Cell Roller Bottles Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433617 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Cell Roller Bottles Market Size

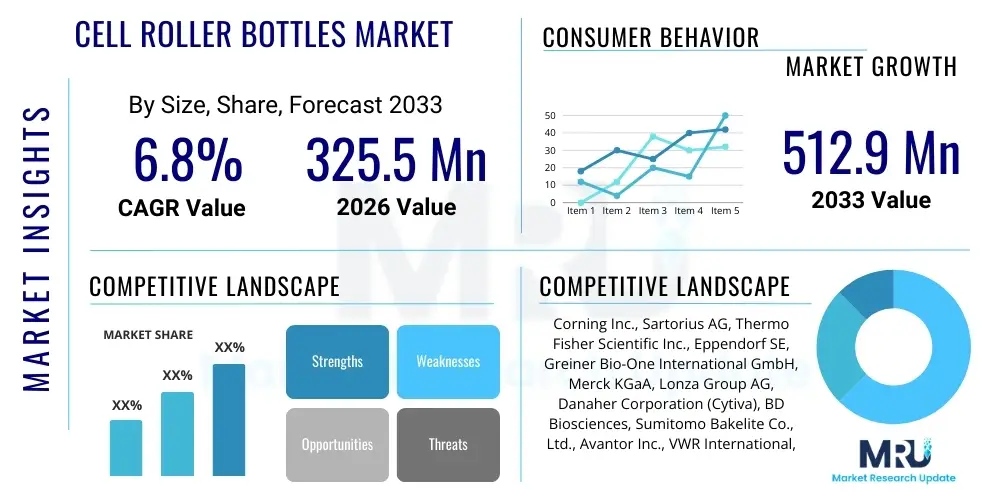

The Cell Roller Bottles Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 325.5 Million in 2026 and is projected to reach USD 512.9 Million by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by the sustained global demand for vaccines, especially high-volume viral vaccines, and the continuous scaling of therapeutic protein manufacturing processes that still rely on large-scale adherent cell culture technologies. The inherent scalability and simplicity of roller bottles provide a cost-effective platform for mass production, ensuring their continued relevance despite the parallel rise of advanced bioreactor systems, particularly in regions focusing on rapid biomanufacturing expansion.

Cell Roller Bottles Market introduction

The Cell Roller Bottles Market encompasses the manufacturing and distribution of specialized cylindrical containers used primarily for the large-scale adherent culture of mammalian cells. These bottles are designed to maximize the surface area available for cell attachment and proliferation by slowly rotating on automated systems, ensuring uniform exposure to culture media and gas exchange. Historically crucial for viral vaccine production, including influenza and polio vaccines, roller bottles remain essential tools in large-volume biomanufacturing where high cell yields are required from anchorage-dependent cell lines. The standard product is typically manufactured from high-grade, optically clear polystyrene (PS) or sometimes polyethylene (PE), often featuring specialized surface treatments to enhance cell adhesion and growth performance.

Major applications of cell roller bottles span across vaccine production, therapeutic protein manufacturing, and the early stages of cell and gene therapy (CGT) manufacturing where initial seed expansion is critical. The high yield per footprint and the standardized handling procedures make them a foundational technology in many established bioprocesses. The design evolution, including multi-surface and high-density formats (such as 2-stack or 5-stack roller bottles), aims to further increase the effective cell culture area without significant increases in incubation space, addressing industry needs for improved efficiency and throughput in high-volume applications.

The primary benefits driving the sustained adoption of cell roller bottles include their relative simplicity, ease of sterilization, disposable nature which minimizes cross-contamination risks, and established regulatory precedence in vaccine manufacturing. The market driving factors include rising investments in life science research, increased prevalence of infectious diseases necessitating rapid vaccine development, and the expansion of Contract Manufacturing Organizations (CMOs) globally, particularly in Asia Pacific, which utilize these scalable tools for cost-efficient production runs. Despite competition from suspension culture systems and specialized bioreactors, roller bottles offer an accessible and reliable method for high-yield culture of demanding adherent cell lines.

Cell Roller Bottles Market Executive Summary

The Cell Roller Bottles Market is characterized by steady, moderate growth, sustained primarily by the robust global vaccine industry and significant advancements in therapeutic protein development. Key business trends indicate a strong focus on enhancing bottle capacity and optimizing surface treatments to support complex, sensitive cell lines utilized in next-generation biologics and regenerative medicine. Suppliers are actively integrating automation compatibility into roller bottle designs, recognizing that efficiency in handling and media exchange is paramount for large-scale operations. Furthermore, the market is experiencing consolidation, with major life science providers leveraging comprehensive portfolios to offer integrated upstream processing solutions, including media, automation equipment, and consumables.

Regionally, the market dynamics are shifting, with North America and Europe maintaining dominance due to high R&D spending, established biopharmaceutical infrastructures, and stringent regulatory standards demanding proven manufacturing platforms. However, the Asia Pacific region, led by China and India, is registering the fastest growth rate. This accelerated expansion is fueled by government initiatives promoting local vaccine production, the influx of biopharma investments, and the rising trend of outsourcing manufacturing activities to CMOs in these cost-effective locations. Latin America and MEA are also showing burgeoning demand, largely centered on public health initiatives and local self-sufficiency in basic biologicals production.

Segment trends reveal that high-capacity roller bottles (>500 cm² surface area) are witnessing disproportionate growth, reflecting the industry's continuous need to scale up production while minimizing labor and facility footprint. By material, high-purity polystyrene continues to dominate due to its optimal optical clarity and consistent surface chemistry, crucial for adherent cultures. The vaccine production segment remains the largest end-user application, though the emerging segment of cell and gene therapy is expected to introduce specialized demand for highly controlled, small-batch, yet scalable roller bottle variants that integrate seamlessly into closed system processing, potentially adopting specialized polymer blends or coatings designed for feeder-free culture.

AI Impact Analysis on Cell Roller Bottles Market

Common user questions regarding AI's influence on the Cell Roller Bottles Market typically center on how an established, low-tech consumable can benefit from advanced computational methods. Users frequently inquire about the feasibility of implementing automated, AI-driven image analysis for real-time confluence monitoring across hundreds of bottles simultaneously, predicting culture failures before manual observation identifies them, and optimizing the rotation speed and gas exchange parameters based on live cell metabolic data. Furthermore, bioprocess engineers are keen to understand how AI can streamline inventory management and logistics for high-volume consumables, ensuring just-in-time delivery for complex campaign scheduling typical in vaccine facilities. These inquiries reflect a desire to mitigate the labor-intensive nature and variability often associated with manual roller bottle handling through smart systems.

Based on this analysis, the key themes summarize that AI's influence is not centered on replacing the physical roller bottle but on vastly improving the efficiency, precision, and monitoring capabilities of the entire roller bottle ecosystem. AI algorithms are increasingly being used to interpret data generated by integrated monitoring systems, such as automated visual inspection and non-invasive spectroscopic sensors, transforming roller bottle operations from a traditionally manual process to a semi-automated, data-driven workflow. This enhances batch-to-batch consistency, reduces human error, and ensures the rapid identification of potential contamination or suboptimal growth conditions, thereby protecting valuable large-scale cell cultures. This modernization helps maintain the competitive edge of roller bottle technology against newer, fully automated bioreactor systems in certain established applications.

- Process Optimization: AI algorithms analyze historical growth curves and metabolic data to optimize roller bottle rotation speeds and environmental parameters (CO2 levels, temperature) for maximum yield.

- Automated Quality Control (AQC): Machine vision coupled with AI assesses cell confluence and morphology in real-time, automating quality checks and predicting harvest timing with higher precision than manual methods.

- Predictive Maintenance: AI monitors the performance of roller bottle apparatus (incubators, rotational systems) to forecast mechanical failures, ensuring continuous, uninterrupted biomanufacturing campaigns.

- Data Integration: Facilitating the seamless integration of roller bottle culture data into larger Manufacturing Execution Systems (MES) for holistic regulatory compliance and historical batch analysis.

- Supply Chain Efficiency: Utilizing predictive analytics to manage demand forecasting for high-volume consumables, minimizing stockouts or overstocking of specific bottle types and volumes.

DRO & Impact Forces Of Cell Roller Bottles Market

The market trajectory is shaped by a confluence of accelerating drivers, structural restraints, and significant long-term opportunities, which collectively define the impact forces influencing technological adoption and market penetration. The primary driving force is the enduring and expanding demand for human and animal vaccines, many of which utilize classic adherent cell lines that thrive optimally in the high surface area provided by roller bottles. This is complemented by the sustained growth of the global biopharmaceutical sector, necessitating reliable, scalable, and validated platforms for initial seed expansion and large-scale manufacturing of certain therapeutic antibodies and recombinant proteins. The relatively low capital expenditure required for setting up a roller bottle facility compared to complex bioreactor suites further propels adoption in emerging markets and smaller biotechnology firms, solidifying their role as a cost-effective workhorse technology in upstream processing.

However, the market faces structural restraints primarily rooted in technological advancements. The significant industry shift toward suspension cell culture systems, which are generally more amenable to advanced stirring bioreactors (both stainless steel and single-use), limits the growth potential of adherent culture methods. Furthermore, the increasing preference for single-use bioreactors (SUBs) in modern facilities offers enhanced automation, reduced cleaning validation burden, and superior process control, often making them more attractive for new facility builds, thus potentially cannibalizing future roller bottle demand. Operationally, roller bottles are labor-intensive, requiring manual handling for media changes and harvesting, which increases operational costs and introduces greater batch variability compared to highly automated closed-system bioreactors.

Opportunities for market expansion are significant, particularly within the nascent cell and gene therapy (CGT) sector. While CGT relies heavily on advanced bioreactor systems, roller bottles find specific niches in scalable viral vector production (e.g., AAV, lentivirus) and in establishing robust, initial expansion phases for anchorage-dependent stem cells. The ongoing push for localized vaccine self-sufficiency, particularly across Asia and Africa, provides substantial commercial opportunities for vendors supplying roller bottles and associated automation equipment tailored for high-volume, cost-sensitive production environments. The major impact forces acting on this market include stringent regulatory requirements demanding proven product consistency and the rapid pace of innovation in competing cell culture technologies (e.g., hollow fiber bioreactors, microcarriers utilized within stirred tanks) which compel roller bottle manufacturers to continuously innovate, primarily through surface chemistry optimization and automation compatibility, to retain market share and relevance.

Segmentation Analysis

The Cell Roller Bottles Market segmentation provides granular insights into demand patterns across various product specifications and end-user applications, crucial for strategic planning. The market is primarily segmented based on the Material used, the Capacity (Surface Area) offered, the specific Application domain, and the key End-User industry. The segmentation reflects a market optimizing for standardization while simultaneously attempting to cater to complex, specialized needs, particularly concerning surface modifications required for sensitive cell lines and high-throughput production volumes.

- By Material:

- Polystyrene (PS)

- Polyethylene (PE)

- Other Materials (e.g., Polycarbonate, specialized polymers for improved gas exchange)

- By Capacity (Surface Area):

- Standard Capacity (100–500 cm²)

- High Capacity (>500 cm² to 1,500 cm²)

- Multi-Surface/Stack Roller Bottles (Offering up to 10,000 cm² or more)

- By Application:

- Vaccine Production (Viral and Non-viral)

- Therapeutic Protein Manufacturing

- Cell and Gene Therapy (Viral vector manufacturing, T-cell expansion)

- Research & Development (R&D)

- By End-User:

- Biopharmaceutical & Biotechnology Companies

- Contract Manufacturing Organizations (CMOs) & Contract Research Organizations (CROs)

- Academic & Research Institutes

Value Chain Analysis For Cell Roller Bottles Market

The value chain for the Cell Roller Bottles Market begins with the upstream sourcing of high-purity raw materials, primarily medical-grade polymers such as virgin polystyrene and polyethylene resins. This upstream segment is characterized by reliance on a few specialized chemical suppliers who must adhere to rigorous quality standards, notably USP Class VI plastics certification, ensuring the materials are non-cytotoxic and possess excellent optical clarity. The cost and quality of these raw materials significantly impact the final product cost and performance, making supplier power relatively moderate but critical, as variations can affect cell culture integrity. Manufacturing processes involve advanced injection molding or extrusion blow molding techniques, followed by surface treatment (plasma treatment or specialized chemical coatings), sterilization (typically gamma irradiation), and stringent quality control, defining the core manufacturing efficiency.

The midstream phase involves the proprietary surface modifications applied by key manufacturers, such as Corning’s CellBIND® or equivalent technologies, which are essential for enhancing the performance of roller bottles in serum-reduced or serum-free media conditions. Efficient manufacturing scale and adherence to ISO and GMP standards are crucial competitive differentiators in this stage. Distribution channels form the crucial link to the downstream end-users. Direct distribution is favored by major global suppliers like Thermo Fisher and Sartorius when servicing large biopharmaceutical clients, allowing for better inventory control and technical support. However, indirect distribution through specialized scientific distributors (e.g., VWR International, Avantor) plays a vital role in reaching smaller academic institutions, CROs, and international markets where local support is necessary.

Downstream analysis focuses on the end-user consumption. Biopharmaceutical companies, particularly those involved in legacy vaccine production, represent the bulk buyers, demanding high volume, consistency, and favorable pricing structures. CMOs and CROs represent a rapidly growing downstream segment, requiring flexible supply chains and robust technical documentation to support their diverse client projects. The purchasing decisions are driven by validation data, compatibility with existing automated roller systems, and consistency in surface treatment quality. The shift toward single-use technology favors the disposable nature of roller bottles, but supply chain resilience and cost management are continuous challenges in the face of rising polymer prices.

Cell Roller Bottles Market Potential Customers

The primary consumers of cell roller bottles are organizations engaged in large-scale biological production and high-throughput research where adherent cell culture is mandatory or preferred. Biopharmaceutical and biotechnology companies constitute the largest segment of potential customers. Within this group, vaccine manufacturers, especially those producing viral vaccines for diseases like influenza, mumps, and rubella, are critical buyers due to the established regulatory path using roller bottle technology. These companies require massive, consistent supply, often negotiating long-term procurement contracts for standardized high-capacity bottles to support multi-year production campaigns. Their buying decisions are heavily influenced by product validation, sterility assurances, and integration compatibility with existing rolling machinery.

Contract Manufacturing Organizations (CMOs) and Contract Research Organizations (CROs) represent the fastest-growing segment of potential customers. As the industry increasingly outsources bioprocessing and testing, CMOs rely on flexible, proven, and scalable platforms like roller bottles to handle diverse client projects, ranging from viral vector production to initial therapeutic protein expression scale-up. CROs utilize these bottles extensively for toxicity testing, viral propagation, and high-throughput screening assays that require large quantities of specific cell types. These entities prioritize vendors who offer excellent supply chain reliability and a wide array of specialized surface treatments to match varying client protocols and complex media requirements.

Academic and Research Institutes form the third significant category of customers, utilizing roller bottles for fundamental research, large-scale cell line maintenance, and early-stage process development before scaling up to industrial levels. While their purchase volumes are generally lower than biopharma, their demand for specialized and novel surface treatments is often higher, particularly those designed for stem cell culture or complex tissue engineering projects. Government agencies, especially public health laboratories and national vaccine centers, also represent steady customers, driven by mandates to maintain emergency production capacity for public health crises, relying on the proven technology infrastructure of roller bottle systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 325.5 Million |

| Market Forecast in 2033 | USD 512.9 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Corning Inc., Sartorius AG, Thermo Fisher Scientific Inc., Eppendorf SE, Greiner Bio-One International GmbH, Merck KGaA, Lonza Group AG, Danaher Corporation (Cytiva), BD Biosciences, Sumitomo Bakelite Co., Ltd., Avantor Inc., VWR International, Cell Culture Company, HiMedia Laboratories, Miltenyi Biotec, Sarstedt AG & Co. KG, Asahi Kasei Corporation, TPP Techno Plastic Products AG, Wuxi AppTec, R&D Systems (A Bio-Techne Brand) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cell Roller Bottles Market Key Technology Landscape

The technology landscape of the Cell Roller Bottles Market, while rooted in simple polymer consumables, is increasingly sophisticated, driven primarily by the need to optimize cell adhesion, improve gas exchange efficiency, and facilitate automated handling. The paramount technological innovation revolves around surface modification techniques. Standard roller bottles require serum to mediate cell attachment; however, modern biomanufacturing demands serum-free and reduced-serum media for cost reduction and regulatory compliance. This necessity has spurred the development of proprietary treated surfaces (e.g., plasma treatment, chemically modified polymer surfaces) that mimic extracellular matrix proteins, significantly enhancing cell proliferation and viability, particularly for sensitive adherent cell lines used in vaccine and vector production. Technologies such as high oxygen transfer polyethylene (PE) are also emerging to address gas exchange limitations inherent in thick-walled polystyrene bottles, offering a path to greater metabolic efficiency.

Another critical area of technological advancement is the design of high-density roller bottles, often marketed as multi-surface or stackable formats. These designs utilize internal baffling or multiple concentric cylinders to exponentially increase the effective surface area (e.g., from 850 cm² to 10,000 cm²) within the same footprint. This capacity scaling is crucial for achieving industrial-level yields while utilizing existing roller apparatus infrastructure, offering a mid-way solution between traditional roller bottles and large-scale fixed-bed bioreactors. These innovations focus on maintaining uniform fluid dynamics and gas exchange across all internal surfaces, which requires complex mold design and precise manufacturing tolerances to ensure batch consistency and reliable performance.

Furthermore, the integration of roller bottles into automated handling and monitoring systems represents a significant technological shift. While the bottle itself remains simple, compatibility with automated media exchange systems, robotic loading and unloading of roller racks, and integrated non-invasive sensors (for pH, dissolved oxygen, or real-time cell monitoring) is essential for modern facilities. This technological evolution allows roller bottles to remain relevant by overcoming their traditional limitation of high labor requirements. The adoption of AI for process monitoring, discussed earlier, further leverages sensor technology to minimize batch variability and optimize harvest schedules, transforming the operational efficiency of large-scale roller bottle facilities.

Regional Highlights

The global distribution and growth rates of the Cell Roller Bottles Market exhibit distinct characteristics across major geographical segments, reflecting regional biomanufacturing maturity and investment priorities. North America, particularly the United States, commands the largest market share, driven by extensive R&D spending, the presence of major biopharmaceutical companies and vaccine producers, and a strong regulatory environment that favors validated, reliable manufacturing platforms. The region acts as an innovation hub, driving demand for specialized, high-performance roller bottles with advanced surface coatings compatible with cutting-edge cell lines.

Europe holds the second-largest market position, supported by leading biotechnology hubs in Germany, the UK, and Switzerland. European demand is bolstered by stringent quality control requirements and robust public health infrastructure necessitating consistent vaccine supply. The region demonstrates a moderate growth rate, balancing the adoption of traditional roller bottle technology with an increasing investment in modern, high-throughput bioprocessing equipment. European manufacturers are focused on sustainability, influencing demand toward optimized, high-yield plastic consumables to reduce overall waste volume.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid expansion is attributed to massive governmental investments in vaccine self-sufficiency, particularly in China, India, and South Korea, coupled with the relocation of global manufacturing activities to these regions due to lower operational costs. APAC countries favor the cost-effective scalability offered by roller bottles for large-volume production. The rising number of CMOs in this region, catering to both local and international clients, further accelerates the demand for consistent and high-quality roller bottle supply chains.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging markets for roller bottles. Growth in LATAM is driven by regional efforts to expand domestic production capabilities for essential medicines and vaccines, notably in Brazil and Mexico. Demand in MEA is primarily associated with international aid programs and public health campaigns that require scalable biological manufacturing tools. While currently smaller in volume, these regions present long-term opportunities as healthcare infrastructures develop and localized biomanufacturing initiatives gain momentum, favoring proven, accessible technologies like roller bottles.

- North America (NA): Market leader, driven by large vaccine manufacturers (e.g., influenza, polio) and high R&D expenditures in bioprocessing; early adopter of automation and advanced surface technologies.

- Europe: Strong regulatory framework and established biotech presence; focus on high-quality manufacturing and sustainability initiatives; significant demand from major pharmaceutical companies.

- Asia Pacific (APAC): Fastest-growing region, fueled by government-backed vaccine programs, expansion of CMO/CRO activities, and increasing biopharmaceutical manufacturing capacity in China and India.

- Latin America (LATAM): Moderate growth driven by regional healthcare infrastructure development and efforts toward biomanufacturing self-sufficiency in key nations.

- Middle East and Africa (MEA): Nascent market, primarily driven by governmental and philanthropic funding aimed at improving local vaccine production capabilities and addressing regional health crises.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cell Roller Bottles Market.- Corning Inc.

- Sartorius AG

- Thermo Fisher Scientific Inc.

- Eppendorf SE

- Greiner Bio-One International GmbH

- Merck KGaA

- Lonza Group AG

- Danaher Corporation (Cytiva)

- BD Biosciences

- Sumitomo Bakelite Co., Ltd.

- Avantor Inc.

- VWR International

- Cell Culture Company

- HiMedia Laboratories

- Miltenyi Biotec

- Sarstedt AG & Co. KG

- Asahi Kasei Corporation

- TPP Techno Plastic Products AG

- Wuxi AppTec

- R&D Systems (A Bio-Techne Brand)

Frequently Asked Questions

Analyze common user questions about the Cell Roller Bottles market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for high-capacity cell roller bottles?

The primary factor is the increasing global demand for high-volume biological products, particularly viral vaccines (like influenza) and therapeutics derived from adherent cell lines. High-capacity roller bottles offer a scalable, cost-effective method to achieve large cell yields while maximizing facility utilization and minimizing labor per batch compared to standard-sized alternatives.

How do single-use bioreactors impact the long-term growth of the Cell Roller Bottles Market?

Single-use bioreactors pose a restraint, mainly in new biomanufacturing facility builds focusing on suspension cultures, due to their superior automation and process control capabilities. However, they do not displace roller bottles entirely, as roller bottles remain the validated standard for established adherent cell processes, especially within legacy vaccine production where regulatory precedent is crucial.

What types of surface treatments are critical for modern cell roller bottles?

Critical surface treatments involve specialized proprietary coatings (e.g., plasma treatments or chemical modifications) designed to enhance cell attachment and proliferation in serum-free or reduced-serum media. These modifications are essential for supporting sensitive adherent cell lines, ensuring higher viability, and meeting regulatory demands for defined media usage.

Which geographical region exhibits the fastest growth rate for cell roller bottle adoption?

The Asia Pacific (APAC) region, driven primarily by major investments in vaccine self-sufficiency in countries like China and India, shows the fastest growth. The market in APAC favors the low capital cost and scalable infrastructure associated with roller bottle technology for mass production.

Are roller bottles suitable for Cell and Gene Therapy (CGT) manufacturing processes?

Yes, roller bottles are utilized in specific phases of CGT, particularly for the initial expansion of anchor-dependent stem cells or for scalable production of viral vectors (like AAV or lentivirus) used in gene therapy delivery. Their utility is focused on reliable, intermediate-scale seed production before transfer to more specialized downstream bioreactors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager