Cell Phone Cases Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431918 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Cell Phone Cases Market Size

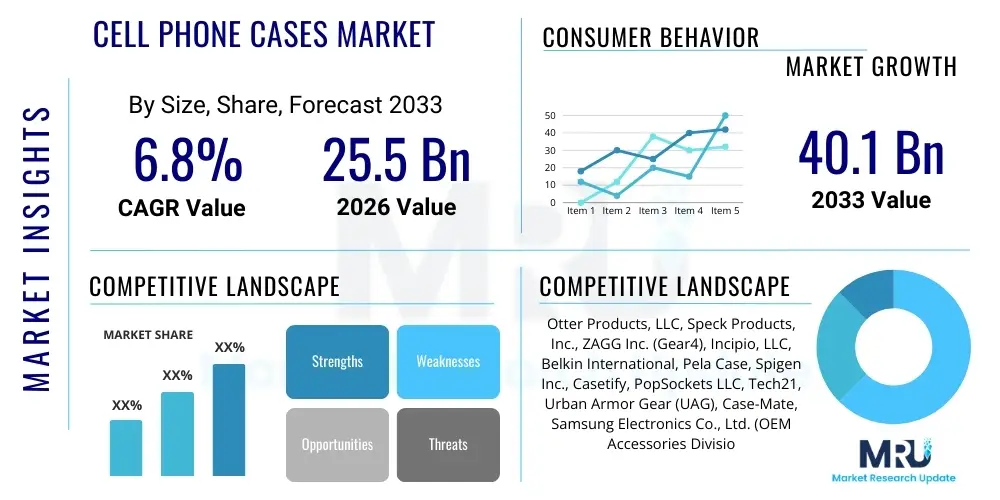

The Cell Phone Cases Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 25.5 Billion in 2026 and is projected to reach USD 40.1 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the rising global smartphone penetration, the increasing consumer awareness regarding device protection, and the rapid obsolescence cycle of mobile technology, which necessitates continuous accessory upgrades.

Market expansion is further supported by innovations in material science, leading to the development of highly durable yet aesthetically pleasing case options, including biodegradable and antimicrobial materials. The premiumization trend, especially in mature markets like North America and Europe, where consumers often view phone cases as fashion statements or personalized accessories rather than mere protective gear, significantly contributes to the revenue growth. Furthermore, the proliferation of specialized phone functionalities, such as advanced camera systems, dictates the need for custom-designed cases that ensure full feature utilization while maintaining device safety.

Cell Phone Cases Market introduction

The Cell Phone Cases Market encompasses the global manufacturing, distribution, and sale of protective and decorative coverings designed for mobile communication devices. These products range widely in material composition, including plastics (polycarbonate, TPU, TPE), silicone, leather, wood, and metal, catering to diverse consumer needs spanning rugged protection, minimalist design, and enhanced functionality such as battery integration or wallet features. The primary application of cell phone cases is physical device protection against drops, scratches, and environmental damage, thereby extending the lifespan of high-value electronic assets. Secondary applications include aesthetic customization, branding, and incorporating technological enhancements like magnetic charging compatibility or integrated stands.

Key benefits driving market adoption include significant damage mitigation, crucial given the rising cost of flagship smartphones, and enabling personalization that reflects individual consumer identity. The continuous influx of new smartphone models with diverse form factors from major manufacturers, including Apple, Samsung, Xiaomi, and Huawei, ensures constant demand for newly compatible accessories. Furthermore, consumer purchasing behavior is influenced by seasonal trends, fashion cycles, and the rapid pace of technological innovation, making the case market highly dynamic and responsive to quick product cycles.

Driving factors propelling this market include the global expansion of 5G infrastructure, accelerating smartphone replacement rates, and the critical role mobile devices play in everyday life, making protection indispensable. Regulatory standards focusing on material safety and sustainability are also subtly reshaping the manufacturing landscape, pushing companies toward eco-friendly and responsibly sourced materials, particularly in developed economies where environmental consciousness is high. The convergence of protective function and lifestyle accessory status solidifies the market's long-term growth trajectory.

Cell Phone Cases Market Executive Summary

The Cell Phone Cases Market is characterized by high fragmentation, rapid product innovation, and strong dependence on the underlying smartphone industry’s sales cycles. Key business trends indicate a shift towards direct-to-consumer (DTC) models and heightened competition from specialized, design-focused brands that leverage strong social media presence and influencer marketing rather than relying solely on traditional retail channels. Furthermore, sustainability is emerging as a critical differentiator, with brands heavily investing in marketing efforts that highlight recycled, recyclable, or biodegradable materials to appeal to environmentally conscious millennials and Gen Z consumers, thereby influencing pricing and product mix.

Regionally, Asia Pacific (APAC) represents the largest and fastest-growing segment due to massive smartphone volume sales, particularly in India and China, and the rapid urbanization and rising disposable incomes driving first-time accessory purchases and upgrades. North America and Europe, while growing slower, exhibit higher average selling prices (ASPs) due to strong demand for premium materials, licensed designs, and technologically advanced cases (e.g., integrated power banks or advanced thermal dissipation features). Latin America and MEA are experiencing growth fueled by expanding mobile internet penetration and increased availability of affordable, feature-rich cases.

In terms of segmentation, the material segment shows dominance by Thermoplastic Polyurethane (TPU) cases owing to their optimal balance of flexibility, protection, and cost-effectiveness. Functionality-wise, standard protective cases still lead by volume, but specialty segments like folio/flip cases and rugged cases are demonstrating strong revenue growth, reflecting specific consumer needs for utility or extreme protection. Online distribution channels continue to gain market share over physical retail, driven by better variety, competitive pricing, and ease of personalized ordering.

AI Impact Analysis on Cell Phone Cases Market

Common user questions regarding AI's impact on the cell phone case market primarily revolve around customization capabilities, supply chain efficiency, and future design trends. Users frequently ask if AI can design cases tailored exactly to personal aesthetic preferences or functional requirements, how AI might automate the fitment process for new phone models, and whether AI-driven demand forecasting will reduce stockouts and waste. The key themes summarized from user queries highlight expectations for hyper-personalization, intelligent inventory management to counter fast-paced market cycles, and the use of generative design algorithms to optimize case aesthetics and protection simultaneously. Concerns often focus on data privacy related to personalized design inputs and the potential displacement of traditional designers.

AI's primary influence is moving beyond simple e-commerce recommendations and integrating into the core product lifecycle. Generative AI tools are being used to create thousands of unique, complex aesthetic patterns instantaneously, dramatically shortening the design phase. Furthermore, Machine Learning algorithms analyze millions of consumer feedback points, social media trends, and regional purchasing data to predict highly granular demand patterns, allowing manufacturers to optimize production runs for specific models, colors, and materials. This capability is critical for reducing slow-moving inventory and ensuring cases for newly released phones are available immediately upon launch, addressing a historical pain point in the market.

In manufacturing, AI-powered computer vision systems are enhancing quality control by instantaneously detecting microscopic flaws in materials or printing errors, leading to significantly reduced defect rates. For the end-consumer, AI is powering sophisticated augmented reality (AR) features within e-commerce apps, allowing users to virtually test how a specific case looks and feels on their phone before purchase, thereby improving the online shopping experience and reducing returns related to aesthetic dissatisfaction. This integration of AI across design, logistics, and retail touchpoints is enhancing responsiveness and personalization across the value chain.

- AI enables hyper-personalized case design through generative algorithms and user data analysis.

- Predictive analytics optimize supply chain and inventory management for rapid smartphone launches.

- Machine Learning enhances e-commerce experience via sophisticated recommendation engines and virtual try-on features (AR).

- AI-driven computer vision systems improve manufacturing quality control, reducing material waste and defect rates.

- Automated trend analysis helps identify emerging aesthetic demands and material preferences faster than traditional market research.

DRO & Impact Forces Of Cell Phone Cases Market

The Cell Phone Cases Market is shaped by powerful internal dynamics and external forces encapsulated by its Drivers, Restraints, and Opportunities (DRO). Major drivers include the persistently high replacement cycle and high cost of modern smartphones, making protection an essential rather than optional purchase. The pervasive trend of digitalization and the increasing reliance on mobile devices for financial transactions, health monitoring, and professional tasks further elevates the need for robust device protection. Conversely, the market faces restraints such as intense price competition, particularly from generic and unbranded cases available through online marketplaces, which compress profit margins for established players. Additionally, the increasing complexity of new smartphone designs (e.g., foldable phones) requires specialized, often proprietary, and expensive case technologies, complicating mass production and accessory innovation.

Significant opportunities exist in the sustainability sector, where brands that successfully integrate fully biodegradable, closed-loop recycling programs, and durable eco-friendly materials are capturing premium market segments and establishing strong brand loyalty among younger consumers. The integration of advanced functionality, such as enhanced MagSafe compatibility, integrated microbial protection, or built-in secure data storage capabilities, also represents a substantial growth avenue. The market's primary impact forces include the rate of smartphone model releases (direct positive correlation), the fluctuation in raw material prices (impacting cost structure), and changes in international trade regulations affecting cross-border manufacturing and distribution, especially concerning tariffs and intellectual property protection.

The market also responds strongly to consumer safety perceptions; following high-profile incidents of screen damage or device failure, demand for ruggedized cases often spikes, demonstrating a reactive impact force driven by perceived risk. Strategic alliances with original equipment manufacturers (OEMs) for official licensing agreements provide a competitive edge, allowing accessory makers to launch certified products concurrent with device release. Addressing the challenge of standardization in wireless charging technology is another key factor; as new charging standards emerge, case manufacturers must quickly adapt designs to ensure seamless functionality, influencing product development timelines and investment priorities.

Segmentation Analysis

The Cell Phone Cases Market is highly fragmented and segmented across several dimensions, including material type, distribution channel, application/functionality, and price range. Understanding these segmentations is crucial for strategic market positioning and product development. Material segmentation, which includes silicon, plastic (PC/TPU), leather, and hybrid composites, dictates key performance characteristics like drop protection rating, weight, and texture. Application segmentation separates standard protective cases from specialized products like battery cases, wallet cases, and waterproof/ruggedized solutions, reflecting varied consumer lifestyles and requirements. The pervasive shift towards online purchasing has solidified the e-commerce channel as the primary revenue generator, overshadowing traditional brick-and-mortar retail by offering greater selection and better price discovery.

- By Material Type:

- Plastic (Polycarbonate, TPU/TPE)

- Silicone

- Leather

- Hybrid/Composite

- Fabric/Cloth

- Wood and Bamboo

- Metal

- By Distribution Channel:

- Online Retail (E-commerce, Company Websites)

- Offline Retail (Specialty Stores, Electronic Stores, Hypermarkets/Supermarkets)

- By Application/Functionality:

- Standard Protective Cases

- Rugged/Extreme Protection Cases

- Wallet/Folio Cases

- Battery/Power Bank Cases

- Stylized/Fashion Cases

- Waterproof Cases

- By Price Range:

- Economy/Budget

- Mid-Range

- Premium/Luxury

Value Chain Analysis For Cell Phone Cases Market

The value chain for the Cell Phone Cases Market begins with upstream activities focused on raw material sourcing and manufacturing. This segment is dominated by suppliers of polymers (TPU, PC), leather, and advanced composites. Key considerations at this stage include price volatility, environmental compliance, and securing reliable material streams, especially for recycled or sustainable inputs. Midstream involves design, molding, printing, and assembly, which are highly specialized processes requiring significant investment in Computer Numerical Control (CNC) machinery and injection molding equipment. Design houses play a crucial role in rapid prototyping to ensure perfect fitment immediately following a new phone launch. The downstream segment encompasses distribution and sales, where efficient logistics are paramount due to the high volume and relatively low unit cost of the product, requiring robust inventory management systems to handle thousands of SKUs across multiple phone models and designs.

Distribution channels are broadly categorized into direct and indirect routes. Direct distribution involves sales through company-owned websites and flagship stores, offering higher margins and direct consumer data access, crucial for personalization strategies. Indirect distribution leverages third-party entities, including major e-commerce platforms (Amazon, eBay, regional equivalents), specialized mobile accessory retailers, and mass merchants. The growing dominance of platforms like Amazon necessitates specific operational efficiencies, including optimized fulfillment processes and competitive platform advertising strategies. This indirect route provides massive market reach but introduces greater margin pressure and reliance on retailer-specific inventory metrics.

Upstream analysis reveals that material innovation, particularly in sustainable plastics that maintain high protective standards, is a significant competitive differentiator, often dictated by technological breakthroughs achieved by chemical and polymer companies. Downstream success is increasingly measured by speed-to-market and the ability to capture consumer attention during the critical initial weeks following a new smartphone release. Effective channel management requires balancing the high visibility offered by large retailers with the higher control and data intelligence gained through direct sales, optimizing the mix based on regional maturity and brand positioning.

Cell Phone Cases Market Potential Customers

The primary potential customers and end-users of cell phone cases are categorized broadly into individual consumers and institutional buyers, though the consumer segment constitutes the vast majority of volume and revenue. Individual buyers can be further segmented based on their primary purchasing driver: protection, style/aesthetics, or functionality. The high-protection segment, typically comprising users engaged in outdoor activities or industrial environments, seeks rugged, impact-resistant, and potentially waterproof cases. The style-conscious demographic views the case as a fashion accessory, prioritizing licensed designs, unique colors, and slim profiles, often leading to multiple case purchases per device lifespan.

The functional segment includes users requiring integrated utilities such as battery boosting cases, wallet cases, or specialized mounts for vehicles or photography accessories. This group values utility and convenience over sheer aesthetics or ruggedness. Furthermore, age demographics play a key role; Gen Z and Millennials, driven by personalization and social trends, are highly receptive to novel materials and limited-edition designs, frequently replacing cases to keep up with trends. Older adults often prioritize ease of grip, anti-slip features, and maximum protection to safeguard their investment.

Institutional buyers, while smaller in volume, represent strategic markets. This includes corporate entities purchasing standardized, often branded or rugged cases for company-issued devices (e.g., field service teams, logistics personnel) to manage asset durability and brand integrity. Government and military organizations require highly specialized, often certified cases meeting stringent drop-test and environmental standards. Additionally, repair shops and device refurbishment companies represent indirect buyers, purchasing cases in bulk for resale or bundling with refurbished devices, focusing on cost-effective, durable generic options.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 25.5 Billion |

| Market Forecast in 2033 | USD 40.1 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Otter Products, LLC, Speck Products, Inc., ZAGG Inc. (Gear4), Incipio, LLC, Belkin International, Pela Case, Spigen Inc., Casetify, PopSockets LLC, Tech21, Urban Armor Gear (UAG), Case-Mate, Samsung Electronics Co., Ltd. (OEM Accessories Division), Apple Inc. (Accessory Division), X-Doria (Defense), Ringke, Catalyst Lifestyle, Nomad Goods, Moment, Aukey. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cell Phone Cases Market Key Technology Landscape

The technology landscape for the Cell Phone Cases Market is characterized by material science advancements and integration technologies that enhance both protection and usability. Key material innovations include the development of proprietary polymers and composite materials, often utilizing D3O or similar non-Newtonian substances, which offer superior shock absorption upon impact without adding significant bulk. Manufacturers are continuously refining injection molding and thermoforming processes to achieve tighter tolerances, ensuring perfect alignment with device ports and buttons, a critical quality factor that distinguishes premium products from generic alternatives. Furthermore, the incorporation of antimicrobial coatings, using silver ion technology or similar chemical compounds, has become a standard feature in high-end cases, addressing growing public health concerns regarding device hygiene.

Integration technology primarily focuses on optimizing wireless charging and magnetic mounting capabilities. The standardization of magnetic attachment systems, driven significantly by Apple’s MagSafe technology, has spurred innovation in case design to incorporate embedded magnetic rings and shielding that facilitate efficient charging while allowing for secure mounting of accessories like wallets and grips. This requires precise component placement and material selection that does not interfere with electromagnetic fields. Additionally, advancements in sustainable manufacturing technology, such as using plant-based bioplastics (e.g., starch- or cellulose-based polymers) and utilizing recycled ocean plastics, are defining the operational technology frontier for socially responsible brands.

Beyond physical design, digital technology plays a vital role. High-resolution UV printing and 3D etching technologies enable complex, detailed customization and durable aesthetic finishes that resist fading and scratching over the device’s lifetime. Furthermore, the implementation of Near-Field Communication (NFC) chips directly into cases is an emerging technology, allowing cases to interact with the device to display unique wallpapers, authenticate accessories, or even store contactless payment credentials. These technological layers elevate the case from a passive protector to an active, integrated component of the mobile experience.

Regional Highlights

The global Cell Phone Cases Market exhibits distinct regional dynamics driven by varying levels of smartphone penetration, disposable income, and consumer preferences for technology and fashion.

- Asia Pacific (APAC): APAC is the dominant market region, primarily due to the sheer volume of smartphone sales in populous nations like China, India, and Indonesia. The market here is highly price-sensitive in the mass-market segments but shows robust growth in the premium segment driven by rising affluence in metropolitan areas. Key trends include high demand for licensed characters and aesthetic designs, alongside increasing adoption of functional cases like power banks due to heavy mobile usage. The rapid turnover of local smartphone brands necessitates swift accessory compatibility.

- North America: Characterized by high average selling prices (ASPs) and a strong preference for rugged and technologically integrated cases. Consumers frequently invest in premium brands known for military-grade drop protection and aesthetic quality. Sustainability and ethical sourcing are growing consumer priorities, giving an advantage to brands that emphasize eco-friendly materials and transparent supply chains. The market is mature, with innovation focusing on integration with accessory ecosystems (e.g., MagSafe).

- Europe: The European market mirrors North America in its demand for high-quality, durable, and sustainable products, with a particularly strong emphasis on design and minimalist aesthetics, especially in Western European countries (Germany, UK, France). Leather and professional folio cases are highly popular among business users. Strict EU regulations regarding material safety and environmental impact significantly shape product development strategies for companies operating in this region.

- Latin America (LATAM): LATAM is a high-growth market driven by increasing internet connectivity and greater access to affordable smartphones. The market leans towards practical, cost-effective protective cases. Brand recognition is steadily increasing, moving away from purely generic products toward entry-level branded accessories. Brazil and Mexico are the primary revenue contributors, showing strong potential for future premiumization as consumer purchasing power increases.

- Middle East and Africa (MEA): This region is characterized by fragmented demand, with the GCC countries exhibiting strong demand for luxury and designer cases reflecting high disposable incomes. Conversely, the African continent is focused on durability and affordability, reflecting the challenging environmental conditions and reliance on mobile money services, making device protection critical. The market is slowly transitioning from offline to online distribution channels.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cell Phone Cases Market.- Otter Products, LLC

- Speck Products, Inc.

- ZAGG Inc. (Gear4)

- Incipio, LLC

- Belkin International

- Pela Case

- Spigen Inc.

- Casetify

- PopSockets LLC

- Tech21

- Urban Armor Gear (UAG)

- Case-Mate

- Samsung Electronics Co., Ltd. (OEM Accessories Division)

- Apple Inc. (Accessory Division)

- X-Doria (Defense)

- Ringke

- Catalyst Lifestyle

- Nomad Goods

- Moment

- Aukey

Frequently Asked Questions

Analyze common user questions about the Cell Phone Cases market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary growth drivers for the Cell Phone Cases Market?

The market is primarily driven by the consistent rise in global smartphone penetration, the high cost of flagship mobile devices necessitating protection, rapid consumer technology upgrade cycles, and increasing demand for personalized and aesthetically unique mobile accessories.

Which material segment dominates the market, and why?

The Thermoplastic Polyurethane (TPU) segment typically dominates the market volume. TPU offers an ideal balance of flexibility for easy installation, strong impact resistance, durability, and cost-effectiveness, making it suitable for a wide range of standard and mid-range protective cases globally.

How is sustainability impacting product development in the case market?

Sustainability is a crucial factor, driving brands toward developing and promoting cases made from recycled plastics, plant-based biopolymers, and fully biodegradable materials. This trend caters to environmentally conscious consumers and aligns with global waste reduction mandates, often commanding a price premium.

Which distribution channel is experiencing the fastest growth?

Online retail (e-commerce) is the fastest-growing distribution channel. It offers consumers vast product variety, detailed price comparison, direct-to-consumer personalization options, and efficient delivery mechanisms, especially crucial during new phone launch cycles.

What is the competitive landscape like for cell phone case manufacturers?

The competitive landscape is highly fragmented and intense, encompassing established global protective brands (e.g., OtterBox, ZAGG), OEM accessory divisions (Apple, Samsung), and rapidly growing specialty design-focused companies (e.g., Casetify). Competition centers on material innovation, design uniqueness, and speed-to-market for new device models.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager