving clinical workflow efficiency and diagnostic consistency across varied clinical settings.

What is the primary driving factor for the rapid growth of the CBCT market in the Asia Pacific (APAC) region?

The primary driver in APAC is the rapid modernization and expansion of dental healthcare infrastructure, coupled with increasing disposable income leading to higher demand for aesthetic and implant-based dental procedures. Government initiatives supporting dental health and medical tourism also contribute significantly to adoption.

What challenges related to radiation dose remain despite CBCT's low exposure profile?

Despite having a much lower dose than conventional CT, residual concerns mandate strict adherence to the ALARA (As Low As Reasonably Achievable) principle. Clinicians must continuously justify the use of 3D imaging, limiting its application to situations where 2D radiography is definitively insufficient for accurate diagnosis and treatment planning.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager