Cement Kilns Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431990 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Cement Kilns Market Size

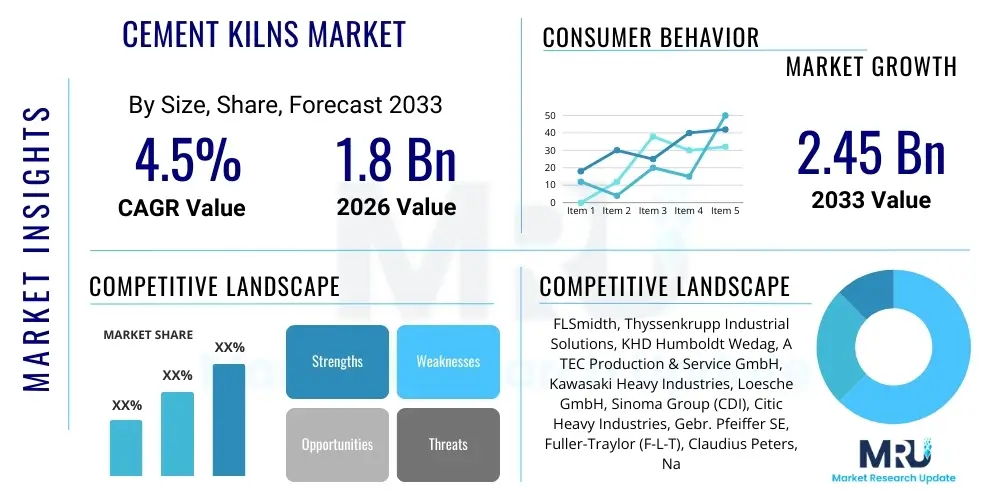

The Cement Kilns Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. This consistent expansion is primarily fueled by accelerated global infrastructure development, particularly in emerging economies, alongside persistent demand for high-quality cement necessary for large-scale urban development projects. The market's stability is also underpinned by ongoing modernization efforts in developed regions focused on enhancing energy efficiency and reducing the carbon footprint of existing kiln installations.

The market is estimated at USD 1.8 Billion in 2026, reflecting the significant capital expenditure required for installing new pyroprocessing equipment and undertaking large-scale retrofitting projects globally. Cement kilns are the core components of cement manufacturing facilities, essential for the high-temperature production of clinker, making investment in this specialized machinery non-discretionary for cement producers aiming for output capacity expansion or operational excellence.

The market is projected to reach USD 2.45 Billion by the end of the forecast period in 2033. This projection considers the increasing adoption of highly efficient kiln technologies, such as advanced dry process kilns with multi-stage preheaters and precalciners, which optimize thermal consumption and maximize production throughput. Furthermore, the rising regulatory pressure concerning CO2 emissions necessitates investment in technologies compatible with alternative fuels and carbon capture, further driving market valuation growth over the next decade.

Cement Kilns Market introduction

The Cement Kilns Market encompasses the manufacturing, installation, maintenance, and upgrade of specialized rotary and shaft furnaces used in the pyroprocessing stage of cement production. These kilns are indispensable equipment responsible for heating raw materials (limestone, clay, etc.) to extremely high temperatures (around 1,450°C) to facilitate the chemical transformation into clinker, the foundational component of cement. The performance and efficiency of a cement kiln directly dictate the overall operational cost, energy consumption, and environmental compliance of a cement plant, making it a critical focus area for industry investment.

Major applications for cement kilns are exclusively concentrated within the cement and construction materials industry, serving both large multinational cement conglomerates and smaller, regional producers. The primary benefit of advanced cement kilns lies in their ability to achieve high production capacity while minimizing fuel consumption per ton of clinker produced, thus improving overall profitability. Modern kilns are engineered for high thermal efficiency through features like multi-stage cyclone preheaters, minimizing heat loss and maximizing fuel utilization, including the use of alternative fuels derived from industrial waste.

Key driving factors for this market include rapid urbanization and massive government investments in public infrastructure projects globally, particularly in Asia Pacific and parts of Africa, which create sustained demand for cement. Furthermore, the stringent global environmental regulations, specifically those targeting reduced greenhouse gas emissions and improved waste utilization, compel manufacturers to continuously upgrade existing kilns and invest in new, state-of-the-art pyroprocessing technology capable of operating under strict emissions limits and integrating alternative raw materials and fuels.

Cement Kilns Market Executive Summary

The global Cement Kilns Market is characterized by robust business trends focusing heavily on digitalization, energy efficiency, and sustainable manufacturing practices. Key business stakeholders are increasingly prioritizing the implementation of advanced process control systems and digital twin technology to optimize kiln operations, reduce thermal variability, and extend equipment lifespan. The shift toward alternative fuel usage, including biomass, tire-derived fuel (TDF), and municipal solid waste (MSW), is a dominant trend, driving the demand for specialized kiln burners and feeding systems capable of handling heterogeneous fuel sources efficiently and safely, thereby mitigating reliance on traditional fossil fuels like coal.

Regionally, Asia Pacific (APAC) remains the undisputed leader in market size and growth, driven by massive infrastructure expansion in India, China, and Southeast Asian nations, leading to continuous new plant construction and capacity expansion projects. Conversely, European and North American regional trends emphasize modernization, focusing less on new capacity and more on retrofitting existing older kilns with modern components (e.g., low NOx burners, advanced heat recovery systems) to meet stringent decarbonization targets and enhance circular economy practices within their established industrial bases. Latin America and MEA are seeing moderate growth tied to resource development and local infrastructure initiatives.

In terms of segmentation, the Rotary Kilns segment, specifically dry process rotary kilns coupled with precalciners, dominates the market share due to their superior efficiency, high throughput capacity, and dominance in large-scale cement plants globally. The technology segmentation is witnessing significant activity in the realm of specialized low-emission kilns designed for high substitution rates of alternative fuels and raw materials (ASR/AFR), signaling a fundamental shift toward sustainable clinker production methods and long-term compliance with global climate goals.

AI Impact Analysis on Cement Kilns Market

User inquiries regarding AI in the Cement Kilns Market frequently revolve around optimizing complex, high-temperature processes, achieving real-time predictive maintenance, and minimizing fuel consumption variability. Common themes include how AI algorithms can stabilize the clinkerization process, which is highly sensitive to variations in raw material quality and fuel input, and how machine learning can provide proactive diagnostics for critical components like kiln shells, refractory linings, and bearings, thus preventing costly unscheduled downtime. Users are primarily concerned with tangible reductions in thermal energy consumption and achieving consistent product quality amidst volatile input conditions, positioning AI as a necessary tool for complex industrial process management rather than just a novelty.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming kiln operations from reactive to predictive paradigms. AI systems leverage vast streams of data from sensors monitoring temperature, gas composition, pressure, and motor load across the entire pyroprocessing line. These systems apply advanced algorithms to detect subtle anomalies that precursors to equipment failure or process instability, allowing operators to make micro-adjustments in real-time. This level of optimization is unattainable through traditional manual or fixed automation methods, resulting in significant improvements in clinker quality consistency, reduced emission spikes, and maximized equipment uptime, directly impacting plant profitability and resource efficiency.

Furthermore, AI plays a crucial role in optimizing alternative fuel utilization. Since alternative fuels possess highly variable caloric values and moisture content compared to consistent fuels like pulverized coal or gas, managing their combustion requires complex control logic. AI models dynamically adjust kiln burner settings, preheater fan speeds, and fuel feed rates based on immediate kiln feedback and predictive models of fuel consumption, ensuring stable flame conditions and complete combustion. This capability not only reduces operational costs but also significantly enhances the industry's ability to transition toward more sustainable and waste-derived energy sources, supporting circular economy objectives.

- AI-driven Predictive Maintenance (PdM) identifying refractory wear and mechanical stress on kiln rollers.

- Machine learning optimization of clinker quality control by analyzing X-ray fluorescence (XRF) data and process variables.

- Real-time adjustment of fuel mixing ratios and combustion air flow to maximize thermal efficiency and alternative fuel substitution rates.

- Digital twins of the kiln system enabling simulated process changes and operator training in a risk-free environment.

- Advanced process control (APC) systems utilizing deep learning to stabilize crucial temperature profiles within the burning zone.

- Automated anomaly detection in emissions data (NOx, SOx, CO) facilitating immediate corrective action to maintain regulatory compliance.

- Optimizing the throughput of the raw meal grinding and blending processes upstream based on predictive kiln demand.

DRO & Impact Forces Of Cement Kilns Market

The Cement Kilns Market dynamics are powerfully shaped by the synergy of structural demand drivers and stringent environmental constraints. The primary driver is the pervasive and continuous need for residential and commercial construction globally, coupled with massive government-backed infrastructure programs, requiring steady output of cement. However, the high capital outlay associated with modern kilns and the volatility of energy prices act as significant restraints. Opportunities are concentrated in technological advancements focusing on reducing the high CO2 footprint of cement production, such as the adoption of calcination technologies compatible with carbon capture, utilization, and storage (CCUS), and the promotion of low-clinker cements that reduce reliance on the traditional pyroprocessing stage.

Key impact forces stem from regulatory shifts and technological maturity. Regulatory enforcement of carbon pricing mechanisms and mandated emission reductions (e.g., lower NOx, SOx, and particulate matter limits) compel cement manufacturers to invest in cleaner kiln technologies, such as selective non-catalytic reduction (SNCR) and advanced dust filtration systems, fundamentally altering investment priorities. Furthermore, the rising maturity and availability of proven, high-efficiency dry process kilns with precalciners are accelerating the replacement cycle of older, less efficient wet and semi-dry kilns, particularly in developing economies seeking immediate operational cost savings.

The increasing acceptance and logistical infrastructure development surrounding alternative fuels (AFR/ASR) constitute a critical positive impact force. Cement manufacturers are increasingly viewed as key partners in industrial waste management, utilizing waste streams as fuel, which provides a cost-effective energy solution while addressing waste disposal challenges. This shift requires specialized adaptations to existing kilns, including complex feeding systems, modified burning zones, and enhanced emissions controls, thereby creating significant sub-market opportunities for retrofit and modification services within the Cement Kilns Market.

Segmentation Analysis

The Cement Kilns Market is primarily segmented based on Type, Process (Technology), and Capacity. Segmentation by Type distinguishes between the dominant Rotary Kilns and the less common Vertical Shaft Kilns (VSK). Rotary kilns, favored for large-scale production, lead the market due to their capacity for continuous, high-volume clinker production and adaptability to advanced auxiliary equipment like preheaters and precalciners. VSKs, while lower in capital cost and often suitable for smaller, localized production and specific types of cement, hold a smaller global share due to output limitations and generally lower thermal efficiency compared to modern rotary systems.

Segmentation by Process defines the technology employed, primarily splitting the market into Dry Process, Semi-Dry Process, and Wet Process categories. The Dry Process segment is overwhelmingly dominant, representing the industry standard for new installations globally. Dry process kilns, which require minimal moisture content in the raw meal, significantly reduce the energy expenditure needed to evaporate water, resulting in vastly superior thermal efficiency compared to the older, energy-intensive Wet Process kilns. The ongoing shift from wet to dry process technology remains a core driver for modernization projects worldwide, reinforcing the dry process segment's market leadership.

Capacity segmentation categorizes kilns by their daily clinker output (e.g., small, medium, large capacity). The large capacity kilns segment (typically exceeding 5,000 tons per day (TPD)) is experiencing the fastest growth, particularly in markets like China and India, where scale and efficiency are paramount. These mega-kilns require sophisticated control systems and highly reliable mechanical components, pushing manufacturers to innovate in materials science and engineering design to ensure durability and continuous operation at maximal throughput. Investment decisions are heavily influenced by the desired scale of operation and regional market demand.

- By Type:

- Rotary Kilns

- Vertical Shaft Kilns (VSK)

- By Process (Technology):

- Dry Process Kilns (Dominant)

- Semi-Dry Process Kilns

- Wet Process Kilns (Declining)

- By Capacity:

- Small Capacity (Under 1,000 TPD)

- Medium Capacity (1,000 - 4,000 TPD)

- Large Capacity (Above 4,000 TPD)

- By Application/End-User:

- Large Cement Manufacturing Plants

- Regional Cement Producers

- Specialty Mineral Processing (e.g., Calcination of Limestone)

- By Component:

- Kiln Shells and Support Systems

- Refractory Linings

- Kiln Burners and Combustion Systems

- Preheaters and Precalciners

- Coolers (Grates and Planetary)

- Drive Systems and Gears

Value Chain Analysis For Cement Kilns Market

The value chain for the Cement Kilns Market begins significantly upstream with the suppliers of specialized raw materials and heavy industrial components, including high-grade steel alloys for kiln shells, refractory materials (magnesia, alumina, silica), and complex mechanical parts such as bearings, girth gears, and sophisticated high-temperature monitoring sensors. These suppliers must meet stringent quality and durability standards due to the extreme operating conditions of a cement kiln. Specialized engineering firms and intellectual property owners for core technologies, such as advanced burner designs and multi-stage preheater configurations, also reside at this crucial upstream segment, dictating innovation and performance benchmarks.

The midstream segment is dominated by Original Equipment Manufacturers (OEMs) and major Engineering, Procurement, and Construction (EPC) firms, who are responsible for the design, fabrication, and assembly of the entire kiln system. These companies not only manufacture the core machinery but also integrate all auxiliary systems, including dust collection (bag houses/ESP), exhaust gas treatment (SNCR/SCR), and advanced control systems (DCS/PLC). The distribution channel predominantly relies on direct sales and highly specialized, long-term contractual engagements between the OEM/EPC contractor and the cement manufacturing client. Due to the custom nature and high cost of the equipment, third-party distributors or indirect channels play a minimal role in the core kiln procurement process, although they are utilized for spare parts and localized maintenance services.

The downstream segment involves the actual installation, commissioning, and long-term servicing of the cement kiln within the client's plant. The end-users—cement manufacturers—rely heavily on ongoing technical support, spare parts availability, and advanced maintenance services provided directly by the OEM or certified specialized service providers. The ultimate successful operation of the kiln depends on optimizing the integration of raw material handling and clinker grinding processes, making the entire value chain interdependent. This direct engagement model ensures quality control and facilitates customized solutions for regional requirements, from seismic considerations to specific fuel types available locally.

Cement Kilns Market Potential Customers

The primary consumers and end-users of cement kilns are large-scale, international cement manufacturing conglomerates, regional cement producers, and increasingly, specialized industrial firms involved in mineral processing that utilizes similar high-temperature rotary processing equipment. Global giants, such as LafargeHolcim, HeidelbergCement, Cemex, and China National Building Material (CNBM), represent the largest segment of potential customers due to their extensive global manufacturing footprint, continuous need for capacity expansion, and rigorous schedules for retrofitting older plants to meet contemporary efficiency and environmental standards. These major players drive demand for high-capacity, state-of-the-art dry process rotary kilns.

Regional cement producers, operating within national or sub-national markets, constitute another significant customer base. While these firms may opt for slightly smaller capacity kilns (in the 2,000 to 4,000 TPD range) or potentially Vertical Shaft Kilns (VSK) for localized niche production, they share the same critical requirements for high thermal efficiency and reliability. Their purchasing decisions are often highly sensitive to local regulatory environments and government stimulus packages supporting infrastructure development, which dictates the necessity for capacity upgrades or new installations to meet fluctuating regional demand.

Furthermore, the market sees demand from emerging economies undergoing rapid industrialization. In these regions, the emphasis is often on rapid setup and maximizing output, sometimes leading to investments in large, integrated plant solutions provided by major EPC contractors. The customers here prioritize robust, proven technologies that minimize long-term maintenance complexity. In essence, any entity engaged in the pyroprocessing of calcareous materials to produce clinker is a core potential customer, driving consistent, cyclical demand for both new installations and necessary aftermarket upgrades.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 2.45 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | FLSmidth, Thyssenkrupp Industrial Solutions, KHD Humboldt Wedag, A TEC Production & Service GmbH, Kawasaki Heavy Industries, Loesche GmbH, Sinoma Group (CDI), Citic Heavy Industries, Gebr. Pfeiffer SE, Fuller-Traylor (F-L-T), Claudius Peters, Nanjing Kisen, Dalmia Cement (Bharat) Ltd. Engineering Division, IKN GmbH, Zhengzhou Dingsheng Engineering Technology Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cement Kilns Market Key Technology Landscape

The contemporary Cement Kilns Market is defined by technologies aimed at maximizing thermal efficiency and dramatically reducing emissions profile. A fundamental technological advancement is the widespread deployment of multi-stage cyclone preheaters coupled with precalciners (the dry process system). The preheater tower uses the hot exhaust gases from the kiln to preheat the raw meal before it enters the rotary section, drastically reducing the energy required in the main kiln. The precalciner further enhances efficiency by separating the calcination process (which requires heat) from the clinkerization process (which requires high temperature), allowing for better thermal management and increased capacity throughput.

Another crucial technological focus area is the adaptation of kilns for alternative fuels and raw materials (AFR/ASR). This requires specialized, robust feeding systems capable of handling variable material sizes and compositions, combined with advanced low-NOx burners (e.g., rotary flow or multi-channel burners) that ensure stable combustion and minimize nitrogen oxide formation, even when burning fuels with higher nitrogen content. Additionally, waste heat recovery (WHR) systems are becoming standard, capturing exhaust heat from both the kiln and the clinker cooler to generate electricity, offsetting the plant’s high internal power consumption and significantly improving overall energy independence and sustainability metrics.

Looking ahead, the technological landscape is rapidly shifting toward preparing kilns for compliance with future decarbonization mandates, particularly through integration with Carbon Capture, Utilization, and Storage (CCUS) readiness. This involves redesigning gas flow and exhaust streams, often requiring oxygen-fired (oxy-fuel) combustion or separation of the calciner exhaust stream, which is rich in CO2. Digitalization technologies, including sophisticated sensors, Industrial IoT (IIoT), and advanced process control systems (APC) utilizing AI and machine learning, represent the competitive frontier, allowing operators to fine-tune the highly complex pyroprocess in real-time, moving operations closer to the theoretical maximum efficiency limits while ensuring environmental compliance.

Regional Highlights

- Asia Pacific (APAC): APAC holds the dominant market share and exhibits the fastest growth due to the unprecedented scale of infrastructure development, urbanization, and residential construction in economies like China, India, and Indonesia. These countries require massive, continuous cement supply, leading to high demand for new, large-capacity dry process rotary kilns. The regional focus is on rapid capacity expansion, though modernization and environmental compliance (driven by local pressures, especially in China) are also increasingly important investment priorities.

- Europe: Europe represents a mature but highly influential market, driven almost exclusively by retrofitting and technological upgrades rather than new plant construction. The European Union's ambitious decarbonization targets, including the Emissions Trading System (ETS) and forthcoming Carbon Border Adjustment Mechanism (CBAM), necessitate continuous investment in cutting-edge technologies, such as advanced alternative fuel systems, waste heat recovery, and especially CCUS-ready kiln designs, positioning Europe as the innovation leader in sustainable clinker production.

- North America: The market in North America is stable, characterized by significant operational efficiency requirements and environmental regulations (particularly the EPA). Investment is concentrated on modernizing aging facilities, increasing the substitution rate of alternative fuels, and implementing advanced digital solutions (AI/IoT) to reduce operational costs and variability. The demand is steady, supported by consistent investment in public works and civil infrastructure.

- Latin America (LATAM): LATAM experiences moderate growth, largely dependent on regional economic stability and domestic infrastructure projects in countries like Brazil and Mexico. The market typically demands reliable, standardized rotary kiln systems, with increasing interest in energy efficiency upgrades to mitigate the impact of volatile energy costs prevalent in the region. Investment cycles can be sporadic but show an overall positive trajectory.

- Middle East and Africa (MEA): This region is a developing market with diverse dynamics. The Middle East focuses on large-scale kilns driven by national development visions (e.g., Saudi Vision 2030), while Africa shows high potential for localized growth, often employing smaller to medium-capacity kilns or VSKs to serve rapidly expanding urban centers where logistics are complex. Both areas are prioritizing cost-effective energy solutions, making high thermal efficiency and alternative fuel readiness increasingly attractive.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cement Kilns Market.- FLSmidth

- Thyssenkrupp Industrial Solutions

- KHD Humboldt Wedag

- A TEC Production & Service GmbH

- Kawasaki Heavy Industries

- Loesche GmbH

- Sinoma Group (CDI)

- Citic Heavy Industries

- Gebr. Pfeiffer SE

- Fuller-Traylor (F-L-T)

- Claudius Peters

- Nanjing Kisen

- Dalmia Cement (Bharat) Ltd. Engineering Division

- IKN GmbH

- Zhengzhou Dingsheng Engineering Technology Co. Ltd.

- Cemtek Environmental

- Fives Group

- Taiheiyo Engineering Corporation

- Metso Outotec

- Pfeiffer Vacuum GmbH

Frequently Asked Questions

Analyze common user questions about the Cement Kilns market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the market shift towards dry process cement kilns?

The shift is primarily driven by superior thermal efficiency. Dry process kilns, utilizing preheaters and precalciners, significantly reduce the high energy consumption associated with evaporating water in older wet processes, leading to lower operational costs, higher output capacity, and reduced greenhouse gas emissions per ton of clinker produced.

How is the cement kiln market addressing environmental concerns like CO2 emissions?

The market is addressing CO2 emissions through several technological pathways: maximizing the use of low-carbon alternative fuels (AFR), integrating waste heat recovery (WHR) systems to reduce reliance on grid electricity, and developing specialized kiln designs ready for future integration of Carbon Capture, Utilization, and Storage (CCUS) technology to capture process emissions.

What role does digitalization play in optimizing cement kiln operations?

Digitalization, via AI and Industrial IoT (IIoT), enables advanced process control (APC) and predictive maintenance (PdM). These tools use real-time data analysis to automatically adjust complex parameters, stabilize the burning zone, optimize fuel input, minimize unscheduled downtime, and ensure consistent clinker quality, directly increasing profitability and efficiency.

Which geographical region represents the largest market opportunity for cement kiln suppliers?

Asia Pacific (APAC), particularly India and Southeast Asia, represents the largest market opportunity. This dominance is driven by high and sustained demand for new cement manufacturing capacity to support massive ongoing infrastructure projects and rapid urbanization across the region.

What is the most critical restraint impacting the construction of new cement kiln plants?

The most critical restraint is the exceptionally high capital expenditure (CAPEX) required for a modern, large-capacity, energy-efficient cement kiln installation, which includes not only the rotary kiln but also the entire complex of auxiliary systems like preheaters, coolers, and sophisticated emissions control equipment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager