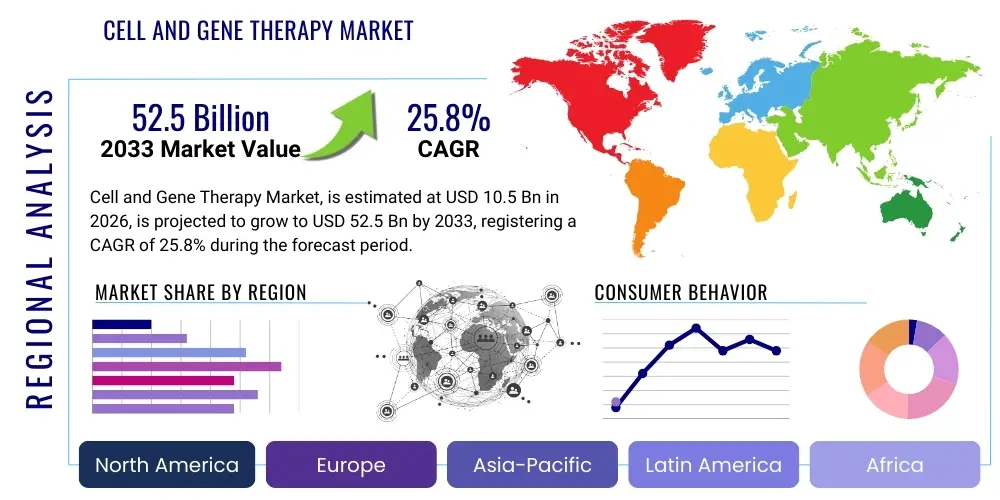

Cell and Gene Therapy Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437981 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Cell and Gene Therapy Market Size

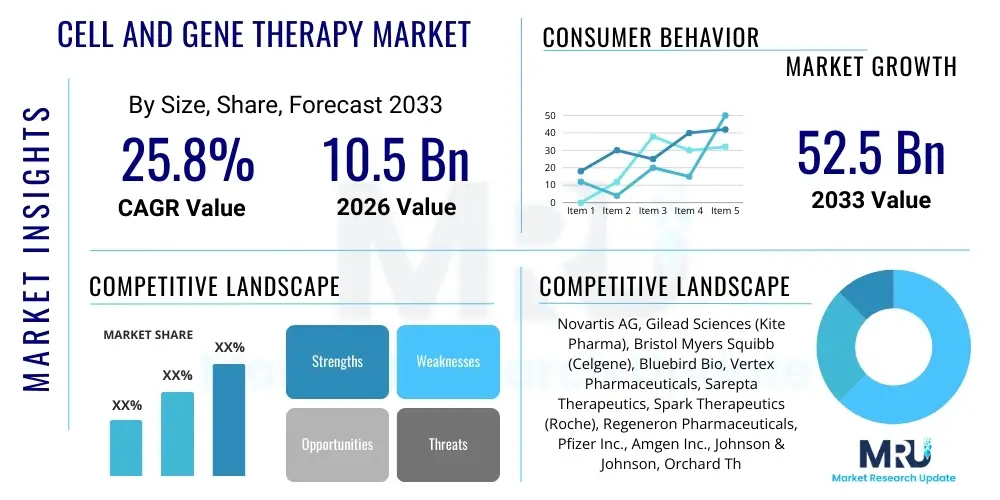

The Cell and Gene Therapy Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 25.8% between 2026 and 2033. The market is estimated at $10.5 Billion in 2026 and is projected to reach $52.5 Billion by the end of the forecast period in 2033.

Cell and Gene Therapy Market introduction

The Cell and Gene Therapy (CGT) market encompasses advanced therapeutic modalities focused on modifying, replacing, or correcting diseased cells or genetic material within a patient's body. These therapies, which include Chimeric Antigen Receptor T-cell (CAR-T) therapies, gene replacement therapies utilizing viral vectors (such as AAV and lentivirus), and various somatic cell therapies, represent a paradigm shift from traditional pharmaceuticals to curative, highly personalized medical solutions. The introduction of these complex biologics targets previously intractable diseases, including rare genetic disorders, specific hematologic malignancies, and degenerative conditions, fundamentally reshaping oncology and inherited disease treatment landscapes. This high growth trajectory is primarily driven by significant breakthroughs in vector delivery systems, increasing regulatory approvals across major jurisdictions, and robust investment in preclinical and clinical pipelines.

Products within the CGT space are inherently complex, requiring sophisticated manufacturing processes, stringent quality control measures, and specialized cold chain logistics. Major applications include oncology (e.g., Kymriah, Yescarta), where CAR-T therapies have demonstrated remarkable remission rates, and monogenic disorders (e.g., Zolgensma, Luxturna) where defective genes are corrected or replaced. The primary benefits of CGT are their potential for long-term, curative effects after a single administration, leading to dramatically improved quality of life and reduced long-term healthcare burdens for chronic illnesses. The market’s dynamism is further fueled by accelerating research into allogeneic (off-the-shelf) therapies, which promise to overcome the logistical and cost challenges associated with current autologous models.

Driving factors sustaining this exponential market expansion include the burgeoning incidence of chronic diseases and cancer globally, heightened venture capital and pharmaceutical R&D spending directed toward advanced biologics, and supportive legislative frameworks such as the FDA’s regenerative medicine advanced therapy (RMAT) designation, which expedites the development and review process for promising therapies. Furthermore, advancements in genome editing technologies, specifically CRISPR-Cas9 systems, are broadening the therapeutic scope beyond replacement therapies to precise in vivo gene correction, positioning CGT as a central pillar of future precision medicine.

Cell and Gene Therapy Market Executive Summary

The Cell and Gene Therapy (CGT) market is characterized by rapid technological evolution and intense commercial activity, with business trends pointing toward significant vertical integration among biopharma companies seeking control over critical components, particularly viral vector manufacturing and specialized clinical delivery networks. Key business strategies focus on securing manufacturing capacity, often through strategic Contract Development and Manufacturing Organization (CDMO) partnerships or proprietary facility expansions, to mitigate supply chain bottlenecks inherent to personalized medicine. Financial trends indicate a shift from pure biotech financing to later-stage, strategic investments and mergers, as companies transition from early research to commercial execution, with emphasis on optimizing cost of goods sold (COGS) through automation and process intensification.

Regional trends highlight North America, particularly the United States, maintaining its dominance due to a highly sophisticated regulatory environment (FDA), unparalleled access to specialized academic research centers, and robust reimbursement mechanisms for high-cost therapies. However, the Asia Pacific (APAC) region is emerging as the fastest-growing market, propelled by increasing healthcare expenditure, government initiatives supporting biotech innovation (especially in China and Japan), and a growing patient pool for oncology and genetic disorders. Europe remains a critical commercial hub, focusing on harmonizing complex regulatory pathways (EMA) and expanding specialized treatment centers to ensure equitable patient access across member states.

Segmentation trends reveal that the Gene Therapy segment, particularly utilizing Adeno-associated Virus (AAV) vectors, is commanding the largest market share, driven by a growing list of approved products for inherited disorders and a strong pipeline targeting neurological diseases. Within Cell Therapies, Autologous CAR-T remains the commercial powerhouse, but the most significant growth is projected in Allogeneic Cell Therapies, which promise scale and faster patient access. The application segment remains dominated by Oncology, yet there is accelerating penetration into rare diseases, hematology, and cardiovascular diseases, reflecting the diversification of clinical trials and successful translation of platform technologies into multiple therapeutic areas.

AI Impact Analysis on Cell and Gene Therapy Market

User inquiries regarding the role of Artificial Intelligence (AI) in the Cell and Gene Therapy (CGT) market frequently revolve around how AI can tackle the inherent complexities of these advanced modalities, specifically concerning personalized manufacturing scalability, clinical trial efficiency, and novel target identification. Users express high expectations for AI to automate and optimize the laborious and variable manufacturing processes, reducing turnaround times and ensuring batch consistency—critical issues for autologous therapies. Furthermore, there is significant interest in AI's capacity to streamline complex clinical trial recruitment by identifying ideal patient candidates based on vast genomic and clinical datasets, accelerating time-to-market. The integration of Machine Learning (ML) algorithms is anticipated to significantly enhance precision in vector design and immunogenicity prediction, moving the field towards safer and more efficacious therapeutic constructs.

- AI accelerates target identification and validation by analyzing complex -omics data, revealing novel disease pathways suitable for genetic intervention.

- Machine Learning optimizes viral vector and non-viral delivery system design, predicting optimal construct stability and maximizing transduction efficiency.

- AI enhances personalized medicine through rapid stratification of patients, predicting responders versus non-responders based on molecular signatures, improving clinical trial success rates.

- Predictive maintenance and process control in manufacturing (CMC) leverage AI to minimize batch failures, optimize bioreactor conditions, and ensure stringent quality attributes in real-time.

- Natural Language Processing (NLP) is used to synthesize vast quantities of scientific literature and patient medical records, aiding regulatory submissions and pharmacovigilance tracking.

- Automated image analysis and flow cytometry data processing using deep learning models standardize cell quality assessment and functional characterization before patient infusion.

DRO & Impact Forces Of Cell and Gene Therapy Market

The Cell and Gene Therapy market is propelled by profound technological advancements and restrained by significant operational and cost hurdles, creating a highly volatile yet rewarding investment environment. Key drivers include overwhelming clinical efficacy data from approved products, strong governmental support for regenerative medicine, and the transition toward allogeneic platforms that promise industrialized scalability. Conversely, major restraints involve the prohibitive cost of therapy (often exceeding $1 million per treatment), complex and fragmented global regulatory requirements that slow multi-regional development, and persistent manufacturing bottlenecks, particularly the global scarcity of high-quality viral vectors. Opportunities abound in expanding therapeutic applications into large patient populations like autoimmune diseases and chronic heart failure, developing robust point-of-care manufacturing solutions, and establishing innovative value-based pricing and reimbursement models to address payer concerns. These dynamics are intensely impacted by patent expirations in foundational technologies, escalating ethical debates surrounding germline editing, and the imperative for cross-industry collaboration to establish standardized quality metrics.

The impact forces influencing this market are predominantly concentrated around intellectual property dominance and the geopolitical alignment of regulatory bodies. Companies that control critical platform technologies, such as novel AAV serotypes or enhanced CAR constructs, exert significant market power. The speed of regulatory adaptation to these novel technologies varies substantially by region; the FDA’s proactive stance provides a competitive edge to US-based developers, while European and Asian harmonization efforts dictate global launch sequence strategies. Furthermore, the sheer financial investment required for large-scale, GMP-compliant manufacturing acts as a significant barrier to entry, channeling competition toward a few well-funded multinational entities capable of sustaining massive infrastructure expenditures. The confluence of these drivers, restraints, and opportunities dictates strategic decisions regarding market entry, partnership selection, and manufacturing location.

Segmentation Analysis

The Cell and Gene Therapy market is meticulously segmented based on product type, therapeutic area, technology platform, and regional adoption patterns, allowing for precise market evaluation and strategic resource allocation. The product segmentation differentiates between Cell Therapy (autologous and allogeneic T-cells, stem cells, and dendritic cells) and Gene Therapy (viral vector delivery systems like AAV, Lentivirus, and non-viral methods). Therapeutic application remains the cornerstone of market distribution, with Oncology dominating revenue, followed by rare monogenic diseases, and emerging fields such as cardiovascular and infectious diseases. Technology platforms segmentation emphasizes the specific tools enabling gene delivery (e.g., CRISPR, TALENs) and the type of cell modification employed. Understanding these segments is vital for stakeholders to identify high-growth niches and potential partnership targets within this rapidly maturing sector.

- Product Type

- Cell Therapy

- Autologous Cell Therapy

- Allogeneic Cell Therapy

- Gene Therapy

- Viral Vectors (AAV, Lentivirus, Adenovirus, Retrovirus)

- Non-Viral Vectors (Plasmid DNA, Liposomes)

- Tissue-Engineered Products

- Cell Therapy

- Therapeutic Area

- Oncology (Hematological and Solid Tumors)

- Rare and Inherited Diseases (Metabolic, Musculoskeletal, Hematological)

- Dermatology

- Cardiovascular Diseases

- Neurological Disorders (Neurodegenerative diseases)

- Infectious Diseases

- Technology Platform

- Targeted Gene Editing (CRISPR-Cas9, ZFN, TALEN)

- Vector Manufacturing Technologies

- Cell Expansion and Processing Technologies

- Cryopreservation and Logistics

Value Chain Analysis For Cell and Gene Therapy Market

The Cell and Gene Therapy value chain is exceptionally complex, highly specialized, and differs significantly from traditional biopharmaceutical pipelines, primarily due to the integrated nature of patient material handling and manufacturing. The upstream segment focuses on fundamental research, target identification, vector development (including securing high-titer, GMP-grade vector supply), and early-stage process development (PD). This stage is characterized by high investment in intellectual property (IP) surrounding novel delivery systems and complex analytics. Key upstream players include academic institutions, specialized biotech firms, and niche CDMOs focused exclusively on vector production, which remains a severe global bottleneck. Efficiency in this phase hinges on rapid iteration using automation and AI-driven design tools to optimize construct performance.

The midstream and core manufacturing segment involves the critical steps of cell collection (apheresis for autologous), cell engineering (transduction/transfection), cell expansion in bioreactors, formulation, and quality control (QC) release testing. This process demands ultra-stringent Good Manufacturing Practice (GMP) compliance and is often performed in highly specialized, closed-system facilities to minimize contamination risk. The unique nature of autologous logistics means that patient data integrity and chain of identity/custody are paramount, requiring sophisticated digital tracking systems. Downstream activities involve specialized cryopreservation, complex cold chain logistics (often requiring ultra-low temperatures), and final delivery to the treatment center, followed by administration.

Distribution channels for CGTs are highly restrictive and direct, typically involving a closed loop between the clinical collection site, the centralized manufacturing facility, and the specialized clinical infusion center. Direct distribution ensures complete control over the chain of identity and temperature excursion monitoring, critical for product viability and patient safety. Indirect channels are virtually nonexistent for commercial autologous therapies but are sometimes utilized for allogeneic or tissue-engineered products through specialized third-party logistics (3PL) providers focused specifically on advanced therapy medicinal products (ATMPs). The dominance of the direct model reflects the high value and extreme sensitivity of these curative treatments, necessitating end-to-end control by the therapy developer.

Cell and Gene Therapy Market Potential Customers

The primary end-users and buyers of Cell and Gene Therapy products are fundamentally the patients suffering from severe, often life-threatening conditions for which standard treatments are ineffective or unavailable. However, in the commercial context, the immediate transactional customers include major academic medical centers and specialized comprehensive cancer centers designated as authorized treatment facilities (ATFs) capable of administering these complex therapies, particularly CAR-T cells. These centers require specialized infrastructure, trained personnel, and certification programs to manage potential severe side effects like cytokine release syndrome (CRS) and neurotoxicity, making them crucial bottlenecks and distribution points.

Additionally, institutional payers—including national health systems (e.g., NHS in the UK, NHI in Japan), governmental agencies (e.g., Medicare/Medicaid in the US), and large private insurance companies—represent the ultimate financial buyers, as they manage the reimbursement strategies for these multi-million-dollar treatments. Their purchasing decisions are heavily influenced by long-term cost-effectiveness data, real-world evidence of durable response, and the development of innovative payment models (e.g., installment payments or outcomes-based reimbursement) designed to mitigate the financial risk associated with high upfront costs. The interaction between manufacturers, treatment centers, and payers defines market access.

Furthermore, Contract Development and Manufacturing Organizations (CDMOs) and technology providers serve as crucial intermediate customers for advanced equipment, high-quality raw materials (e.g., plasmids, specialized media), and outsourced manufacturing services. These organizations purchase CGT-enabling technologies, such as advanced bioreactors, automated cell processing equipment, and analytical instrumentation, to support their biopharma clients' pipelines. Their role is increasingly vital as developers seek external expertise to scale up production capacity and standardize complex manufacturing processes across global supply chains.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $10.5 Billion |

| Market Forecast in 2033 | $52.5 Billion |

| Growth Rate | 25.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Novartis AG, Gilead Sciences (Kite Pharma), Bristol Myers Squibb (Celgene), Bluebird Bio, Vertex Pharmaceuticals, Sarepta Therapeutics, Spark Therapeutics (Roche), Regeneron Pharmaceuticals, Pfizer Inc., Amgen Inc., Johnson & Johnson, Orchard Therapeutics, Sangamo Therapeutics, Takeda Pharmaceutical Company, uniQure N.V., Voyager Therapeutics, Intellia Therapeutics, Crispr Therapeutics, Editas Medicine. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cell and Gene Therapy Market Key Technology Landscape

The technological landscape of the Cell and Gene Therapy (CGT) market is rapidly evolving, defined by continuous innovation in gene delivery, cell engineering, and scalable manufacturing systems. The foundational technology remains the viral vector platform, with Adeno-associated Viruses (AAVs) being the predominant vector for in vivo gene therapy due to their low immunogenicity and stable expression profile, while Lentiviruses are crucial for ex vivo modification of T-cells (CAR-T). Ongoing research focuses on engineering novel AAV serotypes to enhance tissue specificity, reduce required doses, and evade neutralizing antibodies, thereby broadening therapeutic windows and improving safety profiles. Non-viral methods, utilizing lipid nanoparticles and electroporation, are gaining traction as they offer potential advantages in terms of large-scale manufacturing capacity and lower immunogenic risk, particularly for transient expression or mRNA delivery.

A second critical technology cluster revolves around precise genome editing tools, such as CRISPR-Cas9, Zinc Finger Nucleases (ZFNs), and Transcription Activator-Like Effector Nucleases (TALENs). These tools enable highly specific corrections or insertions within the genome, moving beyond simple gene replacement to functional gene repair. CRISPR-based therapies are rapidly moving into clinical trials, offering curative potential for complex diseases like sickle cell disease and certain cancers. The core technical challenge here is optimizing the delivery of the editing machinery (typically an mRNA or sgRNA combined with a protein) safely and efficiently into target cells both ex vivo and directly in vivo, requiring continuous innovation in novel encapsulation methods.

The third major technological focus is the industrialization of manufacturing processes, commonly referred to as Chemistry, Manufacturing, and Controls (CMC). This area utilizes advanced technologies like automated, closed-system cell processing equipment, perfusion bioreactors to maximize cell yields, and advanced analytical technologies (PAT) for real-time quality assurance. Single-use technologies have become ubiquitous, minimizing cross-contamination risk and facilitating flexible, modular manufacturing footprints. Furthermore, digitalization and integration of AI are streamlining the complex data management required for personalized therapies, ensuring robust chain of custody and identity throughout the highly specialized supply chain from vein-to-vein.

Regional Highlights

North America, led by the United States, currently holds the dominant share of the global Cell and Gene Therapy (CGT) market, driven by unparalleled R&D expenditure, a supportive regulatory environment, and high commercial readiness. The US benefits from the presence of the majority of commercialized CGT products, a well-established ecosystem of specialized clinical centers, and sophisticated reimbursement mechanisms like the Centers for Medicare & Medicaid Services (CMS) coverage decisions, which, despite complexities, provide pathways for high-cost therapy adoption. Significant funding from venture capital and government grants, coupled with strong intellectual property protection, continues to solidify this region's leadership in both discovery and commercial launch of novel advanced therapies.

Europe represents the second-largest market, characterized by proactive regulatory bodies like the European Medicines Agency (EMA) seeking to streamline approval processes across member states, although harmonization in pricing and reimbursement remains a persistent challenge due to decentralized healthcare systems. Countries such as Germany, the UK, and France are pioneering clinical adoption and research efforts, benefiting from strong academic biotech linkages. However, the requirement for extensive post-market monitoring and the heterogeneity of national payer negotiations often result in slower commercial uptake compared to the US. Focused initiatives like the adoption of centralized assessment procedures aim to accelerate patient access to approved ATMPs.

The Asia Pacific (APAC) region is projected to exhibit the highest CAGR during the forecast period. This growth is fueled by massive government investments in biotechnology, particularly in China and South Korea, aimed at developing domestic CGT capabilities and addressing the substantial patient burden for cancer and inherited diseases. Japan is a standout market due to its highly progressive regulatory framework for regenerative medicine, which allows for conditional and early approval of innovative therapies. Increasing penetration of sophisticated healthcare infrastructure, a growing clinical trial footprint, and the rising prevalence of chronic conditions are collectively positioning APAC as the critical future manufacturing hub and consumer market for CGTs.

- North America (Dominant Market Share): Robust FDA regulatory pathways (RMAT), highest volume of ongoing clinical trials, dominance of key commercial players (Kite, Novartis), and sophisticated private payer coverage systems.

- Europe (Second Largest Market): Focused on harmonizing EMA approval, increasing investment in specialized manufacturing capacity in countries like Germany and the Netherlands, and addressing pricing hurdles through national Health Technology Assessments (HTA).

- Asia Pacific (Fastest Growing Market): Rapidly increasing R&D investment (especially China and Japan), supportive government policies for biotech localization, increasing prevalence of chronic diseases, and proactive regulatory strategies in key economic nations.

- Latin America (Emerging Potential): Characterized by limited local manufacturing but growing adoption through importation, focused primarily on clinical trials in economically stable nations like Brazil, slowly developing reimbursement structures for high-cost therapies.

- Middle East and Africa (Niche Market Entry): Focused development of specialized centers of excellence in nations like Israel and the UAE, driven by high-net-worth medical tourism and government initiatives aimed at modernizing domestic healthcare provision.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cell and Gene Therapy Market.- Novartis AG

- Gilead Sciences (Kite Pharma)

- Bristol Myers Squibb (Celgene)

- Bluebird Bio

- Vertex Pharmaceuticals

- Sarepta Therapeutics

- Spark Therapeutics (Roche)

- Regeneron Pharmaceuticals

- Pfizer Inc.

- Amgen Inc.

- Johnson & Johnson

- Orchard Therapeutics

- Sangamo Therapeutics

- Takeda Pharmaceutical Company

- uniQure N.V.

- Voyager Therapeutics

- Intellia Therapeutics

- Crispr Therapeutics

- Editas Medicine

- Astellas Pharma (through its subsidiary)

Frequently Asked Questions

Analyze common user questions about the Cell and Gene Therapy market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between autologous and allogeneic cell therapy?

Autologous therapy uses the patient's own cells, requiring rapid, personalized manufacturing (vein-to-vein process). Allogeneic therapy uses donor cells that are modified to prevent rejection (off-the-shelf product), offering scalability and lower manufacturing variability.

What are the biggest restraints on the current growth of the Cell and Gene Therapy market?

The primary restraints are the high cost of goods sold (COGS), which leads to high therapy prices, persistent bottlenecks in GMP-grade viral vector manufacturing supply, and logistical complexities related to ultra-cold chain management and stringent chain of identity requirements.

Which vector type is most commonly used for approved in vivo gene therapies?

Adeno-associated Virus (AAV) vectors are the most common choice for approved in vivo gene therapies, such as those treating inherited blindness or spinal muscular atrophy, due to their favorable safety profile, stability, and ability to transduce non-dividing cells effectively.

How is AI primarily being utilized to improve Cell and Gene Therapy manufacturing?

AI is utilized to optimize manufacturing by using predictive analytics to monitor bioreactor performance, ensure real-time quality control (Process Analytical Technology), and automate complex cell processing steps, thereby reducing batch failure rates and speeding up production cycles.

What therapeutic area holds the largest market share for Cell and Gene Therapies?

Oncology holds the largest market share, predominantly driven by the commercial success and expanding clinical application of Chimeric Antigen Receptor T-cell (CAR-T) therapies for treating hematological malignancies like lymphomas and leukemias.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager