Ceiling Grid System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433277 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Ceiling Grid System Market Size

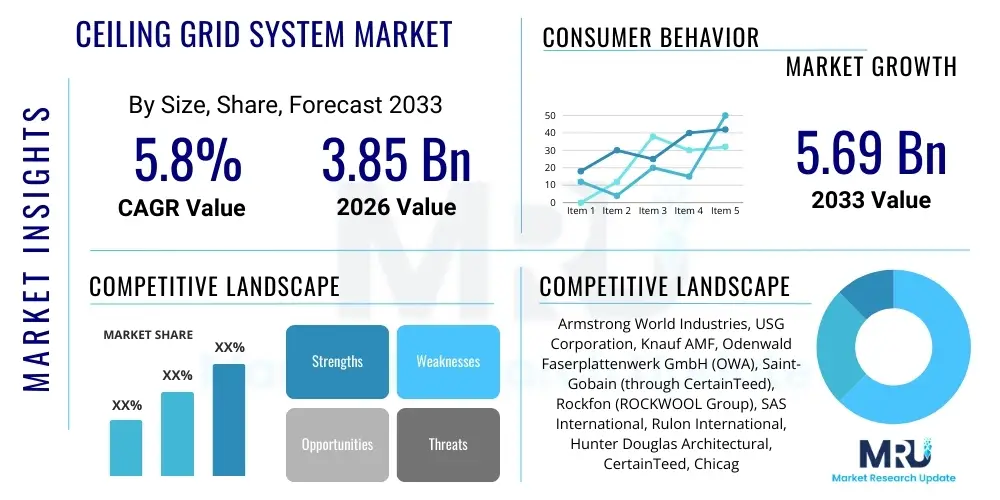

The Ceiling Grid System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at 3.85 Billion USD in 2026 and is projected to reach 5.69 Billion USD by the end of the forecast period in 2033.

Ceiling Grid System Market introduction

The Ceiling Grid System Market encompasses the manufacturing, distribution, and installation of suspension systems used to install acoustic panels, lighting fixtures, and air diffusers in commercial, institutional, and residential buildings. These systems, primarily composed of main tees, cross tees, and wall angles, provide structural support and create a plenum space above the suspended ceiling for housing utilities like HVAC ducts and electrical wiring. Market growth is strongly correlated with global construction activity, particularly in the non-residential sector, where aesthetic appeal, fire safety compliance, and sound absorption capabilities are paramount requirements for modern office spaces, hospitals, and educational facilities.

Product descriptions vary significantly based on material composition—primarily metal (aluminum or steel) and sometimes composite materials—and design complexity, including standard lay-in, tegular, or concealed systems. Major applications include new construction projects, renovation activities aimed at upgrading building infrastructure, and specialized installations demanding high seismic resistance or cleanroom specifications. Key benefits driving adoption include enhanced accessibility to overhead systems for maintenance, improved thermal insulation, superior acoustic performance, and compliance with stringent building codes related to safety and sustainability.

Driving factors propelling market expansion include rapid urbanization in developing economies, increasing global demand for energy-efficient and sustainable building materials, and regulatory mandates favoring the use of suspended ceilings for fire rating and hazard mitigation. Furthermore, technological advancements leading to lighter, more corrosion-resistant, and easier-to-install grid systems are making them increasingly appealing for fast-track construction projects worldwide, establishing ceiling grids as an indispensable component of contemporary interior architecture.

Ceiling Grid System Market Executive Summary

The Ceiling Grid System Market is experiencing robust growth driven primarily by surging commercial real estate development and substantial investment in infrastructure upgrades globally. Business trends highlight a strong shift toward integrated ceiling solutions that combine lighting, air conditioning, and acoustic management into seamless architectural designs, demanding sophisticated and high-load capacity grid systems. Manufacturers are increasingly focusing on automation in production and incorporating recycled content to meet escalating sustainability standards mandated by green building initiatives like LEED and BREEAM, thereby optimizing operational efficiency and aligning with environmental, social, and governance (ESG) goals.

Regional trends indicate that the Asia Pacific (APAC) region is poised to dominate market growth, spurred by unprecedented rates of urbanization, industrial expansion, and government initiatives promoting smart city development in countries such as China and India. North America and Europe, while mature, continue to showcase stable demand, driven primarily by renovation and retrofit projects aimed at modernizing aging commercial buildings and adopting advanced seismic-rated grid systems. Latin America and the Middle East and Africa (MEA) are emerging as high-potential markets, leveraging extensive infrastructure spending related to commercial tourism, healthcare facility development, and ambitious real estate mega-projects.

Segment trends reveal that the metal grid segment, particularly the galvanized steel variety, remains the largest market share holder due to its durability and cost-effectiveness, although the demand for specialized fiberglass and composite grids is increasing in high-humidity or acoustically sensitive environments. The non-residential segment, encompassing office buildings, healthcare, and education sectors, maintains its position as the leading application area, reflecting the mandatory need for accessible and fire-resistant suspended ceilings in public spaces. Furthermore, the T-bar suspension system design continues to be the industry standard, valued for its simplicity and versatility across various ceiling panel types and thicknesses.

AI Impact Analysis on Ceiling Grid System Market

Common user inquiries concerning AI's influence in the Ceiling Grid System Market often center around optimization of design processes, predicting material demand volatility, automating quality control, and improving supply chain efficiency. Users are keen to understand if AI can reduce installation time through robotic assembly or personalized design feedback loops, and how predictive maintenance algorithms could minimize grid failure in critical environments like hospitals. Key themes emerging from this analysis include the potential for AI-driven parametric design to quickly adapt grid layouts based on complex architectural specifications, the anticipation of AI facilitating real-time inventory management for installers, and the expectation that machine learning will enhance quality assurance protocols by autonomously detecting defects in manufactured components, ultimately streamlining the construction lifecycle and reducing labor costs.

The integration of Artificial Intelligence and Machine Learning (ML) algorithms is expected to revolutionize the front-end planning and backend manufacturing of ceiling grid systems. AI-powered software tools are now capable of analyzing intricate blueprints and structural requirements to generate optimal grid layouts instantaneously, minimizing material waste and ensuring compliance with regional structural integrity standards, such as earthquake resistance criteria. This capability significantly shortens the design phase, allowing architects and engineers to iterate designs rapidly and assess the cost implications of various grid configurations before physical construction commences. Furthermore, generative design techniques driven by AI are opening doors to novel, aesthetically superior, and structurally lighter grid designs that were previously too complex or time-consuming to model manually.

In the supply chain and manufacturing domains, AI algorithms are crucial for optimizing production schedules and logistics, especially in managing the high volume of standardized components required for large-scale projects. Predictive analytics models can forecast material price fluctuations and procurement needs based on macroeconomic indicators and project pipeline visibility, enabling manufacturers to secure raw materials like steel and aluminum at advantageous prices and mitigate supply chain risks. On the installation side, augmented reality (AR) paired with AI provides real-time guidance to construction workers, overlaying precise grid placement information onto the physical site, drastically reducing installation errors and improving project turnover speed, thereby enhancing the overall efficiency and precision of ceiling system deployments.

- AI-driven Parametric Design Optimization: Automated generation of optimal grid layouts, reducing material waste by up to 15%.

- Predictive Maintenance: ML algorithms monitor grid integrity in high-stress environments, flagging potential structural failures before they occur.

- Automated Quality Control (AQC): Vision systems using AI detect subtle manufacturing defects in metal tees and angles on the production line.

- Supply Chain Forecasting: Predictive modeling for raw material procurement (steel, aluminum) minimizing exposure to price volatility.

- Construction Robotics Integration: Potential use of robotics, guided by AI, for standardized grid assembly in large commercial projects.

- Enhanced Compliance Verification: AI tools automatically check grid specifications against evolving regional fire and seismic codes.

DRO & Impact Forces Of Ceiling Grid System Market

The Ceiling Grid System Market is shaped by a confluence of accelerating drivers (D), persistent restraints (R), and compelling opportunities (O), which collectively exert significant impact forces on market direction and growth trajectory. Key drivers include the global proliferation of commercial and institutional construction, driven by population growth and economic development, alongside increasingly strict building safety and fire resistance regulations that necessitate robust suspended ceiling installations. The mandatory requirements for improved acoustic performance in modern office environments, hospitals, and educational facilities further solidify the demand for specialized grid systems capable of supporting sophisticated sound-dampening panels, thereby maintaining the market's positive momentum.

However, market expansion is partially constrained by significant material price volatility, particularly for steel and aluminum, which directly impacts manufacturing costs and profit margins across the value chain. Furthermore, the specialized nature of ceiling grid installation often requires skilled labor, and a documented shortage of qualified installers in many regions poses a logistical challenge, potentially leading to project delays and higher installation costs. Competition from alternative ceiling solutions, such as drywall or monolithic ceilings, also presents a moderate restraint, although these alternatives often fail to match the accessibility and fire rating performance inherent in standard suspended grid systems, limiting their competitive threat in high-specification projects.

Opportunities for future growth are abundant, primarily centered around the adoption of innovative, sustainable, and lightweight materials, such as bio-based composites or high-strength recycled aluminum alloys, appealing to the green building movement. Significant growth potential exists in emerging markets where modernization of infrastructure is underway, coupled with the increasing trend towards modular and prefabricated construction techniques which favor easy-to-install, standardized grid components. Moreover, the development of integrated ceiling solutions—where the grid seamlessly incorporates intelligent lighting, sensors, and HVAC distribution—presents a high-value niche that manufacturers are actively exploiting, promising higher margins and market differentiation through technological integration.

Segmentation Analysis

The Ceiling Grid System Market segmentation offers a detailed view of market dynamics based on type, material, application, and end-use, allowing stakeholders to identify high-growth areas and tailor their product strategies accordingly. The market structure is fundamentally influenced by material choice, where the requirement for strength, moisture resistance, and fire rating dictates the adoption of galvanized steel or aluminum systems. Analyzing segment performance reveals a strong preference for standard T-bar suspension systems globally, owing to their ease of installation and versatility across various commercial applications. The dominant application remains in non-residential construction, reflecting the critical need for accessible utility space and mandated safety features in public and private commercial properties.

Segmentation by type—T-bar, concealed, and specialty grids—shows the T-bar system retaining the largest market share due to its established use and cost-efficiency, though concealed systems are gaining traction in premium architectural designs where visual clean lines are prioritized. Material segmentation highlights the dominance of metal grids, driven by structural necessity, but the market is observing steady growth in specialized segments like fiberglass and composite systems, specifically demanded in environments requiring superior corrosion resistance, such as laboratories or indoor swimming facilities, suggesting a trend towards specialized performance requirements rather than purely standardized products.

End-use segmentation underscores the pivotal role of commercial spaces, followed closely by institutional sectors like healthcare and education, which are characterized by rigorous safety standards and demanding acoustic requirements. The renovation and retrofit segment is also rapidly expanding, particularly in developed economies, fueled by regulatory updates requiring older buildings to comply with current fire and seismic codes, necessitating the replacement of outdated or inadequate ceiling systems. This multifaceted market segmentation allows for precise strategic planning, targeting specific high-value customer groups based on their architectural needs and regulatory compliance pressures.

- By Type:

- Standard T-Bar (Exposed Grid)

- Concealed Grid

- Specialty Grid (e.g., Seismic, Cleanroom)

- By Material:

- Metal (Galvanized Steel, Aluminum)

- Composite/Fiberglass

- Others (e.g., PVC)

- By Application:

- New Construction

- Renovation & Retrofit

- By End-Use Sector:

- Commercial (Offices, Retail, Data Centers)

- Institutional (Healthcare, Education, Government)

- Industrial (Manufacturing Plants, Warehouses)

- Residential (Limited High-End Applications)

Value Chain Analysis For Ceiling Grid System Market

The value chain for the Ceiling Grid System Market begins with the upstream segment, primarily involving the procurement and processing of raw materials, predominantly galvanized steel, aluminum, and occasionally specialty alloys, sourced from global metal markets. This phase is characterized by high capital intensity and susceptibility to commodity price volatility, requiring manufacturers to maintain strong hedging strategies and secure long-term contracts with major material suppliers. Efficient upstream management ensures cost-effective production, which is critical given the standardized nature of many grid components where pricing remains highly competitive, forcing early optimization in the manufacturing process.

The core of the value chain involves the manufacturing and assembly of grid components—main tees, cross tees, and wall angles—where precision engineering, high-speed roll forming, and stringent quality control are essential to meet dimensional tolerances and fire safety standards. Midstream activities also include coating processes (e.g., powder coating, anti-corrosion treatments) and packaging, preparing the standardized components for diverse installation environments. The distribution channel is bifurcated into direct sales for large, specialized projects and indirect channels utilizing a vast network of wholesale distributors, building material retailers, and specialized ceiling system suppliers to reach smaller contractors and regional projects.

Downstream activities center on installation, involving specialized contractors who purchase the grids alongside ceiling panels (often acoustic or fire-rated tiles) and manage the on-site assembly. Direct distribution channels are typically used for high-specification projects like healthcare facilities or data centers where precise product knowledge and technical support from the manufacturer are required. Indirect channels, relying on distributors, offer wider geographic reach and lower logistical costs for standard commercial office fit-outs. Customer feedback loop integration at the downstream level is vital, informing manufacturers about ease-of-installation issues, product performance in various climates, and evolving aesthetic preferences, which drives iterative product improvement and optimization for the next generation of grid systems.

Ceiling Grid System Market Potential Customers

The primary potential customers for the Ceiling Grid System Market are entities involved in the design, construction, and management of commercial, institutional, and industrial real estate, who require accessible, durable, and code-compliant suspended ceiling solutions. General contractors and specialized ceiling installation subcontractors form the immediate buying group, sourcing bulk quantities of T-bars, angles, and accessories based on project specifications provided by architects and interior designers. These buyers prioritize product quality, ease of installation, and rapid material delivery schedules to maintain tight construction timelines and adhere to project budgets.

Beyond the direct purchasers, key influencers and end-users include architectural firms and engineering consultants (AECs) who specify the material type, system design (exposed vs. concealed), and performance characteristics (acoustic rating, fire rating, seismic capacity). The decisions of AECs are crucial as they determine the acceptance of premium or specialized grid systems. Institutional facility managers, particularly those overseeing healthcare networks or large university campuses, are vital repeat customers, often dictating procurement decisions based on long-term maintenance costs, anti-microbial properties, and compliance with rigorous internal safety protocols.

Finally, commercial property developers and owners represent the ultimate end-users, driving demand by commissioning new buildings and initiating renovation projects. Their purchasing criteria often revolve around the total cost of ownership, aesthetic integration, sustainability credentials (e.g., use of recycled content), and the system’s ability to support integrated technologies like smart building sensors and complex HVAC distribution networks. Targeting these end-users through value propositions emphasizing longevity, maintenance accessibility, and safety compliance is critical for market penetration and sustained revenue growth within the high-value commercial sector.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | 3.85 Billion USD |

| Market Forecast in 2033 | 5.69 Billion USD |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Armstrong World Industries, USG Corporation, Knauf AMF, Odenwald Faserplattenwerk GmbH (OWA), Saint-Gobain (through CertainTeed), Rockfon (ROCKWOOL Group), SAS International, Rulon International, Hunter Douglas Architectural, CertainTeed, Chicago Metallic Corporation (A division of Rockfon), PABCO Gypsum, Gordon, Grenzebach BSH, Daiken Corporation, Shanghai Simon Wall and Ceiling Systems, Tianjin Gridsteel Co., Ltd., HKD Group, Lindner Group, Burgess Architectural Products |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ceiling Grid System Market Key Technology Landscape

The technology landscape in the Ceiling Grid System Market is rapidly evolving, moving beyond simple metal components to focus on advanced manufacturing processes and material science innovations designed to enhance functionality, installation speed, and sustainability. Key technological advancements include the adoption of high-speed precision roll-forming machinery, enabling manufacturers to produce complex component shapes with superior consistency and dimensional accuracy, reducing on-site adjustments and installation complexity. Material innovation is focused heavily on developing hybrid grid systems, combining the structural strength of steel with the lightweight and non-corrosive properties of fiberglass or specialized aluminum alloys, particularly for high-performance applications like cleanrooms and seismic-prone zones.

Furthermore, digital technologies are fundamentally transforming how ceiling grids are specified and installed. Building Information Modeling (BIM) integration is now standard practice, allowing architects and engineers to model the ceiling grid system digitally, ensuring perfect coordination with other building services (HVAC, electrical conduits) within the plenum space before construction begins. This digital planning significantly minimizes clashes and rework, drastically improving project efficiency. Manufacturers are also leveraging advanced corrosion protection techniques, such as specialized electro-galvanization and multi-layered powder coatings, extending the lifespan of the grid systems, especially in environments exposed to moisture or corrosive agents.

The most forward-looking technological trend involves the development of integrated ceiling solutions. This goes beyond the traditional grid and tile structure, incorporating smart infrastructure directly into the grid members. This includes pre-wiring capabilities, built-in sensor mounts, and specialized attachment points for modular lighting and air diffusion systems, transforming the grid from a passive support structure into an active, intelligent building component. This technological shift addresses the demand for aesthetically pleasing, highly functional commercial spaces that can adapt easily to technological updates, positioning the grid system as a critical component of intelligent building management systems (IBMS).

Regional Highlights

- Asia Pacific (APAC) Market Dominance: The APAC region, led by China, India, and Southeast Asian nations, is the fastest-growing market segment, driven by unprecedented levels of non-residential construction, rapid urbanization, and massive government investment in infrastructure like hospitals, data centers, and commercial business districts. The region’s focus on adopting international building standards, particularly concerning fire safety and acoustic performance in high-density urban settings, necessitates the widespread deployment of standardized and specialized suspended ceiling grid systems, fueling aggressive capacity expansion by regional and international manufacturers. The sheer scale of construction activity ensures that APAC maintains the largest market share throughout the forecast period.

- North America Market Maturity and Renovation Focus: North America represents a mature but stable market, characterized by high penetration rates of sophisticated, high-performance grid systems. Growth here is primarily driven by large-scale renovation and retrofit cycles, particularly in upgrading existing commercial office stock and institutional facilities to meet modern energy efficiency standards and comply with evolving stringent seismic codes, especially in California and surrounding earthquake zones. Demand is strong for acoustically superior and aesthetically refined concealed grid systems, alongside a high prioritization of certified sustainable products (e.g., grids with high recycled content), aligned with green building mandates.

- Europe Market Stability and Sustainability Mandates: The European market maintains stable growth, heavily influenced by strict sustainability regulations and energy performance directives imposed by the European Union. Manufacturers in this region focus intensely on the circular economy, offering products with maximum recyclability and minimal environmental impact. Demand is segmented, with Central and Western Europe prioritizing high-end acoustic systems for acoustic comfort in office environments, while Eastern European markets show accelerated growth in new commercial construction, relying more on cost-effective, durable metal grid systems that meet essential fire safety criteria.

- Middle East & Africa (MEA) High-Growth Potential: The MEA region is demonstrating significant potential, largely propelled by massive investment in commercial and tourism infrastructure, especially in the GCC countries (UAE, Saudi Arabia). These mega-projects often demand high-specification, custom ceiling grid solutions to support complex architectural designs and specialized climate control systems necessary for extreme heat. The growth trajectory is steep, although it remains highly dependent on fluctuations in regional oil revenues and successful execution of large-scale planned construction initiatives.

- Latin America Market Recovery and Commercial Investment: The Latin American market exhibits sporadic growth, linked closely to economic stability in major economies like Brazil and Mexico. Commercial construction, particularly in the retail and office sectors, drives demand. While cost sensitivity remains a key factor, there is a gradual shift towards adopting more technologically advanced and structurally reliable grid systems in alignment with international standards, particularly in professional city centers, focusing on improved fire resistance and durability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ceiling Grid System Market.- Armstrong World Industries

- USG Corporation (now part of Knauf)

- Knauf AMF GmbH & Co. KG

- Odenwald Faserplattenwerk GmbH (OWA)

- Saint-Gobain (through CertainTeed)

- Rockfon (ROCKWOOL Group)

- SAS International

- Rulon International

- Hunter Douglas Architectural

- Chicago Metallic Corporation (A division of Rockfon)

- PABCO Gypsum

- Gordon, Inc.

- Grenzebach BSH GmbH

- Daiken Corporation

- Shanghai Simon Wall and Ceiling Systems Co., Ltd.

- Tianjin Gridsteel Co., Ltd.

- HKD Group

- Lindner Group KG

- Burgess Architectural Products Ltd.

- National Ceiling Systems (NCS)

Frequently Asked Questions

Analyze common user questions about the Ceiling Grid System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving factor for the Ceiling Grid System Market growth?

The market is primarily driven by the increasing volume of non-residential construction projects globally, particularly in commercial and institutional sectors, coupled with strict regulatory mandates requiring fire-rated, accessible, and acoustically performing suspended ceilings in public spaces.

How is sustainability impacting the selection of ceiling grid materials?

Sustainability significantly influences material selection, driving increased demand for ceiling grids made from high levels of recycled content (especially recycled aluminum and steel), and systems that are designed for disassembly and high recyclability to comply with green building certifications like LEED and BREEAM.

What is the difference between exposed T-bar and concealed grid systems?

Exposed T-bar systems utilize visible main and cross tees forming a grid pattern, valued for cost-efficiency and maintenance access. Concealed systems hide the metal structure, creating a seamless, monolithic ceiling appearance, preferred for premium architectural aesthetics despite slightly higher complexity in access.

Which regional market holds the highest growth potential for ceiling grids?

The Asia Pacific (APAC) region, specifically driven by rapid urbanization and extensive infrastructure investment in economies like China and India, holds the highest growth potential due to the sheer volume of new commercial and institutional construction currently underway.

How does the Ceiling Grid System Market incorporate smart building technology?

Modern ceiling grid systems incorporate smart technology by integrating mounting points and pathways for sensors, modular intelligent lighting, and HVAC distribution components directly into the grid structure, transforming the system into an active hub for smart building management and control.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager