CBN Wheels Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431568 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

CBN Wheels Market Size

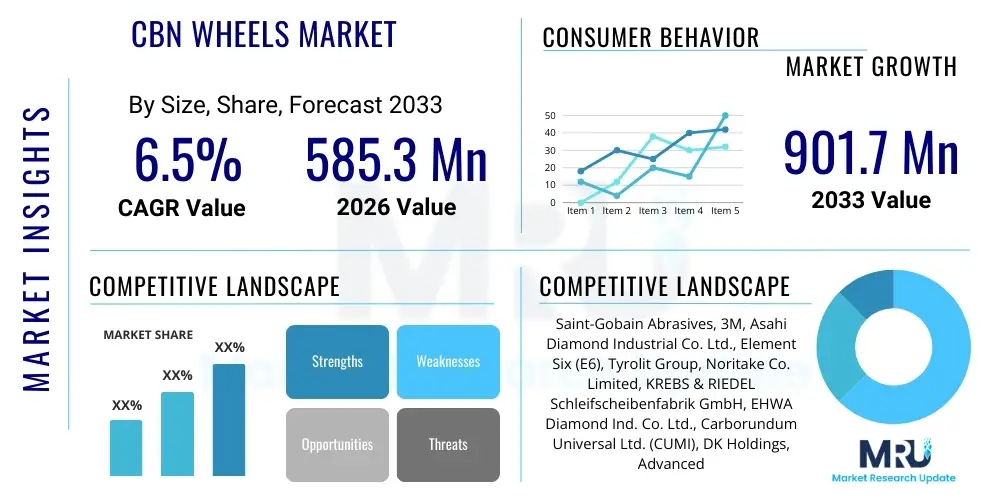

The CBN Wheels Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 585.3 Million in 2026 and is projected to reach USD 901.7 Million by the end of the forecast period in 2033.

CBN Wheels Market introduction

The Cubic Boron Nitride (CBN) Wheels Market encompasses the manufacturing, distribution, and utilization of grinding wheels that employ CBN, a superabrasive material second only to diamond in hardness, primarily for the precision grinding of ferrous metals, high-speed steels, and specialized alloys. These wheels are critical components in modern high-precision manufacturing processes, particularly where thermal stability, rapid material removal, and superior surface finish are non-negotiable requirements. The inherent thermal and chemical resistance of CBN, especially when grinding steel, positions it as the material of choice over traditional abrasives like aluminum oxide and silicon carbide, leading to significant productivity gains and reduced downtime in industrial operations.

The primary applications driving the demand for CBN wheels span several high-growth industries, most notably automotive manufacturing (engine components, transmission parts), aerospace (turbine blades, landing gear), tool and die making (precision molds, cutting tool resharpening), and bearing manufacturing. The product portfolio includes various bonding systems—vitrified, resin, electroplated, and metal bonds—each tailored to specific grinding tasks, such as internal diameter (ID) grinding, external diameter (OD) grinding, surface grinding, and creep feed grinding. The shift towards hard machining and electric vehicle (EV) component production, which utilizes advanced, hard-to-machine alloys, further accelerates the adoption of these high-performance superabrasives.

Key benefits derived from using CBN wheels include substantially longer wheel life, reduced cycle times due to higher grinding speeds, and minimal thermal damage to the workpiece, ensuring integrity and high dimensional accuracy. Driving factors fueling market growth include stringent quality standards across the aerospace and medical device sectors, the increasing complexity of materials used in automotive powertrains, and ongoing global investment in advanced computer numerical control (CNC) grinding machines that are optimally designed to utilize the high-speed capabilities of CBN abrasives. Furthermore, the focus on automation and efficiency in manufacturing facilities globally necessitates the adoption of tools that guarantee consistent, repeatable performance over extended periods.

CBN Wheels Market Executive Summary

The CBN Wheels Market is characterized by robust growth, driven primarily by the escalating demand for precision components across the global automotive, aerospace, and general engineering sectors. Current business trends indicate a strong move toward advanced vitrified and hybrid bond systems, which offer superior porosity control and coolant delivery, thereby maximizing the grinding efficiency of the CBN grain. Manufacturers are focusing heavily on developing application-specific wheels, integrating smart sensors for predictive wear monitoring, and optimizing wheel profiles for specialized hard turning and grinding operations, positioning CBN as an indispensable technology for achieving Industry 4.0 manufacturing standards globally.

Regional trends highlight the Asia Pacific (APAC) region, particularly China and India, as the fastest-growing markets, propelled by massive capital expenditure in domestic automotive production and state-led initiatives promoting advanced manufacturing. North America and Europe remain mature, high-value markets, emphasizing replacement cycles, technological upgrades, and the precision requirements of the aerospace and medical industries. The shift towards lightweight materials and complex geometries in these regions necessitates continuous innovation in CBN wheel specifications to maintain material integrity during demanding finishing operations. Latin America and the Middle East and Africa (MEA) are emerging, primarily driven by expanding infrastructure projects and localized oil and gas equipment maintenance needs.

Segmentation trends reveal that the vitrified bond segment holds the largest market share due to its rigidity, high-speed capability, and ease of truing and dressing, making it ideal for high-volume, precision production grinding. However, the electroplated segment is witnessing significant traction in niche applications requiring complex shapes or high grain exposure, such such as aerospace component repair and specialized tool fabrication. End-user analysis shows that the automotive sector is the dominant application, closely followed by the tool and die industry, which relies on CBN wheels for maintaining the sharpness and accuracy of cutting tools used in mass production.

AI Impact Analysis on CBN Wheels Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the CBN Wheels Market predominantly revolve around optimizing grinding parameters, predictive maintenance for superabrasive tooling, and enhancing wheel design through simulation. Users are keenly interested in how AI can minimize expensive wheel wear, reduce scrap rates associated with thermal damage, and automate the complex process of wheel truing and dressing. Key concerns often focus on the required data infrastructure and the integration complexity of AI algorithms with existing CNC grinding machine controls. Expectations center on achieving unprecedented levels of manufacturing consistency, extending tool life significantly, and moving toward fully autonomous grinding cells where quality adjustments are made in real-time based on sensor fusion data.

The adoption of AI-driven optimization represents a significant evolution in the utilization of CBN wheels. AI algorithms, leveraging data collected from acoustic emission sensors, power consumption monitors, and spindle vibration analysts, can instantaneously adjust feed rates, wheel speed, and coolant flow to maintain optimal grinding conditions. This is particularly crucial for CBN wheels, where overheating can lead to catastrophic failure or workpiece damage. Furthermore, machine learning models are being developed to predict the remaining useful life (RUL) of the CBN wheel, scheduling mandatory replacement or conditioning before quality degradation occurs, thereby ensuring zero-defect manufacturing and maximizing the utilization of this expensive tooling.

This integration fundamentally transforms the market by shifting the value proposition from the physical wheel itself to the accompanying digital services and optimized process protocols. CBN wheel manufacturers are increasingly collaborating with machine tool builders to offer integrated AI-powered solutions, enhancing the efficiency and sustainability of hard material grinding operations. The ability of AI to analyze microscopic variations in workpiece material and instantly compensate through machine adjustments ensures that the superior performance capability of CBN abrasives is consistently achieved, even in highly demanding or variable production environments.

- AI-driven optimization of grinding cycles minimizes thermal damage and maximizes material removal rates.

- Predictive maintenance using machine learning algorithms forecasts wheel wear, reducing unexpected downtime.

- Enhanced CBN wheel design via generative AI models that simulate stress distribution and grain placement.

- Automated truing and dressing processes calibrated in real-time by AI to maintain optimal wheel geometry.

- Integration of sensor data (vibration, acoustics) with CNC systems for closed-loop quality control during grinding.

DRO & Impact Forces Of CBN Wheels Market

The CBN Wheels Market is fundamentally shaped by robust drivers, specific restraints, attractive opportunities, and compelling impact forces that influence its trajectory over the forecast period. The primary drivers include the escalating demand for high-precision components in the automotive and aerospace industries, fueled by the development of complex, hard-to-machine alloys required for weight reduction and increased performance. Furthermore, the global expansion of machine tool manufacturing and the subsequent need for high-quality tool and cutter grinding continuously pushes the demand for CBN abrasives, which offer superior performance and efficiency compared to conventional materials.

However, the market faces significant restraints, chiefly the exceptionally high initial cost of CBN wheels compared to traditional aluminum oxide or silicon carbide wheels. This initial capital expenditure can deter small and medium-sized enterprises (SMEs) from adoption, despite the proven long-term cost-effectiveness. Additionally, the complex technical expertise required for the optimal operation, truing, and dressing of CBN wheels, particularly those utilizing advanced vitrified bonds, presents a barrier to entry in regions with limited skilled labor. Supply chain complexities related to the procurement of high-purity Boron Nitride and the specialized manufacturing processes further contribute to market rigidity.

Opportunities for growth are substantial, particularly in the emerging field of electric vehicle (EV) manufacturing, where CBN wheels are critical for grinding high-precision gears, shafts, and motor components made from challenging materials. The growing medical device sector, requiring extremely tight tolerances and flawless surface finishes on surgical tools and implants, also presents a lucrative niche. Furthermore, advancements in hybrid bond technology, combining the benefits of vitrified and resin systems, are opening new application areas previously dominated by conventional abrasives. The critical impact forces include stringent regulatory standards (especially in aerospace safety) demanding zero defects, and the relentless pressure from manufacturers globally to reduce cycle times and energy consumption, which only high-efficiency superabrasives like CBN can effectively address.

Segmentation Analysis

The CBN Wheels Market is comprehensively segmented based on bond type, grain size, application, and end-user industry, providing manufacturers and stakeholders with targeted insights into market dynamics. The segmentation by bond type—vitrified, resin, metal, and electroplated—is crucial as the bond determines the wheel's performance characteristics, including rigidity, maximum speed, coolant retention, and ease of dressing. Vitrified bond CBN wheels dominate due to their optimal balance of porosity, high material removal rates, and superior thermal stability suitable for high-production grinding environments prevalent in the automotive sector.

Segmentation by application differentiates between internal grinding, external grinding, surface grinding, and tool & cutter grinding, reflecting the diverse geometry and requirements of the workpieces. External cylindrical grinding, often used for manufacturing engine shafts and bearing races, constitutes a major revenue stream. Concurrently, the end-user segmentation—Automotive, Aerospace, Tool & Die, Bearings, and Others—highlights the vertical dependency of the market. The automotive industry remains the cornerstone of demand, requiring CBN wheels for precision finishing of critical powertrain and chassis components necessary for reliability and efficiency.

- By Bond Type:

- Vitrified Bond

- Resin Bond

- Metal Bond

- Electroplated Bond

- By Grain Size:

- Coarse Grain

- Medium Grain

- Fine Grain

- By Application:

- Internal Diameter (ID) Grinding

- External Diameter (OD) Grinding

- Surface Grinding

- Tool and Cutter Grinding

- Creep Feed Grinding

- By End-User Industry:

- Automotive

- Aerospace and Defense

- Tool and Die

- Bearing Industry

- General Engineering

Value Chain Analysis For CBN Wheels Market

The value chain for the CBN Wheels Market commences with the upstream extraction and refinement of raw materials, primarily focusing on high-purity Boron and Nitrogen precursors necessary for synthesizing Cubic Boron Nitride powder under extreme high-pressure, high-temperature (HPHT) conditions. This critical synthesis phase is capital-intensive and concentrated among a limited number of specialized superabrasive manufacturers globally, representing the highest value addition stage in the chain. Other crucial upstream inputs include various bonding materials such as specialized ceramics (for vitrified bonds), phenolic resins, metal powders, and nickel/copper used in electroplating processes, alongside the manufacturing of high-precision wheel cores (e.g., steel or aluminum).

The midstream phase involves the CBN wheel manufacturing process itself, encompassing mixing the CBN grains with the specific bond material, molding, sintering or curing (depending on the bond type), balancing, and precision truing. Manufacturers often specialize in certain bond types or wheel geometries. Distribution channels are varied but rely heavily on specialized technical distributors and direct sales teams. For complex, high-value applications like aerospace component grinding, direct sales by the manufacturer are preferred to ensure tailored product specifications, technical support, and process optimization consulting.

Downstream analysis focuses on the end-user adoption and integration of CBN wheels into advanced CNC grinding machines. Direct channels are prevalent for large volume OEM users (e.g., major automotive manufacturers) who require continuous supply and customized solutions. Indirect channels utilize specialized industrial supply houses and distributors who offer localized technical support, inventory management, and application training to smaller job shops and general engineering firms. The ultimate value delivery is realized at the end-user level through reduced operating costs, increased productivity, and the achievement of stringent quality requirements for finished components, ensuring the integrity of critical parts like engine valves, camshafts, and turbine components.

CBN Wheels Market Potential Customers

The primary consumers and potential customers for CBN wheels are organizations heavily involved in the manufacturing or precision finishing of ferrous materials and specialized superalloys, demanding exceptional material removal rates and superior surface integrity. These end-users are typically characterized by high-volume production needs and investments in advanced multi-axis grinding equipment capable of harnessing the power and precision of superabrasives. The automotive sector, encompassing both traditional internal combustion engine (ICE) component suppliers and emerging electric vehicle (EV) component manufacturers, represents the largest customer base, using CBN wheels extensively for grinding crankshafts, transmission gears, injector components, and differential parts.

Another significant customer segment is the aerospace and defense industry, which utilizes CBN wheels for the intricate grinding of turbine blades, landing gear components, and specialized tooling made from heat-resistant superalloys (HRSAs). These applications require highly customized, often electroplated or metal-bonded CBN wheels, given the zero-tolerance policy for thermal damage or structural imperfections. Furthermore, the tool and die industry constitutes a core customer group, relying on these wheels for the critical production and resharpening of high-speed steel (HSS) and powder metal cutting tools, ensuring the efficiency and longevity of downstream machining operations.

The bearing industry, manufacturing high-precision balls, rollers, and races, is also a crucial consumer, demanding high-quality CBN wheels, predominantly vitrified, to achieve the micro-level surface finish necessary for minimizing friction and maximizing bearing life. Finally, the medical device sector, while smaller in volume, represents a high-value niche market, utilizing CBN wheels for grinding surgical instruments, orthopedic implants, and biocompatible alloys, where surface smoothness and dimensional accuracy are paramount regulatory requirements. These customers prioritize long-term performance, technical support, and certification compliance over initial procurement cost.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 585.3 Million |

| Market Forecast in 2033 | USD 901.7 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Saint-Gobain Abrasives, 3M, Asahi Diamond Industrial Co. Ltd., Element Six (E6), Tyrolit Group, Noritake Co. Limited, KREBS & RIEDEL Schleifscheibenfabrik GmbH, EHWA Diamond Ind. Co. Ltd., Carborundum Universal Ltd. (CUMI), DK Holdings, Advanced Superabrasives Inc. (ASI), Star Cutter Company, Lackmond Products, Precision Grinding Wheels, Mirka Ltd., SuperAbrasives, Inc., Winterthur Technology Group (Grinding Technology), Meister Abrasives, Cinoco Superabrasives, United Diamond Tools. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

CBN Wheels Market Key Technology Landscape

The technological landscape of the CBN Wheels Market is characterized by continuous innovation aimed at optimizing the three main components: the CBN abrasive grain, the bonding system, and the overall wheel architecture. A major focus area involves the synthesis of high-quality CBN crystals with improved thermal stability and fracture toughness, often achieved through specialized crystal growth techniques and surface treatments that enhance adhesion to the bonding matrix. Furthermore, manufacturers are increasingly using advanced powder metallurgy and ceramic processing techniques to create highly porous and uniform vitrified bonds. This porosity is critical for effective coolant penetration directly to the grinding zone, minimizing thermal stress on the workpiece and extending wheel life, thereby unlocking the full potential of high-speed CBN grinding.

Hybrid bond technologies represent a significant technological shift, combining the toughness and free-cutting capability of resin bonds with the rigidity and wear resistance of vitrified or metal bonds. These hybrid systems are gaining traction in demanding applications that require both high material removal rates and superior surface finish in a single pass. Furthermore, advancements in electroplated CBN wheels focus on developing thinner, more consistent nickel coatings and complex geometries, allowing for highly accurate form grinding used extensively in tool and die refurbishment. Digital integration is also paramount; technologies like real-time balancing, acoustic emission monitoring, and thermal imaging are embedded within grinding machines, providing feedback that enables adaptive process control when using CBN wheels.

The design and manufacturing processes for the wheel core are also evolving, with lightweight materials such as carbon fiber and advanced aluminum alloys being utilized to reduce inertial forces, allowing for much higher rotational speeds required for effective CBN utilization. Specialized computer-aided engineering (CAE) tools and finite element analysis (FEA) are employed during the design phase to predict mechanical and thermal stress distributions within the wheel structure, ensuring optimal performance and safety under extreme operational conditions. This continuous refinement across material science, bond chemistry, and integrated monitoring systems underscores the highly technical nature of the CBN wheels market, driving the efficiency gains sought by end-user industries.

Regional Highlights

- North America: This region is a mature market characterized by high demand for precision engineering, particularly from the aerospace and defense sectors, alongside a robust automotive manufacturing base that includes significant electric vehicle (EV) production. The U.S. remains the largest consumer, driven by stringent quality requirements for jet engine components, medical implants, and high-performance tooling. Investment in automated grinding solutions and high-end CNC equipment is consistent, favoring CBN wheels due to their superior efficiency and ability to achieve tight tolerances on specialized alloys.

- Europe: Europe represents a technologically advanced market with strong leadership in the automotive (Germany, Italy, France) and industrial machinery sectors. The region's focus on precision engineering, coupled with strict environmental and efficiency regulations, drives the adoption of energy-efficient CBN grinding processes over conventional methods. Central and Eastern European countries are seeing growth due to expanding industrialization and foreign direct investment in manufacturing facilities, particularly those producing bearings and gears, maintaining Europe as a key revenue generator for high-value CBN products.

- Asia Pacific (APAC): APAC is the fastest-growing region globally, fueled by massive industrial expansion, urbanization, and burgeoning domestic manufacturing capacities, especially in China, Japan, South Korea, and India. China dominates the regional market, driven by its expansive automotive supply chain and significant investment in aerospace and general engineering machinery production. The demand here is dual-layered, covering both high-volume standardized components (requiring resin and vitrified bonds) and specialized, high-precision tooling (requiring electroplated and metal bonds), positioning APAC as the primary engine of future volume growth.

- Latin America: This region shows stable growth, heavily reliant on the automotive manufacturing hubs in countries like Brazil and Mexico. Demand for CBN wheels is primarily driven by replacement tooling needs, maintenance operations, and localized production of engine and transmission components for regional markets. While overall adoption rates are lower than in APAC or North America, infrastructure improvements and increasing foreign investment in localized manufacturing are gradually raising the demand for efficient superabrasive solutions to enhance quality and competitiveness.

- Middle East and Africa (MEA): MEA is an emerging market where CBN wheel demand is mainly concentrated in maintenance, repair, and overhaul (MRO) operations within the oil and gas sector (for refining equipment and drilling components) and, increasingly, in the nascent localized automotive assembly and defense industries. The growth trajectory is tied to diversification efforts away from oil economies, necessitating localized industrialization. Countries like Saudi Arabia and the UAE are showing increased uptake as they invest in large-scale infrastructure and advanced manufacturing capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the CBN Wheels Market.- Saint-Gobain Abrasives

- 3M

- Asahi Diamond Industrial Co. Ltd.

- Element Six (E6)

- Tyrolit Group

- Noritake Co. Limited

- KREBS & RIEDEL Schleifscheibenfabrik GmbH

- EHWA Diamond Ind. Co. Ltd.

- Carborundum Universal Ltd. (CUMI)

- DK Holdings

- Advanced Superabrasives Inc. (ASI)

- Star Cutter Company

- Lackmond Products

- Precision Grinding Wheels

- Mirka Ltd.

- SuperAbrasives, Inc.

- Winterthur Technology Group (Grinding Technology)

- Meister Abrasives

- Cinoco Superabrasives

- United Diamond Tools

Frequently Asked Questions

Analyze common user questions about the CBN Wheels market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between CBN wheels and conventional abrasive wheels?

CBN wheels use Cubic Boron Nitride, a superabrasive material that is extremely hard and thermally stable, making them ideal for grinding hard ferrous materials (steels and alloys) without causing excessive heat or chemical wear, resulting in faster material removal and significantly longer tool life compared to conventional aluminum oxide wheels.

Which bond type of CBN wheel is most popular in high-volume production applications?

The vitrified bond segment dominates high-volume production, particularly in the automotive industry, due to its rigidity, superior porosity for coolant delivery, and ease of truing and dressing, allowing for sustained high-precision grinding at aggressive rates.

How is the electric vehicle (EV) sector influencing the CBN Wheels Market demand?

The EV sector drives demand by requiring the precision grinding of new, complex components such as high-efficiency gears, motor shafts, and battery components often made from challenging materials, necessitating the superior performance and accuracy provided by CBN wheels.

What are the key technical challenges associated with adopting CBN grinding technology?

Key technical challenges include the high initial procurement cost of CBN tooling, the requirement for specialized high-rigidity CNC grinding machines, and the need for skilled operators proficient in the specific truing and dressing procedures required for optimal CBN wheel performance.

Which geographical region is projected to exhibit the highest growth rate for CBN wheels?

The Asia Pacific (APAC) region, specifically China and India, is projected to show the highest CAGR, driven by rapid industrialization, expansion of domestic automotive and aerospace manufacturing capabilities, and increased investment in advanced machinery.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager