Cell Culture Consumable Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432196 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Cell Culture Consumable Market Size

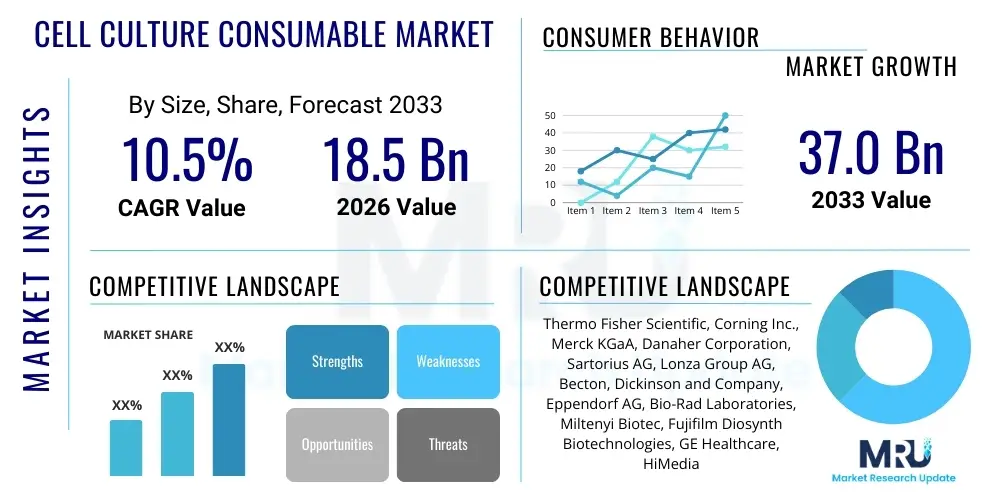

The Cell Culture Consumable Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 37.0 Billion by the end of the forecast period in 2033.

Cell Culture Consumable Market introduction

The Cell Culture Consumable Market encompasses a wide array of specialized products absolutely essential for the proliferation, maintenance, and manipulation of various cell lines outside their natural physiological environment. These critical supplies span sophisticated components such as chemically defined media, high-purity biological reagents (e.g., growth factors and cytokines), specialized plasticware (flasks, multi-well plates with enhanced surface treatments), advanced cryopreservation solutions, and filtration systems tailored for sterile processing. These products form the foundational layer of complex workflows across life science research, drug discovery processes, critical toxicology testing, and the exponentially growing fields of regenerative medicine and large-scale biopharmaceutical manufacturing. Sustained and rapidly accelerating demand is structurally driven by the increasing technical complexity inherent in developing novel cell-based assays, coupled with the regulatory necessity for highly consistent, reproducible, and sterile culture conditions mandated within both rigorous academic research environments and regulated industrial production facilities. Furthermore, the profound technological evolution towards advanced systems, including complex 3D cell culture models and large-volume single-use bioprocess systems, solidifies the market's irreplaceable and pivotal role within the global biotechnology infrastructure. The transition to clinical-grade consumables requires rigorous documentation and validation, further differentiating product requirements based on end-use application, from basic research to commercial therapeutic production.

The core applications demanding these consumables span numerous advanced disciplines, primarily focusing on the scalable production of life-saving therapeutics such as recombinant vaccines, the manufacturing of highly specific monoclonal antibodies, the development and delivery mechanisms of cutting-edge gene and cell therapies (like CAR T-cells), and the implementation of personalized medicine research strategies. Researchers fundamentally depend on high-quality cell culture consumables to meticulously and accurately mimic in vivo microenvironments, enabling highly detailed mechanistic studies of cellular processes, precise investigation into disease progression pathways, and accurate assessment of therapeutic compound efficacy and toxicity profiles. The inherent quality, precise formulation, and consistent regulatory status of these consumables directly and profoundly influence experimental success rates, overall process yield, and, crucially, adherence to strict regulatory body guidelines (such as FDA and EMA standards). Consequently, the strategic selection of appropriate media, certified sera, and validated plasticware represents an essential and often high-risk decision point for end-users across the biotech value chain. Manufacturers are continuously innovating to provide bespoke solutions that cater to the niche requirements of specialized cell lines, such as neurons or mesenchymal stem cells, ensuring optimal growth characteristics and minimizing cellular stress.

The primary and compelling benefits conferred by utilizing validated, high-quality cell culture consumables include dramatically enhanced cell viability and functionality, significantly improved experimental reproducibility across multiple sites and batches, and inherent scalability designed for efficient industrial bioprocessing operations. Key driving factors providing critical market momentum involve the exponential expansion of the global biotechnology and biopharma sectors, substantial and sustained financial backing through governmental grants and large private investment funds specifically targeting life science research and development, and the rapidly accelerating clinical development pipeline for increasingly complex biological drugs and novel cell-based therapeutic modalities. Moreover, the pervasive industry-wide shift towards adopting sophisticated single-use technologies (SUTs) within biomanufacturing settings provides a massive structural impetus for the increased consumption of pre-validated, sterile plasticware, specialized filtration units, and large-scale bioreactor bags, further anchoring the market's sustained growth trajectory over the forecast period. This reliance on disposable systems streamlines production, minimizes turnaround time, and maximizes throughput, particularly for multi-product facilities requiring rapid changeover and stringent contamination control protocols, which are paramount in GMP environments.

Cell Culture Consumable Market Executive Summary

The global Cell Culture Consumable Market is marked by significant business trends centered around technological integration, standardization, and supply chain resilience. Industry leaders are focusing intensely on automation compatibility, designing consumables that integrate seamlessly into high-throughput screening (HTS) and robotic liquid handling platforms to maximize efficiency in drug discovery workflows. A crucial ongoing business development involves the rigorous consolidation of the market, where strategic mergers, acquisitions, and tactical partnerships among key players are utilized to expand geographical reach, optimize complex supply chains, and quickly incorporate novel technologies, such as advanced polymer sciences for superior cell attachment. A substantial operational trend is the pronounced shift towards standardized, high-performance media—specifically serum-free (SFM) and chemically defined (CDM) formulations—driven by international regulatory imperatives demanding maximum batch consistency, elimination of biological risk variability, and improved overall scalability for clinical production runs. This move away from traditional animal serum-based media is restructuring the foundational components of the consumables segment, forcing suppliers to invest heavily in formulation R&D and raw material certification processes.

From a geographical perspective, North America, particularly the United States, holds the dominant market share, an established position secured by unparalleled spending on biopharma R&D, a high concentration of leading biotechnology firms, and a deep-seated infrastructure supporting large-scale biomanufacturing. However, the Asia Pacific (APAC) region is decisively positioned as the foremost engine for future expansion, registering the highest projected Compound Annual Growth Rate (CAGR). This explosive growth is underpinned by substantial governmental commitment to building robust domestic biopharmaceutical ecosystems in key nations like China and South Korea, coupled with the increasing establishment of Contract Manufacturing Organizations (CMOs) that require vast, reliable supplies of clinical-grade consumables. Europe sustains a robust and stable demand, driven by strong academic research funding and continued leadership in specialized areas such as gene editing and complex cell therapy production, maintaining a high-quality, high-value requirement for certified products. Emerging markets in Latin America and MEA are beginning to accelerate, responding to global health initiatives and increasing foreign direct investment in local healthcare and research infrastructure.

Segmentation analysis clearly underscores the enduring importance of cell culture media and reagents, which consistently account for the largest revenue segment due to their status as high-volume, continuously consumed inputs necessary for virtually every laboratory and production operation. Within the physical consumables category, specialized, high-precision plasticware, including multi-well plates specifically engineered for complex 3D culture models and customized bioreactor bags designed for single-use, closed-system manufacturing, are demonstrating exceptionally strong revenue growth momentum. The end-user landscape reflects a critical shift: while academic and governmental research institutions provide consistent foundational demand, the commercial sector, primarily comprising pharmaceutical and biotechnology companies, increasingly dominates overall consumption volume. These commercial entities require enormous quantities of consumables tailored for large-scale production runs of therapeutic biologics, driving industry focus toward industrial-scale, GMP-compliant, and highly automated consumable solutions, prioritizing both supply chain security and cost-efficiency in bulk procurement. This dynamic reinforces the market's trajectory towards industrialization and standardization, pushing suppliers to achieve stringent quality benchmarks.

AI Impact Analysis on Cell Culture Consumable Market

User questions frequently probe the transformative potential of Artificial Intelligence (AI) and Machine Learning (ML) in revolutionizing cell culture workflows, specifically questioning how AI-driven optimization of media component ratios and complex culturing protocols will alter existing consumption patterns. A key concern centers on the possibility that predictive modeling and digital twins of bioreactors could drastically reduce the requirement for large, costly, and resource-intensive screening trials currently used to optimize new media formulations, potentially leading to a decrease in the overall volume of commodity media purchased. Conversely, users expect AI to accelerate the discovery and rapid validation of novel, highly specific, and potent media formulations, requiring new specialized, high-value reagents. There is also substantial commercial interest in implementing ML algorithms for predictive quality control and precise supply chain optimization, utilizing AI to analyze real-time data from culture runs (e.g., pH, dissolved oxygen) to minimize batch failure rates and precisely manage inventory levels, demanding a new generation of smart, sensor-enabled consumable plasticware capable of generating rich, actionable data streams for sophisticated analysis.

- AI-driven optimization algorithms accelerate the design and validation of bespoke chemically defined media formulations, drastically reducing time-to-market for specialized reagents.

- Predictive modeling using machine learning minimizes experimental variability and the unnecessary waste of specialized consumables during process development and upstream optimization.

- Enhanced integration of AI and machine vision into manufacturing lines ensures superior quality control and structural integrity checking for mass-produced plasticware, raising sterility standards.

- Implementation of AI for complex logistics management optimizes the highly sensitive cold chain requirements for media and biological reagents, enhancing supply chain reliability and reducing spoilage.

- Development of next-generation smart culture vessels and bioreactor bags embedded with micro-sensors that feed continuous, high-volume data streams directly into AI monitoring and adjustment systems.

- AI accelerates high-throughput screening (HTS) workflows by efficiently analyzing complex cellular responses, driving increased consumption of specialized, automation-compatible multi-well plates and microfluidic devices.

- Application of ML for identifying key cellular biomarkers and correlating them with media component performance, leading to highly efficient, performance-based consumable procurement strategies.

DRO & Impact Forces Of Cell Culture Consumable Market

The core expansion of the Cell Culture Consumable Market is robustly driven by the global imperative to address the escalating prevalence of chronic and complex diseases, coupled with a fundamental industry-wide shift toward highly advanced therapeutic modalities such as cell and gene therapies. This momentum is intrinsically supported by massive, sustained financial allocations—both governmental grants and substantial private venture capital—directed towards high-impact life science research, particularly in oncology, neurodegenerative disorders, and regenerative medicine, guaranteeing a perpetual and increasing demand for specialized, high-grade consumable inputs. Furthermore, the successful transition and rapid commercial scalability of complex biologics and cutting-edge cell therapy products necessitate continuous, large-volume supplies of highly regulated, clinical-grade consumables, providing strong, reliable long-term market momentum. The accelerating market adoption of physiologically relevant advanced techniques, specifically 3D cell culture models, microfluidic systems, and organ-on-a-chip technologies, inherently requires novel, specialized, and higher-cost consumable formats (e.g., scaffolds, specialized hydrogels), profoundly boosting revenue generation per assay.

Despite the strong growth drivers, the market navigates significant structural restraints that temper its overall expansion rate. A principal restraint involves the persistently high procurement cost associated with advanced components, specifically proprietary, chemically defined media formulations and large-scale, specialized single-use bioreactor bags. These substantial capital expenditures can pose considerable financial barriers to entry and operational sustainability, particularly for smaller academic research laboratories and emerging biomanufacturing start-ups operating with constrained budgets. The necessity to adhere meticulously to complex and continuously evolving regulatory standards, particularly Good Manufacturing Practice (GMP) requirements for consumables slated for clinical use, presents a continuous operational challenge. Regulatory compliance mandates comprehensive documentation, rigorous traceability, and often necessitates complex, time-intensive validation protocols, thereby increasing both the cost and time involved in bringing new or updated consumable products to the clinical market. Additionally, the constant underlying risk of microbial or mycoplasma contamination in non-closed systems, coupled with the global scarcity of highly specialized personnel trained to manage complex and sensitive cell culture processes, acts as a persistent barrier to maximum market penetration in less scientifically developed global regions.

Substantial strategic opportunities for market players are emerging through the intensive focus on innovation and product differentiation. A primary opportunity lies in the development and commercial launch of advanced, proprietary serum-free, xenofree, and completely chemically defined media formulations that not only minimize biological variability but also enhance ethical sourcing compliance, aligning with global trends toward cruelty-free research. The explosive growth potential of the bioprinting and 3D culture space offers a critical avenue for market expansion, demanding rapid innovation in specialized scaffolds, biologically compatible bio-inks, and next-generation microfluidic chip devices capable of moving assays far beyond conventional two-dimensional culture limitations. Impact forces fundamentally shaping the competitive dynamics include the necessity for robust intellectual property protection surrounding proprietary media components and highly specialized plastic surface treatments, which determines market advantage. Furthermore, the increasing globalization of biopharma production necessitates that manufacturers establish localized, highly resilient supply chains and distribution networks worldwide, capable of managing sensitive, temperature-dependent biological products efficiently and reliably across diverse, often challenging, geographical logistics landscapes, making supply chain optimization a key determinant of competitive success and market share retention.

Segmentation Analysis

The Cell Culture Consumable Market is highly fragmented and segmented across several critical dimensions—product type, primary application, and final end-user base—each reflecting the varied and specific technical requirements of the global biotechnology and pharmaceutical sectors. The comprehensive product segmentation is paramount, effectively distinguishing between high-volume, continuously consumed categories such as specialized media, reagents, and sera, and more durable, standardized specialized equipment like culture plasticware and sophisticated single-use bioprocessing filtration and containment devices. This detailed, granular segmentation strategically enables manufacturers to tailor their R&D investments, production capacities, and localized supply chain logistics. Manufacturers are increasingly prioritizing innovation in specialized areas, such as the development of customized media formulations optimized for specific, complex induced pluripotent stem cell (iPSC) lines, or advanced, non-animal-derived surface treatments for superior cell attachment and differentiation, thereby aiming for maximized return on investment.

Application-based segmentation clearly highlights the dominance of large-scale biopharmaceutical production (e.g., monoclonal antibodies and vaccines) and therapeutic development (gene and cell therapy manufacturing) as the primary commercial revenue drivers, necessitating continuous consumption of clinical-grade and high-purity materials with robust regulatory certification. Drug discovery and preclinical toxicology testing also remain vital, though typically requiring smaller volumes for high-throughput screening phases. End-user analysis reveals a clear and ongoing shift in purchasing power dynamics: while academic and non-profit research institutions constitute a large volume of individual customers, biopharmaceutical and large biotechnology companies collectively represent the most substantial and rapidly growing financial segment. These commercial entities demand massive, highly regulated volumes of scalable consumables for commercial production, structurally reinforcing the industry-wide focus on providing automated, GMP-compliant, and economically efficient bulk consumable solutions.

- Product Type

- Cell Culture Media (Classical Media, Serum-free Media, Chemically Defined Media, Specialized Media, Protein-Free Media)

- Reagents (Growth Factors, Cytokines, Buffers, Antibiotics, Cell Dissociation Reagents, Cryopreservation Agents, Virus Transport Media)

- Cell Culture Sera (Fetal Bovine Serum (FBS), Newborn Calf Serum (NCS), Other Animal Sera, Serum Alternatives)

- Cell Culture Plasticware & Consumables (Petri Dishes, Culture Flasks (T-flasks, Erlenmeyer), Multi-well Plates (6 to 384-well), Roller Bottles, Specialized Bioreactor Bags, Filtering Devices, Automated Cell Counters, Cell Scrapers)

- Others (Sterilization Filters and Capsules, Cryogenic Vials and Boxes, Pipettes and Tips, Storage Containers, Single-Use Tubing and Connectors)

- Application

- Biopharmaceutical Production (Monoclonal Antibodies Manufacturing, Recombinant Proteins Synthesis, Vaccine Production, Diagnostics)

- Tissue Culture & Engineering (3D Culture, Organoids, Scaffolds)

- Drug Discovery & Development (High-Throughput Screening, Target Identification, Compound Toxicity Testing)

- Gene & Cell Therapy (CAR T-cell Expansion, Viral Vector Manufacturing, Stem Cell Banking)

- Toxicology Testing & Personalized Medicine

- Academic & Basic Research

- End-User

- Pharmaceutical & Biotechnology Companies (Major Biopharma, Emerging Biotech)

- Academic & Government Research Institutes (Universities, National Laboratories)

- Contract Research Organizations (CROs) & Contract Manufacturing Organizations (CMOs)

- Hospitals, Clinical Laboratories, & Diagnostic Centers

Value Chain Analysis For Cell Culture Consumable Market

The intricate value chain of the cell culture consumable sector commences decisively at the upstream level, which centers on the critical sourcing, meticulous purification, and rigorous quality validation of fundamental raw materials. This includes procuring high-grade, certified chemicals, ultra-pure water systems, essential biological components such as specific amino acids and vitamins, and specialized, medical-grade polymer resins (e.g., high-density polystyrene, polyethylene terephthalate) necessary for plasticware production. Key ingredient suppliers must adhere strictly to exceptionally high purity and traceability standards, often requiring comprehensive ISO 9001 or even GMP certifications, as the initial raw material integrity profoundly dictates the performance characteristics, regulatory approval pathway, and ultimate safety profile of the finished cell culture products. For high-risk biological components like fetal bovine serum or specialized growth factors, stringent ethical sourcing, robust viral screening, and validated inactivation processes are mandated regulatory prerequisites, adding significant complexity, stringent quality checkpoints, and cumulative costs at this formative stage of the value chain. Operational efficiency and strategic vendor management in this upstream segment are absolutely crucial for effectively controlling and stabilizing the final manufacturing cost of high-volume, sensitive products such as basal media and complex specialized media formulations.

Manufacturing, formulation, and specialized production represent the highest value-add segment and the pivotal core of the value chain. This phase involves complex processes including the preparation and blending of proprietary media formulations within certified Grade A/B cleanroom environments, precision injection molding, and highly specialized surface treatments of plasticware (e.g., vacuum plasma treatment, biochemical coating application) engineered to optimize specific cell adhesion, proliferation, and differentiation characteristics. Manufacturers must maintain unwavering compliance with global quality management systems (ISO 13485) and often strict GMP compliance, leveraging sophisticated industrial automation and robotics to guarantee flawless batch-to-batch product consistency—a factor critically important for any media intended for use in commercial clinical applications. The distribution strategy is bifurcated: direct sales models are typically deployed for large, high-volume biopharmaceutical clients or Contract Manufacturing Organizations (CMOs) that require highly specialized or bulk supply orders, enabling close technical collaboration, streamlined customized supply agreements, and rapid responsiveness to operational fluctuations. Conversely, indirect distribution, utilizing vast global networks of specialized third-party distributors and major laboratory supply houses (such as VWR, Fisher Scientific, and others), is strategically preferred for efficiently reaching thousands of smaller academic laboratories, emerging biotech firms, and geographically dispersed end-customers, ensuring broad market reach and rapid localized inventory availability.

Downstream value chain activities are focused intensely on comprehensive customer integration, superior technical support, advanced inventory forecasting, and critical post-sale validation documentation services. Commercial biopharma clients require extensive technical documentation, robust certification evidence, and detailed validation support to successfully integrate new or modified consumable batches into their established, regulated production processes, often involving months of qualification work. The operational effectiveness and reliability of the indirect distribution network are intrinsically reliant on the distributor’s robust logistical capabilities, particularly their proficiency in managing critical cold chain storage requirements for sensitive, temperature-dependent reagents, specialized media, and sera, ensuring absolute product integrity upon arrival. Furthermore, the downstream component includes the growing importance of recycling and sustainable disposal programs for single-use plastic components. Strategic optimization across the totality of the value chain, from meticulous raw material validation and ethical sourcing to efficient, secure final delivery and highly responsive, expert customer technical service, is fundamentally crucial for maintaining decisive competitive advantage, ensuring the integrity and quality of the cell culture product throughout its entire journey to the end-user, and securing long-term customer loyalty in a highly competitive and technically demanding market environment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 37.0 Billion |

| Growth Rate | 10.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thermo Fisher Scientific, Corning Inc., Merck KGaA, Danaher Corporation, Sartorius AG, Lonza Group AG, Becton, Dickinson and Company, Eppendorf AG, Bio-Rad Laboratories, Miltenyi Biotec, Fujifilm Diosynth Biotechnologies, GE Healthcare, HiMedia Laboratories, Greiner Bio-One International GmbH, Agilent Technologies, Promocell GmbH, STEMCELL Technologies, Irvine Scientific, Inc., Zenith Bioproducts, CellGenix GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cell Culture Consumable Market Key Technology Landscape

The technological evolution of the Cell Culture Consumable Market is fundamentally shaped by continuous innovation aimed at drastically enhancing cell line performance (viability, yield, and functionality), minimizing batch-to-batch variability, and crucially, enabling seamless industrial scalability across global biomanufacturing sites. A truly critical foundational technology involves the intensive development and application of advanced surface modification techniques for sterile plasticware, moving significantly beyond conventional, basic tissue culture treated (TCT) polystyrene. These next-generation modifications now include complex, highly specific proprietary coatings such as natural matrices (e.g., customized laminin or collagen variants), synthetic polymer scaffolds, or chemically defined, tailored synthetic surfaces. These surfaces are engineered precisely to robustly support the demanding growth and specific differentiation requirements of highly sensitive and valuable cell types, including complex primary cells and delicate human stem cells, resulting in profoundly improved experimental reliability, dramatically enhanced cellular yields, and far greater reproducibility in highly complex in vitro assays. Furthermore, the widespread and accelerating industrial implementation of advanced Single-Use Technologies (SUTs)—encompassing high-volume bioreactor bags, sophisticated flexible storage containers, and advanced mixing systems—represents a paradigm shift. These SUTs minimize the significant burdens and risks associated with cleaning validation (reducing capital expenditure and operational downtime) and virtually eliminate the perennial risk of cross-contamination in regulated biomanufacturing environments, thus becoming the de facto standard for scalable production.

A second major technological frontier is the focused research and commercial development of complex, highly specialized media and biological reagent formulations. Key technological progress is concentrated on establishing completely chemically defined (CD) and strictly animal component-free (ACF) media formulations. These media are mandatory to meet the stringent international regulatory requirements (FDA, EMA) for clinical-grade manufacturing processes by eliminating the inherent variability and potential biological safety concerns (e.g., prion or viral transmission risks) historically associated with using traditional animal products like Fetal Bovine Serum (FBS). These highly advanced, customized formulations are frequently proprietary and must be meticulously tailored to optimize specific therapeutic production processes, such as the rapid and efficient expansion of autologous T-cells for CAR T-cell therapy or the high-titer manufacturing of various viral vectors. The intricate optimization of these proprietary media leverages sophisticated techniques, including multi-omics analysis (metabolomics, proteomics), high-throughput media screening platforms, and predictive computational modeling, all necessary to precisely fine-tune nutrient delivery, trace element concentrations, and growth factor balances for achieving maximum cellular productivity and consistent biotherapeutic quality.

Finally, the growing commercial maturity of 3D cell culture systems is relentlessly driving the necessity for radical, highly innovative consumable design iterations. This ecosystem now relies heavily on technologically advanced components such as tailored biocompatible hydrogels, porous synthetic and natural scaffold materials, and specialized, precision-engineered multi-channel microplates (e.g., hanging drop systems, forced-aggregation spheroid plates). Furthermore, the burgeoning field of microfluidic devices and complex organs-on-chips represents a pinnacle of consumable sophistication, requiring exceptionally precise, often highly micro-fabricated polymer chips that enable dynamic fluid flow control, mimic vascular systems, and allow for the real-time, non-invasive monitoring of intricate cell-cell and cell-environment signaling interactions under highly controlled conditions. This powerful technological impetus towards creating more physiologically predictive and complex in vitro models ensures the continuous, rapid evolution and diversification of the consumable product portfolio. It necessitates manufacturers invest heavily in high-precision micro-engineering capabilities, advanced materials science, and proprietary surface chemistry expertise to remain competitive and meet the escalating technical demands of modern life science research and therapeutic development across the globe.

Regional Highlights

North America, specifically dominated by the extensive infrastructure of the United States, currently commands and retains the largest and most valuable market share within the global Cell Culture Consumable sector. This commanding market position is directly attributable to several deeply embedded structural factors: the region hosts the largest concentration of globally leading pharmaceutical and biotechnology corporations, it benefits from robust and continuous governmental and private R&D funding streams dedicated to biomedical sciences and advanced life sciences research, and it demonstrates exceptionally high rates of early technology adoption for advanced cell culture methodologies, including complex 3D culture platforms and automated high-throughput screening. The region’s well-defined, predictable regulatory environment (governed by the FDA) and its expansive, established industrial base for commercial biomanufacturing ensure a constant, high-volume requirement for clinical-grade media, specialized biological reagents, and large-scale single-use processing systems. The intense global focus on innovation in highly profitable segments like gene therapy, advanced oncology treatments, and truly personalized medicine protocols is concentrated heavily in this region, thus perpetually driving demand for highly specialized and proprietary next-generation consumable products.

The Asia Pacific (APAC) region is decisively projected to exhibit the highest Compound Annual Growth Rate (CAGR) throughout the entire forecast period, establishing itself as the most dynamic region globally. This extremely rapid expansion trajectory is fundamentally fueled by enormous, strategic governmental investments in key national programs aimed at aggressively developing and maturing robust domestic biopharmaceutical and biotechnology capabilities, particularly within major economies such as China, India, and South Korea. Contributing factors include the growing regional prevalence of chronic diseases demanding new therapeutic approaches, significantly increased public awareness regarding advanced biological therapeutic options, and the crucial establishment of major international manufacturing and R&D hubs by leading global life science corporations seeking to capitalize on lower operational costs and expanding local markets. This surge in manufacturing capacity, particularly in vaccines and biosimilars, is driving an unprecedented demand increase for both foundational research consumables and scalable, certified single-use bioreactor systems necessary to support rapidly expanding production capacity across the region.

Europe represents a crucial, stable, and highly mature market, characterized by an exceptional concentration of world-class academic research institutions and strong pioneering leadership in complex therapeutic development areas like advanced gene editing (CRISPR) and cutting-edge cell therapy production, notably in economic powerhouses such as Germany, Switzerland, and the United Kingdom. The high average adoption rates of advanced, highly automated manufacturing processes, coupled with extremely stringent regional quality requirements imposed by the EMA, ensure a robust and unwavering demand for premium, highly certified, and validated cell culture consumables. Conversely, Latin America (LATAM) and the Middle East & Africa (MEA) are currently classified as developing markets, where regional growth rates are presently constrained by historically lower cumulative R&D expenditure levels, structural healthcare infrastructure limitations, and less robust localized supply chains for sensitive products. However, increasing global public health initiatives, strategic foreign direct investment aimed at healthcare capacity building, and localized efforts to establish domestic research centers are progressively improving regional access to and demand for high-quality, modern cell culture consumables, signaling long-term potential for sustained development.

- North America: Maintains market leadership due to intense biopharma R&D spending, foundational early adoption of complex cell culture technologies, and large-scale, sustained implementation of single-use bioreactor technology in commercial manufacturing.

- Europe: Sustains stable, high-value growth driven by institutional academic excellence, a dense cluster of established biomanufacturing sites, and specialized expertise in therapeutic fields like cell and gene therapy, leading the adoption of advanced 3D culture models.

- Asia Pacific (APAC): Exhibits the highest projected CAGR, primarily catalyzed by massive strategic government investment in creating domestic biopharma autonomy (China, South Korea), rapidly increasing incidence of chronic diseases, and the explosive expansion of outsourced manufacturing (CMO/CRO) activities across the region.

- Latin America (LATAM): A rapidly emerging market segment characterized by increasing national healthcare investments, regulatory modernization efforts, and rising commercial awareness of advanced biologic therapies, although robust cold chain and supply logistics present ongoing infrastructural challenges.

- Middle East & Africa (MEA): Growth is increasingly driven by regional economic diversification efforts into biotechnology research, significant foreign collaborations aimed at knowledge transfer, and enhanced government initiatives focused on improving localized access to advanced laboratory and medical supplies across key regional hubs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cell Culture Consumable Market.- Thermo Fisher Scientific

- Corning Inc.

- Merck KGaA

- Danaher Corporation (including Pall Corporation and Cytiva)

- Sartorius AG

- Lonza Group AG

- Becton, Dickinson and Company (BD)

- Eppendorf AG

- Bio-Rad Laboratories

- Miltenyi Biotec

- Fujifilm Diosynth Biotechnologies

- GE Healthcare (Part of Danaher via Cytiva transaction post-report scope updates in some areas)

- HiMedia Laboratories

- Greiner Bio-One International GmbH

- Agilent Technologies

- Promocell GmbH

- STEMCELL Technologies

- Irvine Scientific, Inc.

- Zenith Bioproducts

- CellGenix GmbH

Frequently Asked Questions

Analyze common user questions about the Cell Culture Consumable market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Cell Culture Consumable Market?

The market growth is fundamentally driven by escalating R&D spending in the biopharmaceutical sector, the rapid expansion of clinical cell and gene therapy pipelines globally, and the increasing operational adoption of advanced culture techniques, such as physiologically relevant 3D cell culture models and automated high-throughput screening systems, all of which necessitate specialized, high-volume consumables with stringent quality standards.

Which product segment accounts for the largest share of the Cell Culture Consumable Market?

Cell culture media and essential biological reagents collectively hold the largest revenue market share. This dominance is due to their inherent status as high consumption volume items, their absolute necessity as recurring purchases in virtually every laboratory and production operation, and their critical role in determining cell growth and productivity across all stages of research and bioproduction.

How is the adoption of single-use technology impacting the demand for cell culture consumables?

Single-use technologies (SUTs), notably large-scale bioreactor bags and sterile connectors, are dramatically boosting the demand for specialized polymer plasticware. SUTs enhance contamination control, lower overall operational costs by eliminating time-consuming cleaning and sterilization validation, and offer crucial flexibility and scalability required by modern, multi-product biomanufacturing facilities adhering to GMP guidelines.

Which geographical region is anticipated to exhibit the fastest growth rate in the forecast period?

The Asia Pacific (APAC) region is strongly projected to register the highest Compound Annual Growth Rate (CAGR). This rapid market acceleration is directly attributed to significant governmental investments in developing robust domestic biotechnology infrastructure, the rapidly expanding regional biomanufacturing capacity facilitated by CMOs, and increasing local demand for advanced therapeutic products in nations such as China and India.

What is the regulatory and commercial significance of chemically defined media in current market trends?

Chemically defined (CD) and serum-free media are of immense significance because they are essential for minimizing biological variability and achieving stringent regulatory compliance, particularly for therapeutics intended for human clinical use. Their adoption eliminates safety concerns related to animal components, ensuring superior process consistency, enhanced traceability, and simplified downstream purification, which are critical for commercial success.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager