Cellulose Nanoparticles Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437339 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Cellulose Nanoparticles Market Size

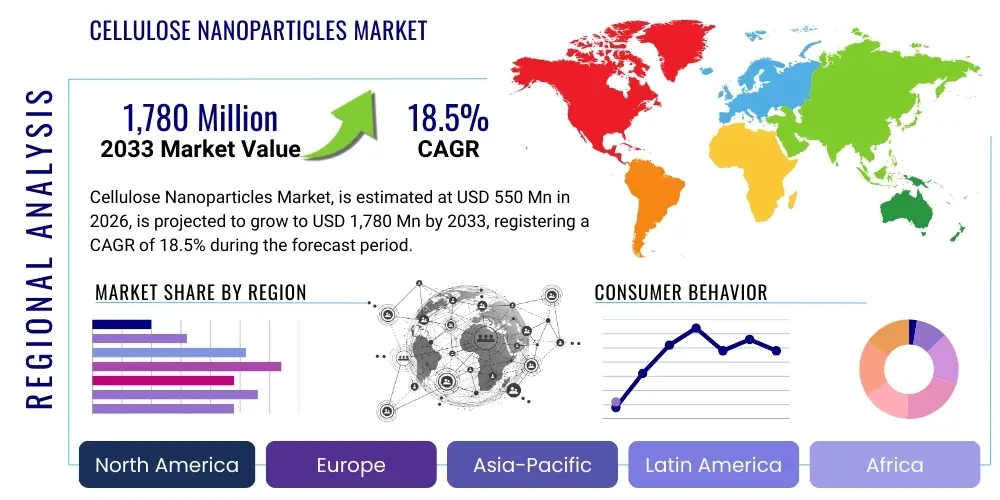

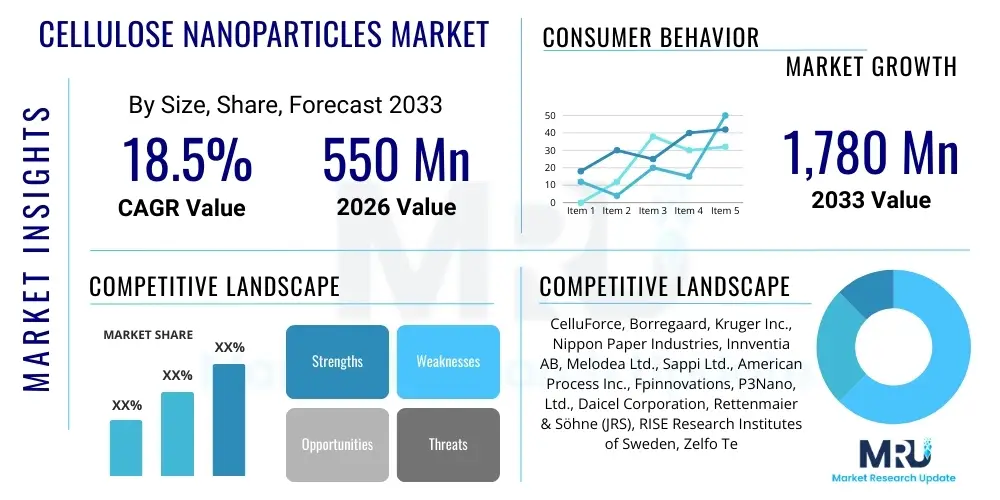

The Cellulose Nanoparticles Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 550 Million in 2026 and is projected to reach USD 1,780 Million by the end of the forecast period in 2033.

Cellulose Nanoparticles Market introduction

The Cellulose Nanoparticles (CNPs) market encompasses materials derived from renewable cellulose sources, primarily categorized into Cellulose Nanofibers (CNF), Cellulose Nanocrystals (CNC), and Bacterial Nanocellulose (BNC). These nanomaterials exhibit exceptional properties, including high tensile strength, low density, high surface area, biodegradability, and unique optical characteristics, positioning them as critical sustainable alternatives to petroleum-based reinforcements and fillers across numerous industries. CNPs are increasingly sought after for developing next-generation high-performance materials due to global pressures favoring circular economy models and bio-based products. Their versatility allows for modification and integration into complex matrices, enhancing mechanical, barrier, and thermal properties significantly.

Major applications of CNPs span across composites and packaging, where they act as reinforcing agents in polymers, enhancing barrier properties against gases and moisture in food packaging films. In the biomedical sector, CNPs are utilized for drug delivery systems, tissue engineering scaffolds, and wound dressings due to their biocompatibility and tunable surface chemistry. Furthermore, the electronics and energy sectors leverage CNPs for flexible electronics, transparent electrodes, and battery separators, capitalizing on their favorable electrical and optical attributes. The driving factors behind this market expansion include stringent environmental regulations promoting sustainable materials, increasing consumer demand for biodegradable products, and advancements in cost-effective industrial-scale production techniques, which are overcoming previous limitations related to energy consumption and yield optimization.

The product description involves extracting nanoscale cellulose from various sources, mainly wood pulp, cotton, or agricultural residues, through mechanical, chemical (acid hydrolysis), or biological processes. CNCs are stiff, rod-like structures, while CNFs are long, spaghetti-like fibers forming an intricate network; BNC is produced via microbial fermentation, often resulting in high purity. The unique combination of natural origin and superior performance attributes—including a Young's Modulus comparable to Kevlar and steel—positions CNPs as a disruptive material platform. This sustainable profile, coupled with functionality, ensures CNPs are foundational to innovation in lightweight transportation, smart packaging, and advanced healthcare materials, collectively driving robust market growth throughout the forecast period.

Cellulose Nanoparticles Market Executive Summary

The Cellulose Nanoparticles Market is characterized by a strong convergence of sustainability initiatives and advanced materials engineering, resulting in high double-digit CAGR projections. Key business trends indicate significant investment in scaling up CNF production capacity, particularly in North America and Europe, driven by demand from the automotive and construction sectors seeking lightweight, high-strength composites. Merger and acquisition activities remain focused on securing access to patented synthesis technologies and raw material supply chains, especially those leveraging agricultural waste or residual biomass, enhancing overall cost-efficiency and circularity of production. Furthermore, the commercialization pipeline is robust, with numerous pilot projects graduating to large-scale operations, shifting CNPs from niche academic interest to mainstream industrial adoption across coatings and packaging.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, primarily fueled by rapid industrialization, burgeoning demand in packaging (especially flexible bioplastics), and significant governmental support for green chemistry initiatives in countries like China, Japan, and South Korea. North America maintains a strong position due to early adoption in the biomedical and automotive industries and a strong research and development ecosystem focusing on innovative CNP functionalization techniques. European markets are driven by the strictest regulations concerning plastic waste and mandates for bio-based content in consumer goods, propelling CNP usage in advanced construction materials and paper products. Strategic partnerships between raw material suppliers, CNP producers, and specialized end-users define the competitive landscape.

Segment trends underscore the dominance of Cellulose Nanofibers (CNF) over Cellulose Nanocrystals (CNC) in terms of volume consumption, attributed to their superior network-forming capabilities, making them ideal for high-viscosity gels, paper additives, and bulk composites. However, CNCs command premium pricing due to their highly crystalline nature and precision applications in optics and specialized drug delivery. Application-wise, the Packaging segment is expected to exhibit the highest growth rate, necessitated by the global shift towards biodegradable food contact materials and the requirement for superior oxygen and water vapor barrier properties. The integration of CNPs into intelligent packaging systems, sensing environmental changes, further bolsters demand within this critical segment, marking a pivotal transition toward functional biopolymers.

AI Impact Analysis on Cellulose Nanoparticles Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Cellulose Nanoparticles (CNP) market frequently center on how machine learning (ML) can optimize complex, energy-intensive synthesis processes, specifically acid hydrolysis for CNC and mechanical homogenization for CNF. Users are concerned about maintaining consistent quality and high crystallinity during large-scale production, asking if AI can predict and control reaction parameters—such as acid concentration, temperature, and residence time—to reduce batch variability and energy consumption. Another key theme is the acceleration of materials discovery; stakeholders are keenly interested in whether generative AI models can design novel surface modifications or composite formulations using CNPs, reducing the lengthy trial-and-error process inherent in materials science R&D. Furthermore, the role of predictive maintenance models for large-scale processing equipment, which often suffers from wear and tear due to high shear forces, is a common operational concern addressed through AI adoption.

The primary concern users voice is the successful transition of AI-driven optimization from laboratory scale to industrial production scale without compromising the unique nanostructural integrity of the particles. Expectations are high that AI and ML algorithms will transform quality control by analyzing spectroscopic and microscopic data in real-time, ensuring stringent criteria are met for pharmaceutical or high-end composite applications. The influence of AI extends into supply chain management, optimizing sourcing of diverse biomass feedstocks based on predictive models of availability, quality, and seasonal variations, thereby stabilizing input costs. Overall, the summarized key themes reflect that users view AI less as a displacement technology and more as an essential tool for achieving the necessary scale, precision, and sustainability metrics required for the widespread commercial viability of CNPs.

The implementation of AI/ML models is crucial for tackling the inherent variability in natural raw materials and the complexity of nanoscale processing. By processing vast datasets generated from rheological measurements, mechanical testing, and microscopy, AI can pinpoint the precise conditions needed to maximize yield while minimizing environmental impact, such as water usage and chemical consumption. This data-driven approach allows manufacturers to achieve tailored CNP products—optimized for specific end-use requirements like high transparency or high stiffness—much faster than traditional methods. This efficiency gain is expected to be a major competitive differentiator for CNP producers who successfully integrate these smart manufacturing principles into their operations.

- AI-driven optimization of CNP synthesis protocols (acid hydrolysis, homogenization) to ensure crystalline consistency and yield maximization.

- Machine learning for real-time quality control, analyzing nanoscale features and particle size distribution instantly, reducing batch variability.

- Accelerated discovery of novel CNP surface functionalization chemistries and composite formulations using generative AI and molecular simulations.

- Predictive modeling for feedstock sourcing, optimizing biomass selection based on desired CNP properties and seasonal supply chain stability.

- Implementation of digital twins and predictive maintenance for high-shear processing equipment, minimizing downtime and operational costs.

DRO & Impact Forces Of Cellulose Nanoparticles Market

The Cellulose Nanoparticles (CNP) market dynamics are shaped by powerful Drivers (D) rooted in sustainability mandates and performance superiority, significant Restraints (R) related to operational and economic challenges, and substantial Opportunities (O) arising from technological convergence and application expansion. The primary driving force is the global imperative to transition toward sustainable, bio-based materials, compelling industries like packaging, construction, and automotive to seek renewable alternatives to fossil fuel derivatives. CNPs offer not only renewability but also mechanical properties that often surpass traditional materials, acting as a disruptive reinforcing agent. However, this growth is significantly restrained by the high capital investment required for large-scale production facilities and the challenge of dispersing CNPs uniformly within non-polar polymer matrices, an issue often leading to material aggregation and reduced performance in end products. Opportunities abound in advanced fields like flexible electronics, additive manufacturing (3D printing), and specialized medical applications, where the unique electrical and biomedical properties of CNPs command premium pricing and foster rapid innovation.

Impact forces within the market are predominantly exerted by the stringent regulatory landscape, particularly in Europe and North America, which heavily favors materials with certified biodegradation profiles and low carbon footprints. Technological impact forces include the continuous advancement in surface modification techniques—such as silanization or grafting—which address the dispersion challenges by making CNPs compatible with hydrophobic polymers, thereby unlocking their full potential in high-volume composite applications. Economic forces dictate market penetration, as CNP prices must become competitive with established reinforcements like glass fibers or carbon black for widespread adoption, making cost-efficient mass production critical. Social forces reflect a growing consumer preference for sustainable products, pushing brands to incorporate bio-based content into their products visibly, further incentivizing industrial adoption of CNPs, especially in the consumer goods sector.

The delicate balance between performance gains and production complexity defines the current competitive environment. While the high Young's Modulus and specific surface area of CNPs represent a major competitive advantage, the inherent difficulties in maintaining particle integrity during compounding and molding processes present a consistent hurdle. Successful market participants are those who not only master the extraction and purification processes but also invest heavily in intermediate steps, such as masterbatch formulation or advanced drying techniques (like freeze-drying or spray drying), to ensure that the material maintains its nanoscale efficacy when delivered to the final product manufacturer. Managing these complex impact forces effectively is key to capitalizing on the substantial long-term growth opportunity presented by sustainable nanomaterials.

Segmentation Analysis

The Cellulose Nanoparticles Market is extensively segmented across Type, Application, and End-Use Industry, reflecting the diverse range of properties and functionalities these materials offer. The segmentation by Type—encompassing Cellulose Nanofibers (CNF), Cellulose Nanocrystals (CNC), and Bacterial Nanocellulose (BNC)—is the most fundamental distinction, as each type possesses distinct morphological, mechanical, and surface chemistry characteristics influencing its suitability for specific applications. CNFs, with their high aspect ratio and strong entanglement capacity, dominate volume consumption in applications requiring network formation, such as thickeners or barrier coatings, while the highly crystalline and stiff structure of CNCs makes them preferred for optical applications and high-strength reinforcement.

Application segmentation illustrates the versatility of CNPs, covering composites, paper & pulp, biomedical, electronics, coatings, and filtration. The composites segment, covering polymer matrices for automotive and construction, remains a major revenue generator, utilizing CNPs to drastically improve strength-to-weight ratios. The most dynamic growth, however, is observed in the biomedical segment, where the biocompatibility of CNPs is leveraged for complex drug delivery systems and advanced wound care matrices. End-Use Industries, spanning automotive, construction, packaging, aerospace, and consumer goods, dictate the scale and specific performance requirements for CNP integration. For instance, the automotive sector demands extreme lightweighting and mechanical robustness, driving the adoption of CNP-reinforced thermoplastics, while the food packaging industry prioritizes biodegradability and exceptional gas barrier performance.

The strategic analysis of these segments reveals that while established industries like paper and pulp provide a stable baseline for CNF demand, future disruptive growth will emanate from high-value, performance-critical sectors. The integration of BNC, synthesized by specific bacteria like Gluconacetobacter xylinus, into specialized medical devices and acoustic membranes represents a premium niche market, commanding higher prices due to its unparalleled purity and unique fibrillar structure. Manufacturers are increasingly focusing on vertical integration and offering functionalized CNP variants tailored specifically for target end-use segments to maximize market penetration and command better pricing power.

- Type: Cellulose Nanofibers (CNF), Cellulose Nanocrystals (CNC), Bacterial Nanocellulose (BNC)

- Application: Composites, Paper & Pulp, Biomedical & Pharmaceutical, Electronics & Optics, Coatings & Paints, Filtration & Separations

- End-Use Industry: Automotive, Construction, Food & Beverage Packaging, Consumer Goods, Aerospace & Defense, Healthcare & Medical

Value Chain Analysis For Cellulose Nanoparticles Market

The Value Chain for the Cellulose Nanoparticles Market begins with the Upstream analysis, focusing on the sourcing and preparation of raw materials, primarily wood pulp, agricultural residues (such as cotton linters, rice straw, or bagasse), and, for BNC, specific fermentation media. This stage is crucial as the quality and purity of the cellulose feedstock directly influence the resulting morphology and quality of the CNPs. Key players in this phase include forestry companies, specialized pulp producers, and agricultural processors. Significant R&D effort is focused here on sustainable sourcing and waste valorization, aiming to reduce dependence on expensive chemical-grade pulp and improve the overall environmental footprint of the process. Efficiency in pretreatment technologies, such as steaming or alkaline washing, is vital to prepare the cellulose for nanoscale breakdown.

The Midstream activities involve the complex conversion of bulk cellulose into CNPs, employing specialized manufacturing processes. This includes chemical methods like sulfuric acid hydrolysis for CNC production and mechanical processes such as high-pressure homogenization or grinding for CNF production. This manufacturing phase is highly capital-intensive and energy-intensive, requiring specialized industrial equipment. Direct channels in this phase include CNP manufacturers selling directly to large, vertically integrated polymer or biomedical companies that possess internal R&D capabilities for composite formulation. Indirect channels involve distributors or specialized chemical suppliers who handle smaller volumes or provide highly customized, functionalized CNP dispersions tailored to specific regional markets or niche applications.

The Downstream analysis focuses on the integration and utilization of CNPs by end-use manufacturers. These buyers, including automotive parts manufacturers, food packaging firms, and medical device companies, transform CNPs into final products. This stage requires significant formulation expertise, particularly mastering dispersion technology to avoid aggregation during compounding and molding. The distribution channel at this level involves selling CNP masterbatches, resins, or specialty coatings, rather than pure CNP powder or dispersion, simplifying the integration process for the end-user. The efficacy of the entire value chain hinges on seamless collaboration and technological transfer between CNP producers and downstream integrators, especially concerning safety data and processing guidelines, ensuring that the unique nano-properties are translated into macro-performance benefits.

Cellulose Nanoparticles Market Potential Customers

The potential customers and end-users of Cellulose Nanoparticles are highly diverse, reflecting the material’s broad applicability across industrial sectors requiring strength, lightweighting, and sustainability. The largest group of customers includes composite manufacturers, particularly those supplying the automotive and aerospace industries, who purchase CNPs primarily for reinforcing lightweight polymer matrices (e.g., polypropylenes, epoxies) to achieve superior mechanical performance and reduced vehicle weight, directly impacting fuel efficiency or battery range. Construction material producers also represent a significant customer base, integrating CNPs into cement, insulation panels, and high-performance coatings to improve durability, crack resistance, and thermal insulation properties, aligning with green building standards.

Another major segment of buyers includes packaging companies, particularly those focused on food and beverage applications. These customers utilize CNPs, specifically CNFs, to create thin film coatings or integrated layers that provide excellent oxygen and moisture barrier properties, significantly extending the shelf life of perishable goods while ensuring the material remains biodegradable and safe for food contact. This group often purchases CNPs in the form of specialized liquid dispersions or masterbatches ready for extrusion or coating processes. The push for eliminating multi-layer, non-recyclable plastic packaging is a key driver for demand from this customer cluster.

Furthermore, the biomedical and electronics sectors represent high-value, niche customers. Pharmaceutical and medical device companies utilize CNPs for highly specialized products such as controlled drug delivery vehicles, bio-scaffolds for tissue engineering, and sophisticated wound dressings due to their high surface area, non-toxicity, and biocompatibility. Electronics manufacturers are exploring CNPs for flexible displays, transparent conductive films, and advanced battery separators, valuing their optical clarity and high dielectric constant. These customers require extremely pure grades of nanocellulose, often BNC or high-purity CNC, reflecting a stringent quality requirement that justifies higher purchase prices.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550 Million |

| Market Forecast in 2033 | USD 1,780 Million |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | CelluForce, Borregaard, Kruger Inc., Nippon Paper Industries, Innventia AB, Melodea Ltd., Sappi Ltd., American Process Inc., Fpinnovations, P3Nano, Ltd., Daicel Corporation, Rettenmaier & Söhne (JRS), RISE Research Institutes of Sweden, Zelfo Technology GmbH, Oji Holdings Corporation, Stora Enso, Alberta Innovates, BASF SE, Lignol Energy Corporation, Bio-Vision A/S |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cellulose Nanoparticles Market Key Technology Landscape

The technological landscape of the Cellulose Nanoparticles market is centered on achieving efficient, scalable, and cost-effective methods for nanofibrillation and crystallization while ensuring the preservation of the unique nanoscale morphology. The primary technologies are divided into top-down methods (mechanical and chemical processing) and bottom-up methods (microbial synthesis). Mechanical homogenization, involving equipment like high-pressure homogenizers and microfluidizers, is the dominant technology for large-scale production of Cellulose Nanofibers (CNF), requiring significant pre-treatment (such as TEMPO-mediated oxidation or enzymatic hydrolysis) to reduce the energy consumption inherent in breaking down the strong cellulose structure. This combination of pre-treatment and mechanical shearing is critical for producing high-quality CNF dispersions suitable for coatings and composites, although balancing throughput with the risk of fiber damage remains a constant technological challenge.

For Cellulose Nanocrystals (CNC), the established primary technology is strong acid hydrolysis, typically using sulfuric acid, which selectively removes the amorphous regions of the cellulose fiber, leaving behind the highly crystalline, rod-like structures. Recent advancements in this chemical process focus on minimizing environmental impact by developing greener solvents, ionic liquids, or enzymatic hydrolysis techniques as sustainable alternatives to traditional mineral acids. Furthermore, the development of continuous flow reactors for acid hydrolysis aims to improve reaction control, consistency, and scalability, moving away from traditional batch processing which often leads to variance in particle size and surface charge. The precise control of reaction kinetics is paramount in this area to tailor the surface chemistry (e.g., sulfation level) which directly affects CNC stability in dispersion.

A burgeoning technological area involves the functionalization and modification of CNPs. Since pristine cellulose is inherently hydrophilic, integrating it into hydrophobic polymer matrices (like polyethylene or polycarbonate) requires surface engineering technologies, such as chemical grafting (e.g., esterification, silanization) or physical adsorption of surfactants. These functionalization techniques enhance compatibility, leading to better dispersion, and significantly expanding the application scope into high-performance engineering plastics and solvent-based coatings. Additionally, freeze-drying and spray-drying technologies are becoming essential for transforming CNP dispersions into free-flowing powders, a necessary step for logistical efficiency and integration into compounding processes, while minimizing irreversible hornification (aggregation) that damages performance.

Regional Highlights

- Asia Pacific (APAC) Market Dominance and Growth Trajectory: APAC is anticipated to be the fastest-growing region in the Cellulose Nanoparticles market, driven by substantial industrial expansion in key economies like China, India, and Southeast Asian nations. The region's vast access to agricultural biomass and the increasing focus on advanced manufacturing, particularly in electronics and flexible packaging, underpin this growth. Governments in this region are actively promoting green technology adoption and investing in indigenous R&D capabilities for bio-based materials. The rapid expansion of the construction sector and the rising demand for sophisticated, sustainable food packaging solutions in densely populated areas further accelerate the commercial uptake of CNPs, especially CNF, as a cost-effective performance additive.

- North American Leadership in Innovation and High-Value Applications: North America maintains a strong leadership position, characterized by significant governmental and corporate investment in pilot and commercial-scale CNP production, particularly in Canada and the United States. This region excels in high-value, technically demanding applications such as aerospace composites, advanced automotive parts, and specialized biomedical materials. The robust presence of research institutions and leading material science companies drives continuous innovation in functionalization techniques and composite formulation, ensuring early adoption of CNC and high-purity BNC in niche markets. Strict fuel economy standards in the U.S. push automotive manufacturers to prioritize CNP-based lightweighting solutions.

- European Focus on Sustainability and Regulatory Mandates: Europe is a mature and highly regulated market, where demand is primarily driven by rigorous environmental policies, particularly the circular economy package and targets for reducing plastic waste. This regulatory pressure makes CNPs an attractive material for substituting traditional plastics in packaging, films, and consumer goods. Countries like Sweden, Norway, and Finland, with large forestry industries, have a strategic advantage in raw material sourcing and are heavily invested in CNF production technologies. The European market focuses heavily on integrating CNPs into construction materials (e.g., concrete additives) and specialized coatings to meet stringent energy efficiency standards and improve fire resistance.

- Latin America (LATAM) and Emerging Opportunities in Raw Material Exploitation: LATAM represents an emerging market with significant potential due to abundant renewable raw material sources, including specific agricultural residues (e.g., sugarcane bagasse). While the market size remains smaller compared to APAC or North America, there is increasing localized interest in using CNPs to enhance commodity products, such as paperboard and basic composites, thereby adding local value to raw material exports. Brazil and Mexico are leading the way, focusing efforts on cost-effective extraction methods suitable for local biomass, often collaborating with international research partners to optimize low-cost, decentralized production.

- Middle East and Africa (MEA) Investment in Diversification and Infrastructure: The MEA region, particularly the Gulf Cooperation Council (GCC) countries, is showing growing interest in CNPs as part of economic diversification strategies moving away from hydrocarbon dependence. Investment is focused on infrastructure development, where CNPs can enhance the durability and sustainability of construction materials. Furthermore, there is rising demand for advanced filtration systems, where CNPs can offer highly effective membrane separators for water treatment and desalinization processes, addressing critical regional water scarcity challenges.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cellulose Nanoparticles Market.- CelluForce

- Borregaard

- Kruger Inc.

- Nippon Paper Industries

- Innventia AB (now part of RISE)

- Melodea Ltd.

- Sappi Ltd.

- American Process Inc. (API)

- Fpinnovations

- P3Nano, Ltd.

- Daicel Corporation

- Rettenmaier & Söhne (JRS)

- RISE Research Institutes of Sweden

- Zelfo Technology GmbH

- Oji Holdings Corporation

- Stora Enso

- Alberta Innovates

- BASF SE

- Lignol Energy Corporation

- Bio-Vision A/S

- Norske Skog

- UPM-Kymmene Corporation

- Ashland Global Holdings Inc.

- Mitsubishi Paper Mills Ltd.

- Verso Corporation

Frequently Asked Questions

Analyze common user questions about the Cellulose Nanoparticles market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary commercial applications driving the growth of the Cellulose Nanoparticles market?

The primary commercial applications driving market growth include sustainable packaging, leveraging CNPs for superior gas and moisture barrier properties in food films; lightweight composites, utilizing high tensile strength in the automotive and aerospace sectors; and advanced biomedical materials, where biocompatibility is key for drug delivery and tissue scaffolds.

What is the main difference between Cellulose Nanofibers (CNF) and Cellulose Nanocrystals (CNC) in industrial use?

CNF consists of long, entangled, flexible fibers with both crystalline and amorphous regions, making them ideal for network formation, thickening agents, and high-volume applications like paper and coatings. CNC consists of short, stiff, highly crystalline rod-like structures, prized for mechanical reinforcement, optical properties, and high-precision applications requiring specific surface chemistry.

What are the biggest challenges restricting the widespread adoption and scaling of CNPs?

The biggest challenges include the high capital expenditure required for industrial-scale processing equipment, the high energy consumption of mechanical fibrillation, and the technical difficulty of achieving stable, uniform dispersion of hydrophilic CNPs within hydrophobic polymer matrices during compounding and manufacturing processes.

How are advancements in surface modification technologies impacting the market?

Advancements in surface modification, such as chemical grafting and silanization, are critically impacting the market by overcoming the poor compatibility barrier between CNPs and common engineering polymers. This functionalization enables effective integration into high-performance thermoplastic composites, unlocking substantial market potential in automotive and construction sectors.

Which region currently holds the largest share of the Cellulose Nanoparticles market, and which is growing fastest?

North America currently holds a significant market share due to early R&D investment and strong adoption in high-value sectors like biomedical and aerospace. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, fueled by rapid industrialization, abundant biomass resources, and escalating demand for sustainable packaging and advanced materials.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager