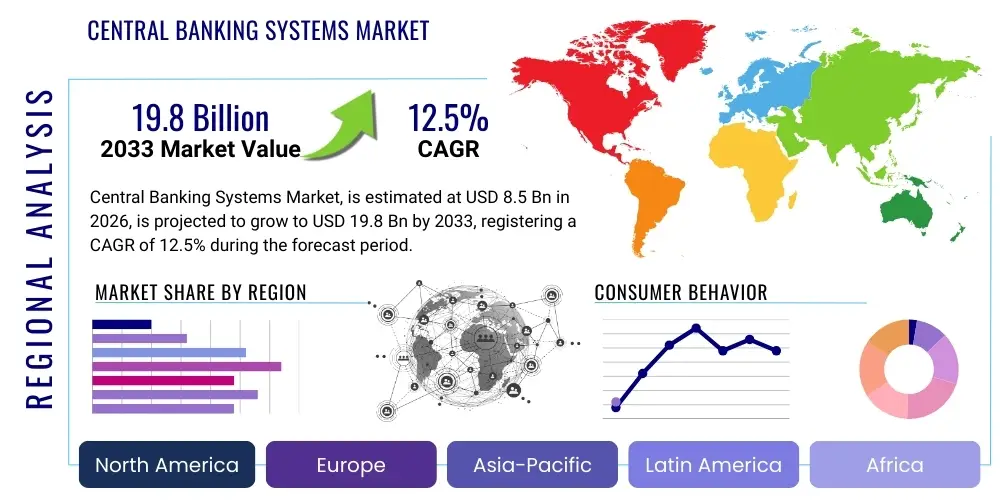

Central Banking Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435658 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Central Banking Systems Market Size

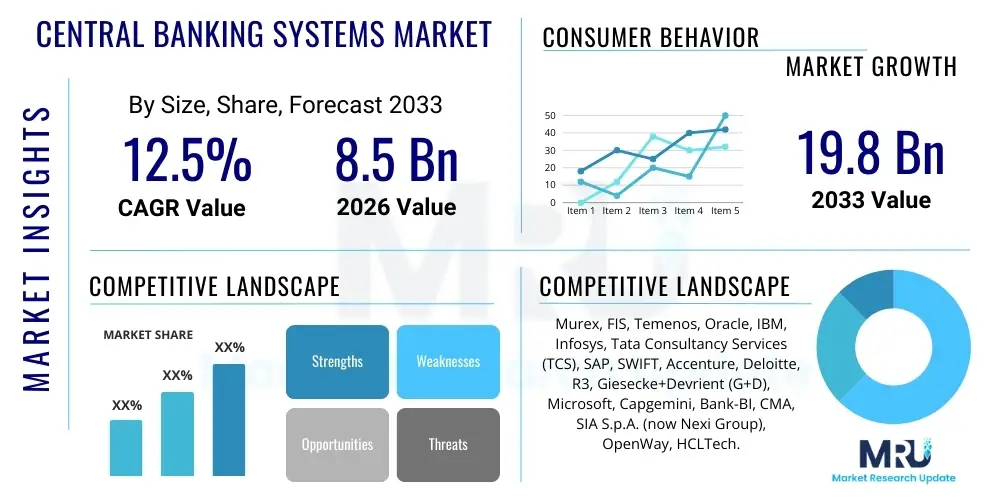

The Central Banking Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at $8.5 Billion in 2026 and is projected to reach $19.8 Billion by the end of the forecast period in 2033.

Central Banking Systems Market introduction

The Central Banking Systems Market encompasses the technological infrastructure, software solutions, and specialized services deployed by national monetary authorities to manage core functions, including monetary policy implementation, financial stability oversight, reserve management, and payment system operation. These sophisticated systems are fundamental to modern financial governance, enabling central banks to process high volumes of transactions, manage complex risk models, and communicate critical economic data securely and efficiently. Products within this market range from core banking platforms tailored for central bank needs (such as ledger management and open market operations systems) to specialized analytical tools for economic modeling and supervisory technology (SupTech) used for regulating commercial banks and financial institutions. The necessity for real-time gross settlement (RTGS) systems, coupled with the rising complexity of cross-border transactions and the emergence of digital currencies, significantly drives the demand for continuous modernization within this sector.

The primary applications of these systems are diverse, extending across currency issuance management, foreign exchange and gold reserve administration, national debt management (acting as the government's banker), and operating critical national payment infrastructures (such as instant payment networks and high-value payment systems). The benefits derived from implementing advanced central banking systems include enhanced operational resilience, crucial for maintaining public confidence during financial crises, improved data integrity and regulatory compliance, and greater efficiency in executing monetary policy decisions. Furthermore, modern systems facilitate seamless integration with global financial infrastructures, supporting international collaboration and standardized reporting, which is vital for multinational financial stability assessments.

Major driving factors propelling market growth include the global trend toward digital transformation in finance, necessitating robust cybersecurity measures and cloud-native architectural capabilities. The push towards launching Central Bank Digital Currencies (CBDCs) across various economies represents a massive undertaking, demanding entirely new technological stacks and secure ledger capabilities, thus fueling significant investment. Additionally, stringent regulatory environments, particularly those related to anti-money laundering (AML) and counter-terrorist financing (CTF), require central banks to deploy advanced data analytics and AI-driven monitoring tools, contributing substantially to market expansion. The pressure to integrate environmental, social, and governance (ESG) factors into monetary policy and risk assessment also necessitates updated data management and reporting capabilities.

Central Banking Systems Market Executive Summary

The Central Banking Systems Market is undergoing a rapid evolution characterized by substantial capital expenditure reallocation towards modular, cloud-based architectures designed for scalability and resilience. Key business trends indicate a strong move away from monolithic legacy systems (often proprietary mainframes) towards API-driven microservices that facilitate easier integration of FinTech innovations and decentralized ledger technologies (DLT). Vendors are focusing intensely on providing solutions that support multi-jurisdictional compliance and offer sophisticated risk surveillance capabilities, especially pertinent given the volatility in global economic conditions and geopolitical uncertainties. The competitive landscape is shifting, with specialized software providers challenging traditional core banking behemoths by offering niche expertise in areas like algorithmic monetary operations and quantum-resistant security protocols.

Regionally, Asia Pacific (APAC) is dominating market expansion, driven by massive investments in new payment infrastructures (e.g., harmonization of regional payment gateways) and pioneering CBDC pilot programs launched by major economies such as China and India. North America and Europe, while already possessing mature infrastructures, are focusing efforts on cybersecurity hardening, integrating AI for fraud detection, and migrating critical operations to sovereign clouds to ensure data sovereignty and operational independence. The Middle East and Africa (MEA) region shows accelerating growth, primarily centered around modernizing interbank settlement systems and leveraging technology to enhance financial inclusion initiatives.

Segment trends reveal that the deployment of advanced risk management and compliance solutions is the fastest-growing segment, reflecting the post-2008 regulatory environment and the increasing sophistication of financial crime. Infrastructure spending is heavily skewed toward implementing Instant Payment Systems (IPS) and preparing the underlying technology necessary for CBDC issuance and management, including secure tokenization and distribution mechanisms. Furthermore, the increasing adoption of Infrastructure-as-a-Service (IaaS) and Platform-as-a-Service (PaaS) models within central banking operations highlights a preference for operational expenditure (OpEx) over capital expenditure (CapEx) in managing complex IT environments, ensuring agility and minimizing technical debt associated with system upgrades.

AI Impact Analysis on Central Banking Systems Market

Common user questions regarding AI's impact on Central Banking Systems revolve primarily around four themes: automation of monetary policy execution, effectiveness of AI in real-time surveillance (SupTech/RegTech), implications for job displacement within central bank operations, and the ethical considerations of using algorithmic decision-making in high-stakes economic governance. Users seek assurance regarding AI's reliability in maintaining systemic stability, particularly concerning flash crashes or liquidity events triggered by automated trading systems monitored by AI. The key expectations center on AI providing predictive analytics for inflation modeling and systemic risk detection with unparalleled speed and accuracy, thereby moving central banking from reactive response to proactive intervention. Concerns often surface regarding model interpretability (the "black box" problem) and ensuring AI systems adhere strictly to neutrality and impartiality in policy recommendations, thereby summarizing user focus on efficiency, reliability, ethical governance, and strategic foresight.

- Automation of Monetary Operations: AI algorithms manage liquidity forecasting, optimizing open market operations, and executing real-time adjustments to reserve requirements based on instantaneous market data, reducing manual intervention.

- Enhanced Financial Stability Monitoring (SupTech): Machine learning models analyze vast datasets from commercial banks to detect early warning signs of systemic risk, fraud patterns, and compliance breaches with high precision, dramatically improving supervisory efficiency.

- Predictive Economic Modeling: Advanced AI models provide superior inflation forecasting, GDP growth projection, and stress testing capabilities, incorporating unconventional data sources (e.g., satellite imagery, social media sentiment) for richer policy insights.

- Cybersecurity and Fraud Detection: AI-powered behavioral analytics protect critical infrastructure, identifying zero-day attacks and anomalous transaction patterns in national payment systems and reserve management platforms instantly.

- Central Bank Digital Currency (CBDC) Management: AI assists in analyzing the flow and impact of digital currencies on bank profitability, consumer behavior, and monetary velocity, optimizing distribution strategies and countering illicit use.

- Regulatory Compliance Automation (RegTech): AI systems automate the reporting burden for supervised entities and ensure central banks’ internal compliance procedures meet international standards (e.g., Basel III/IV requirements) through automated auditing.

DRO & Impact Forces Of Central Banking Systems Market

The Central Banking Systems Market is heavily influenced by a potent combination of dynamic drivers, entrenched restraints, and significant opportunities, which collectively define the impact forces shaping its trajectory. The primary driver is the necessity for financial stability and modern governance, demanding continuous technological upgrades to handle increasingly complex and interconnected global finance. Restraints largely center on the bureaucratic challenges inherent in public sector digital transformation, specifically legacy system integration difficulties and the significant human capital investment required for specialized technical skills. Opportunities are strongly linked to pioneering new digital infrastructure, such as multi-CBDC platforms and the adoption of quantum computing resilience mechanisms, promising substantial gains in efficiency and security. These factors create an environment where high initial investment costs and regulatory inertia act as friction, but the overwhelming necessity for systemic modernization due to global digitalization and geopolitical risk provides an unstoppable forward momentum.

Impact forces are categorized by their influence severity and immediacy. High-impact forces include global monetary policy convergence efforts and the mandated adoption of new instant payment standards (e.g., ISO 20022), forcing central banks globally to harmonize their data structures and processing capabilities. Medium-impact forces involve the ongoing tension between data privacy requirements (e.g., GDPR mandates) and the need for enhanced surveillance tools to combat financial crime, leading to complex architectural design choices. Low-impact forces often relate to cyclical budget constraints or minor geopolitical disputes that temporarily delay specific project phases but do not halt the overall trend towards digitalization.

The necessity for central banks to maintain undisputed trust and operational independence dictates that all technological choices must prioritize resilience, security, and absolute control over national financial data. This unique operational environment means that while commercial banking systems rapidly adopt public cloud services, central banks often require hybrid or dedicated sovereign cloud deployments, adding complexity and cost. However, the existential threat posed by sophisticated state-sponsored cyberattacks ensures that cybersecurity solutions integration remains the highest priority impact force, overriding cost considerations in favor of resilience, thereby ensuring robust demand for specialized, high-security technology providers.

- Drivers:

- Mandates for Central Bank Digital Currency (CBDC) exploration and implementation.

- Increasing volume and complexity of high-frequency cross-border payment transactions.

- Need for enhanced financial stability monitoring (SupTech and RegTech adoption).

- Obsolescence of legacy mainframe systems requiring modernization and migration.

- Global rise in sophisticated cyber threats targeting critical national infrastructure.

- Restraints:

- High initial capital expenditure and long deployment cycles associated with core system replacement.

- Regulatory and bureaucratic inertia within public sector institutions.

- Shortage of highly specialized IT talent proficient in central banking specific technologies (e.g., DLT, monetary modeling).

- Challenges related to integrating diverse, siloed legacy systems and ensuring data continuity.

- Sovereignty concerns hindering full adoption of commercial public cloud services.

- Opportunity:

- Development of multi-currency, interoperable CBDC platforms addressing cross-border settlement friction.

- Leveraging Artificial Intelligence and Machine Learning for advanced economic forecasting and policy simulation.

- Deployment of modular, microservices-based architecture enabling faster integration of FinTech partnerships.

- Transition to sovereign and hybrid cloud models tailored for financial critical infrastructure resilience.

- Expansion of green finance technologies, allowing central banks to integrate climate risk into financial supervision.

- Impact Forces:

- Policy Mandates: Regulatory harmonization (e.g., ISO 20022 migration deadline). (High)

- Technological Shift: Accelerated DLT adoption for interbank settlements. (High)

- Security Risks: Escalation of state-sponsored cyberattacks. (Highest)

- Economic Conditions: Pressure for real-time monetary data during inflationary periods. (High)

Segmentation Analysis

The Central Banking Systems Market is comprehensively segmented based on the type of component (software, services, and hardware), the deployment model (on-premise, cloud, and hybrid), the specific application function (monetary policy management, payment systems, reserve management, and SupTech), and the geographical region. This segmentation provides a granular view of investment priorities, highlighting the strategic shift from capital investment in dedicated hardware towards subscription-based software and specialized consulting services. The dominance of the Services segment, particularly implementation support and continuous managed services, reflects the complexity of deploying and maintaining highly secure, compliant financial infrastructures that require specialized vendor expertise rather than in-house generalist IT teams.

Analyzing the application segmentation confirms that Payment Systems modernization, specifically the build-out of Instant Payment Systems (IPS) and preparations for CBDCs, currently commands the largest share of market expenditure. This investment is crucial for national competitiveness and consumer expectations for immediate fund availability. However, the SupTech and Risk Management segment is anticipated to exhibit the highest CAGR, driven by global regulatory pressures demanding continuous, data-driven oversight of commercial bank stability and adherence to increasingly complex global financial standards. Deployment model segmentation shows a definitive trend toward hybrid cloud solutions, balancing the need for scalability and cost efficiency with the imperative for data sovereignty and control over critical core ledger systems.

Furthermore, segmentation by component indicates that specialized software solutions—including ledger technology, advanced analytics engines, and dedicated monetary policy modeling tools—form the core revenue generator for market vendors. Hardware procurement remains critical for on-premise components of the hybrid setup, particularly high-security modules and dedicated cryptographic infrastructure, but its market share is diminishing relative to services and software subscriptions. The ability of vendors to offer modular, scalable software that integrates seamlessly with existing complex infrastructures, rather than forcing a complete system overhaul, is a key determinant of market success across all geographic regions.

- By Component:

- Software (Core Banking Platforms, Payment Solutions, Risk & Compliance Tools, Data Analytics)

- Services (Consulting, Implementation & Integration, Managed Services, Support & Maintenance)

- Hardware (Servers, Storage, Networking, Security Modules)

- By Application:

- Monetary Policy Operations (Open Market Operations, Liquidity Management)

- Payment and Settlement Systems (RTGS, ACH, Instant Payments, CBDC Platforms)

- Reserve and Debt Management (Foreign Exchange, Gold Reserves, Government Securities)

- Financial Stability and Supervision (SupTech, Risk Modeling, AML/CTF Compliance)

- Currency Issuance and Management

- By Deployment Model:

- On-Premise

- Cloud (Public, Private, Sovereign)

- Hybrid

- By Region:

- North America (NA)

- Europe (EU)

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Central Banking Systems Market

The value chain for Central Banking Systems is highly specialized, starting with upstream activities focused on foundational technology development and intellectual property creation. This upstream phase is dominated by core technology providers who invest heavily in R&D for distributed ledger technology, quantum-resistant cryptography, and sophisticated economic modeling algorithms. Success in this stage is predicated on deep expertise in highly secure, fault-tolerant systems, leading to specialized partnerships between academic institutions, defense contractors (for security), and established financial technology firms. Key activities here include architectural design for resilience (N-tier redundancy) and adherence to international banking standards (e.g., Basel requirements for data quality).

The midstream phase involves the design, customization, and implementation of the software solutions tailored specifically for a central bank's operational mandate. This customization is critical because no two central banks have identical regulatory frameworks or legacy infrastructure. System Integrators (SIs) and specialist vendors play a crucial role here, managing the complex process of migrating data from decades-old mainframes to modern, secure platforms. Distribution channels are predominantly direct, involving high-level government procurement processes characterized by extensive tendering, stringent security vetting, and long contractual cycles, reflecting the strategic importance of the buyer.

Downstream activities focus on post-implementation support, continuous managed services, and iterative system optimization. Given the criticality of central bank operations, the reliance on indirect channels (third-party resellers or generic IT outsourcing) is minimal. Direct engagement ensures immediate support during crises, facilitates regulatory updates, and enables rapid adoption of new modules (e.g., a new CBDC layer). The overall value chain emphasizes trust, security certifications, and vendor stability, often outweighing price as the primary procurement factor, reflecting the non-negotiable requirement for operational integrity in national financial infrastructure.

Central Banking Systems Market Potential Customers

The primary consumers and end-users of Central Banking Systems are unequivocally the national monetary authorities and their subsidiary institutions responsible for macroeconomic stability and financial sector oversight. This includes over 170 central banks globally, ranging from the Federal Reserve and the European Central Bank to smaller, emerging market central banks facing accelerated digitalization mandates. Additionally, regional economic blocs that operate common monetary policies or shared payment infrastructures, such as the European System of Central Banks or the West African Monetary Zone, are significant collective buyers, often seeking standardized, interoperable solutions.

Beyond the core monetary institutions, secondary potential customers include specialized public financial bodies like national treasury departments, sovereign wealth funds, and national debt management agencies, particularly where central banks act as the government's fiscal agent. These entities often require integrated modules for managing public debt auctions, government security settlements, and real-time reconciliation of public accounts, necessitating seamless communication with the central bank’s core ledgers and payment systems. These customers require similar levels of security and operational resilience, expanding the scope of necessary services beyond pure monetary management.

Furthermore, international financial institutions (IFIs) such as the Bank for International Settlements (BIS), the International Monetary Fund (IMF), and the World Bank are influential indirect customers. While they do not directly purchase national central banking systems, they establish the global regulatory frameworks (e.g., data reporting standards, financial stability benchmarks) that mandate central banks to upgrade their systems. Compliance with IFI recommendations drives significant modernization cycles, making their strategic guidance a powerful market determinant and confirming the deeply interwoven nature of public finance technology procurement.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $8.5 Billion |

| Market Forecast in 2033 | $19.8 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Murex, FIS, Temenos, Oracle, IBM, Infosys, Tata Consultancy Services (TCS), SAP, SWIFT, Accenture, Deloitte, R3, Giesecke+Devrient (G+D), Microsoft, Capgemini, Bank-BI, CMA, SIA S.p.A. (now Nexi Group), OpenWay, HCLTech. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Central Banking Systems Market Key Technology Landscape

The core technology landscape for Central Banking Systems is rapidly pivoting toward integrating capabilities that support real-time transactions, massive data ingestion, and uncompromised security. Distributed Ledger Technology (DLT), while still cautiously evaluated, is fundamental to the development of CBDCs, offering transparent, tamper-proof ledgers for tokenized currency issuance and settlement. Beyond DLT, the adoption of microservices architecture is essential, allowing central banks to decouple large, rigid legacy systems into smaller, independently deployable components, drastically improving agility and reducing the risk associated with system-wide updates. This modularity facilitates the seamless integration of specialized FinTech solutions without disrupting critical core functions, representing a crucial shift in operational design.

A second critical technological pillar is the strategic utilization of Advanced Analytics and Artificial Intelligence (AI) for systemic risk modeling and regulatory surveillance (SupTech). Technologies such as machine learning, natural language processing (NLP) for unstructured data analysis (e.g., news and political commentary), and deep learning models are employed to predict financial stress, identify complex money laundering networks, and simulate the effects of various monetary policy adjustments before implementation. This move towards predictive governance demands massive computational power, driving the need for optimized data management platforms and high-performance computing (HPC) environments, often provisioned through secure private or hybrid cloud structures.

Finally, cybersecurity technology forms the indispensable foundation, encompassing quantum-resistant cryptography research, sophisticated identity and access management (IAM) systems tailored for high-security environments, and zero-trust network architectures. Central banks are increasingly investing in next-generation Security Information and Event Management (SIEM) systems integrated with AI for instantaneous threat response. Furthermore, the migration toward ISO 20022 messaging standards mandates significant technological updates to core payment engines and data warehousing systems, ensuring global interoperability and enriched data exchange capabilities necessary for enhanced compliance and analytical functions, collectively defining the highly technical demands of the market.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the engine of growth for the Central Banking Systems Market, primarily due to the accelerated pace of digital transformation and the region’s leadership in CBDC initiatives. Countries like China (Digital Yuan) and India (Digital Rupee pilot programs) are undertaking massive infrastructure overhauls to support real-time, high-volume digital currency transactions and harmonize regional payment infrastructures. The market here is characterized by government mandates pushing for financial inclusion through technology and a willingness to leapfrog traditional banking stages by adopting cutting-edge DLT and AI solutions. This creates immense opportunities for vendors specializing in scalable, high-throughput payment solutions and robust digital identity verification technologies.

- North America (NA): The North American market, led by the US Federal Reserve, is defined by significant investment in modernizing foundational payment infrastructures, notably the establishment of the FedNow Instant Payment service, which necessitated widespread technology upgrades across the US financial ecosystem. Although the approach to CBDC development remains cautious and research-focused, investment in advanced risk management, cybersecurity hardening (especially against critical infrastructure threats), and the implementation of sophisticated SupTech tools is robust. NA central banks prioritize resilience, operational control, and the integration of highly complex economic modeling tools to manage global monetary fluctuations, leading to high-value contracts for established, high-security vendors.

- Europe: The European Central Bank (ECB) and the associated national central banks are strategically focused on achieving harmonization across the Eurozone, driving expenditure on common payment platforms (like TARGET Services) and leading the exploration of the Digital Euro. The European market is highly regulated, placing enormous emphasis on compliance with strict data sovereignty mandates (GDPR) and complex regulatory reporting (Basel IV). The demand for hybrid cloud solutions that meet stringent European security standards is high. Europe is also a key adopter of green finance technologies, requiring central banks to update their systems to incorporate climate risk into financial stability assessments and portfolio management.

- Latin America (LATAM): The LATAM region presents a dynamic yet fragmented market, with accelerating growth driven by the need to combat high inflation rates and enhance financial inclusion. Central banks in countries like Brazil and Mexico are pioneering instant payment schemes (e.g., Pix in Brazil) which require substantial back-end system upgrades. Investment focuses heavily on modular solutions that can be rapidly deployed to manage volatile economic conditions and leverage mobile technology to reach underserved populations. The challenge remains in overcoming budget constraints and integrating technology across diverse regulatory environments, leading to a strong demand for flexible, cost-effective, and regionalized managed services.

- Middle East and Africa (MEA): The MEA region is characterized by high growth rates, particularly in the Gulf Cooperation Council (GCC) nations, which are rapidly transitioning their economies through large-scale digitalization programs (e.g., Saudi Vision 2030, UAE's digital initiatives). Central banks in this region are investing heavily in establishing modern RTGS systems, exploring cross-border CBDC pilots (like Project Aber), and deploying robust cybersecurity frameworks. In contrast, parts of Africa are utilizing central banking system upgrades to leapfrog traditional infrastructure barriers, focusing on mobile banking integration and basic financial connectivity, creating demand for highly adaptable, scalable core banking platforms.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Central Banking Systems Market.- Murex

- FIS

- Temenos

- Oracle Corporation

- IBM Corporation

- Infosys Limited

- Tata Consultancy Services (TCS)

- SAP SE

- SWIFT

- Accenture plc

- Deloitte

- R3

- Giesecke+Devrient (G+D)

- Microsoft Corporation

- Capgemini SE

- Bank-BI

- CMA (Consultants in Management and Administration)

- SIA S.p.A. (now Nexi Group)

- OpenWay

- HCL Technologies Limited (HCLTech)

- Finastra

- Wipro Limited

- NCR Corporation

Frequently Asked Questions

Analyze common user questions about the Central Banking Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What major technological trends are driving central banking system modernization?

The primary drivers are the impending adoption of Central Bank Digital Currencies (CBDCs), the global migration to the ISO 20022 messaging standard for enriched data exchange in payments, and the deployment of Artificial Intelligence (AI) for advanced financial surveillance (SupTech) and systemic risk modeling.

How is the market addressing the security and compliance challenges of core banking operations?

Security is addressed through mandatory sovereign or dedicated private cloud deployments, the implementation of zero-trust architectures, and significant investment in quantum-resistant cryptographic research. Compliance focuses on utilizing AI-driven RegTech solutions to automate reporting and adhere to international AML/CTF and data sovereignty regulations.

Which geographical region is showing the fastest growth in central banking system expenditure?

Asia Pacific (APAC) exhibits the fastest market growth, fueled by aggressive national initiatives in developing and piloting CBDCs (e.g., China and India) and major infrastructure projects aimed at achieving comprehensive financial inclusion and modernized national payment gateways.

What are the primary restraints hindering rapid digital transformation in central banks?

Key restraints include the complexity and high cost associated with decommissioning and replacing decades-old monolithic legacy systems, internal regulatory inertia and bureaucratic resistance to change, and a critical shortage of specialized IT talent required to manage complex new technologies like DLT and sophisticated AI platforms.

What is the current vendor strategy regarding core banking system architecture?

Vendors are aggressively moving towards modular, API-driven microservices architectures. This shift allows central banks to integrate new specialized functions (like CBDC modules or AI tools) iteratively without requiring a disruptive, full-scale overhaul of the entire core system, enhancing agility and reducing technical debt.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager