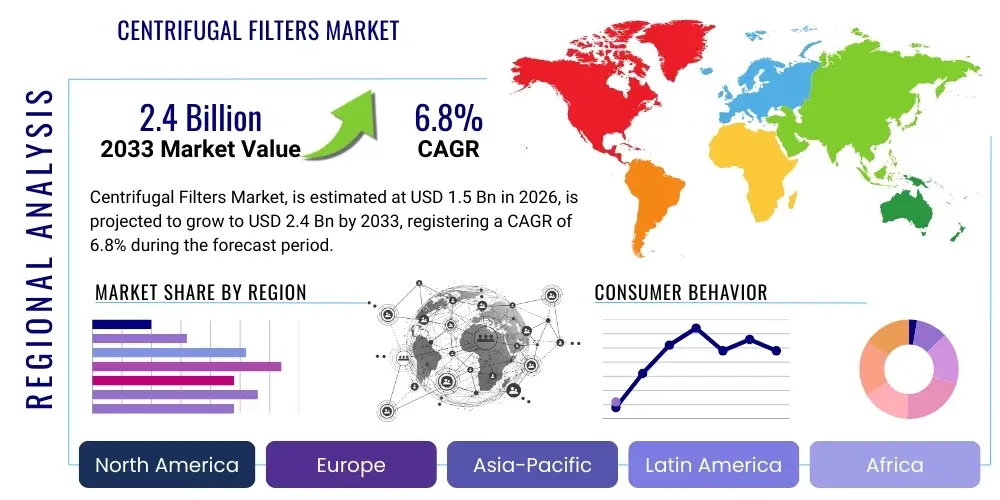

Centrifugal Filters Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436576 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Centrifugal Filters Market Size

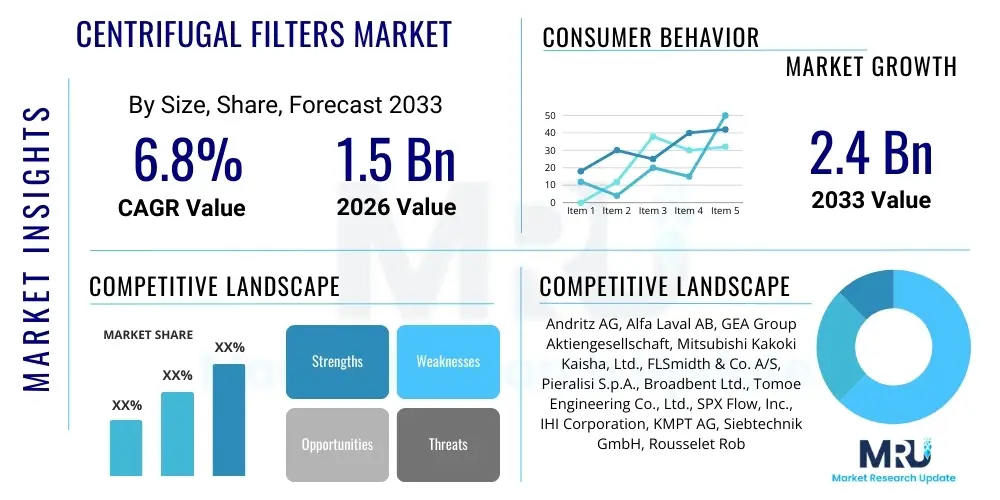

The Centrifugal Filters Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.4 Billion by the end of the forecast period in 2033.

Centrifugal Filters Market introduction

The Centrifugal Filters Market encompasses specialized separation equipment designed to remove solids or impurities from liquid streams utilizing centrifugal force. These devices are crucial across various industrial and commercial processes where high-efficiency particle separation and liquid clarification are required. Centrifugal filters operate by spinning the fluid mixture, causing denser particles to migrate outward and separate from the lighter liquid phase, offering a highly effective, often continuous, method of purification compared to static filtration systems. Key applications span high-value sectors such as pharmaceutical manufacturing, biotechnology, food and beverage processing, and stringent industrial wastewater treatment, where product quality and regulatory compliance depend heavily on contaminant removal.

The primary benefits of deploying centrifugal filtration technology include minimal moving parts (reducing maintenance), high throughput capacity, and the ability to process large volumes of fluid continuously without frequent filter media replacement. This efficiency translates directly into lower operational costs and enhanced production reliability. Furthermore, modern centrifugal filters are often designed for automated operation, integrating sensors and controls to monitor performance and optimize separation efficiency dynamically. The inherent strength of this technology lies in its versatility—it can handle fluids with varying viscosities and solid concentrations, making it indispensable in diverse operational environments from large-scale chemical plants to sensitive biological laboratories.

Driving factors propelling market expansion include the stringent implementation of environmental regulations mandating effective wastewater treatment and pollution control, particularly in industrialized nations. The rapid growth of the biopharmaceutical industry, which requires extremely high purity levels for therapeutic agents and vaccines, necessitates advanced and scalable separation solutions like centrifugal filters. Additionally, increased focus on resource efficiency and product recovery in the food and beverage sector further stimulates demand for reliable, high-speed filtration systems that minimize product loss and maintain hygienic standards.

Centrifugal Filters Market Executive Summary

The Centrifugal Filters Market is characterized by robust growth, driven primarily by technological advancements focused on automation and higher efficiency, coupled with expanding industrial and bioprocessing applications worldwide. Business trends indicate a strong focus on modular and integrated filtration systems that offer ease of scalability and lower operational footprints, appealing especially to facilities undergoing modernization or expansion. Key players are investing heavily in materials science to enhance corrosion resistance and compatibility with aggressive chemical agents used in cleaning and sterilization processes. The prevailing competitive landscape is marked by strategic acquisitions aimed at consolidating specialized niche technologies and expanding geographic market reach, particularly into rapidly industrializing regions where infrastructure investment is escalating.

Regionally, North America and Europe maintain dominance, attributed to mature regulatory frameworks governing industrial emissions and substantial existing infrastructure in pharmaceutical and chemical manufacturing. However, the Asia Pacific (APAC) region is projected to exhibit the highest CAGR during the forecast period, fueled by massive investments in water management projects, rapid expansion of the manufacturing sector, and increasing governmental focus on public health and environmental protection in populous economies like China and India. Latin America and MEA are emerging as lucrative markets, driven by modernization in the oil and gas sector and necessary upgrades to municipal water treatment facilities, indicating a shift towards adopting advanced separation technologies to address water scarcity and industrial waste challenges.

Segment trends reveal that the Pharmaceutical and Biotechnology application segment is leading in terms of revenue growth, underpinned by the increasing complexity of biologics manufacturing, demanding highly controlled and sterile separation processes. In terms of product type, automated disk stack centrifuges are gaining traction due to their high separation efficiency and ability to handle high solid concentrations continuously. Furthermore, there is a pronounced shift towards filters constructed from advanced polymers and stainless steel alloys optimized for clean-in-place (CIP) and steam-in-place (SIP) capabilities, ensuring compliance with strict industry hygiene standards and extending equipment longevity.

AI Impact Analysis on Centrifugal Filters Market

Analysis of common user questions regarding the impact of Artificial Intelligence (AI) on the Centrifugal Filters Market reveals a strong focus on optimization, predictive maintenance, and quality control. Users frequently inquire about how AI algorithms can predict filter fouling rates, schedule maintenance proactively to prevent costly downtime, and dynamically adjust centrifuge speed and feed rates based on real-time fluid characteristics. Key concerns center around the integration costs of AI-enabled sensors and software, data security protocols for proprietary process information, and the required expertise gap for operating and interpreting sophisticated AI models. Expectations are high regarding AI’s ability to maximize operational uptime, significantly reduce energy consumption by optimizing throughput, and provide instantaneous diagnostics for process anomalies, ultimately enhancing the overall economic viability and reliability of centrifugal filtration systems.

- AI enables Predictive Maintenance (PdM) through machine learning models analyzing vibration data and pressure drops, anticipating equipment failure before it occurs.

- Dynamic Process Optimization utilizing neural networks allows real-time adjustment of centrifugal force and flow parameters based on instantaneous analysis of fluid composition and viscosity.

- Enhanced Quality Control (QC) achieved through AI-powered image analysis of effluent samples, ensuring immediate detection of particle breakthrough or contamination.

- Energy Consumption Minimization by optimizing operating cycles and reducing unnecessary high-speed operation based on predictive load modeling.

- Automated Fault Diagnosis and Root Cause Analysis, drastically reducing troubleshooting time and improving Mean Time To Repair (MTTR).

- Simulation and Digital Twin creation for testing various fluid inputs and operating conditions virtually before deployment, streamlining commissioning.

DRO & Impact Forces Of Centrifugal Filters Market

The market dynamics are significantly influenced by a synergistic relationship between increasing global demand for high-purity separation, strict regulatory requirements for industrial discharges, and continuous technological innovation within the filtration sector. The primary driver is the exponential growth in bioprocessing, demanding separation techniques capable of handling delicate biological material efficiently and maintaining sterility. Coupled with this is the escalating crisis of water scarcity and pollution, which necessitates large-scale, robust water and wastewater treatment infrastructure where centrifugal filtration plays a vital role in primary solids removal and sludge dewatering. These macro-environmental and industrial pressures create a sustained, high-volume demand curve for advanced centrifugal technologies.

Conversely, significant restraints hinder wider market adoption, notably the substantial initial capital expenditure required for purchasing and installing industrial-grade centrifugal filter systems. These systems are complex, demanding specialized engineering and installation, which can be prohibitive for small and medium-sized enterprises (SMEs). Furthermore, operational challenges, including the need for specialized training for maintenance personnel and the high energy consumption associated with maintaining high rotational speeds in older or less optimized units, pose long-term cost barriers. The competitive threat from alternative high-efficiency separation technologies, such as advanced membrane filtration or ultrafiltration systems, also acts as a market restraint, forcing manufacturers to continually justify the cost-effectiveness and performance benefits of centrifugal solutions.

Opportunities for market expansion are abundant, particularly in the hybridization of filtration systems, integrating centrifugal pre-treatment with downstream membrane processes to maximize overall system efficiency and longevity. The untapped potential in emerging economies, driven by rapid industrialization and governmental mandates for infrastructure modernization, presents a significant growth avenue. The development of compact, portable, and energy-efficient centrifugal filters tailored for localized or modular applications, such as mobile water purification units or small-scale food processing facilities, opens new customer segments. The cumulative impact force of these factors indicates a market poised for steady, regulated growth, where performance differentiation through automation and material science will be the key determinants of success.

Segmentation Analysis

The Centrifugal Filters Market is comprehensively segmented based on product type, material, application, and end-use, reflecting the diverse industrial requirements for separation technology. Analyzing these segments provides crucial insights into market penetration and growth trajectories within specialized sectors. The segmentation is vital for manufacturers to tailor product development and marketing strategies, ensuring optimal alignment with specific process needs, whether they involve high-speed clarification in chemical synthesis or low-shear separation in bioprocessing. This granular approach allows for accurate forecasting of demand across various industrial ecosystems, from highly regulated environments like pharmaceuticals to high-volume sectors like water management.

- By Product Type

- Disk Stack Centrifuges

- Basket Centrifuges

- Decanter Centrifuges

- Tubular Bowl Centrifuges

- By Material

- Stainless Steel (304, 316L)

- High-Performance Polymers

- Specialty Alloys (e.g., Hastelloy, Titanium)

- Composites

- By Application

- Pharmaceutical and Biotechnology (Biologics, Vaccines, Cell Harvesting)

- Food and Beverage (Dairy, Fruit Juices, Edible Oils)

- Water and Wastewater Treatment

- Chemical Processing

- Oil and Gas (Drilling Mud Separation, Fuel Clarification)

- Mineral Processing

- By End-Use

- Industrial Manufacturing

- Research and Development Laboratories

- Municipal Utilities

Value Chain Analysis For Centrifugal Filters Market

The value chain for the Centrifugal Filters Market begins with upstream analysis, focusing on the sourcing and processing of critical raw materials, primarily high-grade stainless steel (316L being essential for corrosive environments), specialized polymers, and advanced sensor components. Key suppliers are metal fabricators and precision machining companies that adhere to strict material quality standards, especially for high-speed rotational components where material integrity is paramount for safety and efficiency. Strong relationships with reliable component suppliers are crucial, as delays or quality issues in specialized materials can significantly impact manufacturing timelines and final product performance. Innovation upstream is focused on developing lighter, yet stronger, alloys that can withstand higher G-forces and chemical exposure, optimizing the energy profile of the final centrifuge unit.

The midstream involves the core manufacturing process, where original equipment manufacturers (OEMs) design, assemble, and rigorously test the centrifugal systems. This stage is characterized by high technological barriers, requiring expertise in fluid dynamics, mechanical engineering, and control systems integration. OEMs often specialize in specific centrifuge types (e.g., decanter vs. disk stack) based on the target application (e.g., heavy solids vs. fine liquid clarification). Post-manufacturing, distribution channels are bifurcated into direct sales for large, customized industrial systems and indirect sales through specialized distributors and integrators for standardized laboratory or smaller-scale industrial units. Direct sales offer enhanced control over installation and post-sales servicing, which is critical given the complexity and capital cost of the equipment.

Downstream analysis focuses on installation, commissioning, and comprehensive post-sales service, including predictive maintenance contracts, spare parts supply, and technical support. The effectiveness of the service network significantly influences customer satisfaction and loyalty, as downtime in critical processes (like pharmaceutical manufacturing) is exceptionally costly. Potential customers, including major corporations in the pharmaceutical and energy sectors, typically favor suppliers offering integrated solutions that cover the entire lifecycle of the equipment. Furthermore, third-party engineering consulting firms often act as influential intermediaries, guiding end-users on system specification and procurement, thus becoming an important element in the overall distribution ecosystem.

Centrifugal Filters Market Potential Customers

Potential customers for centrifugal filters span a wide array of capital-intensive industries where separation efficiency directly impacts product quality, regulatory compliance, or environmental sustainability. The primary buyers are large corporations operating within the Pharmaceutical and Biotechnology sectors, particularly those engaged in upstream and downstream bioprocessing steps such as cell harvesting, protein separation, and vaccine manufacturing. These entities demand systems that provide sterile operation, high yields, and guaranteed scalability to meet increasing global demand for biological therapeutics. Regulatory bodies, such as the FDA and EMA, indirectly influence purchasing decisions by setting strict purification standards, driving the adoption of high-precision centrifugal technology.

Another major segment comprises Food and Beverage manufacturers, where centrifugal filters are essential for clarification processes (e.g., separating cream from milk, clarifying beer/wine, extracting edible oils) and ensuring product safety and shelf life. These customers prioritize equipment with robust hygienic design, clean-in-place (CIP) compatibility, and high throughput to maintain continuous production schedules. Municipal and Industrial Water Treatment utilities constitute a rapidly growing customer base, utilizing large-scale decanter centrifuges for the dewatering of sludge derived from primary and secondary treatment processes, significantly reducing waste volume and disposal costs. These utilities seek reliability, low maintenance costs, and energy-efficient designs capable of continuous heavy-duty operation.

Finally, the Oil and Gas and Chemical Processing industries represent vital niche markets. In the Oil and Gas sector, centrifugal filters are used for separating drilling muds and clarifying fuels and lubricants, enhancing operational efficiency and reducing environmental impact. Chemical processors require systems capable of handling corrosive and high-temperature streams for separating catalysts, intermediates, and final products. Procurement cycles for these large industrial customers are typically lengthy, involving detailed technical specifications, validation studies, and rigorous vendor qualification, underscoring the importance of supplier reputation and proven performance history in the marketplace.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.4 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Andritz AG, Alfa Laval AB, GEA Group Aktiengesellschaft, Mitsubishi Kakoki Kaisha, Ltd., FLSmidth & Co. A/S, Pieralisi S.p.A., Broadbent Ltd., Tomoe Engineering Co., Ltd., SPX Flow, Inc., IHI Corporation, KMPT AG, Siebtechnik GmbH, Rousselet Robatel, Tema Systems, Inc., Heinkel Process Technology GmbH, US Centrifuge Systems, Schlumberger Limited, Russell Finex Ltd., Toper A.S., JWC Environmental |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Centrifugal Filters Market Key Technology Landscape

The technological landscape of the Centrifugal Filters Market is rapidly evolving, moving beyond traditional mechanical separation towards integrated, smart systems. One of the most significant advancements is the integration of high-definition sensors (vibration, temperature, pressure) and flow meters directly into the centrifuge assembly, facilitating real-time monitoring of operational health and fluid properties. This sensory data is crucial for implementing Condition Monitoring Systems (CMS), which transition maintenance strategies from reactive to predictive, dramatically reducing unplanned downtime. Furthermore, the development of specialized bowl and disk designs—such as hydrohermetic sealing systems—minimizes oxygen pickup and shear stress, making centrifugal filters suitable for handling highly sensitive biological materials without compromising viability or product integrity, a critical requirement in modern biopharma.

Another major technological focus is the optimization of energy efficiency and throughput through advanced motor and control systems. Manufacturers are increasingly utilizing Variable Frequency Drives (VFDs) and high-efficiency permanent magnet motors, allowing precise control over rotational speed and torque based on the instantaneous solid load, thereby reducing overall energy consumption significantly compared to fixed-speed systems. Furthermore, the development of fully automated Clean-in-Place (CIP) and Sterilize-in-Place (SIP) methodologies, particularly for disk stack and tubular centrifuges used in sanitary applications, ensures rapid turnaround and minimizes the risk of cross-contamination. These automated cleaning cycles use precisely controlled steam or chemical injection protocols, validated to meet the most rigorous regulatory standards globally.

Material science innovation also plays a pivotal role, particularly in enhancing the durability and chemical resistance of internal components. The use of duplex and super-duplex stainless steels offers superior corrosion resistance in harsh chemical environments, extending the operational life of decanter centrifuges in applications like acidic sludge dewatering or salt crystallization. Looking forward, the application of smart coatings and self-cleaning surfaces aims to minimize product adhesion and fouling rates, maintaining high separation efficiency over longer operational cycles. This blend of intelligent control, robust materials, and optimized mechanical design defines the current state-of-the-art in centrifugal filtration technology, positioning it as a core component of modern industrial separation processes.

Regional Highlights

- North America: The region maintains market leadership due to substantial investment in pharmaceutical R&D and manufacturing capacity, particularly in the US. Strict environmental protection laws drive consistent demand for advanced water and wastewater treatment centrifuges. High technological adoption rates ensure continuous demand for AI-integrated, high-efficiency models, solidifying its position as a key revenue generator and early adopter of new filtration technologies.

- Europe: Characterized by strong regulatory oversight from bodies like the European Medicines Agency (EMA) and the presence of major chemical and food processing hubs (Germany, Italy). The emphasis on circular economy principles and sustainable water management practices fuels the demand for energy-efficient decanter centrifuges for sludge processing. Mature industrial infrastructure necessitates ongoing equipment upgrades and replacement cycles, ensuring stable market growth.

- Asia Pacific (APAC): Projected to be the fastest-growing region, driven by explosive industrial growth, massive urbanization, and corresponding infrastructure development in China, India, and Southeast Asia. Government initiatives focused on improving water quality and expanding domestic manufacturing capabilities (e.g., biopharma production) create high, untapped potential for centrifugal technology adoption. Competitive pricing and local manufacturing partnerships are critical strategies for market penetration.

- Latin America: Growth is steady, primarily concentrated in the resource extraction (Oil & Gas, Mining) and agricultural processing sectors (Sugar, Ethanol). Economic stabilization in major economies like Brazil and Mexico is leading to delayed infrastructure upgrades, creating pent-up demand for robust industrial centrifuges. The need for reliable separation in corrosive environments drives demand for specialty alloy units.

- Middle East and Africa (MEA): Growth is strongly tied to water security challenges, driving investment in desalination pre-treatment and municipal wastewater recovery systems. The Oil & Gas sector remains a dominant buyer for heavy-duty separation and drilling mud handling equipment. Adoption is increasing but often reliant on imported technology and technical expertise from North America and Europe.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Centrifugal Filters Market.- Andritz AG

- Alfa Laval AB

- GEA Group Aktiengesellschaft

- Mitsubishi Kakoki Kaisha, Ltd.

- FLSmidth & Co. A/S

- Pieralisi S.p.A.

- Broadbent Ltd.

- Tomoe Engineering Co., Ltd.

- SPX Flow, Inc.

- IHI Corporation

- KMPT AG

- Siebtechnik GmbH

- Rousselet Robatel

- Tema Systems, Inc.

- Heinkel Process Technology GmbH

- US Centrifuge Systems

- Schlumberger Limited

- Russell Finex Ltd.

- Toper A.S.

- JWC Environmental

Frequently Asked Questions

Analyze common user questions about the Centrifugal Filters market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of centrifugal filters over conventional static filtration systems?

Centrifugal filters offer superior continuous processing capabilities, higher throughput, and reduced reliance on consumables (filter media). They are particularly effective for separating fine solids from liquids at high efficiency and often require less maintenance downtime.

Which application segment drives the highest demand for centrifugal filtration technology?

The Pharmaceutical and Biotechnology segment currently drives the highest value demand due to the critical requirement for high-purity separation, especially for cell harvesting, clarification of biologics, and compliance with stringent sanitary regulations.

What factors contribute to the high initial cost of industrial centrifugal filter units?

High initial costs are attributed to the precision engineering required for high-speed rotational components, the use of specialized, often high-grade, corrosion-resistant materials (like 316L stainless steel), and the integration of sophisticated control and automation systems.

How is AI impacting the operational efficiency of centrifugal filtration?

AI primarily impacts efficiency through predictive maintenance scheduling, dynamic optimization of operating parameters (speed and flow) based on real-time fluid analysis, and rapid fault diagnosis, maximizing uptime and minimizing energy consumption.

Which centrifugal filter type is preferred for municipal wastewater sludge dewatering?

Decanter Centrifuges are the preferred type for municipal wastewater sludge dewatering due to their ability to handle high volumes of varying solid concentrations continuously, effectively reducing sludge volume for disposal with minimal polymer consumption.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager