CDNA Clone Vectors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437485 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

CDNA Clone Vectors Market Size

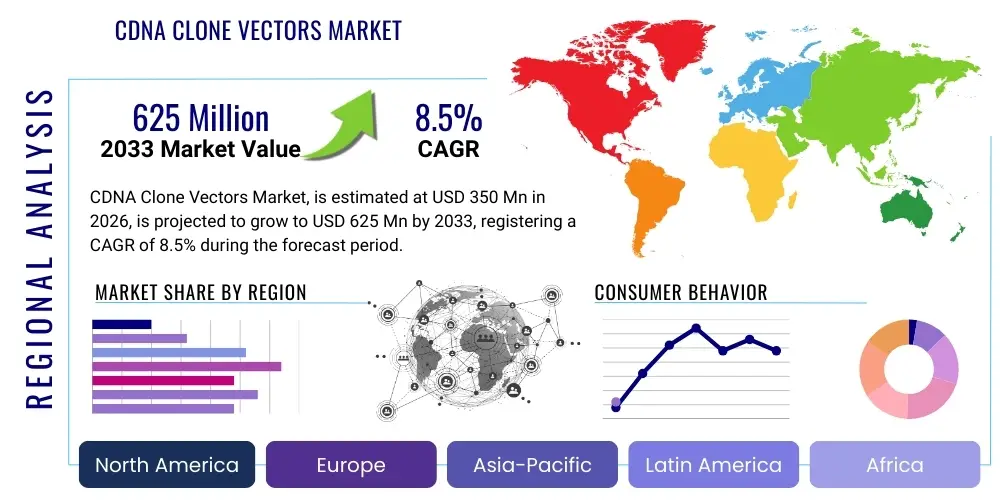

The CDNA Clone Vectors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 350 Million in 2026 and is projected to reach USD 625 Million by the end of the forecast period in 2033.

CDNA Clone Vectors Market introduction

The cDNA Clone Vectors Market encompasses the production, distribution, and utilization of specialized DNA molecules designed to carry complementary DNA (cDNA) fragments for replication, storage, and expression within host cells. These vectors are fundamental tools in molecular biology and biotechnology, serving as the backbone for genomic research, protein production, and genetic engineering. The market spans various vector types, including plasmids, bacteriophages, cosmids, and artificial chromosomes, each tailored for specific applications concerning insert size capacity and host compatibility. The primary objective of using cDNA vectors is to create stable and comprehensive libraries representing the transcribed genes of an organism or specific cell type, providing critical insights into gene function and regulation.

The essential applications of cDNA clone vectors are centered around functional genomics, drug discovery, and the development of biopharmaceuticals. In functional genomics, these tools enable researchers to study the expression patterns and biological roles of specific genes without the interference of introns, making them ideal for prokaryotic expression systems. Furthermore, in pharmaceutical development, they are crucial for producing recombinant proteins, such as therapeutic antibodies and hormones, in large quantities. The increasing prevalence of chronic diseases and the subsequent acceleration in research focused on gene therapy and molecular diagnostics significantly propel the demand for high-quality, reliable cDNA cloning systems.

The core benefits derived from utilizing these vectors include highly stable maintenance of genetic material, efficient gene transfer into target cells, and robust expression capabilities, often coupled with selectable markers for easy identification of successful clones. Key driving factors influencing market expansion include substantial investments in proteomics and genomics research across academic and governmental institutions, the escalating demand for personalized medicine approaches, and continuous technological advancements in cloning techniques, such as restriction-free and ligation-independent cloning (LIC), which enhance efficiency and throughput in laboratory settings.

CDNA Clone Vectors Market Executive Summary

The CDNA Clone Vectors market is characterized by robust growth driven primarily by surging global investments in biopharmaceutical R&D and the increasing adoption of functional genomics techniques. Business trends highlight a strong focus on developing expression-optimized vectors tailored for mammalian systems, particularly for therapeutic protein production and gene therapy applications. Strategic partnerships between academic research centers and biotechnology firms are accelerating the commercialization of novel cloning technologies, addressing the persistent need for higher efficiency, larger insert capacity, and enhanced regulatory control mechanisms in gene expression. The market is also seeing greater integration of high-throughput screening technologies, making vector-based assays faster and more scalable for drug target identification.

Regional trends indicate North America and Europe retaining dominant market shares due to established biotech infrastructure, significant government funding for life sciences research, and the presence of major industry players specializing in cloning and vector technologies. However, the Asia Pacific (APAC) region is poised for the highest growth rate, fueled by expanding clinical trial activities, rising healthcare expenditure, and the rapid development of pharmaceutical manufacturing capabilities in countries like China, India, and South Korea. This shift is attracting foreign direct investment (FDI) aimed at establishing regional production hubs and research collaborations, particularly in vaccine development, which heavily relies on vector systems.

In terms of segmentation, the expression vector segment is expected to maintain its leadership, reflecting the immense demand for synthesizing therapeutic proteins and large-scale vaccine components. Within the end-user vertical, pharmaceutical and biotechnology companies represent the largest consumer base, utilizing cDNA vectors extensively for drug discovery validation and biomanufacturing. Academic and research institutes, driven by grant funding and basic scientific exploration, form the secondary high-growth segment. Current segment trends emphasize the increasing demand for customized vector solutions that offer cell-specific promoters and inducible expression systems, mitigating toxicity risks and enhancing product yield in complex biological systems.

AI Impact Analysis on CDNA Clone Vectors Market

Users frequently inquire about how Artificial Intelligence (AI) can streamline the notoriously time-consuming and labor-intensive process of cDNA cloning and vector optimization. Common questions revolve around AI’s role in predicting vector stability, optimizing expression levels, and accelerating the design of novel, high-performance vectors tailored for specific cellular environments or therapeutic applications. Users express key concerns regarding the reliability of AI algorithms in handling complex biological data noise and the need for standardized data sets to train these predictive models accurately. Expectations are high that AI will drastically reduce experimental failure rates, rapidly iterate vector designs, and identify optimal host-vector combinations that maximize yield and therapeutic efficacy, thereby cutting R&D costs and accelerating the timeline for commercializing gene therapies and recombinant proteins.

AI is beginning to revolutionize the market by providing sophisticated computational tools that move beyond traditional, trial-and-error cloning approaches. Machine learning algorithms are now being employed to analyze vast genomic and proteomic data sets, predicting the optimal sequence elements, promoter strengths, and regulatory motifs necessary for desired gene expression profiles within specific host cells. This predictive capability minimizes the need for extensive physical screening of numerous vector constructs. For instance, AI can evaluate potential off-target effects or sequence incompatibilities before synthesis, ensuring a higher likelihood of successful cloning and functional expression in the first attempt, which is crucial for high-value applications like gene therapy manufacturing.

The impact of AI extends to improving the design parameters of complex vectors, such as viral vectors (though often used for genomic DNA, the optimization principles apply to cDNA delivery systems) and large capacity bacterial artificial chromosomes (BACs). By leveraging deep learning, researchers can model the entire lifecycle of the vector within the host, including transcription efficiency, mRNA stability, and translation fidelity. Furthermore, AI assists in automating the documentation and quality control processes associated with vector production, ensuring regulatory compliance and consistency across batches. This integration of computational power transforms vector development from an empirical discipline into a highly optimized, data-driven engineering process.

- AI-driven optimization of vector sequence elements for enhanced expression kinetics and stability.

- Machine learning algorithms predicting optimal promoter-enhancer combinations for cell-specific targeting.

- Accelerated identification of ideal host cell lines for maximal recombinant protein yield based on vector characteristics.

- Automation of experimental design and failure prediction in high-throughput cloning workflows.

- Computational modeling to assess immunogenicity and toxicity profiles of vector components pre-clinical testing.

DRO & Impact Forces Of CDNA Clone Vectors Market

The CDNA Clone Vectors market is significantly influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape its growth trajectory and competitive landscape. The market is primarily driven by the exponential growth in global genomics and proteomics research, coupled with the critical need for efficient tools in the burgeoning fields of personalized medicine and gene therapy. Restraints largely stem from the inherent technical complexities associated with cloning large or repetitive cDNA inserts, the high cost of advanced vector construction kits, and stringent regulatory frameworks governing gene therapy products, which demand meticulous quality control and validation of vector components. Conversely, substantial opportunities arise from the ongoing development of next-generation cloning technologies (e.g., synthetic biology tools), the expansion of biomanufacturing capabilities worldwide, and the increasing applicability of cDNA libraries in sophisticated disease modeling platforms, such as organoids and patient-derived xenografts (PDXs).

The key impact forces exerting pressure on the market include technological substitution threats from emerging, potentially vector-less gene editing technologies like CRISPR, the intense competitive rivalry among established life science tool providers, and the bargaining power of major biopharmaceutical companies who demand highly customized, large-scale vector production services. The bargaining power of suppliers remains moderate but is increasing due to the specialized nature of enzymes and reagents required for high-fidelity cloning. Furthermore, the economic force of increasing R&D expenditure in emerging economies acts as a powerful catalyst, widening the geographic scope of demand. Regulatory clarity and harmonization across major markets are also crucial impact forces, directly influencing the speed at which novel vector systems can transition from research tools to clinical products, particularly in the viral vector segment.

These forces necessitate that market players continually innovate, focusing on reducing turnaround times, improving vector reliability, and offering cost-effective, ready-to-use vector systems. The need to overcome restraints like insert size limitations drives investments into larger capacity vectors, while the opportunities presented by gene therapy mandate a pivot toward GMP-grade production capabilities. Success in this market is intrinsically tied to the ability of manufacturers to address both the basic research requirements for high-throughput cloning and the complex, regulatory-heavy demands of clinical and commercial biomanufacturing.

Segmentation Analysis

The CDNA Clone Vectors Market is comprehensively segmented based on product type, vector type, application, and end-user. This segmentation provides a granular view of market dynamics, revealing varying growth rates and demand drivers across different segments. The market relies heavily on the differentiation of product offerings, ranging from basic cloning kits to highly specialized expression systems designed for mammalian, bacterial, or yeast hosts. The continuous evolution in vector design, incorporating features like inducible promoters and fusion tags, directly influences the market share captured by specific product types. Application-based segmentation underscores the shift from fundamental research toward therapeutic and diagnostic applications, which command higher value and volume due to increasing demand in the biopharma sector.

Product Type segmentation includes cloning kits, specialized vectors (both expression and non-expression), and essential reagents and consumables. Vector type is critically segmented into plasmids, bacteriophages, viral vectors (primarily lentiviral and adeno-associated virus, though often used for genomic context, they are key delivery systems), and artificial chromosomes. The choice of vector is dictated by the desired insert size, the intended host organism, and the necessity for transient versus stable expression. While plasmids remain the staple workhorse for fundamental research, the therapeutic potential of viral vectors, particularly for gene delivery, drives their high-value contribution to the overall market.

Application analysis highlights gene expression studies, protein functional analysis, high-throughput screening, and therapeutic development as primary demand areas. The move towards personalized medicine is particularly boosting the therapeutic development segment. Finally, end-user segmentation clearly defines the primary consumers, placing pharmaceutical and biotechnology companies as the dominant category due to their expansive R&D pipelines and commercial biomanufacturing activities. This detailed analysis allows market players to strategically focus their development efforts and marketing outreach toward the fastest-growing and highest-value segments.

- By Product:

- Cloning Kits (e.g., TA Cloning Kits, TOPO Cloning Kits, Ligation Kits)

- Expression Vectors (Mammalian, Bacterial, Yeast, Insect)

- Non-Expression/Shuttle Vectors (e.g., Maintenance vectors)

- Reagents and Consumables (Enzymes, Buffers, Host Cells)

- By Vector Type:

- Plasmid Vectors (High-Copy, Low-Copy, Inducible)

- Bacteriophage Vectors (Lambda, M13)

- Viral Vectors (Lentivirus, Adenovirus, AAV)

- Artificial Chromosomes (BACs, YACs)

- By Application:

- Gene Function Analysis

- Therapeutic Protein Production

- Drug Discovery and Target Validation

- Gene Therapy and Vaccine Development

- High-Throughput Screening

- By End-User:

- Pharmaceutical and Biotechnology Companies

- Academic and Research Institutes

- Contract Research Organizations (CROs)

- Hospitals and Diagnostic Laboratories

Value Chain Analysis For CDNA Clone Vectors Market

The value chain for the cDNA Clone Vectors market initiates with upstream activities centered on the discovery, synthesis, and purification of foundational components. This includes the production of specialized restriction enzymes, high-fidelity DNA polymerases, and proprietary vector backbones, often developed through extensive internal R&D or licensed from academic institutions. Key upstream suppliers include providers of essential molecular biology reagents and synthetic DNA manufacturing services. Maintaining high quality and batch-to-batch consistency in these fundamental components is paramount, as any failure upstream directly impacts the efficiency and reliability of the final cloning product. Technological expertise in bioinformatics and synthetic biology drives innovation at this stage, focusing on designing novel vectors with improved features like reduced toxicity and enhanced expression profiles.

Midstream activities involve the core manufacturing and functional validation of the finished cDNA cloning kits and specialized vectors. This stage includes meticulous quality control (QC) testing for sterility, functionality, and performance across various host systems. Manufacturers assemble comprehensive kits, optimize protocols, and often provide custom vector design services to meet specific researcher requirements. The complexity of these activities demands specialized laboratory infrastructure and skilled personnel. Distribution channels then move the finished products downstream. Direct channels, typically utilized by large market leaders, involve selling directly to end-users (biopharma companies, major research centers) through proprietary e-commerce platforms and dedicated sales teams, allowing for greater control over pricing and technical support. Indirect channels involve partnerships with specialized distributors and regional agents, particularly crucial for accessing smaller labs and international markets, requiring robust inventory management and logistics capabilities.

The downstream segment is dominated by the end-users: academic researchers and biopharmaceutical firms who integrate these vectors into their ongoing studies, clinical trials, and manufacturing processes. For academic users, vectors are consumed in research projects, while biopharma companies utilize them for high-volume therapeutic production (e.g., vaccine intermediates or recombinant proteins). Technical support and training provided by the manufacturers become a critical value addition in the downstream segment, ensuring successful implementation of complex cloning protocols. The continuous feedback loop from these end-users is essential for driving future vector design improvements and addressing real-world application challenges, thus completing the cyclical nature of the market’s value chain.

CDNA Clone Vectors Market Potential Customers

The primary purchasers and users of cDNA clone vectors are categorized based on their scale of operations, research focus, and funding sources. The largest segment comprises Pharmaceutical and Biotechnology Companies, particularly those engaged in preclinical drug discovery, target validation, and the commercial-scale manufacturing of biologics. These companies require high-quality, scalable, and often GMP-compliant vector systems for producing recombinant proteins, monoclonal antibodies, and components for advanced therapies such as gene and cell therapies. Their buying decisions are heavily influenced by performance metrics like vector stability, expression yield, and ease of scalability.

Academic and Research Institutes form the second major customer base. These institutions utilize cDNA vectors extensively for fundamental molecular biology research, genetic studies, and exploring gene function. Procurement decisions here are often driven by grant availability, the need for cost-effective solutions, and the demand for a broad range of general-purpose cloning tools, making them frequent buyers of standard cloning kits and comprehensive vector libraries. Government-funded research programs significantly underpin the purchasing power of this segment, particularly in high-income regions like North America and Europe, focusing on basic science advancements.

A growing segment includes Contract Research Organizations (CROs) and Contract Development and Manufacturing Organizations (CDMOs). These organizations serve as intermediaries, providing outsourced R&D, preclinical testing, and manufacturing services to biotech and pharma clients. CROs and CDMOs require diverse and highly reliable vector systems to manage multiple client projects simultaneously, often needing both customized expression vectors and robust viral delivery systems. Their demand is highly correlated with the overall outsourcing trend within the pharmaceutical industry, positioning them as rapid adopters of new, high-efficiency cloning technologies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350 Million |

| Market Forecast in 2033 | USD 625 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thermo Fisher Scientific, Merck KGaA, Bio-Rad Laboratories, Takara Bio Inc., New England Biolabs (NEB), Promega Corporation, GenScript, QIAGEN N.V., OriGene Technologies, VectorBuilder Inc., Aldevron, CellGenix GmbH, Precision Bioscience, DNA2.0 (now part of Aldevron), System Biosciences (SBI), ABL Inc., Oxford Genetics (now part of WUXI Biologics), GeneCopoeia, Clontech (now Takara Bio), Zymo Research. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

CDNA Clone Vectors Market Key Technology Landscape

The technology landscape of the cDNA Clone Vectors Market is undergoing rapid transformation, moving beyond classical restriction enzyme-based cloning toward highly efficient, sequence-independent methods. Ligation-Independent Cloning (LIC) and Recombination Cloning (such as Invitrogen's Gateway technology) have significantly improved throughput and reduced the time required for generating expression constructs. LIC eliminates the need for ligase, offering directional cloning with high efficiency, while recombination-based systems allow for easy shuttling of cDNA inserts between various destination vectors, accelerating the creation of diverse construct libraries for functional screening. These technologies are crucial for high-throughput applications like genomic sequencing validation and protein expression libraries.

A significant focus within the technology landscape is the optimization of expression systems, particularly for mammalian cell lines, which are critical for producing complex therapeutic proteins with correct post-translational modifications. This involves developing vectors with strong, tightly regulated inducible promoter systems (e.g., Tet-On/Off systems) to control gene expression precisely, mitigating cytotoxicity, and maximizing yield. Furthermore, the integration of synthetic biology principles is leading to the creation of modular vector architectures. These systems allow researchers to swap out functional elements (promoters, antibiotic resistance markers, purification tags) quickly and reliably, facilitating faster iteration and customized design essential for therapeutic development and viral vector packaging optimization.

The growing reliance on automation and miniaturization in laboratories demands vector systems compatible with robotic liquid handling and multi-well plate formats. The emergence of next-generation sequencing (NGS) has also increased the need for specialized vectors suitable for library preparation and functional validation of newly discovered genes. Future technological advancements are expected to concentrate on reducing the complexity and cost of large-scale, clinical-grade vector manufacturing, particularly for complex viral vectors, utilizing technologies like transient transfection optimization and novel bioprocessing techniques to ensure scalability, purity, and regulatory compliance.

Regional Highlights

The North American region, particularly the United States, dominates the CDNA Clone Vectors Market. This leadership is underpinned by several factors, including the world’s largest biopharmaceutical industry, immense governmental and private funding directed toward genomics and cancer research, and the presence of major market leaders specializing in molecular biology tools and vector systems. The high adoption rate of advanced technologies such as gene therapy platforms and personalized medicine approaches fuels consistent, high-value demand for specialized viral and non-viral cDNA delivery vectors. Furthermore, a robust academic research base ensures continuous innovation and a steady flow of research projects requiring cloning resources.

Europe constitutes the second-largest market, characterized by strong regulatory frameworks and significant public funding through initiatives like Horizon Europe supporting life sciences R&D. Countries such as Germany, the UK, Switzerland, and France are key contributors, hosting major biopharma clusters and leading research institutions. The European market exhibits a particularly high demand for vectors used in large-scale therapeutic protein production and vaccine development, leveraging established expertise in bioprocessing and quality manufacturing standards (GMP). Regulatory alignment within the European Union facilitates cross-border collaboration and distribution, albeit with complex regional variations in intellectual property enforcement and clinical trial approval.

The Asia Pacific (APAC) region is projected to be the fastest-growing market over the forecast period. This rapid expansion is driven by escalating healthcare investments, increasing prevalence of chronic diseases necessitating drug discovery efforts, and the outsourcing of pharmaceutical R&D and manufacturing activities to countries like China and India. Government initiatives in these nations, aimed at building self-sufficient biotechnology sectors and improving infrastructure, are spurring the establishment of new research laboratories and biomanufacturing plants. The demand in APAC is increasing across both the basic research segment (academia) and the high-volume manufacturing segment (biopharma), creating substantial opportunities for both local and international vector suppliers.

- North America: Market dominance, driven by extensive R&D expenditure in the US, mature biotech sector, and high adoption of advanced gene therapy vectors.

- Europe: Strong second position, supported by stringent quality standards, significant governmental research funding, and a focus on therapeutic protein manufacturing.

- Asia Pacific (APAC): Highest CAGR, fueled by rapid expansion in China and India's biopharma industries, infrastructure improvement, and increasing clinical trial activities.

- Latin America (LATAM): Emerging market characterized by increasing healthcare investments in Brazil and Mexico, focusing mainly on academic research applications.

- Middle East and Africa (MEA): Nascent market growth driven by strategic investments in biomedical research infrastructure in countries like Saudi Arabia and UAE, primarily dependent on imported technology.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the CDNA Clone Vectors Market.- Thermo Fisher Scientific

- Merck KGaA (MilliporeSigma)

- Bio-Rad Laboratories

- Takara Bio Inc.

- New England Biolabs (NEB)

- Promega Corporation

- GenScript

- QIAGEN N.V.

- OriGene Technologies

- VectorBuilder Inc.

- Aldevron

- Precision Bioscience

- DNA2.0 (now part of Aldevron)

- System Biosciences (SBI)

- ABL Inc.

- Oxford Genetics (now part of WUXI Biologics)

- GeneCopoeia

- Zymo Research

- Cellecta, Inc.

- CellGenix GmbH

Frequently Asked Questions

Analyze common user questions about the CDNA Clone Vectors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the demand for cDNA clone vectors?

Demand is primarily driven by the exponential growth in global genomics and proteomics research, increased funding for personalized medicine initiatives, and the critical need for efficient expression systems in the booming biopharmaceutical sector, particularly for therapeutic protein and vaccine development.

How do viral vectors compare to plasmid vectors in the context of cDNA cloning?

Plasmid vectors are commonly used for general research due to their ease of manipulation, low cost, and high copy number. Viral vectors (like lentivirus or AAV) are preferred for clinical applications and gene therapy because they offer highly efficient delivery and stable integration of cDNA into hard-to-transfect mammalian cells, albeit with higher complexity and cost.

Which geographical region holds the largest market share for CDNA clone vectors?

North America currently holds the largest market share, attributed to its advanced biotech infrastructure, substantial R&D investments by both private and governmental organizations, and the dominant presence of key market players and major biopharmaceutical companies.

What role does synthetic biology play in the future of cDNA vector design?

Synthetic biology enables the rational, modular design of vectors, allowing researchers to precisely control gene expression by integrating standardized biological parts. This minimizes design complexity, accelerates construct assembly, and allows for optimization of regulatory elements to improve vector safety and performance in clinical settings.

What are the key restraints impacting the growth of the CDNA Clone Vectors Market?

Major restraints include the technical difficulties encountered when attempting to clone large or repetitive cDNA sequences, the requirement for highly skilled technical personnel, the substantial cost associated with advanced, high-purity vector manufacturing (especially GMP-grade viral vectors), and stringent regulatory hurdles for therapeutic applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager