Cellular Core Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434329 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Cellular Core Market Size

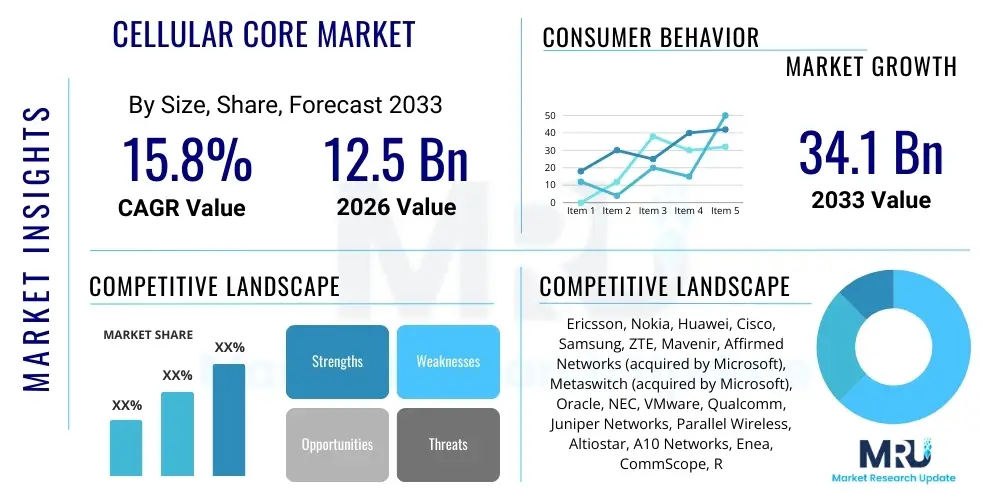

The Cellular Core Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. This robust growth is fueled primarily by the accelerating global deployment of 5G infrastructure and the subsequent demand for highly scalable, software-defined core network solutions capable of supporting massive machine-type communications (mMTC) and ultra-reliable low-latency communication (URLLC). The foundational shift towards cloud-native architectures is central to this expansion, enabling telecom operators to reduce operational expenditure while introducing innovative new services.

The market is estimated at $12.5 Billion in 2026 and is projected to reach $34.1 Billion by the end of the forecast period in 2033. This valuation reflects the increasing investment across all major geographical regions, particularly in Asia Pacific and North America, where early adoption of standalone 5G cores is paving the way for advanced applications such as autonomous vehicles, industrial automation, and sophisticated mobile edge computing (MEC) deployments. Market dynamics are heavily influenced by the competitive landscape among traditional infrastructure providers and emerging software-centric vendors, driving innovation in network function virtualization (NFV) and containerization technologies.

Cellular Core Market introduction

The Cellular Core Market encompasses the technologies and infrastructure required for managing, controlling, and optimizing mobile network traffic and subscriber services. The core network, often referred to as the brain of the cellular system, handles authentication, mobility management, session management, and connectivity to external networks like the internet. Key products within this market include specialized hardware (servers, routers, switching equipment), software components (policy control functions, user plane functions, authentication servers), and related professional services for deployment and maintenance. The transition from legacy Evolved Packet Core (EPC) utilized in 4G networks to the modern, cloud-native 5G Core architecture is the definitive trend shaping the current market landscape, offering operators unparalleled flexibility and scalability.

Major applications of cellular core technologies span consumer mobile services, enterprise private networks, and mission-critical communications across various vertical industries. In the consumer space, the core network facilitates high-speed data access, voice over LTE (VoLTE), and seamless handovers between cell sites. For enterprises, particularly those adopting Industry 4.0 principles, the core supports dedicated private 5G networks, offering enhanced security, guaranteed quality of service (QoS), and ultra-low latency crucial for automated factory environments and smart logistics. Benefits derived from advanced cellular core implementations include improved network efficiency, reduced total cost of ownership (TCO) through virtualization, faster time-to-market for new services, and the ability to enable network slicing—a key feature for monetizing 5G capabilities.

Driving factors for the market expansion are multifaceted, including the global mandate for comprehensive 5G coverage, the exponential increase in data consumption driven by video streaming and advanced applications, and the accelerating demand for connecting billions of IoT devices efficiently and securely. Furthermore, geopolitical factors influencing supply chain resilience and national digital transformation initiatives are compelling operators globally to modernize their core infrastructure. This modernization often involves adopting cloud architectures and migrating critical network functions to hybrid or public cloud platforms, which enhances operational agility and scalability compared to monolithic hardware-centric designs.

Cellular Core Market Executive Summary

The Cellular Core Market is undergoing a fundamental transformation driven by technological convergence and evolving business models, specifically the widespread shift towards virtualization and cloud-native architecture. Business trends indicate a strong move away from integrated proprietary hardware towards software-defined networking (SDN) and Network Function Virtualization (NFV), allowing telecom operators to leverage standard commercial off-the-shelf (COTS) hardware and optimize resource utilization. This paradigm shift encourages competition by lowering entry barriers for software-focused vendors, accelerating innovation cycles, and facilitating the development of sophisticated services such as network slicing, which is crucial for maximizing 5G return on investment. Furthermore, M&A activity remains high as established vendors acquire specialized cloud-native firms to strengthen their core offerings and accelerate cloud migration capabilities.

Regional trends reveal significant disparities in 5G Core adoption maturity. North America and parts of Asia Pacific (South Korea, Japan, China) are leading the investment cycle, rapidly deploying standalone (SA) 5G cores necessary for unlocking advanced features like ultra-low latency and massive connectivity. European markets, while progressing, show a more measured pace, often prioritizing non-standalone (NSA) deployments initially, but are now catching up, driven by industrial digitalization efforts. The Middle East and Africa (MEA) and Latin America are poised for exponential growth, fueled by government initiatives to improve digital connectivity and attract foreign investment in telecommunications infrastructure, necessitating modern, scalable core networks to handle rising mobile data traffic and increasing connectivity demands in rapidly urbanizing areas.

Segmentation trends highlight the dominance of the software and services segments, reflecting the industry's virtualization journey. The 5G generation segment is projected to exhibit the highest CAGR, completely overshadowing legacy 4G/LTE core components during the forecast period. Among deployment models, the cloud-based segment, encompassing both private and public cloud implementations of core network functions, is gaining rapid traction due to its inherent advantages in elasticity, resilience, and operational efficiency, although on-premise solutions remain critical for highly regulated or specialized private enterprise networks that prioritize strict data control and localized security protocols. The end-user segment is increasingly diversified, with private enterprise networks (especially manufacturing, utilities, and logistics) becoming a major growth driver alongside traditional mobile network operators (MNOs).

AI Impact Analysis on Cellular Core Market

User queries regarding the impact of Artificial Intelligence (AI) on the Cellular Core Market frequently revolve around automation, network optimization, predictive maintenance, and enhanced security mechanisms. Key user themes include how AI can manage the complexity introduced by 5G network slicing, how machine learning algorithms can dynamically optimize resource allocation across virtualized functions, and the role of AI in detecting sophisticated security threats and anomalies within the high-throughput core. There is significant interest in understanding AI's potential to enable ‘zero-touch’ operations, reducing the need for human intervention in configuration, fault resolution, and capacity scaling, thereby leading to substantial reductions in OPEX for mobile network operators (MNOs). Furthermore, users are exploring AI's capability to analyze vast volumes of network data in real-time to provide superior quality of experience (QoE) management and personalized subscriber services.

The integration of AI and Machine Learning (ML) into the cellular core is fundamental to managing the sheer scale and dynamic nature of 5G and future 6G networks. AI algorithms are essential for automating complex tasks such as traffic steering, load balancing, and dynamic configuration of network functions deployed as containers or virtual machines. By analyzing operational data, AI models can predict potential network congestion points or hardware failures before they occur, shifting operations from reactive troubleshooting to proactive self-healing networks. This proactive capability significantly enhances network reliability and availability, which are non-negotiable requirements for mission-critical industrial applications relying on 5G core infrastructure.

Security is another critical domain where AI provides invaluable benefits. As the core network becomes increasingly software-defined and distributed (extending to the edge), the attack surface expands dramatically. AI-powered security solutions are deployed to continuously monitor network traffic for anomalous behaviors indicative of intrusion attempts, denial-of-service attacks, or data exfiltration. These intelligent systems learn baseline network behavior and use advanced pattern recognition to identify zero-day threats far more effectively than traditional signature-based security tools, thereby protecting the integrity and confidentiality of subscriber data and critical control plane functions within the core network infrastructure.

- AI-Driven Network Automation: Enables zero-touch provisioning and orchestration of complex 5G network functions, minimizing human error and latency in deployment and scaling.

- Resource Optimization: Utilizes machine learning to dynamically allocate compute, storage, and network resources across virtualized core network functions based on real-time traffic demand and predicted load patterns.

- Predictive Maintenance: AI algorithms analyze performance data to predict hardware or software failures, allowing MNOs to initiate preventative actions, thereby maximizing uptime and network reliability.

- Enhanced Security and Threat Detection: ML models continuously analyze control plane and user plane traffic to identify and mitigate advanced persistent threats (APTs) and sophisticated network anomalies in real-time.

- Quality of Experience (QoE) Management: AI correlates network performance data with user feedback to optimize service delivery parameters, ensuring high customer satisfaction across various service level agreements (SLAs).

- Network Slicing Management: AI is critical for automating the lifecycle management, isolation, and assurance of multiple virtual network slices, each tailored to specific latency, bandwidth, and security requirements.

DRO & Impact Forces Of Cellular Core Market

The Cellular Core Market is predominantly driven by the pervasive global rollout of 5G technology, which necessitates a complete overhaul of legacy 4G core infrastructure to realize new functionalities like network slicing and mobile edge computing (MEC). The exponential increase in connected devices, particularly within the IoT and IIoT ecosystems, generates massive data volumes and demands for superior mobility and session management capabilities that only a modern cloud-native core can efficiently handle. Furthermore, the rising need for dedicated private cellular networks in industrial and governmental sectors creates a strong opportunity for focused, localized core deployments. However, the market faces significant restraints, chiefly the substantial initial capital expenditure (CAPEX) required for migrating core infrastructure to cloud environments, along with ongoing concerns regarding security and interoperability in highly virtualized, multi-vendor ecosystems.

Key impact forces shaping the industry include technological shifts such as the move towards Open RAN (O-RAN) and the continuous standardization efforts by the 3rd Generation Partnership Project (3GPP). The adoption of O-RAN principles encourages open interfaces and disaggregated core components, fostering greater competition and potentially reducing vendor lock-in, which directly impacts procurement strategies for MNOs globally. This shift forces incumbent vendors to rapidly innovate their software offerings and embrace open standards. Opportunities are abundant in the areas of network slicing monetization—creating tailored connectivity services for verticals—and the deep integration of core network functions with edge computing platforms, enabling ultra-low latency applications closer to the end-user. These opportunities provide pathways for MNOs to transition from being mere connectivity providers to true digital service enablers.

The convergence of telecommunications and cloud infrastructure, exemplified by partnerships between MNOs and hyperscalers (like AWS, Azure, and Google Cloud), represents a powerful impact force. This partnership allows telcos to offload non-critical or burstable core functions to the public cloud, achieving economies of scale and accelerating service deployment. Conversely, restraints such as regulatory fragmentation across different regions regarding spectrum allocation and data localization mandate the need for highly adaptable core solutions. Successfully navigating these constraints while capitalizing on technological drivers like AI/ML integration for autonomous operation will determine the trajectory of market leaders and new entrants alike, necessitating strategic investments in talent skilled in cloud-native network architecture.

Segmentation Analysis

The Cellular Core Market is segmented based on critical technical and operational attributes that dictate deployment strategies and market dynamics for different user groups. Key segmentation categories include the components utilized (hardware, software, services), the deployment model chosen (on-premise or cloud-based), the network generation supported (4G, 5G, 6G), and the type of end-user (MNOs, Enterprises, Government). Analyzing these segments provides a clear understanding of where investment is concentrated, with the 5G generation segment being the primary engine of growth, driving immense demand for flexible, software-centric core solutions and associated professional services necessary for complex migration and integration processes.

The shift from proprietary hardware-centric systems to software-defined networks has fundamentally altered the segmentation landscape. Software and Services now dominate the value proposition, emphasizing network function virtualization (NFV) capabilities and specialized consulting services for cloud adoption, security hardening, and ongoing maintenance. The cloud deployment segment is expanding rapidly, reflecting operators' increasing comfort and confidence in using public, private, and hybrid cloud environments for mission-critical core functions, offering superior scalability and resilience. This detailed segmentation helps vendors tailor their offerings—such as specialized user plane functions (UPFs) for edge computing or highly secure control plane functions for private networks—to meet the distinct requirements of different customer verticals and technological maturity levels.

Segmentation by end-user further illuminates specific market niches. While Mobile Network Operators (MNOs) remain the largest segment, the enterprise segment is gaining velocity, driven by the rollout of industrial 5G and campus private networks. These enterprises, particularly in manufacturing, logistics, and healthcare, demand dedicated core solutions that offer tailored control, guaranteed performance, and strict compliance with local regulations. The governmental sector also constitutes a stable segment, focused on secure, resilient core networks for public safety and defense applications, often mandating robust on-premise or dedicated private cloud deployments due to high security and sovereignty requirements.

- By Component:

- Hardware (Servers, Switching Equipment, Routers)

- Software (Control Plane Functions, User Plane Functions, Management Systems)

- Services (Consulting, Integration, Managed Services, Maintenance)

- By Deployment:

- On-Premise

- Cloud-Based (Public Cloud, Private Cloud, Hybrid Cloud)

- By Network Generation:

- 4G/LTE Evolved Packet Core (EPC)

- 5G Core (5GC) Standalone (SA)

- 6G Research and Development Core Systems

- By End-User:

- Mobile Network Operators (MNOs)

- Enterprises (Manufacturing, Healthcare, Logistics, Automotive)

- Government and Public Safety Agencies

Value Chain Analysis For Cellular Core Market

The value chain for the Cellular Core Market begins with upstream activities centered on core technology development and component sourcing. Upstream involves semiconductor manufacturers producing high-performance processors and specialized network interface cards (NICs) required for dense traffic processing, alongside software developers creating the foundational operating systems and container platforms crucial for cloud-native core environments. System integrators and specialized software vendors then develop the actual network functions (e.g., Access and Mobility Management Function (AMF), Session Management Function (SMF), User Plane Function (UPF)) that adhere to 3GPP specifications and are optimized for cloud deployment. The competitive advantage at this stage often lies in intellectual property surrounding virtualization efficiency and security protocols.

The midstream phase focuses on the integration, deployment, and operation of these core components. Mobile Network Operators (MNOs) and private network deployers are the key players here, procuring integrated core solutions, conducting rigorous testing, and managing the rollout across their infrastructure. Distribution channels are predominantly direct, involving large-scale, long-term contracts between core network vendors (like Ericsson, Nokia, and Mavenir) and MNOs. However, the rise of cloud-based core solutions introduces an indirect channel through hyperscalers (like Amazon Web Services and Microsoft Azure), who act as infrastructure providers and distribution partners, facilitating the deployment of core functions as a service (NFaaS) for smaller MNOs and enterprise clients.

Downstream activities involve service delivery, maintenance, and monetization. This includes professional services for network planning, optimization, and advanced managed services, often leveraging AI tools for autonomous operation and performance assurance. The end-users—subscribers and enterprises—receive the connectivity services enabled by the core. Success in the downstream market relies heavily on the core's ability to support innovative service models, such as charging and billing systems optimized for network slicing and guaranteeing the stringent SLAs required by industrial clients. Therefore, the core network's architecture dictates the MNO's ability to effectively monetize their 5G investments and establish differentiated service portfolios in a highly competitive market environment.

Cellular Core Market Potential Customers

The primary and largest segment of potential customers for Cellular Core products and services consists of Mobile Network Operators (MNOs) globally. These operators, including major national and multinational telecom carriers, are undergoing extensive capital expenditure programs to migrate their core infrastructure from legacy 4G EPC to the highly scalable and flexible 5G Core (5GC) architecture. Their purchasing decisions are driven by the need to handle escalating data traffic, reduce operational expenditure through virtualization, and enable new revenue streams derived from advanced 5G capabilities such as network slicing and mobile edge computing. MNOs seek full end-to-end solutions that offer high performance, robust security, and seamless integration with existing radio access network (RAN) and billing systems.

A rapidly expanding segment of potential customers comprises large enterprises and industrial entities looking to deploy dedicated Private Cellular Networks (PCNs). Companies in manufacturing, energy (utilities, oil and gas), port operations, and logistics require localized, highly reliable, and secure connectivity that traditional Wi-Fi often cannot deliver. These customers purchase compact, often cloud-hosted or highly localized core networks specifically designed for campus or industrial site deployment. Their core requirements focus on ultra-low latency, strict data control (often mandating on-premise user plane functions), and specialized support for massive IoT device density within constrained geographic areas. This segment represents a significant growth vector for core network vendors offering solutions optimized for enterprise environments.

Furthermore, government and public safety agencies represent a stable, mission-critical customer base. These organizations require highly resilient and secure core networks for national security, emergency services (such as FirstNet in the U.S. or similar public safety networks globally), and critical infrastructure control. Their demands prioritize security compliance, redundancy, and long-term support, often necessitating specialized core functionalities like group communication, broadcast services, and robust disaster recovery capabilities. Additionally, emerging regional and niche operators, along with Mobile Virtual Network Operators (MVNOs) transitioning to hybrid core models, also form a significant customer base, leveraging cloud-native core solutions to minimize CAPEX and maximize service agility.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $12.5 Billion |

| Market Forecast in 2033 | $34.1 Billion |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ericsson, Nokia, Huawei, Cisco, Samsung, ZTE, Mavenir, Affirmed Networks (acquired by Microsoft), Metaswitch (acquired by Microsoft), Oracle, NEC, VMware, Qualcomm, Juniper Networks, Parallel Wireless, Altiostar, A10 Networks, Enea, CommScope, Red Hat |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cellular Core Market Key Technology Landscape

The Cellular Core Market is characterized by a high degree of technological sophistication, driven by the shift towards cloud-native architectures that utilize microservices and containers (primarily Docker and Kubernetes). This fundamental technological change allows core network functions (NFs) to be deployed as loosely coupled services, significantly enhancing scalability, resilience, and operational agility. Key technologies deployed include Network Function Virtualization (NFV), which decouples network functions from proprietary hardware, and Software-Defined Networking (SDN), which centralizes network control to enable dynamic traffic management and rapid service provisioning. These technologies are foundational for the 5G Core (5GC), enabling the critical separation of the control plane (CP) and user plane (UP), allowing the User Plane Function (UPF) to be distributed geographically to the network edge for low-latency service delivery.

Furthermore, critical technologies involve advanced security frameworks and Quality of Service (QoS) mechanisms. Within the 5GC, technologies such as enhanced authentication protocols (e.g., 5G AKA), robust encryption methods, and integrated security gateways are essential to protect the integrity of subscriber data and control signaling. The core leverages advanced policy control mechanisms (Policy Control Function, PCF) to dynamically enforce QoS rules and manage subscriber access based on complex service level agreements (SLAs), especially vital for monetizing tailored services via network slicing. The adoption of Open RAN (O-RAN) principles, while primarily focused on the RAN, indirectly influences the core by necessitating standardized, open interfaces between the core and the distributed units, fostering multi-vendor interoperability and greater technological diversity within the total network architecture.

The emerging technological focus is on Mobile Edge Computing (MEC) and the integration of Artificial Intelligence/Machine Learning (AI/ML) for network automation. MEC involves deploying compute and storage resources alongside the UPF at the network edge, enabling ultra-low latency applications crucial for autonomous systems and industrial IoT. AI/ML technologies are being embedded into core management systems to facilitate cognitive network operations, enabling functions such as predictive resource scaling, automated fault diagnosis, and continuous performance optimization. These advancements push the cellular core beyond simple connectivity management towards becoming an intelligent, self-optimizing platform capable of supporting the most demanding computational and connectivity requirements of future digital ecosystems, including those envisioned for 6G research initiatives.

Regional Highlights

Regional dynamics play a crucial role in shaping the Cellular Core Market, with varied levels of investment driven by differing regulatory environments, subscriber densities, and technological maturity levels across continents. The regional highlights reflect the global competitive landscape and localized priorities in 5G deployment and digitalization initiatives.

- North America: This region is characterized by high investment in standalone (SA) 5G Core architecture, driven by leading MNOs aggressively pursuing monetization opportunities through enhanced mobile broadband (eMBB), fixed wireless access (FWA), and nascent private 5G enterprise networks. The US market, in particular, is a leader in adopting cloud-native core solutions, often partnering with hyperscalers to leverage public cloud infrastructure for core functions, demonstrating a strong push for operational efficiency and rapid service deployment. Regulatory clarity and competitive pressure ensure continuous technological advancement in this region.

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market globally, primarily fueled by massive infrastructure rollouts in China, South Korea, and Japan, which are pioneers in 5G density and coverage. High population density and subsequent massive data traffic necessitate highly scalable and robust core networks. Emerging markets like India and Southeast Asia are now accelerating their 5G investments, often leapfrogging older technologies and embracing software-defined core solutions directly, making this region critical for volume growth and competitive pricing pressures.

- Europe: The European market shows steady, though sometimes slower, adoption, driven by strong governmental support for industrial digitalization (Industry 4.0) and mandated coverage improvements. Key focus areas include network slicing for industrial verticals, particularly in Germany and the Nordics. Regulatory emphasis on data privacy and security often favors resilient, localized core deployments, though the shift toward shared infrastructure models and increased adoption of Open RAN within the core environment is gaining momentum to reduce CAPEX.

- Latin America (LATAM): This region is marked by significant growth potential, driven by national initiatives to bridge the digital divide and improve connectivity in densely populated urban centers. Investments are focused on modernizing core infrastructure to support new 5G spectrum allocations. Economic volatility can sometimes restrain large-scale infrastructure projects, but the shift towards cloud-native, scalable core solutions helps MNOs manage capital expenditures more effectively and accelerate time-to-market for basic 5G services.

- Middle East and Africa (MEA): The MEA region exhibits high growth potential, especially in the Gulf Cooperation Council (GCC) countries, where high per-capita digital services consumption drives investment in advanced core networks for smart city projects and ultra-broadband connectivity. Africa, while facing infrastructure challenges, sees rapid mobile penetration, pushing MNOs to invest in efficient, scalable core systems capable of handling explosive growth in subscriber numbers and data volume across diverse geographical landscapes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cellular Core Market. These profiles analyze business overview, financial performance, product portfolio, strategic initiatives, and SWOT analysis, providing a comprehensive view of the competitive landscape and strategic positioning of key market participants in the transition to cloud-native 5G Core.- Ericsson

- Nokia

- Huawei

- Cisco

- Samsung

- ZTE

- Mavenir

- Affirmed Networks (acquired by Microsoft)

- Metaswitch (acquired by Microsoft)

- Oracle

- NEC

- VMware

- Qualcomm

- Juniper Networks

- Parallel Wireless

- Altiostar

- A10 Networks

- Enea

- CommScope

- Red Hat

Frequently Asked Questions

Analyze common user questions about the Cellular Core market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a 4G EPC and a 5G Core?

The primary difference is architecture and flexibility. The 4G Evolved Packet Core (EPC) is generally monolithic and hardware-centric, making scaling difficult. In contrast, the 5G Core (5GC) is based on a Service-Based Architecture (SBA), leveraging cloud-native technologies like microservices and containers, which separates the control plane and user plane (UPF). This separation enables virtualization, rapid deployment, massive scalability, and crucial features like network slicing and Mobile Edge Computing (MEC), which are unavailable in 4G EPC.

How does network slicing impact the profitability of MNOs using 5G Core?

Network slicing is a critical profitability driver for Mobile Network Operators (MNOs) as it allows them to partition the physical network into multiple isolated virtual networks, each optimized for specific customer demands (e.g., ultra-low latency for autonomous vehicles or high bandwidth for video streaming). This capability enables MNOs to create highly customized, tiered service level agreements (SLAs) for enterprise verticals, moving beyond simple connectivity provision and generating premium revenue streams from dedicated, performance-guaranteed services.

What role do hyperscalers play in the Cellular Core Market?

Hyperscalers (such as AWS, Microsoft Azure, and Google Cloud) are increasingly acting as critical infrastructure providers for the Cellular Core Market. MNOs are deploying core network functions (NFs), particularly non-performance-critical functions and management plane components, directly onto public cloud platforms. This allows MNOs to benefit from the hyperscalers' scale, elasticity, and global footprint, accelerating time-to-market and significantly reducing reliance on proprietary hardware, while adhering to required data sovereignty regulations using dedicated cloud regions.

What are the main security challenges faced by cloud-native Cellular Cores?

The shift to cloud-native architectures introduces new security challenges, primarily related to the expanded attack surface due to virtualization and decentralization, particularly with the UPF deployed at the edge. Key concerns include container security, securing APIs within the Service-Based Architecture (SBA), ensuring proper isolation between network slices, and managing security policy consistency across multi-vendor, multi-cloud environments. Effective defense relies heavily on adopting advanced Zero Trust models and integrating AI/ML for real-time anomaly detection and mitigation.

Is the Open RAN movement extending its influence to the Cellular Core?

Yes, while Open RAN (O-RAN) primarily addresses the Radio Access Network, its principles of disaggregation, open interfaces, and standardization are strongly influencing the core. This is manifested through the push for greater interoperability among core network components, encouraging software-centric vendors, and accelerating the deployment of cloud-native core functions on COTS hardware. This trend reduces vendor lock-in and promotes greater innovation velocity across the entire end-to-end cellular infrastructure stack, including the core.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager