Cell Expansion Technologies Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436568 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Cell Expansion Technologies Market Size

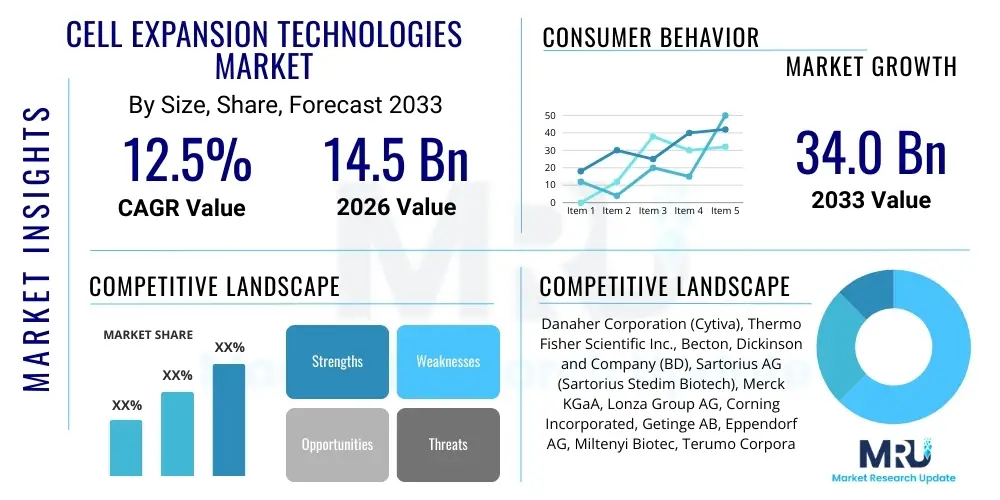

The Cell Expansion Technologies Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at $14.5 Billion in 2026 and is projected to reach $34.0 Billion by the end of the forecast period in 2033.

Cell Expansion Technologies Market introduction

The Cell Expansion Technologies Market encompasses the tools, equipment, consumables, and services essential for the proliferation and scaling of various cell types, including stem cells, primary cells, and immortalized cell lines, required for research, therapeutic development, and large-scale manufacturing. These technologies are foundational to advanced biotechnological fields such as regenerative medicine, cell and gene therapies (especially CAR-T and CRISPR applications), drug screening, and complex disease modeling. Effective cell expansion is critical as it dictates the viability, purity, and quantity of cells available, directly impacting the success and cost-efficiency of downstream clinical and commercial applications.

Key product segments within this market include specialized culture media and reagents, sophisticated bioreactors (e.g., stirred tank, rocking motion, hollow fiber), automated cell culture systems, and monitoring and visualization tools. The increasing complexity of therapeutic cell lines, such as pluripotent stem cells and mesenchymal stem cells, necessitates highly controlled, reproducible, and scalable expansion environments. Modern systems focus on reducing manual intervention, minimizing contamination risk, and optimizing parameters like pH, dissolved oxygen, and temperature to ensure maximal cell yield and potency.

The primary driving factors accelerating market adoption include the surging global investment in cell-based research and clinical trials, particularly in oncology and chronic disease management. Furthermore, advancements in personalized medicine and the rapid commercialization of approved cell and gene therapies are placing immense pressure on the industry to develop robust, closed-system cell expansion platforms capable of meeting commercial scale demands while adhering to stringent Good Manufacturing Practices (GMP) guidelines. The inherent benefits of these technologies—improved consistency, enhanced scalability, and reduced labor costs—are solidifying their indispensable role in the biopharmaceutical ecosystem.

Cell Expansion Technologies Market Executive Summary

The Cell Expansion Technologies Market is characterized by robust commercial trends, driven primarily by the shift towards fully automated and closed-system bioprocessing solutions designed to streamline manufacturing in the burgeoning cell therapy sector. Key businesses are investing heavily in integrated bioreactor systems that offer dynamic control over culture environments, moving away from traditional static culture dishes. This transition addresses critical industry challenges related to contamination risk, batch-to-batch variability, and the high labor requirements of manual processes. Strategic mergers, acquisitions, and collaborations between technology providers and Contract Manufacturing Organizations (CMOs) are also shaping the competitive landscape, aimed at creating end-to-end solutions that accelerate therapeutic time-to-market.

Regionally, North America remains the dominant revenue generator, fueled by significant governmental and private sector funding for regenerative medicine research, a high concentration of leading biotechnology firms, and a clear, albeit rigorous, regulatory pathway for cell-based products. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, particularly in countries like China, Japan, and South Korea. This growth is underpinned by rapidly expanding clinical trial activities, favorable government initiatives supporting biotech innovation, and the establishment of manufacturing hubs utilizing lower operational costs to service global cell therapy supply chains.

Segmentally, the consumables sub-segment, particularly specialized culture media and growth factors, accounts for the largest market share due to its high volume usage and continuous repurchase cycle necessary for ongoing culture maintenance. Application trends show oncology leading the demand, driven by the proliferation of Chimeric Antigen Receptor (CAR) T-cell therapies. Within technology types, the adoption of single-use bioreactors is rapidly outpacing conventional stainless steel systems due to benefits such as quicker turnaround times, reduced sterilization validation requirements, and enhanced flexibility for handling diverse small-batch therapeutic products.

AI Impact Analysis on Cell Expansion Technologies Market

User inquiries regarding the integration of Artificial Intelligence (AI) in the Cell Expansion Technologies Market frequently revolve around three core themes: optimization, automation, and predictive quality control. Users are keen to understand how AI algorithms can move beyond simple automation to truly optimize complex biological processes—specifically, identifying optimal feed schedules, media compositions, and critical process parameters (CPPs) that maximize cell yield and maintain desired critical quality attributes (CQAs). There is also significant concern and expectation regarding AI’s ability to standardize the highly variable manufacturing process of personalized cell therapies, thereby reducing costs and accelerating regulatory approval.

AI's primary influence is manifested through sophisticated machine learning models applied to real-time process monitoring data gathered from bioreactors and automated culture systems. By analyzing high-dimensional datasets encompassing metabolic profiles, image morphology (phenotypic analysis), and growth kinetics, AI can detect subtle deviations from optimal conditions far earlier than human operators. This capability enables predictive maintenance and dynamic, closed-loop control adjustments, minimizing the risk of costly batch failure and ensuring consistency across manufacturing runs, which is paramount for commercial scalability.

Furthermore, AI is instrumental in accelerating the initial stages of technology development, such as screening vast libraries of growth factor combinations or designing novel scaffolds for 3D culture. By predicting the performance of untested formulations, AI drastically reduces the reliance on laborious trial-and-error experiments, thereby shortening the development cycle for next-generation expansion media and minimizing the consumption of expensive reagents. This predictive capability translates directly into faster innovation and improved cost-efficiency within the cell expansion ecosystem.

- AI optimizes bioreactor operational parameters (e.g., dissolved oxygen, flow rates) in real-time for maximal yield.

- Machine learning enhances image analysis for non-invasive cell counting, viability assessment, and morphological QC.

- AI accelerates the formulation of proprietary, serum-free culture media by predicting optimal nutrient ratios.

- Predictive modeling minimizes batch-to-batch variability in GMP manufacturing workflows.

- Automated anomaly detection reduces human error and contamination risks in large-scale expansion facilities.

DRO & Impact Forces Of Cell Expansion Technologies Market

The market dynamics are governed by powerful drivers and significant restraints, tempered by lucrative opportunities, forming a complex set of impact forces. A primary driver is the exponentially increasing global demand for advanced therapies, particularly those utilizing autologous and allogeneic T-cells and stem cells, which necessitate highly scalable and efficient expansion platforms. Additionally, substantial government and private sector investments in regenerative medicine research globally, coupled with favorable regulatory designations (like FDA Fast Track or EMA PRIME), are incentivizing companies to adopt and refine these expansion technologies rapidly. Technological advancements, specifically the shift towards fully integrated, automated, and closed systems, are also compelling market growth by addressing concerns about process contamination and manual complexity.

Conversely, significant restraints hinder universal adoption. The prohibitive capital expenditure required for establishing automated, GMP-compliant manufacturing facilities—including specialized bioreactors and supporting infrastructure—represents a major barrier, especially for smaller biotech firms and academic spin-offs. Furthermore, the complexity and variability associated with handling and expanding sensitive primary and induced pluripotent stem cells (iPSCs) pose continuous technical challenges regarding maintaining cell potency and purity during scale-up. Regulatory scrutiny remains intense, requiring extensive validation and documentation for every component and process change, which slows down technology implementation and increases operational costs.

Opportunities for growth are concentrated in the continuous evolution of 3D cell culture technologies, which better mimic in vivo environments and offer higher cell densities, and the penetration of these technologies into emerging economies. The development of cost-effective, chemically defined, and serum-free media formulations represents a key commercial opportunity, reducing both cost and regulatory complexity associated with animal-derived components. Strategic partnerships focused on establishing regional cell therapy manufacturing capacity, especially in Asia, where clinical trials are accelerating, will be instrumental in shaping future market leadership and expanding geographical reach.

Segmentation Analysis

The Cell Expansion Technologies Market is comprehensively segmented based on product type, application, end-user, and cell type, reflecting the diverse needs of the life sciences industry. Product segmentation, encompassing instruments, consumables, and accessories, highlights the critical reliance on high-volume, recurring purchases of culture media, reagents, and disposables, which constitute the largest revenue stream. The evolution of instruments, particularly towards miniaturized, high-throughput automated systems, caters directly to the burgeoning demand from Contract Research Organizations (CROs) for scalable drug screening models and toxicity testing.

Application segmentation reveals that therapeutic uses, primarily in oncology and cardiovascular diseases, drive the majority of market valuation, necessitating GMP-grade expansion systems. However, research applications, including basic science and translational studies, continue to drive innovation in smaller-scale, highly adaptable systems. End-user analysis clearly delineates the critical role of pharmaceutical and biotechnology companies as the largest consumers, due to their significant R&D budgets and large-scale manufacturing requirements for approved therapies, contrasting with academic and research institutes which primarily purchase media and bench-top instruments.

The segmentation by cell type underscores the technological requirements specific to different biological entities. The expansion of stem cells (both adult and embryonic/iPSC) demands sophisticated, highly monitored environments to maintain pluripotency and viability, pushing the boundaries of bioreactor design. Conversely, the high volume expansion of specialized immune cells (T-cells, NK cells) for adoptive cell transfer therapies necessitates rapid, efficient, and cost-controlled expansion protocols, favoring advanced single-use and perfusion bioreactor designs optimized for closed-system operations.

- By Product:

- Consumables (Culture Media, Reagents, Sera, Disposables)

- Instruments (Bioreactors, Automated Cell Expansion Systems, Centrifuges, Incubators)

- By Cell Type:

- Stem Cells (Adult Stem Cells, Pluripotent Stem Cells)

- Differentiated Cells (T-cells, NK Cells, Hepatocytes, Keratinocytes)

- Primary Cells

- By Application:

- Regenerative Medicine

- Cell & Gene Therapy (Oncology, Cardiovascular, Neurology)

- Drug Discovery and Development

- Tissue Engineering

- By End User:

- Biotechnology & Pharmaceutical Companies

- Academic & Research Institutes

- Contract Research & Manufacturing Organizations (CROs & CMOs)

Value Chain Analysis For Cell Expansion Technologies Market

The value chain of the Cell Expansion Technologies Market is highly integrated, starting with upstream suppliers and culminating in therapeutic delivery or advanced research applications. Upstream activities involve the crucial supply of high-purity raw materials, particularly specialized chemicals, basal media components, growth factors, and recombinant proteins, often sourced from niche biochemical manufacturers. The quality and consistent supply of these raw materials directly influence the efficacy and regulatory compliance of the final cell product. Key challenges at this stage include minimizing supply chain vulnerability and ensuring strict compliance with GMP standards for all starting materials.

The midstream segment is dominated by technology developers and system manufacturers who convert raw materials into functional products: advanced bioreactors, automated systems, and proprietary media formulations. This stage requires significant intellectual property investment in engineering and biological research to create systems capable of reproducible, large-scale, and closed cell expansion. Distribution channels are predominantly indirect, relying heavily on specialized life science distributors and regional agents who possess the necessary technical expertise for installation, validation, and maintenance support for complex equipment sold to biopharma clients globally.

Downstream activities involve the end-users—biopharmaceutical companies, academic institutions, and CMOs—who utilize these technologies to manufacture clinical-grade cell therapies or conduct large-scale screening and research. Direct distribution is common for high-value strategic sales to major pharma clients requiring extensive customization and validation services. The efficiency and success of the entire value chain depend on seamless information flow and stringent quality control protocols enforced from raw material acquisition through to the final manufacturing process, ensuring the integrity and viability of the expanded cells for clinical use.

Cell Expansion Technologies Market Potential Customers

Potential customers for Cell Expansion Technologies are primarily clustered within high-value biotechnology and pharmaceutical sectors, driven by the need to scale up cell therapy manufacturing under GMP conditions. These customers require highly specialized, robust, and often customized expansion systems to produce sufficient cell doses for clinical trials and eventual commercialization. Their purchasing decisions are heavily influenced by regulatory compliance, system scalability, and proven track record of reducing batch variability, making them the largest revenue contributors to the market.

A second major customer segment includes Contract Manufacturing Organizations (CMOs) and Contract Research Organizations (CROs). CMOs, which often handle manufacturing for smaller biotech firms, require versatile, multi-product cell expansion platforms that can quickly switch between different cell types (e.g., T-cells, MSCs) and batch sizes. CROs leverage high-throughput automated expansion systems for large-scale drug toxicity screening, compound testing, and disease modeling, demanding reliability and integration capabilities with other laboratory automation tools.

Academic and governmental research institutions constitute a third vital customer base. While their volume requirements are generally smaller than biopharma, they are critical for early-stage technology adoption and foundational research. These entities prioritize instruments that offer flexibility, ease of use, and compatibility with various research-grade cell lines. Their procurement decisions are often budget-constrained, leading them to purchase advanced media and specialized reagents at high frequency, while preferring multi-purpose benchtop instruments over massive production bioreactors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $14.5 Billion |

| Market Forecast in 2033 | $34.0 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Danaher Corporation (Cytiva), Thermo Fisher Scientific Inc., Becton, Dickinson and Company (BD), Sartorius AG (Sartorius Stedim Biotech), Merck KGaA, Lonza Group AG, Corning Incorporated, Getinge AB, Eppendorf AG, Miltenyi Biotec, Terumo Corporation, Fujifilm Diosynth Biotechnologies, BPS Bioscience, STEMCELL Technologies Inc., ATCC, Cook Group Incorporated, Solida Biotech Srl, InvivoGen, Bio-Rad Laboratories, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cell Expansion Technologies Market Key Technology Landscape

The technology landscape in the Cell Expansion Technologies Market is rapidly evolving, moving decisively toward advanced, highly controlled, and scalable bioprocessing solutions that address the inherent challenges of large-scale cell therapy production. A core technology advancement is the proliferation of various bioreactor designs, each optimized for specific cell characteristics and production scales. Stirred-tank bioreactors, adapted from traditional biopharma, remain prevalent for large volumes, but there is increasing adoption of specialized systems such as hollow fiber bioreactors and fixed-bed/packed-bed reactors, which offer significantly higher surface area-to-volume ratios, making them ideal for adherent cell lines like Mesenchymal Stem Cells (MSCs).

Automation constitutes another fundamental technological pillar, with integrated cell processing platforms dominating the high-end market. These systems combine critical steps—including cell isolation, expansion, washing, and harvest—into a single, closed, and automated workflow. This transition minimizes manual handling, drastically reducing contamination risk and ensuring high levels of reproducibility, which are non-negotiable requirements for GMP manufacturing environments. Technologies like microfluidic devices are also emerging, offering precise control over the cellular microenvironment for research-scale expansion and high-throughput screening applications.

Furthermore, the continuous innovation in culture media and surface science is driving technological breakthroughs. The shift from animal-serum-containing media to fully chemically defined, serum-free, and xeno-free media formulations is crucial for regulatory clearance and therapeutic safety, necessitating advanced biochemical engineering. Parallel developments in scaffold and substrate technologies—such as specialized coatings, microcarriers, and porous hydrogels—are enabling more effective 3D cell expansion, better mimicking the physiological environment and resulting in cells with superior functional characteristics compared to traditional 2D culture methods.

Regional Highlights

The global Cell Expansion Technologies Market exhibits distinct regional dynamics driven by varying levels of research funding, regulatory maturity, and commercialization activities. North America, specifically the United States, commands the largest share of the market revenue. This dominance is attributed to a highly concentrated ecosystem of leading pharmaceutical and biotechnology companies, unparalleled federal and private funding for regenerative medicine (including NIH and venture capital), and robust infrastructure for cell therapy manufacturing. The FDA’s proactive approach to approving novel cell and gene therapies provides a strong incentive for technology adoption and large-scale facility expansion across the region, cementing its position as a global innovation hub.

Europe represents the second-largest market, characterized by strong governmental support for biotech clusters in countries like Germany, the UK, and Switzerland. The European market benefits from established academic excellence and a stringent, yet supportive, regulatory framework established by the European Medicines Agency (EMA). While regulatory harmonization across member states can sometimes present challenges, focused efforts on translational research and the proliferation of CMOs specializing in cell therapy production are driving steady demand for high-quality, validated cell expansion systems.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market globally. This accelerated expansion is primarily fueled by rapid economic development, increasing healthcare expenditure, and governmental policies in countries like China, Japan, and South Korea aimed at fostering local biotech industries. Japan, in particular, has expedited regulatory pathways for regenerative medicine (e.g., the SAkigake system), leading to swift clinical translation. Moreover, lower operational costs in several APAC nations are positioning them as attractive locations for establishing large-scale, cost-effective cell manufacturing hubs designed to service global supply chains, increasing the demand for scalable and automated cell expansion technologies.

- North America: Dominates market share due to high R&D expenditure, mature biopharma industry, and leading concentration of cell and gene therapy clinical trials.

- Europe: Exhibits steady growth, driven by academic research excellence, strong government funding, and growing adoption of closed-system automation in Germany and the UK.

- Asia Pacific (APAC): Fastest-growing region, stimulated by supportive governmental initiatives, relaxed regulatory frameworks in specific countries (Japan, South Korea), and expanding CMO infrastructure.

- Latin America & MEA: Represent nascent markets with significant long-term potential, primarily driven by investments in chronic disease management and increasing accessibility of imported Western technologies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cell Expansion Technologies Market.- Danaher Corporation (Cytiva)

- Thermo Fisher Scientific Inc.

- Becton, Dickinson and Company (BD)

- Sartorius AG (Sartorius Stedim Biotech)

- Merck KGaA

- Lonza Group AG

- Corning Incorporated

- Getinge AB

- Eppendorf AG

- Miltenyi Biotec

- Terumo Corporation

- Fujifilm Diosynth Biotechnologies

- BPS Bioscience

- STEMCELL Technologies Inc.

- ATCC

- Cook Group Incorporated

- Solida Biotech Srl

- InvivoGen

- Bio-Rad Laboratories, Inc.

- Sartorius Stedim Biotech

Frequently Asked Questions

Analyze common user questions about the Cell Expansion Technologies market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key drivers impacting the growth of the Cell Expansion Technologies Market?

The primary drivers include the accelerated development and commercialization of cell and gene therapies, substantial global investments in regenerative medicine research, and the necessity for scalable, automated bioprocessing solutions to meet clinical manufacturing demand.

How is automation changing the landscape of cell expansion?

Automation is crucial for reducing batch-to-batch variability, minimizing contamination risk, and allowing for high-throughput processing. Closed, integrated systems are replacing manual methods to ensure GMP compliance and scalability necessary for commercial production.

Which product segment holds the largest share in the Cell Expansion Market?

The Consumables segment, particularly specialized culture media, reagents, and disposables, dominates the market share due to its essential and recurring use in every stage of cell culture, driving continuous revenue streams for suppliers.

What role do advanced bioreactors play in large-scale cell expansion?

Advanced bioreactors (such as stirred-tank and hollow-fiber systems) provide precisely controlled environments (pH, oxygen, temperature) for optimal cell growth. They are essential for achieving the high cell yields and densities required for clinical-scale therapeutic manufacturing efficiently.

Which region is expected to experience the fastest market growth through 2033?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate, driven by governmental support for biotech, expanding clinical trial infrastructure, and the establishment of cost-effective manufacturing hubs in countries like China and Japan.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager