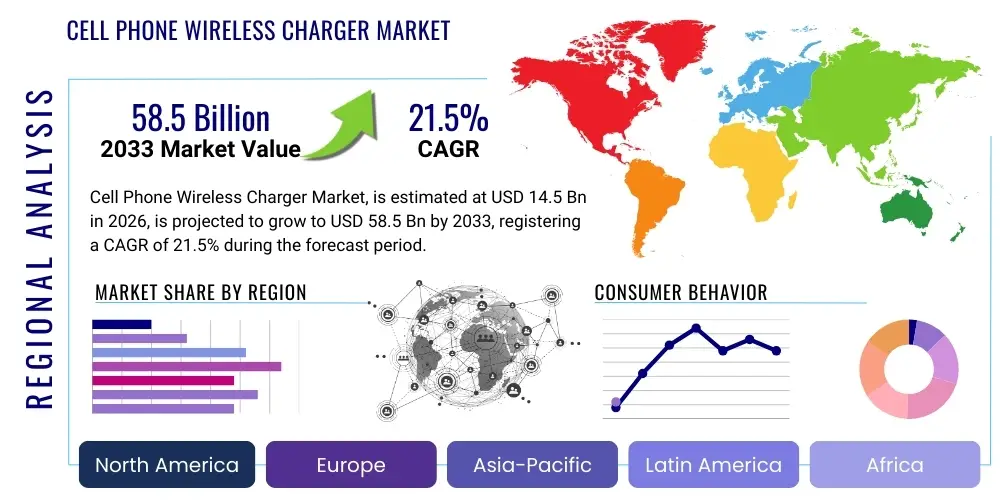

Cell Phone Wireless Charger Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435620 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Cell Phone Wireless Charger Market Size

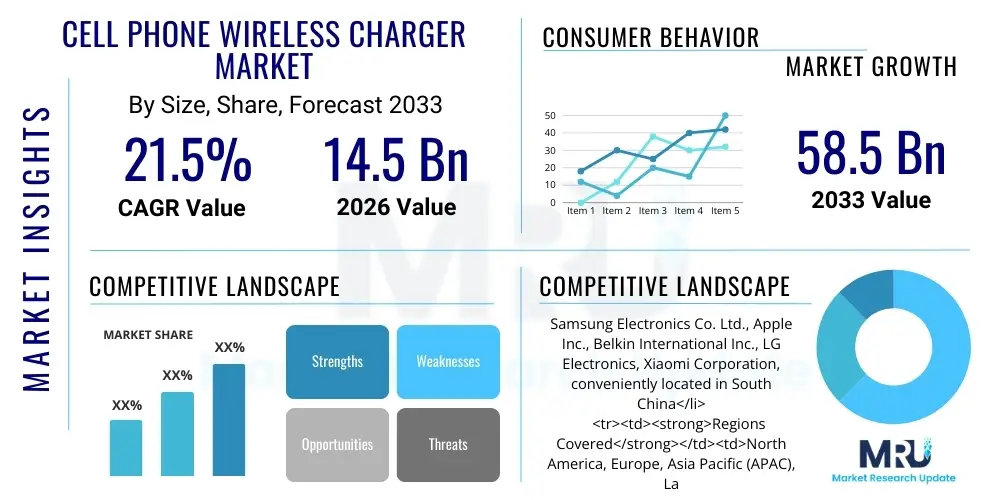

The Cell Phone Wireless Charger Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 21.5% between 2026 and 2033. The market is estimated at USD 14.5 Billion in 2026 and is projected to reach USD 58.5 Billion by the end of the forecast period in 2033.

Cell Phone Wireless Charger Market introduction

The Cell Phone Wireless Charger Market encompasses devices that utilize electromagnetic induction or resonant coupling to transfer energy from a charging pad or station to a mobile device without the need for a physical cable connection. This technology enhances convenience, reduces wear and tear on charging ports, and supports the development of waterproof and dustproof mobile designs. Key products include charging pads, stands, integrated furniture chargers, and car mounts designed specifically for smartphone devices adhering primarily to the Qi standard established by the Wireless Power Consortium (WPC). The primary applications span consumer electronics, automotive integration, and public infrastructure charging solutions.

The core benefits driving market adoption include user convenience, aesthetically pleasing design integration, and improved safety protocols compared to traditional wired charging, particularly in preventing electrical hazards associated with damaged cables. The seamless experience of merely placing a device onto a surface to initiate charging is a significant consumer draw, especially as modern smartphones increasingly offer integrated wireless charging capabilities. Furthermore, the standardization efforts around technologies like Qi have ensured interoperability across different device manufacturers, accelerating the mass market appeal and global expansion of this charging method. This technological maturation is fostering new application areas beyond standard home use.

Driving factors propelling market growth include the rising penetration of wireless charging modules in mid-range and budget smartphones, increasing demand for aesthetically integrated charging solutions in premium automotive vehicles and smart homes, and the proliferation of public wireless charging spots in cafes, airports, and hotels. Continuous advancements in charging speed, efficiency, and distance are overcoming historical limitations, making wireless charging a viable and often preferred alternative to traditional wired charging methods. Government initiatives promoting smart city infrastructure and the continuous innovation in charging coil design further bolster market expansion globally.

Cell Phone Wireless Charger Market Executive Summary

The global Cell Phone Wireless Charger Market is characterized by robust business trends driven by technological convergence, standardization of the Qi protocol, and aggressive integration by major smartphone OEMs such as Apple, Samsung, and Huawei. Key business dynamics include strategic partnerships between accessory manufacturers and automotive companies to embed charging pads directly into vehicle consoles, and increasing investment in advanced materials science to improve thermal management and power transfer efficiency. The market is also witnessing a shift towards higher-wattage charging solutions (e.g., 15W and above) and the introduction of magnetic alignment technologies like MagSafe, which significantly enhance user experience and power delivery consistency, thereby stabilizing market demand despite economic fluctuations.

Regionally, Asia Pacific (APAC) currently dominates the market, fueled by the massive smartphone manufacturing ecosystem in China and South Korea, high consumer adoption rates of new mobile technologies, and rapid development of smart infrastructure. North America and Europe, however, represent lucrative growth regions, primarily driven by the high penetration of premium smartphones capable of wireless charging and strong demand from the automotive sector for in-car wireless solutions. Developing economies in Latin America and MEA are showing promising growth trajectories, stimulated by increasing disposable incomes and the gradual decline in the manufacturing cost of entry-level wireless charging accessories, making the technology accessible to a broader consumer base.

Segmentation trends highlight the inductive charging technology segment as the largest, primarily due to the widespread adoption of the Qi standard. However, the resonant charging segment is anticipated to exhibit the fastest growth, particularly for niche applications requiring greater distance or simultaneous charging of multiple devices. By application, the consumer electronics segment remains the largest volume driver, while the automotive application segment is projected to show accelerated growth due to regulatory mandates and premium consumer expectations for integrated connectivity solutions. The market structure remains competitive, with emphasis on differentiation through features such as multi-device charging capability, portability, and sophisticated safety features like Foreign Object Detection (FOD).

AI Impact Analysis on Cell Phone Wireless Charger Market

Analysis of common user questions reveals significant interest in how AI can optimize the wireless charging experience, focusing on energy management, safety, and operational efficiency. Users frequently inquire about "smart" charging capabilities, asking if AI can predict optimal charging times based on user habits, minimize energy waste, or dynamically adjust power transmission to prolong battery health. Concerns also revolve around AI's role in improving Foreign Object Detection (FOD) accuracy and ensuring device temperature management during high-speed wireless charging. The expectation is that AI integration will transform wireless charging from a passive accessory into an active, intelligent power management system that integrates seamlessly into the smart home ecosystem, prioritizing efficiency and longevity.

AI's influence is poised to move beyond simple power transmission to sophisticated power management and optimization. By leveraging machine learning algorithms to analyze user behavior—such as when the user wakes up, leaves the home, or uses high-power applications—the charger can intelligently modulate the charging cycle. This "smart charging" minimizes the time a device spends at 100% capacity, thereby reducing battery degradation and extending the lifespan of the mobile device. Furthermore, AI models trained on thermal data can proactively throttle power delivery if excessive temperature fluctuations are detected, preventing overheating incidents and improving safety standards for high-wattage chargers.

The deployment of AI in diagnostic capabilities represents another major impact area. AI-enhanced detection systems can differentiate between benign metal objects (like paperclips) and critical foreign objects, minimizing false-negative detections which can otherwise pose fire risks or interrupt charging unnecessarily. Integrating AI-driven fault detection and predictive maintenance into public charging infrastructure ensures greater reliability and uptime. As the market pivots towards embedded and long-distance charging solutions, AI will be crucial for managing complex, multi-device power flow and ensuring fair and efficient energy distribution across all connected devices simultaneously, solidifying the transition to truly seamless power delivery networks.

- AI-driven personalized charging scheduling based on user usage patterns and calendar data.

- Enhanced thermal management systems using machine learning to dynamically adjust power output to prevent device overheating.

- Improved Foreign Object Detection (FOD) accuracy through advanced sensor fusion and AI classification algorithms.

- Predictive maintenance and diagnostics for public wireless charging kiosks and embedded automotive units.

- Optimization of energy transfer efficiency by adapting frequency and amplitude based on coupling distance and device requirements.

- Seamless integration of charging status and optimization recommendations into smart home platforms (e.g., Google Home, Alexa).

DRO & Impact Forces Of Cell Phone Wireless Charger Market

The Cell Phone Wireless Charger Market is intensely influenced by a dynamic set of Drivers, Restraints, and Opportunities (DRO) which collectively dictate its trajectory and market penetration rates. Key drivers include the massive increase in the integration of wireless charging coils into flagship and mid-range smartphones, consumer demand for enhanced convenience and aesthetic integration in home and office environments, and the critical global standardization provided by the Qi protocol which ensures market interoperability. These factors combine to accelerate the obsolescence of purely wired charging as the primary method for mobile devices, pushing manufacturers toward innovative, integrated solutions. The rising popularity of complementary devices, such as wireless earbuds and smartwatches that utilize the same charging standards, further fuels demand for multi-device charging stations.

However, significant restraints temper the market’s explosive growth potential. Primary among these is the inherent efficiency loss during inductive power transfer, resulting in slower charging speeds and greater heat generation compared to high-wattage wired solutions (e.g., 65W or 120W fast charging), which remains a critical barrier for time-sensitive users. Furthermore, the higher manufacturing cost associated with incorporating wireless charging hardware into both the phone and the accessory keeps prices elevated, particularly in cost-sensitive emerging markets. Another major constraint involves user perception regarding the lack of mobility during charging, as the device must remain stationary on the pad, limiting usage while powering up.

Opportunities for market players are abundant and centered around technological breakthroughs and strategic market expansion. The development of true long-distance resonant charging or radio frequency (RF) charging solutions promises to eliminate the need for precise placement, potentially revolutionizing the user experience and overcoming current mobility constraints. Significant opportunity lies in expanding wireless charging applications into public infrastructure, medical devices, and industrial IoT sensors, creating entirely new revenue streams outside of traditional consumer electronics. Furthermore, the focus on sustainable and recyclable wireless charging accessories, coupled with increased safety features like advanced Foreign Object Detection (FOD), presents a chance for market leaders to differentiate their products and capture environmentally conscious consumer segments, driving future market penetration and value creation.

Segmentation Analysis

The Cell Phone Wireless Charger Market segmentation provides a granular view of the industry structure based on technology, application, component, and distribution channel. The technology segment is crucial, dividing the market into inductive, resonant, and radio frequency charging, with inductive charging currently holding the largest market share due to the dominance of the universally adopted Qi standard. By application, the market is broadly divided into Consumer Electronics (the largest volume driver), Automotive, and Industrial/Infrastructure applications, each exhibiting unique growth patterns and demand specifications. Component analysis separates the market into transmitters (charging pads/stations) and receivers (integrated modules within the phone), reflecting the complex supply chain. Understanding these segments is vital for businesses aiming to tailor product development and market strategies to specific high-growth areas or established high-volume markets.

- Technology:

- Inductive Charging

- Resonant Charging

- Radio Frequency (RF) Charging

- Application:

- Consumer Electronics (Smartphones, Wearables)

- Automotive (In-car consoles)

- Industrial & Commercial (Public charging stations, Furniture)

- Component:

- Transmitter (Pads, Stands, Coils)

- Receiver (Integrated chipsets, Receiver Coils)

- Power Output:

- Below 5W

- 5W to 10W

- Above 10W (Fast Charging)

- Distribution Channel:

- Online Retail

- Offline Retail (Specialty Stores, Hypermarkets)

- OEM/Direct Sales

Value Chain Analysis For Cell Phone Wireless Charger Market

The value chain for the Cell Phone Wireless Charger Market is multi-layered, beginning with raw material sourcing and extending through manufacturing, distribution, and end-user consumption. Upstream activities involve the procurement of specialized materials, including copper wire for charging coils, ferrite sheets for magnetic shielding, high-efficiency semiconductors (power management ICs, microcontrollers), and advanced plastics or metals for casing. The cost and quality of these components, particularly the specialized ICs that handle power regulation and communication (such as compliance with the Qi protocol), significantly influence the final product’s performance and safety profile. Key upstream challenges include managing volatility in semiconductor supply and ensuring reliable sourcing of high-purity copper and rare earth elements for advanced coil designs.

Midstream processes focus on complex manufacturing and assembly, including the highly technical fabrication of coils, integration of thermal management solutions (heatsinks, passive cooling materials), and rigorous quality control testing for Foreign Object Detection (FOD) and electromagnetic interference (EMI) compliance. Companies specializing in chipset design (like IDT or Broadcom) play a pivotal role here, providing the intellectual property necessary for efficient power transfer. The value addition at this stage is high, as it transforms raw components into certified, functional charging products. Manufacturers must adhere to strict international standards set by bodies like the WPC and regional regulatory agencies (e.g., FCC, CE).

Downstream activities center on market access and customer acquisition. Distribution channels are bifurcated into direct sales (OEMs bundling chargers with phones or selling via proprietary online stores) and indirect sales through retail partners. Indirect channels, including large e-commerce platforms (Amazon, Alibaba) and brick-and-mortar specialty electronics stores (Best Buy, MediaMarkt), dominate accessory sales, requiring robust logistics and competitive marketing. The shift towards Answer Engine Optimization (AEO) dictates that distributors and retailers must provide highly informative, easily discoverable product listings that clearly articulate technical specifications, safety certifications, and compatibility, ensuring high conversion rates and effective market penetration globally.

Cell Phone Wireless Charger Market Potential Customers

The primary customers for the Cell Phone Wireless Charger Market are segmented across several distinct categories, each driven by different motivations and use cases. The largest cohort is the general consumer segment, comprising owners of modern smartphones (iPhone 8 and newer, Samsung Galaxy S series, etc.) who prioritize convenience, decluttering, and integrating technology into their smart home environments. These buyers typically seek stylish, high-speed charging pads or multi-device docks for use on nightstands and desks. This segment’s purchasing decisions are heavily influenced by brand loyalty, charging speed specifications, and aesthetic design integration within their personal spaces.

A rapidly expanding customer base is the automotive sector (OEMs and aftermarket buyers). Automotive manufacturers integrate wireless charging pads directly into vehicle consoles as a standard or premium feature, catering to consumers who demand seamless connectivity and charging during commuting or long journeys. These customers value durability, integration with vehicle electrical systems, and minimal distraction. The industrial and commercial segment constitutes another crucial customer group, primarily businesses such as hotels, cafes, corporate offices, hospitals, and airports that purchase embedded charging solutions for public convenience, enhancing customer satisfaction and modernizing their infrastructure offerings, often buying in large bulk orders requiring rigorous commercial-grade durability and safety certifications.

Finally, technology enthusiasts and early adopters represent a key target market for high-wattage fast chargers and advanced resonant charging systems. This group drives demand for novel technologies, such as magnetic alignment chargers and systems capable of charging devices through thick surfaces. Furthermore, specialized device manufacturers, particularly those in the healthcare sector producing hearing aids, medical wearables, or specialized remote monitoring equipment, represent niche but high-value customers needing highly customized, reliable, and often waterproof wireless power transmission solutions tailored to meet stringent regulatory standards for health and safety.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 14.5 Billion |

| Market Forecast in 2033 | USD 58.5 Billion |

| Growth Rate | 21.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Samsung Electronics Co. Ltd., Apple Inc., Belkin International Inc., LG Electronics, Xiaomi Corporation, conveniently located in South China |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cell Phone Wireless Charger Market Key Technology Landscape

The technological landscape of the Cell Phone Wireless Charger Market is primarily defined by the evolution and optimization of electromagnetic induction, driven largely by the Wireless Power Consortium’s (WPC) Qi standard. Inductive charging remains the bedrock, utilizing coupled coils to transfer energy over very short distances (millimeters). Recent innovations in this established technology focus heavily on enhancing coil design, moving from single-coil systems to multi-coil arrays, enabling users to place their devices anywhere on the pad without precise alignment. Furthermore, advancements in semiconductor materials, particularly the use of Gallium Nitride (GaN) components, are enabling smaller, more efficient, and faster-charging transmitters capable of handling high power outputs (15W and 30W) while minimizing heat generation, directly addressing one of the core limitations of previous inductive systems.

A critical emerging technology is magnetic resonance charging, which uses magnetic fields oscillating at specific frequencies to transfer power over greater distances (up to several centimeters) and through non-metallic objects, allowing for integration under desks or countertops. While resonant technology offers superior spatial freedom and the potential to charge multiple devices with different power requirements simultaneously, its commercialization is hampered by higher costs and current limitations on mass production standardization, though organizations like the AirFuel Alliance are working to establish global protocols. Resonant technology holds the key to the next generation of truly embedded, furniture-integrated charging solutions that eliminate visible charging accessories entirely.

The integration of proprietary magnetic alignment systems, exemplified by Apple’s MagSafe technology, represents a significant development in enhancing the user experience. By utilizing magnets, these systems ensure perfect coil alignment every time, maximizing power transfer efficiency and enabling higher charging speeds while ensuring the device remains securely attached. Concurrently, there is continued research into genuine long-distance charging solutions, typically employing focused Radio Frequency (RF) energy. Although still in nascent stages and facing significant regulatory hurdles concerning power output and safety exposure, successful implementation of RF charging could fundamentally disrupt the market by allowing devices to charge anywhere within a room, eliminating the need for pads altogether and realizing the ultimate vision of ubiquitous wireless power.

Regional Highlights

- Asia Pacific (APAC): APAC represents the dominant region in the global market, primarily driven by mass manufacturing capabilities in China, South Korea, and Taiwan, which serve as global hubs for both smartphone and accessory production. High smartphone penetration rates, particularly in urban areas, coupled with a strong consumer tendency to adopt new mobile technologies quickly, ensure continuous high-volume demand. Governments in this region, especially in countries like Singapore and South Korea, are actively investing in smart infrastructure, incorporating public wireless charging solutions into cafes, airports, and transport hubs.

- North America: North America is characterized by high adoption of premium and flagship smartphones, driving demand for high-speed (15W+) and aesthetically pleasing wireless chargers. The region is a strong market for innovative solutions like magnetic alignment chargers and multi-device charging stations. Significant growth is concentrated in the automotive sector, where most major manufacturers offer integrated wireless charging as a standard amenity in new vehicles, reflecting the affluent consumer base's expectations for integrated technology.

- Europe: The European market demonstrates steady growth, driven by stringent quality standards, emphasis on eco-friendly and sustainable accessories, and robust adoption in commercial settings, such as corporate offices and hospitality. Western European countries lead in market maturity, demanding highly certified products that comply with strict electromagnetic compatibility (EMC) regulations. The growth is further supported by the increasing trend of integrating wireless power into furniture and public transportation systems across the EU.

- Latin America (LATAM): LATAM is an emerging market with significant growth potential, fueled by increasing disposable incomes and a growing middle class that is rapidly upgrading to feature-rich smartphones that support wireless charging. While cost remains a sensitive factor, the demand for affordable, functional wireless charging accessories is rising, particularly in major economies like Brazil and Mexico, leading to a competitive landscape dominated by both global brands and local producers focusing on value offerings.

- Middle East and Africa (MEA): Growth in MEA is concentrated in the Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia) due to high infrastructure investment, rapid digitalization, and high purchasing power for luxury and premium electronics. Demand is strong in the hospitality, aviation, and high-end automotive sectors. The wider African market is experiencing slower but stable growth, dependent on the proliferation of affordable mid-range smartphones with built-in wireless charging capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cell Phone Wireless Charger Market.- Samsung Electronics Co. Ltd.

- Apple Inc.

- Belkin International Inc.

- LG Electronics

- Xiaomi Corporation

- Anker Innovations Technology Co. Ltd.

- Energizer Holdings Inc.

- Integrated Device Technology (IDT) / Renesas Electronics

- Broadcom Inc.

- Fossil Group Inc.

- Mophie (Zagg Inc.)

- TDK Corporation

- Murata Manufacturing Co. Ltd.

- Texas Instruments Incorporated

- NXP Semiconductors N.V.

- Qualcomm Technologies Inc.

- Baseus Technology Co. Ltd.

- RavPower (Sunvalley Group)

- Convenient Power (HK) Ltd.

- Witricity Corporation

Frequently Asked Questions

Analyze common user questions about the Cell Phone Wireless Charger market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most widely adopted standard for cell phone wireless charging globally?

The most widely adopted global standard is Qi (pronounced Chee), managed by the Wireless Power Consortium (WPC). Qi is an inductive charging protocol that guarantees interoperability across over 90% of smartphones and accessories that feature built-in wireless charging capabilities, ensuring seamless power transfer regardless of the brand.

Is wireless charging faster or slower than traditional wired charging methods?

Currently, high-wattage wired charging (e.g., 65W or 120W) is generally faster than wireless charging due to minimal energy loss. While standard wireless charging typically operates between 5W and 15W, advanced magnetic alignment systems and optimized charging pads are rapidly closing this gap, with some premium wireless chargers now achieving 30W output.

Does wireless charging degrade the cell phone battery health over time?

Wireless charging generates slightly more heat than wired charging, and excessive heat is the primary factor accelerating battery degradation. However, modern wireless chargers and smartphones incorporate advanced thermal management systems and AI-driven optimization features to mitigate this heat, ensuring the impact on long-term battery health is minimized and generally comparable to wired methods.

What is Foreign Object Detection (FOD) and why is it important in wireless chargers?

Foreign Object Detection (FOD) is a crucial safety mechanism that detects metal objects (like keys or coins) placed between the charger and the phone. If a foreign object is detected, the charger shuts off power transmission to prevent overheating, which could damage the object or the charger, and crucially, prevents fire hazards, adhering to strict safety standards (e.g., Qi certification requirements).

How significant is the automotive sector in driving future growth of the wireless charger market?

The automotive sector is a key growth area, projected to accelerate significantly. Consumers increasingly expect integrated connectivity, and in-car wireless charging offers unmatched convenience for navigation and media streaming. High-end vehicle manufacturers are rapidly adopting integrated charging pads as a standard feature, boosting demand for durable, certified, high-quality embedded transmitter modules globally.

The global market for Cell Phone Wireless Chargers continues to demonstrate exponential growth, fueled by technological standardization and consumer demand for seamless integration into daily life. The transition towards smart charging solutions, leveraging AI for efficiency and safety, is redefining the value proposition of these accessories. As manufacturers address persistent challenges related to charging speed and thermal management, and as regulatory frameworks stabilize around new resonant technologies, the wireless charging ecosystem is poised for ubiquitous adoption across consumer, automotive, and public infrastructure domains. Market participants who invest in high-efficiency components, robust safety features like advanced FOD, and proprietary alignment technologies are best positioned to capture market share and sustain competitive advantage throughout the forecast period ending 2033. Strategic expansion into emerging markets, coupled with strong adherence to global standards, remains crucial for long-term revenue generation and market leadership.

Further analysis into component pricing trends, particularly for high-power management ICs and customized coil structures, reveals that cost optimization will be essential for mass market penetration beyond premium segments. The increasing competition from lower-cost manufacturers, predominantly based in the APAC region, pressures established brands to differentiate through superior reliability, brand trust, and expanded warranty services. The future success of this market will heavily rely on overcoming the current limitations of distance and precision placement, pushing research and development towards true long-range wireless power transmission, which promises to unlock unprecedented market potential across diverse industrial and consumer applications that require continuous, cable-free power delivery. This ongoing innovation ensures that the wireless power transfer segment remains one of the most dynamic and rapidly evolving sectors within the broader consumer electronics industry.

The market structure is becoming increasingly complex due to the interplay between smartphone OEMs, dedicated accessory manufacturers, and core technology providers (chipset designers). Collaboration across this value chain is becoming standard practice, particularly in developing bespoke solutions for automotive and specialized industrial clients. Furthermore, environmental concerns are driving demand for materials science innovation, focusing on reducing the environmental footprint of charging accessories, including the use of recycled plastics and the implementation of energy-saving standby modes. Regulatory pressure, especially in Europe, concerning electronic waste and energy efficiency is likely to favor manufacturers demonstrating proactive compliance and offering sustainable product lifecycles, thus influencing consumer purchasing behavior and establishing new benchmarks for product quality and corporate responsibility in the sector.

Technological advancement is not limited to power transfer mechanics; the market is also seeing rapid development in user interface and interaction. Integration with mobile operating systems provides real-time feedback on charging status, estimated time to full charge, and temperature monitoring, improving transparency and trust in the technology. The development of specialized accessories, such as modular charging systems that combine pads for phones, watches, and earbuds, is catering to the multi-device ownership trend. This trend requires sophisticated power allocation and management systems to efficiently divide power without compromising the charging speed of any individual device, representing a critical area of ongoing hardware and software refinement across the industry.

The geopolitical landscape also impacts the supply chain, particularly regarding the sourcing of crucial semiconductor components and rare earth magnets used in high-efficiency coils. Diversification of manufacturing bases and strategic long-term sourcing agreements are becoming standard practices for market leaders to mitigate risks associated with regional trade disputes or supply shortages. Overall, the market remains characterized by a healthy balance of mature, standardized technology (Qi inductive) and high-potential emerging technologies (resonant and RF), ensuring sustained investor interest and rapid product cycle innovation over the next seven years. The strong financial performance projected for the Cell Phone Wireless Charger Market reflects its indispensable role in the evolving digital lifestyle.

As competition intensifies, intellectual property rights and patent protection concerning high-speed charging protocols and thermal management techniques will become central to market dominance. Companies are actively filing patents to safeguard innovations related to magnetic field control and optimized charging algorithms. Furthermore, the role of standardization bodies, beyond the WPC, in shaping the future resonant charging standards (AirFuel) is critical for minimizing market fragmentation and accelerating the integration of long-distance solutions into consumer products. Failure to adhere to or influence these standards poses a significant risk to future market accessibility and profitability, making participation in consortiums a strategic imperative for all major players seeking global relevance.

The emphasis on safety protocols, driven partly by consumer litigation risk and regulatory mandates, has led to substantial investment in advanced circuitry that protects against over-current, over-voltage, and short-circuit scenarios. These inherent safety features, coupled with sophisticated FOD capabilities, reassure consumers and facilitate broader adoption in sensitive environments like children's bedrooms or automotive cabins. Consequently, third-party certification and adherence to regional safety marks (UL, CE, etc.) are non-negotiable prerequisites for market entry and sustained commercial viability. The move toward integrated charging solutions within public infrastructure also mandates higher levels of security and tamper-proofing, requiring robust physical design and monitoring systems to ensure durability and public safety across all deployed units.

In terms of distribution strategy, the increasing reliance on e-commerce platforms requires significant digital marketing capabilities, including SEO and AEO optimization, to ensure product visibility amidst a crowded accessory market. High-quality product images, detailed technical specifications, and transparent user reviews are crucial for building consumer trust online. Simultaneously, maintaining strong relationships with mobile network operators (MNOs) and traditional brick-and-mortar retail chains allows companies to leverage promotional bundling and physical demonstration opportunities, capturing segments of the population less inclined to purchase solely online. The optimization of the omnichannel sales approach is therefore vital for maximizing global market reach and achieving the projected growth figures in both established and emerging markets worldwide.

The growth trajectory in the Cell Phone Wireless Charger Market is intrinsically linked to the parallel growth in wearable devices, such as smartwatches and hearables, many of which rely exclusively on wireless charging due to size constraints. This symbiotic relationship multiplies the demand for multi-device charging accessories and integrated power solutions. Manufacturers are increasingly designing charging ecosystems rather than standalone products, offering users a holistic power management solution for their entire suite of portable electronics. This ecosystem approach locks customers into specific brands or technologies, fostering strong brand loyalty and providing a sustainable competitive advantage in a segment where product commoditization is a constant threat to profitability and market differentiation, necessitating continuous innovation in design and function.

The implementation of edge computing and IoT principles is also influencing the next generation of wireless chargers. Smart chargers can communicate their status, efficiency metrics, and potential faults directly to the user or a central smart home hub. This data-driven approach allows for granular control over energy consumption and enables proactive identification of maintenance needs, particularly for publicly installed units. As 5G networks become more pervasive, facilitating faster and more reliable communication between devices and charging infrastructure, the capabilities of smart, connected wireless charging solutions will further expand, driving adoption in advanced smart city projects and high-tech industrial environments requiring constant power availability for remote sensors and machinery.

Finally, market maturity across different regions dictates varying competitive strategies. In mature markets like North America and Europe, the focus is on premium features, brand image, and integration into high-value sectors (automotive, luxury goods). In contrast, emerging markets require strategies focused on manufacturing scalability, cost reduction, and offering robust entry-level products that meet essential safety standards while remaining affordable. Navigating this geographic diversity requires flexible supply chains and localized marketing efforts that address region-specific consumer preferences and regulatory requirements, ensuring that the global market potential of the Cell Phone Wireless Charger Market is fully realized across all forecasted territories through 2033.

Technological advancement is not limited to power transfer mechanics; the market is also seeing rapid development in user interface and interaction. Integration with mobile operating systems provides real-time feedback on charging status, estimated time to full charge, and temperature monitoring, improving transparency and trust in the technology. The development of specialized accessories, such as modular charging systems that combine pads for phones, watches, and earbuds, is catering to the multi-device ownership trend. This trend requires sophisticated power allocation and management systems to efficiently divide power without compromising the charging speed of any individual device, representing a critical area of ongoing hardware and software refinement across the industry.

The geopolitical landscape also impacts the supply chain, particularly regarding the sourcing of crucial semiconductor components and rare earth magnets used in high-efficiency coils. Diversification of manufacturing bases and strategic long-term sourcing agreements are becoming standard practices for market leaders to mitigate risks associated with regional trade disputes or supply shortages. Overall, the market remains characterized by a healthy balance of mature, standardized technology (Qi inductive) and high-potential emerging technologies (resonant and RF), ensuring sustained investor interest and rapid product cycle innovation over the next seven years. The strong financial performance projected for the Cell Phone Wireless Charger Market reflects its indispensable role in the evolving digital lifestyle.

As competition intensifies, intellectual property rights and patent protection concerning high-speed charging protocols and thermal management techniques will become central to market dominance. Companies are actively filing patents to safeguard innovations related to magnetic field control and optimized charging algorithms. Furthermore, the role of standardization bodies, beyond the WPC, in shaping the future resonant charging standards (AirFuel) is critical for minimizing market fragmentation and accelerating the integration of long-distance solutions into consumer products. Failure to adhere to or influence these standards poses a significant risk to future market accessibility and profitability, making participation in consortiums a strategic imperative for all major players seeking global relevance.

The emphasis on safety protocols, driven partly by consumer litigation risk and regulatory mandates, has led to substantial investment in advanced circuitry that protects against over-current, over-voltage, and short-circuit scenarios. These inherent safety features, coupled with sophisticated FOD capabilities, reassure consumers and facilitate broader adoption in sensitive environments like children's bedrooms or automotive cabins. Consequently, third-party certification and adherence to regional safety marks (UL, CE, etc.) are non-negotiable prerequisites for market entry and sustained commercial viability. The move toward integrated charging solutions within public infrastructure also mandates higher levels of security and tamper-proofing, requiring robust physical design and monitoring systems to ensure durability and public safety across all deployed units.

In terms of distribution strategy, the increasing reliance on e-commerce platforms requires significant digital marketing capabilities, including SEO and AEO optimization, to ensure product visibility amidst a crowded accessory market. High-quality product images, detailed technical specifications, and transparent user reviews are crucial for building consumer trust online. Simultaneously, maintaining strong relationships with mobile network operators (MNOs) and traditional brick-and-mortar retail chains allows companies to leverage promotional bundling and physical demonstration opportunities, capturing segments of the population less inclined to purchase solely online. The optimization of the omnichannel sales approach is therefore vital for maximizing global market reach and achieving the projected growth figures in both established and emerging markets worldwide.

The growth trajectory in the Cell Phone Wireless Charger Market is intrinsically linked to the parallel growth in wearable devices, such as smartwatches and hearables, many of which rely exclusively on wireless charging due to size constraints. This symbiotic relationship multiplies the demand for multi-device charging accessories and integrated power solutions. Manufacturers are increasingly designing charging ecosystems rather than standalone products, offering users a holistic power management solution for their entire suite of portable electronics. This ecosystem approach locks customers into specific brands or technologies, fostering strong brand loyalty and providing a sustainable competitive advantage in a segment where product commoditization is a constant threat to profitability and market differentiation, necessitating continuous innovation in design and function.

The implementation of edge computing and IoT principles is also influencing the next generation of wireless chargers. Smart chargers can communicate their status, efficiency metrics, and potential faults directly to the user or a central smart home hub. This data-driven approach allows for granular control over energy consumption and enables proactive identification of maintenance needs, particularly for publicly installed units. As 5G networks become more pervasive, facilitating faster and more reliable communication between devices and charging infrastructure, the capabilities of smart, connected wireless charging solutions will further expand, driving adoption in advanced smart city projects and high-tech industrial environments requiring constant power availability for remote sensors and machinery.

Finally, market maturity across different regions dictates varying competitive strategies. In mature markets like North America and Europe, the focus is on premium features, brand image, and integration into high-value sectors (automotive, luxury goods). In contrast, emerging markets require strategies focused on manufacturing scalability, cost reduction, and offering robust entry-level products that meet essential safety standards while remaining affordable. Navigating this geographic diversity requires flexible supply chains and localized marketing efforts that address region-specific consumer preferences and regulatory requirements, ensuring that the global market potential of the Cell Phone Wireless Charger Market is fully realized across all forecasted territories through 2033.

Technological refinement is continuously pushing the boundaries of power efficiency, addressing one of the initial critical drawbacks of wireless charging compared to wired alternatives. Advances in power electronics, specifically the integration of highly sophisticated power management integrated circuits (PMICs) and advanced algorithms, minimize energy loss during transmission. Furthermore, the development of intelligent standby modes ensures that the chargers consume negligible power when not actively charging a device, thereby satisfying stringent energy efficiency regulations in regions like the European Union and contributing to overall consumer acceptance and sustainability goals within the market ecosystem.

The growing preference for magnetic alignment charging systems is revolutionizing the user experience by simplifying the process and enhancing charging stability. These systems not only ensure optimal coil alignment for maximum efficiency and speed but also enable innovative use cases, such as vertically mounted charging stands and secure mounting in fast-moving environments like vehicle dashboards. This innovation is leading to a premium market segment focused on branded magnetic accessories that offer superior build quality and performance, attracting consumers willing to invest in seamless integration with their high-end mobile devices and demonstrating a clear trajectory towards personalized, feature-rich power solutions.

The industrial and commercial application segment presents substantial untapped potential. Beyond public charging spots, wireless power is increasingly being adopted for internal logistics, powering autonomous guided vehicles (AGVs), remote sensors, and industrial tablets where physical connectors are susceptible to damage or contamination. The resilience and sealed nature of wireless power transfer offer compelling operational advantages in harsh or sterile industrial environments, positioning this segment for high-value, albeit lower-volume, specialized market growth. This expansion diversification beyond purely consumer applications is critical for stabilizing the market against cyclical downturns in the general electronics sector.

Future market evolution will likely feature tighter integration between charging technology and smart home ecosystems. Imagine a scenario where a smart home system dynamically prioritizes power allocation—for example, ensuring a critical health monitoring wearable is fully charged before allocating higher power to a smartphone overnight. This predictive and prioritized power management, enabled by advanced networking and machine learning, will transform wireless charging from a simple convenience feature into a fundamental component of the interconnected digital home, further increasing its perceived utility and driving replacement cycles as users upgrade to more intelligent and integrated power solutions throughout the 2026-2033 forecast period.

Final note: The success in the Cell Phone Wireless Charger Market will be dictated by the delicate balance between technical performance (speed, efficiency, distance) and consumer accessibility (cost, standardization, and aesthetic integration). Maintaining high safety standards remains paramount, establishing a foundation of trust that encourages widespread adoption across all geographic and demographic segments worldwide.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager